Antenna Transducer And Radome Market Report

Published Date: 31 January 2026 | Report Code: antenna-transducer-and-radome

Antenna Transducer And Radome Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Antenna Transducer and Radome market, examining insights from 2023 to 2033, including market size, trends, segmentation, and forecasts to guide industry stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

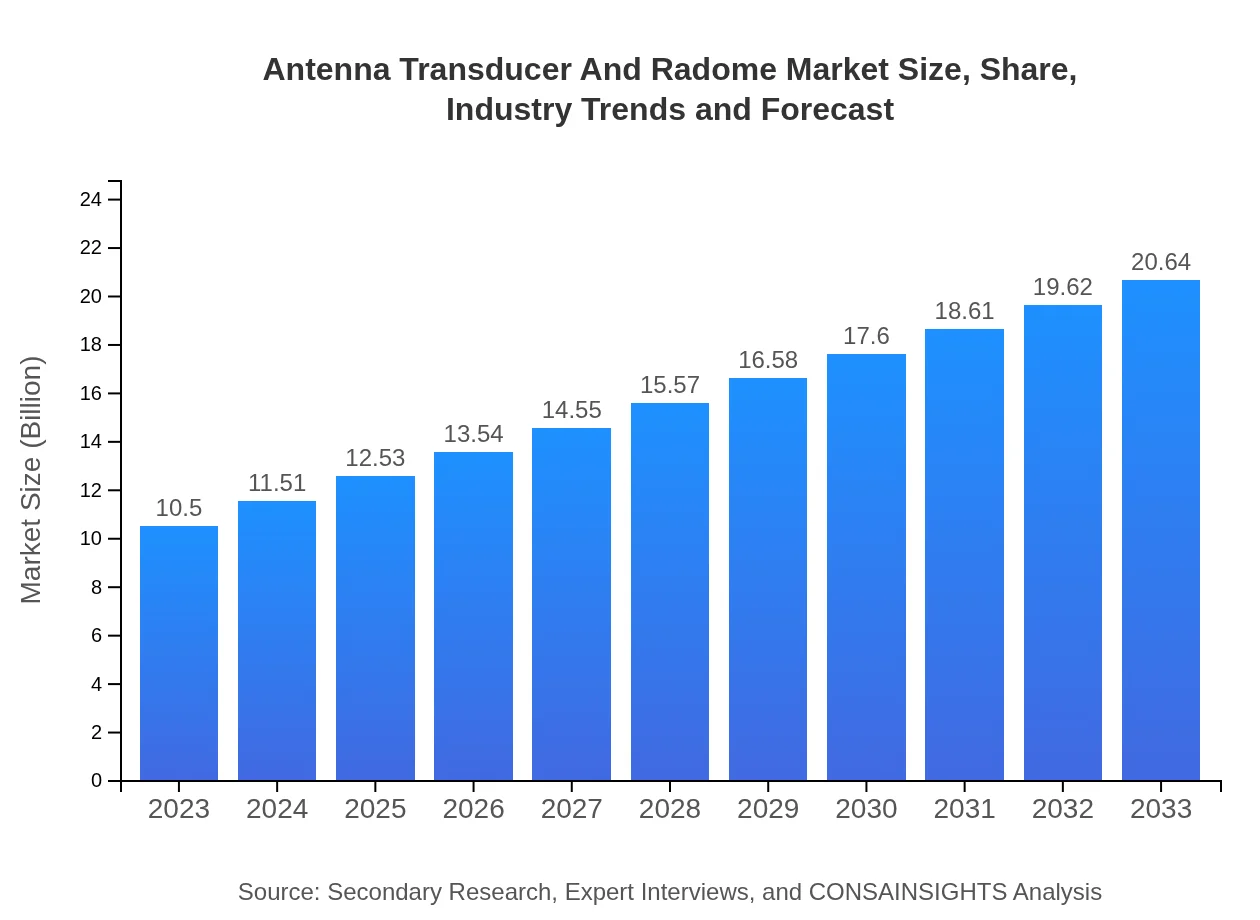

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman, Harris Corporation, SAAB, Thales Group |

| Last Modified Date | 31 January 2026 |

Antenna Transducer And Radome Market Overview

Customize Antenna Transducer And Radome Market Report market research report

- ✔ Get in-depth analysis of Antenna Transducer And Radome market size, growth, and forecasts.

- ✔ Understand Antenna Transducer And Radome's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Antenna Transducer And Radome

What is the Market Size & CAGR of Antenna Transducer And Radome market in 2023 and 2033?

Antenna Transducer And Radome Industry Analysis

Antenna Transducer And Radome Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Antenna Transducer And Radome Market Analysis Report by Region

Europe Antenna Transducer And Radome Market Report:

In Europe, the market was valued at $3.43 billion in 2023 and is expected to reach $6.74 billion by 2033. Europe's focus on 5G implementation and defense modernization programs contributes to this expected growth.Asia Pacific Antenna Transducer And Radome Market Report:

In 2023, the Asia-Pacific region accounted for a significant market size of $1.88 billion, projected to grow to $3.70 billion by 2033. Growth is driven by rising demand for advanced communication technologies, particularly in countries like China and India, where defense expenditures and telecommunications upgrades are prominent.North America Antenna Transducer And Radome Market Report:

North America holds a substantial market share at $3.81 billion in 2023, projected to rise to $7.49 billion by 2033. The region benefits from a robust telecommunications sector, military advancements, and significant R&D investments driven by major players.South America Antenna Transducer And Radome Market Report:

The South American market is relatively small, with a size of $0.04 billion in 2023, expected to increase to $0.07 billion by 2033. Growth factors include increasing governmental efforts to enhance communication infrastructure and security systems.Middle East & Africa Antenna Transducer And Radome Market Report:

The Middle East and Africa market exhibited a value of $1.34 billion in 2023, with projections indicating growth to $2.63 billion by 2033. The increasing focus on military capabilities and communication reliability plays a key role in accelerating market demand.Tell us your focus area and get a customized research report.

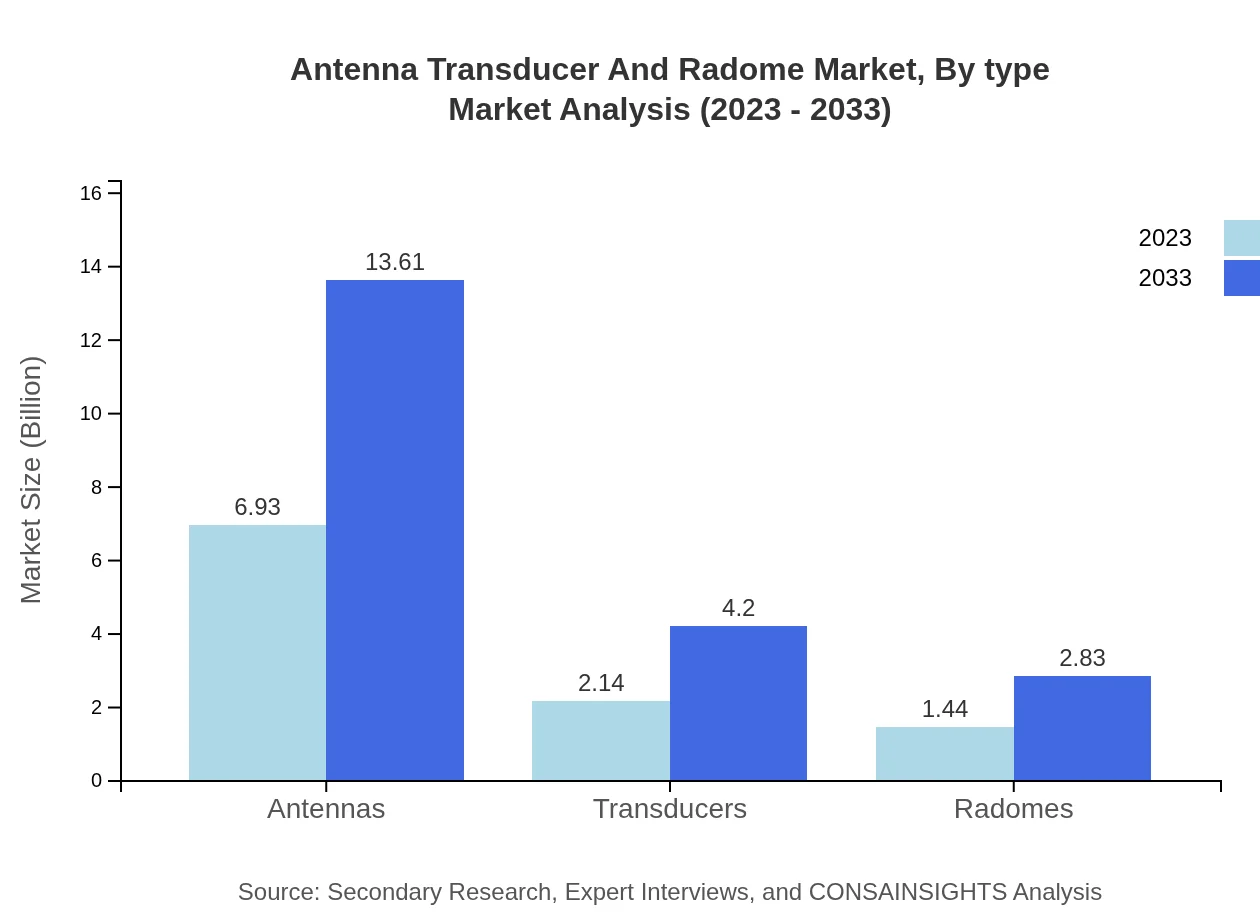

Antenna Transducer And Radome Market Analysis By Type

The market is largely driven by antennas, which are projected to grow from $6.93 billion in 2023 to $13.61 billion by 2033. Transducers contribute $2.14 billion and will grow to $4.20 billion, while radomes will see growth from $1.44 billion to $2.83 billion over the same period, indicating their specialized roles across various applications.

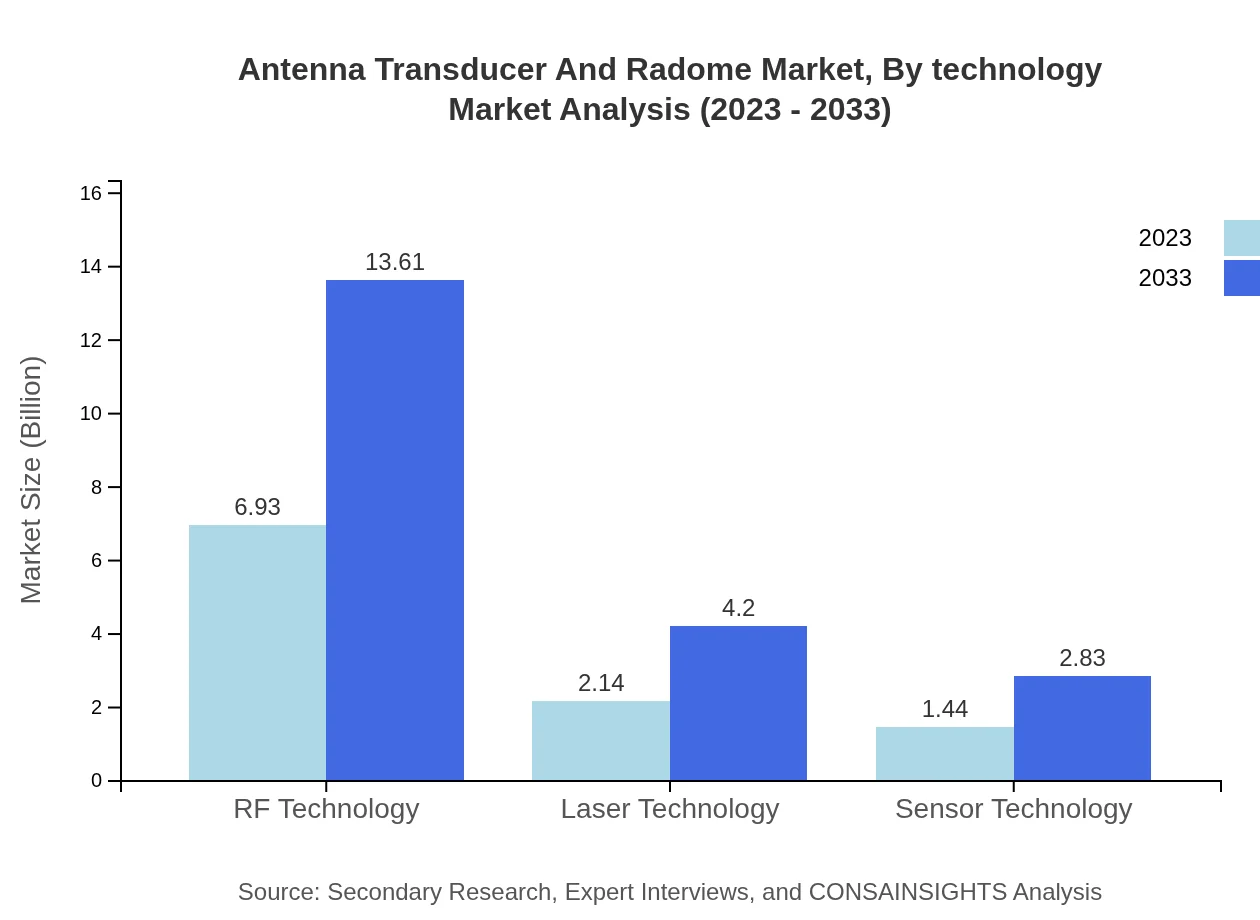

Antenna Transducer And Radome Market Analysis By Technology

Key technologies shaping this market include RF technology, laser technology, and sensor technology. RF technology remains dominant, standing at $6.93 billion in 2023 and set to reach $13.61 billion by 2033. Likewise, laser and sensor technologies also show promising growth, driven by advancements in data transmission and sensor integrations.

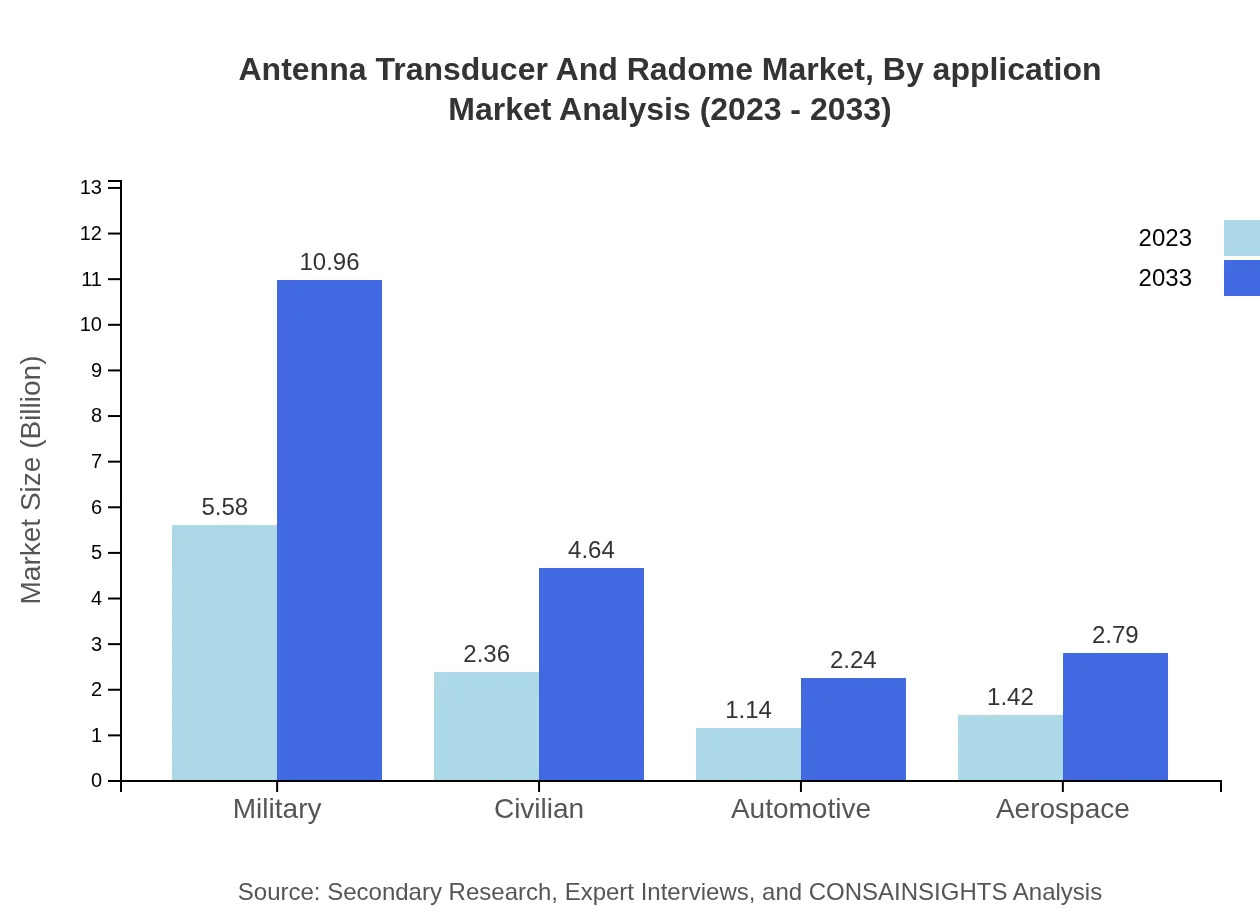

Antenna Transducer And Radome Market Analysis By Application

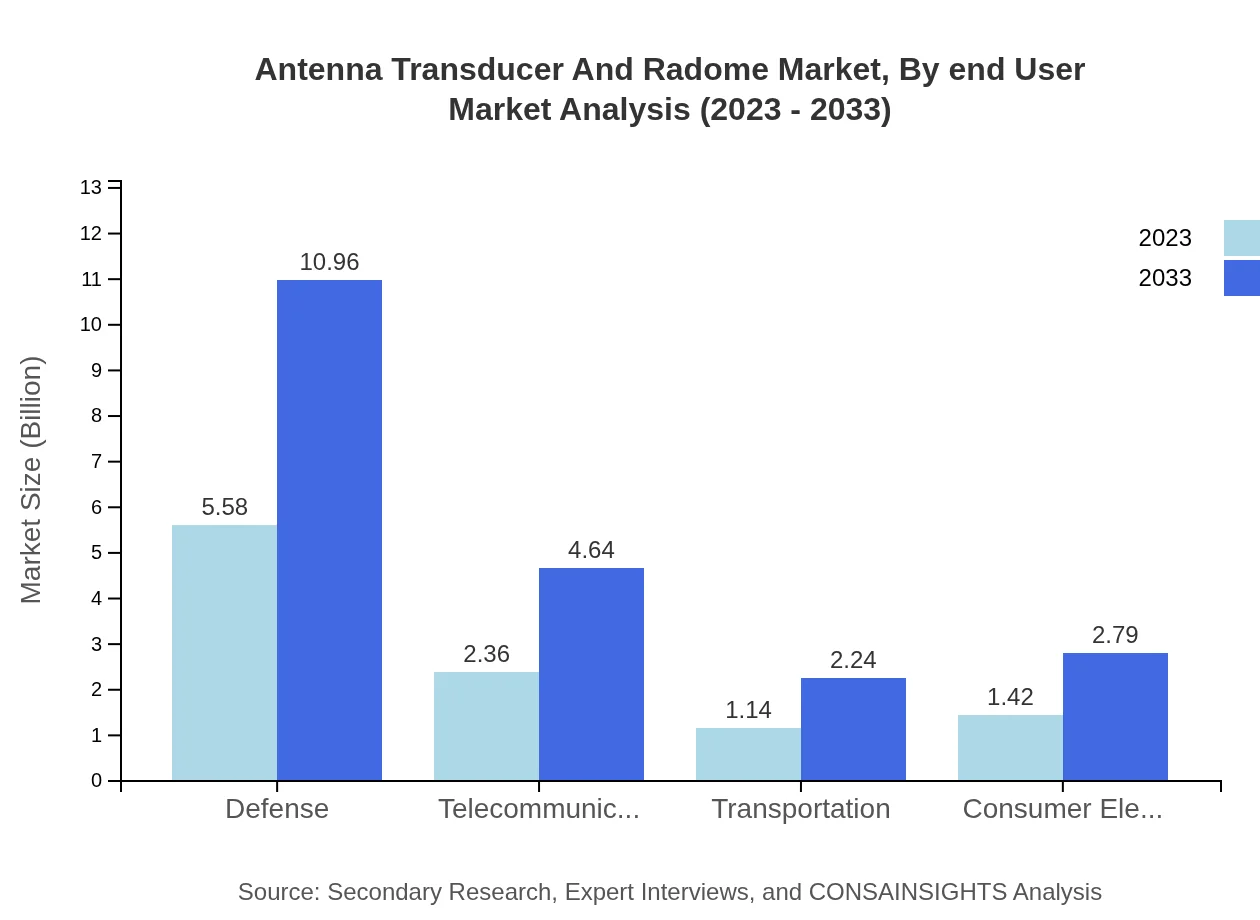

The Antenna Transducer and Radome market is segmented by applications such as defense, telecommunications, transportation, consumer electronics, and aerospace. Defense applications account for the largest share, valued at $5.58 billion in 2023 and expected to grow to $10.96 billion by 2033 due to rising military investments. Telecommunications applications also exhibit robust growth.

Antenna Transducer And Radome Market Analysis By End User

End-users in this market include military, civilian, automotive, and aerospace sectors. The military end-user segment is projected to maintain its dominance, growing from $5.58 billion in 2023 to $10.96 billion by 2033. Civilian applications will rise as well with increased connectivity demands.

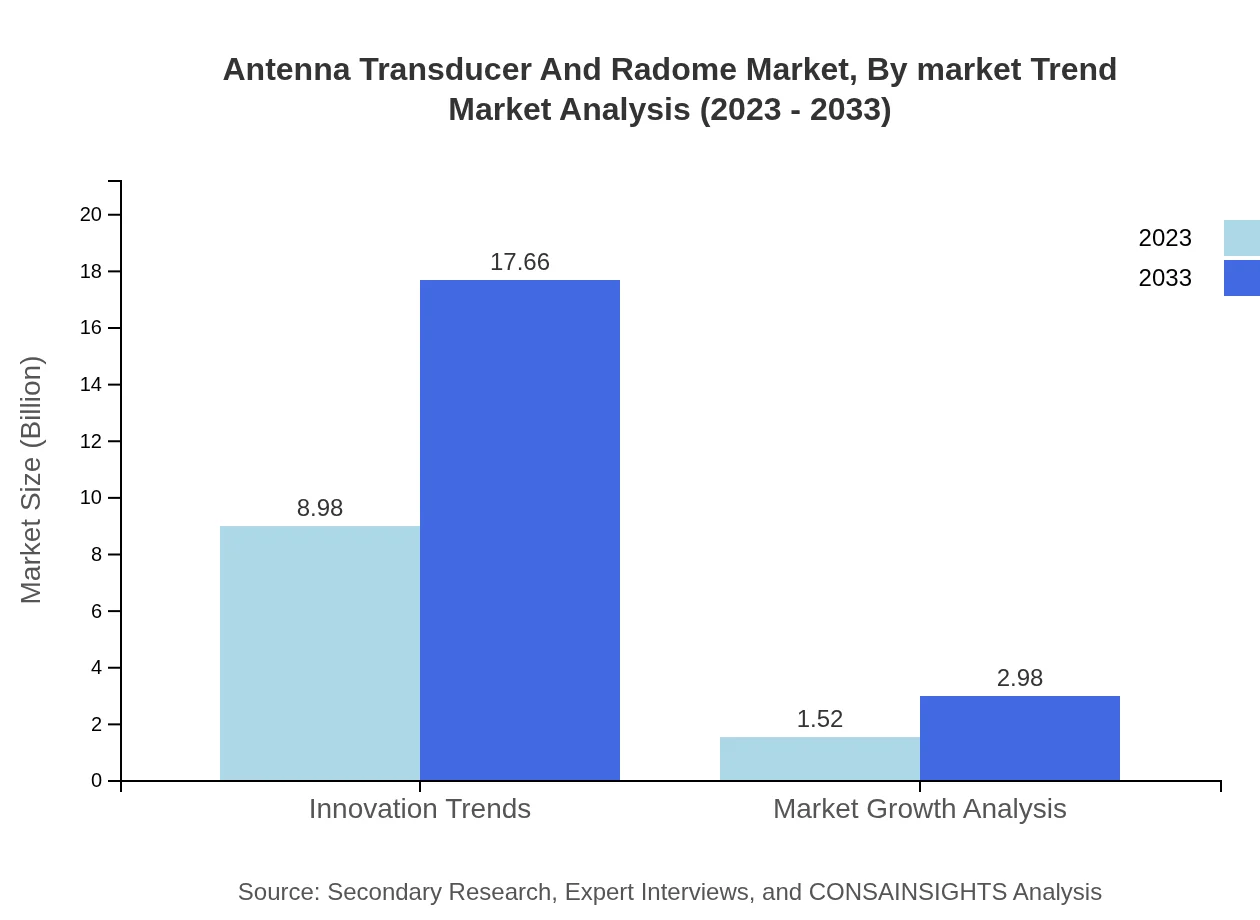

Antenna Transducer And Radome Market Analysis By Market Trend

Current trends indicate an emphasis on innovation with the potential for market growth analysis estimated at $1.52 billion in 2023, scaling up to $2.98 billion by 2033. This sector's future will likely reflect heightened investments in R&D to facilitate the development of next-gen communication solutions.

Antenna Transducer And Radome Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Antenna Transducer And Radome Industry

Raytheon Technologies:

A leader in defense technologies, Raytheon focuses on advanced communication and radar systems, contributing significantly to military applications.Northrop Grumman:

Northrop Grumman is key in aerospace and defense technology, providing cutting-edge antenna and radome solutions tailored for high-stakes applications.Harris Corporation:

Known for its innovations in communications technologies, Harris Corporation supplies a range of transducers and antennas to the telecommunications sector.SAAB:

SAAB develops advanced electronic warfare and radar systems, significantly enhancing performance and operational capabilities.Thales Group:

Thales specializes in equipment for the aerospace and defense industries, focusing on antennas and radomes for secure communications.We're grateful to work with incredible clients.

FAQs

What is the market size of antenna Transducer And Radome?

The global antenna, transducer, and radome market is projected to grow from $10.5 billion in 2023 to a significantly larger market by 2033, with a CAGR of 6.8%. This growth reflects increasing technological advancements and rising demand across various sectors.

What are the key market players or companies in this antenna Transducer And Radome industry?

Key players in the antenna, transducer, and radome market include leading technology firms and electronics manufacturers specialized in RF and radar technologies. They play critical roles in driving product innovation and catering to diverse industrial needs.

What are the primary factors driving the growth in the antenna Transducer And Radome industry?

Factors driving growth include the rising demand for advanced communication systems, increased defense spending, and technological advancements in satellite and wireless communications. Additionally, the expansion of IoT applications fuels the need for innovative antenna technologies.

Which region is the fastest Growing in the antenna Transducer And Radome?

The fastest-growing region is North America, with market size projected to grow from $3.81 billion in 2023 to $7.49 billion by 2033. This growth is driven by substantial investments in defense and advanced communication technologies.

Does ConsaInsights provide customized market report data for the antenna Transducer And Radome industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the antenna, transducer, and radome industry, allowing businesses to gain insights relevant to their operations and strategic objectives.

What deliverables can I expect from this antenna Transducer And Radome market research project?

Deliverables include comprehensive market analysis, segmentation data, competitive landscape assessment, and regional forecasts. Clients receive actionable insights, market trends, and forecasts for informed decision-making.

What are the market trends of antenna Transducer And Radome?

Market trends include a surge in demand for smart antennas, the integration of AI in signal processing, and advancements in materials used for radomes. Sustainability efforts are also influencing product development and manufacturing processes.