Anti Infective Drugs Market Report

Published Date: 31 January 2026 | Report Code: anti-infective-drugs

Anti Infective Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive overview of the Anti Infective Drugs market, detailing market size, growth forecasts, industry analysis, segmentation, and regional insights from 2023 to 2033.

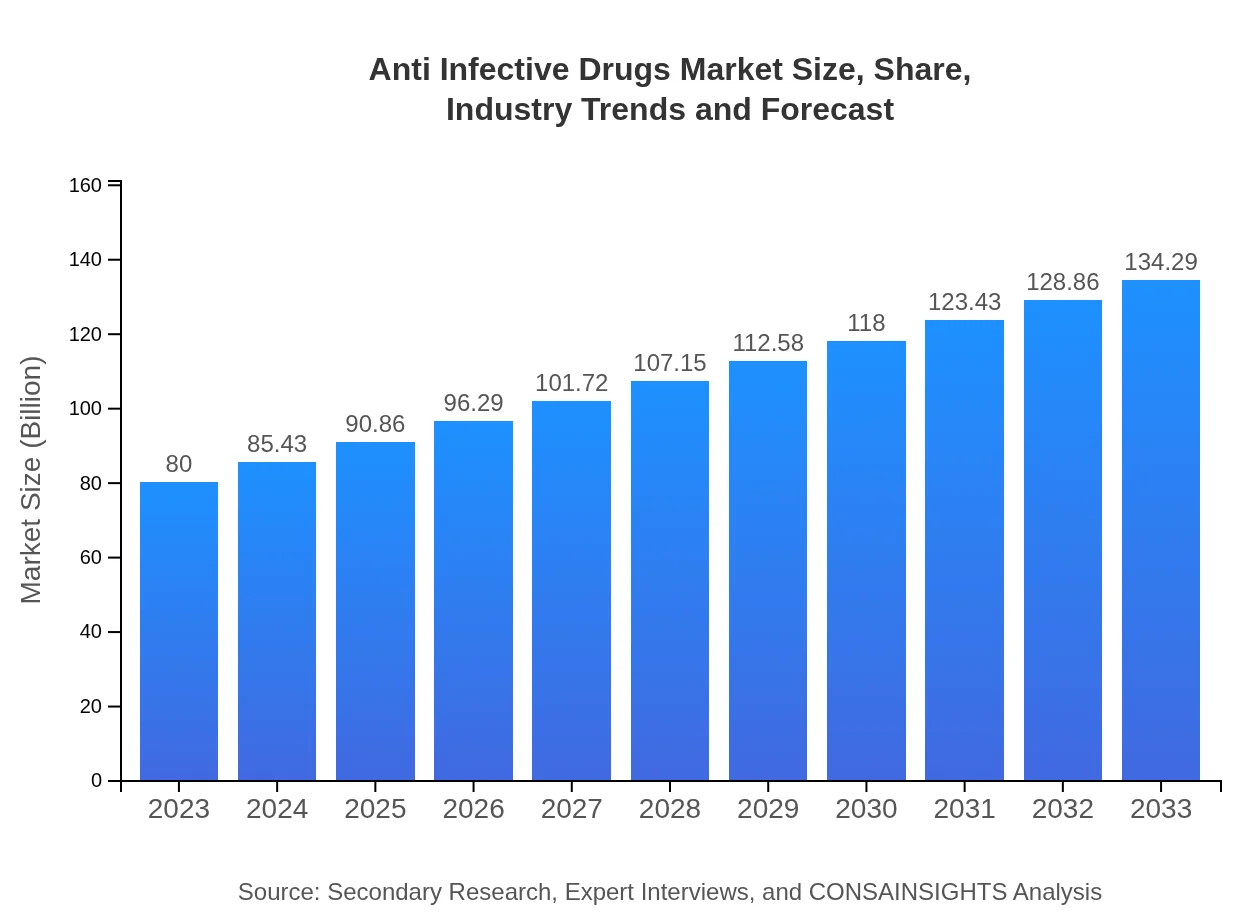

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $80.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $134.29 Billion |

| Top Companies | Pfizer , Johnson & Johnson, Merck & Co. |

| Last Modified Date | 31 January 2026 |

Anti Infective Drugs Market Overview

Customize Anti Infective Drugs Market Report market research report

- ✔ Get in-depth analysis of Anti Infective Drugs market size, growth, and forecasts.

- ✔ Understand Anti Infective Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Infective Drugs

What is the Market Size & CAGR of the Anti Infective Drugs market in 2023?

Anti Infective Drugs Industry Analysis

Anti Infective Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Infective Drugs Market Analysis Report by Region

Europe Anti Infective Drugs Market Report:

The European market for Anti Infective Drugs is expected to grow from $21.55 billion in 2023 to $36.18 billion by 2033, driven by supportive regulatory frameworks, high investments in R&D, and increasing prevalence of infectious diseases.Asia Pacific Anti Infective Drugs Market Report:

In the Asia Pacific region, the Anti Infective Drugs market is expected to grow from $15.54 billion in 2023 to $26.09 billion by 2033. This growth is driven by a rise in healthcare expenditures, increasing awareness of healthcare among the population, and the high prevalence of infectious diseases in densely populated areas.North America Anti Infective Drugs Market Report:

North America remains the largest market, with a value of $25.93 billion in 2023, projected to reach $43.52 billion by 2033. This growth is underpinned by high healthcare investments, stringent regulations, and leading positions by major pharmaceutical companies in the development of new medications.South America Anti Infective Drugs Market Report:

The market in South America is projected to increase from $7.32 billion in 2023 to $12.29 billion by 2033. Development in healthcare infrastructure and a growing demand for advanced medical treatments are primary factors contributing to the market expansion in this region.Middle East & Africa Anti Infective Drugs Market Report:

The Middle East and Africa market is anticipated to expand from $9.66 billion in 2023 to $16.21 billion by 2033. Growth in this region is largely facilitated by improving healthcare systems and increased access to medications.Tell us your focus area and get a customized research report.

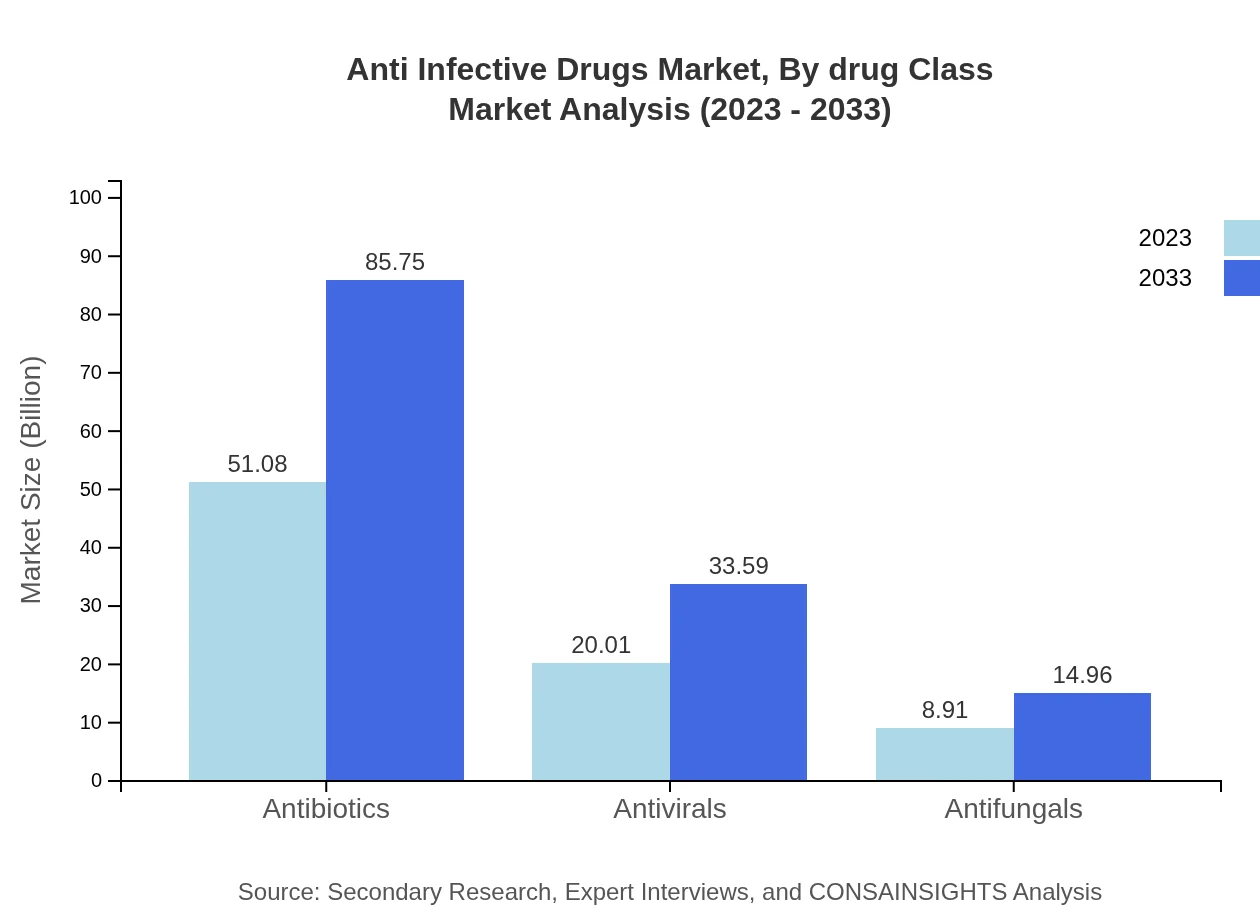

Anti Infective Drugs Market Analysis By Drug Class

The Anti-Infective Drugs market is dominated by antibiotics, accounting for 63.85% market share in 2023. Antivirals and antifungals follow, with growing relevance due to changing disease patterns. The growing incidence of viral infections has increased investments in antiviral drug development, while antifungal therapies are gaining prominence due to rising awareness of fungal infections.

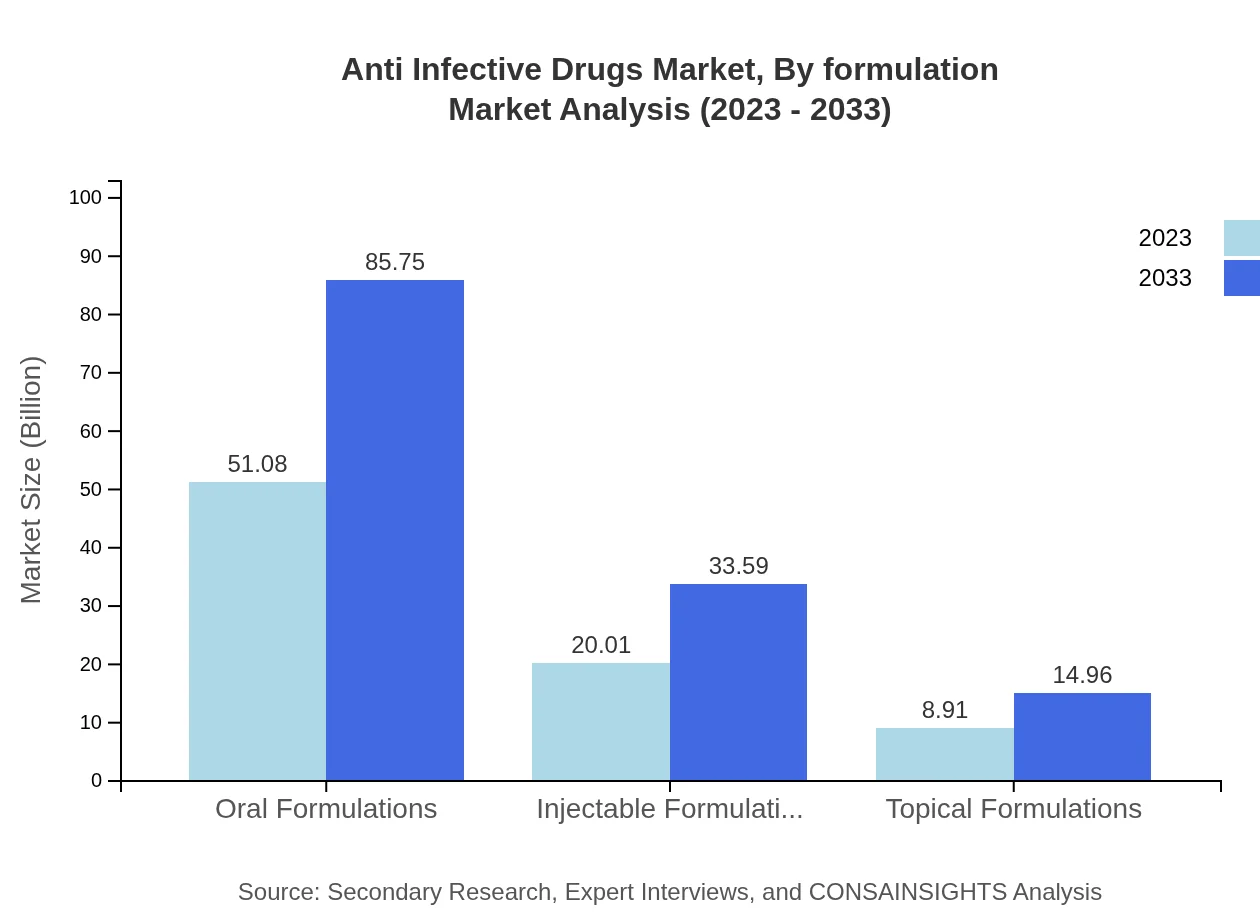

Anti Infective Drugs Market Analysis By Formulation

In terms of formulation, oral formulations hold the largest market share, accounting for approximately 63.85% in 2023. Injectable and topical formulations are also significant, particularly in hospital settings. The preference for oral formulations is primarily due to patient compliance and ease of use.

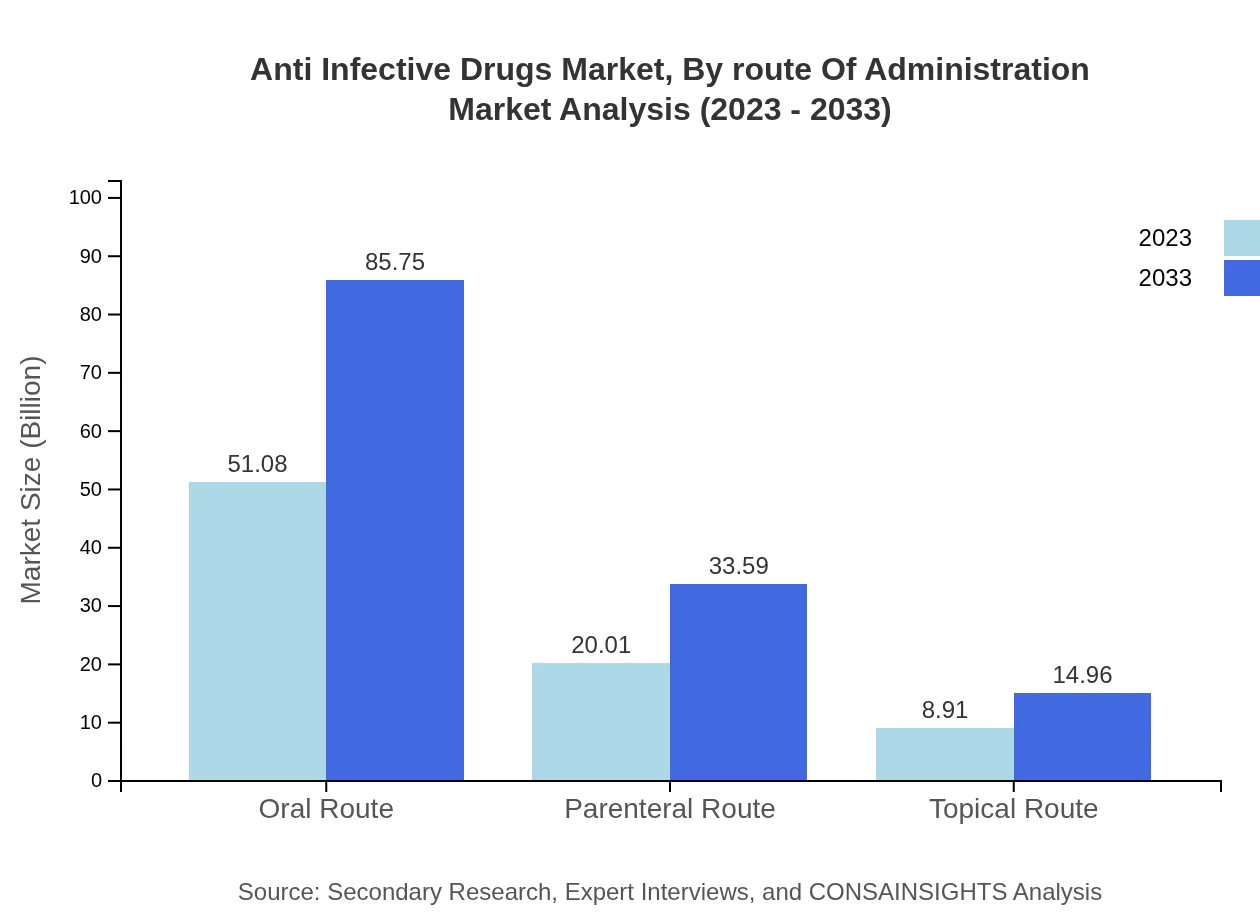

Anti Infective Drugs Market Analysis By Route Of Administration

The oral route of administration is the most preferred, occupying 63.85% of the market share in 2023. However, parenteral routes are crucial in acute care settings, especially for severe infections requiring immediate intervention.

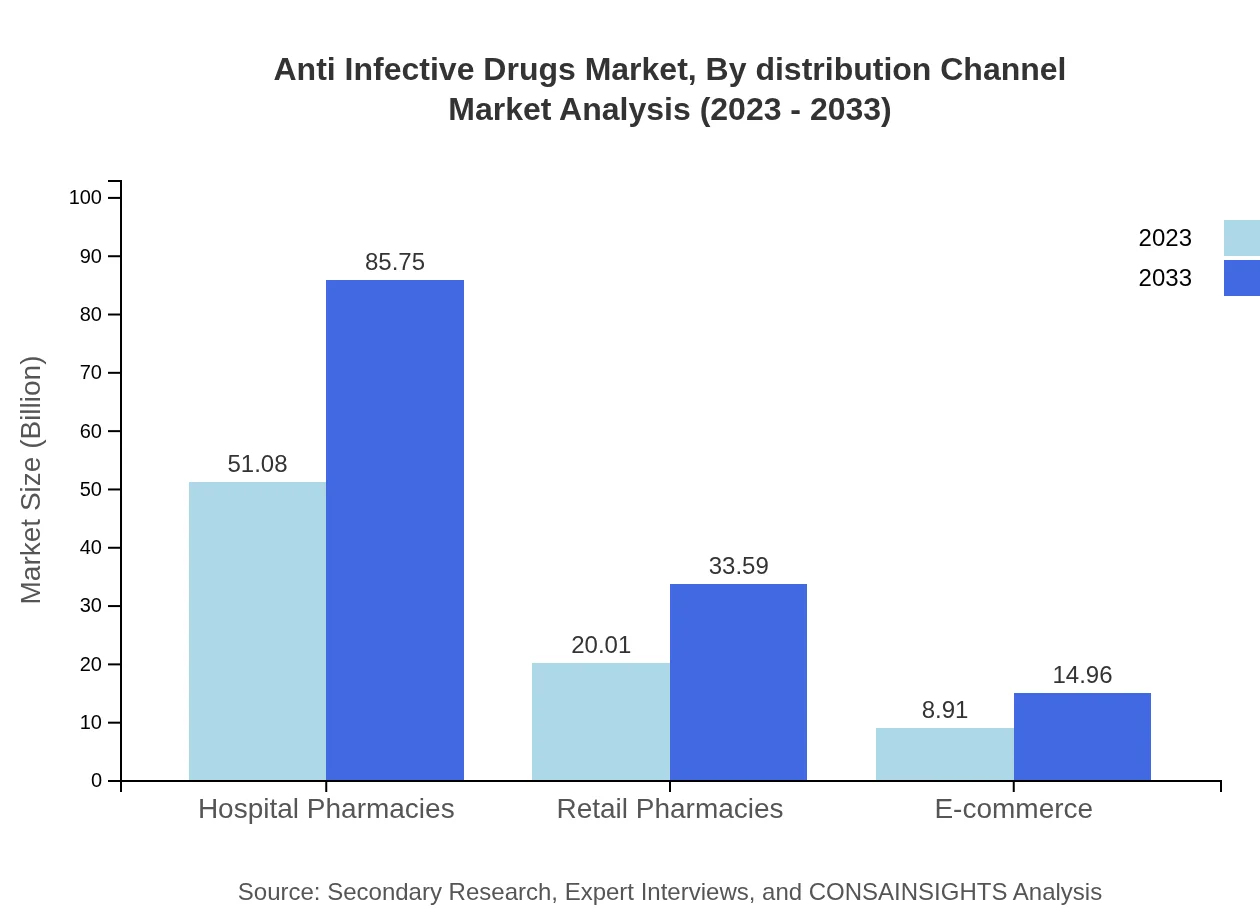

Anti Infective Drugs Market Analysis By Distribution Channel

Hospitals dominate the distribution channels, contributing to 63.85% share in the market. Retail and online pharmacies are also growing in importance, driven by changes in consumer behavior post-pandemic.

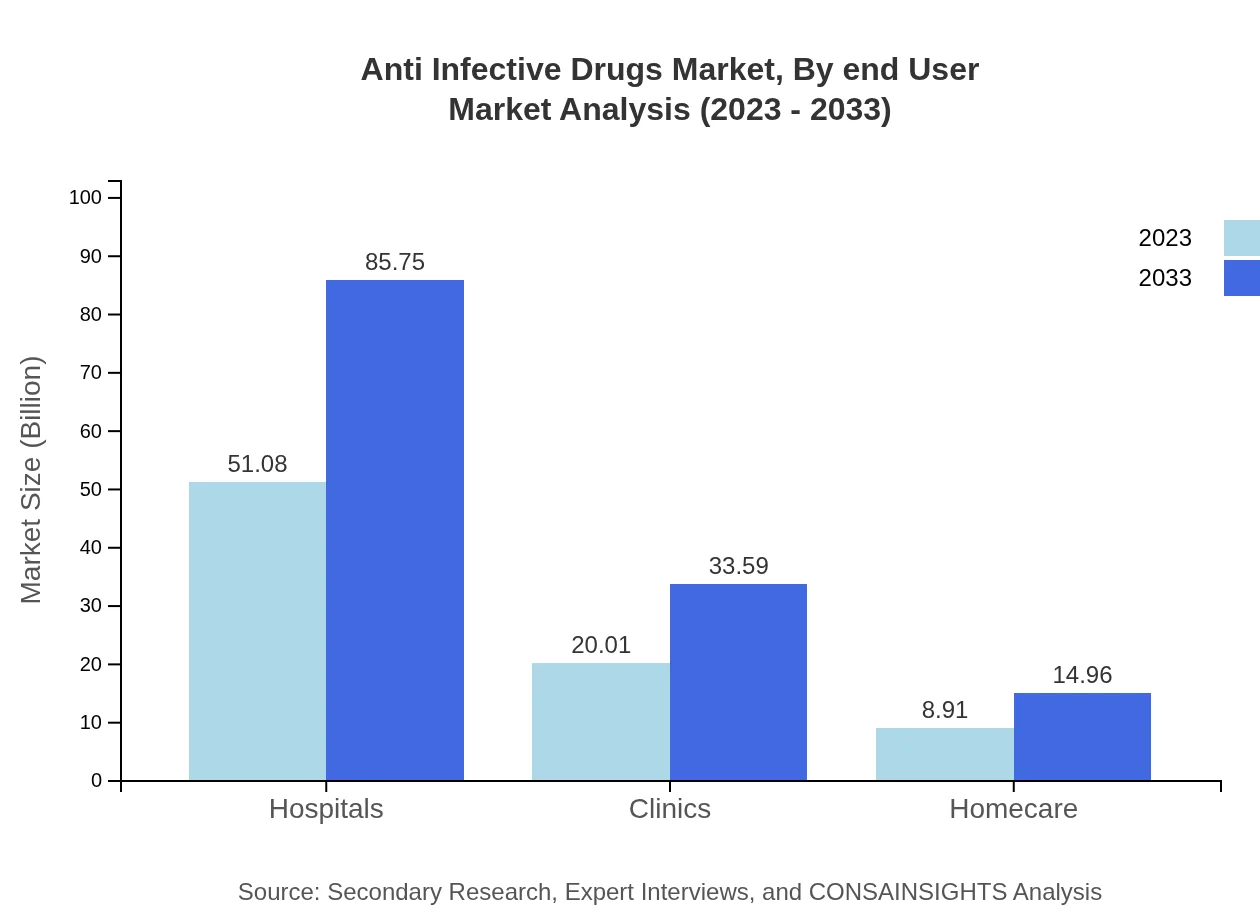

Anti Infective Drugs Market Analysis By End User

Hospitals lead as end users, accounting for significant sales due to higher volumes of anti-infective prescriptions compared to other channels like clinics and home care.

Anti Infective Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Anti Infective Drugs Industry

Pfizer :

A leading global biopharmaceutical company, Pfizer has made significant contributions to the anti-infective market, famous for its innovative antibiotic treatments and extensive research on infectious diseases.Johnson & Johnson:

Known for its broad portfolio of healthcare solutions, Johnson & Johnson actively engages in the development of anti-infective medications, focusing on novel treatments and strategic partnerships in research.Merck & Co.:

Merck is recognized for its pioneering antibiotic and antiviral therapies, playing a crucial role in combatting infectious diseases through continuous innovation and extensive clinical trials.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Infective drugs?

The global market size for anti-infective drugs is estimated to reach $80 billion by 2033, growing at a CAGR of 5.2%. This growth trajectory highlights the increasing demand for effective treatments in combating infections across various healthcare settings.

What are the key market players or companies in the anti Infective drugs industry?

Key players in the anti-infective drugs market include pharmaceutical giants such as Pfizer, Merck & Co., Johnson & Johnson, and GlaxoSmithKline, among others. These companies are at the forefront in developing innovative treatments to address the rising incidences of infections.

What are the primary factors driving the growth in the anti Infective drugs industry?

Growth in the anti-infective drugs market is driven by several factors including an increase in infectious diseases, advancements in drug development, rising government initiatives for healthcare improvement, and the growing aging population which is more susceptible to infections.

Which region is the fastest Growing in the anti Infective drugs market?

The Asia Pacific region is poised to be the fastest-growing market, with projections indicating an increase from $15.54 billion in 2023 to $26.09 billion by 2033. This growth results from increasing healthcare access and rising investment in pharmaceutical innovations.

Does ConsaInsights provide customized market report data for the anti Infective drugs industry?

Yes, ConsaInsights offers tailored market report data for the anti-infective drugs industry, allowing clients to obtain specific insights related to market dynamics, competitive landscape, and emerging trends suitable for their unique business needs.

What deliverables can I expect from this anti Infective drugs market research project?

Clients can expect comprehensive deliverables, including detailed market analysis reports, customized datasets, competitive intelligence insights, and projections regarding growth trends, segment performances, and geographical opportunities in the anti-infective drugs market.

What are the market trends of anti Infective drugs?

Current trends in the anti-infective drugs market include a shift towards personalized medicine, increasing focus on antibiotic resistance, and the expansion of biopharmaceuticals. Companies are also innovating in drug delivery systems and exploring novel formulations.