Aniline Market Report

Published Date: 02 February 2026 | Report Code: aniline

Aniline Market Size, Share, Industry Trends and Forecast to 2033

This detailed report provides insights into the Aniline market from 2023 to 2033, covering market size, trends, industry analysis, regional performance, and forecasts. It also explores market segmentation, leading players, and emerging technologies that are shaping the future of the Aniline industry.

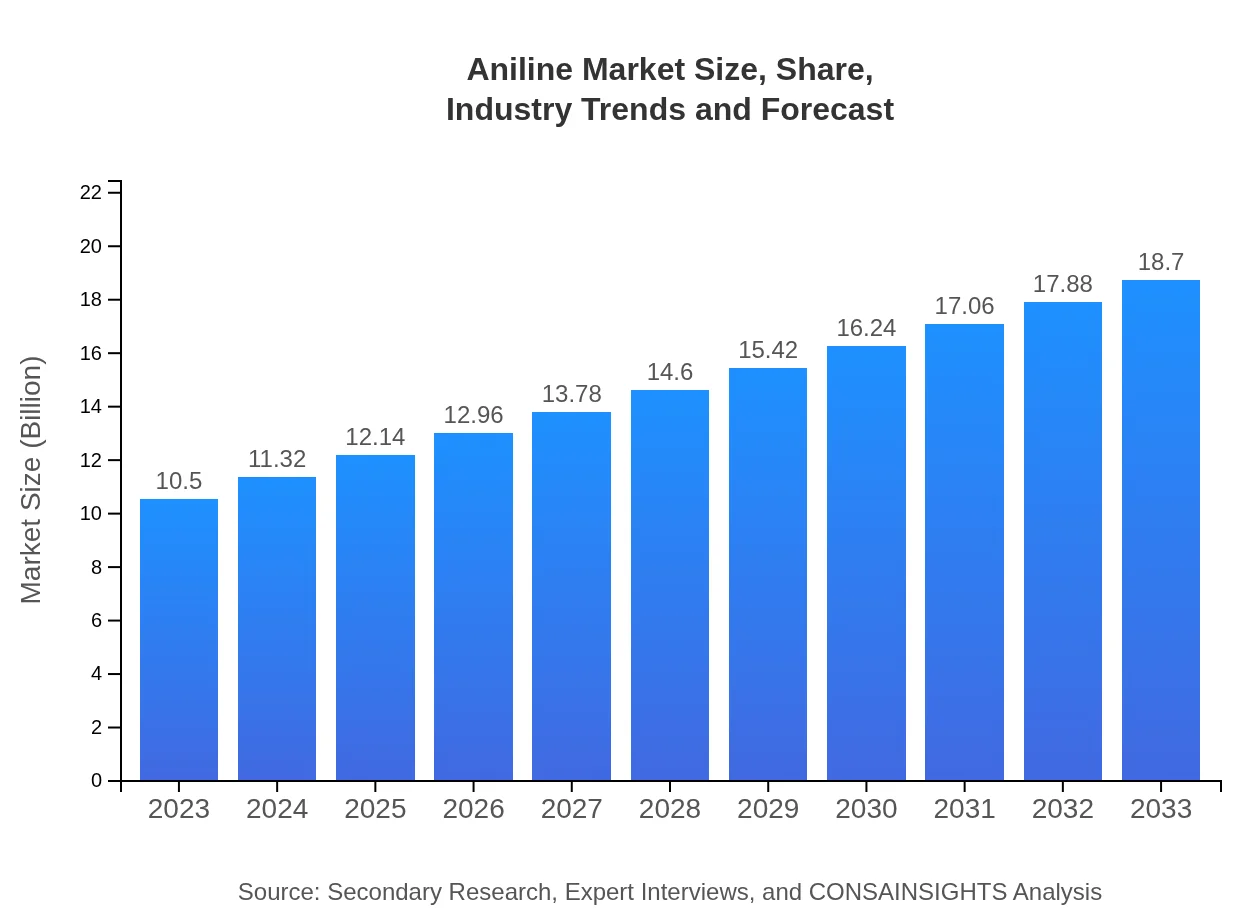

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | BASF, Huntsman Corporation, Lanxess AG, Dow Chemical Company |

| Last Modified Date | 02 February 2026 |

Aniline Market Overview

Customize Aniline Market Report market research report

- ✔ Get in-depth analysis of Aniline market size, growth, and forecasts.

- ✔ Understand Aniline's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aniline

What is the Market Size & CAGR of Aniline market in 2023?

Aniline Industry Analysis

Aniline Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aniline Market Analysis Report by Region

Europe Aniline Market Report:

The European Aniline market is forecasted to grow from $2.76 billion in 2023 to $4.91 billion by 2033. The region is characterized by stringent regulatory frameworks focusing on environmental impacts, driving innovation in production methods.Asia Pacific Aniline Market Report:

The Asia Pacific region is a major hub for Aniline production and consumption, projected to grow from $2.03 billion in 2023 to $3.62 billion by 2033. The expansion in this region is primarily driven by robust industrial growth in countries like China and India, alongside increasing demand for textiles and automotive components.North America Aniline Market Report:

North America is anticipated to see significant growth, with market size rising from $3.85 billion in 2023 to $6.86 billion by 2033. This growth is supported by advancements in production technologies and the presence of established end-use industries like pharmaceuticals and automotive.South America Aniline Market Report:

In South America, the Aniline market is expected to increase from $0.86 billion in 2023 to $1.54 billion in 2033. The growth is attributed to rising agricultural applications and expanding manufacturing sectors, with a focus on sustainable chemical production methods.Middle East & Africa Aniline Market Report:

The Middle East and Africa market is projected to expand from $0.99 billion in 2023 to $1.77 billion by 2033. Growth potential lies in tapping into emerging economies, with increasing investments in industrial sectors and chemical manufacturing.Tell us your focus area and get a customized research report.

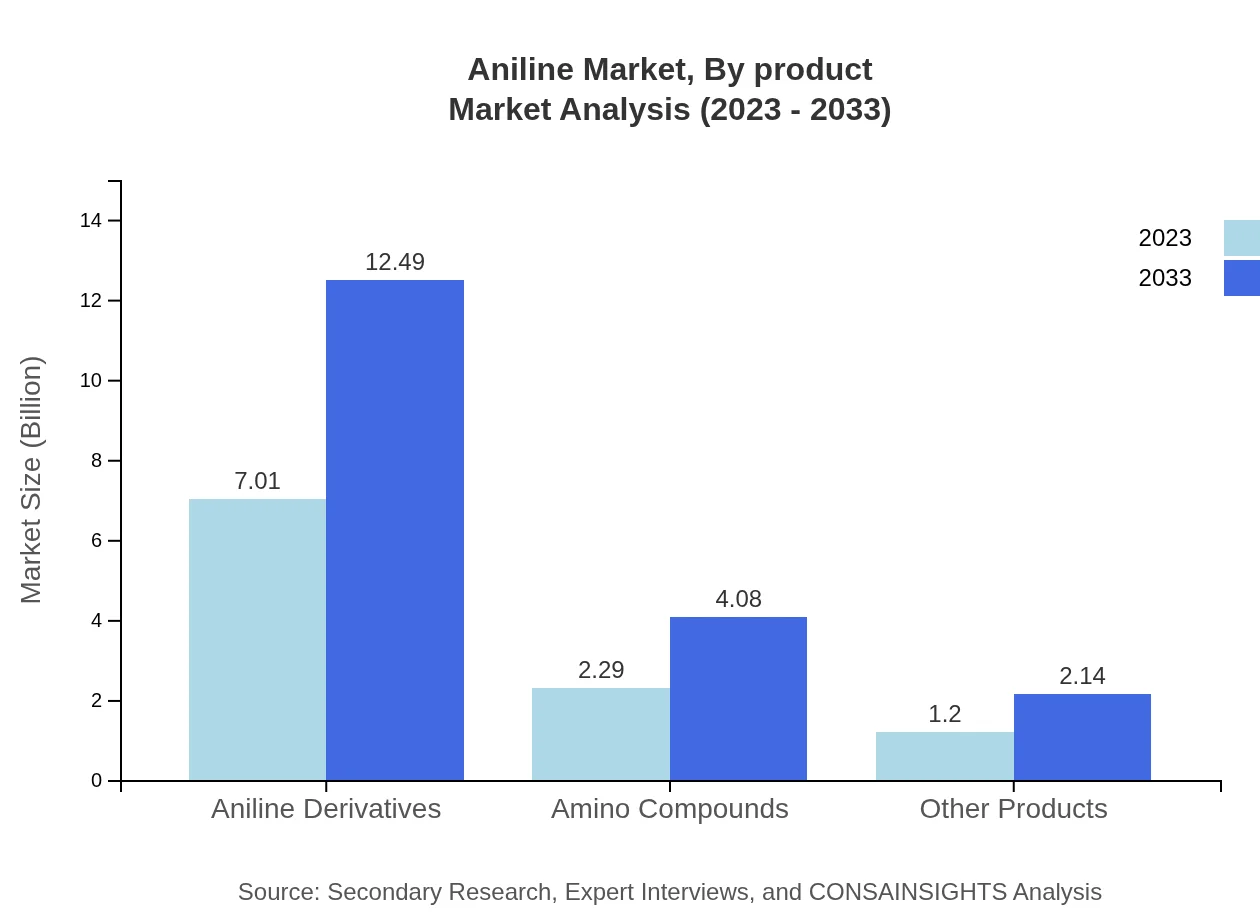

Aniline Market Analysis By Product

Aniline Derivatives dominate the market, valued at $7.01 billion in 2023, projected to reach $12.49 billion by 2033, holding a significant market share of 66.77%. Amino Compounds account for 21.79% of the market at $2.29 billion in 2023, growing to $4.08 billion by 2033. Other products such as Textiles and Rubber contribute significantly to overall market dynamics, indicating diverse applications and end-use sectors.

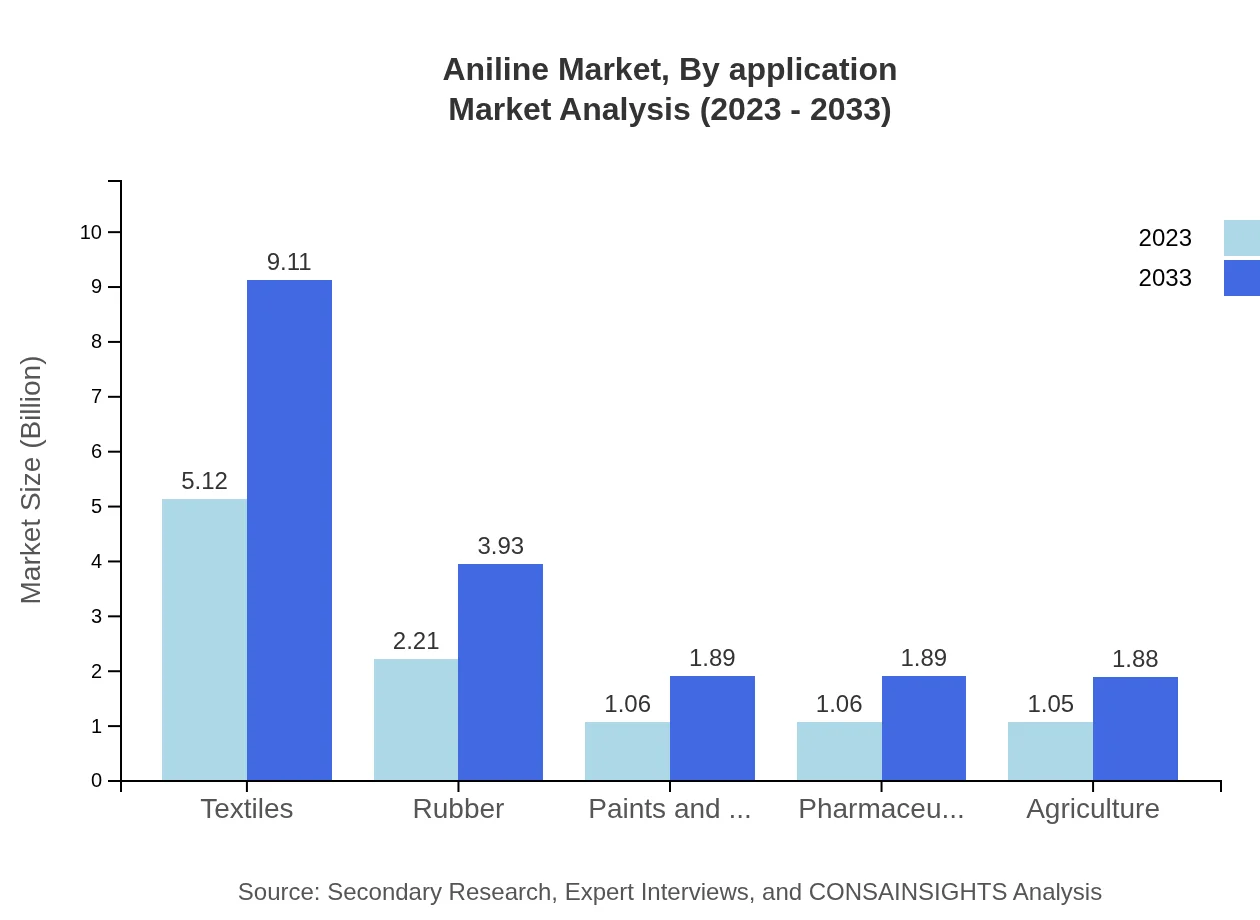

Aniline Market Analysis By Application

In terms of applications, the Textiles sector is a major consumer of Aniline, valued at $5.12 billion in 2023, expected to reach $9.11 billion by 2033, holding a market share of 48.72%. Other applications such as Automotive and Pharmaceuticals also show substantial market presence, reflecting the versatility of Aniline across various industry sectors.

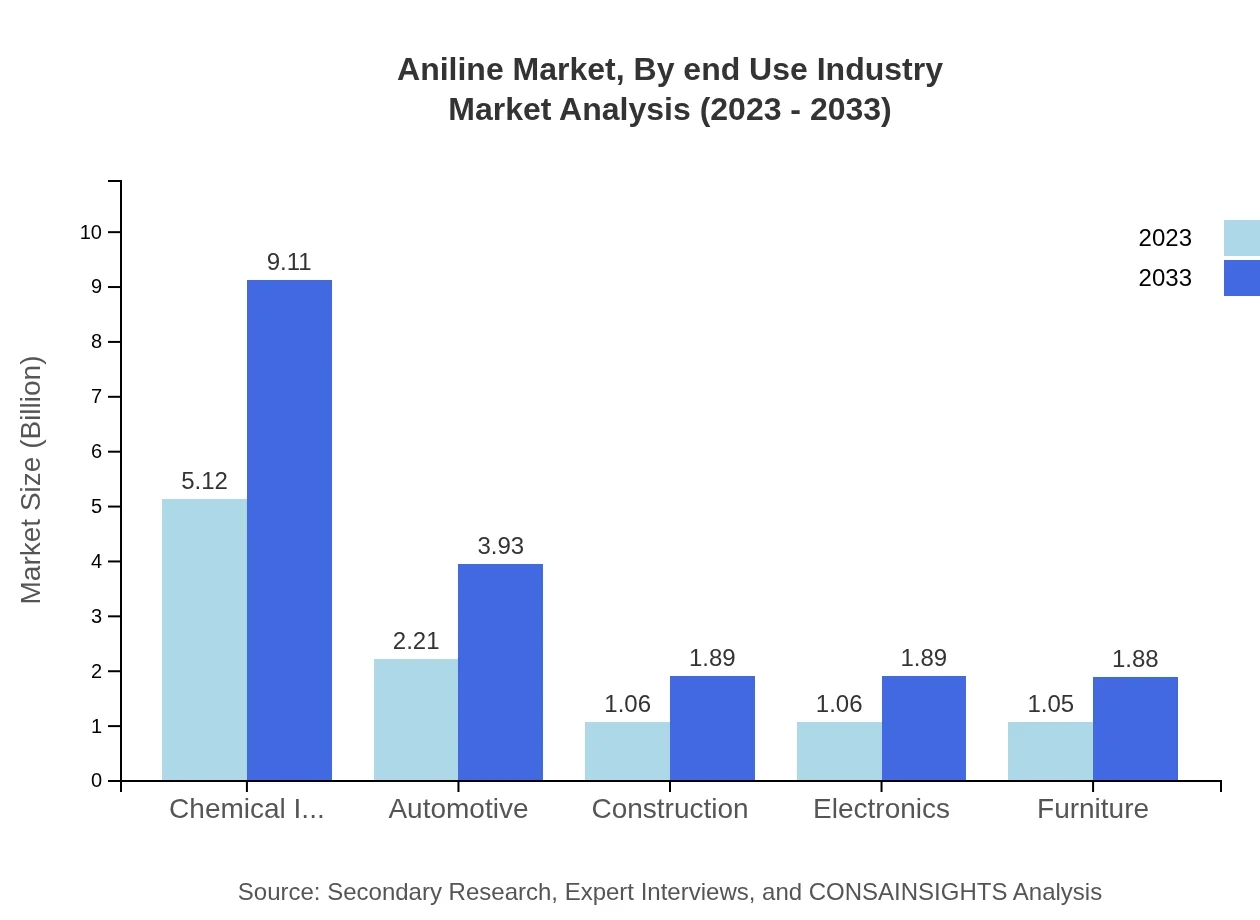

Aniline Market Analysis By End Use Industry

The chemical industry plays a vital role in the Aniline market, currently valued at $5.12 billion in 2023, projected to grow to $9.11 billion by 2033. The Rubber and Textile industries are key contributors to this growth, where Aniline is extensively utilized in production processes, fundamentally affecting overall market expansion.

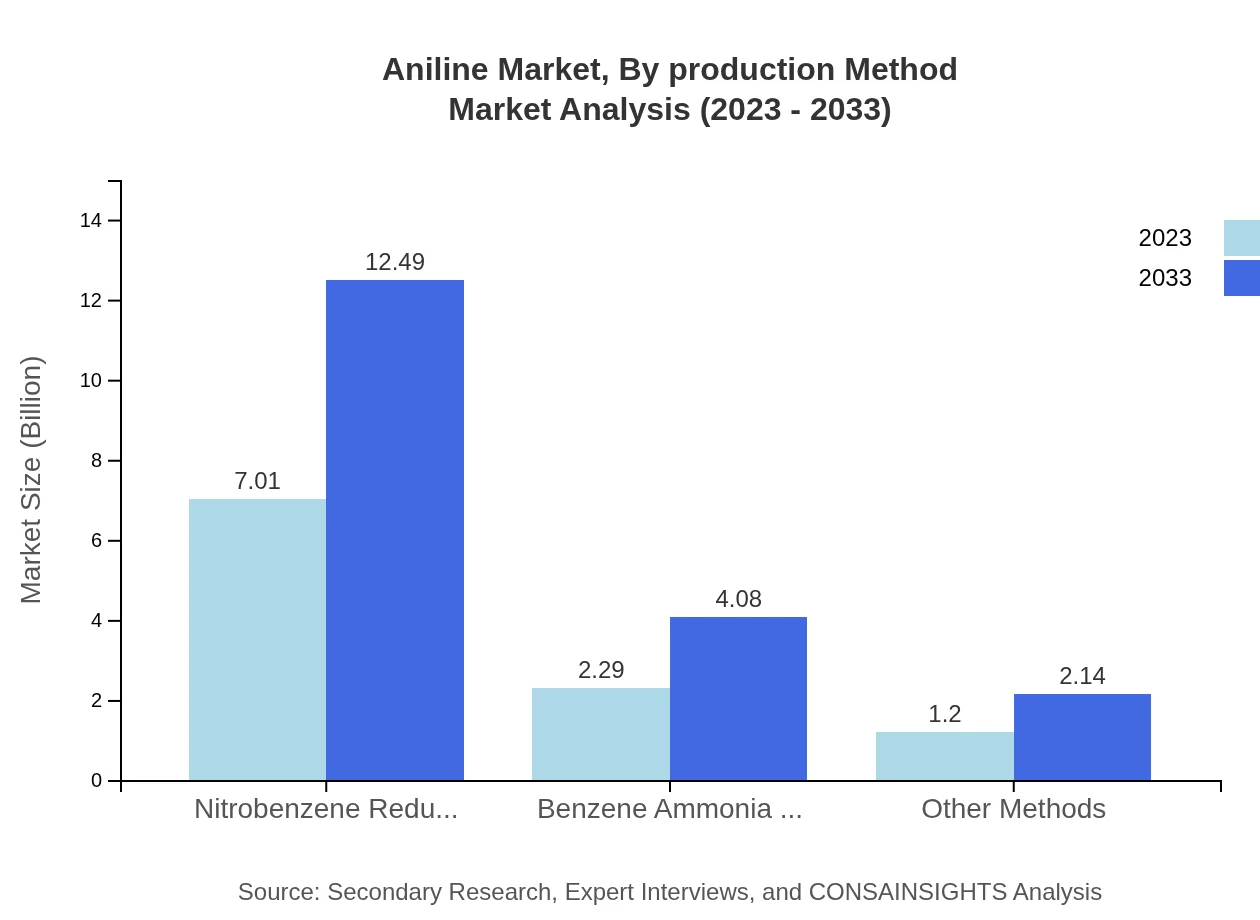

Aniline Market Analysis By Production Method

The Nitrobenzene Reduction method currently leads Aniline production with a market size of $7.01 billion and forecasted growth to $12.49 billion by 2033, holding a 66.77% market share. The Benzene Ammonia Reaction contributes notably, reflecting advancements in production technologies aimed at enhancing yield and reducing environmental impact.

Aniline Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aniline Industry

BASF:

BASF is a leading petrochemical company that offers a wide range of chemical products, including Aniline, focusing on sustainable practices and innovations in chemical manufacturing.Huntsman Corporation:

Huntsman is a global manufacturer and marketer of differentiated chemicals, including Aniline products, known for their commitment to technological advancements and sustainability.Lanxess AG:

Lanxess AG specializes in specialty chemicals, including Aniline and its derivatives, emphasizing performance and efficiency in production.Dow Chemical Company:

Dow is a multinational chemical corporation known for its diverse product portfolio including Aniline, focusing on innovation and sustainability in its operations.We're grateful to work with incredible clients.

FAQs

What is the market size of aniline?

The global aniline market is valued at approximately $10.5 billion in 2023, with an anticipated CAGR of 5.8% projected until 2033.

What are the key market players or companies in the aniline industry?

Key players in the aniline market include BASF, Huntsman International LLC, and Dow Chemical Company, each significantly contributing to market innovations and expansions.

What are the primary factors driving the growth in the aniline industry?

The growth in the aniline industry is primarily driven by increasing demand in textiles, automotive, and rubber sectors, as well as innovations in pharmaceuticals and agriculture.

Which region is the fastest Growing in the aniline market?

The Asia Pacific region is the fastest-growing market for aniline, projected to expand from $2.03 billion in 2023 to $3.62 billion by 2033.

Does ConsaInsights provide customized market report data for the aniline industry?

Yes, ConsaInsights provides customized market report data tailored to the specific needs and queries of clients within the aniline industry.

What deliverables can I expect from this aniline market research project?

From the aniline market research project, expect comprehensive reports, detailed trend analyses, market projections, and actionable insights tailored for strategic decision-making.

What are the market trends of aniline?

Current trends in the aniline market include a focus on sustainable production methods, increased use in alternatives to traditional chemicals, and growth in emerging markets for innovative applications.