Anti Money Laundering Solutions Market Report

Published Date: 31 January 2026 | Report Code: anti-money-laundering-solutions

Anti Money Laundering Solutions Market Size, Share, Industry Trends and Forecast to 2033

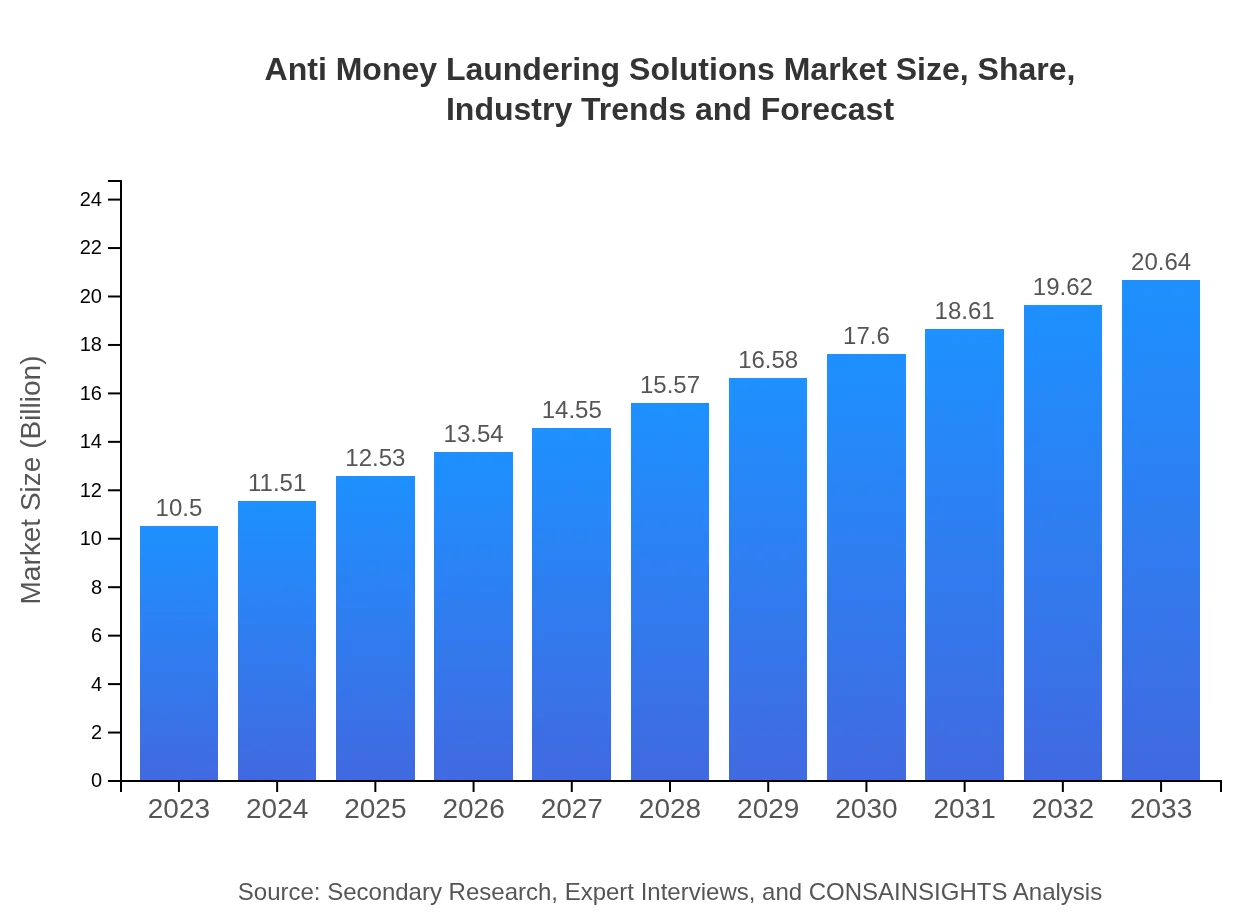

This comprehensive report provides insights into the Anti Money Laundering Solutions market, covering trends, size, and forecasts from 2023 to 2033. Key data points, including market growth rates and regional performance, will be discussed to inform stakeholders and investors about future opportunities.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | LexisNexis Risk Solutions, FICO, Oracle Financial Services Analytical Applications, ACTICO, SAS Institute |

| Last Modified Date | 31 January 2026 |

Anti Money Laundering Solutions Market Overview

Customize Anti Money Laundering Solutions Market Report market research report

- ✔ Get in-depth analysis of Anti Money Laundering Solutions market size, growth, and forecasts.

- ✔ Understand Anti Money Laundering Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Money Laundering Solutions

What is the Market Size & CAGR of Anti Money Laundering Solutions market in 2023?

Anti Money Laundering Solutions Industry Analysis

Anti Money Laundering Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Money Laundering Solutions Market Analysis Report by Region

Europe Anti Money Laundering Solutions Market Report:

The European market for Anti Money Laundering Solutions is set to expand from $2.59 billion in 2023 to $5.10 billion by 2033. Ongoing efforts to enhance transparency and compliance within the financial system, particularly following high-profile financial scandals, are propelling this growth.Asia Pacific Anti Money Laundering Solutions Market Report:

In the Asia Pacific region, the Anti Money Laundering Solutions market is projected to grow from $2.28 billion in 2023 to $4.48 billion by 2033, driven by increasing regulatory scrutiny and the adoption of advanced technologies. Countries like China, India, and Australia are investing significantly in automation and compliance measures to combat financial crimes.North America Anti Money Laundering Solutions Market Report:

North America is a dominant player in the AML Solutions market, expected to grow from $4.04 billion in 2023 to $7.94 billion by 2033, primarily due to stringent regulations in the United States and Canada. Financial institutions are actively implementing AML technologies to prevent substantial penalties.South America Anti Money Laundering Solutions Market Report:

The South American AML market, valued at $0.53 billion in 2023, is expected to reach $1.05 billion by 2033. The growing number of financial institutions and a focus on regulatory compliance amidst economic fluctuations are key factors driving this growth.Middle East & Africa Anti Money Laundering Solutions Market Report:

In the Middle East and Africa, the AML market is anticipated to grow from $1.06 billion in 2023 to $2.08 billion by 2033. Increasing awareness of financial crimes amid evolving regulatory landscapes is driving demand for AML solutions in this region.Tell us your focus area and get a customized research report.

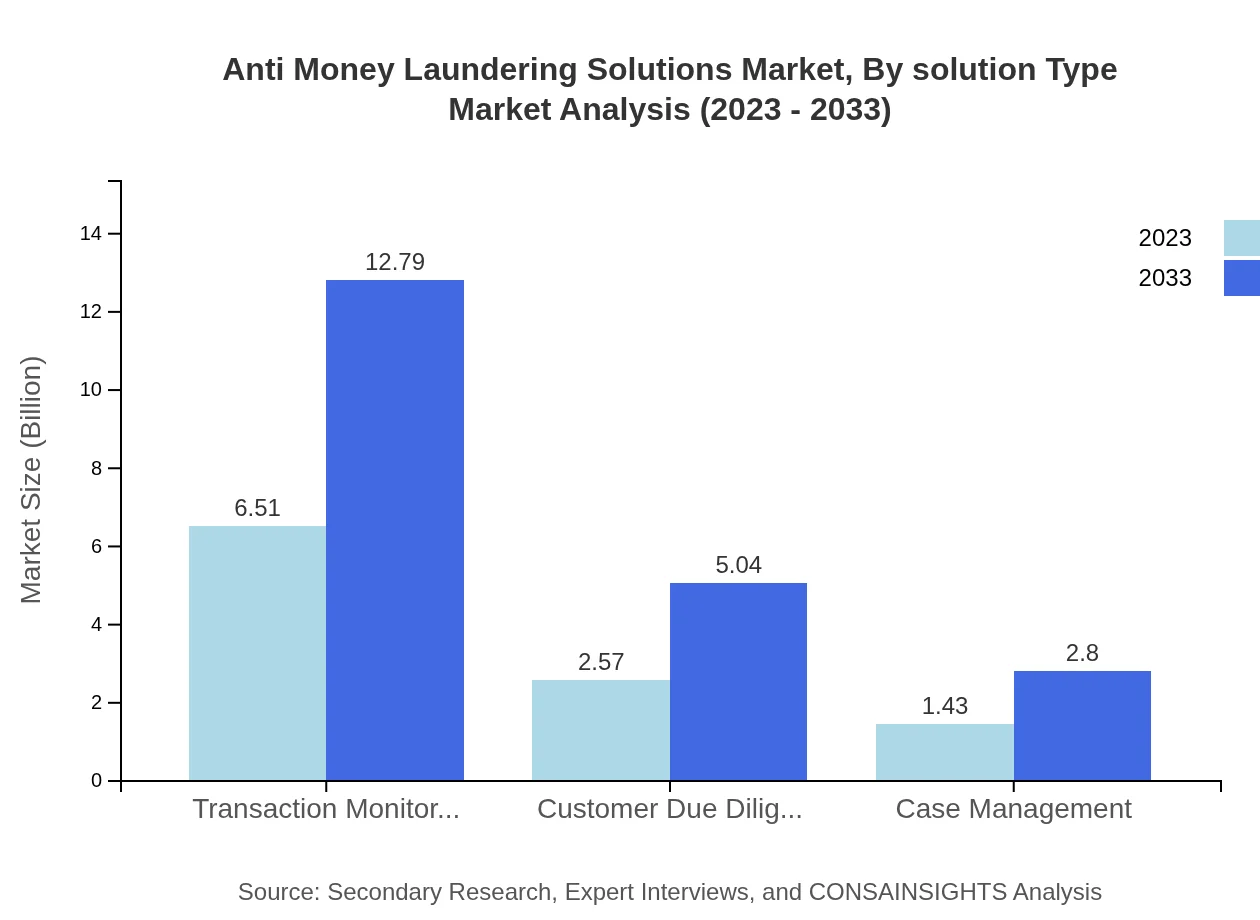

Anti Money Laundering Solutions Market Analysis By Solution Type

The Anti-Money Laundering Solutions Market is segmented by solution type, with transaction monitoring leading the market at $6.51 billion in 2023, maintaining a market share of 61.98%. CDD follows with a market worth $2.57 billion and a share of 24.44%. The insurance sector contributes with $2.62 billion at 24.95%, reflecting growing compliance needs.

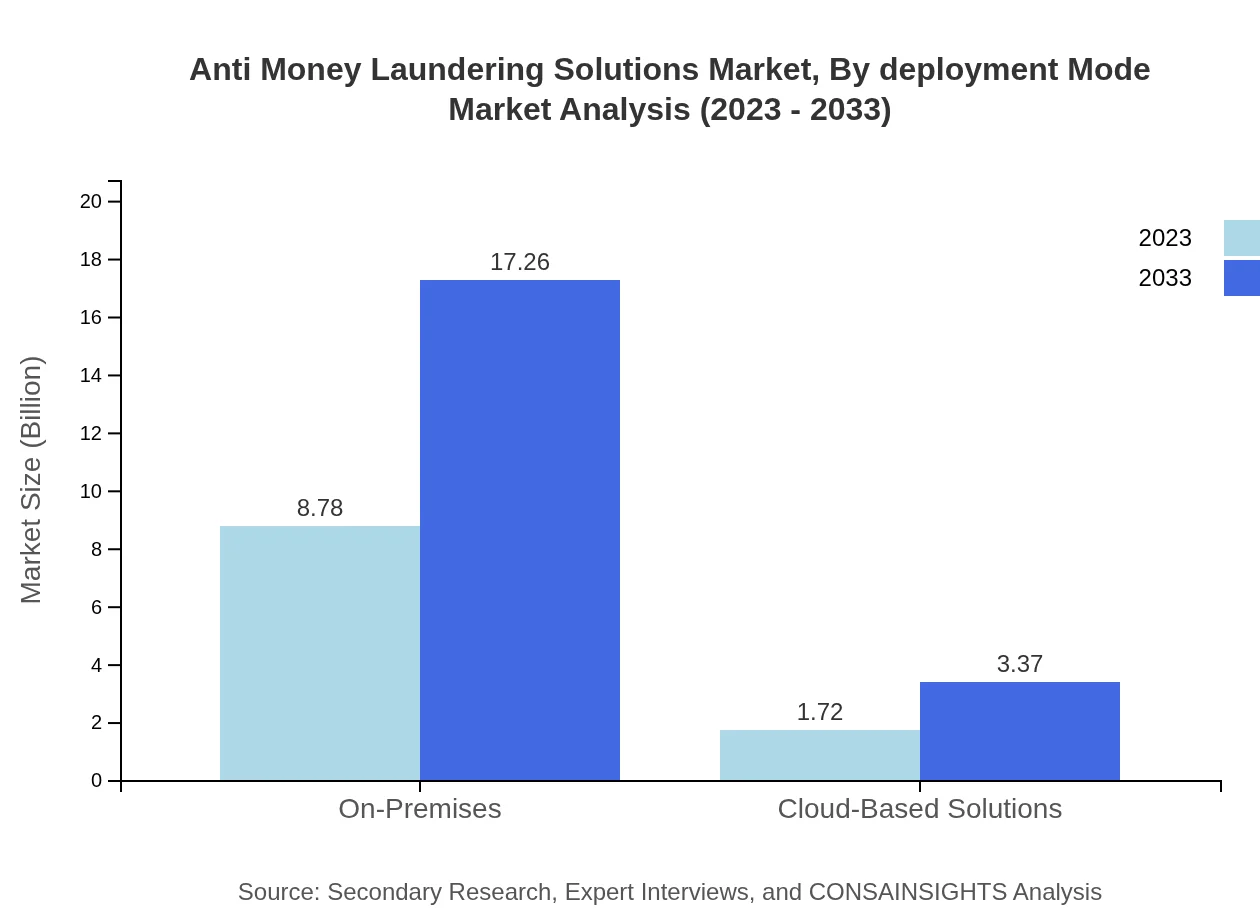

Anti Money Laundering Solutions Market Analysis By Deployment Mode

The deployment mode analysis reveals that on-premises solutions dominate the market with $8.78 billion (83.65% share) in 2023, providing security and control for larger enterprises. However, cloud-based solutions are emerging rapidly, expected to grow from $1.72 billion (16.35% share) in 2023 to $3.37 billion by 2033 as businesses seek scalability and cost-effectiveness.

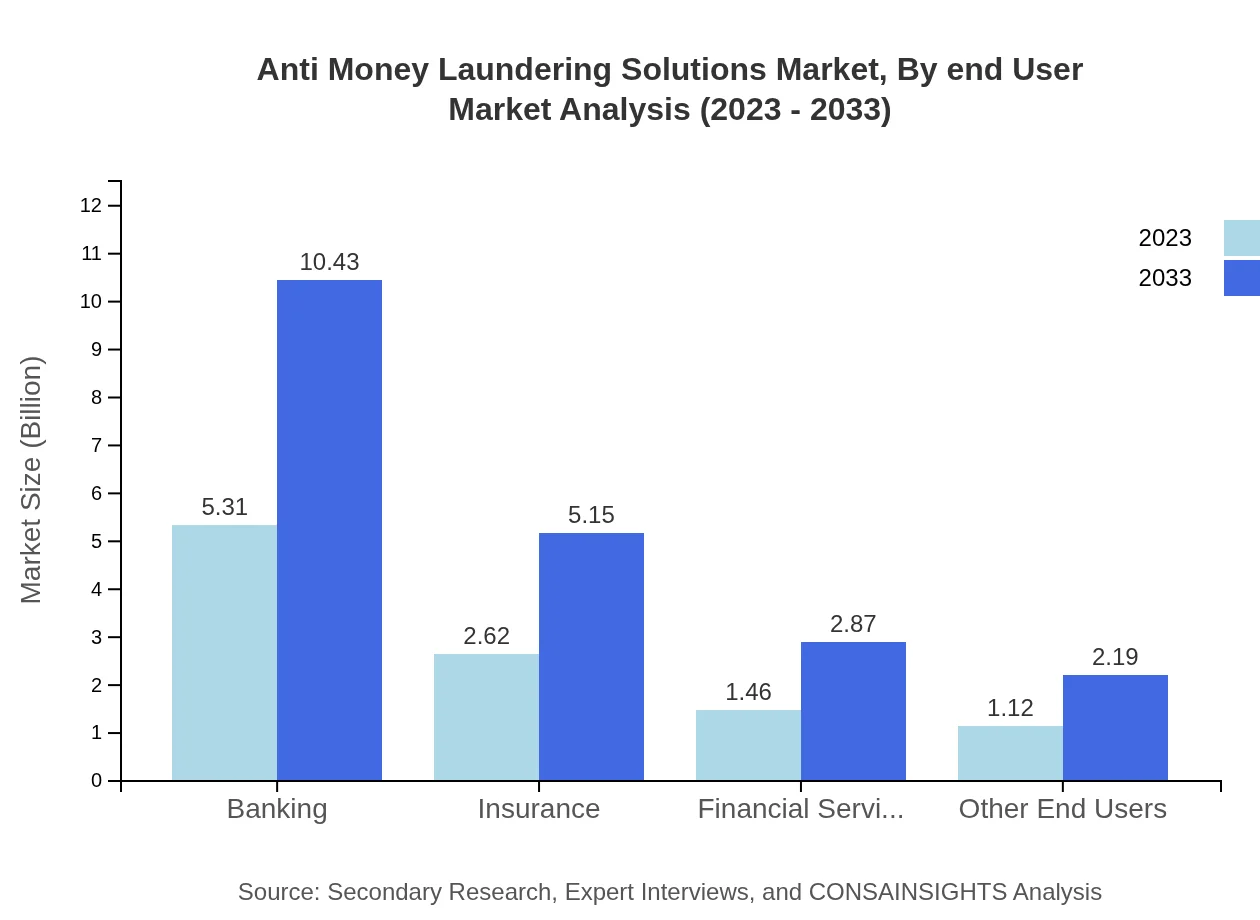

Anti Money Laundering Solutions Market Analysis By End User

The banking sector is the largest end-user of AML solutions, commanding $5.31 billion with a significant 50.54% market share in 2023. The insurance sector follows closely at $2.62 billion (24.95%), driven by ensuring compliance with regulations. Financial services also contribute with $1.46 billion (13.89%), while other end-users add $1.12 billion (10.62%).

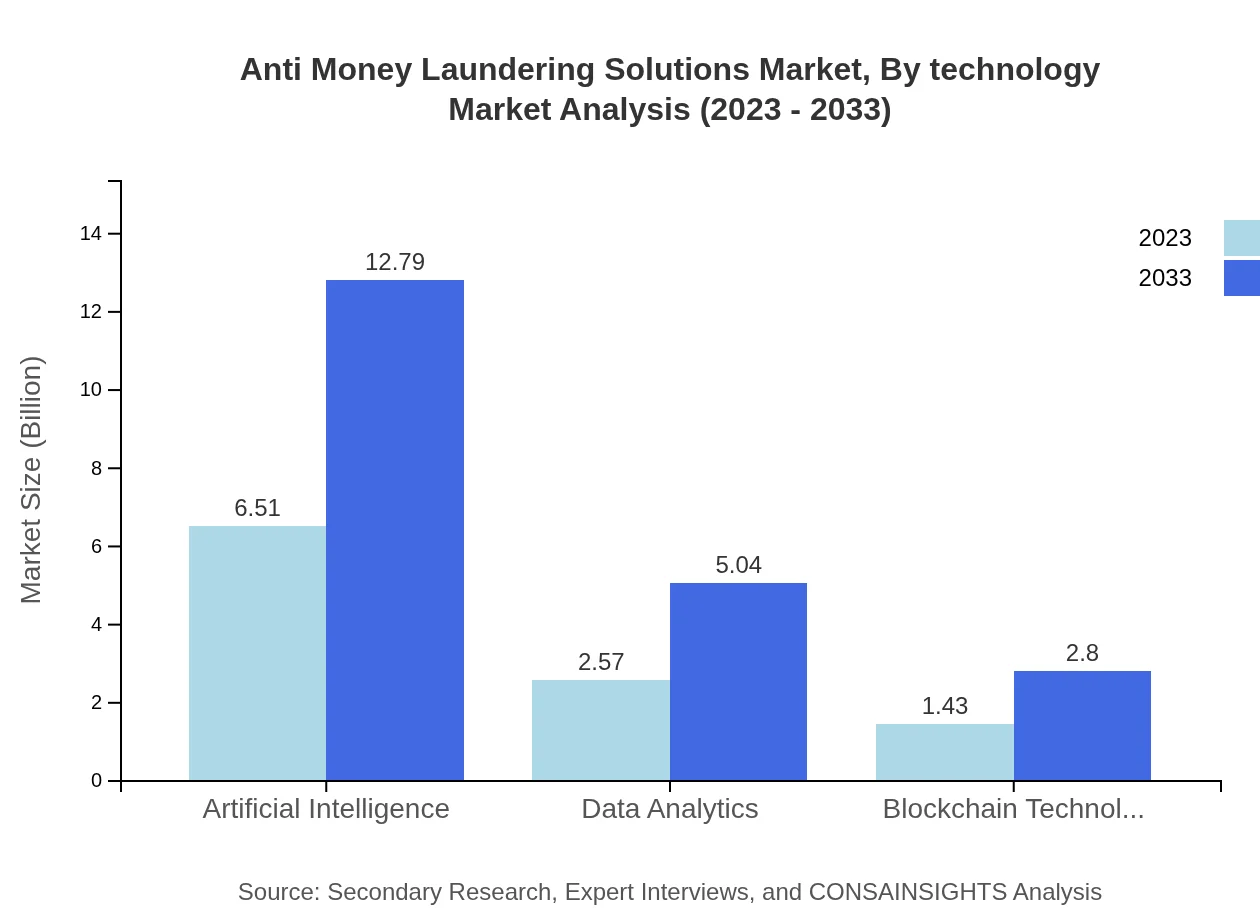

Anti Money Laundering Solutions Market Analysis By Technology

Technologically, artificial intelligence leads with $6.51 billion (61.98% market share) in 2023, showcasing its pivotal role in enhancing AML operations. Data analytics holds a substantial $2.57 billion segment (24.44%), enabling organizations to draw insights from vast datasets. Blockchain technology is also crucial, valued at $1.43 billion (13.58%), offering transparency and traceability in transactions.

Anti Money Laundering Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Money Laundering Solutions Industry

LexisNexis Risk Solutions:

LexisNexis provides advanced analytical capabilities and comprehensive compliance solutions that help organizations detect and prevent money laundering activities effectively.FICO:

FICO offers enterprises solutions that leverage predictive analytics and AI-driven insights to enhance their fraud and AML capabilities.Oracle Financial Services Analytical Applications:

Oracle provides a holistic suite of financial services applications, including tools to mitigate risks related to money laundering through real-time analytics and reporting.ACTICO:

ACTICO specializes in compliance solutions that empower organizations to manage regulatory obligations and implement effective AML strategies.SAS Institute:

SAS Institute provides analytics solutions that aid in AML detection and reporting, helping companies stay compliant with the ever-evolving regulatory landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Money Laundering Solutions?

The anti-money laundering solutions market is projected to grow from approximately $10.5 billion in 2023, with a CAGR of 6.8%, reaching significant market size in the following years. This consistent growth reflects the increasing demand for compliance solutions in financial sectors.

What are the key market players or companies in the anti Money Laundering Solutions industry?

Key players in the anti-money laundering solutions market include established companies in financial technology, compliance software, and data analytics sectors. These firms are investing in advanced technologies to enhance their offerings, including AI and blockchain.

What are the primary factors driving the growth in the anti Money Laundering Solutions industry?

Growth drivers for the anti-money laundering solutions market include tightening regulations, increased financial crimes, and advancements in technology. Companies are adopting robust solutions to mitigate risks and ensure compliance with evolving legal frameworks.

Which region is the fastest Growing in the anti Money Laundering Solutions?

The fastest-growing region for anti-money laundering solutions is North America, anticipated to expand from $4.04 billion in 2023 to $7.94 billion by 2033, due to the high number of financial institutions and stringent regulatory requirements.

Does ConsaInsights provide customized market report data for the anti Money Laundering Solutions industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the anti-money laundering solutions industry. This includes tailored market insights, trends, and competitive analysis to align with client objectives.

What deliverables can I expect from this anti Money Laundering Solutions market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, growth trends, competitive benchmarking, and segmented data insights for various regions and market segments within the anti-money laundering solutions landscape.

What are the market trends of anti Money Laundering Solutions?

Market trends include the adoption of AI and data analytics in transaction monitoring, a shift towards cloud-based solutions, and increasing integration of compliance technologies across various sectors to enhance fraud detection capabilities.