Animal Feed Additives Market Report

Published Date: 02 February 2026 | Report Code: animal-feed-additives

Animal Feed Additives Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Animal Feed Additives market, offering insights from 2023 to 2033. It covers market size, trends, segmentation, and regional analyses, providing a comprehensive understanding of the industry landscape and future predictions.

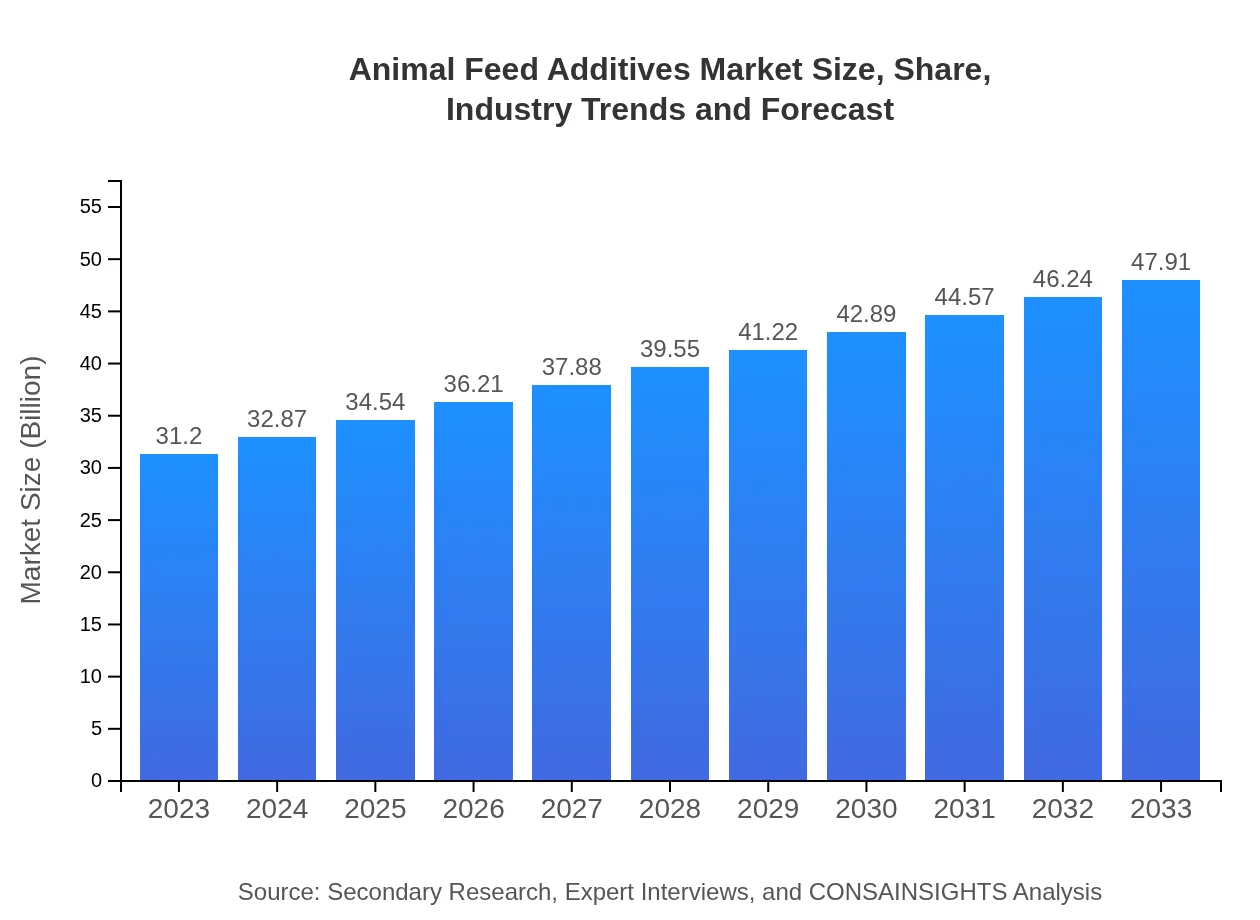

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $31.20 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $47.91 Billion |

| Top Companies | Cargill, Inc., BASF SE, Alltech, Inc., ADM Animal Nutrition, Nutreco N.V. |

| Last Modified Date | 02 February 2026 |

Animal Feed Additives Market Overview

Customize Animal Feed Additives Market Report market research report

- ✔ Get in-depth analysis of Animal Feed Additives market size, growth, and forecasts.

- ✔ Understand Animal Feed Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Animal Feed Additives

What is the Market Size & CAGR of Animal Feed Additives from 2023 to 2033?

Animal Feed Additives Industry Analysis

Animal Feed Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Animal Feed Additives Market Analysis Report by Region

Europe Animal Feed Additives Market Report:

Europe is expected to maintain a strong market position, growing from $10.47 billion in 2023 to $16.08 billion by 2033. This growth is fueled by increasing regulations on animal welfare and food safety, alongside a shift toward organic and natural feed additives.Asia Pacific Animal Feed Additives Market Report:

The Asia Pacific region is anticipated to emerge as a significant market for Animal Feed Additives, projected to grow from $5.97 billion in 2023 to $9.17 billion by 2033. The demand for feed additives in countries like China and India is driven by rapid demand for meat and dairy products, alongside advancements in farming practices and increased livestock production.North America Animal Feed Additives Market Report:

North America showcases a robust market due to high meat consumption, expected to grow from $10.05 billion in 2023 to $15.43 billion by 2033. The presence of large livestock farms and strict regulations on feed quality significantly influence market dynamics in this region.South America Animal Feed Additives Market Report:

The South American market, while smaller, is also experiencing growth, expanding from $1.18 billion in 2023 to $1.81 billion by 2033. Brazil's poultry and cattle sectors are crucial drivers, with rising export demands for meat prompting investments in feed quality and additives.Middle East & Africa Animal Feed Additives Market Report:

The Middle East and Africa market, projected to grow from $3.53 billion in 2023 to $5.41 billion by 2033, sees rising demand for poultry and aquaculture feed additives, supported by population growth and urbanization trends influencing food demand.Tell us your focus area and get a customized research report.

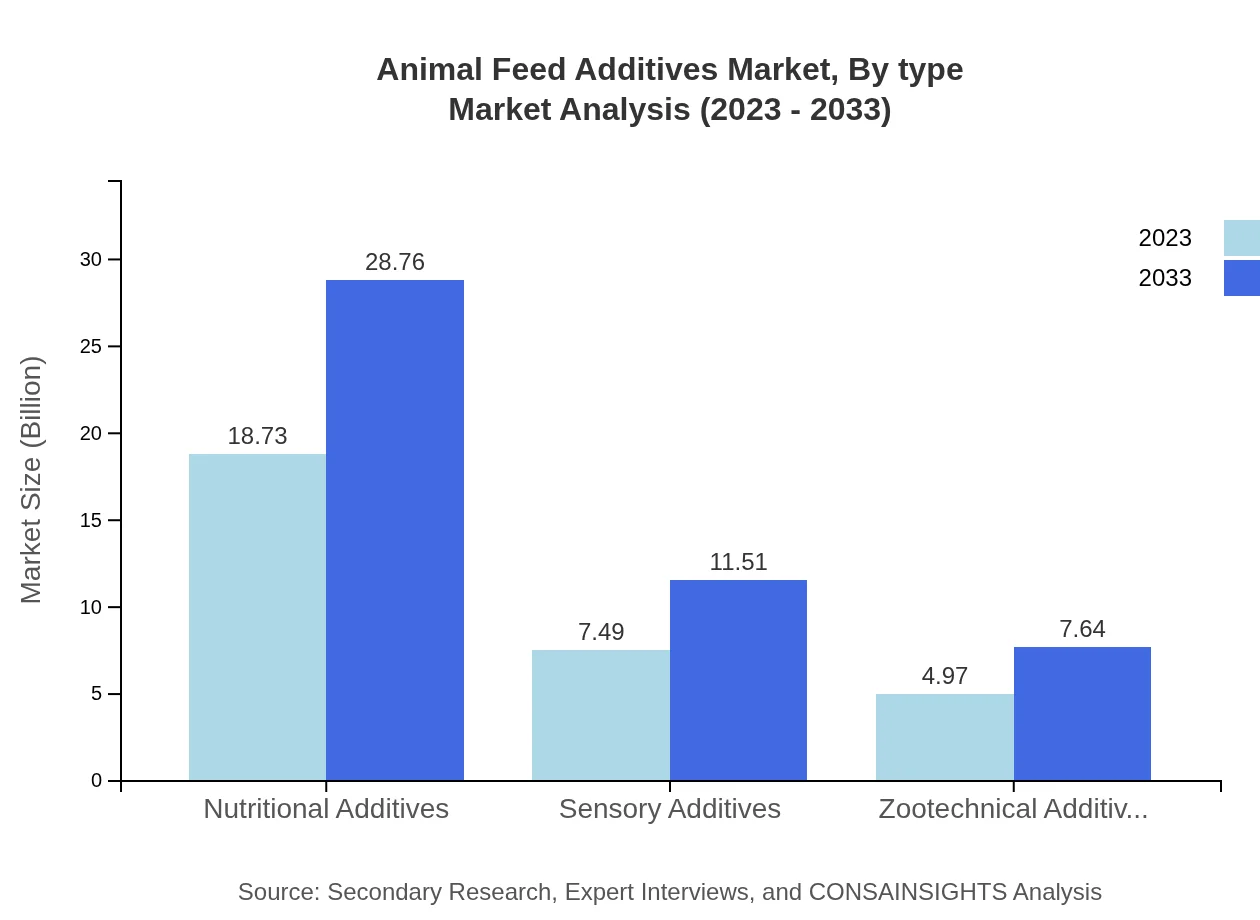

Animal Feed Additives Market Analysis By Type

The Animal Feed Additives market by type includes: - **Nutritional Additives**: Projected size from $18.73 billion in 2023 to $28.76 billion in 2033, dominating the market share with 60.04%. - **Sensory Additives**: Estimated to grow from $7.49 billion to $11.51 billion, maintaining a 24.02% market share. - **Zootechnical Additives**: Growth expected from $4.97 billion to $7.64 billion, sharing 15.94% of the market. - **Health Benefit Additives**: Forecasted to rise from $4.97 billion to $7.64 billion, also holding a share of 15.94%.

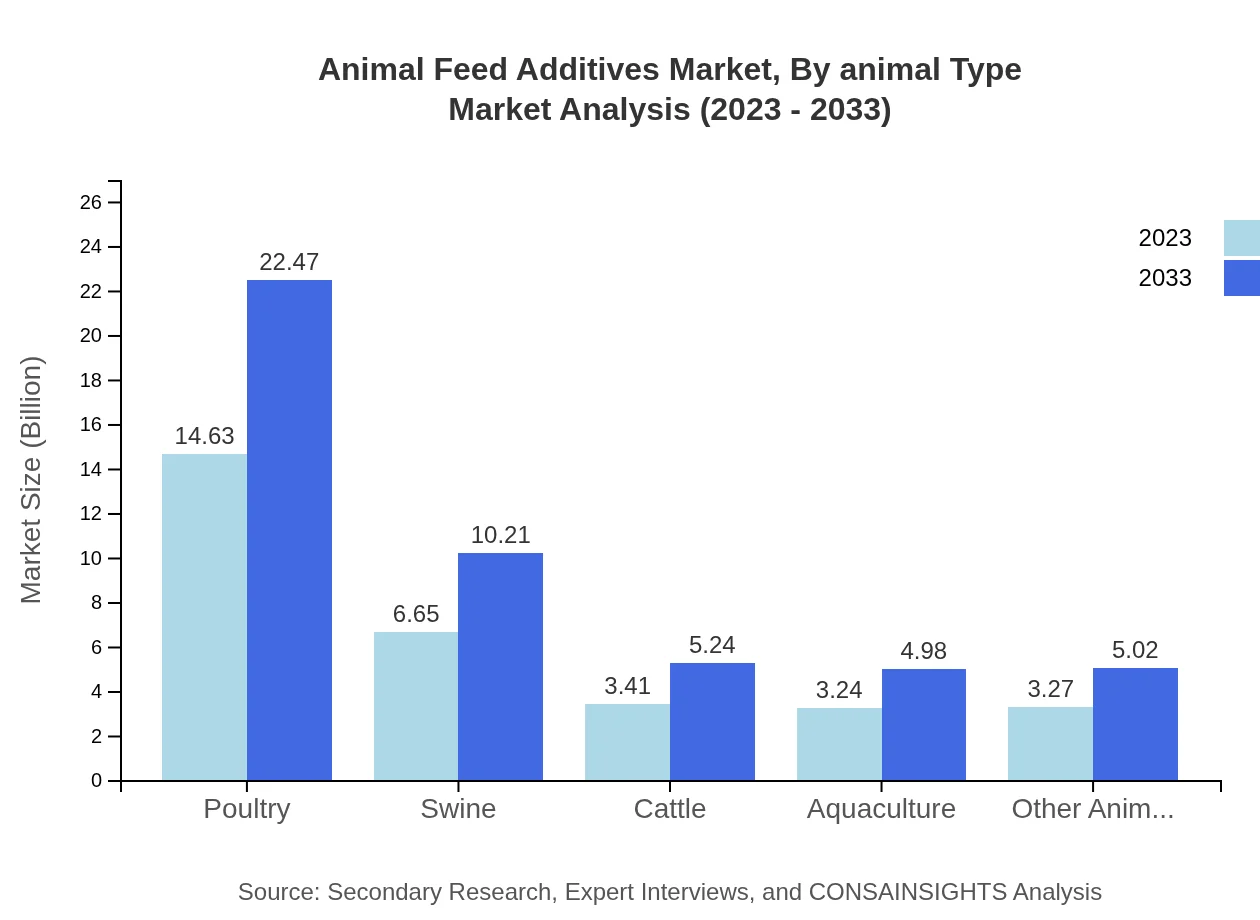

Animal Feed Additives Market Analysis By Animal Type

The Animal Feed Additives market segmented by animal type includes: - **Poultry**: Size expected to increase from $14.63 billion to $22.47 billion, holding an impressive share of 46.9%. - **Swine**: Anticipated growth from $6.65 billion to $10.21 billion, representing a 21.31% market share. - **Cattle**: Projected to expand from $3.41 billion to $5.24 billion, maintaining a 10.93% share. - **Aquaculture and Other Animals**: Expected to grow from $3.24 billion to $4.98 billion and from $3.27 billion to $5.02 billion respectively, with shares of 10.39% and 10.47%.

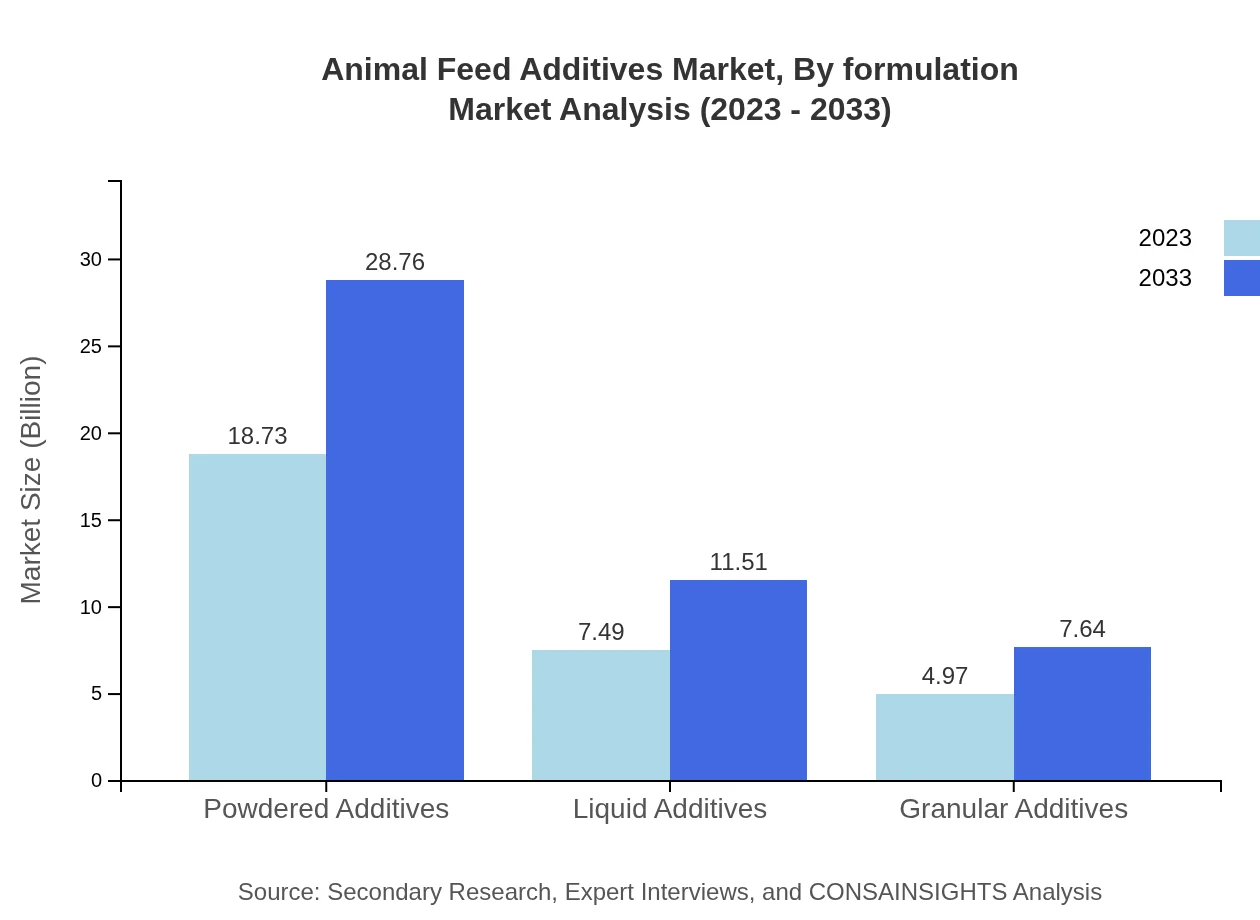

Animal Feed Additives Market Analysis By Formulation

By formulation, the market data reveals: - **Powdered Additives**: Size expected to rise from $18.73 billion to $28.76 billion, capturing 60.04% share. - **Liquid Additives**: Growth anticipated from $7.49 billion to $11.51 billion, with 24.02% share. - **Granular Additives**: Expected to expand from $4.97 billion to $7.64 billion, representing a 15.94% market share.

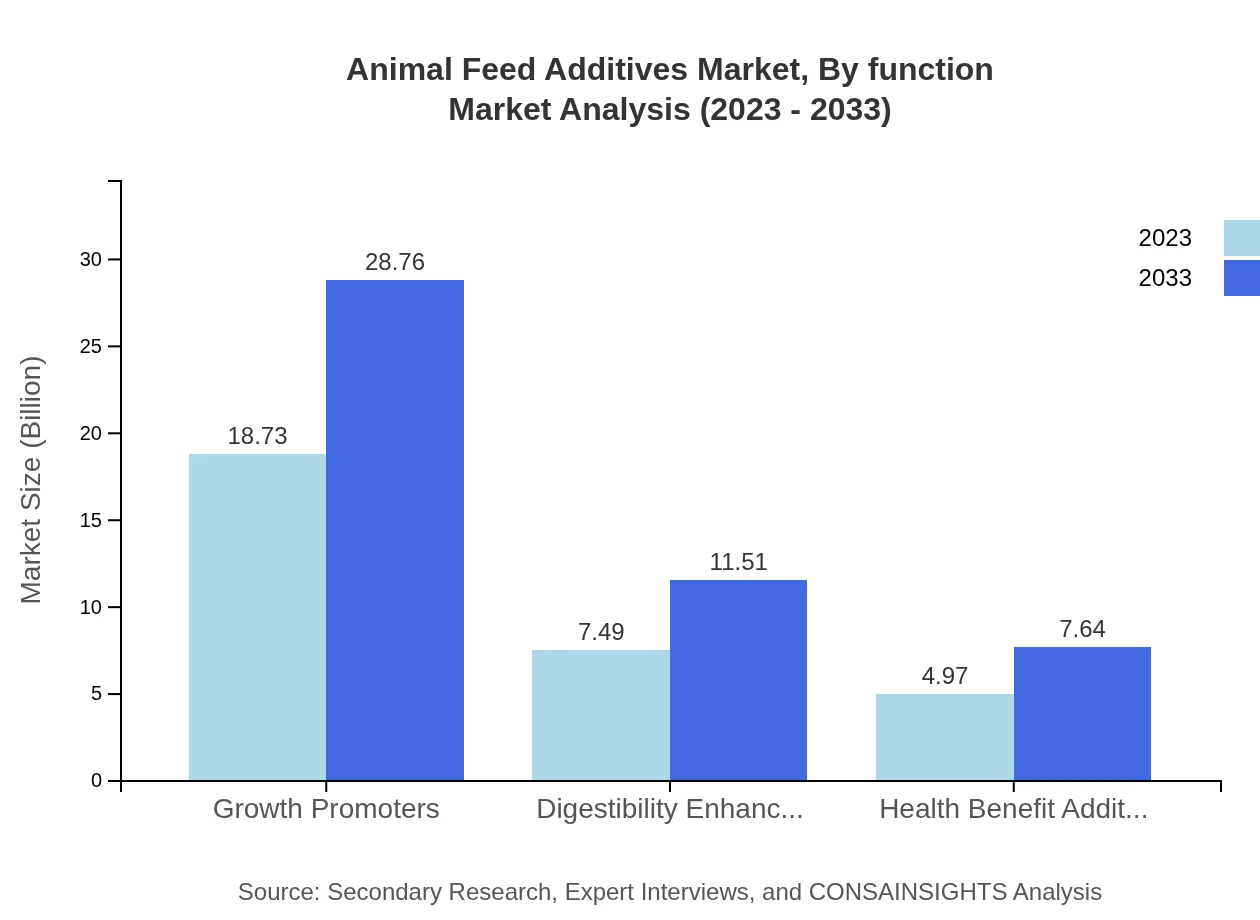

Animal Feed Additives Market Analysis By Function

Function-wise, the market is assessed as follows: - **Growth Promoters**: Estimated to constitute the largest segment, maintained from $18.73 billion to $28.76 billion, with market share of 60.04%. - **Digestibility Enhancers**: Expected growth from $7.49 billion to $11.51 billion, holding a 24.02% share. - **Other Function Additives**: Including health benefits corresponding to a growth trajectory similar to that of the digestibility enhancers.

Animal Feed Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Animal Feed Additives Industry

Cargill, Inc.:

A leader in the agricultural sector, Cargill produces and supplies a variety of animal nutrition and feed additives, focusing on innovation and sustainability.BASF SE:

BASF is a global leader in chemical products, including animal feed additives that enhance health and growth rates in livestock.Alltech, Inc.:

Alltech specializes in animal nutrition and health, providing a wide range of innovative feed additives aimed at optimizing performance.ADM Animal Nutrition:

A well-known player in animal nutrition, ADM offers comprehensive feed solutions and innovative additives that ensure animal health and productivity.Nutreco N.V.:

Nutreco focuses on animal nutrition and aquafeed, developing specialized feed additives that promote growth and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of animal Feed Additives?

The global animal feed additives market is projected to reach a size of 31.2 billion dollars by 2033, growing at a CAGR of 4.3% from 2023. This growth reflects increasing demand for higher-quality protein sources in livestock production.

What are the key market players or companies in the animal Feed Additives industry?

Key players in the animal feed additives market include major corporations specializing in nutritional enhancers, such as ADM, BASF, Cargill, and DSM. These companies lead the market with their innovative products and vast distribution networks, ensuring broad accessibility.

What are the primary factors driving the growth in the animal Feed Additives industry?

Growth drivers include rising demand for nutritious animal products, increasing adoption of advanced feed technologies, and heightened awareness of livestock health and productivity. Additionally, regulatory support for safe feeds enhances industry prospects as well.

Which region is the fastest Growing in the animal Feed Additives?

The fastest-growing region for animal feed additives is Europe, with market growth from 10.47 billion in 2023 to an estimated 16.08 billion by 2033. The increases in Asia-Pacific and North America also highlight significant regional growth.

Does ConsaInsights provide customized market report data for the animal Feed Additives industry?

Yes, ConsaInsights offers tailored market report services for the animal feed additives industry, accommodating specific needs like regional analysis, detailed segment breakdowns, and direct insights into market dynamics for strategic decision-making.

What deliverables can I expect from this animal Feed Additives market research project?

Expect comprehensive deliverables including market size data, growth forecasts, competitive analysis, segment insights, and regional breakdowns. This ensures stakeholders have a thorough understanding of the animal feed additives landscape.

What are the market trends of animal Feed Additives?

Market trends indicate a shift towards sustainable feed solutions, increased investment in research for new additives, and rising popularity of natural feed products. There is also a focus on improving digestive health and enhancing animal nutrition through innovative formulations.