Anesthesia Gases Market Report

Published Date: 31 January 2026 | Report Code: anesthesia-gases

Anesthesia Gases Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Anesthesia Gases market, including market size, growth forecasts, industry trends, and regional insights from 2023 to 2033.

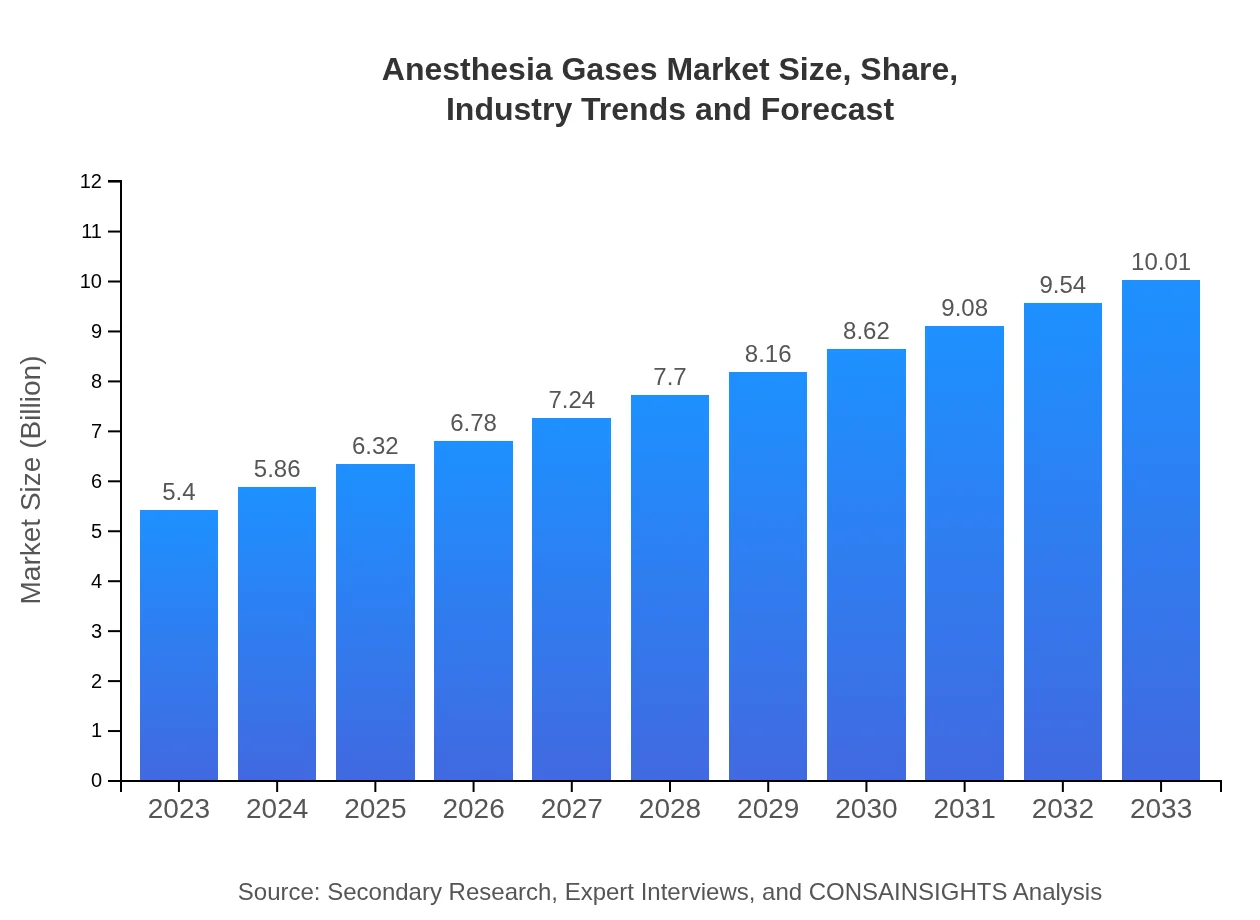

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.01 Billion |

| Top Companies | Abbott Laboratories, Baxter International Inc., Medtronic , Fresenius Kabi, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Anesthesia Gases Market Overview

Customize Anesthesia Gases Market Report market research report

- ✔ Get in-depth analysis of Anesthesia Gases market size, growth, and forecasts.

- ✔ Understand Anesthesia Gases's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anesthesia Gases

What is the Market Size & CAGR of Anesthesia Gases market in 2023?

Anesthesia Gases Industry Analysis

Anesthesia Gases Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anesthesia Gases Market Analysis Report by Region

Europe Anesthesia Gases Market Report:

Europe's Anesthesia Gases market was valued at $1.83 billion in 2023 and is forecasted to reach $3.39 billion by 2033. The stable healthcare infrastructure, government initiatives to enhance surgical capabilities and patient safety, and innovation in anesthetic practices are key factors driving growth in this region.Asia Pacific Anesthesia Gases Market Report:

In the Asia Pacific region, the Anesthesia Gases market was valued at $0.96 billion in 2023 and is expected to grow to $1.78 billion by 2033. Factors driving this growth include increasing healthcare investments, rising surgical volumes, and growing awareness about modern anesthetic practices. Countries like China and India are anticipated to lead the growth due to their substantial population and expanding healthcare infrastructure.North America Anesthesia Gases Market Report:

North America holds the largest market share, valued at $1.87 billion in 2023, expected to increase to $3.47 billion by 2033. The significant presence of healthcare facilities, advanced technology adoption, and a high volume of surgical procedures contribute to this robust growth. Additionally, the rising geriatric population requiring surgical interventions fuels market demand.South America Anesthesia Gases Market Report:

The South America Anesthesia Gases market is relatively smaller, with a value of $0.05 billion in 2023, projected to reach $0.09 billion by 2033. Growth in this region is driven by an improving healthcare system and increasing surgical interventions, although market expansion may be constrained by budgetary limitations and access to advanced medical technologies.Middle East & Africa Anesthesia Gases Market Report:

The Middle East and Africa market for Anesthesia Gases stood at $0.69 billion in 2023, with projections reaching $1.29 billion by 2033. An increasing emphasis on modern healthcare services and surgical procedures in emerging markets in this region is expected to drive growth, although challenges such as economic constraints may hinder substantial growth.Tell us your focus area and get a customized research report.

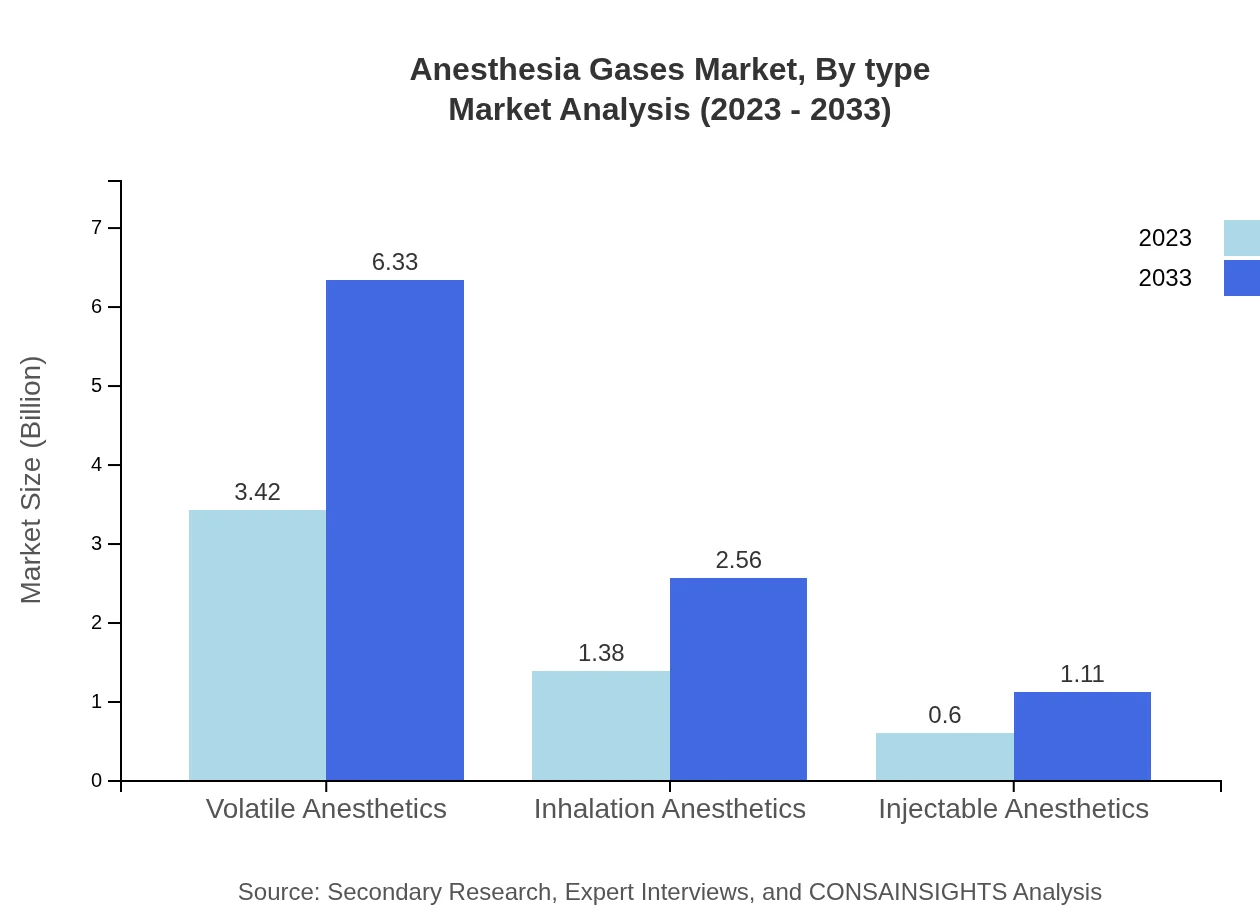

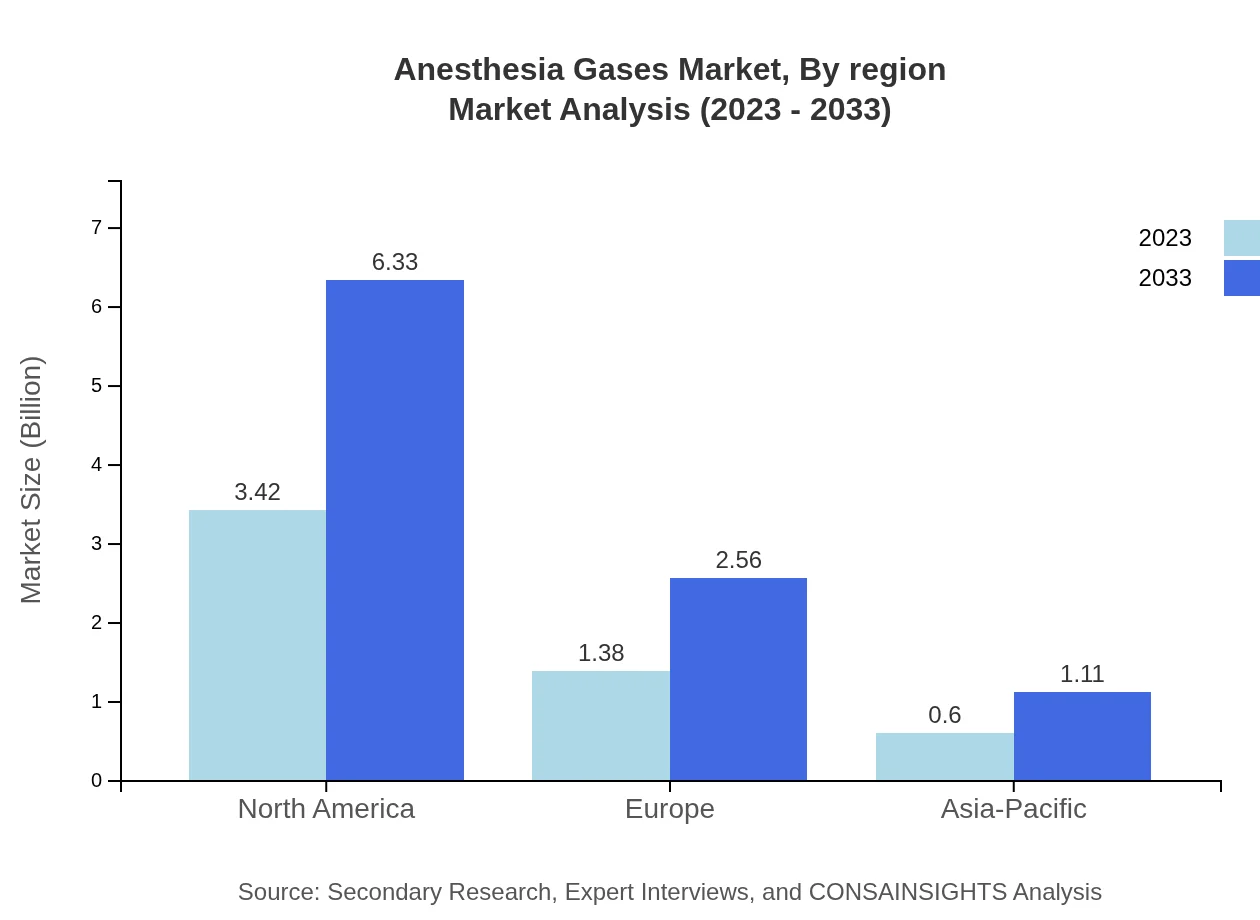

Anesthesia Gases Market Analysis By Type

The market by type shows that volatile anesthetics dominate with a market size of $3.42 billion in 2023, expected to grow to $6.33 billion by 2033, holding a 63.29% share. Inhalation anesthetics, valued at $1.38 billion in 2023, are projected to see growth to $2.56 billion by 2033, representing a 25.59% share. Injectable anesthetics have a market size of $0.60 billion in 2023, increasing to $1.11 billion by 2033, with an 11.12% share.

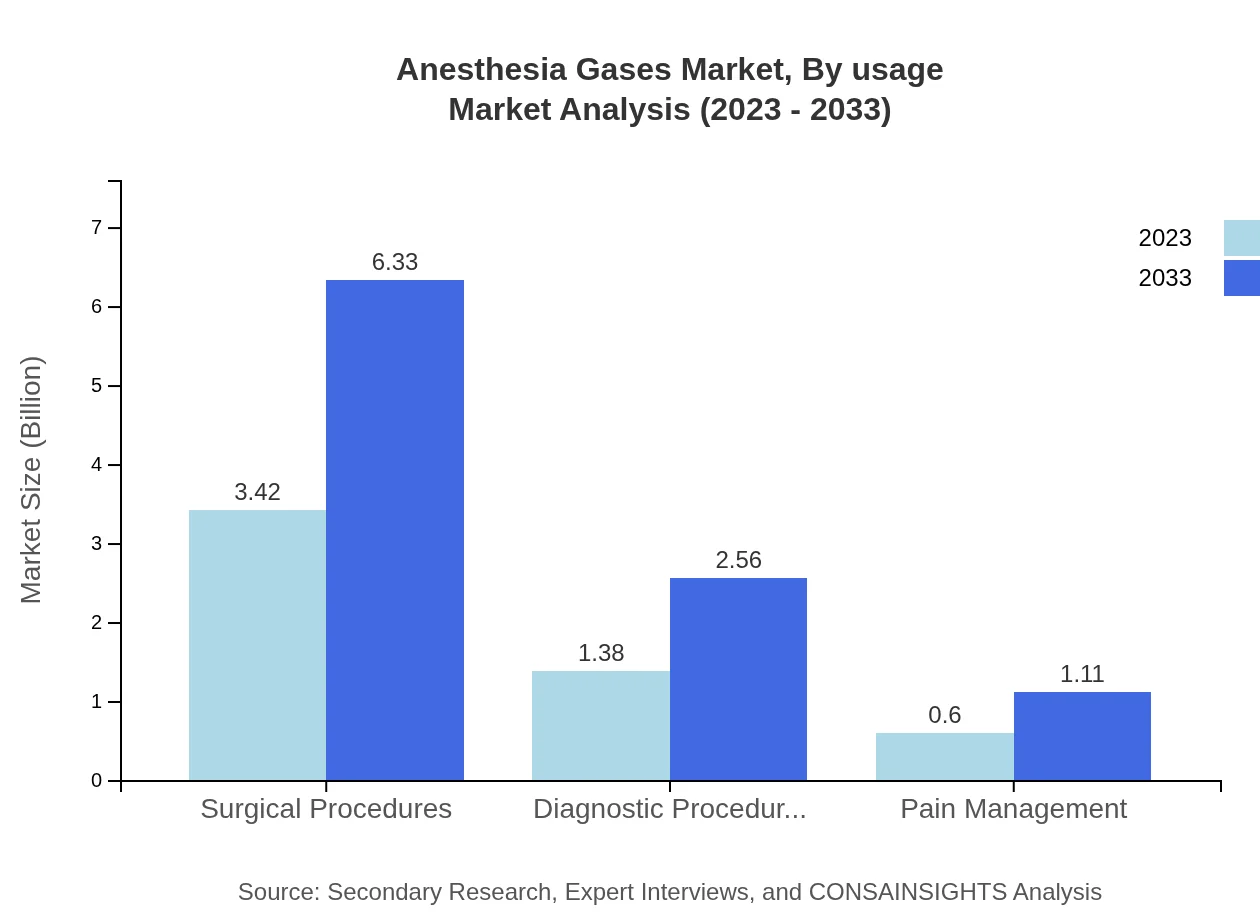

Anesthesia Gases Market Analysis By Usage

Surgical procedures account for the largest share in usage, with a market size of $3.42 billion in 2023, expected to rise to $6.33 billion by 2033, maintaining a 63.29% share. Diagnostic procedures hold a market size of $1.38 billion in 2023, growing to $2.56 billion by 2033, with a 25.59% share. Pain management represents a smaller segment with a market size of $0.60 billion in 2023 and projected to grow to $1.11 billion by 2033, equating to an 11.12% share.

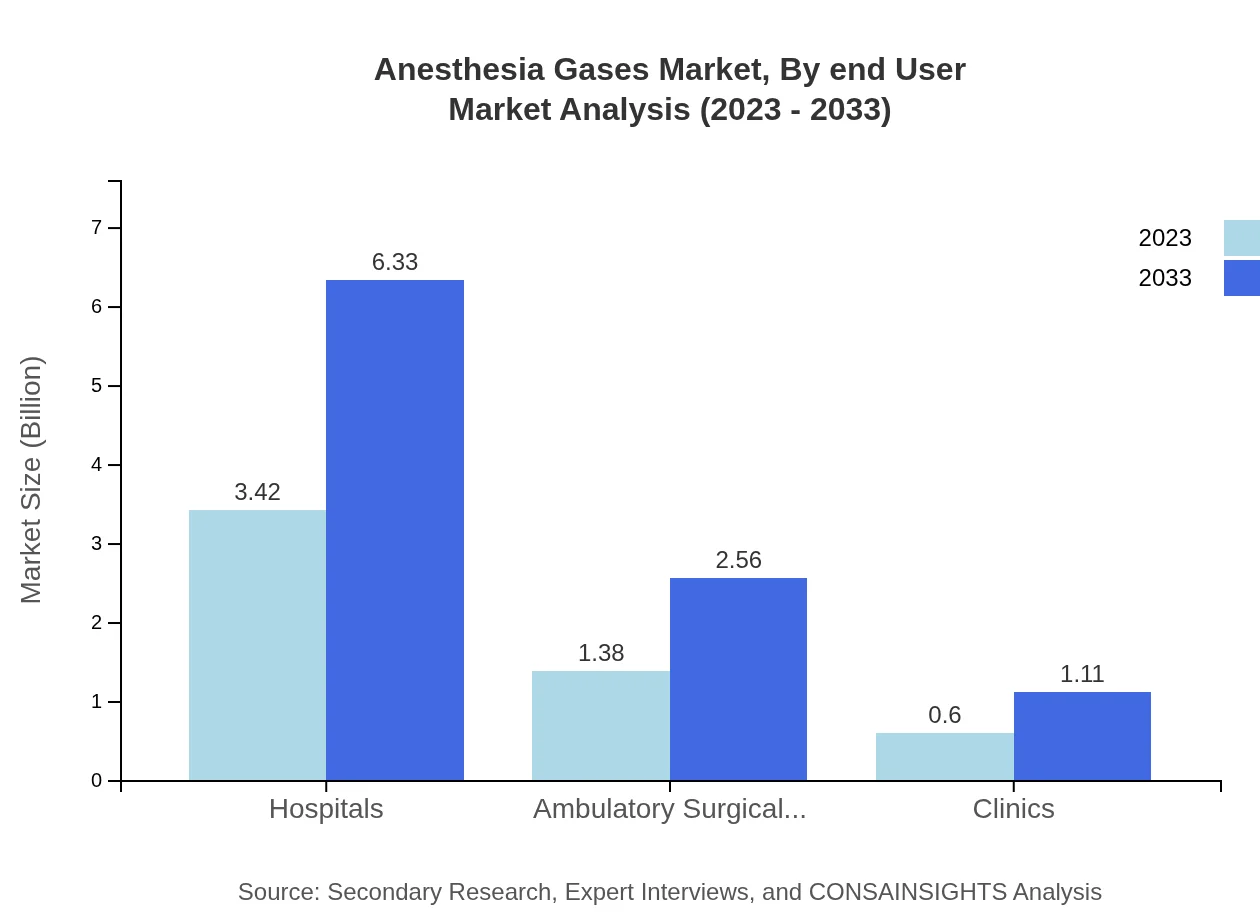

Anesthesia Gases Market Analysis By End User

Hospitals significantly lead the end-user segment with a market size of $3.42 billion in 2023, projected to reach $6.33 billion by 2033, maintaining a 63.29% share. Ambulatory surgical centers account for $1.38 billion in 2023, expected to rise to $2.56 billion by 2033, holding a 25.59% share. Clinics represent the smallest segment with a size of $0.60 billion in 2023, increasing to $1.11 billion by 2033, at an 11.12% share.

Anesthesia Gases Market Analysis By Region

Overall, the regional distribution shows North America leading with substantial market size, followed by Europe, while Asia Pacific is rapidly growing driven by increasing healthcare investments. South America and Middle East and Africa exhibit comparatively lower but positive growth trajectories.

Anesthesia Gases Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anesthesia Gases Industry

Abbott Laboratories:

Abbott is a key player in the anesthesia gas market, providing innovative solutions and a wide range of anesthetic agents to healthcare professionals.Baxter International Inc.:

Baxter offers a variety of anesthesia delivery systems and medication, focusing on improving patient outcomes and safety in surgical settings.Medtronic :

Medtronic is recognized for its advanced medical technologies, including anesthesia monitoring and delivery systems, contributing significantly to the market.Fresenius Kabi:

Fresenius Kabi manufactures a range of anesthetic substances, emphasizing quality and efficacy, and is an established player in the global market.GE Healthcare:

GE Healthcare provides advanced imaging and anesthesia delivery systems that enhance safety and improve surgical outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of anesthesia Gases?

The global anesthesia gases market is projected to reach $5.4 billion by 2033, growing at a CAGR of 6.2% from its current value in 2023.

What are the key market players or companies in this anesthesia gases industry?

Key players in the anesthesia gases market include major pharmaceutical and medical gas manufacturers that develop and supply various anesthesia gases for surgical procedures.

What are the primary factors driving the growth in the anesthesia gases industry?

Major factors driving growth include the increasing volume of surgical procedures, technological advancements in anesthesia delivery systems, and the rise in chronic disease prevalence requiring surgical interventions.

Which region is the fastest Growing in the anesthesia gases market?

The fastest-growing region is North America, where the market is expected to increase from $1.87 billion in 2023 to $3.47 billion by 2033. Following closely is Europe from $1.83 billion to $3.39 billion.

Does ConsaInsights provide customized market report data for the anesthesia gases industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the anesthesia gases industry, ensuring comprehensive insights and strategic recommendations.

What deliverables can I expect from this anesthesia gases market research project?

Deliverables include detailed market analysis reports, segmentation data, regional forecasts, competitive landscape assessments, and actionable insights tailored to the anesthesia gases market.

What are the market trends of anesthesia gases?

Current trends include an increased focus on safety and efficacy in anesthetic practices, innovations in gas delivery technologies, and a growing demand for tailored anesthetic protocols in diverse medical settings.