Anti Caking Market Report

Published Date: 31 January 2026 | Report Code: anti-caking

Anti Caking Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Anti Caking market, showcasing insights into market trends, size, segmentation, and forecasts from 2023 to 2033.

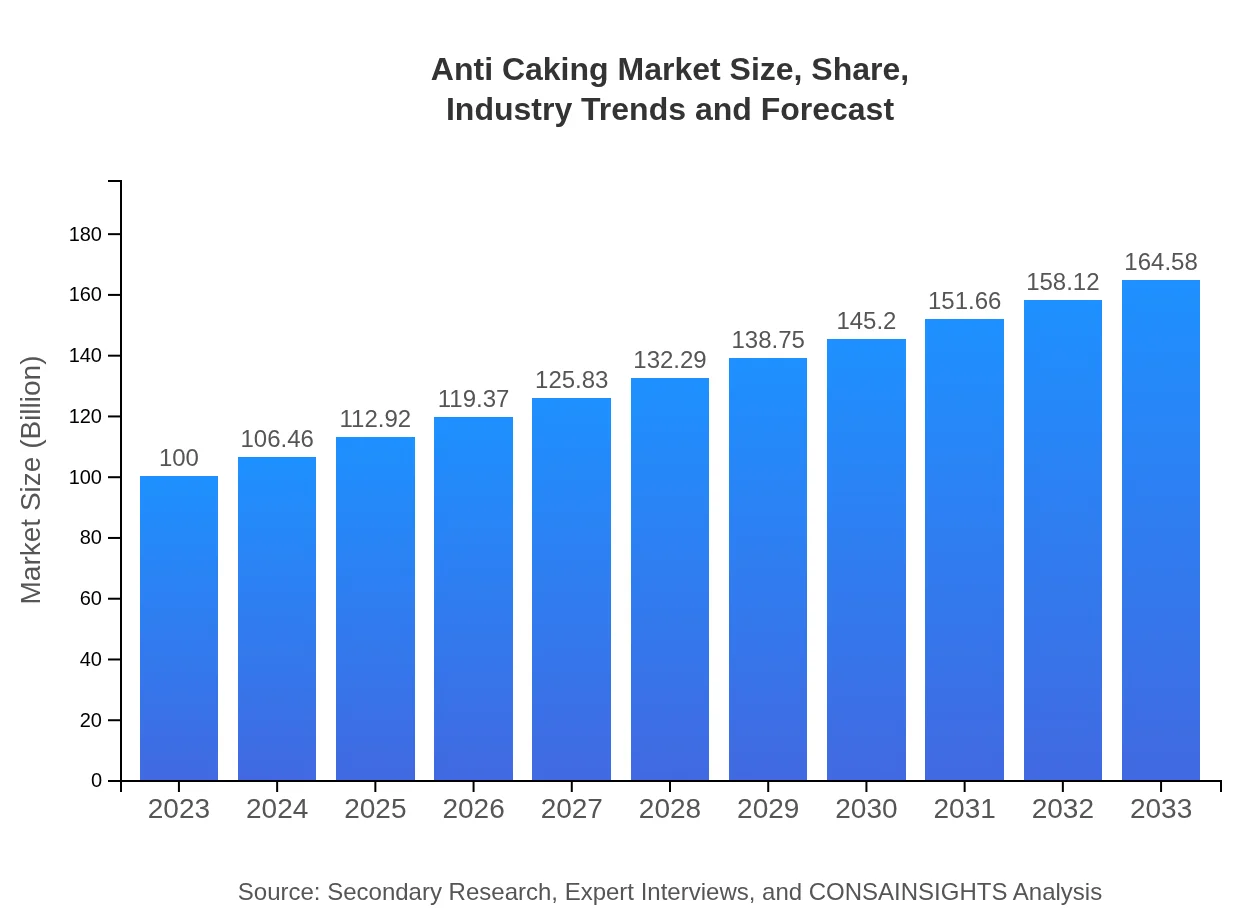

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Evonik Industries AG, BASF SE, FMC Corporation, Kraton Corporation, Hawkins, Inc. |

| Last Modified Date | 31 January 2026 |

Anti Caking Market Overview

Customize Anti Caking Market Report market research report

- ✔ Get in-depth analysis of Anti Caking market size, growth, and forecasts.

- ✔ Understand Anti Caking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Caking

What is the Market Size & CAGR of Anti Caking market in 2023 and 2033?

Anti Caking Industry Analysis

Anti Caking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Caking Market Analysis Report by Region

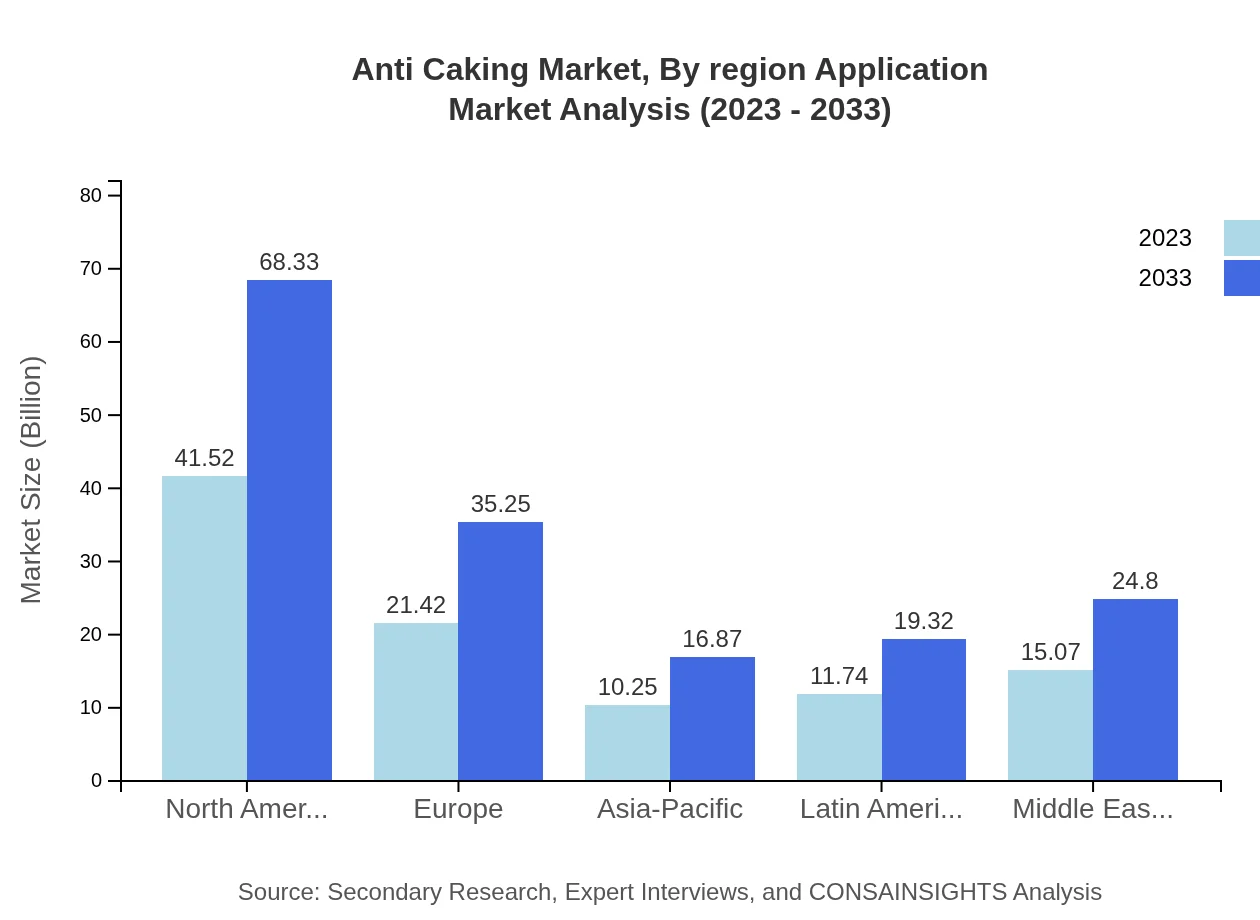

Europe Anti Caking Market Report:

The European Anti Caking market stands at about USD 29.07 million in 2023, projected to reach USD 47.84 million by 2033. The increasing demand for packaged food and the growth of the dietary supplement sector are key growth factors, supported by a shift towards clean label products.Asia Pacific Anti Caking Market Report:

In 2023, the Asia Pacific Anti Caking market is valued at USD 19.01 million and is expected to grow to USD 31.29 million by 2033. The region is witnessing increased industrialization and growing food-processing activities which fuel the demand for anti-caking solutions. This is compounded by rising health awareness leading consumers to prefer processed herbal and natural food products.North America Anti Caking Market Report:

North America leads the market with a valuation of USD 36.92 million in 2023, anticipated to rise to USD 60.76 million by 2033. The region is characterized by a well-established food and beverage industry and stringent food quality regulations, promoting the use of advanced anti-caking agents.South America Anti Caking Market Report:

The South American market is projected to grow from USD 9.77 million in 2023 to USD 16.08 million by 2033. Economic growth in countries like Brazil and Argentina is contributing to greater investments in food production and agricultural processing, thus driving demand for anti-caking agents.Middle East & Africa Anti Caking Market Report:

In the Middle East and Africa, the market is projected to expand from USD 5.23 million in 2023 to USD 8.61 million by 2033. Factors influencing this growth include rising urbanization, increased demand for processed foods, and agricultural advancements that require anti-caking agents in various applications.Tell us your focus area and get a customized research report.

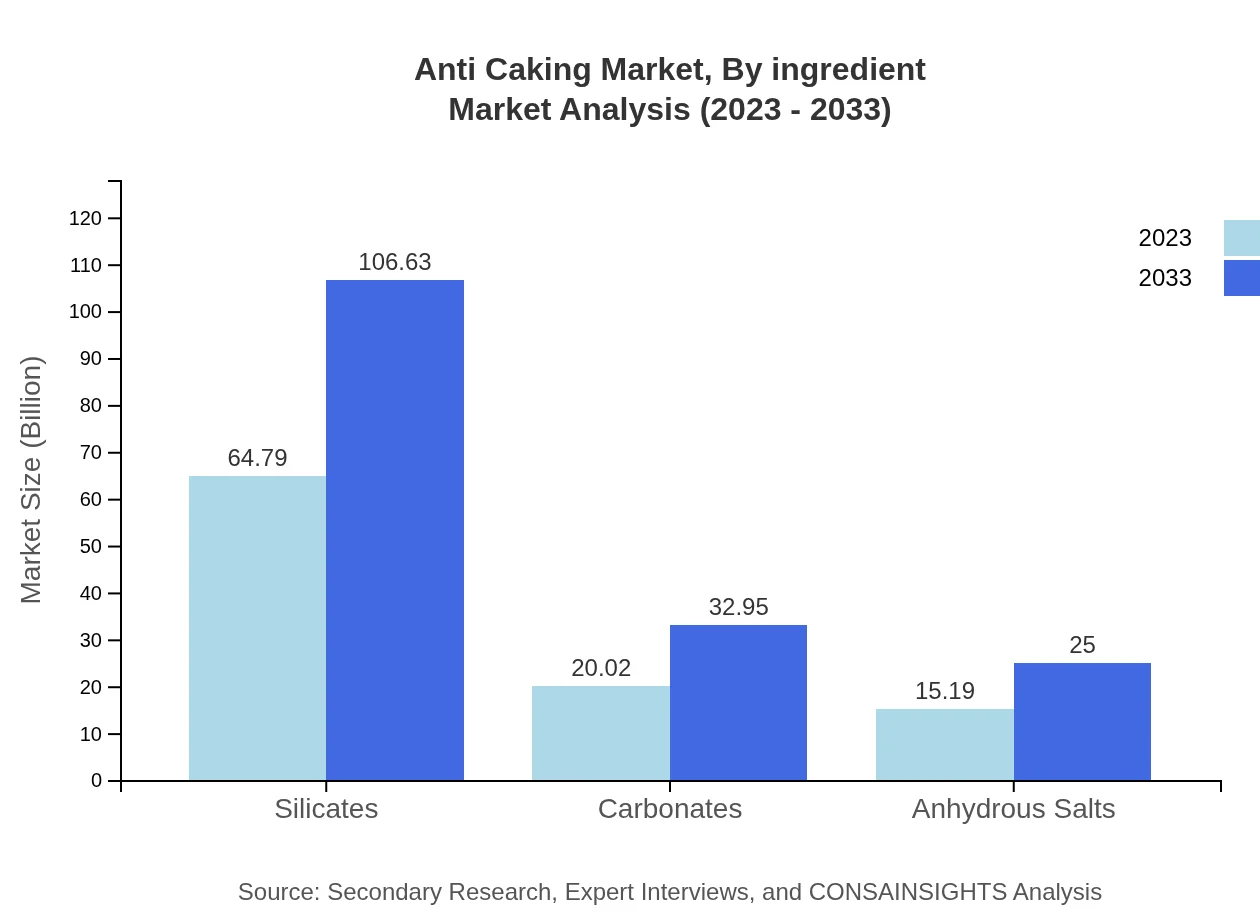

Anti Caking Market Analysis By Ingredient

The ingredient segment is dominated by silicates, comprising a major share of the market. By 2033, the market for silicates is projected to be valued at USD 106.63 million, while carbonate and anhydrous salt segments are expected to reach USD 32.95 million and USD 25 million, respectively. Each ingredient varies in application significance, with silicates often being preferred for their efficiency.

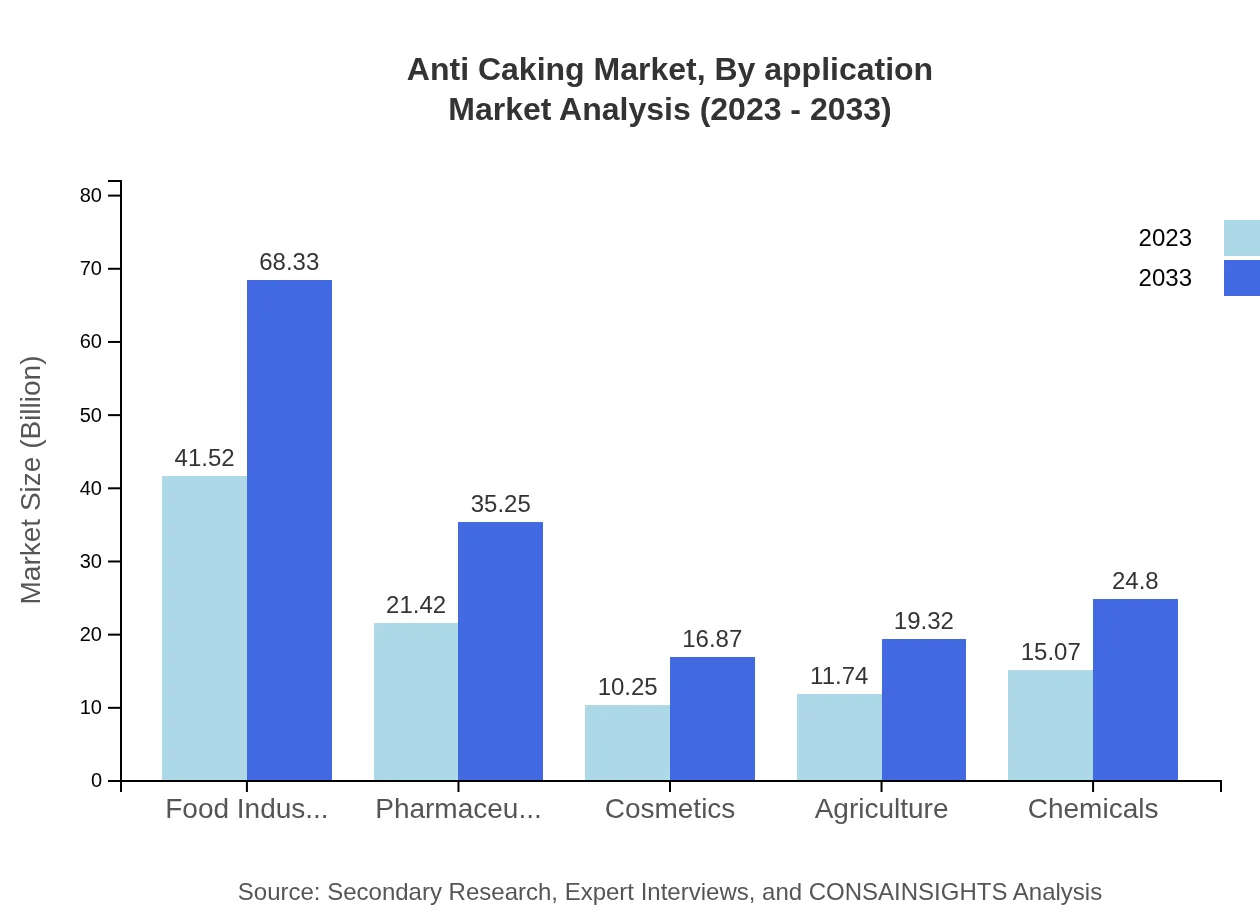

Anti Caking Market Analysis By Application

Food and beverage applications account for the largest segment, valued at USD 41.52 million in 2023 and expected to grow to USD 68.33 million. The rise of the health-conscious consumer is influencing this trend. Pharmaceuticals and personal care sectors are also significant, with projections of significant growth, thus broadening the market landscape.

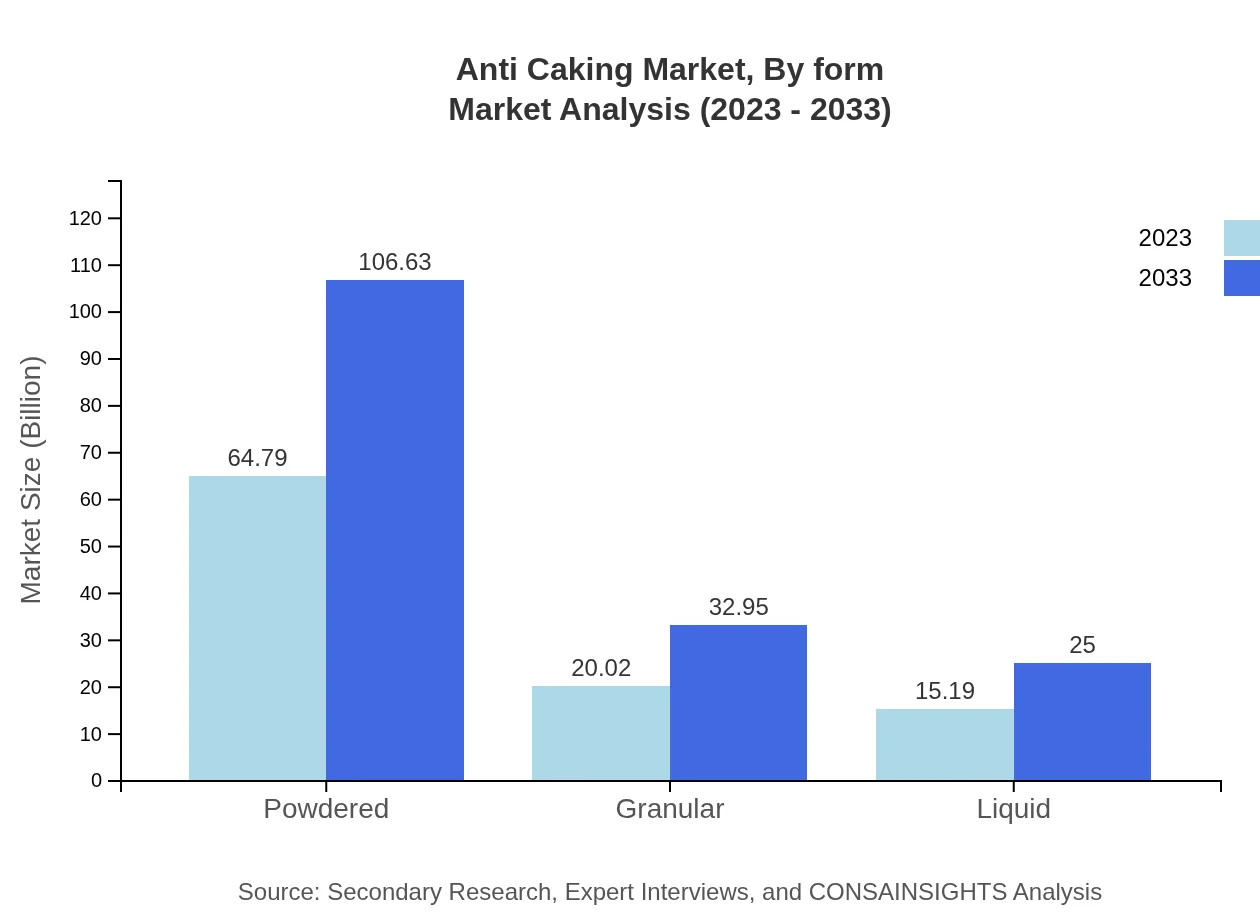

Anti Caking Market Analysis By Form

The form segment includes powdered, granular, and liquid anti-caking agents. The powdered form holds a significant market share, expected to be valued at USD 106.63 million by 2033. Granular forms follow closely, showcasing growth owing to their application in industrial processes.

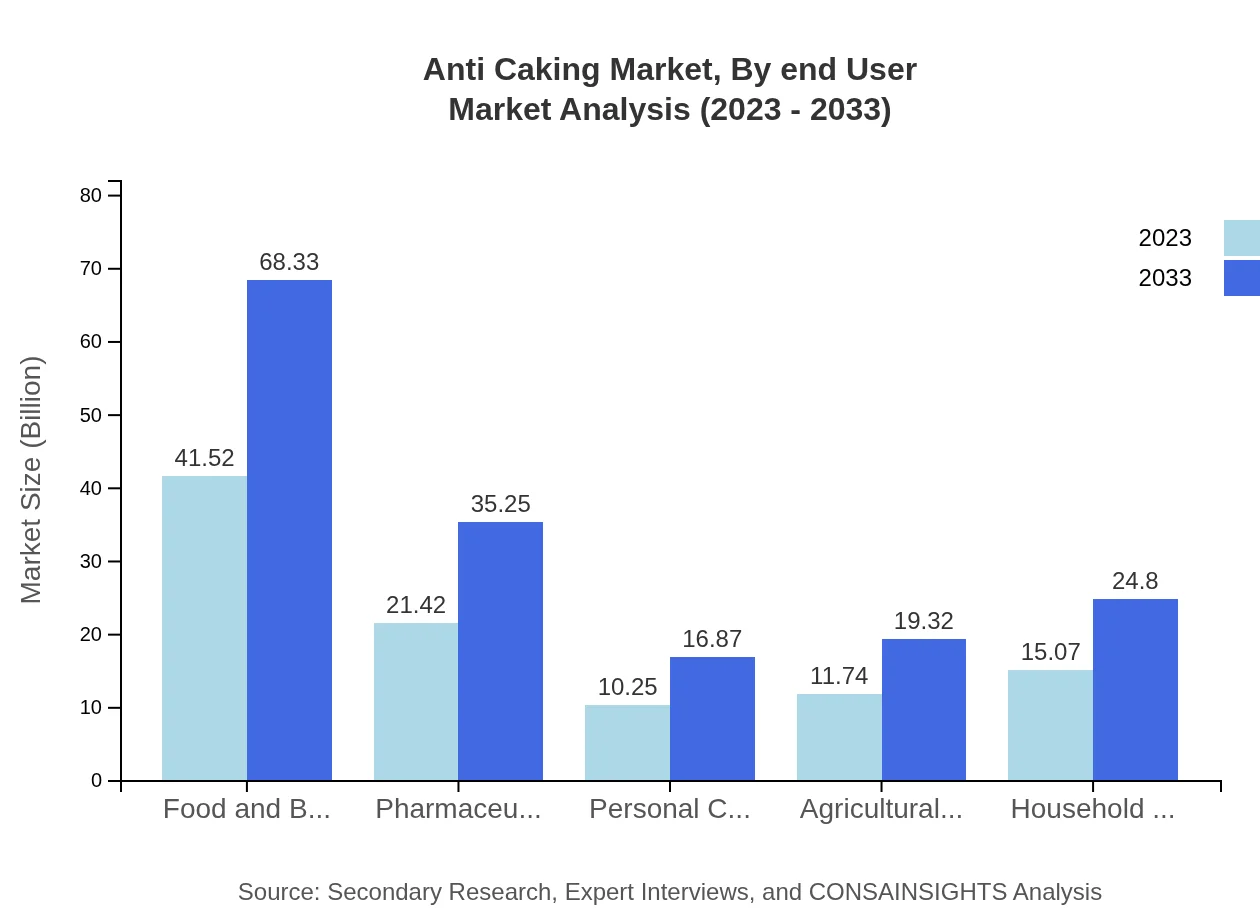

Anti Caking Market Analysis By End User

Key end-users include food processing, pharmaceuticals, and agricultural sectors. The food processing industry remains the largest segment, benefiting from ongoing consumer trends favoring convenience and quality. Pharmaceuticals display promising growth potential due to increasing demand for effective active pharmaceutical ingredients.

Anti Caking Market Analysis By Region Application

Regional applications reflect the global demand curve, with North America leading significantly. Europe and Asia-Pacific are also strongholds, with increasing demand for clean-label products, supported by regulatory advances promoting higher quality standards across the board.

Anti Caking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Caking Industry

Evonik Industries AG:

A leading specialty chemicals company known for its innovative anti-caking agents and solutions that enhance product performance across various applications.BASF SE:

A global chemical company providing high-quality anti-caking agents, which play a critical role in maintaining the quality and stability of food products.FMC Corporation:

Specialized in developing and manufacturing innovative solutions including anti-caking agents for the agricultural and food industries.Kraton Corporation:

Renowned for producing high-performance additives and has a strong portfolio of anti-caking agents utilized across multiple sectors.Hawkins, Inc.:

A leading provider of anti-caking solutions, particularly in the food industry, with a strong commitment to quality and customer service.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Caking?

The global anti-caking market is projected to reach approximately $100 million by 2033, growing at a CAGR of 5% from 2023. This indicates steady demand for anti-caking agents across various industries, facilitating smoother processing and stabilization of products.

What are the key market players or companies in the anti Caking industry?

Major players in the anti-caking market include established firms that specialize in food additives and industrial chemicals. These companies focus on developing innovative solutions to meet the growing demand for anti-caking agents, enhancing product quality and usability.

What are the primary factors driving the growth in the anti Caking industry?

Key growth drivers include the increasing demand for processed foods, rising consumer awareness regarding product quality, and advancements in food processing technologies. These factors collectively contribute to the expanding utilization of anti-caking agents across various sectors.

Which region is the fastest Growing in the anti Caking market?

North America is currently the fastest-growing region in the anti-caking market, with a forecasted market size increase from $36.92 million in 2023 to $60.76 million by 2033. Growth is fueled by a booming food and beverage sector.

Does ConsaInsights provide customized market report data for the anti Caking industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, providing in-depth analysis and detailed insights into the anti-caking industry, including market size, trends, and competitive landscape information.

What deliverables can I expect from this anti Caking market research project?

Deliverables from this research project will include comprehensive market analysis, trend forecasts, competitive landscape, and segment breakdowns, ensuring clients receive a holistic view of the anti-caking market for informed decision-making.

What are the market trends of anti Caking?

Current trends in the anti-caking market include the increasing use of natural anti-caking agents, enhanced regulatory standards for food safety, and a growing preference for clean-label products, reflecting consumer demand for transparency in ingredient sourcing.