Animal Parasiticides Market Report

Published Date: 31 January 2026 | Report Code: animal-parasiticides

Animal Parasiticides Market Size, Share, Industry Trends and Forecast to 2033

This detailed market report provides in-depth insights into the Animal Parasiticides market from 2023 to 2033. The report covers market size, segmentation, regional analysis, industry trends, and forecasts, equipping stakeholders with critical data for strategic decision-making.

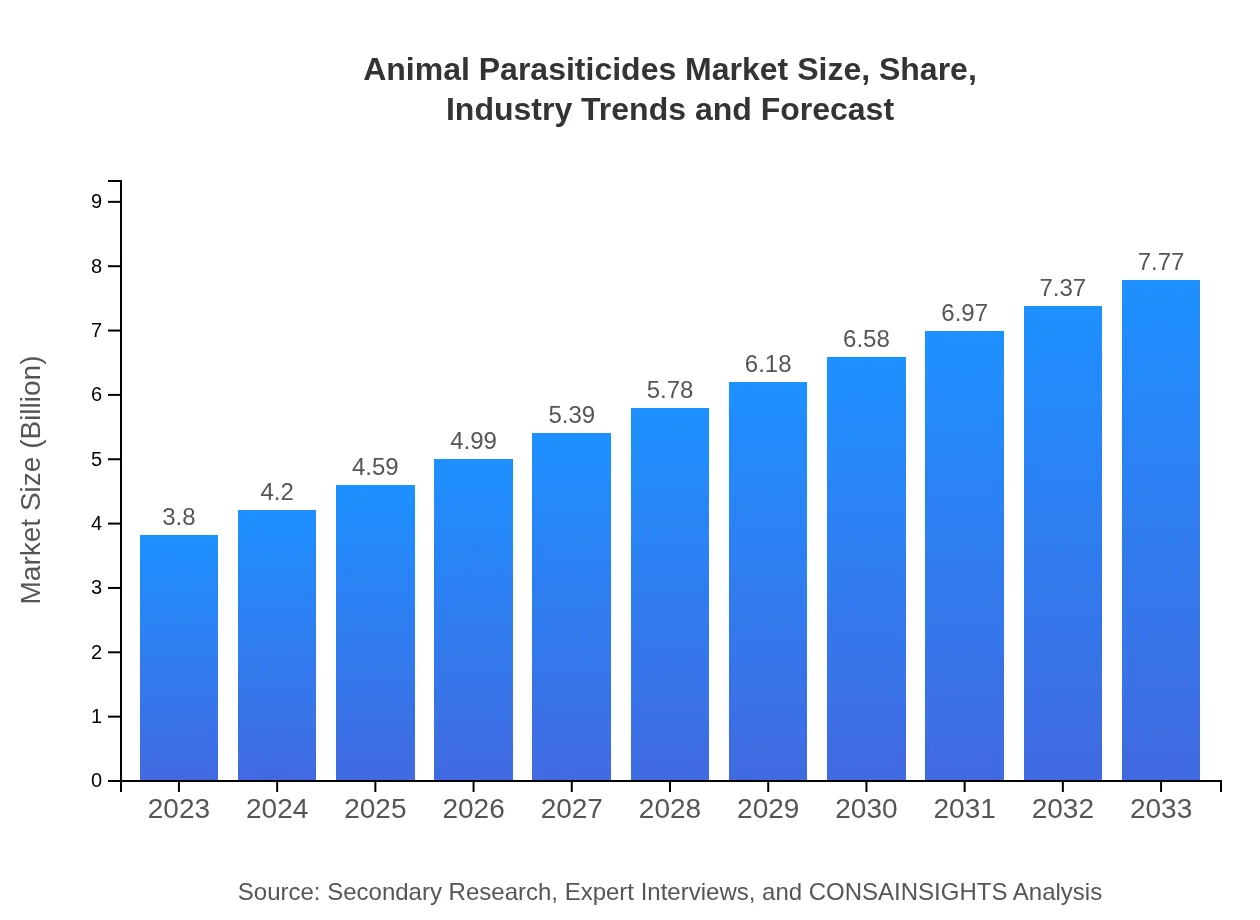

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.77 Billion |

| Top Companies | Boehringer Ingelheim, Merck Animal Health, Elanco Animal Health, Zoetis, BASF |

| Last Modified Date | 31 January 2026 |

Animal Parasiticides Market Overview

Customize Animal Parasiticides Market Report market research report

- ✔ Get in-depth analysis of Animal Parasiticides market size, growth, and forecasts.

- ✔ Understand Animal Parasiticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Animal Parasiticides

What is the Market Size & CAGR of Animal Parasiticides market in 2023?

Animal Parasiticides Industry Analysis

Animal Parasiticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Animal Parasiticides Market Analysis Report by Region

Europe Animal Parasiticides Market Report:

Europe's Animal Parasiticides market is set to grow from 1.38 billion USD in 2023 to 2.81 billion USD by 2033. The region features advanced veterinary care practices, an increase in pet adoption rates, and a rising consciousness about preventive animal healthcare, making it a critical market for parasiticides.Asia Pacific Animal Parasiticides Market Report:

The Asia Pacific region, valued at 0.67 billion USD in 2023, is anticipated to grow to 1.36 billion USD by 2033. The increasing pet ownership rates, coupled with expanding livestock farming, contribute to this growth. Countries like China and India are leading markets due to their large populations and agricultural sectors.North America Animal Parasiticides Market Report:

North America, with a projected value of 1.26 billion USD in 2023, is expected to reach 2.57 billion USD by 2033. The U.S. leads this market due to the high expenditure on pet health and welfare combined with stringent regulations on animal health products, boosting the demand for innovative parasiticides.South America Animal Parasiticides Market Report:

In South America, the Animal Parasiticides market is projected to increase from 0.30 billion USD in 2023 to 0.61 billion USD by 2033. The rise in livestock production and animal husbandry practices in countries like Brazil and Argentina drives this market, leading to greater demand for effective parasitic control methods.Middle East & Africa Animal Parasiticides Market Report:

The Middle East and Africa market, although smaller, is progressing from 0.21 billion USD in 2023 to approximately 0.42 billion USD in 2033. The growth is supported by increased livestock management practices in Africa and expanding veterinary services in the Middle East, requiring effective management of parasitic threats.Tell us your focus area and get a customized research report.

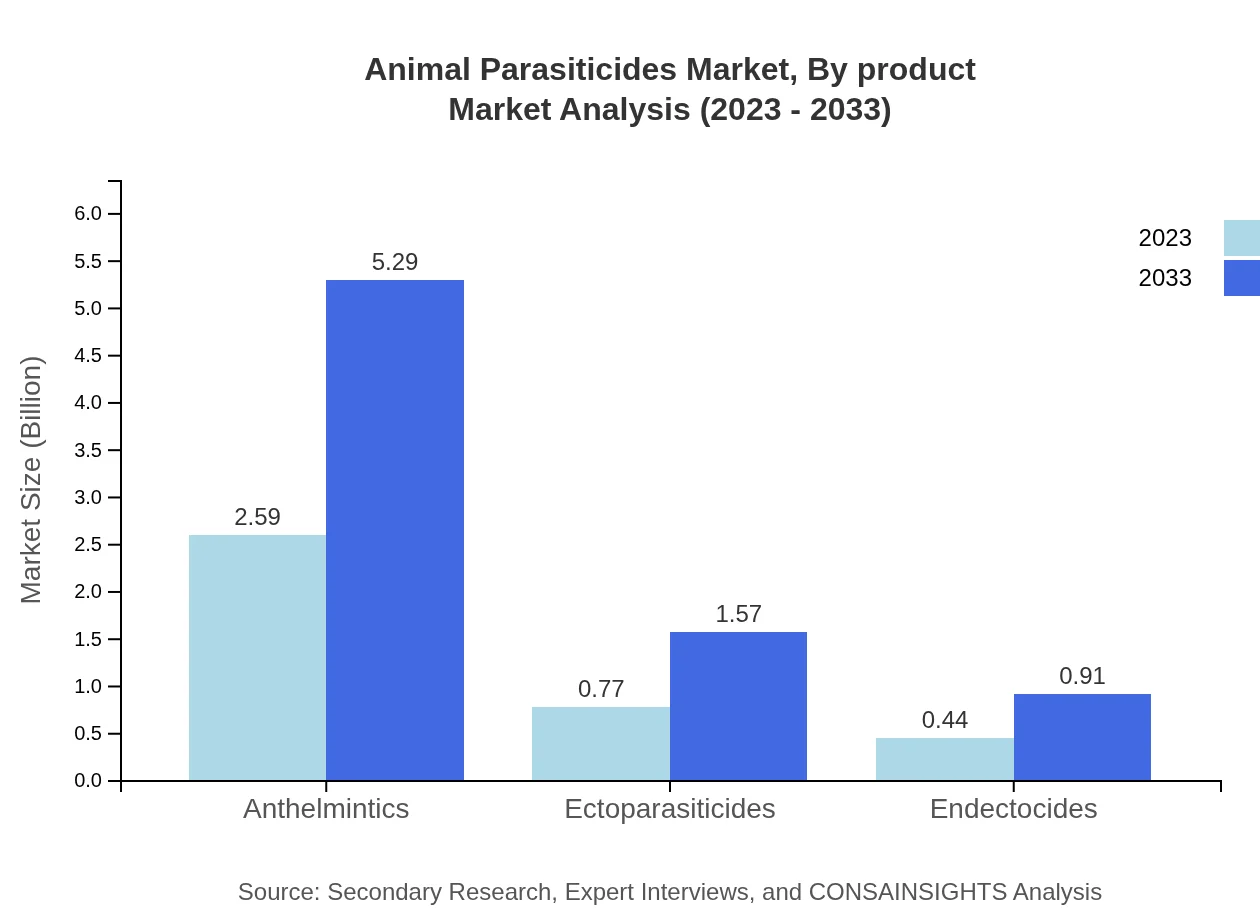

Animal Parasiticides Market Analysis By Product

The split of the Animal Parasiticides market by product type shows a prominent share for anthelmintics, holding a market size of 2.59 billion USD in 2023, projected to grow to 5.29 billion USD by 2033, reflecting a robust demand for internal parasite control. The ectoparasiticides segment, including products like flea and tick treatments, shows a market size of 0.77 billion USD in 2023, expected to expand to 1.57 billion USD. Endectocides, combining effects on both external and internal parasites, will grow from 0.44 billion USD to 0.91 billion USD, highlighting the trend towards comprehensive treatment solutions.

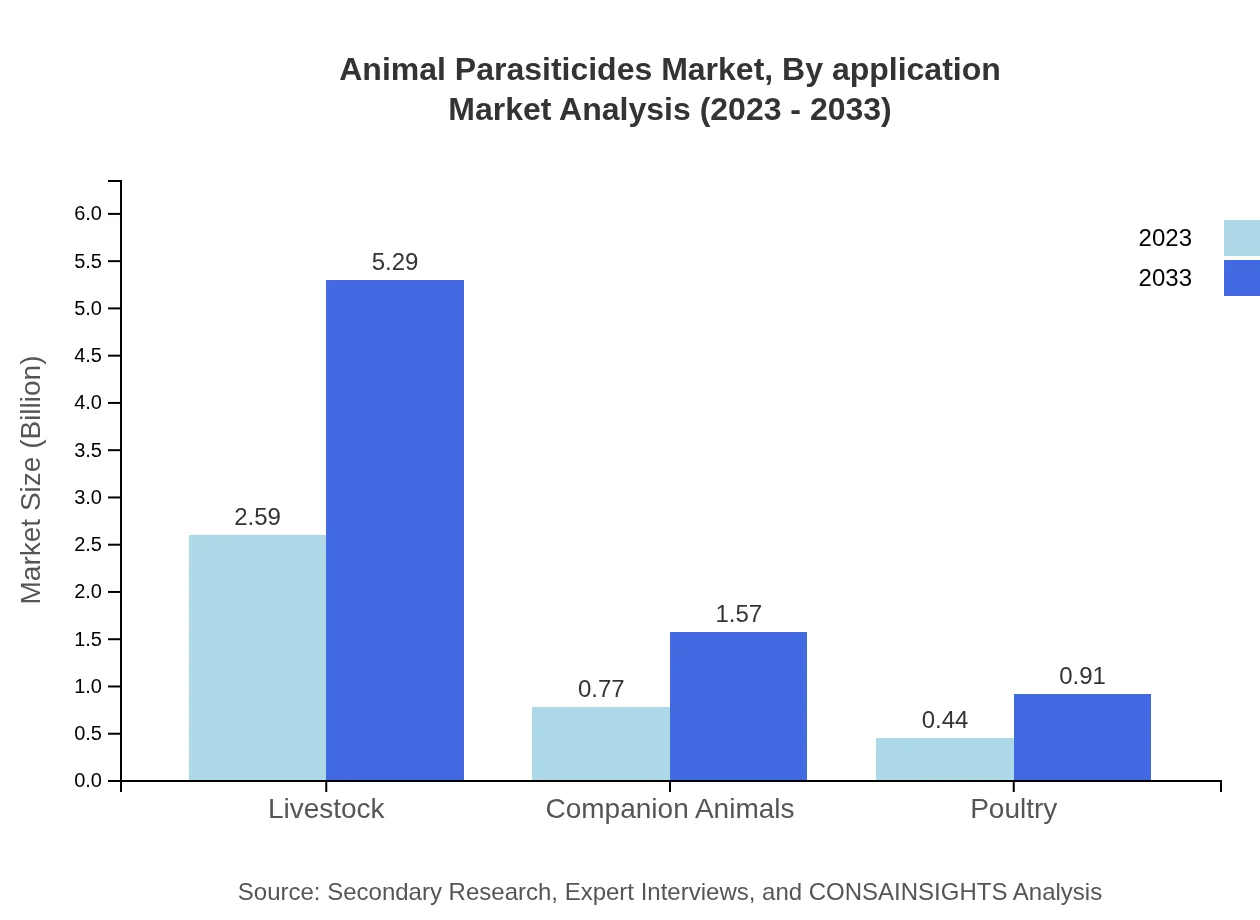

Animal Parasiticides Market Analysis By Application

Key applications in the Animal Parasiticides market include livestock (cattle, sheep, and goats) and companion animals (dogs and cats). The livestock application holds a dominant position, accounting for a major segment of 2.59 billion USD in 2023, set to reach approximately 5.29 billion USD by 2033, driven by increased meat and dairy consumption. Companion animals, representing a growing sector, will increase from 0.77 billion USD to 1.57 billion USD, reflecting growing spending on pet health.

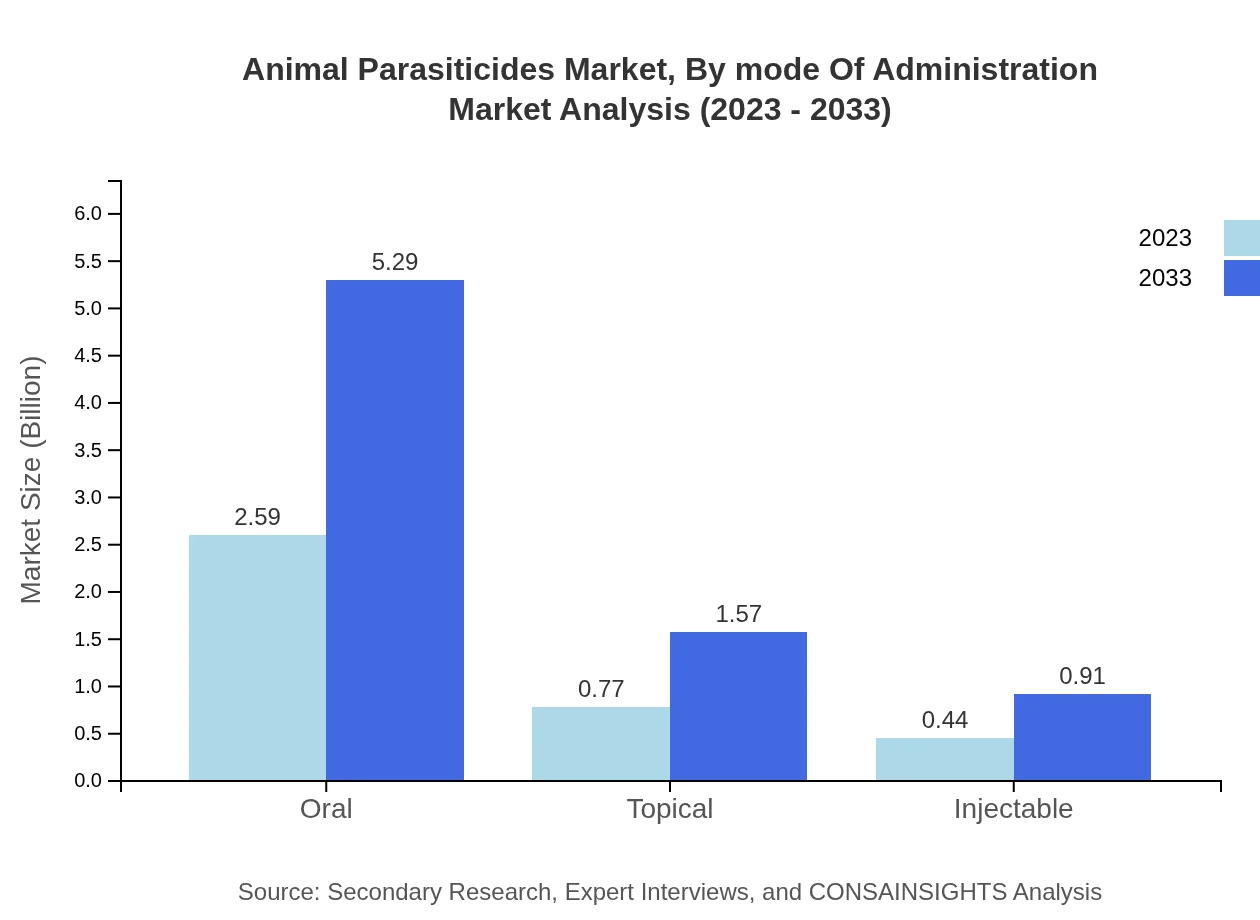

Animal Parasiticides Market Analysis By Mode Of Administration

Product administration modes, including oral (2.59 billion USD), topical (0.77 billion USD), and injectable (0.44 billion USD), delineate market strategies. Oral formulations dominate due to ease of use and effectiveness, projected to grow to 5.29 billion USD by 2033. Topical solutions, evolving to enhance user convenience and targeting ectoparasites, will see growth to 1.57 billion USD. Injectables remain pivotal for severe infestations, expanding from 0.44 billion USD to near 0.91 billion USD as new formulations emerge.

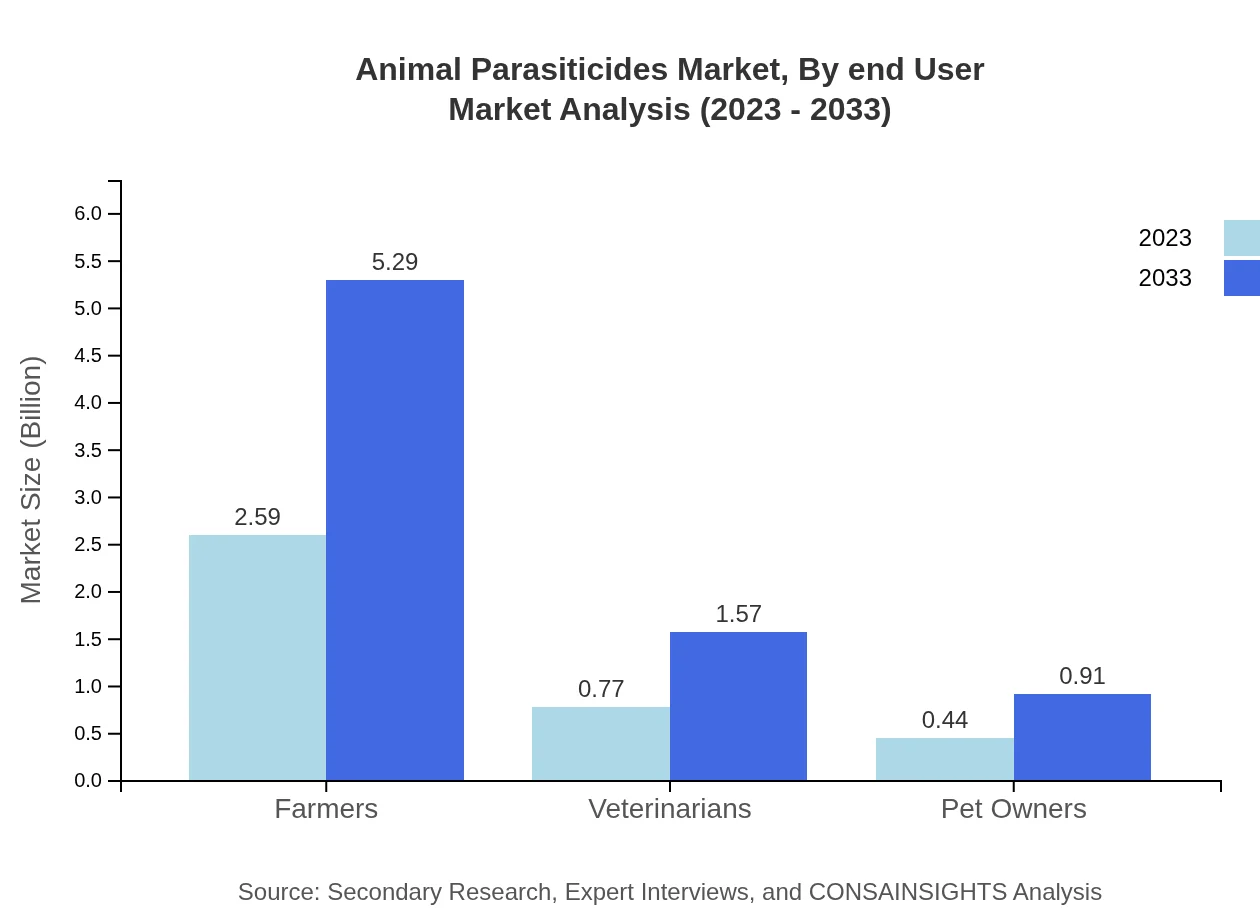

Animal Parasiticides Market Analysis By End User

The end-user segmentation reveals farmers as the primary consumers, commanding 68.09% of the market share in 2023, with expectations of growth to 68.09% by 2033 due to continual livestock management practices. Veterinarians hold a significant share with 20.2%, anticipated to match this percentage by 2033 due to their role in professional treatments. Pet owners, representing 11.71%, are increasingly purchasing products directly for home use, also expecting growth in the future.

Animal Parasiticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Animal Parasiticides Industry

Boehringer Ingelheim:

A leading player in the Animal Parasiticides market, known for its innovative research and a robust portfolio that addresses both livestock and companion animal needs.Merck Animal Health:

A prominent company focused on developing products for the veterinary sector, with a strong emphasis on animal health and welfare, offering a range of parasiticides.Elanco Animal Health:

Known for its advanced solutions, Elanco emphasizes sustainability and efficacy in its product offerings, aiming to improve livestock productivity.Zoetis:

A global leader providing a vast range of animal health products, specializing in the development and marketing of parasiticides for both livestock and pets.BASF:

With a focus on Agricultural Solutions, BASF extends its reach into the animal health sector, offering an array of products to manage parasitic challenges.We're grateful to work with incredible clients.

FAQs

What is the market size of animal Parasiticides?

The animal parasiticides market is valued at approximately $3.8 billion in 2023, with a projected CAGR of 7.2% from 2023 to 2033, indicating consistent growth and increasing demand in the veterinary and agricultural sectors.

What are the key market players or companies in the animal Parasiticides industry?

Key players in the animal-parasiticides market include major pharmaceutical companies and specialized agrochemical firms that focus on innovative parasiticide solutions, ensuring the safety and health of livestock and companion animals across the globe.

What are the primary factors driving the growth in the animal Parasiticides industry?

The growth in the animal-parasiticides market is driven by increasing demand for livestock, rising pet ownership, and the need for effective disease control and management solutions to ensure animal health and productivity.

Which region is the fastest Growing in the animal Parasiticides?

The fastest-growing region in the animal-parasiticides market is projected to be Europe, with market growth from $1.38 billion in 2023 to approximately $2.81 billion by 2033, attributed to stringent regulations and heightened animal health awareness.

Does ConsaInsights provide customized market report data for the animal Parasiticides industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the animal-parasiticides industry, ensuring clients receive comprehensive insights tailored to their strategic objectives.

What deliverables can I expect from this animal Parasiticides market research project?

Deliverables from this market research project will include detailed reports on market size, growth forecasts, competitive analysis, segmentation data, and actionable insights tailored to stakeholders in the animal-parasiticides sector.

What are the market trends of animal Parasiticides?

Current trends in the animal-parasiticides market include the rising focus on organic and sustainable products, advancements in formulation technologies, and increased consumer awareness regarding animal health and welfare.