Anesthesia Drugs Market Report

Published Date: 31 January 2026 | Report Code: anesthesia-drugs

Anesthesia Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Anesthesia Drugs market, exploring its segmentation, regional dynamics, industry trends, and future forecasts for the period 2023 to 2033.

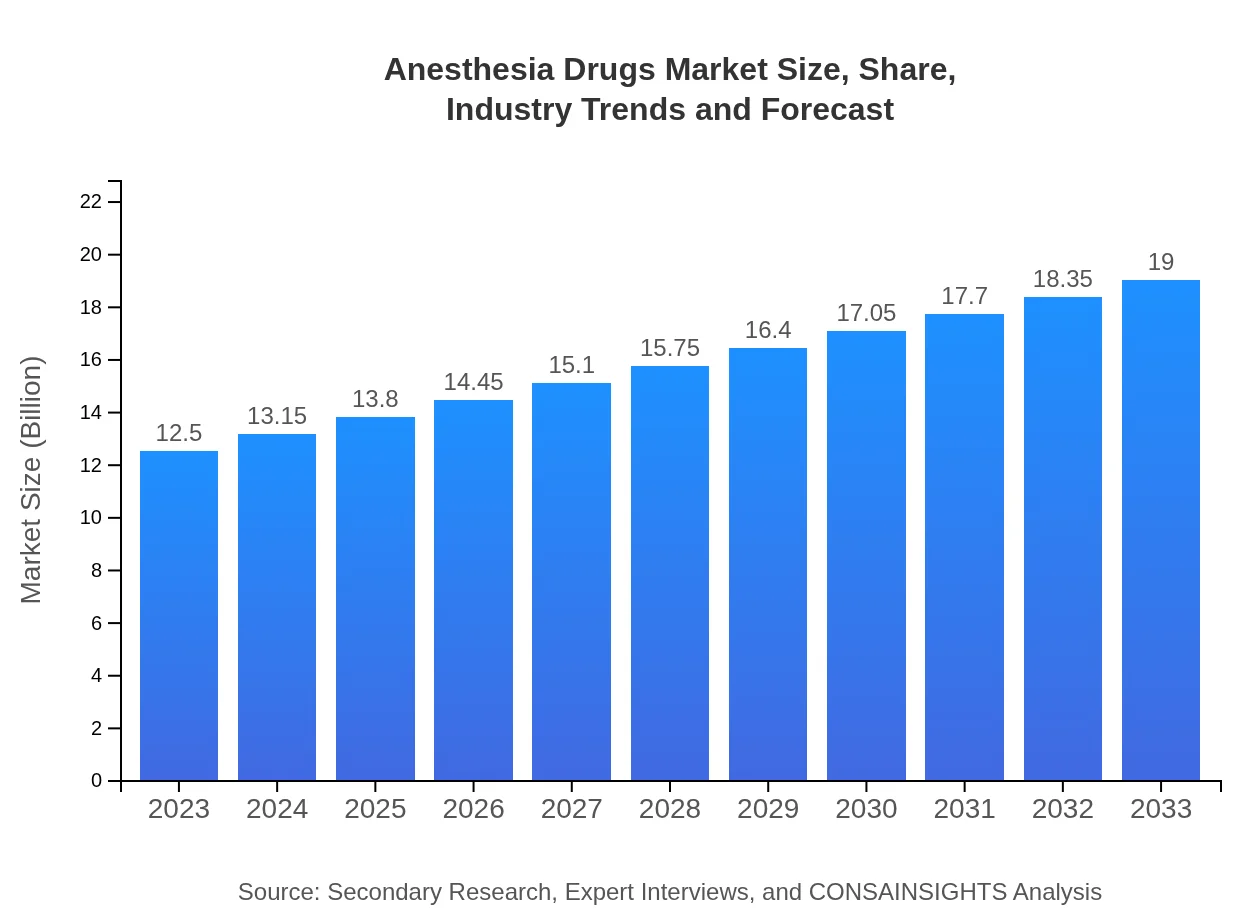

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $19.00 Billion |

| Top Companies | Fresenius Kabi AG, Abbott Laboratories, Baxter International Inc., Hikma Pharmaceuticals |

| Last Modified Date | 31 January 2026 |

Anesthesia Drugs Market Overview

Customize Anesthesia Drugs Market Report market research report

- ✔ Get in-depth analysis of Anesthesia Drugs market size, growth, and forecasts.

- ✔ Understand Anesthesia Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anesthesia Drugs

What is the Market Size & CAGR of Anesthesia Drugs market in 2023?

Anesthesia Drugs Industry Analysis

Anesthesia Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anesthesia Drugs Market Analysis Report by Region

Europe Anesthesia Drugs Market Report:

In Europe, the market for anesthesia drugs is forecasted to grow from $3.15 billion in 2023 to $4.79 billion by 2033. The presence of key market players and innovative research activities in countries like Germany and France contribute to robust market growth.Asia Pacific Anesthesia Drugs Market Report:

In the Asia Pacific region, the anesthesia drugs market is set to grow from $2.49 billion in 2023 to $3.79 billion by 2033. The rise in surgical procedures, combined with increasing government health initiatives and rising disposable incomes, are primary growth drivers in countries like India and China.North America Anesthesia Drugs Market Report:

North America leads the anesthesia drugs market, valued at $4.08 billion in 2023 and expected to reach $6.20 billion by 2033. This growth is spurred by high healthcare expenditure, advanced healthcare infrastructure, and an increasing number of surgical procedures performed annually.South America Anesthesia Drugs Market Report:

The South America anesthesia drugs market is projected to grow from $1.19 billion in 2023 to $1.81 billion by 2033, as countries like Brazil and Argentina enhance their healthcare infrastructures and focus on improving surgical facilities.Middle East & Africa Anesthesia Drugs Market Report:

The Middle East and Africa region's anesthesia drugs market is anticipated to increase from $1.59 billion in 2023 to $2.42 billion by 2033. The region is witnessing growth due to improved healthcare access and investments in medical technology.Tell us your focus area and get a customized research report.

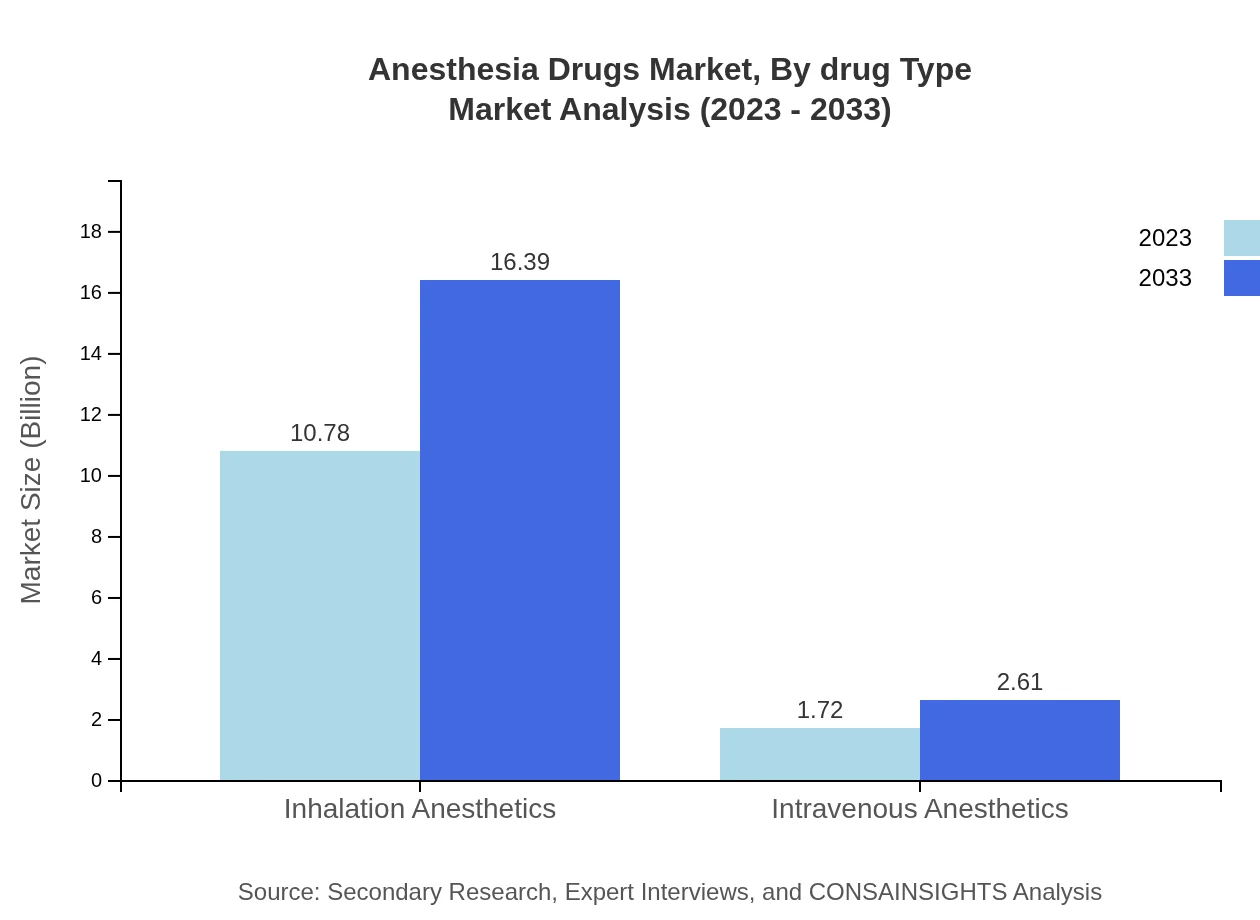

Anesthesia Drugs Market Analysis By Drug Type

The Anesthesia Drugs Market by drug type highlights the dominance of inhalation anesthetics, which accounted for $10.78 billion (86.27% market share) in 2023 and is projected to reach $16.39 billion by 2033. Intravenous anesthetics are also significant, estimated at $1.72 billion (13.73% market share) in 2023, and are expected to show steady growth, reflecting advancements in intraoperative medicine.

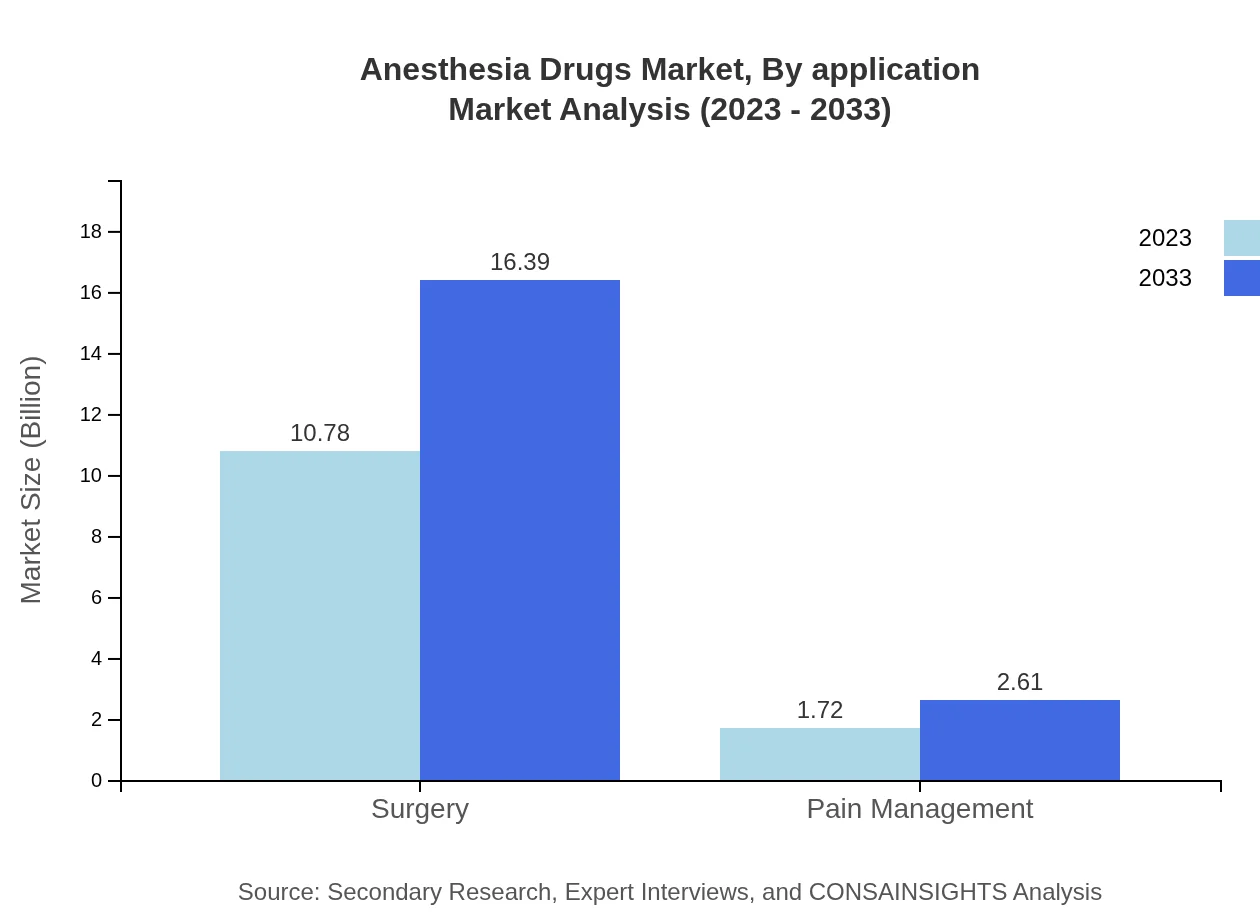

Anesthesia Drugs Market Analysis By Application

Surgical applications represent the largest share of the anesthetic drugs market, capturing approximately 86.27% of the total market in 2023. The surgery segment is expected to grow from $10.78 billion in 2023 to $16.39 billion by 2033, reflecting rising surgical rates globally. Pain management follows with a smaller market share but significant growth potential as chronic pain management becomes a more prominent focus in healthcare.

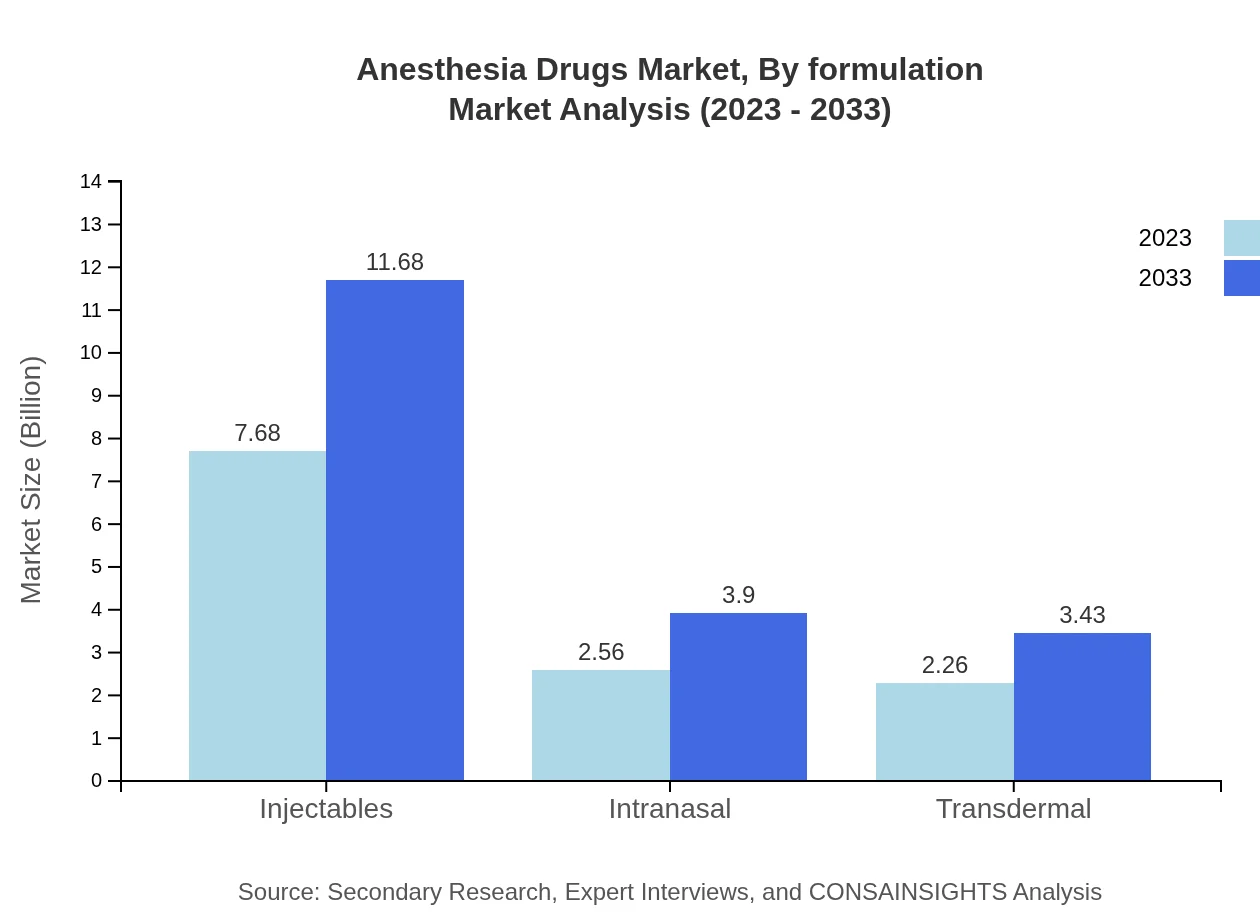

Anesthesia Drugs Market Analysis By Formulation

Analyzing the market by formulation, injectables maintain a leading market share of 61.45%, valued at $7.68 billion in 2023 and projected to reach $11.68 billion by 2033. The oral and intranasal formulations, while smaller segments, reflect trends towards patient convenience and adherence.

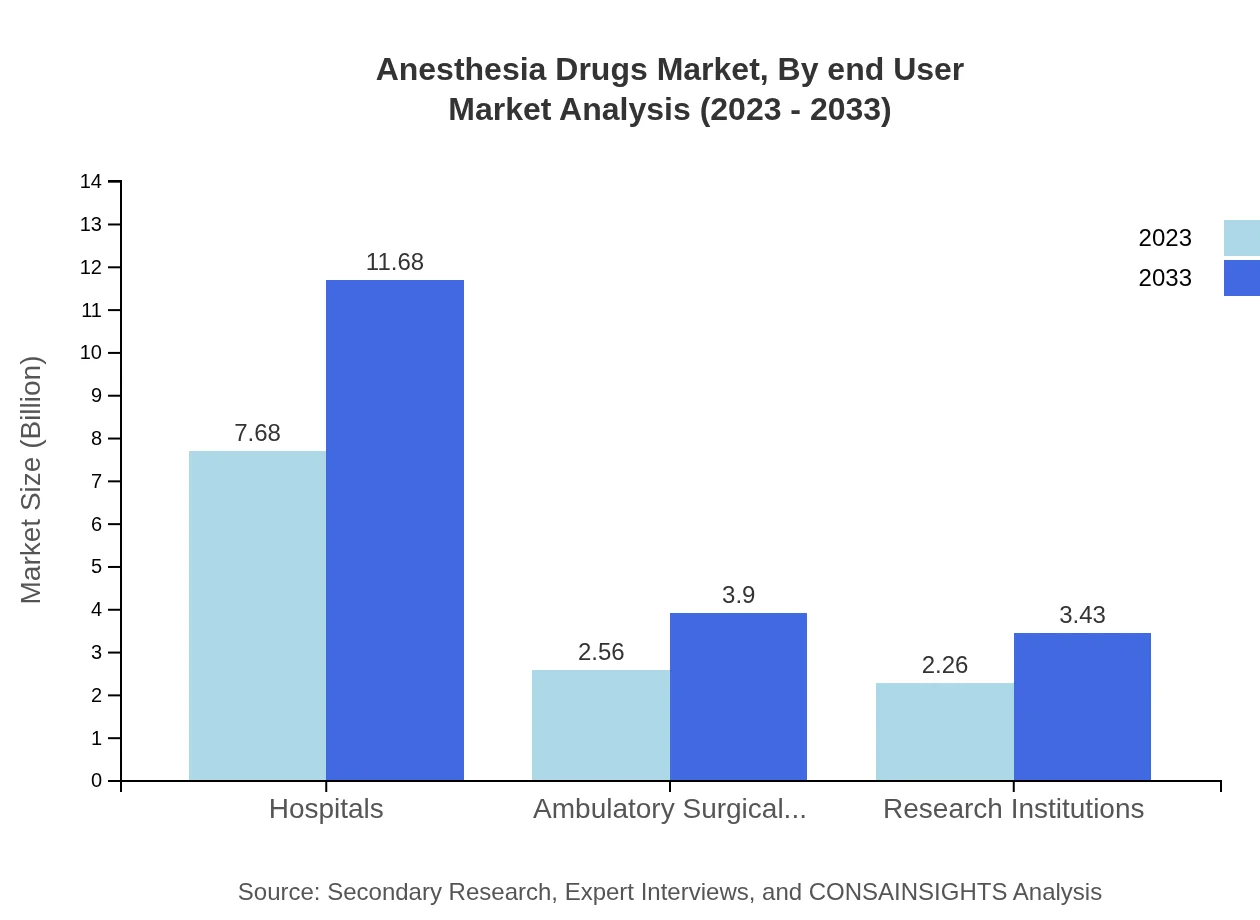

Anesthesia Drugs Market Analysis By End User

The end-user analysis reveals hospitals as the primary consumers of anesthesia drugs, commanding 61.45% of the market with a value of $7.68 billion in 2023, expected to grow to $11.68 billion by 2033. Ambulatory surgical centers and research institutions play essential supporting roles, accounting for 20.5% and 18.05% of the market share, respectively.

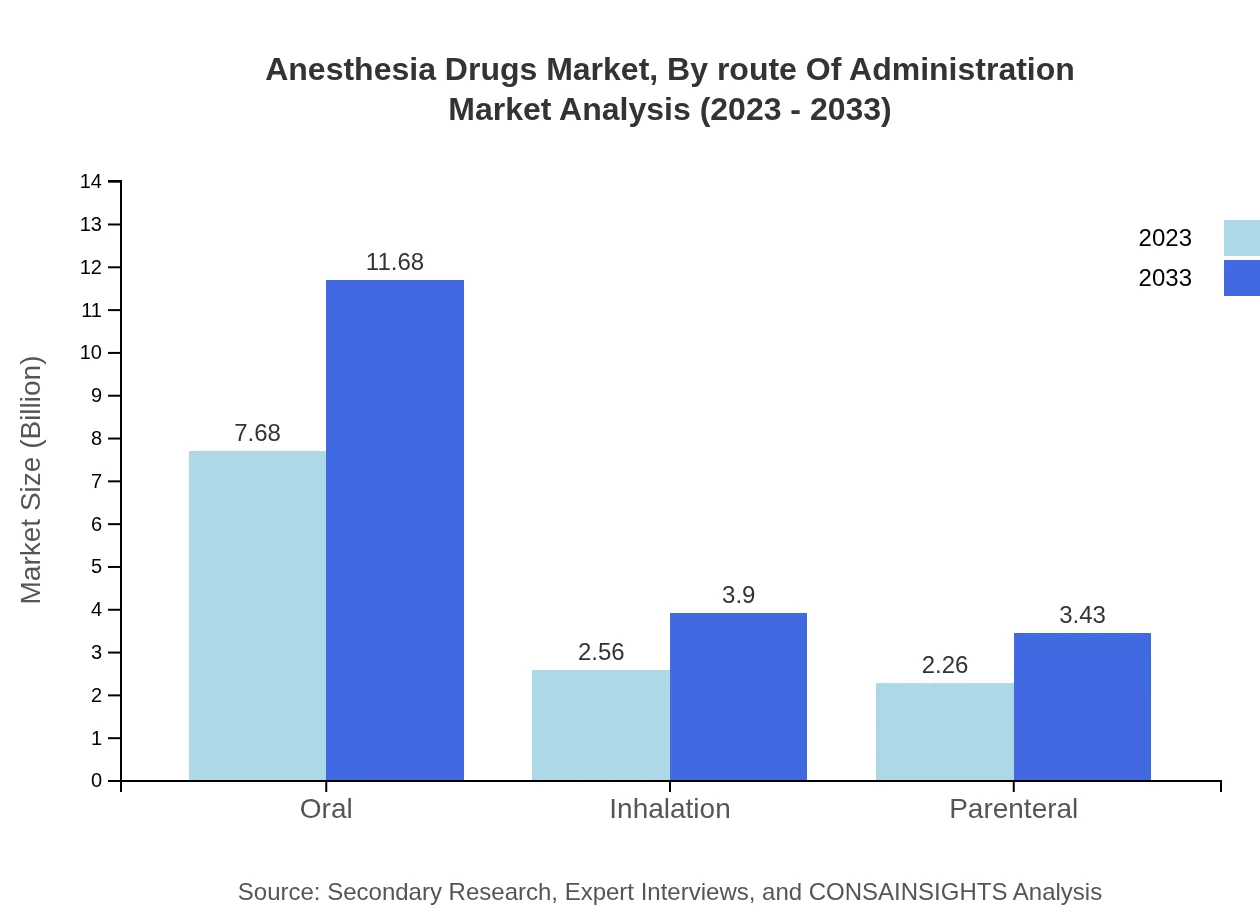

Anesthesia Drugs Market Analysis By Route Of Administration

When segmented by route of administration, inhalation methods dominate with significant market shares. Inhalation anesthesia is expected to see growth in both size and share, reflecting its effectiveness and widespread use across surgical procedures, while alternative routes like intranasal and transdermal are emerging as innovations aimed at improving patient comfort.

Anesthesia Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anesthesia Drugs Industry

Fresenius Kabi AG:

A leading player in the field of injectable anesthetics, Fresenius Kabi AG is renowned for its commitment to providing high-quality drugs and comprehensive healthcare solutions.Abbott Laboratories:

Abbott Laboratories is a major contributor to the anesthetic drugs market through its innovative formulations and healthcare technologies that improve surgical outcomes.Baxter International Inc.:

Baxter is dedicated to advancing surgical techniques and pain management solutions, offering a broad portfolio of anesthesia drugs.Hikma Pharmaceuticals:

Hikma Pharmaceuticals specializes in generic injectable anesthetics, significantly impacting the market through affordability and accessibility.We're grateful to work with incredible clients.

FAQs

What is the market size of anesthesia Drugs?

The global anesthesia drugs market is valued at approximately $12.5 billion in 2023, with a projected growth at a CAGR of 4.2%, expected to reach significant expansion by 2033, driven by increasing surgical procedures and anesthetic advancements.

What are the key market players or companies in the anesthesia Drugs industry?

Key players in the anesthesia drugs market include major pharmaceutical companies that specialize in anesthetics, such as Pfizer, Bristol-Myers Squibb, and AbbVie. These companies play a crucial role in innovation, production, and distribution within the industry.

What are the primary factors driving the growth in the anesthesia drugs industry?

The growth of the anesthesia drugs market is driven by advancements in technology, increasing surgical procedures, and a rise in the global geriatric population requiring surgeries. Additionally, the demand for pain management therapies boosts market expansion.

Which region is the fastest Growing in the anesthesia drugs market?

The Asia Pacific region is emerging as the fastest-growing market for anesthesia drugs, with the market size expected to grow from $2.49 billion in 2023 to $3.79 billion by 2033, driven by increasing healthcare investments and surgical demands.

Does ConsaInsights provide customized market report data for the anesthesia Drugs industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and inquiries in the anesthesia drugs industry, ensuring clients receive data relevant to their strategic planning and market analysis.

What deliverables can I expect from this anesthesia Drugs market research project?

Typical deliverables from the anesthesia drugs market research project include comprehensive market analysis reports, market forecasts, competitive landscape assessments, and detailed insights into regional and segment performance.

What are the market trends of anesthesia drugs?

Current trends in the anesthesia drugs market include a growing preference for minimally invasive surgical procedures, increased focus on patient safety, and the adoption of innovative drug formulations, enhancing efficacy and reducing side effects.