Angiography Equipment Market Report

Published Date: 31 January 2026 | Report Code: angiography-equipment

Angiography Equipment Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report on Angiography Equipment analyzes the current landscape, forecasts future growth, and presents insights into key product segments and regional performance from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

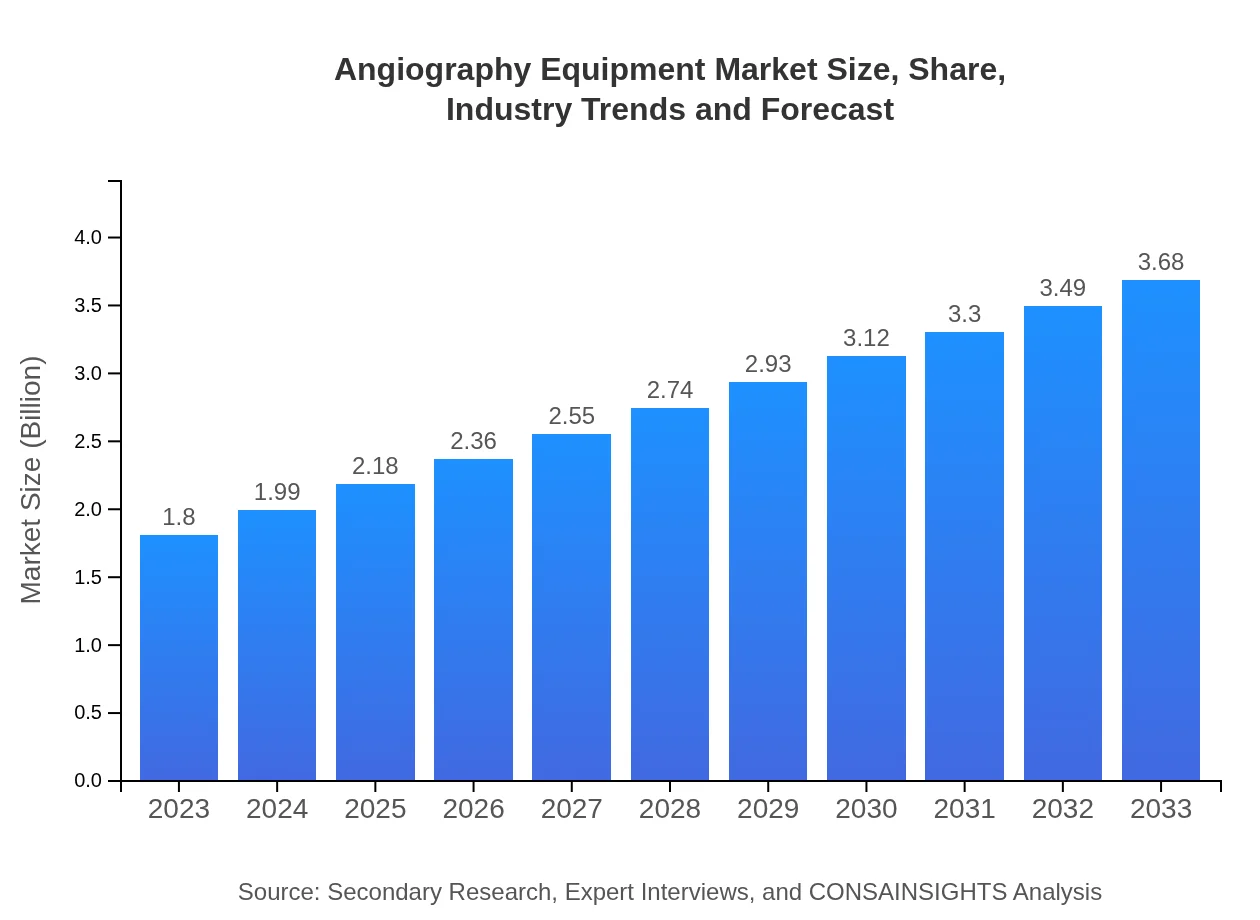

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.68 Billion |

| Top Companies | Siemens Healthineers, Philips Healthcare, GE Healthcare, Canon Medical Systems, Medtronic |

| Last Modified Date | 31 January 2026 |

Angiography Equipment Market Overview

Customize Angiography Equipment Market Report market research report

- ✔ Get in-depth analysis of Angiography Equipment market size, growth, and forecasts.

- ✔ Understand Angiography Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Angiography Equipment

What is the Market Size & CAGR of Angiography Equipment market in 2023?

Angiography Equipment Industry Analysis

Angiography Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Angiography Equipment Market Analysis Report by Region

Europe Angiography Equipment Market Report:

Europe’s market is projected to expand from $0.62 billion in 2023 to $1.27 billion by 2033, fueled by increasing demand for advanced healthcare technologies and the rising prevalence of cardiovascular diseases among the aging population.Asia Pacific Angiography Equipment Market Report:

The Asia Pacific region is expected to witness steady growth in the Angiography Equipment market, projected to expand from $0.34 billion in 2023 to $0.70 billion by 2033. Factors contributing to this growth include increased healthcare spending, rising prevalence of chronic diseases, and the expansion of healthcare facilities in emerging economies.North America Angiography Equipment Market Report:

North America is leading the market with significant anticipated growth from $0.60 billion in 2023 to $1.23 billion by 2033. This growth is driven by technological advancements, high healthcare spending, and the presence of leading market players investing in innovative angiography solutions.South America Angiography Equipment Market Report:

The South America market faces challenges, with a projected decline from -$0.01 billion in 2023 to -$0.02 billion by 2033. This reduction indicates fewer investments in advanced healthcare technologies and market consolidation as hospitals re-evaluate their operational costs amid economic instability.Middle East & Africa Angiography Equipment Market Report:

The Middle East and Africa region are expected to grow from $0.25 billion in 2023 to $0.51 billion by 2033 due to improving healthcare infrastructure and increased investments from both public and private sectors in diagnostic imaging.Tell us your focus area and get a customized research report.

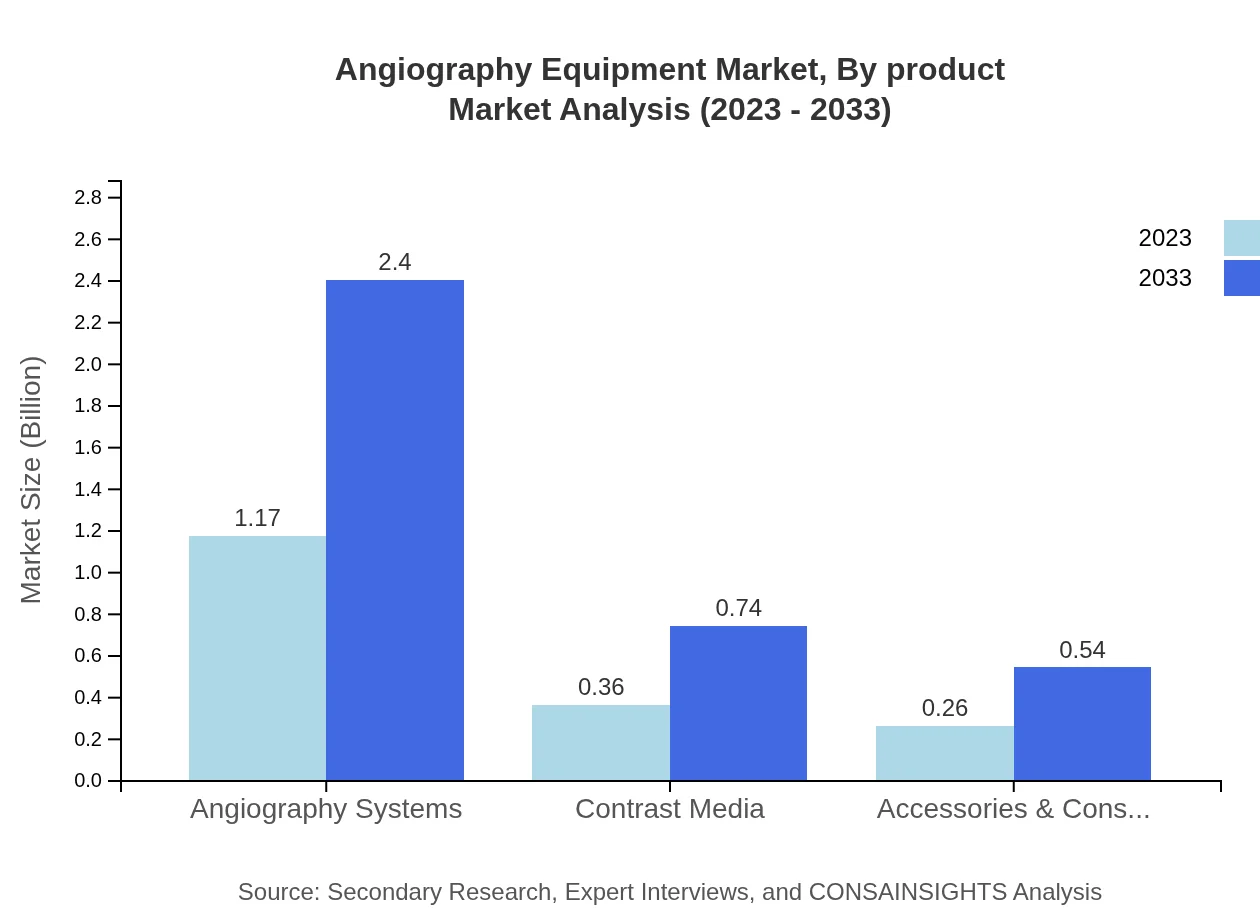

Angiography Equipment Market Analysis By Product

In terms of product segmentation, Angiography Systems dominate the market size, reaching $1.17 billion in 2023 and projected to grow to $2.40 billion by 2033. Contrast Media follows with a market size of $0.36 billion, expected to grow to $0.74 billion. Accessories & Consumables contribute significantly as well, approaching $0.26 billion in 2023 and $0.54 billion by 2033, supporting various angiography procedures.

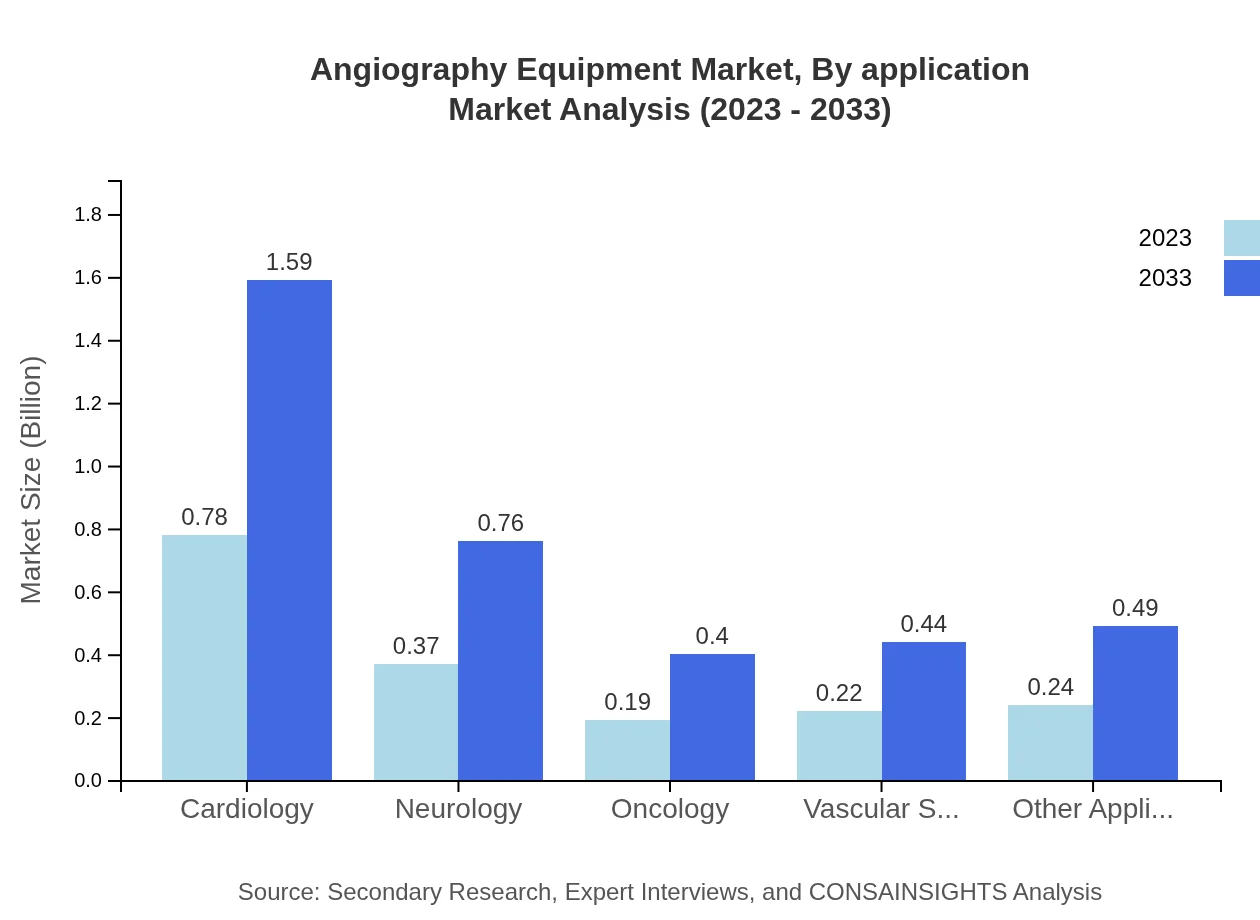

Angiography Equipment Market Analysis By Application

The application segment showcases the significance of cardiology, which leads with a market size of $0.78 billion in 2023, expected to grow to $1.59 billion. Neurology and oncology are also important, with sizes of $0.37 billion and $0.19 billion respectively in 2023. These applications highlight the crucial role of angiography in the treatment of various conditions.

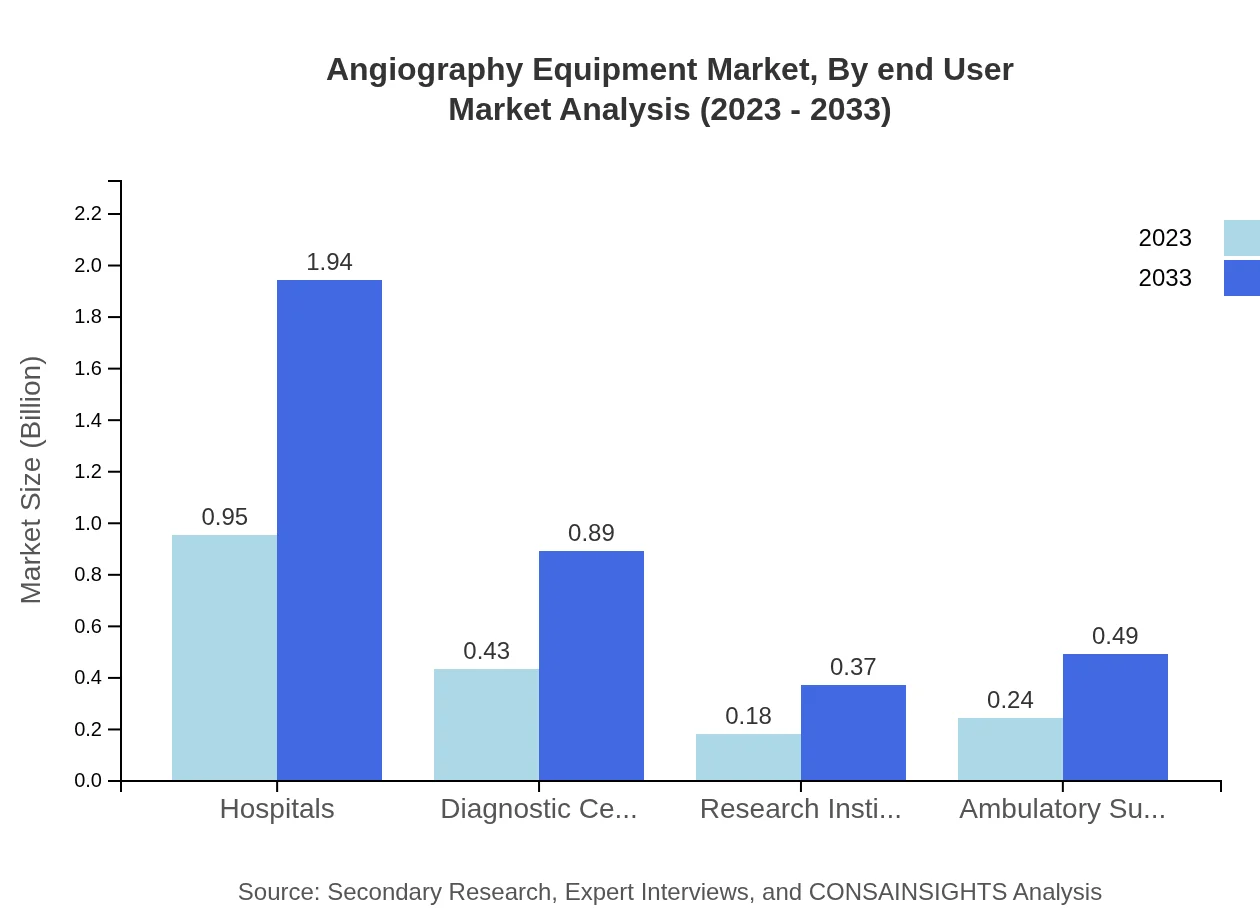

Angiography Equipment Market Analysis By End User

Hospitals dominate the end-user segment with a market size of $0.95 billion in 2023, projected to grow to $1.94 billion. Diagnostic Centers and Research Institutes also play a role, contributing significantly with $0.43 billion and $0.18 billion in 2023, supported by an increasing number of minimally invasive procedures across the healthcare sector.

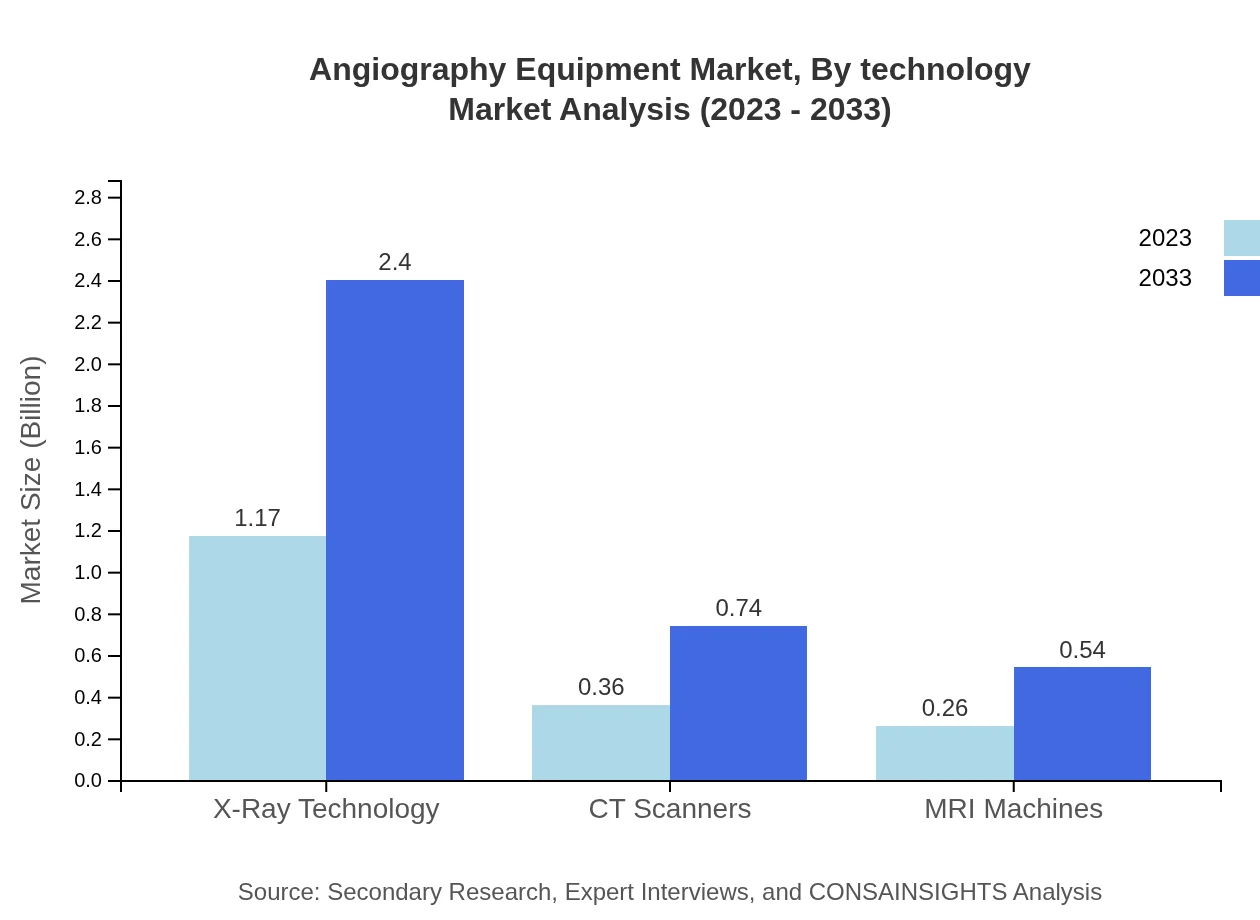

Angiography Equipment Market Analysis By Technology

Technological advancements shape the Angiography Equipment market, with X-ray technology leading the segment at $1.17 billion in 2023, expected to reach $2.40 billion by 2033. CT Scanners and MRI Machines also contribute meaningfully, enhancing the diagnostic capabilities of angiography systems.

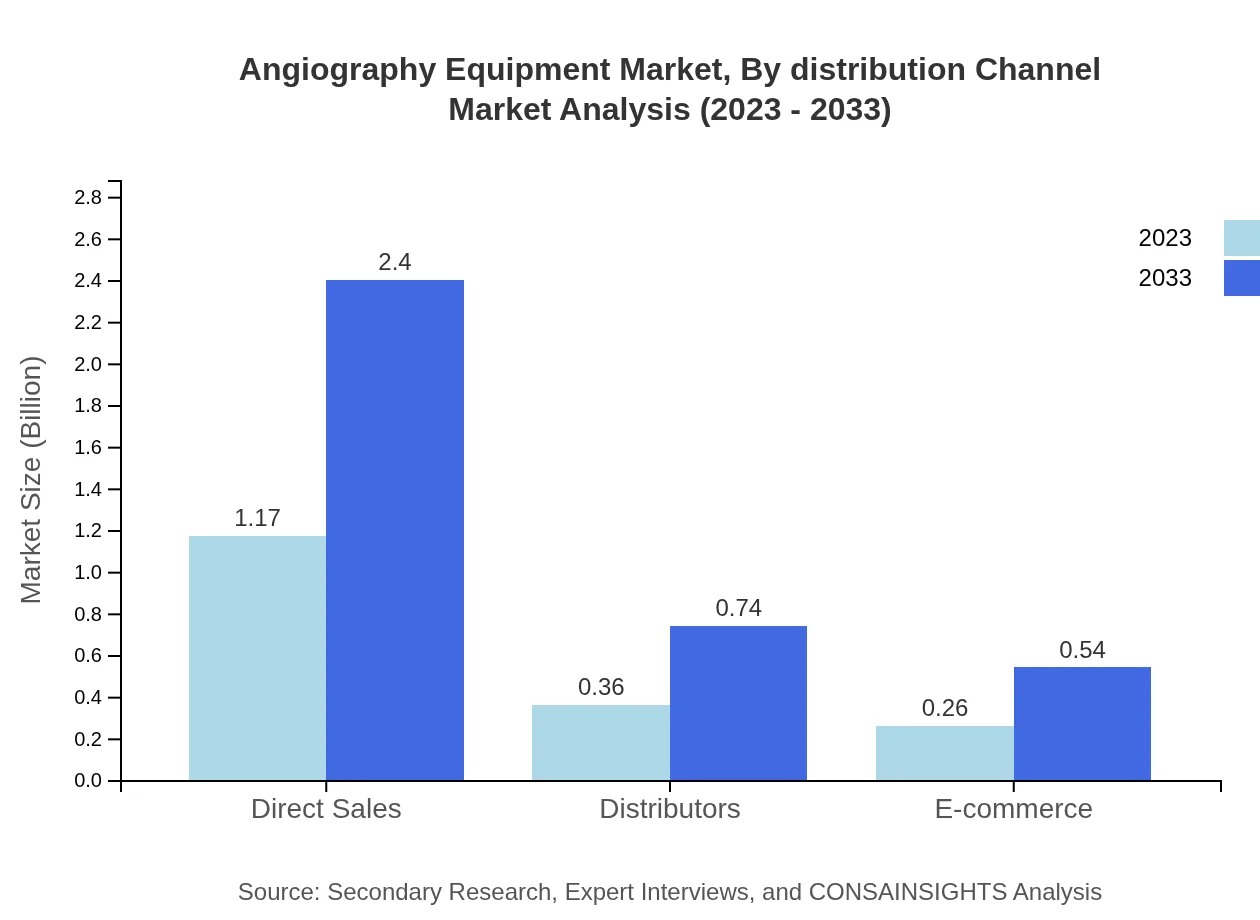

Angiography Equipment Market Analysis By Distribution Channel

Regarding distribution channels, direct sales are prevalent, accounting for $1.17 billion in 2023, with growth expected to continue. Distributors and e-commerce channels are also vital, offering increasing accessibility to healthcare providers and supporting the market's overall expansion.

Angiography Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Angiography Equipment Industry

Siemens Healthineers:

A leader in medical imaging technology, Siemens Healthineers focuses on innovation in imaging systems, enhancing diagnostic capabilities in angiography.Philips Healthcare:

Philips Healthcare is known for its advanced diagnostic imaging solutions, constantly pushing the boundaries of angiography technology with a focus on patient care.GE Healthcare:

GE Healthcare offers a diverse range of imaging solutions, leading the market with state-of-the-art angiography equipment that integrates advanced imaging techniques.Canon Medical Systems:

Canon Medical Systems specializes in high-quality imaging modalities and innovative technologies for diagnostic imaging in angiography.Medtronic :

Medtronic is a prominent player in cardiovascular therapies, offering products that enhance angiography procedures and overall patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of angiography equipment?

The angiography equipment market is currently valued at approximately $1.8 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching significant growth by 2033. This growth is attributed to advancements in technology and increasing healthcare demands.

What are the key market players or companies in the angiography equipment industry?

Key players in the angiography equipment market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems. These companies contribute significantly to market advancements through innovative research and development in imaging technology and patient care solutions.

What are the primary factors driving the growth in the angiography equipment industry?

The growth of the angiography equipment market is primarily driven by rising incidences of cardiovascular diseases, technological advancements in imaging, increased healthcare spending, and a growing number of diagnostic centers that adopt angiography for patient diagnostics and treatment.

Which region is the fastest Growing in the angiography equipment market?

The Asia Pacific region is the fastest-growing market for angiography equipment, with a market size projected to increase from $0.34 billion in 2023 to $0.70 billion by 2033, driven by increasing investments in healthcare infrastructure and rising patient awareness.

Does ConsaInsights provide customized market report data for the angiography equipment industry?

Yes, ConsaInsights offers customized market reports for the angiography equipment industry. These reports are tailored to meet specific client needs, with insights into niche markets, region-specific data, and detailed analysis of competitive landscapes.

What deliverables can I expect from this angiography equipment market research project?

Deliverables from the angiography equipment market research project include detailed market analysis reports, competitor profiling, regional market assessments, growth forecasts, and insights into market trends and consumer behavior, enabling informed decision-making.

What are the market trends of angiography equipment?

Current trends in the angiography equipment market include an increasing shift towards minimally invasive procedures, advancements in imaging technology, integration of AI in diagnostics, and a growing demand for portable and advanced angiography systems.