Anti Drone Market Report

Published Date: 03 February 2026 | Report Code: anti-drone

Anti Drone Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Anti Drone market from 2023 to 2033, covering market size, growth trends, regional insights, and competitive landscape. It offers valuable data for understanding the trends and challenges in this rapidly evolving sector.

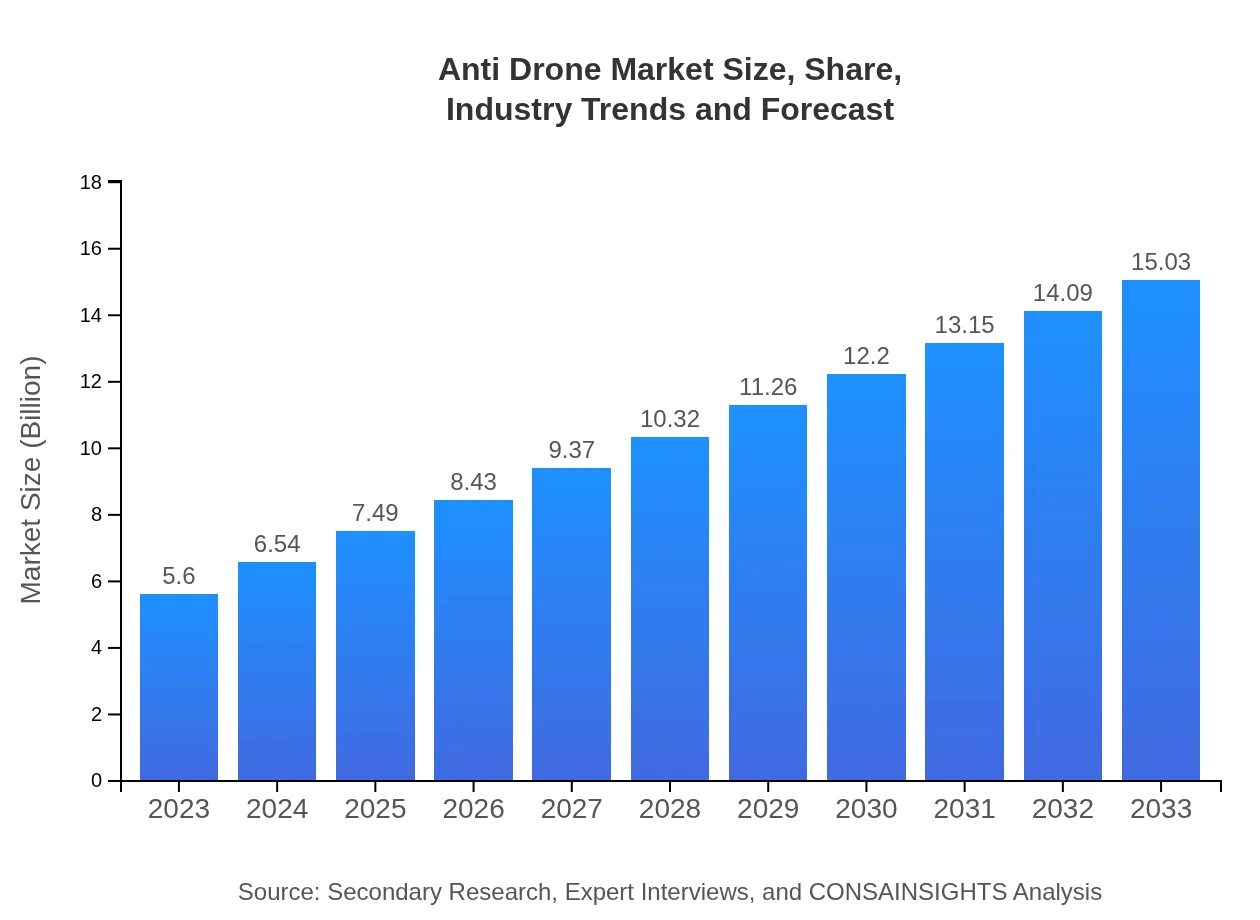

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $15.03 Billion |

| Top Companies | Northrop Grumman, Raytheon Technologies, Lockheed Martin, DroneShield |

| Last Modified Date | 03 February 2026 |

Anti Drone Market Overview

Customize Anti Drone Market Report market research report

- ✔ Get in-depth analysis of Anti Drone market size, growth, and forecasts.

- ✔ Understand Anti Drone's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Drone

What is the Market Size & CAGR of Anti Drone market in 2023?

Anti Drone Industry Analysis

Anti Drone Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Drone Market Analysis Report by Region

Europe Anti Drone Market Report:

The European Anti Drone market stands at $1.49 billion in 2023, expected to reach $4.01 billion by 2033. Stringent regulations regarding drone use in Europe necessitate the adoption of effective countermeasures.Asia Pacific Anti Drone Market Report:

In 2023, the Anti Drone market in Asia Pacific is valued at $1.10 billion, expected to grow to $2.95 billion by 2033, driven by increased drone usage in urban areas and the need for security systems in densely populated environments.North America Anti Drone Market Report:

With a valuation of $2.01 billion in 2023, North America’s Anti Drone market is anticipated to rise to $5.40 billion by 2033, fueled by significant investments in defense technology and the rising demand from commercial sectors.South America Anti Drone Market Report:

The South American market, valued at $0.23 billion in 2023, is projected to reach $0.61 billion by 2033. Emerging economies are beginning to adopt anti-drone technologies amid rising security concerns.Middle East & Africa Anti Drone Market Report:

In 2023, the market in the Middle East and Africa is valued at $0.77 billion, projected to grow to $2.08 billion by 2033, driven by regional security threats and an increase in military expenditures.Tell us your focus area and get a customized research report.

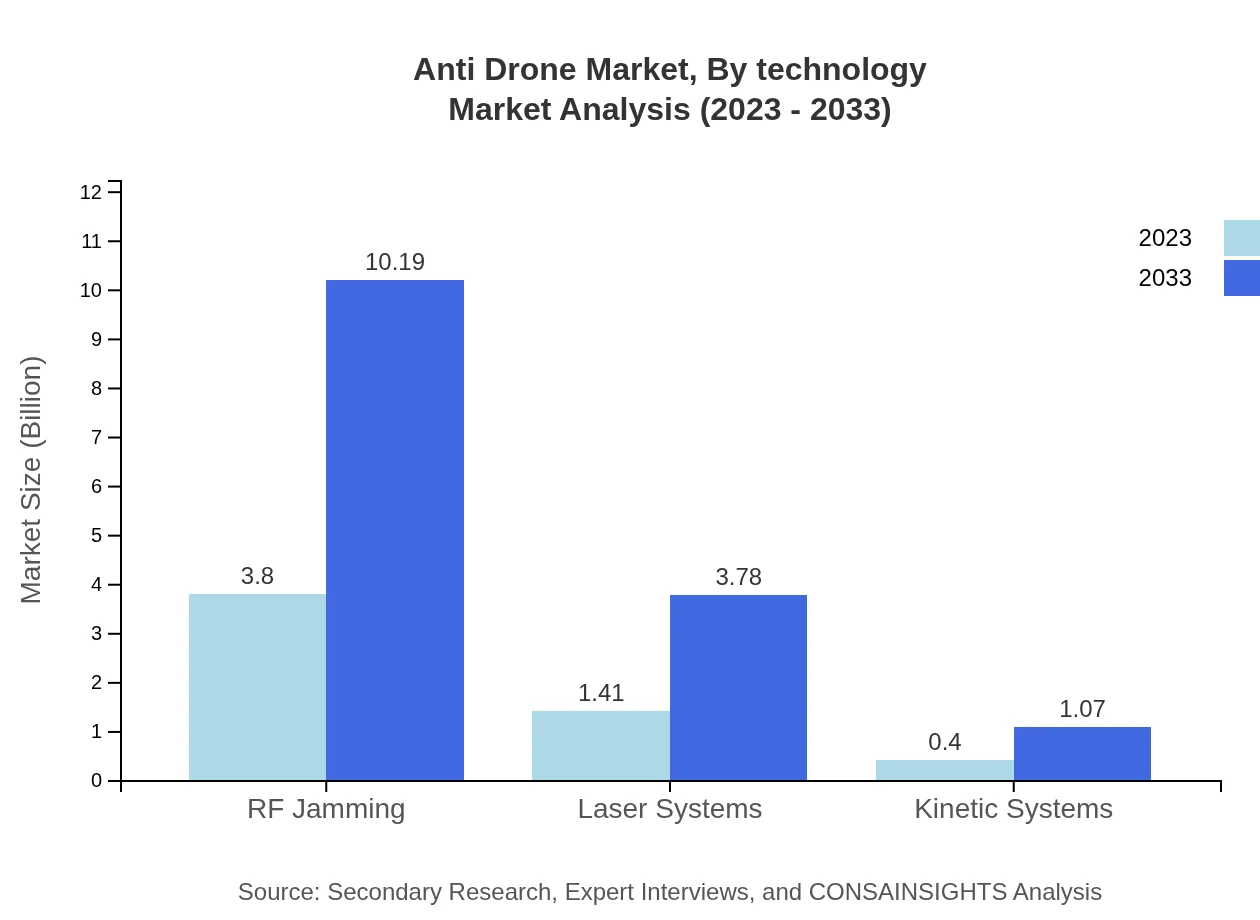

Anti Drone Market Analysis By Technology

The Anti Drone market is segmented by technology into RF Jamming, Laser Systems, and Kinetic Systems. RF Jamming leads the market with a significant share, contributing to 67.77% in 2023 and expected to maintain this share through 2033. Laser systems hold a 25.12% market share, attracting investments due to their precision and lower collateral damage, while Kinetic Systems, although smaller, are gaining traction in military applications.

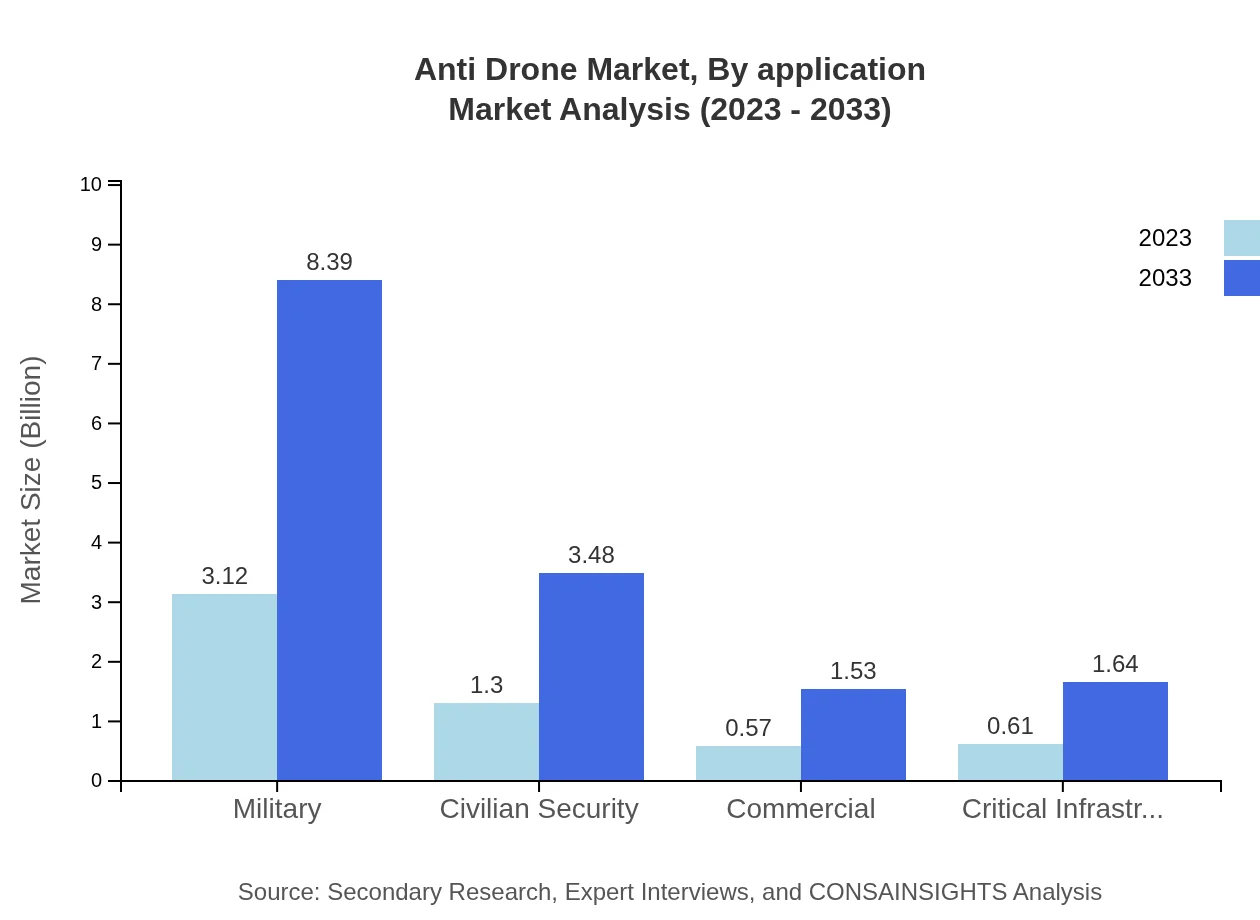

Anti Drone Market Analysis By Application

In terms of application, the military sector dominates the Anti Drone market, accounting for 55.8% in 2023 and projected to remain steady through 2033. The civilian security sector follows closely, with a share of 23.14%, as governments and private entities increasingly protect against drone interference in sensitive areas.

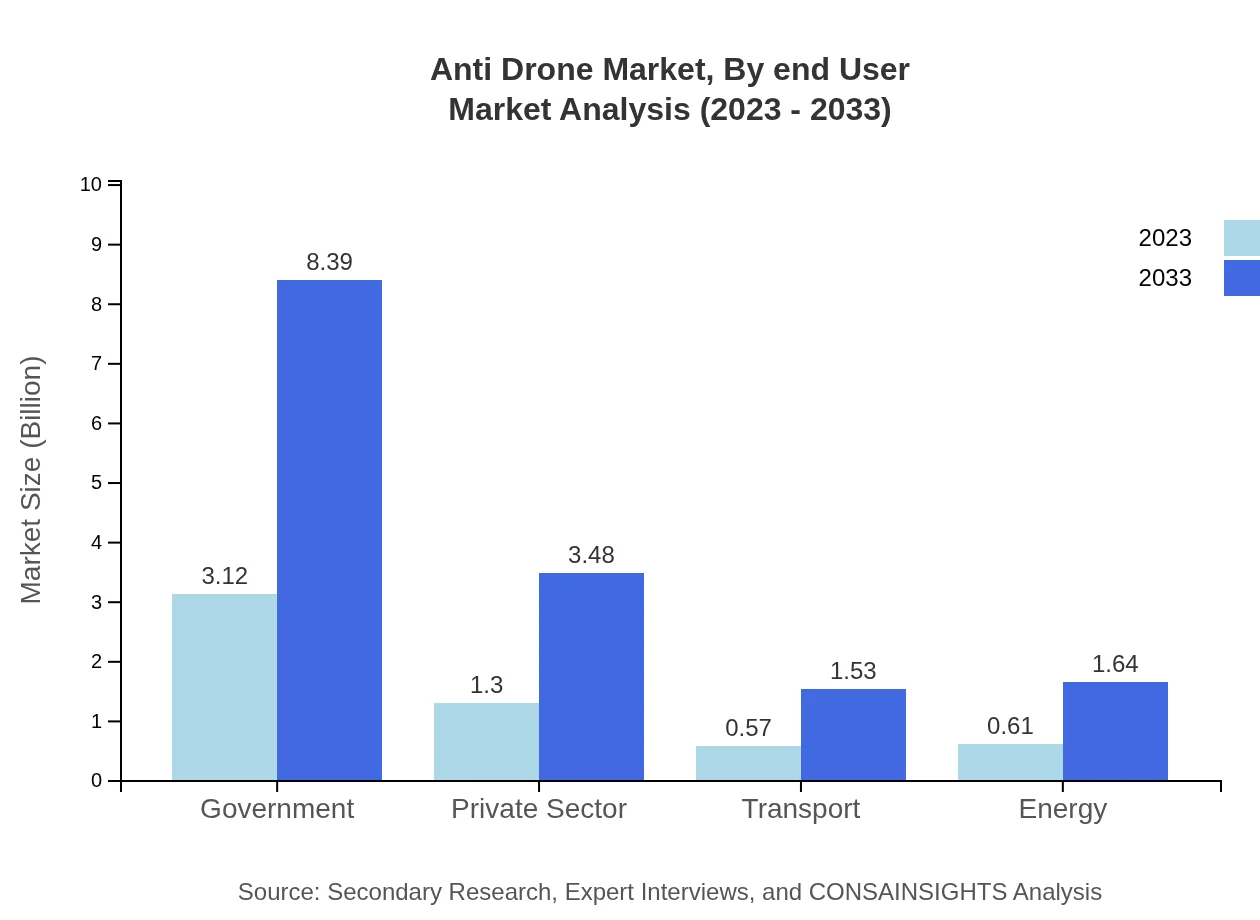

Anti Drone Market Analysis By End User

The end-user segmentation reveals a diverse array of applications. The government sector holds a major share at 55.8%, focusing on national security, whereas private-sector demand is growing, accounting for 23.14% in 2023, as businesses invest in anti-drone systems to protect their operations.

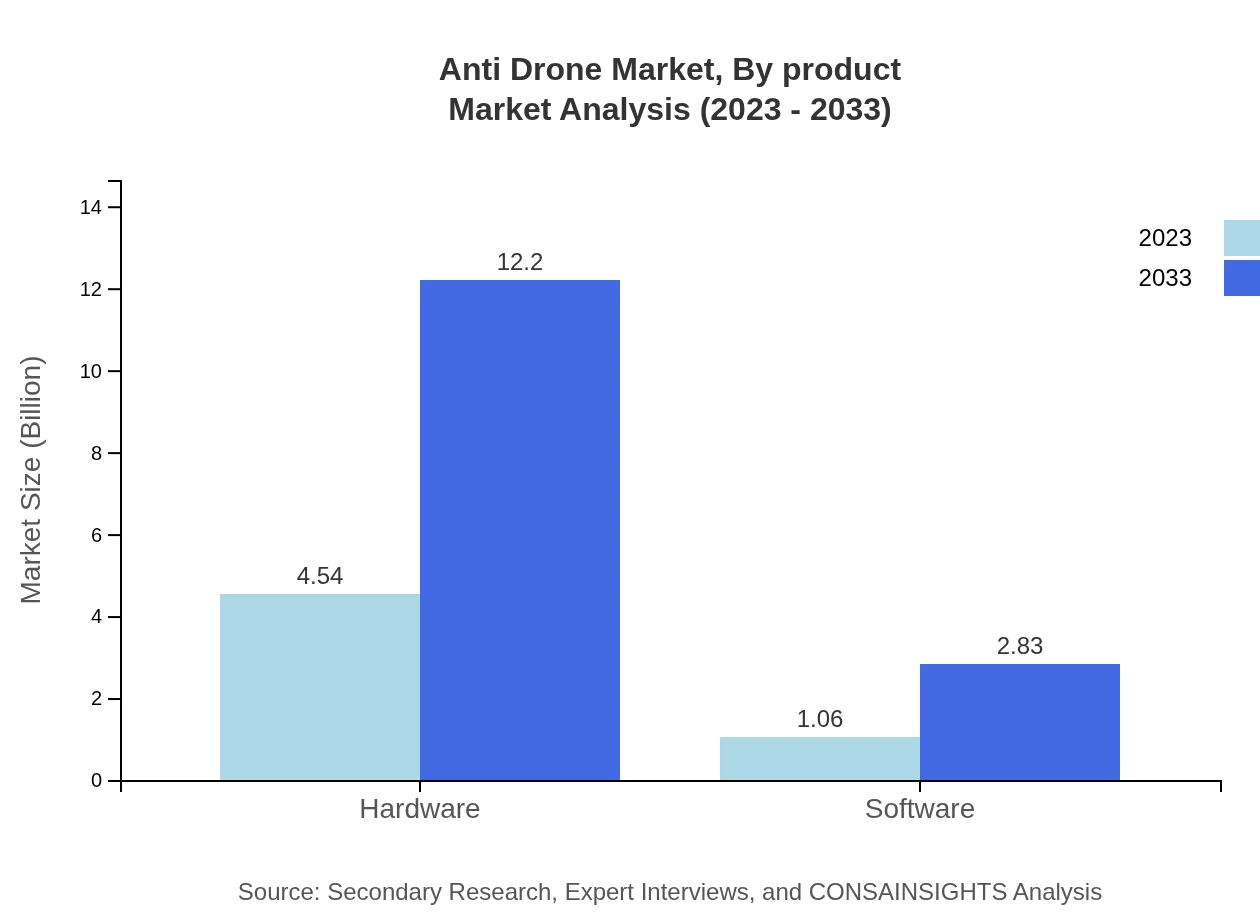

Anti Drone Market Analysis By Product

In terms of product offerings, hardware dominates the market with a substantial share of 81.15%, reflecting the physical infrastructure required for comprehensive drone defense systems. Software solutions contribute 18.85% of the market share, essential for operational efficiency and data management.

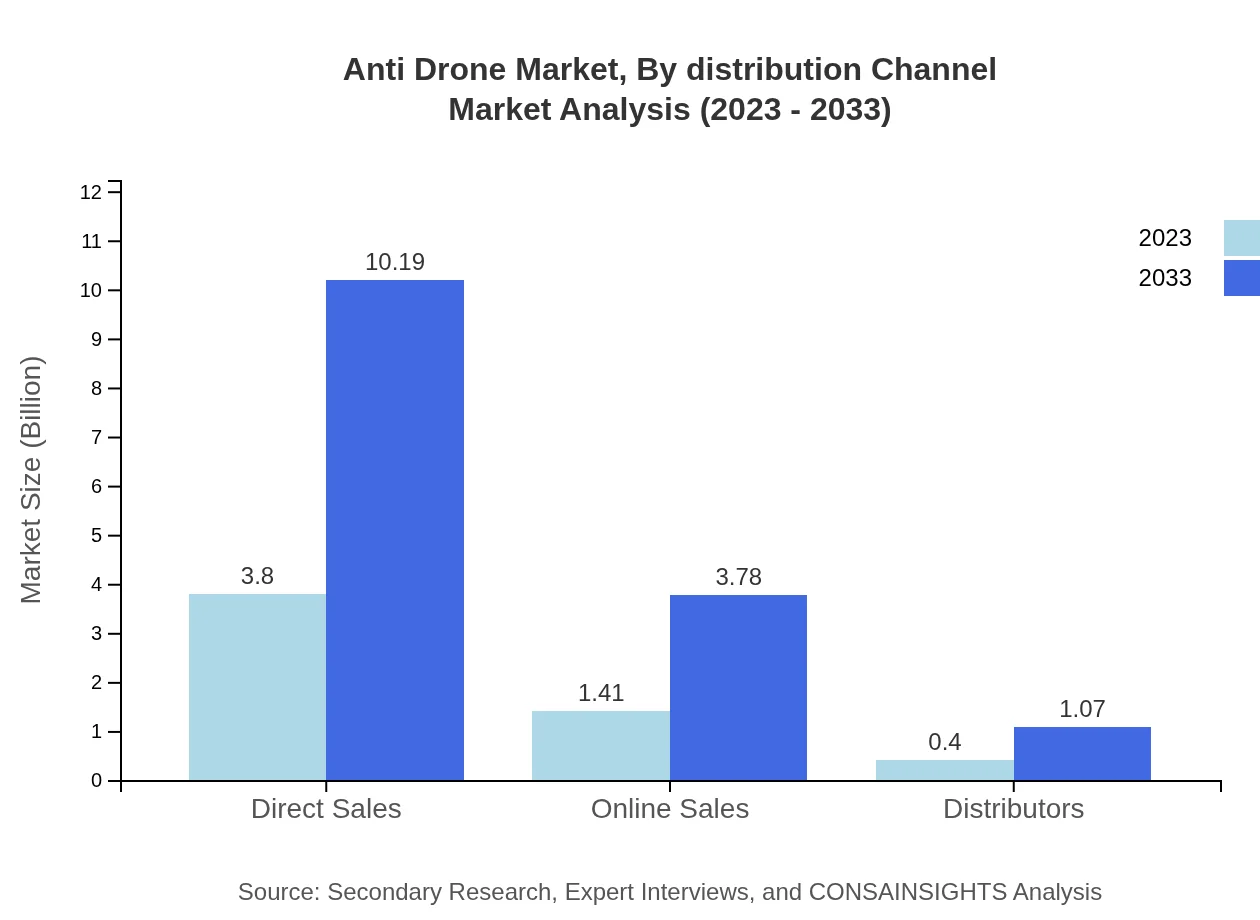

Anti Drone Market Analysis By Distribution Channel

Direct sales comprise the largest share of distribution channels at 67.77%, preferred by governmental buyers for securing contracts, whereas online sales and distributors also play significant roles, catering to the increasing demand from private sectors.

Anti Drone Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Drone Industry

Northrop Grumman:

Major defense contractor known for advanced drone detection technologies and comprehensive defense solutions.Raytheon Technologies:

Leading producer of anti-drone systems, focusing on innovative technologies like RF jamming and laser systems.Lockheed Martin:

Specializes in advanced military technologies, providing cutting-edge anti-drone solutions integrated into defense systems.DroneShield:

Pioneers in commercial anti-drone technology, offering versatile solutions for both military and civilian applications.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Drone?

The anti-drone market was valued at $5.6 billion in 2023 and is projected to grow at a CAGR of 10%, leading to significant expansion over the next decade.

What are the key market players or companies in the anti Drone industry?

Key players in the anti-drone industry include major defense contractors, manufacturers of drone detection and neutralization systems, and software developers specializing in aerial security solutions.

What are the primary factors driving the growth in the anti Drone industry?

Growth in the anti-drone industry is primarily driven by increasing security concerns, advancements in drone technology, and rising incidents of drone-related threats to privacy, infrastructure, and public safety.

Which region is the fastest Growing in the anti Drone market?

The fastest-growing region in the anti-drone market is Europe, with a market size projected to grow from $1.49 billion in 2023 to $4.01 billion by 2033, reflecting robust demand for security solutions.

Does ConsaInsights provide customized market report data for the anti Drone industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the anti-drone industry, ensuring relevant insights and actionable intelligence.

What deliverables can I expect from this anti Drone market research project?

Deliverables from the anti-drone market research project include detailed market analysis reports, forecasts, competitive landscape assessments, segment identifications, and actionable strategic recommendations.

What are the market trends of anti Drone?

Current market trends in the anti-drone sector include a shift towards integrated systems, increased investments in research and development, and a focus on regulatory compliance in drone operations.