Animal Feed Probiotic Bacteria Market Report

Published Date: 02 February 2026 | Report Code: animal-feed-probiotic-bacteria

Animal Feed Probiotic Bacteria Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Animal Feed Probiotic Bacteria market, covering key insights, market dynamics, trends, and projections from 2023 to 2033. It includes data related to market size, segmentation, regional performances, and key players shaping the industry.

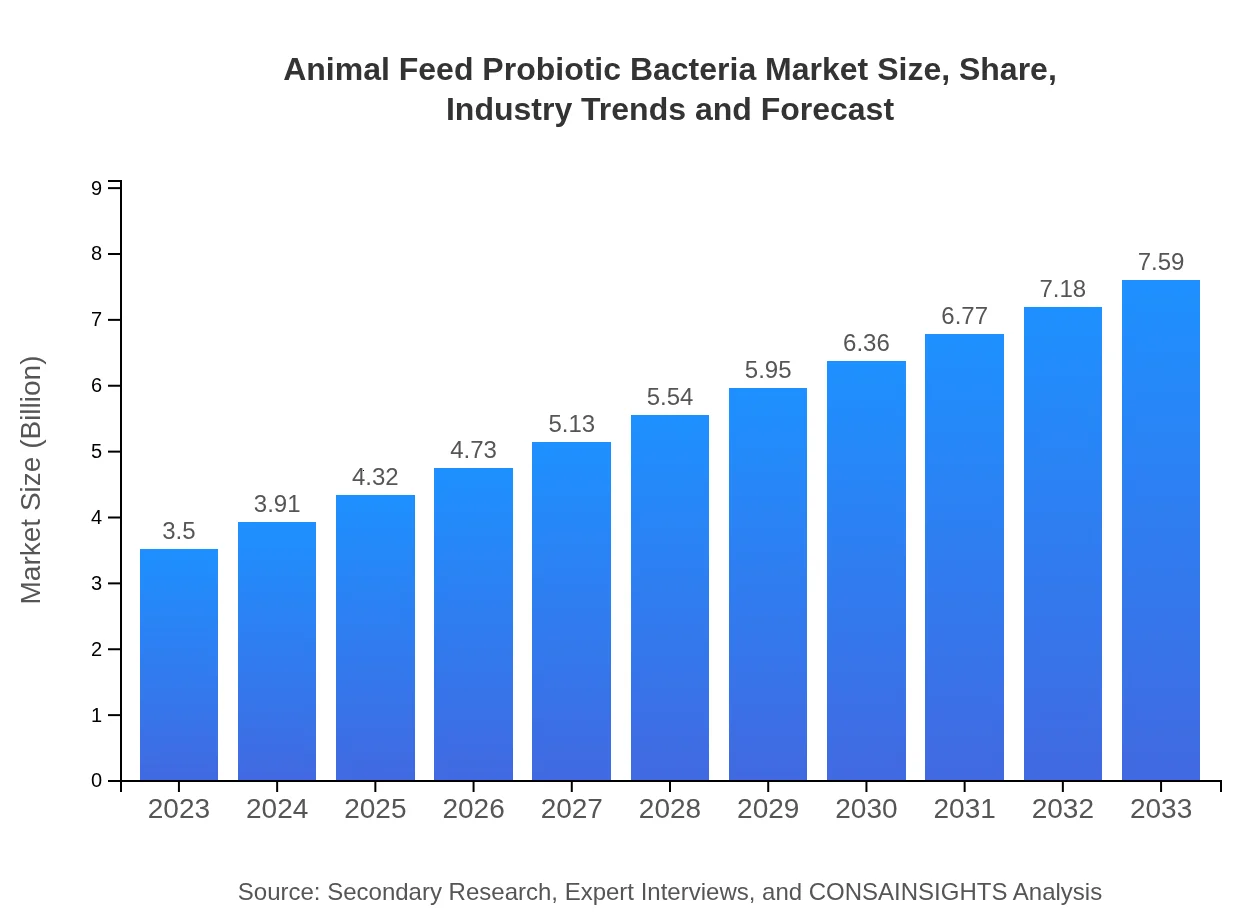

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.59 Billion |

| Top Companies | Alltech, BASF SE, CP Ingredients, Inc., Chr. Hansen |

| Last Modified Date | 02 February 2026 |

Animal Feed Probiotic Bacteria Market Overview

Customize Animal Feed Probiotic Bacteria Market Report market research report

- ✔ Get in-depth analysis of Animal Feed Probiotic Bacteria market size, growth, and forecasts.

- ✔ Understand Animal Feed Probiotic Bacteria's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Animal Feed Probiotic Bacteria

What is the Market Size & CAGR of Animal Feed Probiotic Bacteria market in 2023?

Animal Feed Probiotic Bacteria Industry Analysis

Animal Feed Probiotic Bacteria Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Animal Feed Probiotic Bacteria Market Analysis Report by Region

Europe Animal Feed Probiotic Bacteria Market Report:

Europe's market for Animal Feed Probiotic Bacteria is anticipated to grow from $1.08 billion in 2023 to $2.35 billion by 2033. The stringent regulations promoting food safety in livestock products and rising consumer awareness concerning animal welfare are key factors driving this growth.Asia Pacific Animal Feed Probiotic Bacteria Market Report:

In 2023, the market size for Animal Feed Probiotic Bacteria in the Asia Pacific region is approximately $0.67 billion, projected to grow to $1.46 billion by 2033. This growth is driven by increasing livestock production and the rising adoption of probiotics in aquaculture due to consumer demand for high-quality fish products.North America Animal Feed Probiotic Bacteria Market Report:

North America is a significant market for probiotics, valued at $1.19 billion in 2023, with projections of $2.58 billion by 2033. The burgeoning demand for organic and natural feed alternatives is propelling this growth alongside strong regulatory support.South America Animal Feed Probiotic Bacteria Market Report:

The South America market is relatively smaller, with a size of $0.11 billion in 2023 and expected to reach $0.23 billion by 2033. The growth potential is backed by increasing investments in livestock farming and heightened awareness of animal health.Middle East & Africa Animal Feed Probiotic Bacteria Market Report:

In the Middle East and Africa, the market size is expected to grow from $0.45 billion in 2023 to $0.97 billion by 2033, with increasing meat consumption and the growth of the poultry segment playing a pivotal role.Tell us your focus area and get a customized research report.

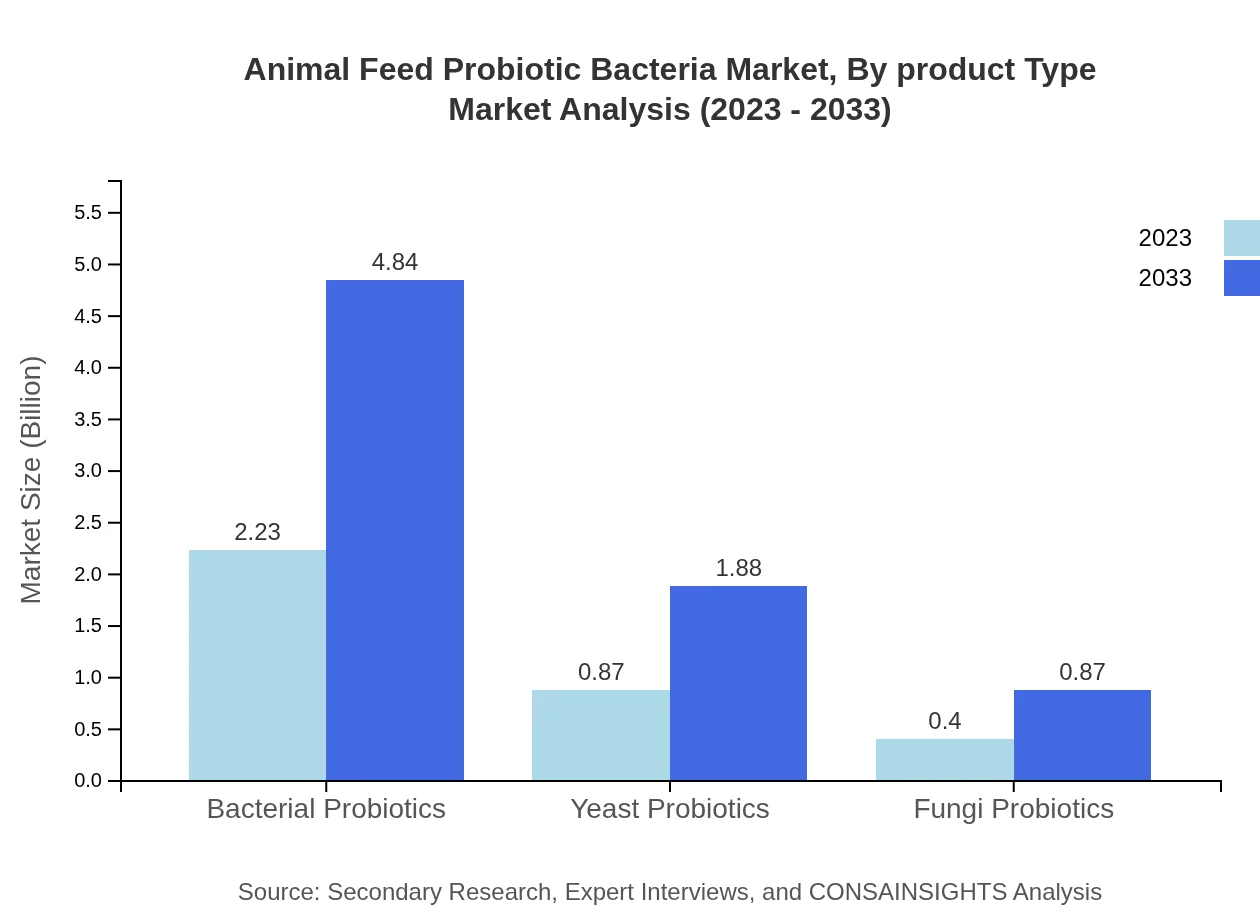

Animal Feed Probiotic Bacteria Market Analysis By Product Type

The product type segment is dominated by bacterial probiotics, which hold a market size of $2.23 billion in 2023 and is expected to reach $4.84 billion by 2033, maintaining a market share of 63.82%. Yeast probiotics are also significant, with a market size of $0.87 billion in 2023, projected to grow to $1.88 billion, representing 24.72% of the market. Fungi probiotics, while smaller, account for a market size of $0.40 billion and expected to rise to $0.87 billion over the same period.

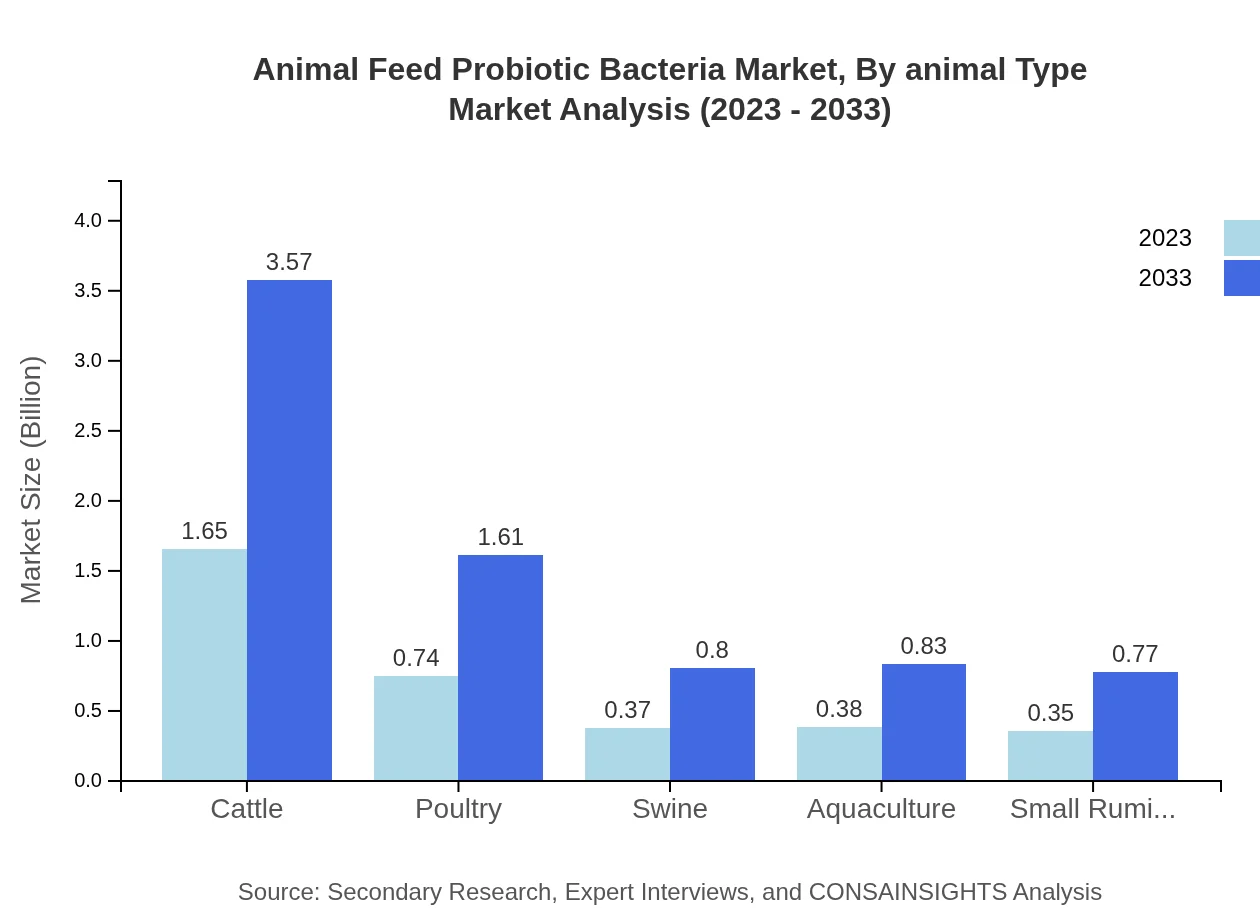

Animal Feed Probiotic Bacteria Market Analysis By Animal Type

Cattle dominate the market with a size of $1.65 billion in 2023, projected to grow to $3.57 billion by 2033, comprising 47.11% of the share. Poultry follows with a size of $0.74 billion, expected to reach $1.61 billion, accounting for 21.27% of the market. Other segments like swine, aquaculture, and small ruminants represent smaller shares with sizes of $0.37 billion, $0.38 billion, and $0.35 billion in 2023, respectively.

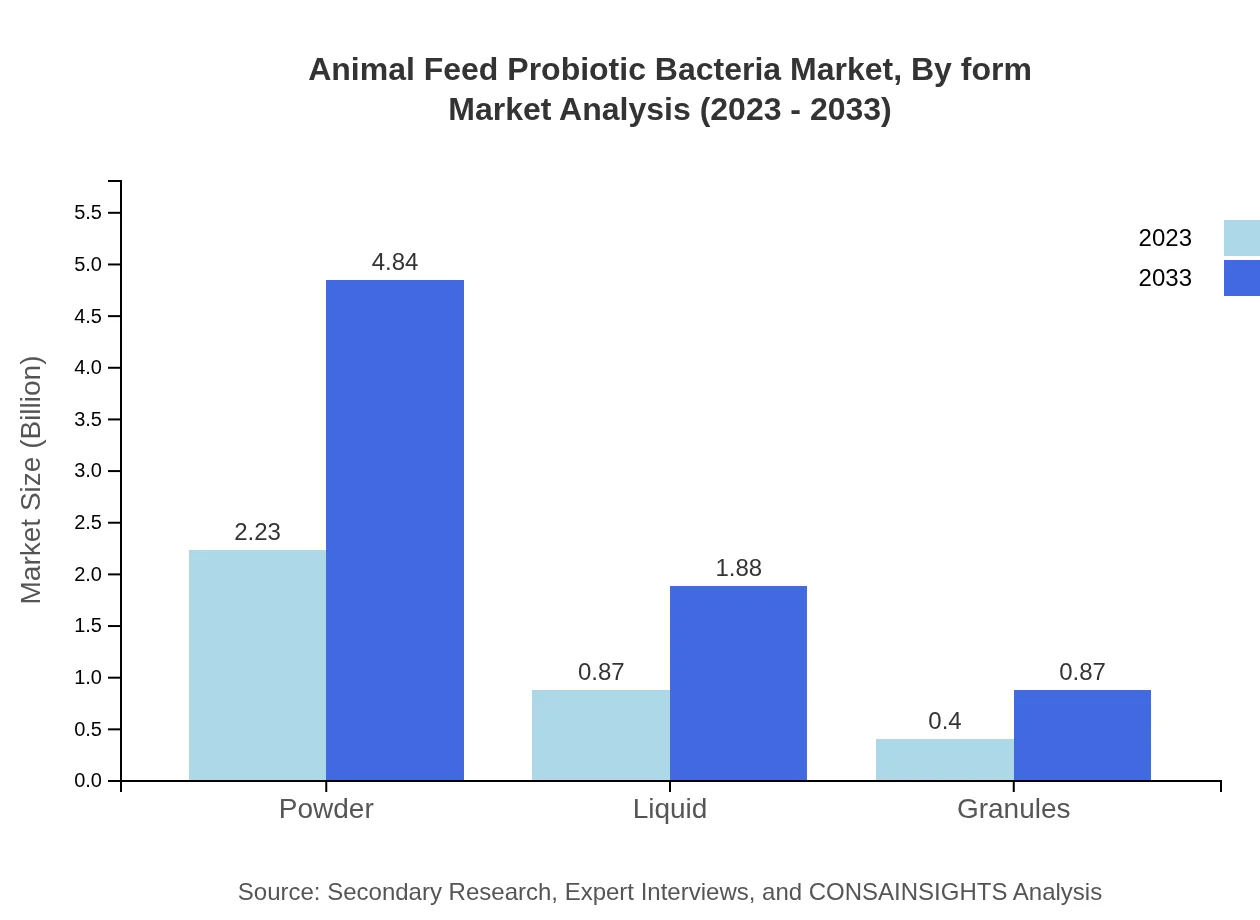

Animal Feed Probiotic Bacteria Market Analysis By Form

The powder form is the leading segment with a market size of $2.23 billion in 2023 and reaching $4.84 billion by 2033, holding a substantial share of 63.82%. Liquid form, valued at $0.87 billion in 2023, is expected to grow to $1.88 billion, with a share of 24.72%. Granulated forms, accounting for $0.40 billion, will grow to $0.87 billion by 2033.

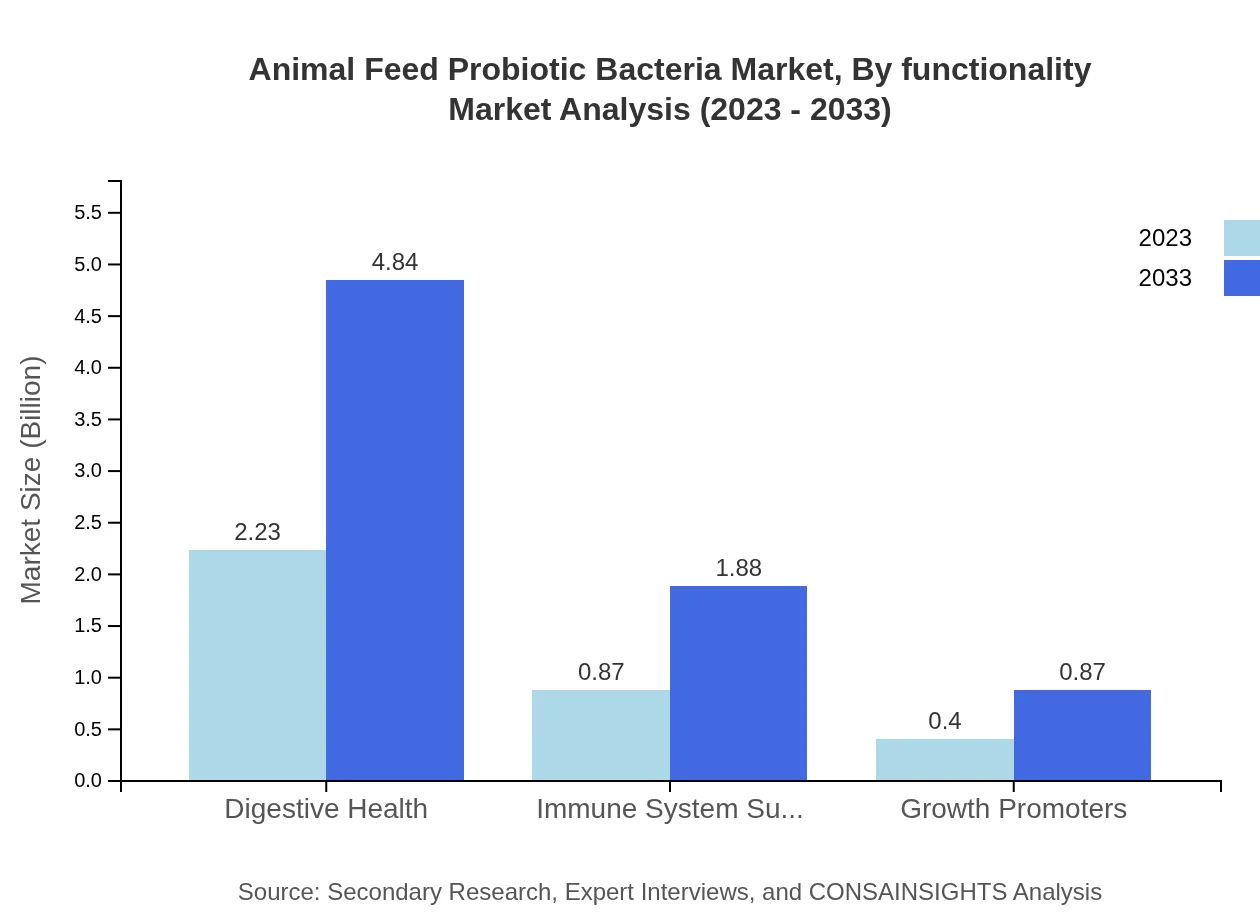

Animal Feed Probiotic Bacteria Market Analysis By Functionality

The market for digestive health probiotics is prominent, with a size of $2.23 billion in 2023 and projected to rise to $4.84 billion, ensuring a 63.82% market share. Immune system support constitutes a significant part of the market at $0.87 billion in 2023, likely to reach $1.88 billion post-2033 with a 24.72% share, while growth promoters make up a market size of $0.40 billion, growing to $0.87 billion.

Animal Feed Probiotic Bacteria Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Animal Feed Probiotic Bacteria Industry

Alltech:

A leader in animal nutrition and health, Alltech provides innovative probiotic solutions that enhance animal performance and well-being.BASF SE:

BASF is a global chemical company that offers a diverse range of animal nutrition solutions, including probiotics aimed at improving gut health.CP Ingredients, Inc.:

CP Ingredients specializes in providing animal health solutions, including high-quality probiotics that promote growth and health in livestock.Chr. Hansen:

Chr. Hansen is renowned for its natural solutions, delivering probiotics tailored to enhance animal nutrition and support digestive health.We're grateful to work with incredible clients.

FAQs

What is the market size of animal Feed Probiotic Bacteria?

The animal-feed-probiotic-bacteria market is valued at $3.5 billion in 2023, with an expected CAGR of 7.8% over the next decade, indicating significant growth potential as demand increases.

What are the key market players or companies in this animal Feed Probiotic Bacteria industry?

Key players include major animal feed manufacturers and probiotic specialists. Their innovation in product formulations and emphasis on quality standards are core to maintaining competitive advantage in this growing market.

What are the primary factors driving the growth in the animal Feed Probiotic Bacteria industry?

Increasing awareness of animal health, rising demand for organic animal products, and regulations promoting probiotic use are primary growth drivers, pushing market expansion and innovation in product offerings.

Which region is the fastest Growing in the animal Feed Probiotic Bacteria?

The Europe region is the fastest-growing area, projected to rise from $1.08 billion in 2023 to $2.35 billion by 2033, signifying an increasing focus on animal welfare and product quality across the region.

Does ConsaInsights provide customized market report data for the animal Feed Probiotic Bacteria industry?

Yes, ConsaInsights offers tailored market reports that address specific inquiries and data needs for businesses looking to optimize strategies within the animal-feed-probiotic-bacteria industry.

What deliverables can I expect from this animal Feed Probiotic Bacteria market research project?

Expect comprehensive reports including market analysis, growth forecasts, segmentation data, competitive analysis, and insights into emerging trends relevant to the animal-feed-probiotic-bacteria industry.

What are the market trends of animal Feed Probiotic Bacteria?

Key trends include increasing use of bacterial probiotics, a shift toward liquid formats due to ease of application, and an emphasis on digestive health solutions aimed at improving livestock productivity.