Analytical Instrumentation Market Report

Published Date: 31 January 2026 | Report Code: analytical-instrumentation

Analytical Instrumentation Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers the Analytical Instrumentation market, providing insights into market size, growth trends, and forecasts from 2023 to 2033. It delves into various market segments, regional dynamics, and leading industry players for informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

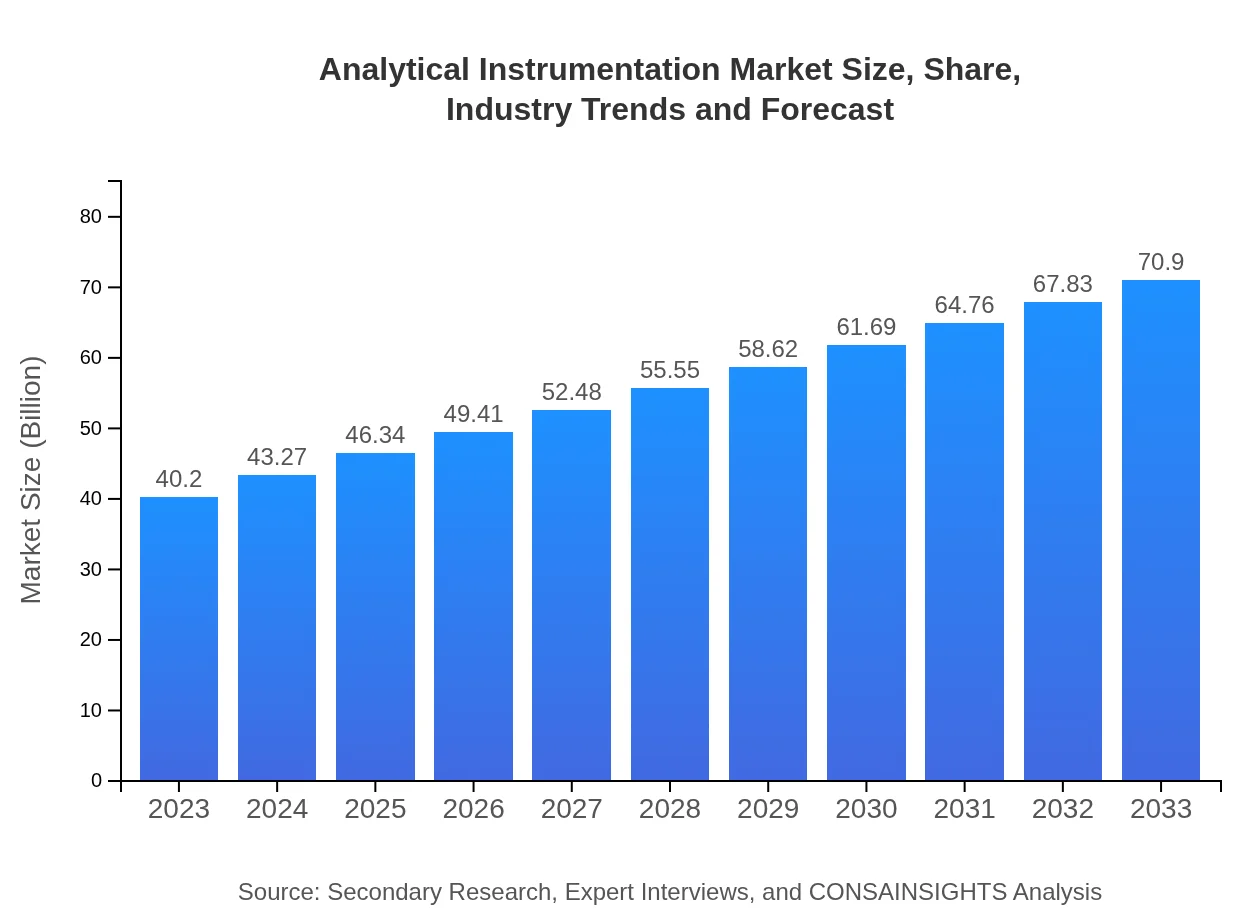

| 2023 Market Size | $40.20 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $70.90 Billion |

| Top Companies | Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Siemens Healthcare, Waters Corporation |

| Last Modified Date | 31 January 2026 |

Analytical Instrumentation Market Overview

Customize Analytical Instrumentation Market Report market research report

- ✔ Get in-depth analysis of Analytical Instrumentation market size, growth, and forecasts.

- ✔ Understand Analytical Instrumentation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Analytical Instrumentation

What is the Market Size & CAGR of the Analytical Instrumentation market in 2023?

Analytical Instrumentation Industry Analysis

Analytical Instrumentation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Analytical Instrumentation Market Analysis Report by Region

Europe Analytical Instrumentation Market Report:

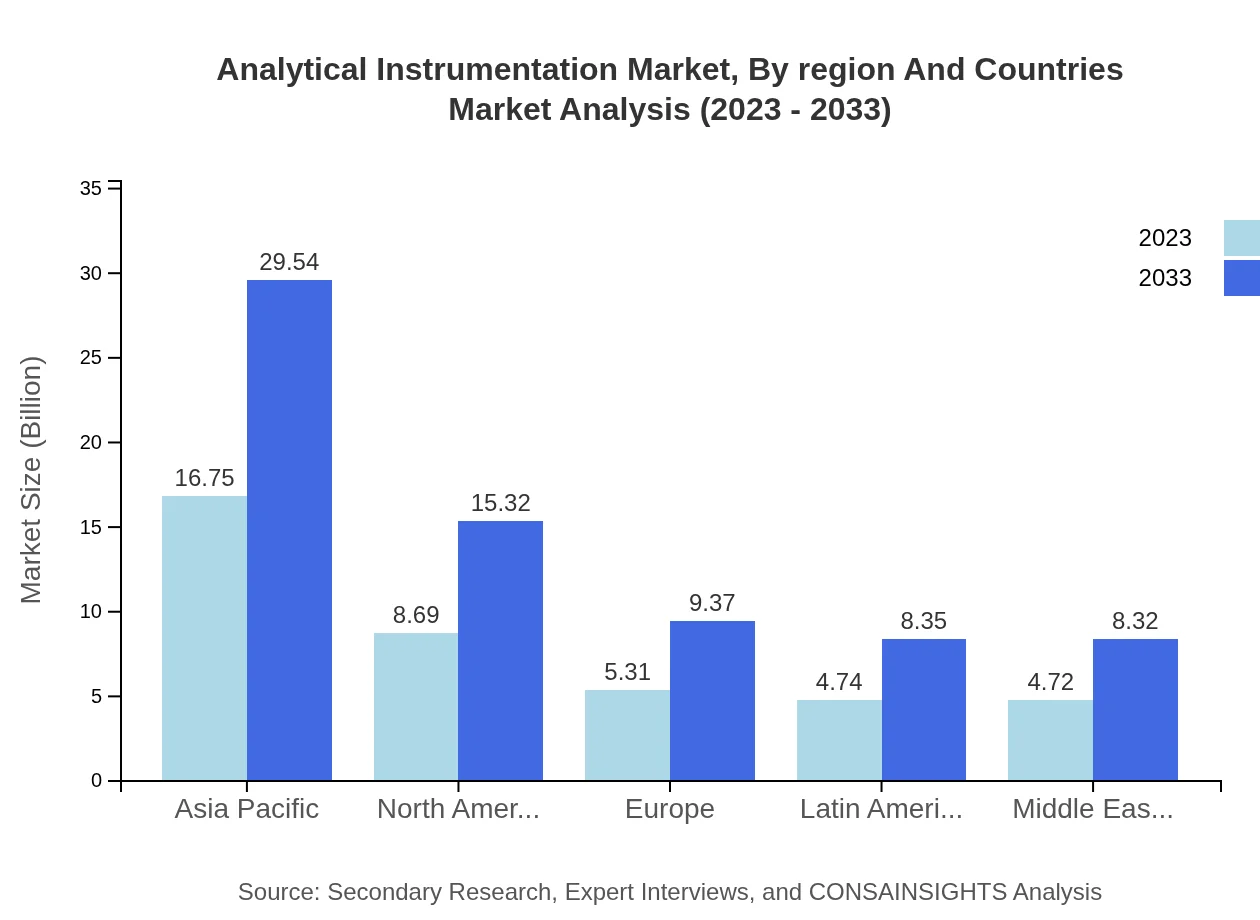

Europe holds a significant share of the market with a valuation of USD 14.44 billion in 2023, anticipated to expand to USD 25.47 billion by 2033 at a CAGR of 6.06%. Regulatory compliance in pharmaceuticals and environmental protection drives demand for advanced analytical instruments in this region.Asia Pacific Analytical Instrumentation Market Report:

In 2023, the Asia Pacific Analytical Instrumentation market is valued at approximately USD 6.91 billion, which is expected to grow to USD 12.19 billion by 2033, at a CAGR of around 6.00%. Key factors driving this growth include increased R&D investments in countries like China and India, as well as expanding pharmaceutical and environmental sectors in the region.North America Analytical Instrumentation Market Report:

The North American Analytical Instrumentation market is estimated at USD 13.43 billion in 2023, expected to grow to USD 23.69 billion by 2033, representing a CAGR of 6.05%. The strong presence of key market players and continuous innovation in laboratory technologies fuel this region's growth.South America Analytical Instrumentation Market Report:

South America’s market size in 2023 is around USD 1.67 billion, projected to reach USD 2.95 billion by 2033 with a CAGR of 5.80%. Growth is supported by rising investments in environmental testing and food safety practices, amid an increasing focus on public health regulations.Middle East & Africa Analytical Instrumentation Market Report:

The market in the Middle East and Africa is projected to grow from USD 3.74 billion in 2023 to USD 6.59 billion by 2033, equating to a CAGR of 5.73%. Increased investments in oil and gas, as well as healthcare sectors, notably enhance market prospects.Tell us your focus area and get a customized research report.

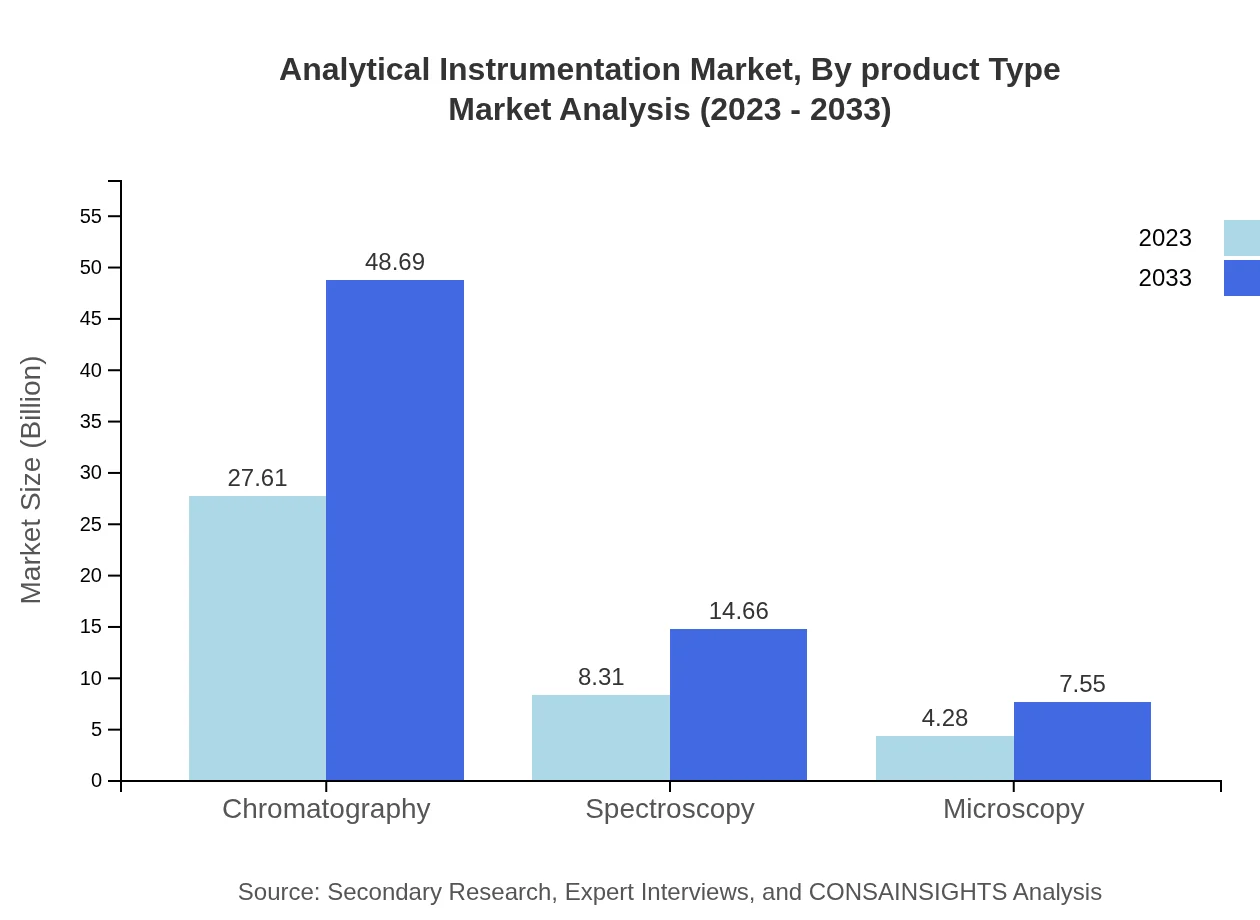

Analytical Instrumentation Market Analysis By Product Type

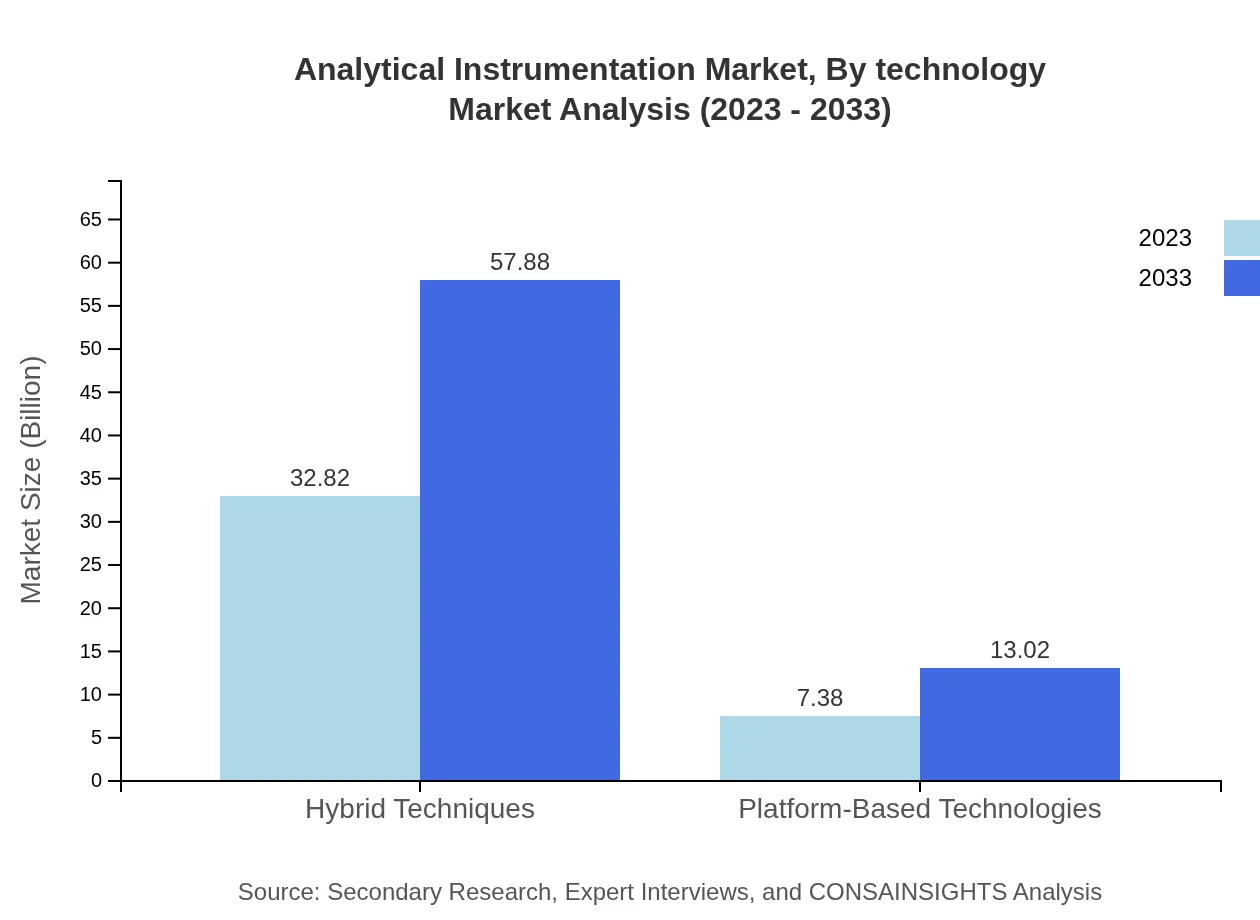

The market is broadly segmented by product type, including Hybrid Techniques, Chromatography, Spectroscopy, and Microscopy. For Hybrid Techniques, the market is projected to grow from USD 32.82 billion in 2023 to USD 57.88 billion in 2033. Chromatography is anticipated to increase from USD 27.61 billion to USD 48.69 billion, driven by its applications in drug development. Spectroscopy and Microscopy will continue to play vital roles, with expected growth from USD 8.31 billion to USD 14.66 billion and USD 4.28 billion to USD 7.55 billion, respectively.

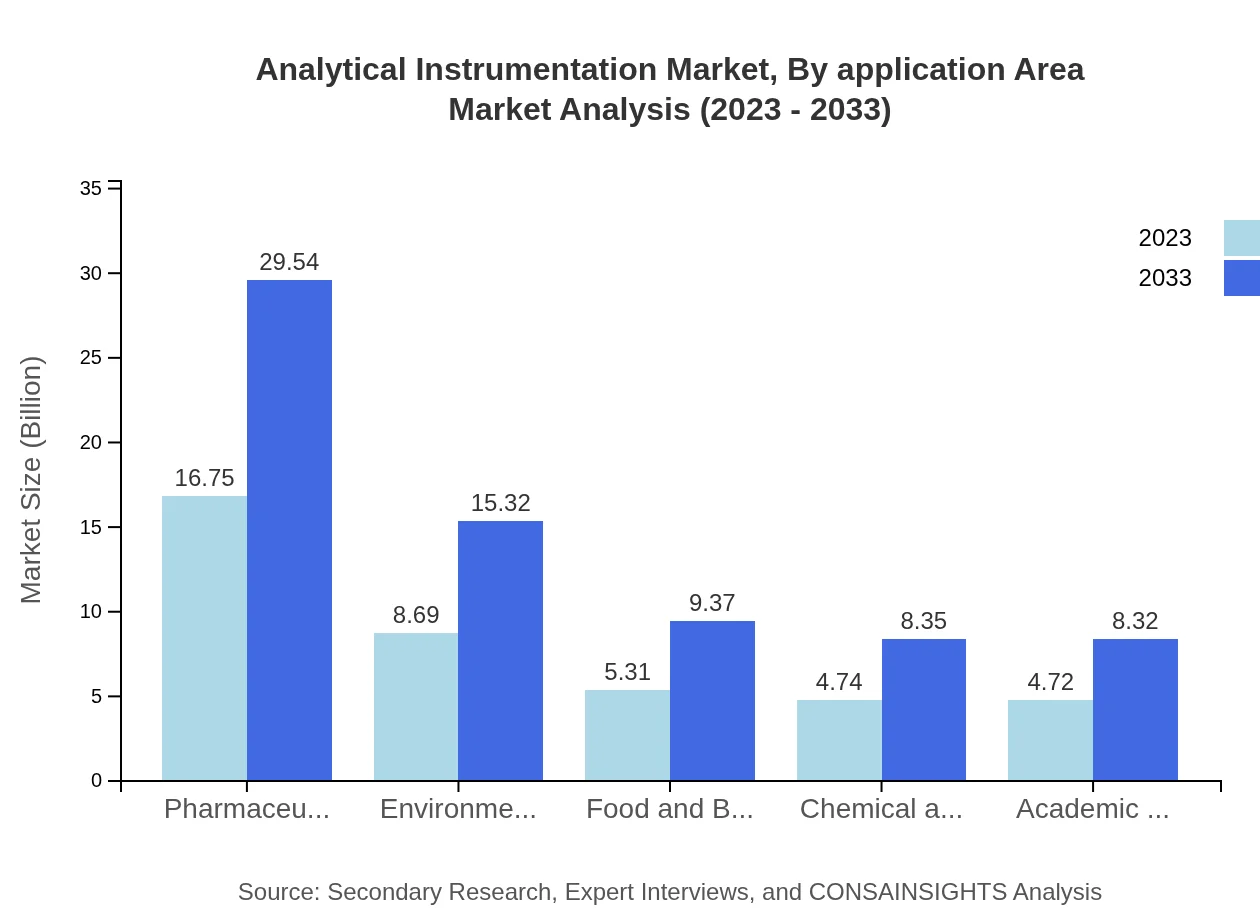

Analytical Instrumentation Market Analysis By Application Area

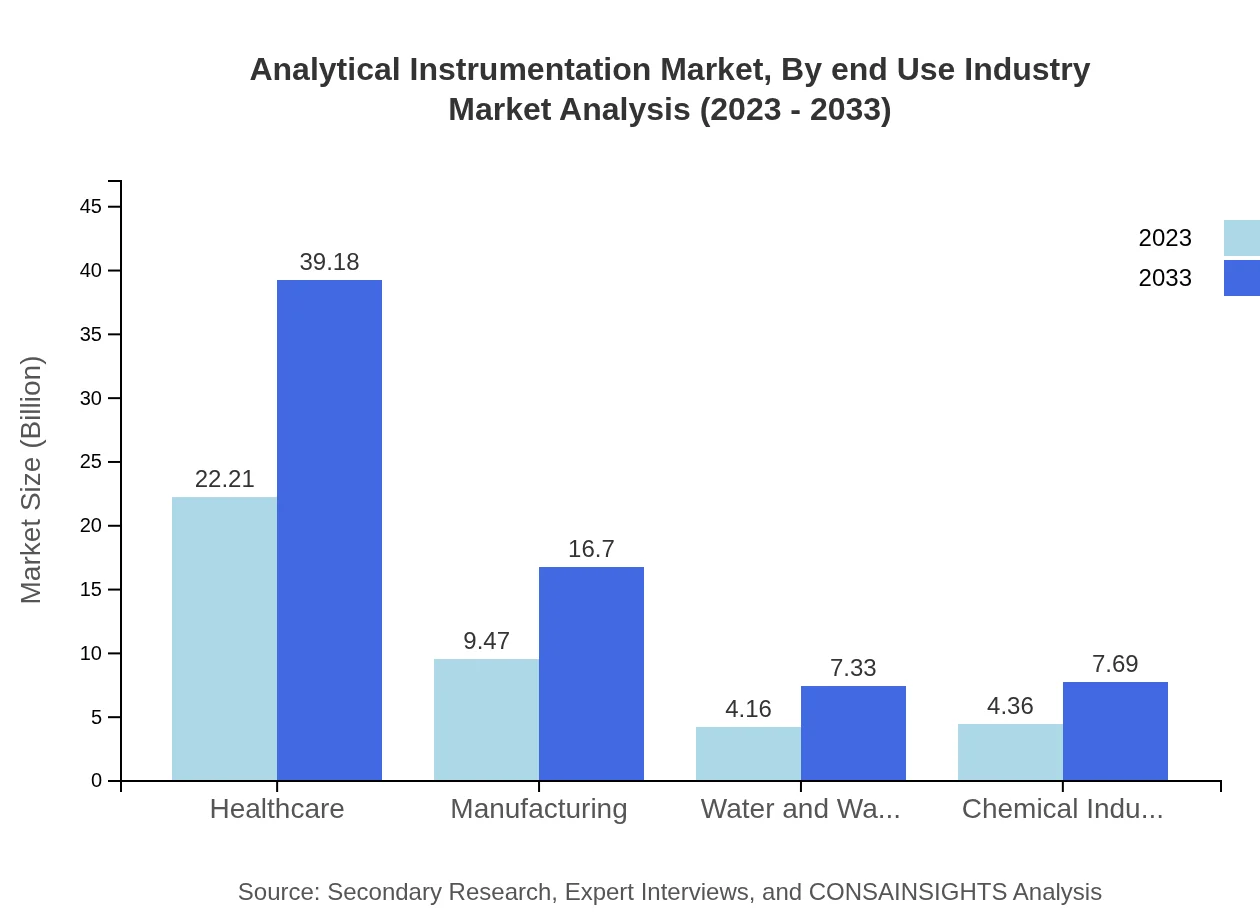

In terms of application areas, Pharmaceutical testing, Environmental Testing, Food and Beverage testing, and Healthcare are significant segments. Pharmaceuticals are predicted to expand from USD 16.75 billion to USD 29.54 billion, signifying their critical role in drug safety. Environmental Testing will grow from USD 8.69 billion to USD 15.32 billion, reflecting heightened regulatory scrutiny. Similarly, Healthcare applications are anticipated to rise from USD 22.21 billion to USD 39.18 billion, addressing the growing demand for diagnostic services.

Analytical Instrumentation Market Analysis By Technology

The technological landscape in Analytical Instrumentation is shifting towards more automated and high-throughput systems. The dominance of Hybrid Techniques and Chromatography is substantial, and these technologies are expected to advance significantly. For example, Chromatography is set to increase its market share from 68.67% in 2023 to 68.67% by 2033, while Spectroscopy and Microscopy maintain shares of 20.68% and 10.65%, respectively.

Analytical Instrumentation Market Analysis By End Use Industry

Across various end-use industries, the Pharmaceutical, Environmental, and Food industries demonstrate considerable reliance on analytical instrumentation. The Pharmaceutical industry will continue to dominate, holding a 41.66% market share in 2023, extending to the same by 2033. The Environmental Testing and Food & Beverage industries showcase growth as regulatory standards rise, further driving the application of analytical tools.

Analytical Instrumentation Market Analysis By Region And Countries

Regional segmentation showcases a diverse market landscape. North America and Europe maintain significant shares, fueled by consistent R&D activities. Meanwhile, Asia Pacific demonstrates rapid growth potential, driven by burgeoning pharmaceutical and environmental concerns. Synthesizing these elements reveals a robust framework for market expansion across varied geographies.

Analytical Instrumentation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Analytical Instrumentation Industry

Thermo Fisher Scientific:

A leader in analytical instrumentation providing innovative solutions for the life sciences and laboratory markets, Thermo Fisher is renowned for its cutting-edge technologies in chromatography and mass spectrometry.Agilent Technologies:

Agilent specializes in instruments, software, and services for laboratories across various industries, leading in the development of analytical technologies such as chromatography and spectroscopy.PerkinElmer:

A prominent global corporation delivering analytical instrumentation for environmental, pharmaceutical, food quality, and life sciences applications, PerkinElmer has a strong portfolio in spectroscopy and microscopy.Siemens Healthcare:

Siemens Healthcare focuses on diagnostic and therapeutic tools, advancing analytical instrumentation that enhances healthcare worldwide with diagnostic imaging and laboratory automation.Waters Corporation:

Waters is known for its high-performance liquid chromatography (HPLC) and mass spectrometry technologies, contributing significantly to research and development in various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of analytical Instrumentation?

The analytical instrumentation market is projected to reach approximately $40.2 billion by 2033, expanding at a CAGR of 5.7%. This growth reflects the increasing demand for advanced analytical techniques across various sectors, fueling significant investments in the industry.

What are the key market players or companies in this analytical Instrumentation industry?

Key players in the analytical instrumentation market include companies like Agilent Technologies, Thermo Fisher Scientific, and PerkinElmer, among others. These companies play crucial roles in developing innovative solutions and technologies to enhance analytical practices worldwide.

What are the primary factors driving the growth in the analytical Instrumentation industry?

The growth of the analytical instrumentation industry is driven by increased healthcare spending, advancements in technology, and the rising need for quality testing in pharmaceuticals and environmental monitoring, alongside stringent regulatory compliance mandates.

Which region is the fastest Growing in the analytical Instrumentation?

The Asia-Pacific region is the fastest-growing market for analytical instrumentation, expected to grow from $6.91 billion in 2023 to $12.19 billion by 2033. This growth is fueled by rapid industrialization and investments in healthcare and research.

Does ConsaInsights provide customized market report data for the analytical Instrumentation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the analytical instrumentation industry. Clients can request detailed analyses that reflect their unique market interests and strategic objectives.

What deliverables can I expect from this analytical Instrumentation market research project?

Clients can expect comprehensive deliverables such as detailed market analysis reports, competitive landscape assessments, growth forecasts, and actionable insights tailored to the analytical instrumentation market.

What are the market trends of analytical Instrumentation?

Current trends in the analytical instrumentation market include a shift towards automation and digitalization, increased adoption of hybrid techniques, and growing investment in advanced manufacturing processes across various end-user sectors.