Anti Malarial Drugs Market Report

Published Date: 31 January 2026 | Report Code: anti-malarial-drugs

Anti Malarial Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Anti Malarial Drugs market, highlighting key trends, growth opportunities, and forecasts from 2023 to 2033. The report provides market size, CAGR insights, segmentation, and regional analyses across various demographics.

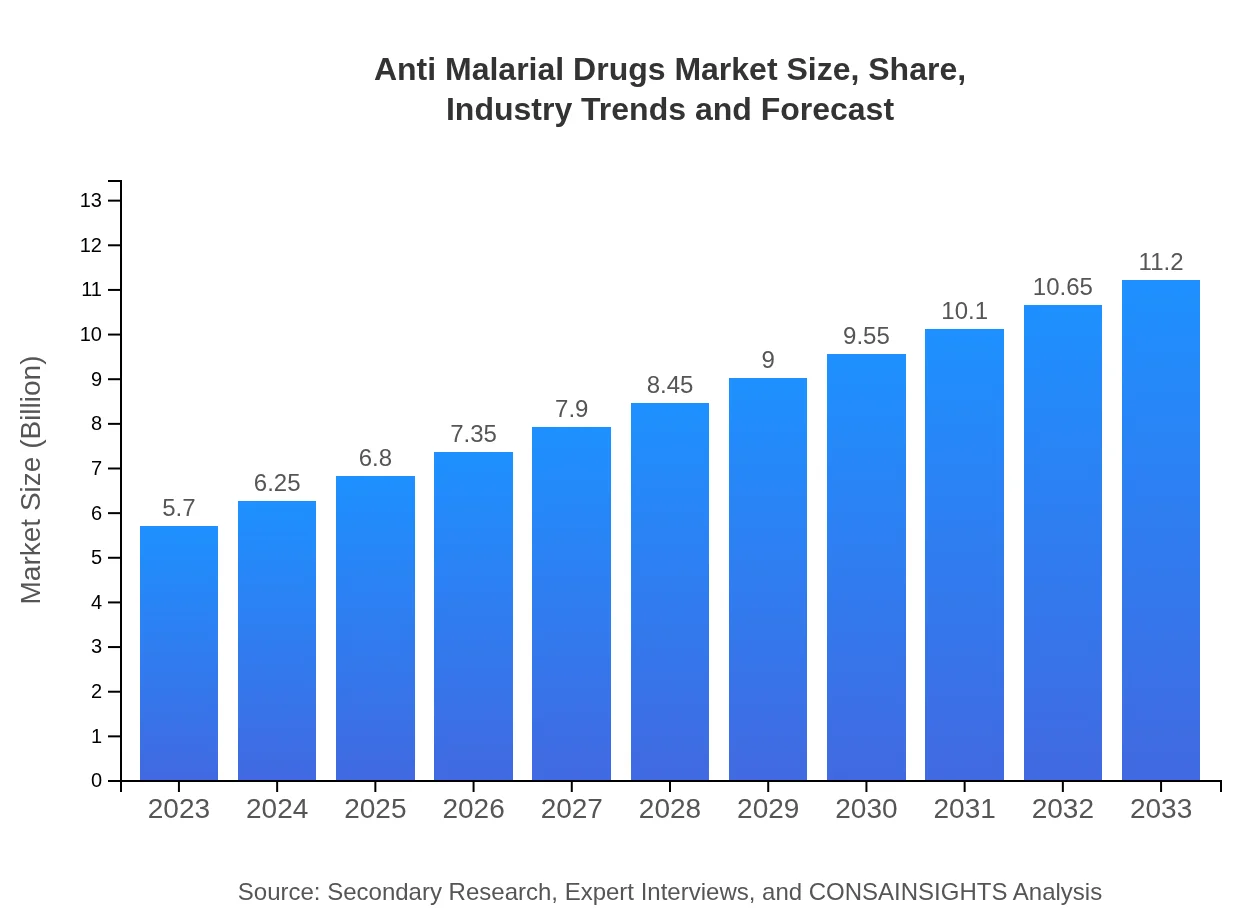

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.20 Billion |

| Top Companies | Roche, Novartis, GlaxoSmithKline, Sanofi, Pfizer |

| Last Modified Date | 31 January 2026 |

Anti Malarial Drugs Market Overview

Customize Anti Malarial Drugs Market Report market research report

- ✔ Get in-depth analysis of Anti Malarial Drugs market size, growth, and forecasts.

- ✔ Understand Anti Malarial Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Malarial Drugs

What is the Market Size & CAGR of Anti Malarial Drugs market in 2023?

Anti Malarial Drugs Industry Analysis

Anti Malarial Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Malarial Drugs Market Analysis Report by Region

Europe Anti Malarial Drugs Market Report:

Europe's market size is forecast to grow from $1.45 billion in 2023 to $2.85 billion by 2033, driven by the presence of key pharmaceutical giants and robust regulatory environments that facilitate drug development and innovation.Asia Pacific Anti Malarial Drugs Market Report:

The Asia Pacific region, with a market size of $1.15 billion in 2023 and projected growth to $2.26 billion by 2033, is pivotal due to the high incidence of malaria. Countries like India and Indonesia have ongoing programs aimed at prevention, driving demand for both diagnostics and treatments.North America Anti Malarial Drugs Market Report:

The North American market, estimated at $2.14 billion in 2023, is expected to climb to $4.21 billion by 2033. The growth is bolstered by increasing travel-related malaria cases and strong research initiatives focused on drug resistance.South America Anti Malarial Drugs Market Report:

In South America, the market is valued at $0.40 billion in 2023, growing to $0.78 billion by 2033. Despite lower prevalence rates, the increasing focus on malaria eradication programs boosts the uptake of anti-malarial therapies in areas like the Amazon basin.Middle East & Africa Anti Malarial Drugs Market Report:

In the Middle East and Africa, the market is projected to escalate from $0.56 billion in 2023 to $1.10 billion by 2033. The significant burden of malaria in Sub-Saharan Africa emphasizes the need for effective treatment regimens, stimulating market growth.Tell us your focus area and get a customized research report.

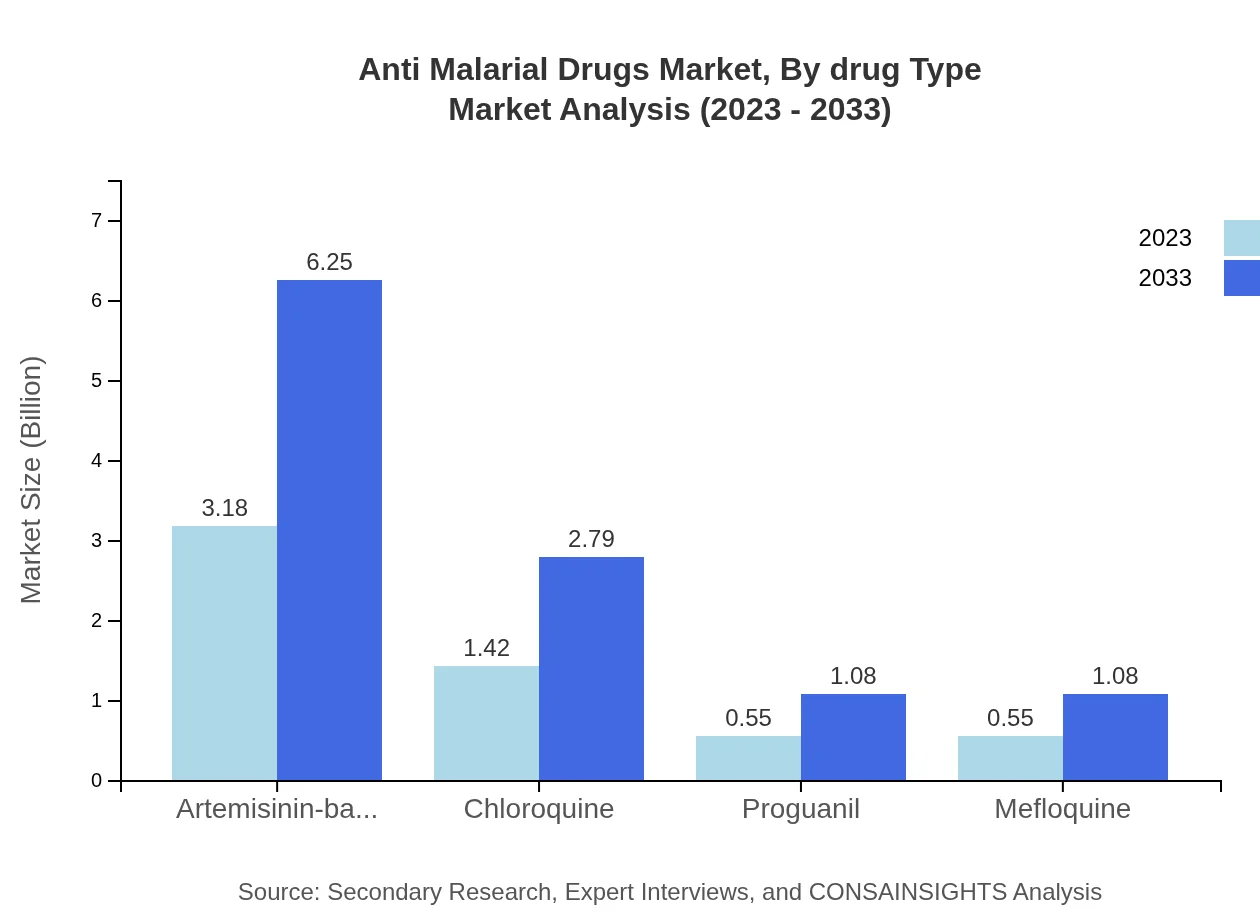

Anti Malarial Drugs Market Analysis By Drug Type

The market for anti-malarial drugs is dominantly led by Artemisinin-based Combination Therapies (ACTs), which held a substantial market size of $3.18 billion in 2023 and is projected to reach approximately $6.25 billion by 2033, maintaining a consistent market share of 55.83%. Chloroquine, on the other hand, accounts for $1.42 billion in 2023 with growth to $2.79 billion by 2033, holding 24.88% market share.

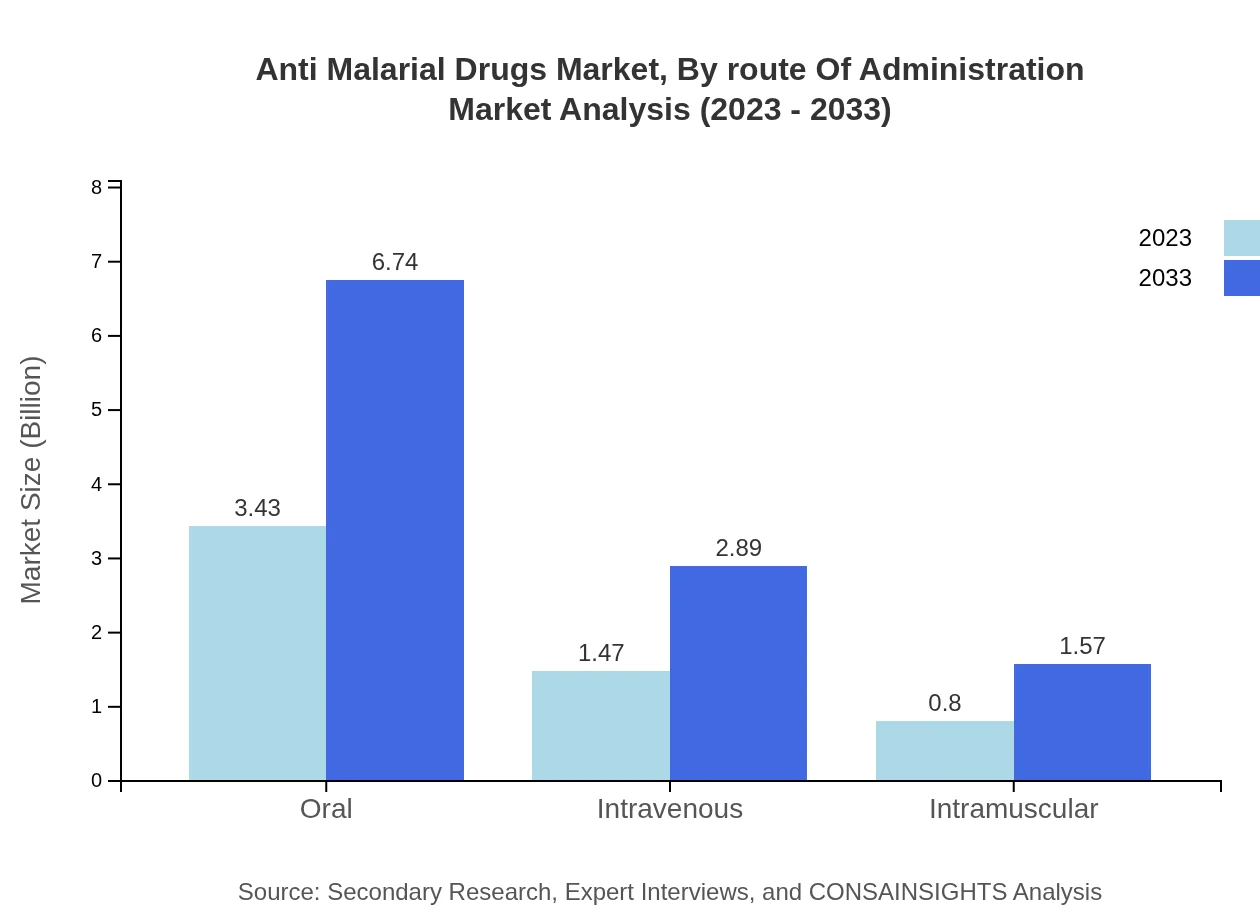

Anti Malarial Drugs Market Analysis By Route Of Administration

The oral formulation remains widely favored, contributing $3.43 billion in 2023 and anticipated to grow to $6.74 billion by 2033, representing 60.17% of market share. Injectable formulations, although less common, are projected to double their value from $0.80 billion to $1.57 billion in the same period.

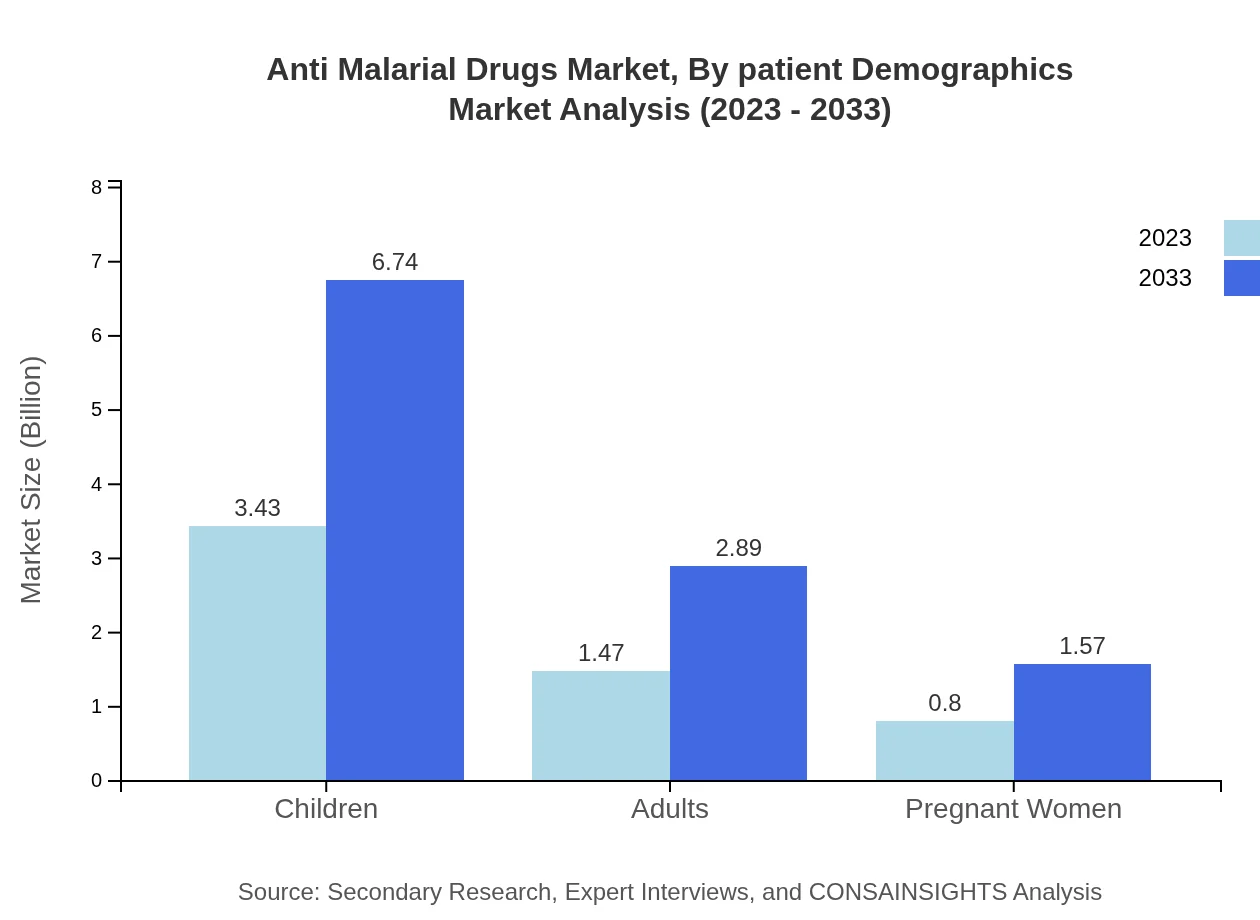

Anti Malarial Drugs Market Analysis By Patient Demographics

The demographic landscape shows that treatments for children dominate the market with $3.43 billion in 2023. Meanwhile, adult prescriptions follow closely at $1.47 billion, reflecting the growing recognition of tailored treatments for avoiding complications in vulnerable populations, such as pregnant women.

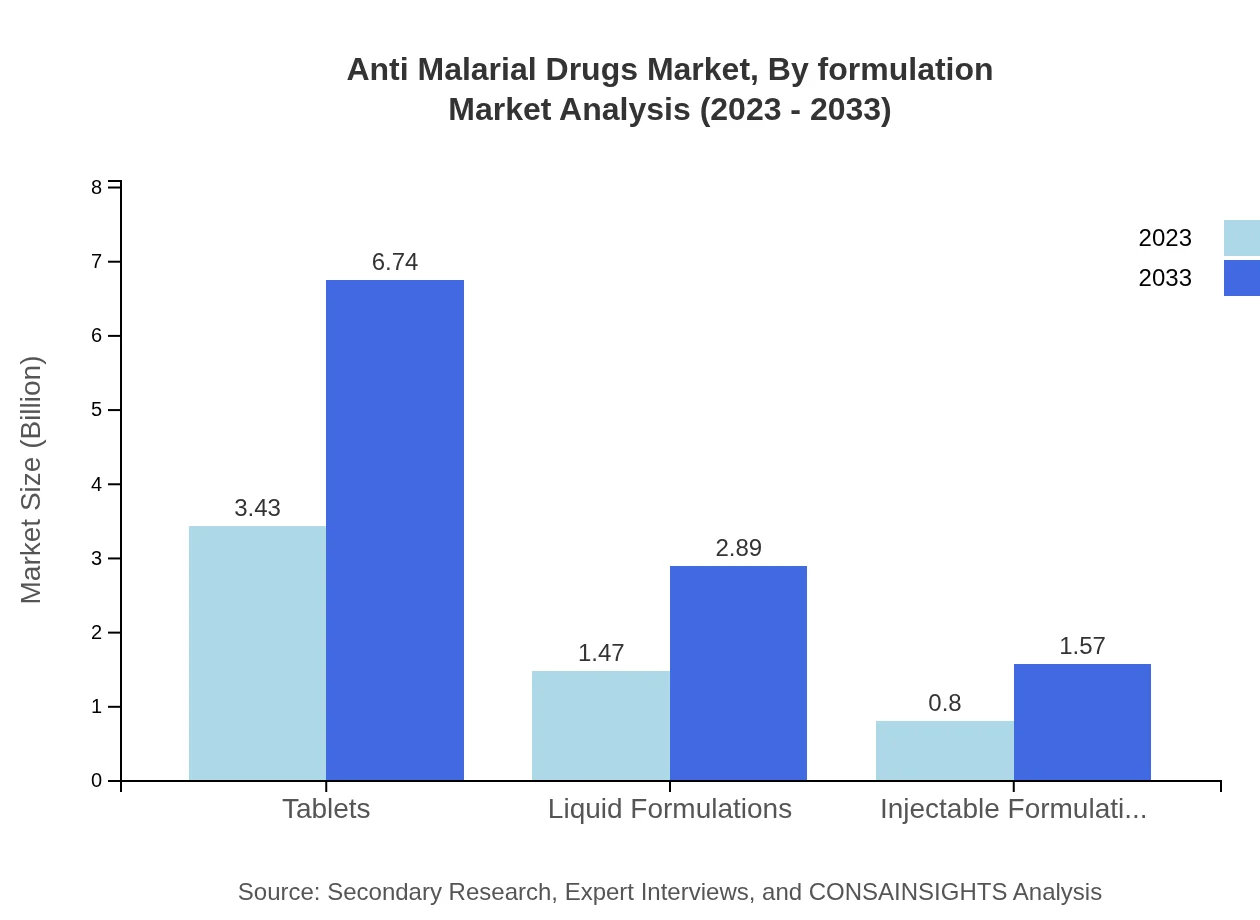

Anti Malarial Drugs Market Analysis By Formulation

Tablets are the preferred formulation type, generating $3.43 billion by 2023 and projected to reach $6.74 billion by 2033. Liquid formulations and injectable options provide necessary alternatives for patients requiring different administration routes.

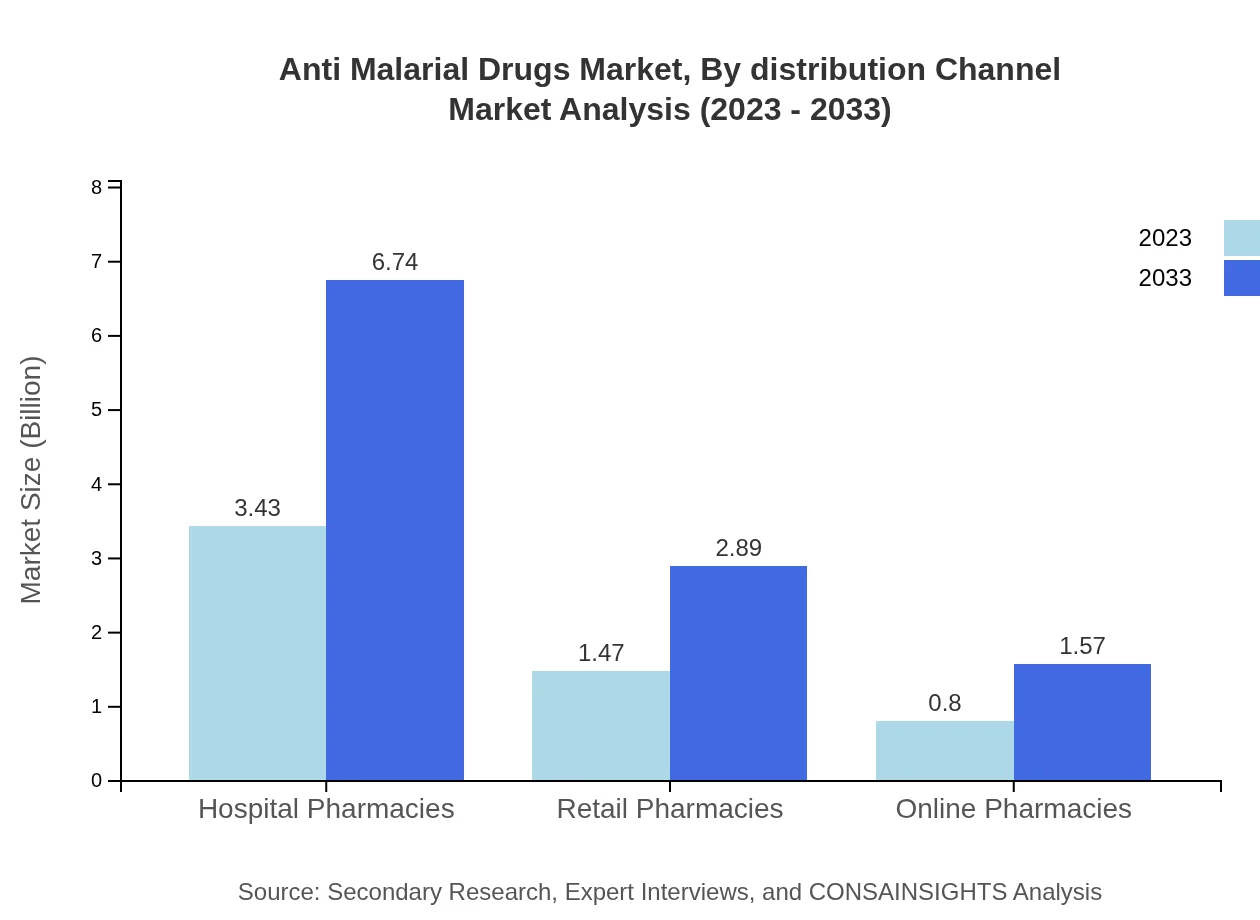

Anti Malarial Drugs Market Analysis By Distribution Channel

Hospital pharmacies are the leading distribution channel, contributing to a market size of $3.43 billion in 2023 and expected to grow to $6.74 billion. Online pharmacies, although a smaller segment, are witnessing growth fueled by increasing digital health trends, with gains from $0.80 billion to $1.57 billion.

Anti Malarial Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Malarial Drugs Industry

Roche:

Known for its robust research initiatives in malaria treatments, Roche has developed several innovative anti-malarial drugs that have transformed treatment protocols.Novartis:

A leading player in the malaria space, Novartis focuses on the development and distribution of affordable ACTs and has initiatives promoting healthcare access.GlaxoSmithKline:

GSK actively participates in advancing global health through malaria research, fostering partnerships that enhance treatment accessibility.Sanofi:

A key contributor to anti-malarial drug development, Sanofi is well-regarded for its ongoing commitment to research in new and traditional therapies.Pfizer :

Pfizer engages in the research and production of anti-malarials and actively involves itself in health initiatives aimed at combating malaria globally.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Malarial drugs?

The global anti-malarial drugs market is projected to reach USD 5.7 billion by 2033, growing at a CAGR of 6.8% from 2023. The market is influenced by rising incidence rates and demand for effective treatments.

What are the key market players or companies in the anti Malarial drugs industry?

Key players in the anti-malarial drugs market include GSK, Novartis, Sanofi, and Bayer. These companies lead in innovation, production, and distribution of effective therapeutic options to combat malaria.

What are the primary factors driving the growth in the anti Malarial drugs industry?

The growth of the anti-malarial drugs market is driven by increasing malaria prevalence, advancements in drug formulations, rising healthcare expenditures, and growing public awareness and efforts for malaria control.

Which region is the fastest Growing in the anti Malarial drugs market?

The North America region is the fastest-growing market for anti-malarial drugs, projected to grow from USD 2.14 billion in 2023 to USD 4.21 billion by 2033, reflecting a significant increase in demand.

Does ConsaInsights provide customized market report data for the anti Malarial drugs industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the anti-malarial drugs industry, enabling more precise insights and strategic planning for stakeholders.

What deliverables can I expect from this anti Malarial drugs market research project?

Deliverables from the anti-malarial drugs market research project typically include comprehensive market analysis reports, market forecasts, competitive landscape, segmentation analysis, and actionable business insights.

What are the market trends of anti Malarial drugs?

Current trends in the anti-malarial drugs market include increasing adoption of combination therapies, a shift towards liquid formulations, and heightened focus on R&D for novel drug solutions to combat resistance.