Anti Obesity Drugs Market Report

Published Date: 31 January 2026 | Report Code: anti-obesity-drugs

Anti Obesity Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Anti Obesity Drugs market from 2023 to 2033, delivering insights on market trends, segmentation, regional dynamics, and key players, along with detailed forecasts and growth projections.

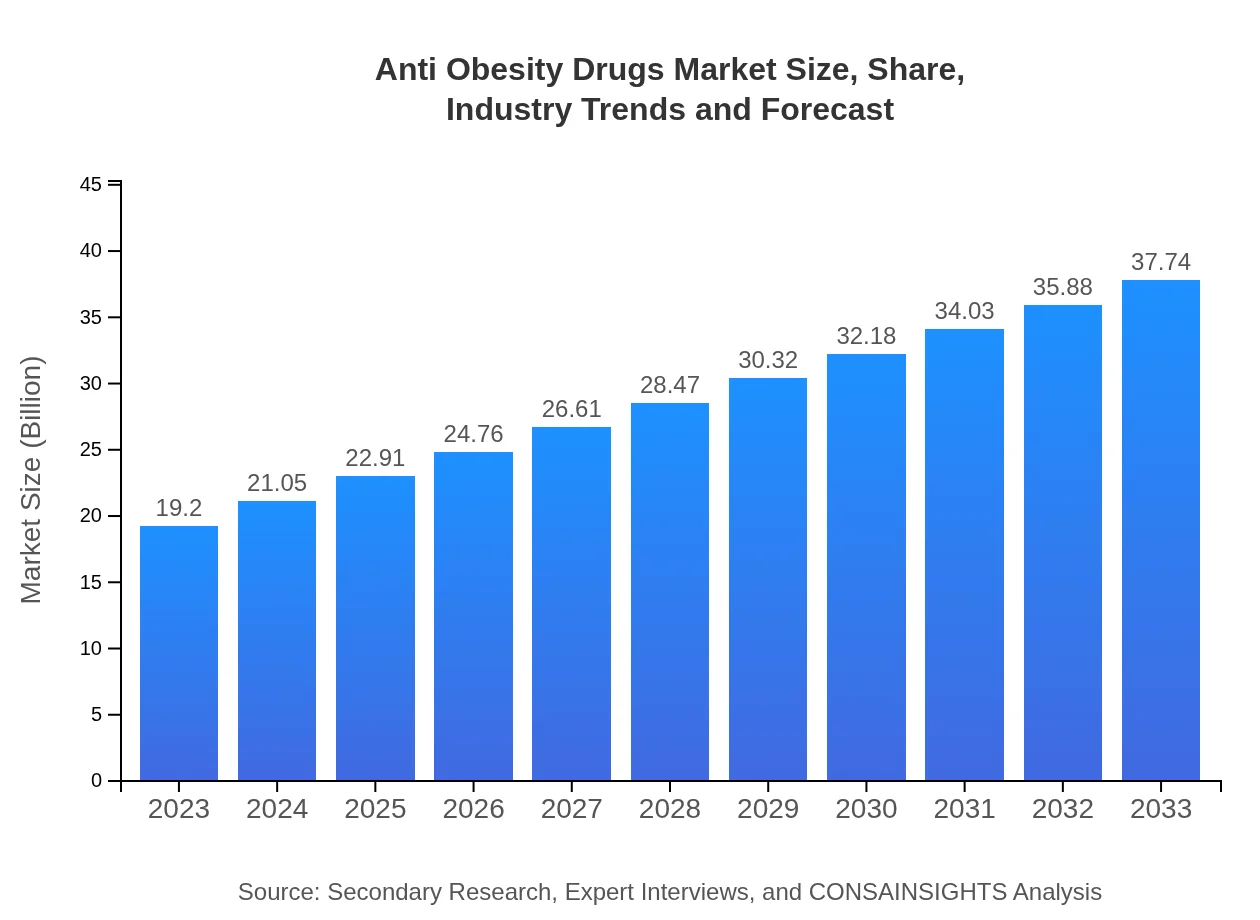

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $19.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $37.74 Billion |

| Top Companies | Novo Nordisk, Johnson & Johnson, Amgen, Boehringer Ingelheim |

| Last Modified Date | 31 January 2026 |

Anti Obesity Drugs Market Overview

Customize Anti Obesity Drugs Market Report market research report

- ✔ Get in-depth analysis of Anti Obesity Drugs market size, growth, and forecasts.

- ✔ Understand Anti Obesity Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Obesity Drugs

What is the Market Size & CAGR of Anti Obesity Drugs market in 2023?

Anti Obesity Drugs Industry Analysis

Anti Obesity Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Obesity Drugs Market Analysis Report by Region

Europe Anti Obesity Drugs Market Report:

The European market is valued at $5.05 billion in 2023, rising to $9.93 billion by 2033. Increased investment in healthcare and technological advancements in treatment options are driving this growth.Asia Pacific Anti Obesity Drugs Market Report:

In 2023, the Anti Obesity Drugs market in the Asia Pacific region is valued at $4.15 billion and is expected to reach $8.17 billion by 2033, driven by rising obesity rates and increased healthcare spending.North America Anti Obesity Drugs Market Report:

North America currently leads the Anti Obesity Drugs market with a valuation of $6.59 billion in 2023, expected to grow to $12.95 billion by 2033. The growth is attributed to robust healthcare infrastructure and a high prevalence of obesity.South America Anti Obesity Drugs Market Report:

The South American market is projected to grow from $1.68 billion in 2023 to $3.30 billion by 2033. The awareness of obesity-related health risks is driving regional demand for effective weight management solutions.Middle East & Africa Anti Obesity Drugs Market Report:

The Middle East and Africa market holds a value of $1.72 billion in 2023, anticipated to increase to $3.39 billion by 2033. Growing health awareness and improving medical facilities are major factors influencing market growth.Tell us your focus area and get a customized research report.

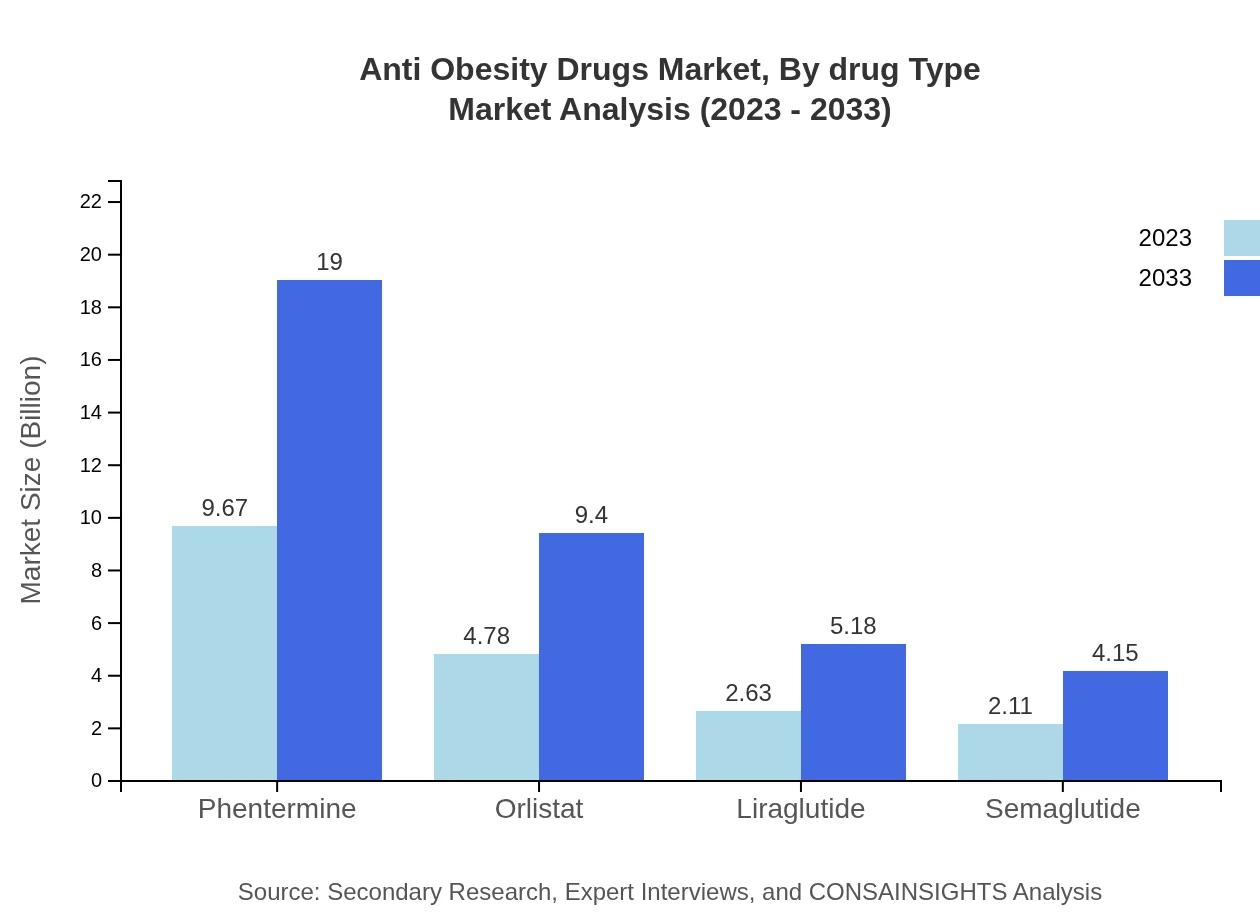

Anti Obesity Drugs Market Analysis By Drug Type

The Anti-Obesity Drugs market is predominantly driven by Phentermine and Orlistat, accounting for substantial market shares in 2023. Phentermine holds a market size of $9.67 billion, while Orlistat stands at $4.78 billion. Emerging drugs like Liraglutide and Semaglutide contribute to the newer market dynamics, targeting specific patient populations.

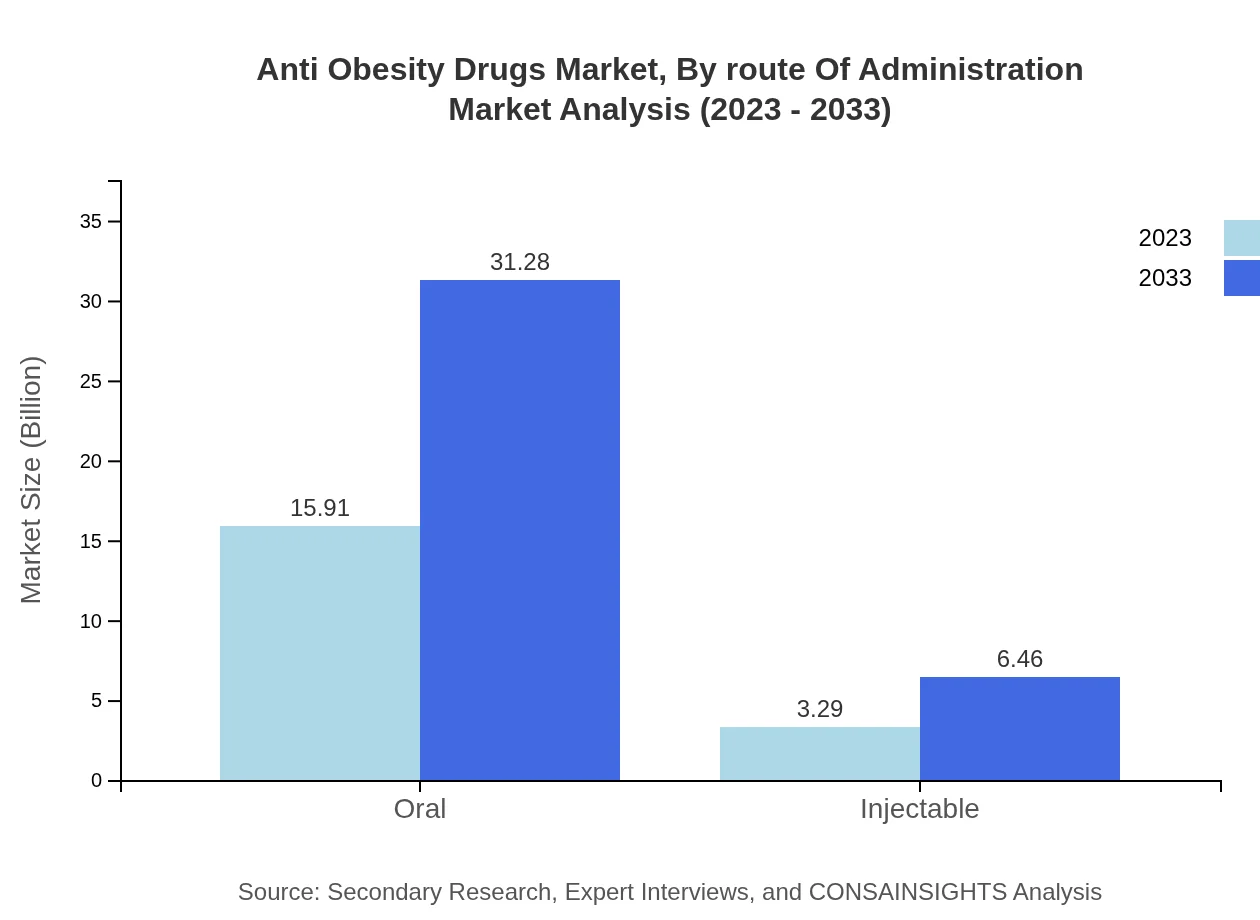

Anti Obesity Drugs Market Analysis By Route Of Administration

The market is segmented into oral and injectable routes, with oral medications occupying an extensive market share driven by ease of use. In 2023, oral medications, including Phentermine and Orlistat, total a market size of approximately $15.91 billion, whereas injectables are valued at $3.29 billion.

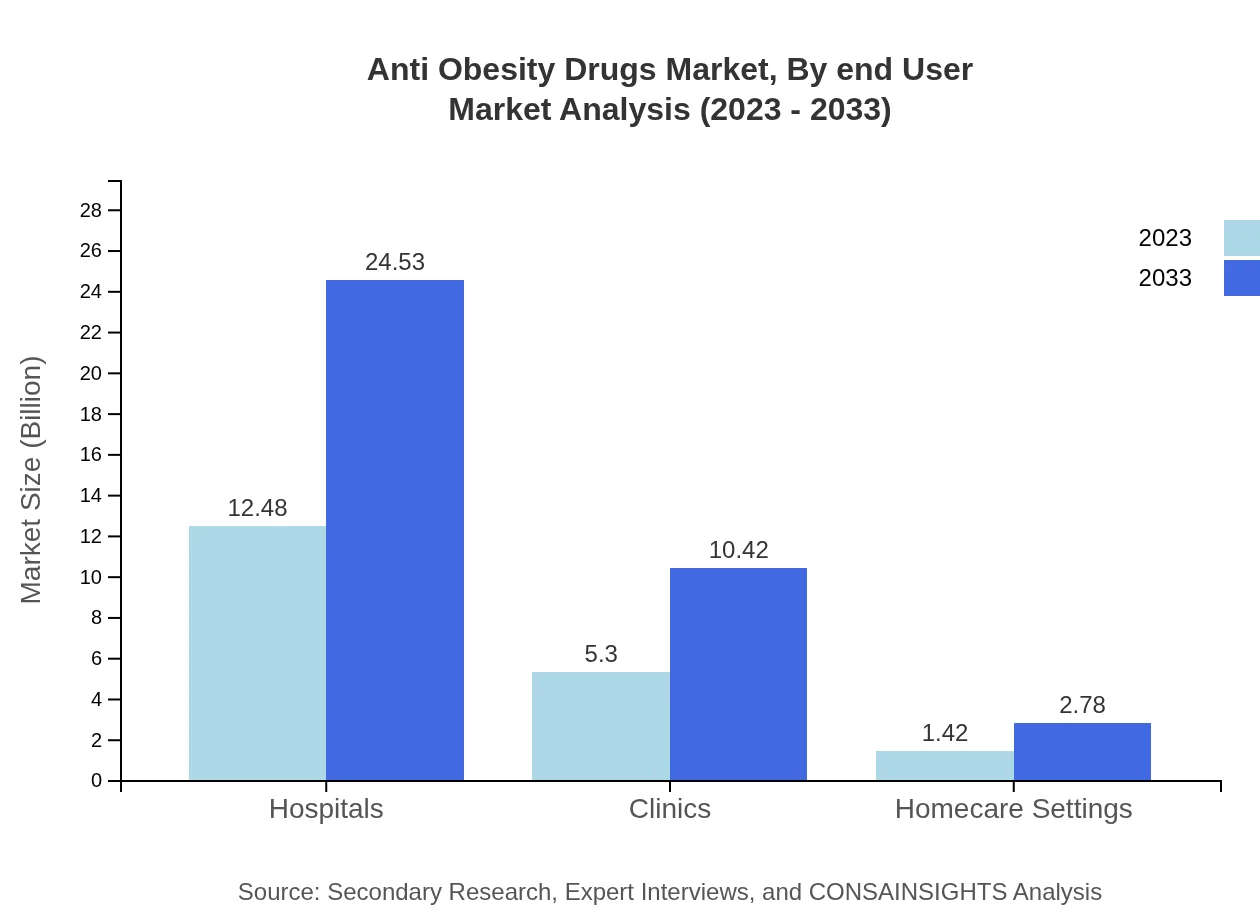

Anti Obesity Drugs Market Analysis By End User

Hospitals represent the largest user segment in the Anti Obesity Drugs market, valued at $12.48 billion in 2023, a substantial share influenced by comprehensive healthcare services. Clinics and homecare settings follow, representing emerging avenues for drug distribution and consumption.

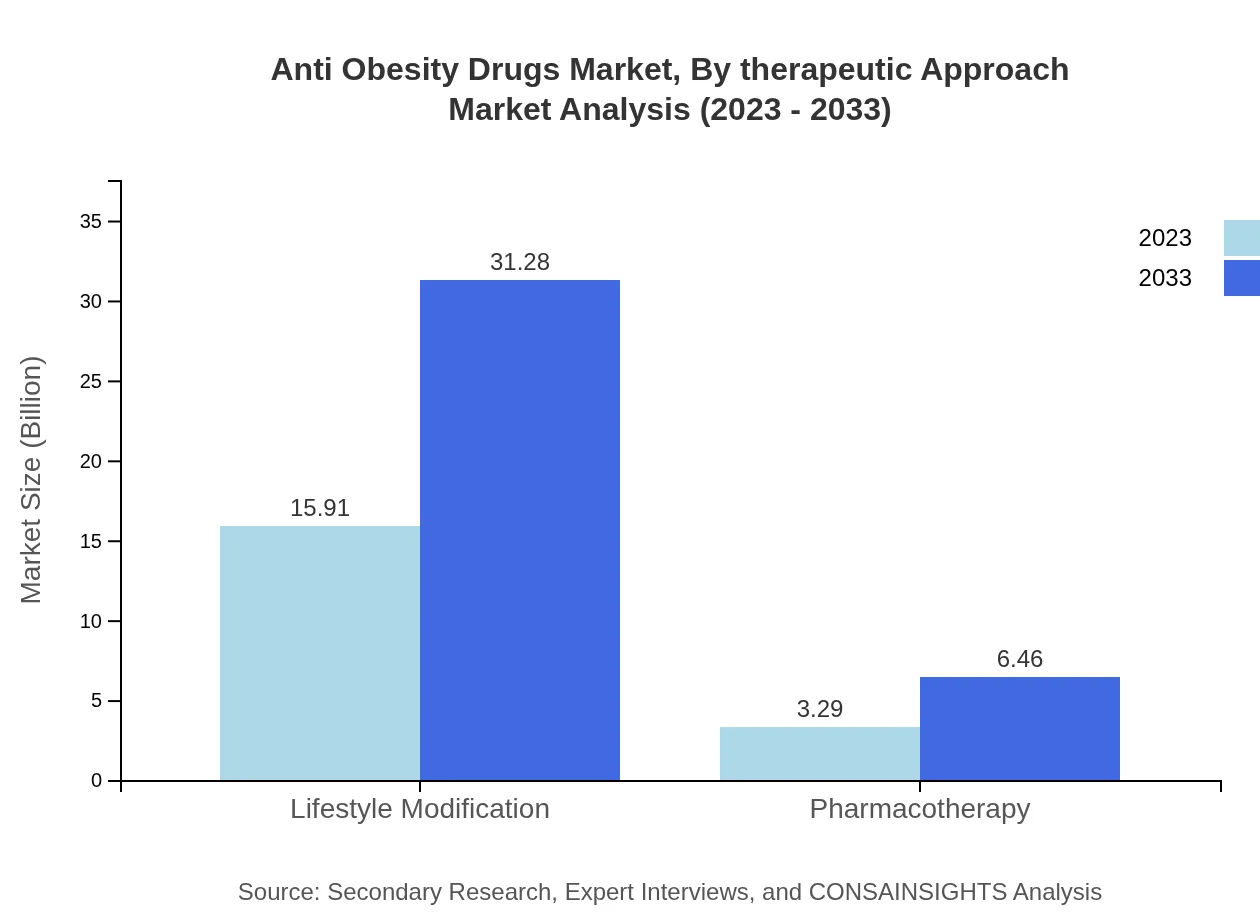

Anti Obesity Drugs Market Analysis By Therapeutic Approach

The therapeutic approach segment is dominated by lifestyle modification therapies, which account for approximately $15.91 billion in 2023. Pharmacotherapy complements these approaches, capturing attention as part of combination therapies for enhanced efficacy.

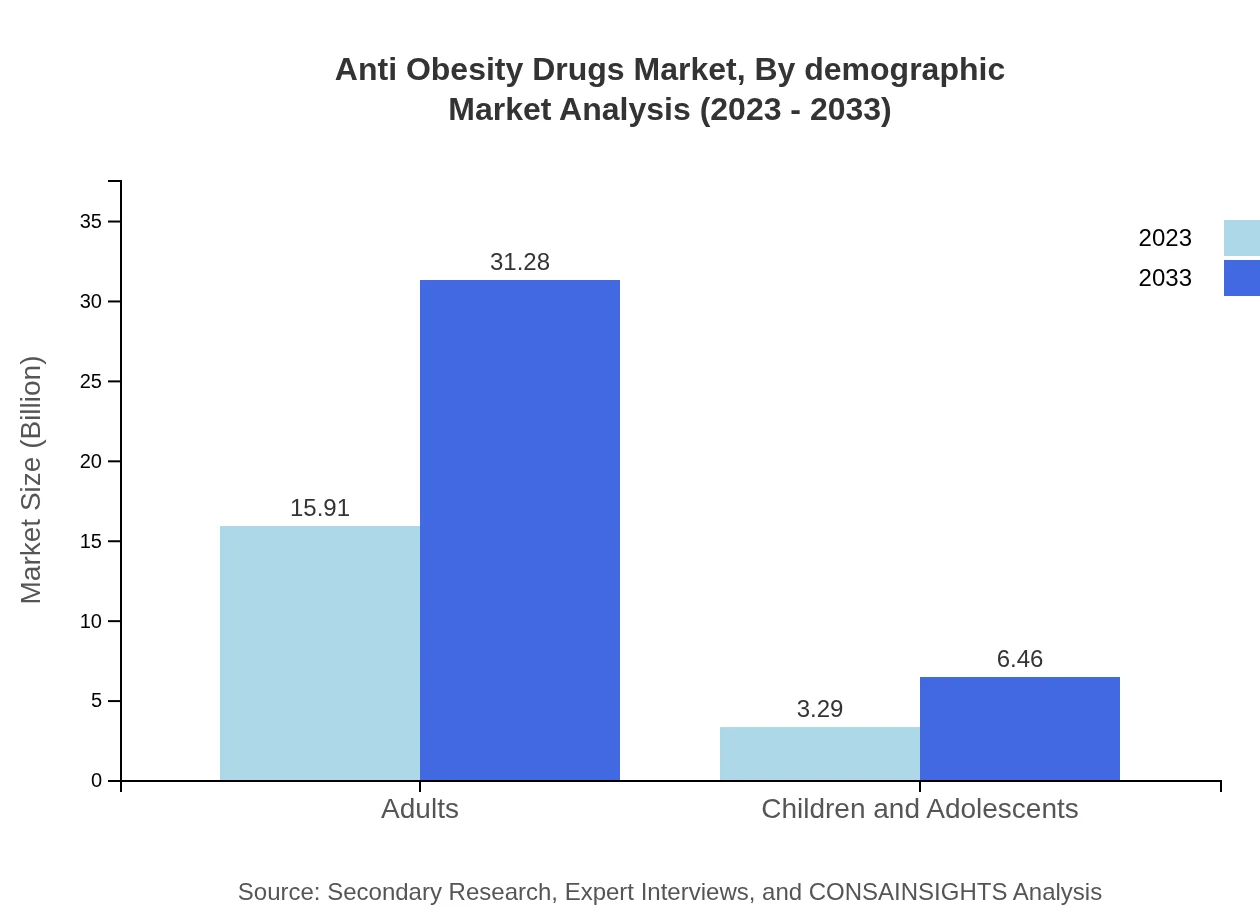

Anti Obesity Drugs Market Analysis By Demographic

Adults comprise the majority of the user base in the Anti Obesity Drugs market, with a market size of $15.91 billion in 2023. Children and adolescents represent a smaller segment but are gaining attention with tailored formulations to meet their specific health requirements.

Anti Obesity Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Obesity Drugs Industry

Novo Nordisk:

A leader in drug development and manufacturing, Novo Nordisk specializes in diabetes and obesity medications, including Semaglutide, significantly contributing to the anti-obesity market.Johnson & Johnson:

Johnson & Johnson markets several anti-obesity products and invests heavily in R&D, focusing on innovative therapies that address the pressing issue of global obesity.Amgen:

Amgen is renowned for its pioneering research in biotechnology, developing drugs that have applications in weight management and metabolic health.Boehringer Ingelheim:

This company is committed to developing advanced treatments for metabolic conditions, including efficacious anti-obesity drugs, emphasizing patient-centric research.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Obesity drugs?

The global anti-obesity drugs market is projected to reach approximately $19.2 billion by 2033, growing at a CAGR of 6.8% from 2023. Factors influencing this growth include increasing obesity rates and rising health awareness.

What are the key market players or companies in the anti Obesity drugs industry?

Key players in the anti-obesity drugs market include major pharmaceuticals like Novo Nordisk, Eli Lilly, and Takeda. These companies focus on innovative drug development and marketing strategies to cater to a growing consumer base.

What are the primary factors driving the growth in the anti Obesity drugs industry?

Major drivers include the rising prevalence of obesity globally, increased healthcare spending, and growing awareness of obesity-related health risks. Advances in drug formulations and new treatment methodologies further bolster market growth.

Which region is the fastest Growing in the anti Obesity drugs market?

North America is anticipated to be the fastest-growing region, with market size projected to increase from $6.59 billion in 2023 to $12.95 billion by 2033. This trend is backed by high obesity rates and access to healthcare facilities.

Does Consainsights provide customized market report data for the anti Obesity drugs industry?

Yes, Consainsights offers customized market reports tailored to specific client needs in the anti-obesity drugs industry, providing in-depth analysis, forecasts, and strategic insight into market dynamics.

What deliverables can I expect from this anti Obesity drugs market research project?

Deliverables include comprehensive market reports featuring analyses of current trends, competitive landscape, growth forecasts, and segment data, along with actionable insights tailored to support strategic decision-making.

What are the market trends of anti Obesity drugs?

Trends in the anti-obesity drugs market include a shift towards combination therapies, increased use of injectable medications, and a growing focus on personalized treatment plans. These trends reflect evolving consumer demands and advanced research.