Analogtodigital Converters Market Report

Published Date: 31 January 2026 | Report Code: analogtodigital-converters

Analogtodigital Converters Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Analog to Digital Converters market from 2023 to 2033, detailing market dynamics, trends, forecasts, and insights. It covers market size, segmentation, regional analysis, and leading companies, offering a data-driven outlook for stakeholders.

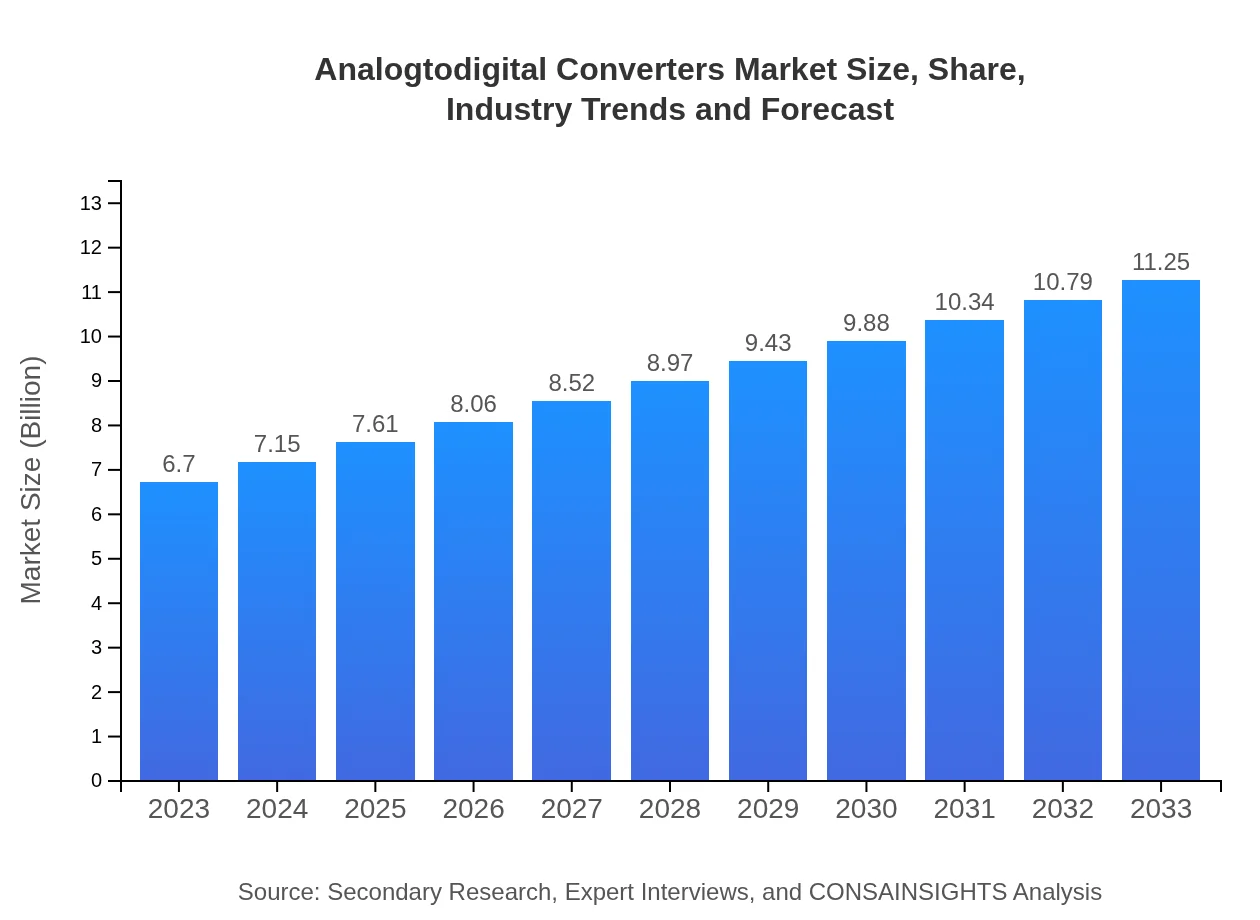

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.70 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $11.25 Billion |

| Top Companies | Analog Devices, Inc., Texas Instruments Incorporated, Maxim Integrated, STMicroelectronics, NXP Semiconductors |

| Last Modified Date | 31 January 2026 |

Analog to Digital Converters Market Overview

Customize Analogtodigital Converters Market Report market research report

- ✔ Get in-depth analysis of Analogtodigital Converters market size, growth, and forecasts.

- ✔ Understand Analogtodigital Converters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Analogtodigital Converters

What is the Market Size & CAGR of Analog to Digital Converters market in 2023?

Analog to Digital Converters Industry Analysis

Analog to Digital Converters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Analog to Digital Converters Market Analysis Report by Region

Europe Analogtodigital Converters Market Report:

In Europe, the ADC market is worth $2.18 billion as of 2023, expected to rise to $3.66 billion by 2033. The demand is primarily driven by advancements in automotive technologies and increasing automation in manufacturing sectors.Asia Pacific Analogtodigital Converters Market Report:

In 2023, the Asia Pacific ADC market is valued at $1.23 billion, anticipated to reach $2.06 billion by 2033, driven by increasing consumer electronics and automotive manufacturing. Countries like China and Japan lead the market due to their robust electronics industries and innovation in automotive technologies.North America Analogtodigital Converters Market Report:

The North American market for ADCs is valued at $2.35 billion in 2023 and is projected to grow to $3.94 billion by 2033, propelled by the high demand in automotive applications, particularly electric vehicles, and the healthcare industry.South America Analogtodigital Converters Market Report:

The South American market is estimated at $0.41 billion in 2023 and expected to grow to $0.68 billion by 2033. The region's expansion is supported by increased investments in renewable energy technologies and industrial automation.Middle East & Africa Analogtodigital Converters Market Report:

The Middle East and Africa ADC market is valued at $0.54 billion in 2023 and is forecasted to expand to $0.90 billion by 2033, attributed to infrastructure improvements and technology adoption in telecommunications and industrial sectors.Tell us your focus area and get a customized research report.

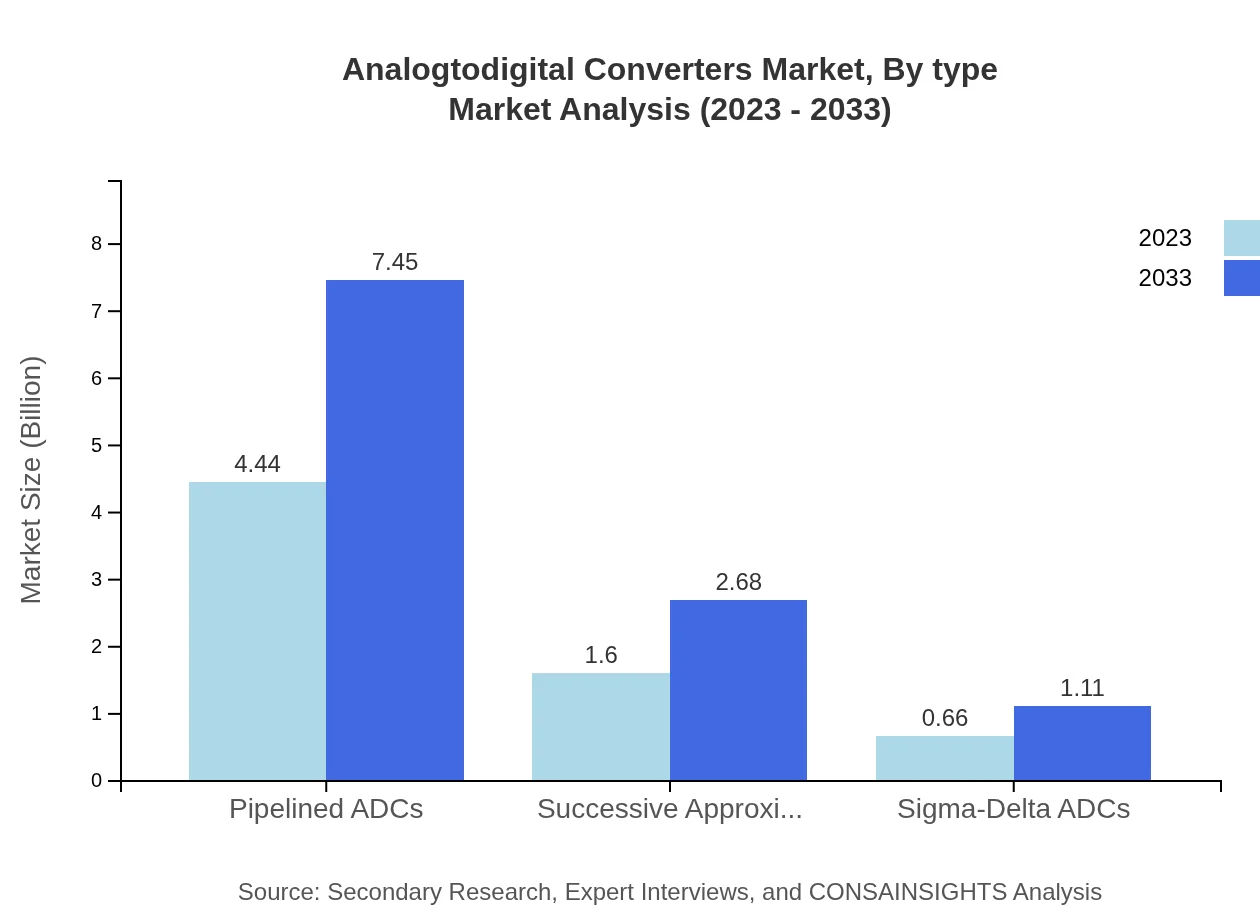

Analogtodigital Converters Market Analysis By Type

The ADC market segmented by type includes the following insights: Pipelined ADCs, dominating the market with a size of $4.44 billion in 2023, projected to rise to $7.45 billion by 2033, holds a market share of 66.26%. Successive Approximation Register ADCs have a market size of $1.60 billion in 2023, expected to expand to $2.68 billion by 2033, with a share of 23.87%. Sigma-Delta ADCs, with a market size of $0.66 billion in 2023, forecasted to reach $1.11 billion by 2033, capturing a smaller share of 9.87%.

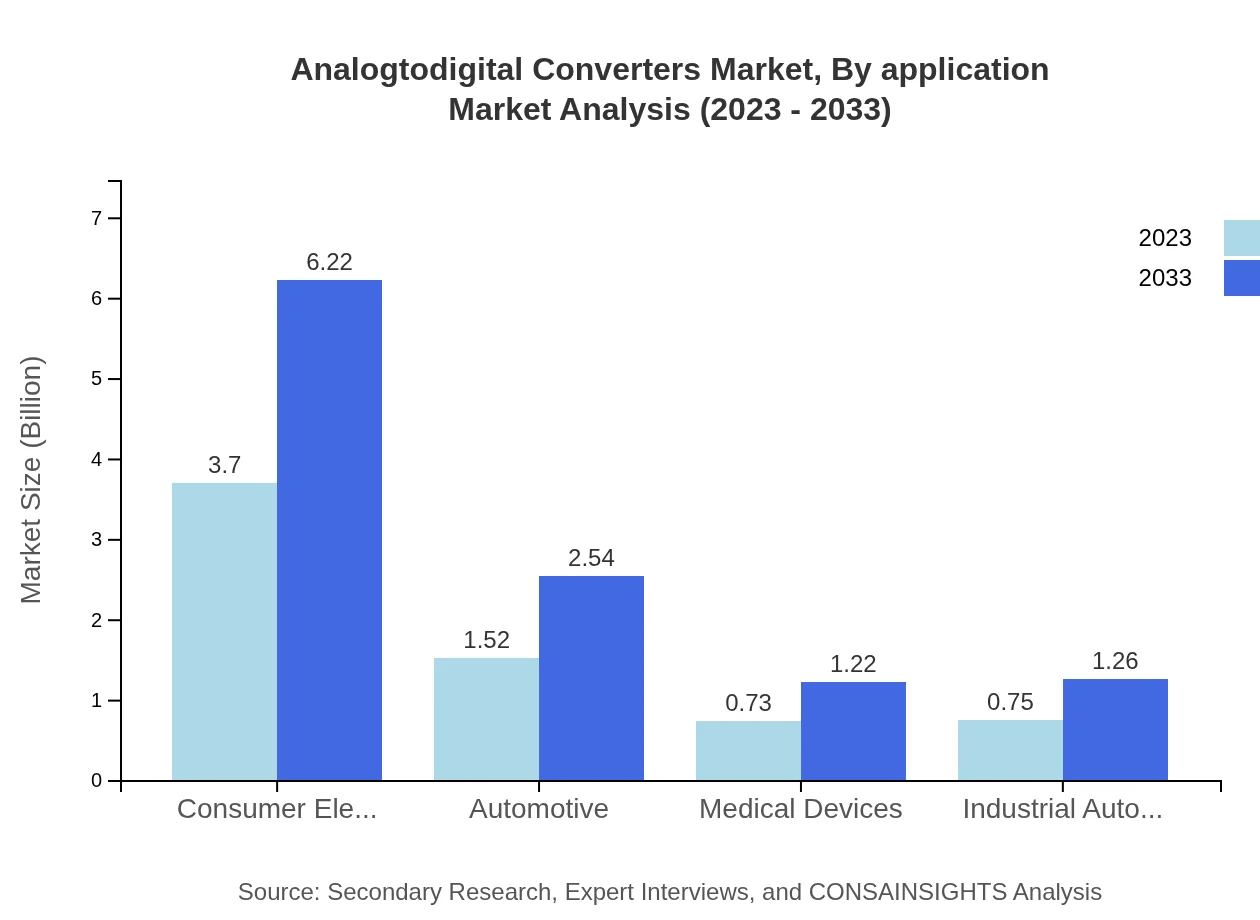

Analogtodigital Converters Market Analysis By Application

In terms of applications, Consumer Electronics lead with a market size of $3.70 billion in 2023, projected to grow to $6.22 billion by 2033, while holding a significant market share of 55.29%. The automotive sector represents a size of $1.52 billion in 2023, increasing to $2.54 billion by 2033, with a share of 22.62%. Medical Devices and Industrial Automation segments contribute with sizes of $0.73 billion and $0.75 billion, respectively, both showing strong growth potential as digital technologies advance.

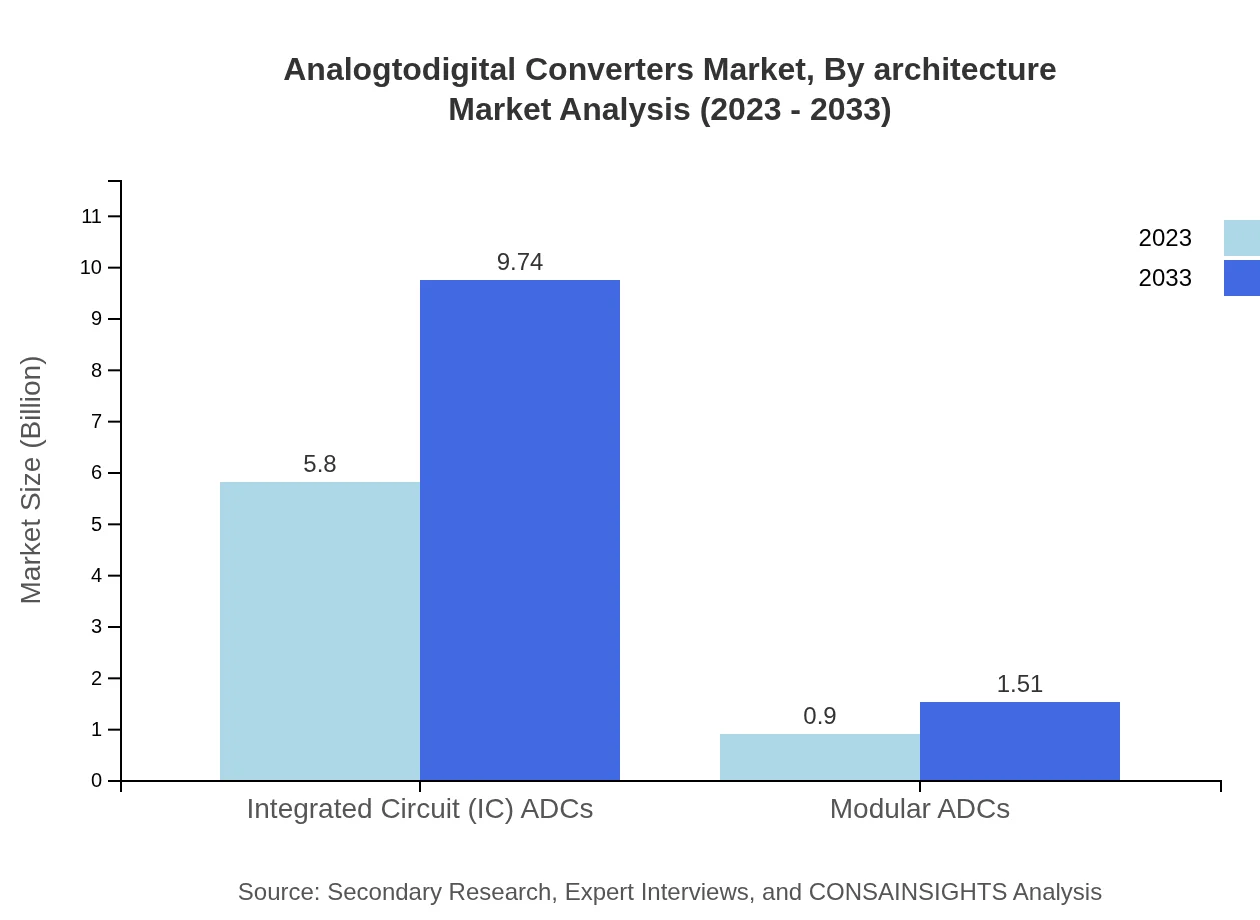

Analogtodigital Converters Market Analysis By Architecture

The market based on architecture mainly distinguishes between Integrated Circuit (IC) ADCs and Modular ADCs. IC ADCs dominate, valued at $5.80 billion in 2023, and expected to reach $9.74 billion by 2033, holding an impressive share of 86.59%. Modular ADCs follow, with a market size of $0.90 billion in 2023, projected to grow to $1.51 billion by 2033, capturing a share of 13.41%.

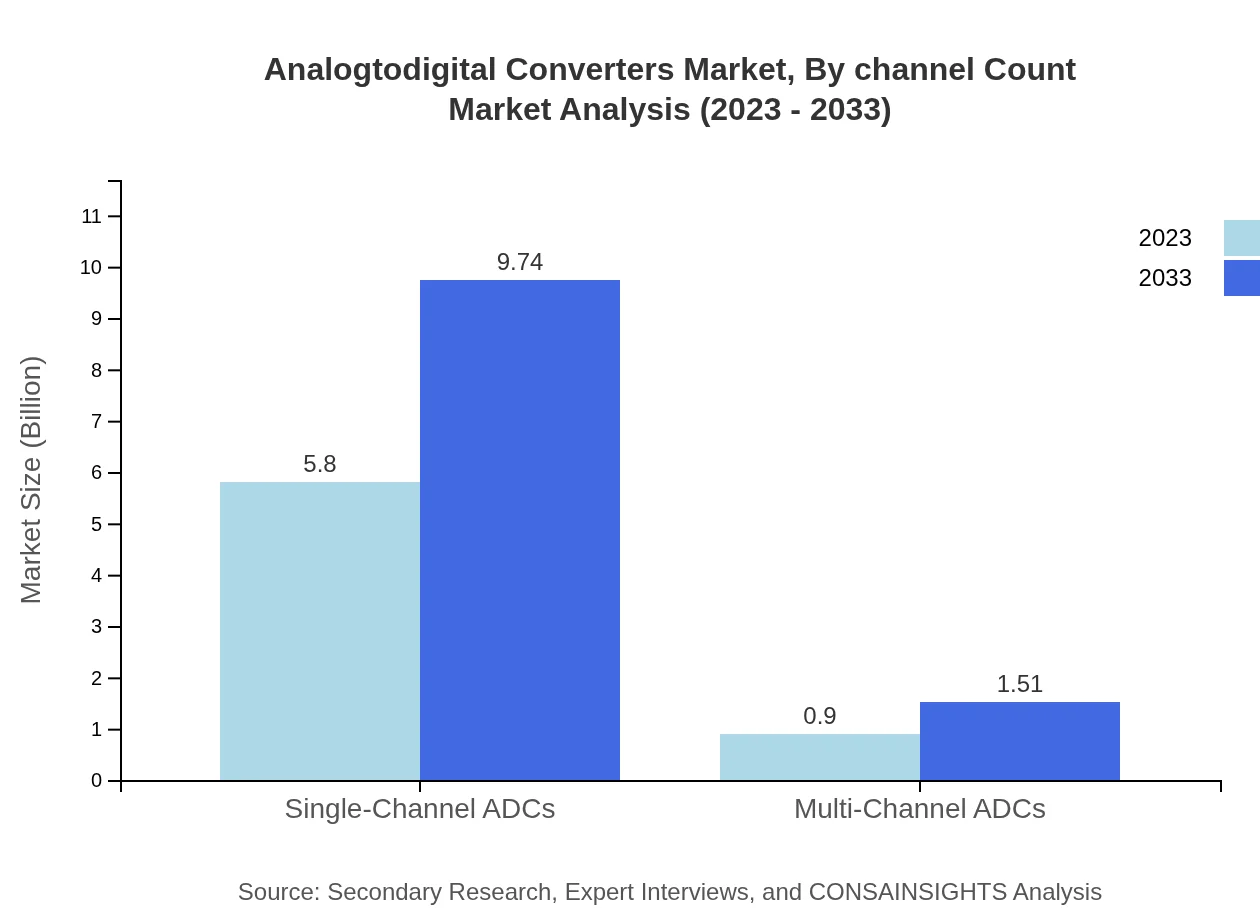

Analogtodigital Converters Market Analysis By Channel Count

When analyzed by channel count, Single-Channel ADCs demonstrate significant performance with a size of $5.80 billion in 2023, set to expand to $9.74 billion by 2033, retaining a market share of 86.59%. Conversely, Multi-Channel ADCs are valued at $0.90 billion in 2023 and will reach $1.51 billion by 2033, with a share of 13.41%. These developments reflect the varying demands based on application requirements in different sectors.

Analog to Digital Converters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Analog to Digital Converters Industry

Analog Devices, Inc.:

A leading manufacturer of high-performance analog, mixed-signal, and digital signal processing (DSP) integrated circuits. Their ADC products are extensively used in various applications across industries.Texas Instruments Incorporated:

Known for its innovative solutions in analog and digital semiconductor technologies, Texas Instruments offers a wide range of ADCs that cater to automotive, industrial, and consumer sectors.Maxim Integrated:

Provides advanced analog and mixed-signal solutions including ADCs optimized for high speed and low power consumption, widely used in portable consumer electronics.STMicroelectronics:

A global semiconductor leader, STMicroelectronics designs and manufactures a variety of ADCs, contributing to their central role in automotive and industrial applications.NXP Semiconductors:

Focuses on security and automotive solutions, NXP is a well-known player in the ADC market with products targeting automotive, medical, and industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Analog To-Digital Converters?

The Analog-to-Digital Converters market is projected to grow from a size of 6.7 billion in 2023 to an expected expansion due to a CAGR of 5.2%, highlighting the increasing demand in various applications.

What are the key market players or companies in this Analog To-Digital Converters industry?

Major players in the Analog-to-Digital Converters industry include Texas Instruments, Analog Devices, Maxim Integrated, NXP Semiconductors, and STMicroelectronics, all contributing significantly to market advancements through innovative technologies.

What are the primary factors driving the growth in the Analog To-Digital Converters industry?

Key growth drivers include the rising demand for consumer electronics, advancements in automotive technology, increasing applications in medical devices, and the push for industrial automation, all necessitating high-performance ADCs.

Which region is the fastest Growing in the Analog To-Digital Converters?

The Asia-Pacific region demonstrates the fastest growth in the Analog-to-Digital Converters market, from 1.23 billion in 2023 to 2.06 billion by 2033, fueled by technological advancements and increased electronics manufacturing.

Does ConsaInsights provide customized market report data for the Analog To-Digital Converters industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the Analog-to-Digital Converters industry, providing insights relevant to unique business objectives and market challenges.

What deliverables can I expect from this Analog To-Digital Converters market research project?

Expect comprehensive insights including market size, growth forecasts, competitive analysis, segment analysis, regional market data, and actionable strategies for market entry, expansion, or innovation in the ADC sector.

What are the market trends of Analog To-Digital Converters?

Current trends in the Analog-to-Digital Converters market include the rise of integrated ADC solutions, increasing use in IoT applications, the shift toward energy-efficient designs, and the growing importance of data conversion in emerging technologies.