Amphoteric Surfactants Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Amphoteric Surfactants market, including trends, market size, segmentation, and regional insights for the forecast period 2023 – 2033.

| Metric | Value |

|---|---|

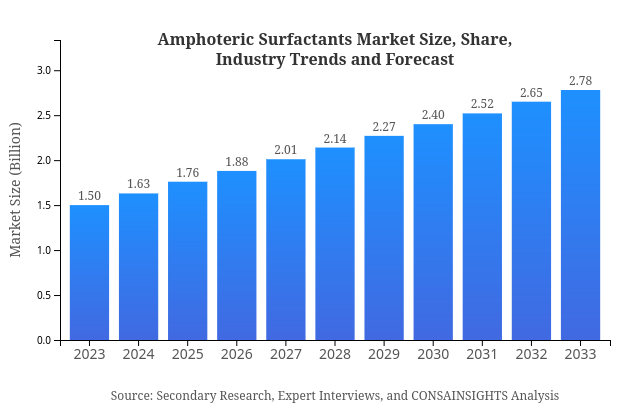

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | BASF SE, AkzoNobel N.V., Huntsman Corporation, Clariant AG |

| Last Modified Date | 02 March 2025 |

Amphoteric Surfactants Market Overview

What is the Market Size & CAGR of Amphoteric Surfactants market in 2023?

Amphoteric Surfactants Industry Analysis

Amphoteric Surfactants Market Segmentation and Scope

Request a custom research report for industry.

Amphoteric Surfactants Market Analysis Report by Region

Europe Amphoteric Surfactants Market Report:

The European amphoteric surfactants market is projected to grow from USD 0.46 billion in 2023 to USD 0.85 billion by 2033. The increasing regulations demanding environmentally safe products and the surge in demand for personal care products contribute to this growth. Innovation and sustainability are key focal points in this region.Asia Pacific Amphoteric Surfactants Market Report:

The Asia Pacific region is a dominant player in the amphoteric surfactants market, expected to witness growth from USD 0.30 billion in 2023 to USD 0.55 billion by 2033. This growth is propelled by rising disposable incomes, urbanization, and consumer trends towards personal care and household products, particularly in countries like China, India, and Japan.North America Amphoteric Surfactants Market Report:

North America is anticipated to expand from USD 0.51 billion in 2023 to USD 0.95 billion by 2033. The presence of major cosmetic brands and robust regulatory frameworks supporting sustainable practices are expected to bolster market growth. The rise in demand for eco-friendly products also plays a critical role in this growth.South America Amphoteric Surfactants Market Report:

The South American market for amphoteric surfactants is forecasted to grow from USD 0.07 billion in 2023 to USD 0.12 billion by 2033. The significant growth in sectors such as cosmetics and food processing is expected to drive demand, alongside increasing investments in the region's chemical industries.Middle East & Africa Amphoteric Surfactants Market Report:

The Middle East and Africa region is expected to see growth from USD 0.16 billion in 2023 to USD 0.30 billion by 2033. Growing industrial applications and an increasing consumer base focused on sustainable products will drive market growth in this region.Request a custom research report for industry.

Amphoteric Surfactants Market Analysis By Product

Global Amphoteric Surfactants Market, By Product Type Market Analysis (2024 - 2033)

The product segmentation in the amphoteric surfactants market consists of Betaines, Amphoteric Sulfobetaines, and Propylene Glycol Amidoethyl Betaine. Betaines dominate the market, with a substantial share, reaching USD 1.01 billion in 2023 and projected to grow to USD 1.87 billion by 2033. Amphoteric Sulfobetaines and Propylene Glycol Amidoethyl Betaine follow, with respective market sizes of USD 0.42 billion and USD 0.07 billion in 2023. Each product type's growth reflects its versatility and application across various industries.

Amphoteric Surfactants Market Analysis By Application

Global Amphoteric Surfactants Market, By Application Market Analysis (2024 - 2033)

In terms of applications, personal care is the leading segment at USD 0.78 billion in 2023, expected to reach USD 1.45 billion by 2033. Cosmetics, industrial cleaning, and food & beverage segments show robust growth as well due to evolving consumer preferences and the need for effective cleaning and emulsifying agents. Growth in the pharmaceutical segment is also noteworthy as formulations become more sophisticated.

Amphoteric Surfactants Market Analysis By End User

Global Amphoteric Surfactants Market, By End-User Industry Market Analysis (2024 - 2033)

End-user industries utilizing amphoteric surfactants include personal care, food and beverage, pharmaceuticals, and household cleaning. Personal care accounts for a significant market share (52.19% in 2023), supported by consumer preferences for safe and mild formulations. Other segments like food and beverage (21.9%) also exhibit growth potential reflecting the emphasis on clean-label ingredients in food processing.

Amphoteric Surfactants Market Analysis By Formulation Type

Global Amphoteric Surfactants Market, By Formulation Type Market Analysis (2024 - 2033)

Formulation types in this market are categorized into liquid, solid, and powder formulations. Liquid formulations represent the largest share, which is expected to remain dominant given their ease of use and versatility across applications. Solid formulations, though smaller in market size, are gaining traction in specific industries demanding stability and concentration. The demand for powdered formulations remains steady, especially in industrial applications.

Amphoteric Surfactants Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Amphoteric Surfactants Industry

BASF SE:

BASF is a global leader in chemistry, providing a wide range of amphoteric surfactants for various applications, including personal care and industrial uses, focusing on sustainability and innovation.AkzoNobel N.V.:

AkzoNobel offers specialty surfactants, including amphoteric types, underscoring their commitment to enhancing product performance across several industries, with an emphasis on eco-friendliness.Huntsman Corporation:

Huntsman provides a diverse range of amphoteric surfactants used in cleaning and personal care products, with a focus on delivering advanced solutions and sustainable practices.Clariant AG:

Clariant specializes in sustainable solutions and offers a portfolio of amphoteric surfactants tailored to personal care and cleaning applications, emphasizing innovation and safety.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of amphoteric surfactants?

The global amphoteric surfactants market is projected to reach $1.5 billion by 2033, with a CAGR of 6.2%. This growth indicates a robust demand and an expanding market landscape over the next decade.

What are the key market players or companies in the amphoteric surfactants industry?

Key players in the amphoteric surfactants market include BASF, Evonik Industries, and Huntsman Corporation, among others. These companies are leveraging innovation to maintain their competitive edge and cater to diverse industrial needs.

What are the primary factors driving the growth in the amphoteric surfactants industry?

Growth in the amphoteric surfactants industry is primarily driven by the increasing demand from personal care, household cleaning, and industrial applications. Additionally, strict regulations on synthetic surfactants fuel the shift towards eco-friendly amphoteric options.

Which region is the fastest Growing in the amphoteric surfactants market?

The Asia Pacific region is the fastest-growing market for amphoteric surfactants, projected to rise from $0.30 billion in 2023 to $0.55 billion by 2033, driven by rapid industrialization and rising consumer demand.

Does ConsaInsights provide customized market report data for the amphoteric surfactants industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the amphoteric surfactants industry, ensuring clients receive relevant insights and market analyses that align with their strategic goals.

What deliverables can I expect from this amphoteric surfactants market research project?

Expect comprehensive deliverables including market sizing, regional analysis, competitive landscape, segment breakdown, and trends that illuminate opportunities and strategic movements in the amphoteric surfactants market.

What are the market trends of amphoteric surfactants?

Current trends in the amphoteric surfactants market include a shift toward sustainable products, increasing adoption in personal care and cosmetics, and innovations in product formulations that enhance performance while reducing environmental impact.