Anti Fungal Drugs Market Report

Published Date: 31 January 2026 | Report Code: anti-fungal-drugs

Anti Fungal Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Anti Fungal Drugs market, including insights into current trends, market size forecasts for 2023 to 2033, and detailed statistics segmented by drug type, application, and region.

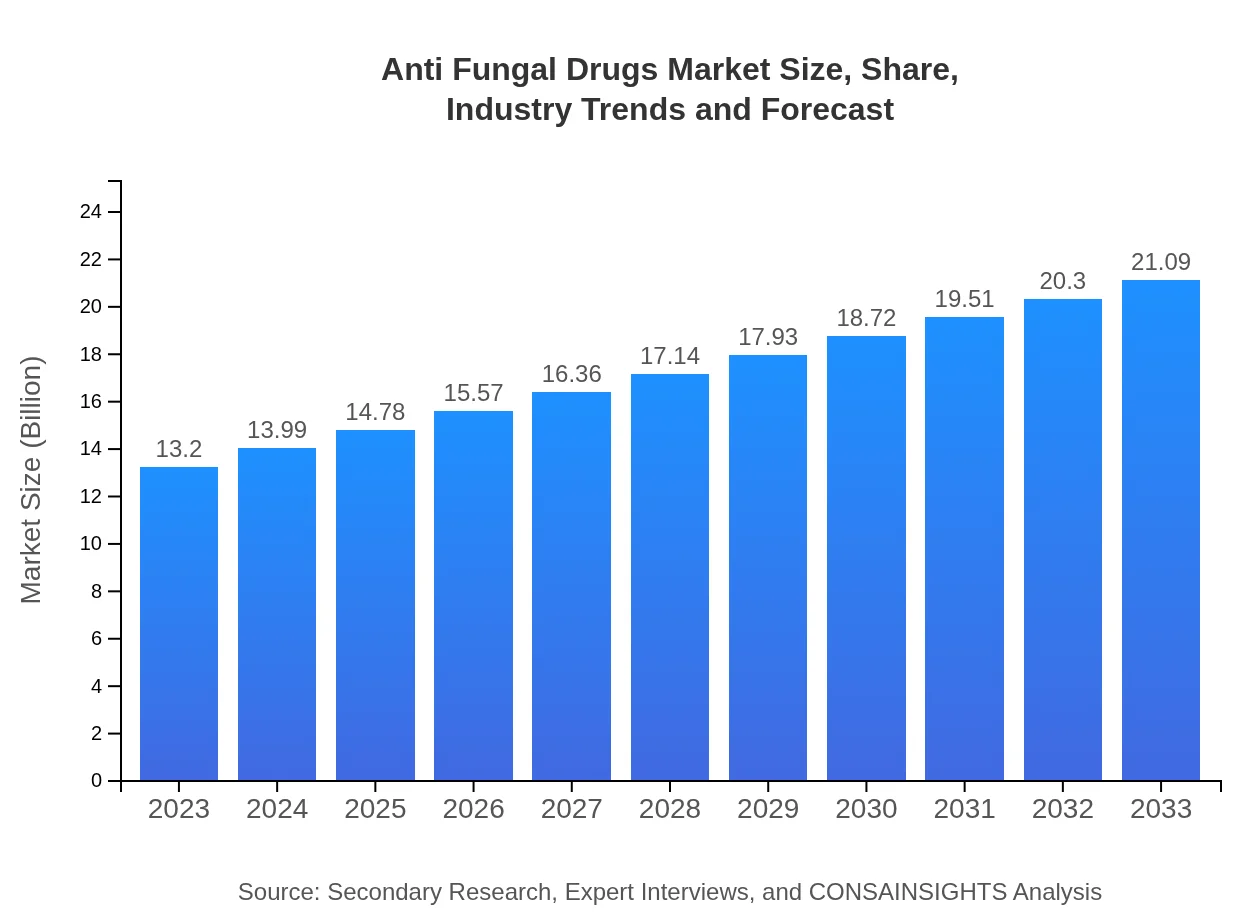

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $13.20 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $21.09 Billion |

| Top Companies | Pfizer , Merck & Co., Inc., Bristol-Myers Squibb, Gilead Sciences, Astellas Pharma |

| Last Modified Date | 31 January 2026 |

Anti Fungal Drugs Market Overview

Customize Anti Fungal Drugs Market Report market research report

- ✔ Get in-depth analysis of Anti Fungal Drugs market size, growth, and forecasts.

- ✔ Understand Anti Fungal Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Fungal Drugs

What is the Market Size & CAGR of Anti Fungal Drugs market in 2023?

Anti Fungal Drugs Industry Analysis

Anti Fungal Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Fungal Drugs Market Analysis Report by Region

Europe Anti Fungal Drugs Market Report:

The market in Europe is expected to grow from USD 4.51 billion in 2023 to USD 7.21 billion by 2033. Increasing healthcare expenditures and a robust regulatory environment favor product approvals in the region, driving market growth for anti-fungal therapies.Asia Pacific Anti Fungal Drugs Market Report:

In 2023, the Asia Pacific Anti Fungal Drugs market is valued at USD 2.36 billion, projected to reach USD 3.77 billion by 2033. This growth is fueled by a rising incidence of fungal infections alongside increased healthcare expenditure and improved access to medical facilities. The region is witnessing a surge in healthcare initiatives to combat infectious diseases, further motivating market development.North America Anti Fungal Drugs Market Report:

North America leads the Anti Fungal Drugs market with a valuation of USD 4.70 billion in 2023, expected to expand to USD 7.52 billion by 2033. The market is characterized by advanced research capabilities, high awareness levels of fungal infections, and significant healthcare investments that promote effective treatment options.South America Anti Fungal Drugs Market Report:

The South American market for anti-fungal drugs is anticipated to move from USD 0.13 billion in 2023 to USD 0.20 billion by 2033. Market growth will be driven by improving healthcare infrastructure and rising awareness of fungal infections, but remain challenged by regional economic fluctuations.Middle East & Africa Anti Fungal Drugs Market Report:

The Middle East and Africa are estimated to grow from USD 1.50 billion in 2023 to USD 2.40 billion by 2033. While the market is impacted by limited healthcare resources, increasing pharmaceutical investments and a focus on disease management are improving market prospects.Tell us your focus area and get a customized research report.

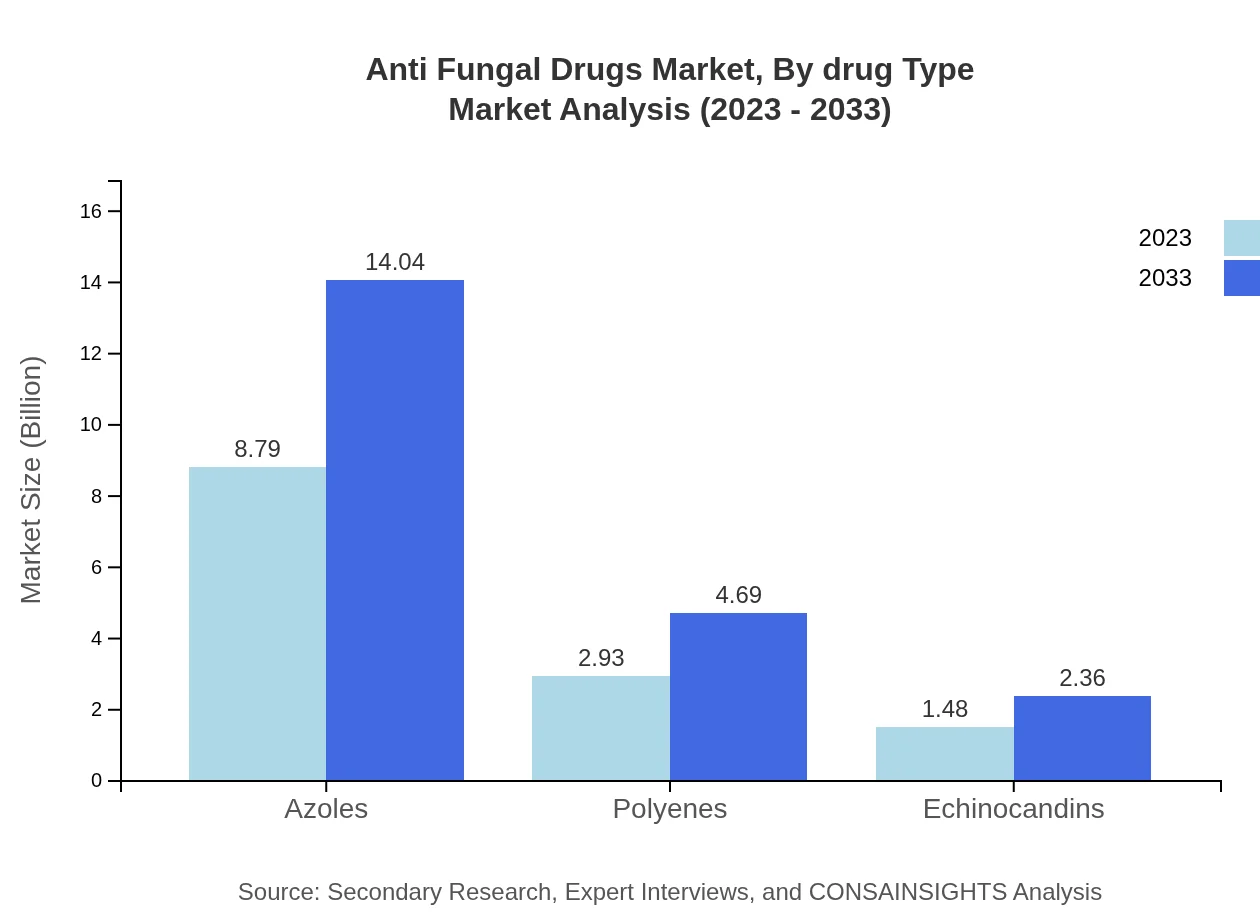

Anti Fungal Drugs Market Analysis By Drug Type

In 2023, the market for Anti-Fungal Drugs by drug type is led by azoles, with a market size of USD 8.79 billion. Projected growth to USD 14.04 billion by 2033 indicates the continued dominance of azoles due to their wide therapeutic efficacy. Polyenes and echinocandins follow, with increasing demand in niche markets.

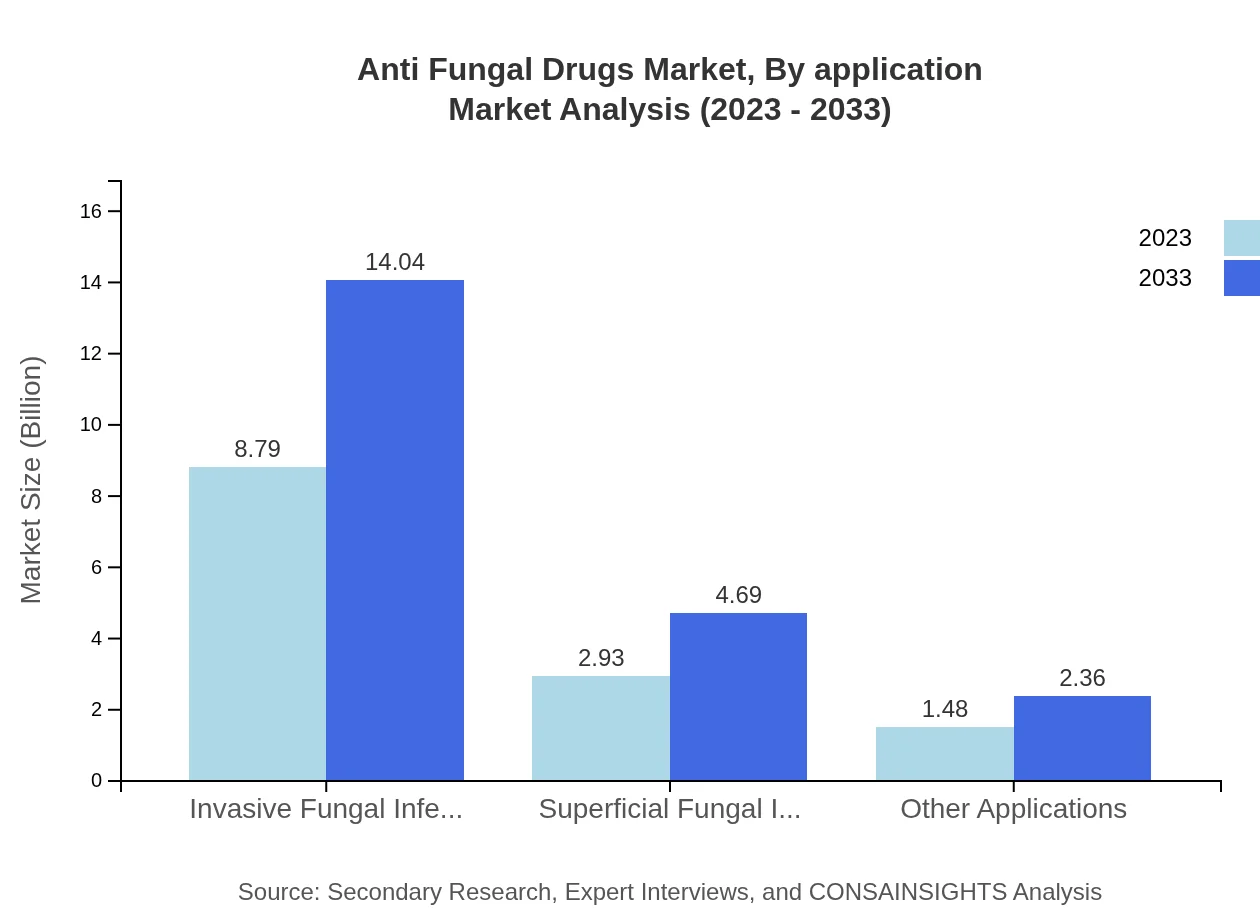

Anti Fungal Drugs Market Analysis By Application

The segment for invasive fungal infections holds a prominent position, generating USD 8.79 billion in 2023 and expected to reach USD 14.04 billion by 2033. Superficial fungal infections and alternative applications are also substantial, signifying a comprehensive range of treatments catered to various infections.

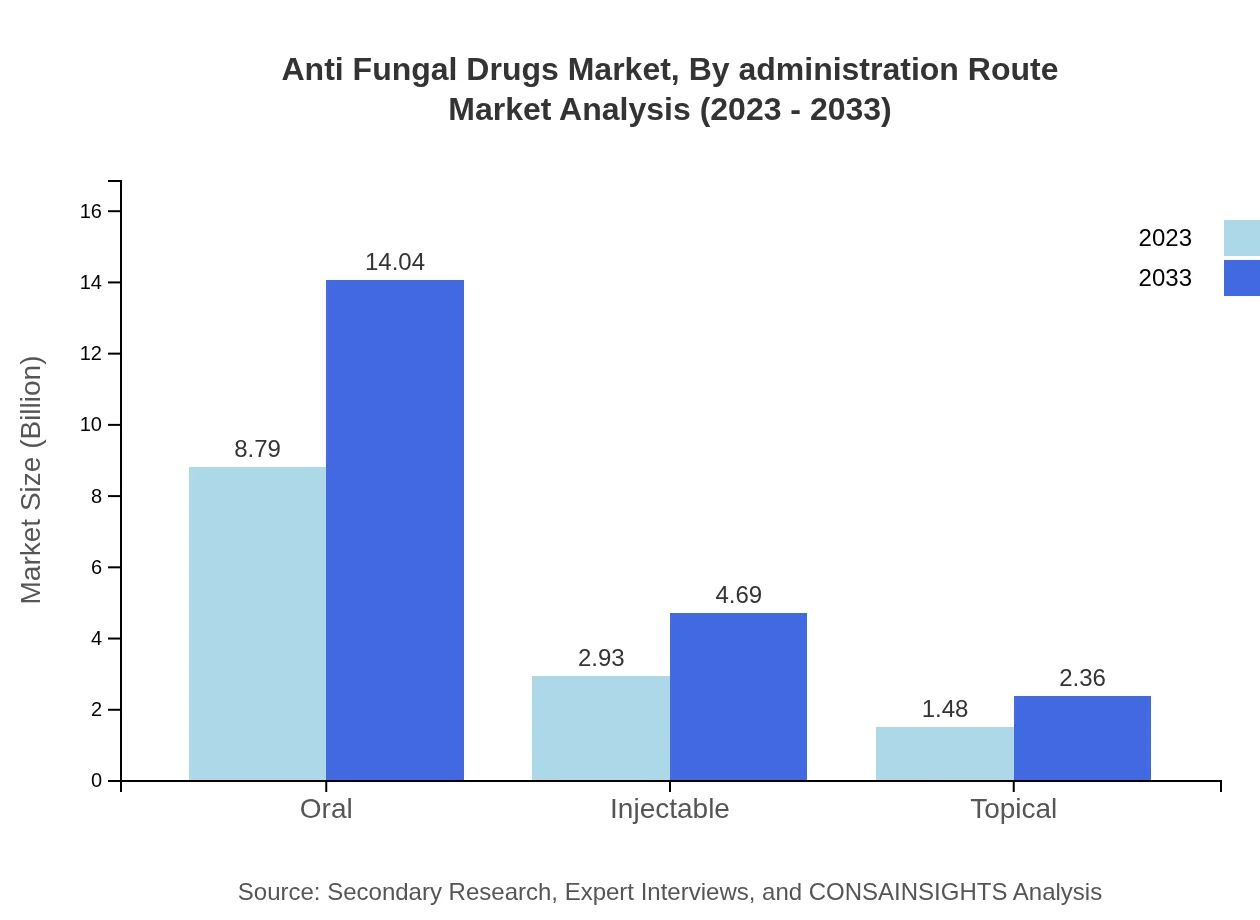

Anti Fungal Drugs Market Analysis By Administration Route

Market share by route indicates oral administration holds the largest share with USD 8.79 billion in 2023, expected to grow to USD 14.04 billion by 2033. Injectable and topical routes remain critical for targeted therapies, thereby diversifying the delivery methods in an evolving market.

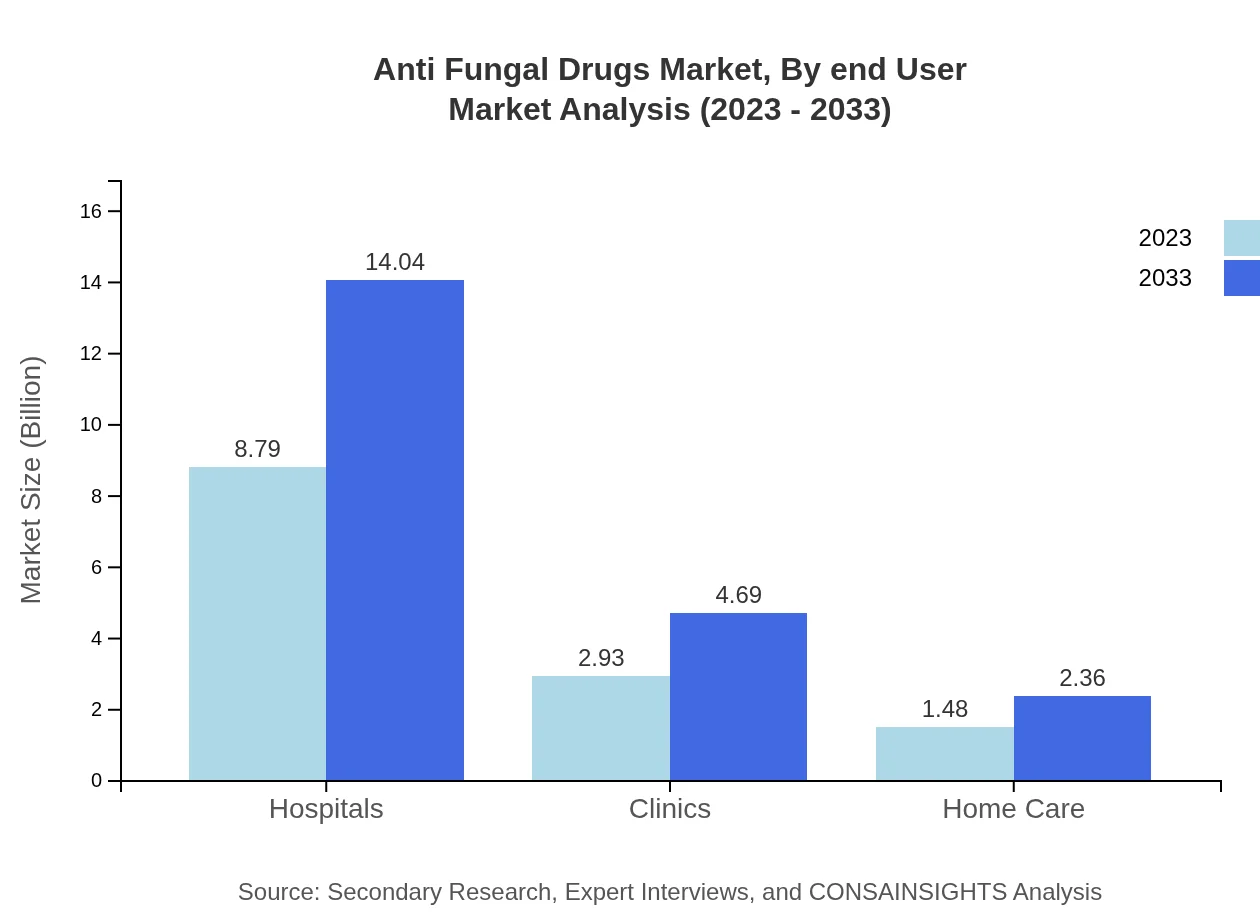

Anti Fungal Drugs Market Analysis By End User

Hospitals comprise the largest share of end users, valued at USD 8.79 billion in 2023, growing to USD 14.04 billion by 2033. Clinics and home care settings also show significant shares, reflecting changing patient care dynamics and healthcare delivery methods.

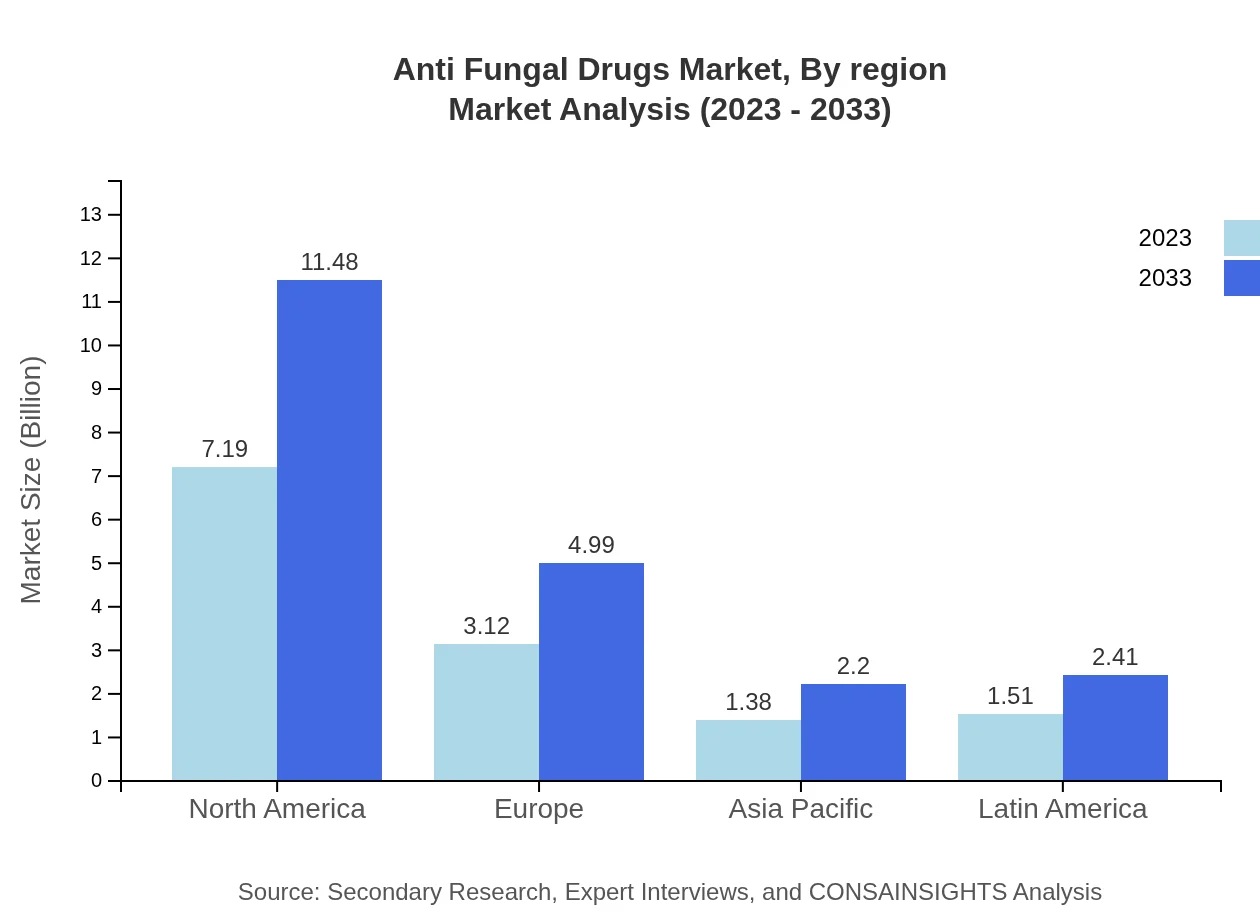

Anti Fungal Drugs Market Analysis By Region

The regional segmentation reveals North America commanding a market size of USD 7.19 billion in 2023, while Europe follows with USD 4.99 billion. The growth trajectory in Asia Pacific (USD 2.20 billion) and Latin America (USD 2.41 billion) highlights emerging markets with rising healthcare investments.

Anti Fungal Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Fungal Drugs Industry

Pfizer :

Pfizer is a leading global biopharmaceutical company with a prevalent portfolio in antifungal therapies, particularly with its widely recognized drug fluconazole.Merck & Co., Inc.:

Merck & Co. has a robust antifungal pipeline that includes innovative therapies aimed at serious fungal infections, conforming to newer treatment guidelines.Bristol-Myers Squibb:

Specializing in immuno-oncology, Bristol-Myers Squibb offers critical support in antifungal treatment protocols for cancer patients.Gilead Sciences:

Gilead is recognized for its contributions to antifungal innovation, including the development of drugs for resistant fungal strains.Astellas Pharma:

Astellas focuses on research-driven antifungal solutions, concentrating on patient-focused therapies and enhancing clinical treatment outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Fungal Drugs?

The global anti-fungal drugs market is valued at approximately $13.2 billion in 2023, with a projected CAGR of 4.7% by 2033, indicating consistent demand and growth in this sector.

What are the key market players or companies in this anti Fungal Drugs industry?

Key players include Pfizer, Merck, GlaxoSmithKline, and Novartis, who dominate the anti-fungal drug market through innovative research, development, and extensive distribution channels.

What are the primary factors driving the growth in the anti Fungal Drugs industry?

The growth in the anti-fungal drugs industry is spurred by increasing fungal infections, growing healthcare expenditures, innovations in drug formulations, and rising awareness regarding antifungal treatments globally.

Which region is the fastest Growing in the anti Fungal Drugs market?

The fastest-growing region for anti-fungal drugs is Europe, with market size expected to rise from $4.51 billion in 2023 to $7.21 billion by 2033, showcasing a strong demand in this area.

Does ConsaInsights provide customized market report data for the anti Fungal Drugs industry?

Yes, ConsaInsights offers customized market report data, delivering tailored insights specific to client needs regarding trends, forecasts, and competitive analyses in the anti-fungal drugs sector.

What deliverables can I expect from this anti Fungal Drugs market research project?

Deliverables include in-depth market analysis, segment insights, competitive landscape assessments, growth forecasts, and actionable recommendations based on the latest market data.

What are the market trends of anti Fungal Drugs?

Current trends include an increasing focus on developing novel antifungal agents, the rise of personalized medicine, improved diagnostic techniques, and a surge in telehealth services for patient care.