Animal Antibiotics And Antimicrobials Market Report

Published Date: 31 January 2026 | Report Code: animal-antibiotics-and-antimicrobials

Animal Antibiotics And Antimicrobials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Animal Antibiotics and Antimicrobials market, detailing trends, market dynamics, and forecasts from 2023 to 2033. Insights into market size, regional performance, and leading players are included to inform strategic decisions.

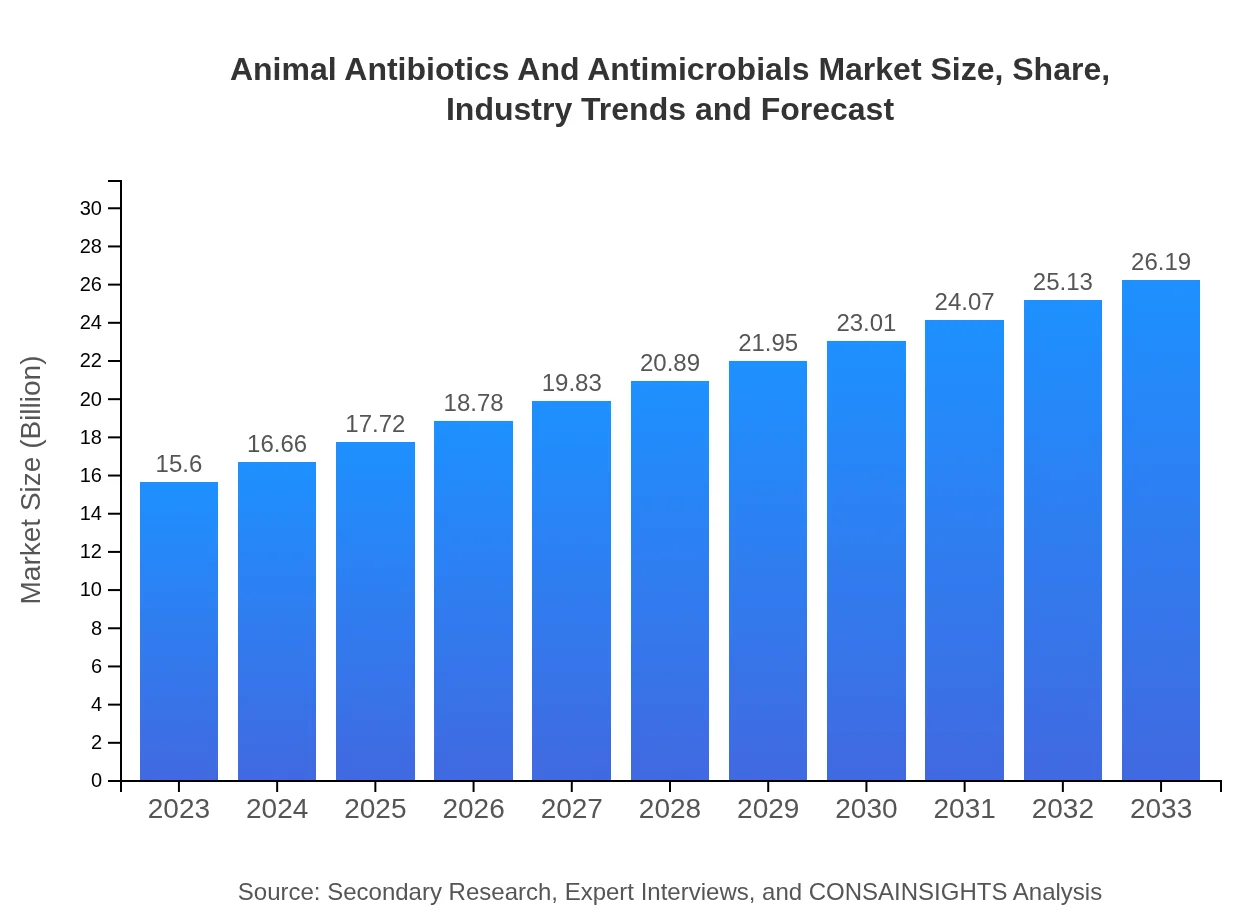

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | Zoetis Inc., Boehringer Ingelheim, Merck Animal Health, Elanco Animal Health |

| Last Modified Date | 31 January 2026 |

Animal Antibiotics And Antimicrobials Market Overview

Customize Animal Antibiotics And Antimicrobials Market Report market research report

- ✔ Get in-depth analysis of Animal Antibiotics And Antimicrobials market size, growth, and forecasts.

- ✔ Understand Animal Antibiotics And Antimicrobials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Animal Antibiotics And Antimicrobials

What is the Market Size & CAGR of Animal Antibiotics And Antimicrobials market in 2023?

Animal Antibiotics And Antimicrobials Industry Analysis

Animal Antibiotics And Antimicrobials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Animal Antibiotics And Antimicrobials Market Analysis Report by Region

Europe Animal Antibiotics And Antimicrobials Market Report:

Europe's Animal Antibiotics and Antimicrobials market is valued at $4.51 billion in 2023, set to expand to $7.58 billion by 2033. The market is influenced by stringent regulations on antibiotic use in livestock, driving innovation and the demand for alternative therapies.Asia Pacific Animal Antibiotics And Antimicrobials Market Report:

The Asia Pacific region's market was valued at $3.18 billion in 2023, projected to reach $5.34 billion by 2033. The rising livestock population and increasing disposable incomes contribute significantly to this growth. Additionally, regulatory frameworks are evolving to promote responsible antibiotic use, impacting market dynamics positively.North America Animal Antibiotics And Antimicrobials Market Report:

North America's market is expected to grow from $5.04 billion in 2023 to $8.47 billion by 2033. The region benefits from advanced veterinary healthcare infrastructure and a high level of R&D investments, addressing growing concerns about antibiotic resistance and promoting responsible use in agriculture.South America Animal Antibiotics And Antimicrobials Market Report:

In South America, the market size in 2023 stands at $1.29 billion, anticipated to grow to $2.16 billion by 2033. The demand for livestock products in emerging economies drives market growth, along with rising awareness of animal health management practices.Middle East & Africa Animal Antibiotics And Antimicrobials Market Report:

In the Middle East and Africa, the market size was $1.57 billion in 2023 and is expected to climb to $2.64 billion by 2033. Increasing investments in livestock health and rising dietary requirements for protein-rich foods are key growth factors in this region.Tell us your focus area and get a customized research report.

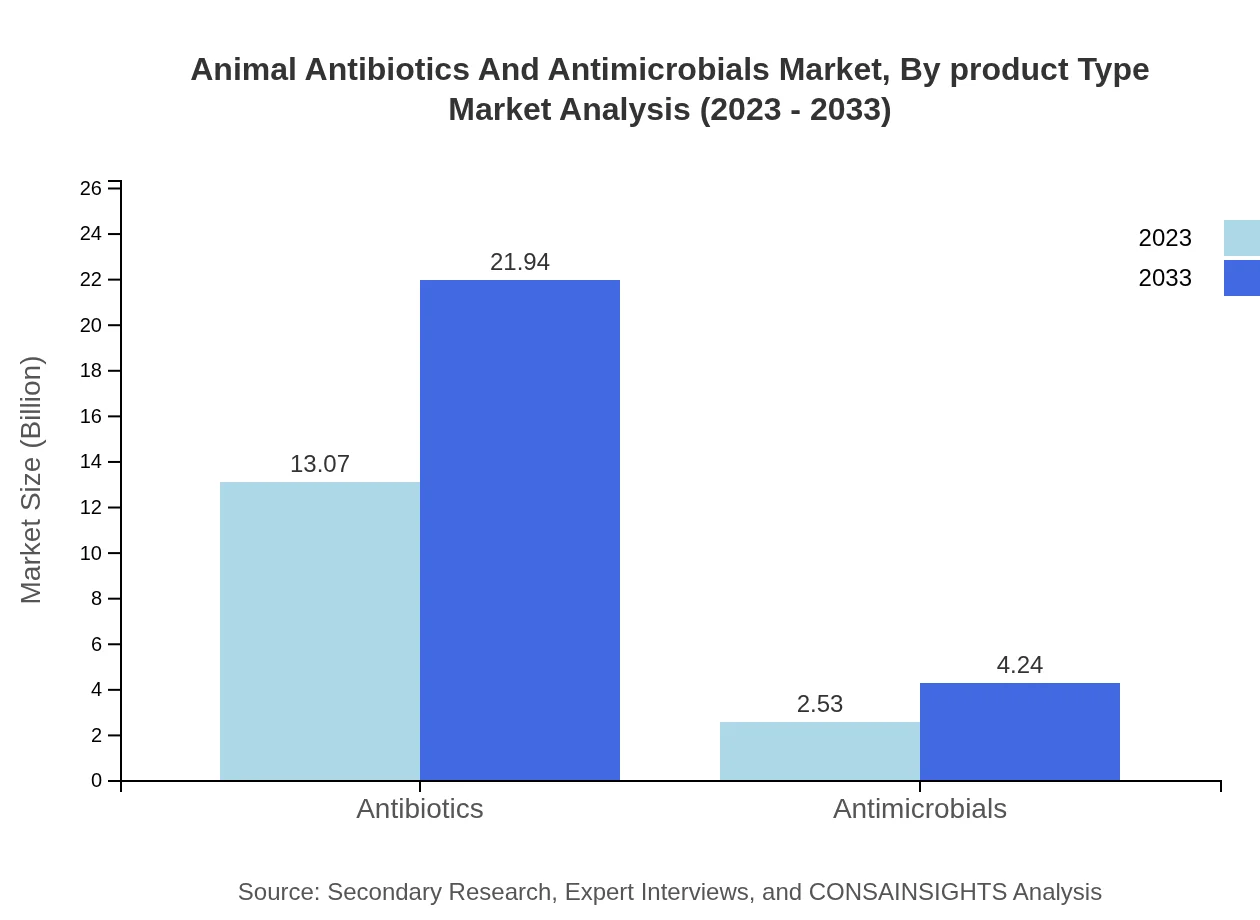

Animal Antibiotics And Antimicrobials Market Analysis By Product Type

The segment for antibiotics dominates with a market size of $13.07 billion in 2023, representing 83.79% of the market share. Antimicrobials follow, with corresponding figures of $2.53 billion at a 16.21% share. Both drug classes are crucial for maintaining animal health and productivity across various livestock.

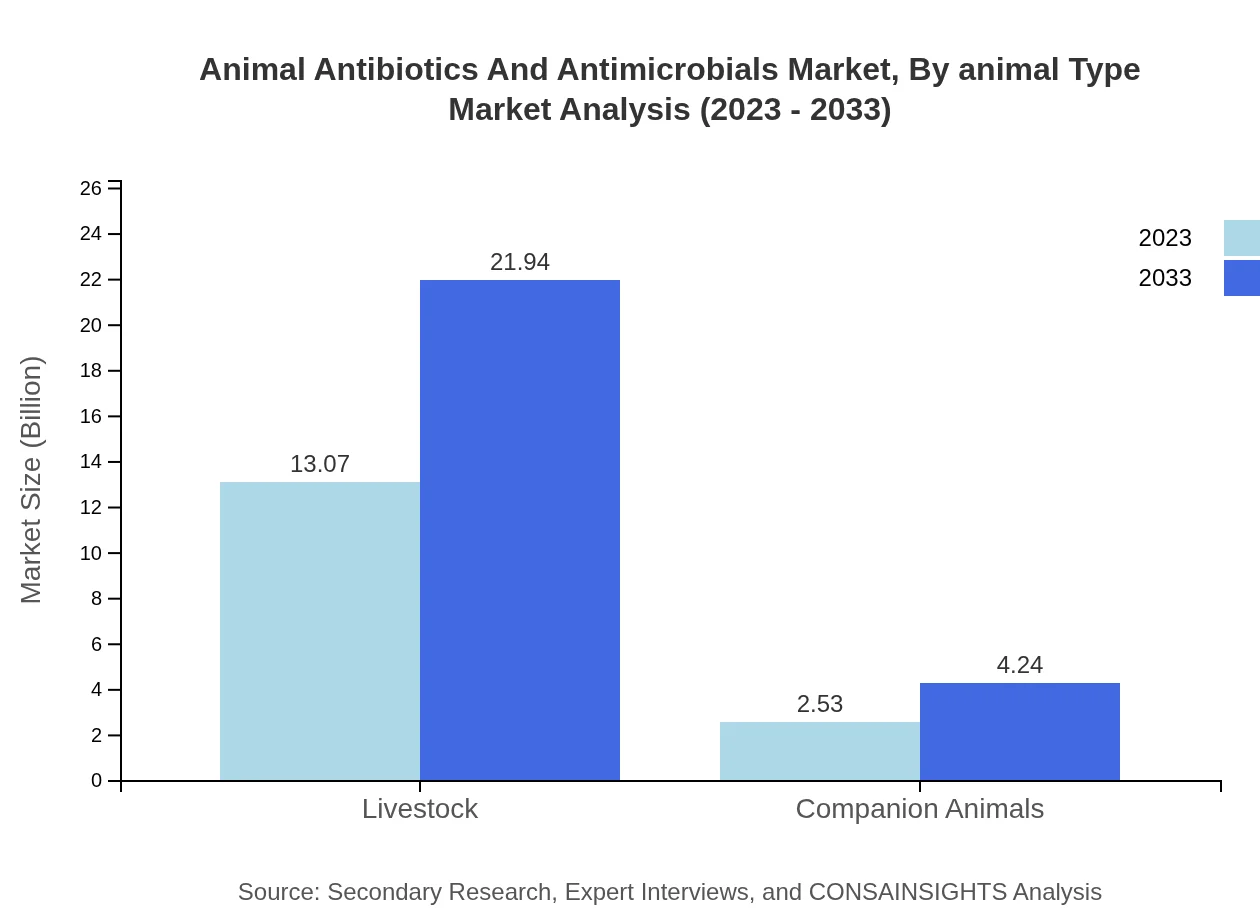

Animal Antibiotics And Antimicrobials Market Analysis By Animal Type

Farms and livestock segments lead the market, projected to grow from $13.07 billion to $21.94 billion by 2033, maintaining an 83.79% market share. The companion animals segment, although smaller, shows significant growth potential, anticipated to reach $4.24 billion by 2033, reflecting an increasing investment in pet healthcare.

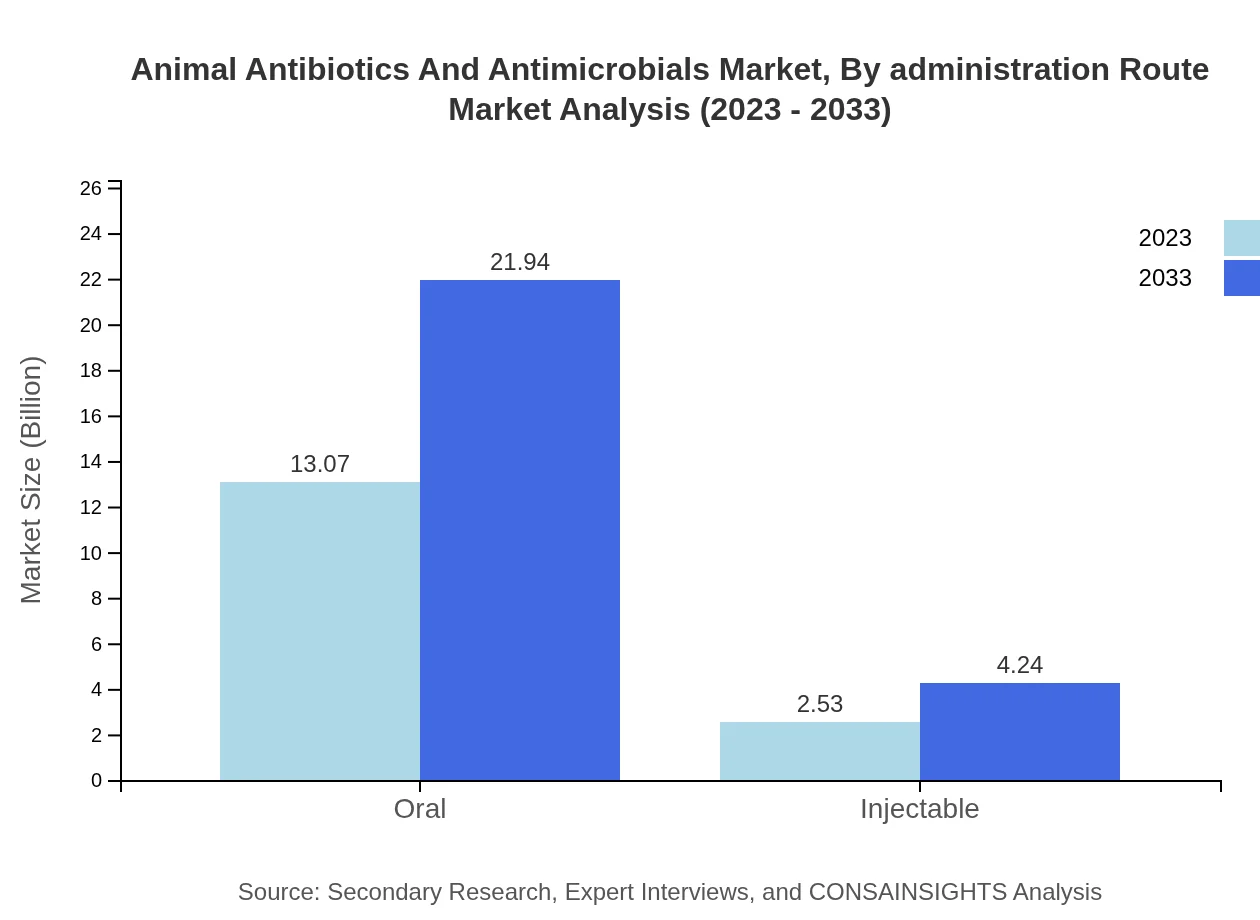

Animal Antibiotics And Antimicrobials Market Analysis By Administration Route

The oral administration route remains the most prominent, holding an 83.79% share with a projected market of $13.07 billion in 2023. Injectable methods account for the remainder and are expected to expand as advancements facilitate better delivery systems in veterinary practice.

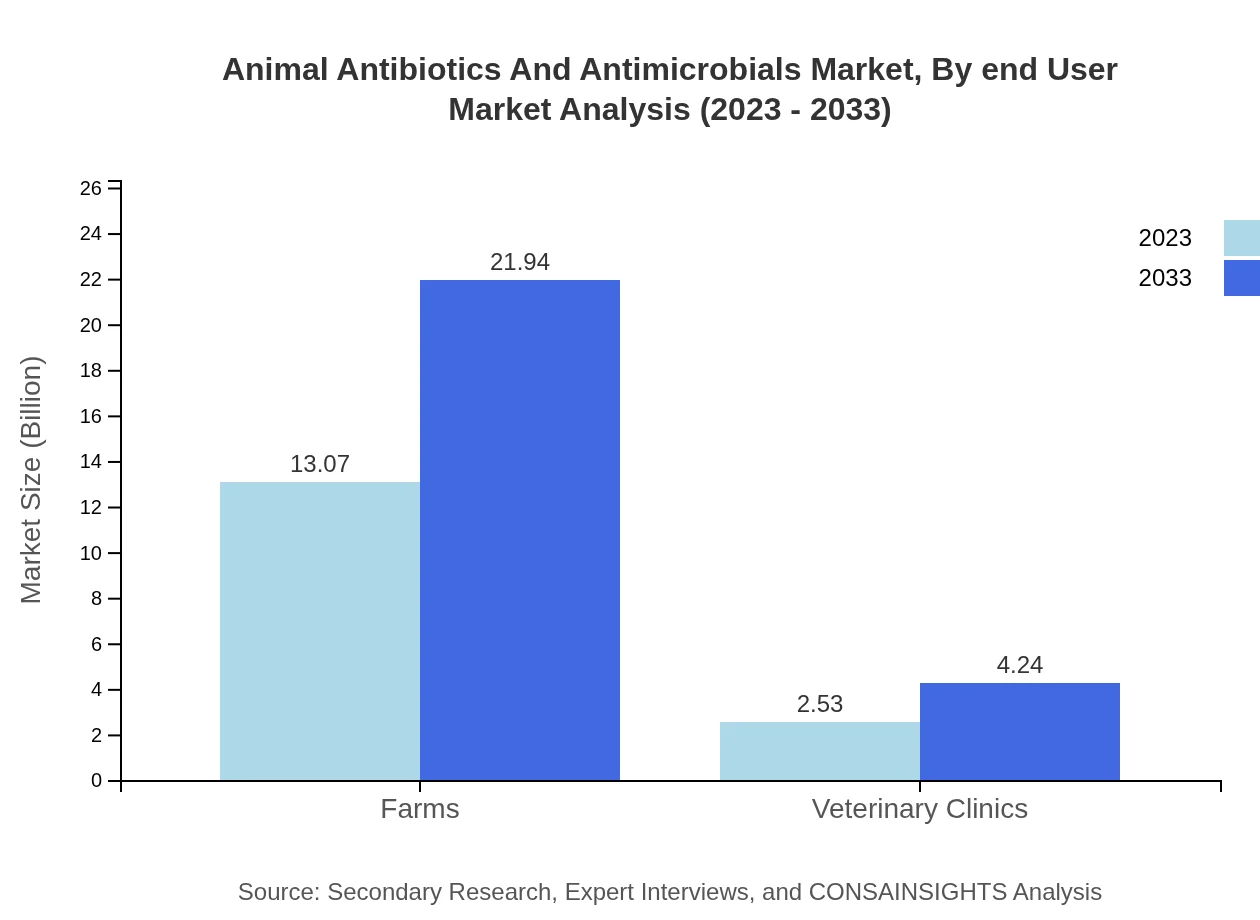

Animal Antibiotics And Antimicrobials Market Analysis By End User

Veterinary clinics and farms are the primary end-users, with veterinary clinics expected to grow to $4.24 billion by 2033. Farms' consistent reliance on antibiotics for livestock health management underscores the market's structure and expected trajectory.

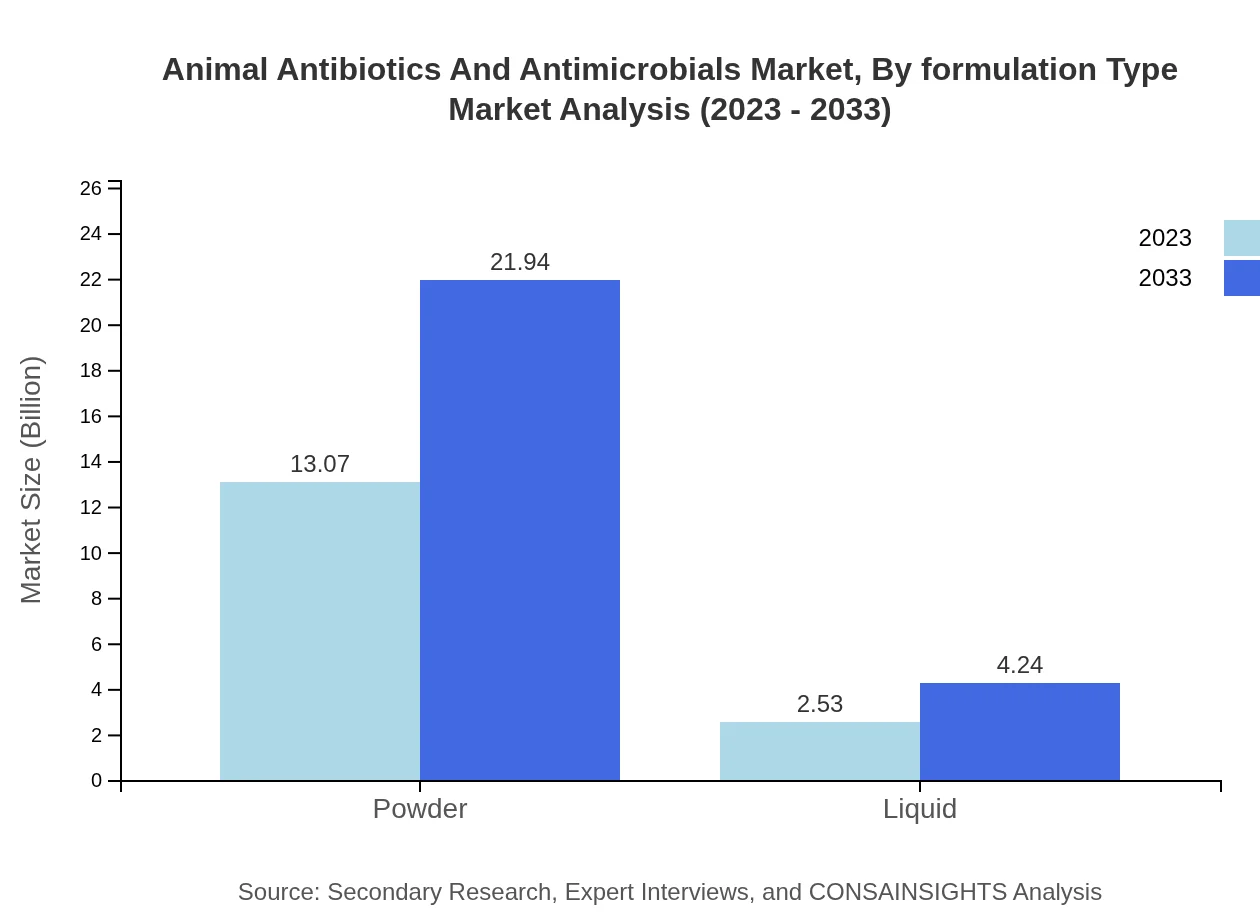

Animal Antibiotics And Antimicrobials Market Analysis By Formulation Type

Powder formulations currently dominate by representing 83.79% of the market, set to grow from $13.07 billion in 2023 to $21.94 billion by 2033. Liquid formulations, while smaller in market share, are gaining traction due to ease of application and versatility.

Animal Antibiotics And Antimicrobials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Animal Antibiotics And Antimicrobials Industry

Zoetis Inc.:

A leading global animal health company specializing in the discovery, development, and manufacturing of veterinary vaccines, pharmaceuticals, and diagnostic products.Boehringer Ingelheim:

Significant player in the animal health sector, focusing on research and development of innovative solutions to prevent and treat diseases in livestock and companion animals.Merck Animal Health:

Part of Merck & Co., it offers a comprehensive portfolio of antibiotics and antimicrobials to enhance animal health and welfare while complying with global regulations.Elanco Animal Health:

Dedicated to developing innovative solutions and offering products that promote health and productivity in livestock and companion animals.We're grateful to work with incredible clients.

FAQs

What is the market size of animal Antibiotics And Antimicrobials?

The global market size for animal antibiotics and antimicrobials is projected to be $15.6 billion in 2023, with a compound annual growth rate (CAGR) of 5.2% expected through 2033.

What are the key market players or companies in the animal Antibiotics And Antimicrobials industry?

Key market players include Zoetis, Elanco, Merck Animal Health, Bayer Animal Health, and Boehringer Ingelheim, which lead in developing innovative solutions and expanding their global presence in animal health markets.

What are the primary factors driving the growth in the animal Antibiotics And Antimicrobials industry?

Key drivers include increasing demand for animal protein, rising incidences of animal diseases, and growing awareness regarding animal health, alongside an expanding livestock industry heavily reliant on antibiotics.

Which region is the fastest Growing in the animal Antibiotics And Antimicrobials market?

The Asia Pacific region is the fastest-growing in the animal antibiotics and antimicrobials market, expected to grow from $3.18 billion in 2023 to $5.34 billion by 2033.

Does ConsInsights provide customized market report data for the animal Antibiotics And Antimicrobials industry?

Yes, ConsInsights offers customized market reports tailored to user specifications, providing in-depth analyses and insights specific to the animal antibiotics and antimicrobials market.

What deliverables can I expect from this animal Antibiotics And Antimicrobials market research project?

You can expect comprehensive deliverables including detailed market analyses, growth forecasts, competitive landscape assessments, and insights into consumer trends within the animal antibiotics and antimicrobials sector.

What are the market trends of animal Antibiotics And Antimicrobials?

Trends include a shift towards more sustainable and safe antibiotic use, rising adoption of alternative therapies, and increased regulatory scrutiny aiming to reduce antibiotic residues in food products.