Angiographic Catheters Market Report

Published Date: 31 January 2026 | Report Code: angiographic-catheters

Angiographic Catheters Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Angiographic Catheters market, covering market trends, segmentation, regional insights, and forecasts from 2023 to 2033.

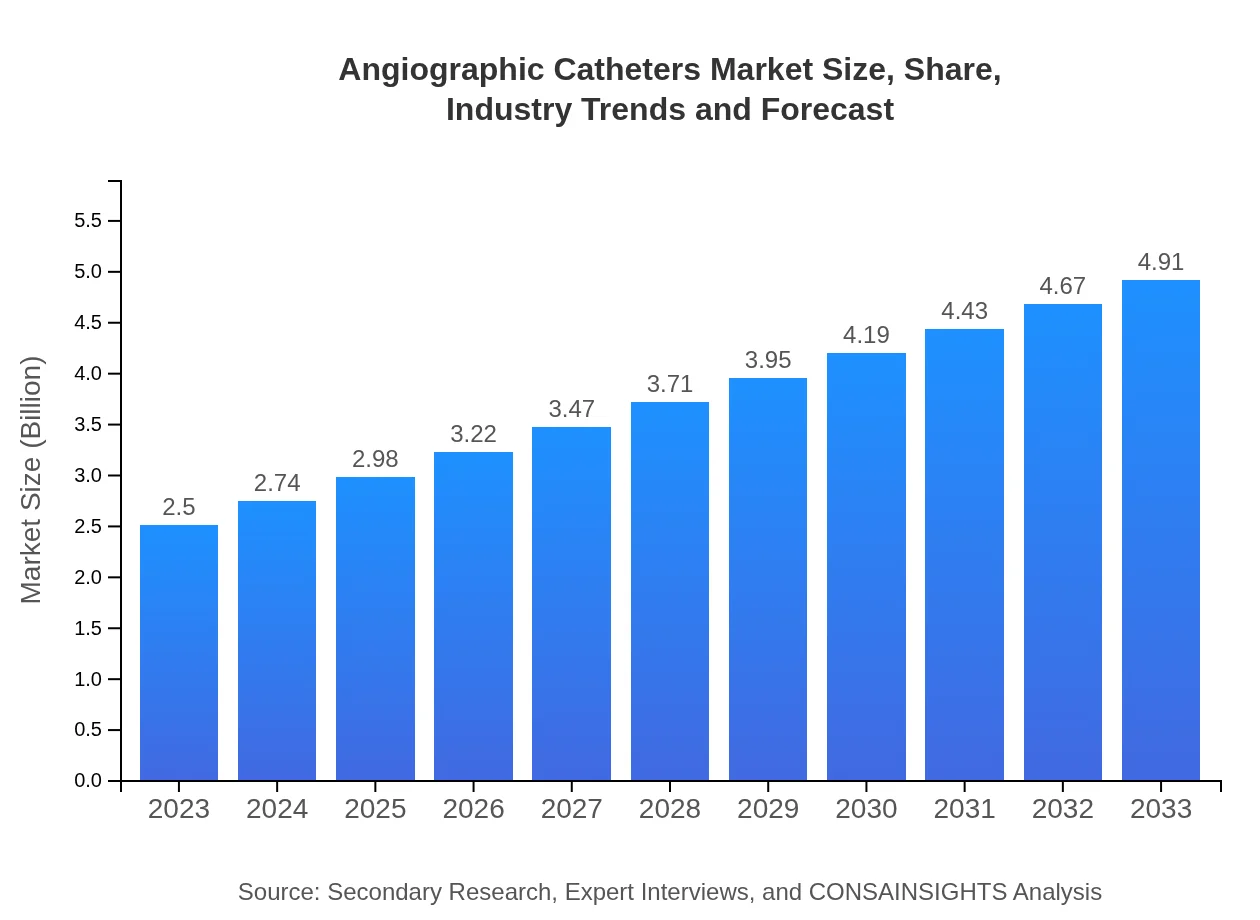

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Boston Scientific, Medtronic , Abbott Laboratories, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Angiographic Catheters Market Overview

Customize Angiographic Catheters Market Report market research report

- ✔ Get in-depth analysis of Angiographic Catheters market size, growth, and forecasts.

- ✔ Understand Angiographic Catheters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Angiographic Catheters

What is the Market Size & CAGR of Angiographic Catheters market in 2023?

Angiographic Catheters Industry Analysis

Angiographic Catheters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Angiographic Catheters Market Analysis Report by Region

Europe Angiographic Catheters Market Report:

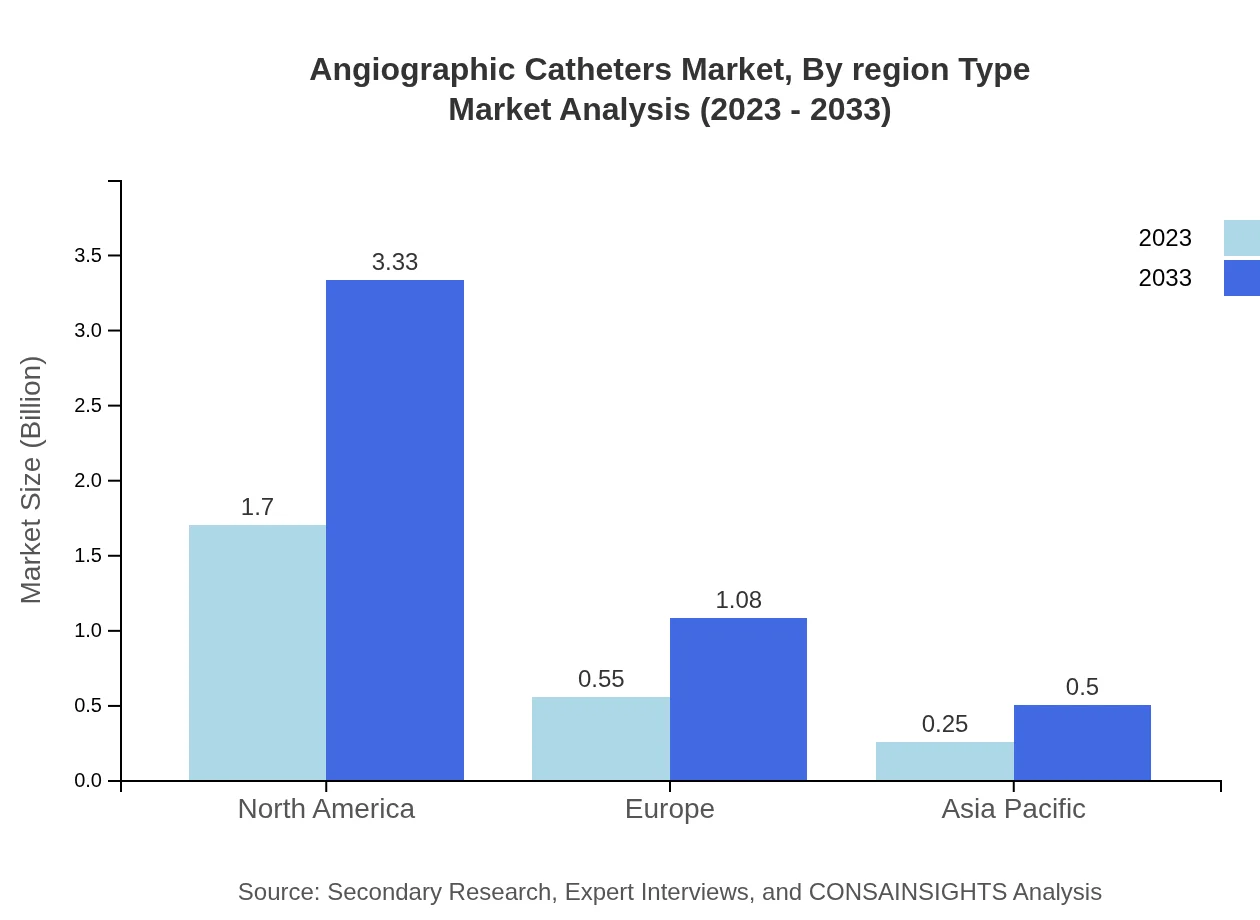

Europe's market for Angiographic Catheters is anticipated to expand from $0.62 billion in 2023 to $1.22 billion in 2033, driven by a well-established medical infrastructure and a rising geriatric population necessitating various vascular interventions.Asia Pacific Angiographic Catheters Market Report:

The Asia Pacific region is poised for significant growth, with the market projected to increase from $0.49 billion in 2023 to $0.95 billion by 2033. This growth is fueled by a rising prevalence of cardiovascular diseases and expanding healthcare infrastructure.North America Angiographic Catheters Market Report:

North America leads the market, with a current size of $0.94 billion expected to grow to $1.84 billion by 2033. The presence of key market players, coupled with high healthcare expenditure, guarantees strong market development in this region.South America Angiographic Catheters Market Report:

South America shows a modest market size increase from $0.23 billion in 2023 to $0.45 billion in 2033. However, challenges such as economic fluctuations and limited access to advanced medical technologies may hinder faster growth in this region.Middle East & Africa Angiographic Catheters Market Report:

In the Middle East and Africa, the market size is projected to increase from $0.23 billion in 2023 to $0.45 billion by 2033. Growth in this region is largely contingent upon improving healthcare facilities and rising awareness of advanced surgical techniques.Tell us your focus area and get a customized research report.

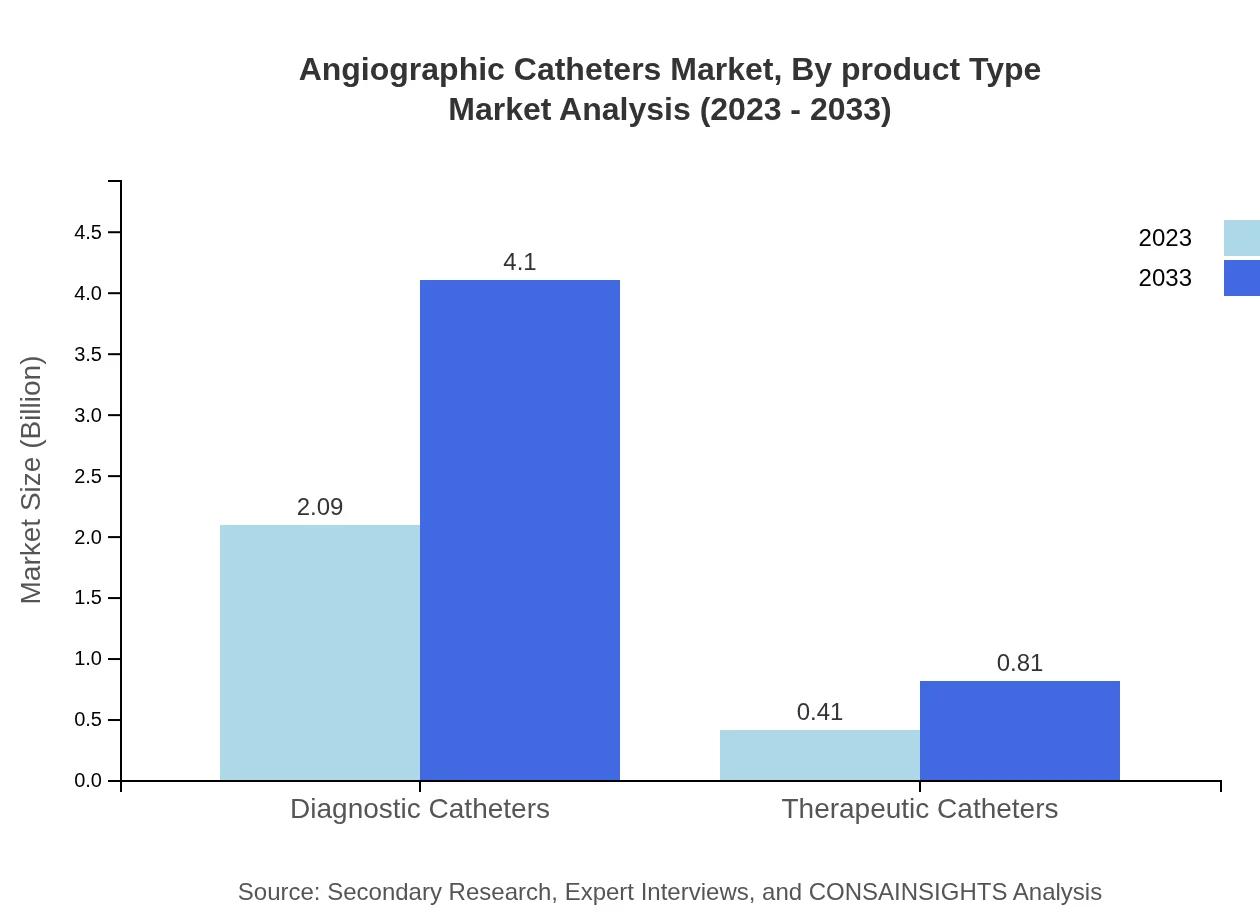

Angiographic Catheters Market Analysis By Product Type

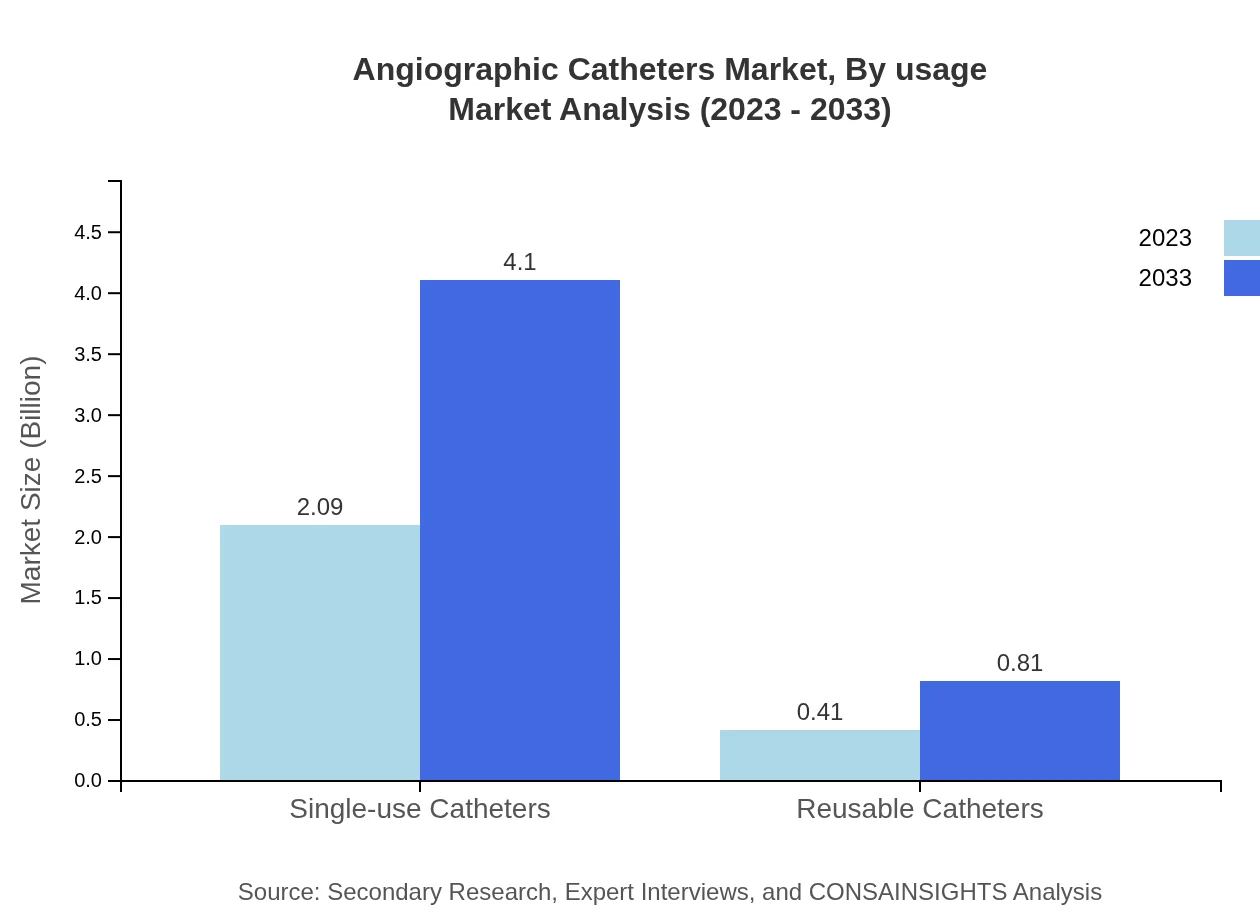

Single-use catheters dominate the Angiographic Catheters market, with a size of $2.09 billion in 2023 projected to grow to $4.10 billion by 2033, maintaining an 83.45% market share due to enhanced safety. Reusable catheters, though representing a smaller segment, are also projected to grow from $0.41 billion to $0.81 billion, accounting for 16.55% share due to cost-effectiveness in certain applications.

Angiographic Catheters Market Analysis By Usage

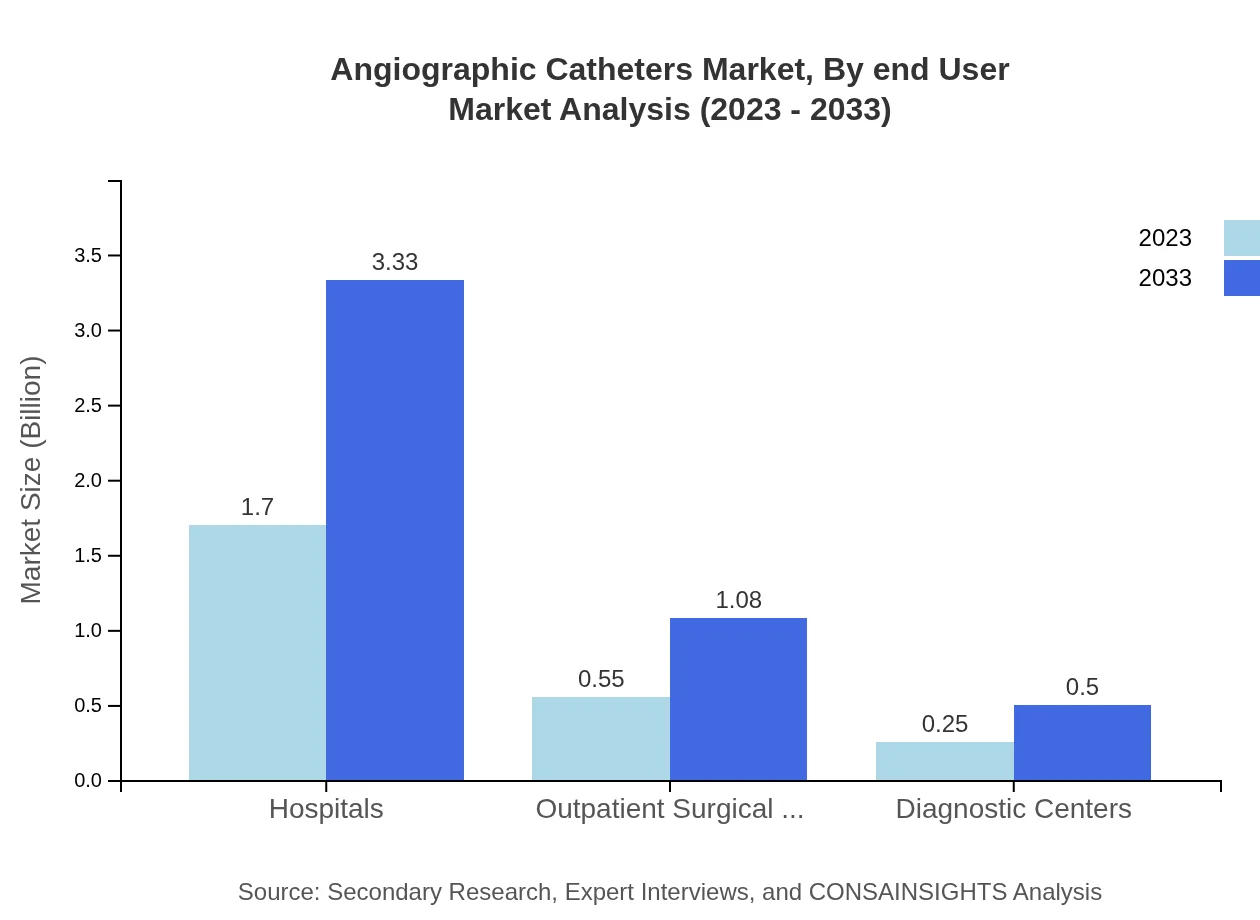

By usage, the Hospitals segment leads the market, currently valued at $1.70 billion in 2023, expected to reach $3.33 billion by 2033 with a share of 67.85%, driven by increasing patient visits. Outpatient surgical centers are evolving rapidly, growing from $0.55 billion in 2023 to $1.08 billion by 2033, while diagnostic centers will double from $0.25 billion to $0.50 billion, highlighting evolving healthcare delivery models.

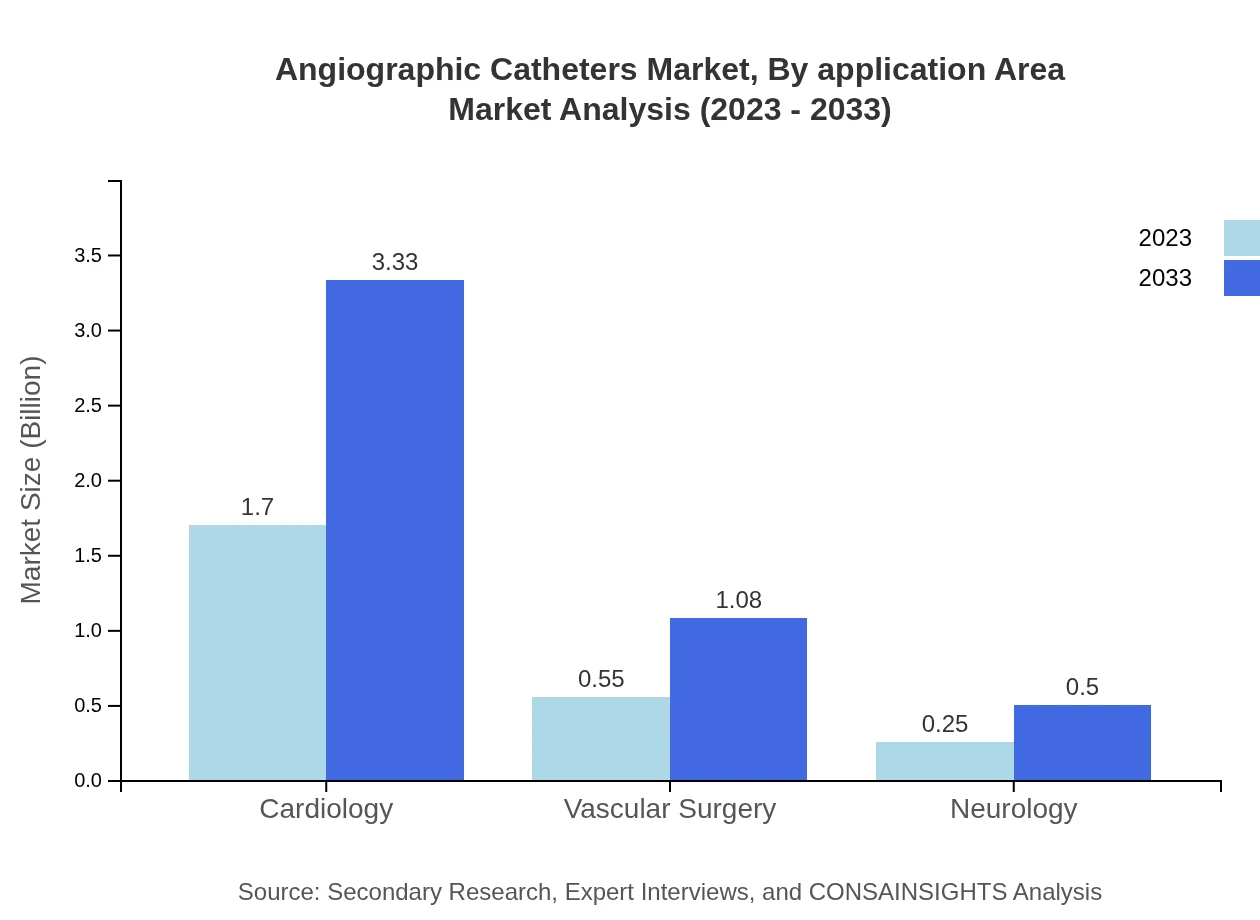

Angiographic Catheters Market Analysis By Application Area

The cardiology segment remains the largest application area for Angiographic Catheters, projected to grow from $1.70 billion in 2023 to $3.33 billion by 2033, reflecting the rising incidence of cardiac disorders. Vascular surgery will also see growth from $0.55 billion to $1.08 billion, maintaining a steady share, and neurology is expected to parallel these trends, indicating broader applications of angiographic technology.

Angiographic Catheters Market Analysis By End User

Hospitals continue to dominate as end-users, heralding a market increase from $1.70 billion to $3.33 billion in 2033. Outpatient centers are gradually increasing their share as well, indicating a shift towards outpatient surgical procedures. The sector is expanding its footprint in advanced diagnostics and minimally invasive surgical interventions.

Angiographic Catheters Market Analysis By Region Type

Regional dynamics indicate differing growth trajectories, with North America holding the primary share, followed by Europe and Asia Pacific. Each region’s dynamics are shaped by local healthcare policies, economic factors, and demographic profiles influencing the adoption of angiographic technologies.

Angiographic Catheters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Angiographic Catheters Industry

Boston Scientific:

A leader in medical devices, Boston Scientific provides innovative solutions to meet the needs of patients and healthcare providers worldwide.Medtronic :

Medtronic is a global leader in medical technology, committed to alleviating pain, restoring health, and extending life for millions of people around the world.Abbott Laboratories:

Abbott is a healthcare company with a wide-ranging portfolio in diagnostics, medical devices, nutrition, and branded generic pharmaceuticals.Terumo Corporation:

Terumo Corporation specializes in medical technology and has a strong presence in the fields of cardiovascular and operative surgery.We're grateful to work with incredible clients.

FAQs

What is the market size of angiographic catheters?

The angiographic catheters market is estimated to be valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.8%, indicating strong growth potential leading up to 2033.

What are the key market players or companies in the angiographic catheters industry?

Key players in the angiographic catheters market include major medical device manufacturers that specialize in cardiovascular products, leading to competitive advancements in technology and product offerings.

What are the primary factors driving the growth in the angiographic catheters industry?

Key factors driving growth in the angiographic catheters market include an increase in cardiovascular diseases, technological advancements in catheterization, and growing healthcare expenditure in emerging markets.

Which region is the fastest Growing in the angiographic catheters market?

The fastest-growing region in the angiographic catheters market is North America, projected to expand from $0.94 billion in 2023 to $1.84 billion by 2033, showcasing robust market development.

Does ConsaInsights provide customized market report data for the angiographic catheters industry?

Yes, ConsaInsights offers customized market report data for the angiographic catheters industry, allowing clients to obtain tailored insights and actionable information specific to their business needs.

What deliverables can I expect from this angiographic catheters market research project?

Deliverables from the angiographic catheters market research project typically include detailed reports, market analysis, trends, forecasts, and competitive landscape assessments, providing valuable insights.

What are the market trends of angiographic catheters?

Current trends in the angiographic catheters market include the increased adoption of single-use catheters, advancements in minimally invasive procedures, and the rising demand for efficient diagnostic tools.