Anti Reflective Coatings Market Report

Published Date: 02 February 2026 | Report Code: anti-reflective-coatings

Anti Reflective Coatings Market Size, Share, Industry Trends and Forecast to 2033

This market report analyses the global anti-reflective coatings industry, exploring key insights, trends, forecasts, and regional dynamics from 2023 to 2033. It provides comprehensive data on market size, growth rates, and industry leaders to enhance strategic decision-making.

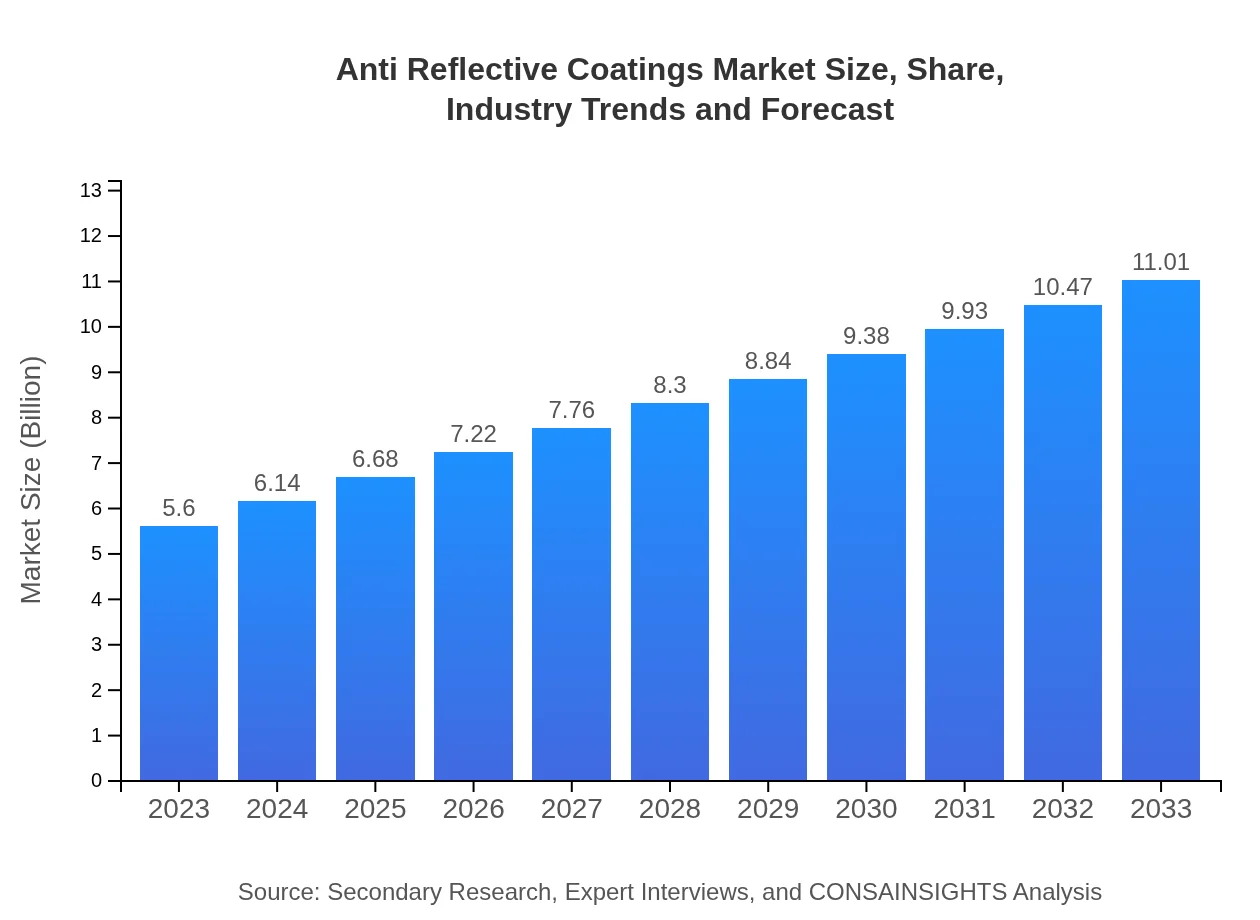

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | PPG Industries, Inc., Essilor International, Carl Zeiss AG, Honeywell International Inc., Mitsui Chemicals, Inc. |

| Last Modified Date | 02 February 2026 |

Anti Reflective Coatings Market Overview

Customize Anti Reflective Coatings Market Report market research report

- ✔ Get in-depth analysis of Anti Reflective Coatings market size, growth, and forecasts.

- ✔ Understand Anti Reflective Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Reflective Coatings

What is the Market Size & CAGR of Anti Reflective Coatings market in 2023?

Anti Reflective Coatings Industry Analysis

Anti Reflective Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Reflective Coatings Market Analysis Report by Region

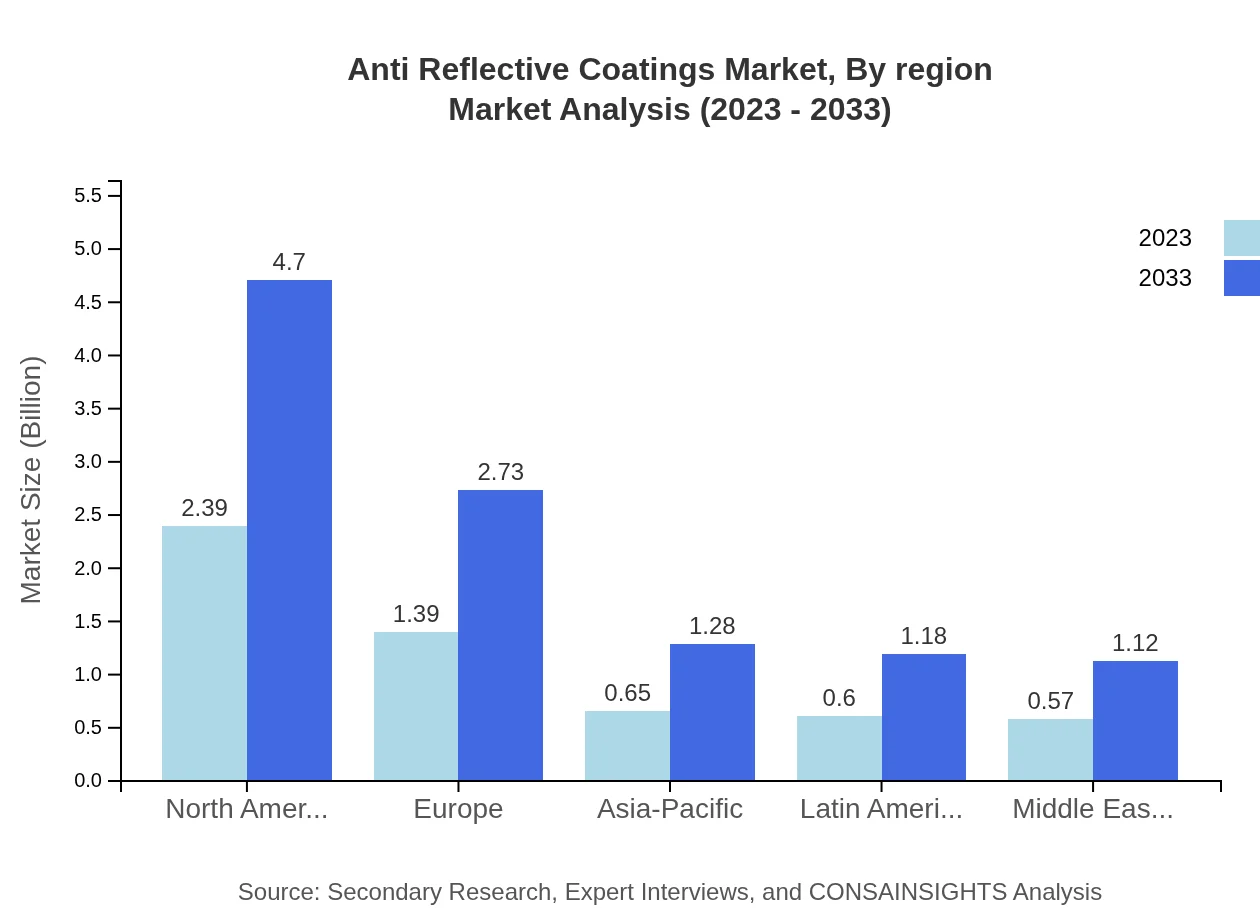

Europe Anti Reflective Coatings Market Report:

Europe's anti-reflective coatings market is forecasted to rise from $1.37 billion in 2023 to $2.69 billion by 2033. Growth is fueled by stringent regulations supporting the adoption of eco-friendly products, advancements in optical technologies, and increasing demand from the automotive industry for enhanced safety features.Asia Pacific Anti Reflective Coatings Market Report:

In the Asia Pacific region, the anti-reflective coatings market is expected to grow from $1.19 billion in 2023 to $2.34 billion by 2033. The strong electronics manufacturing base, especially in countries like China, Japan, and South Korea, supports this growth, while increasing investments in automotive and healthcare drive demand for advanced coatings.North America Anti Reflective Coatings Market Report:

North America, with a market size of $2.17 billion in 2023 expected to reach $4.26 billion by 2033, is one of the leading regions for anti-reflective coatings. The presence of major industry players, an innovative technology landscape, and high consumption in the electronics and automotive sectors contribute to this growth.South America Anti Reflective Coatings Market Report:

The South American market is projected to expand from $0.53 billion in 2023 to $1.05 billion by 2033. The region's growth is driven by increasing demand in consumer electronics, particularly in Brazil and Argentina, alongside gradual industrial development.Middle East & Africa Anti Reflective Coatings Market Report:

The Middle East and Africa market, valued at $0.34 billion in 2023 and expected to grow to $0.66 billion by 2033, is driven by rising investments in the technology sector and the increasing traction of anti-reflective coatings in the healthcare and automotive industries.Tell us your focus area and get a customized research report.

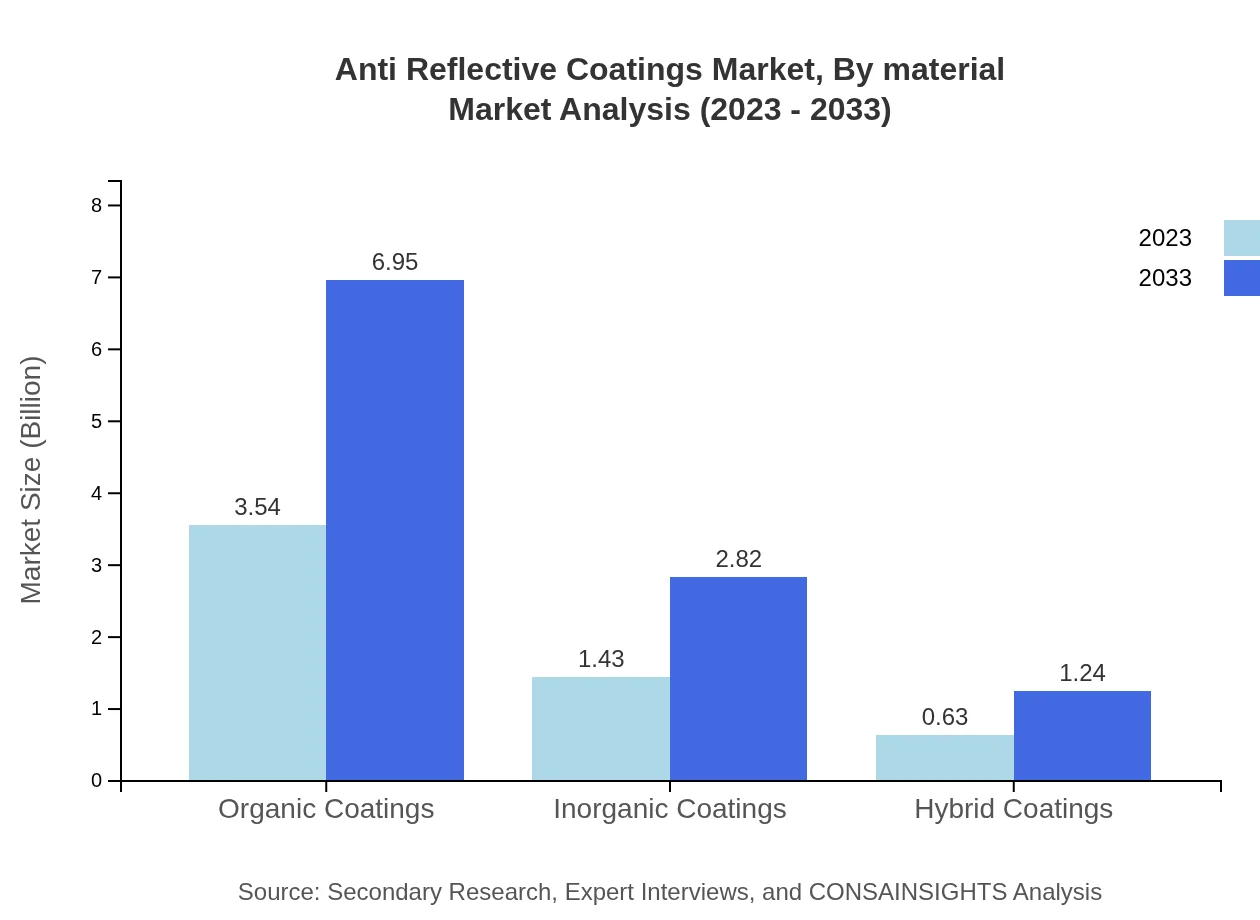

Anti Reflective Coatings Market Analysis By Material

The material segment includes organic, inorganic, and hybrid coatings. Organic coatings accounted for 63.15% of the market size in 2023, projected to grow to 63.15% by 2033, driven by their versatility and ease of application. Inorganic coatings, representing 25.59% of the market, focus on durability, while hybrid coatings gain traction for their combined performance benefits.

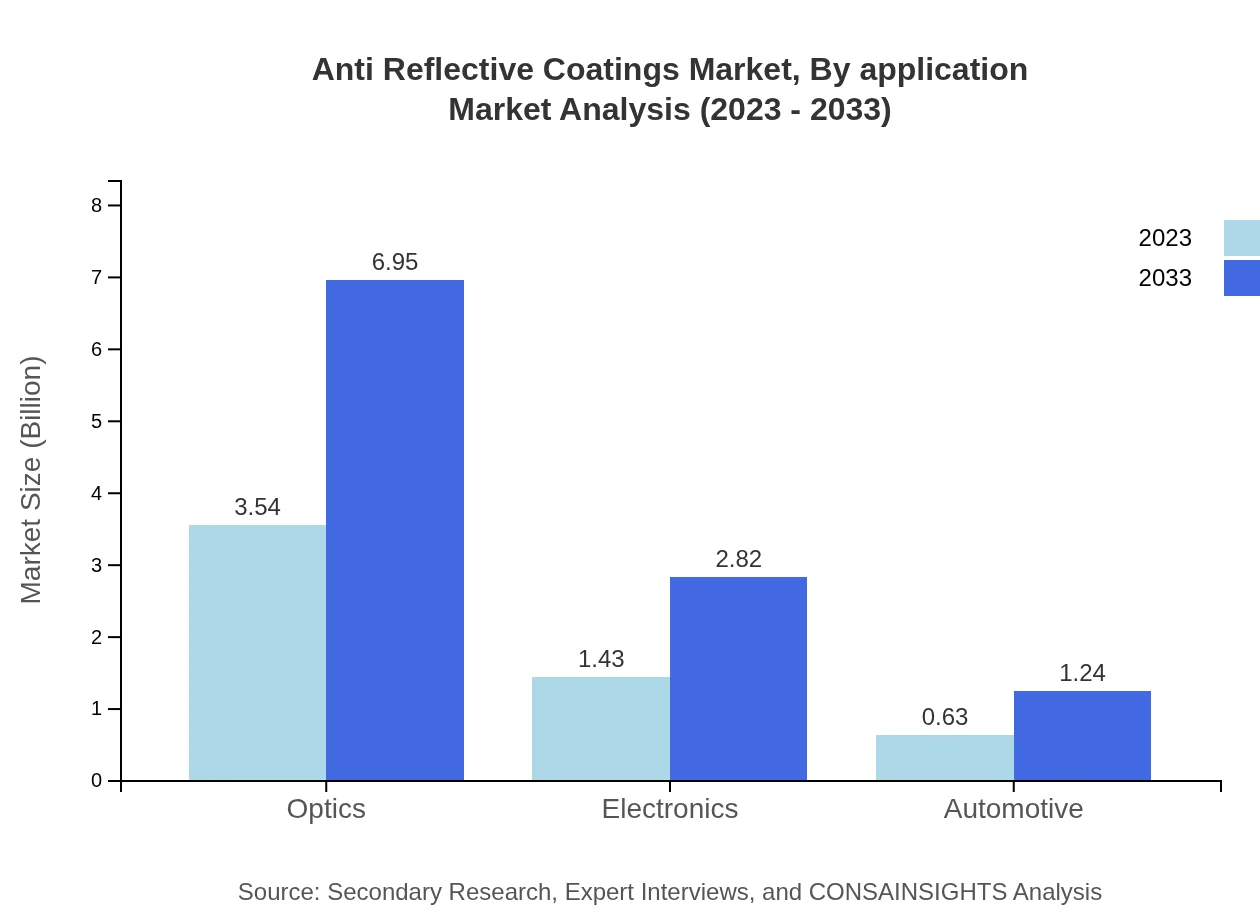

Anti Reflective Coatings Market Analysis By Application

Applications include consumer electronics, healthcare devices, automotive, and optics. Consumer electronics dominated with 63.15% market share in 2023, as anti-reflective coatings enhance display quality in smartphones and televisions. Healthcare devices followed with 25.59%, while the automotive segment is poised for growth due to increasing safety regulations mandating better visibility.

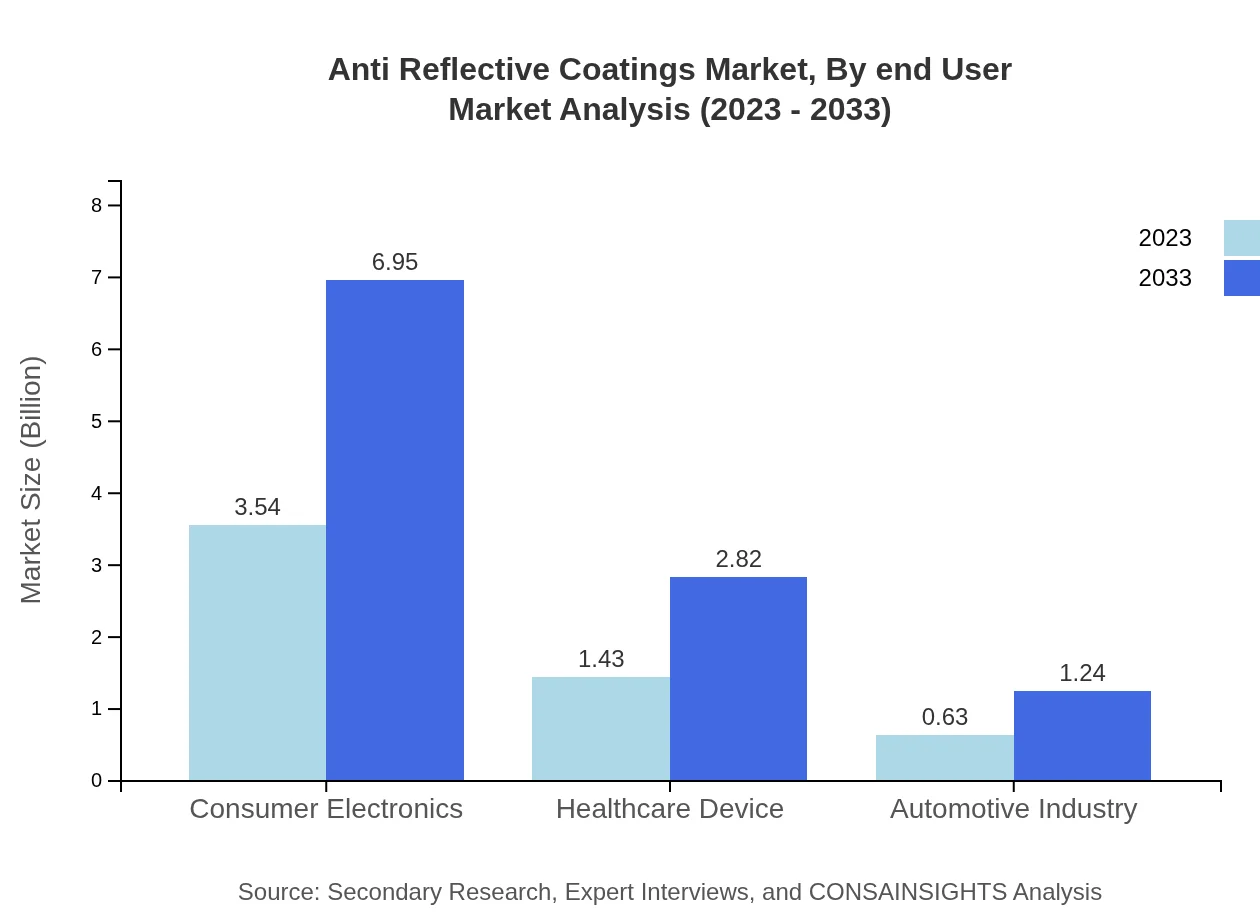

Anti Reflective Coatings Market Analysis By End User

The end-user industry includes electronics, automotive, optics, and healthcare. Electronics lead the market at 63.15% share in 2023, followed by automotive at 11.26%. The optics sector demonstrates significant growth potential due to rising demand for high-quality lenses in both consumer and professional applications.

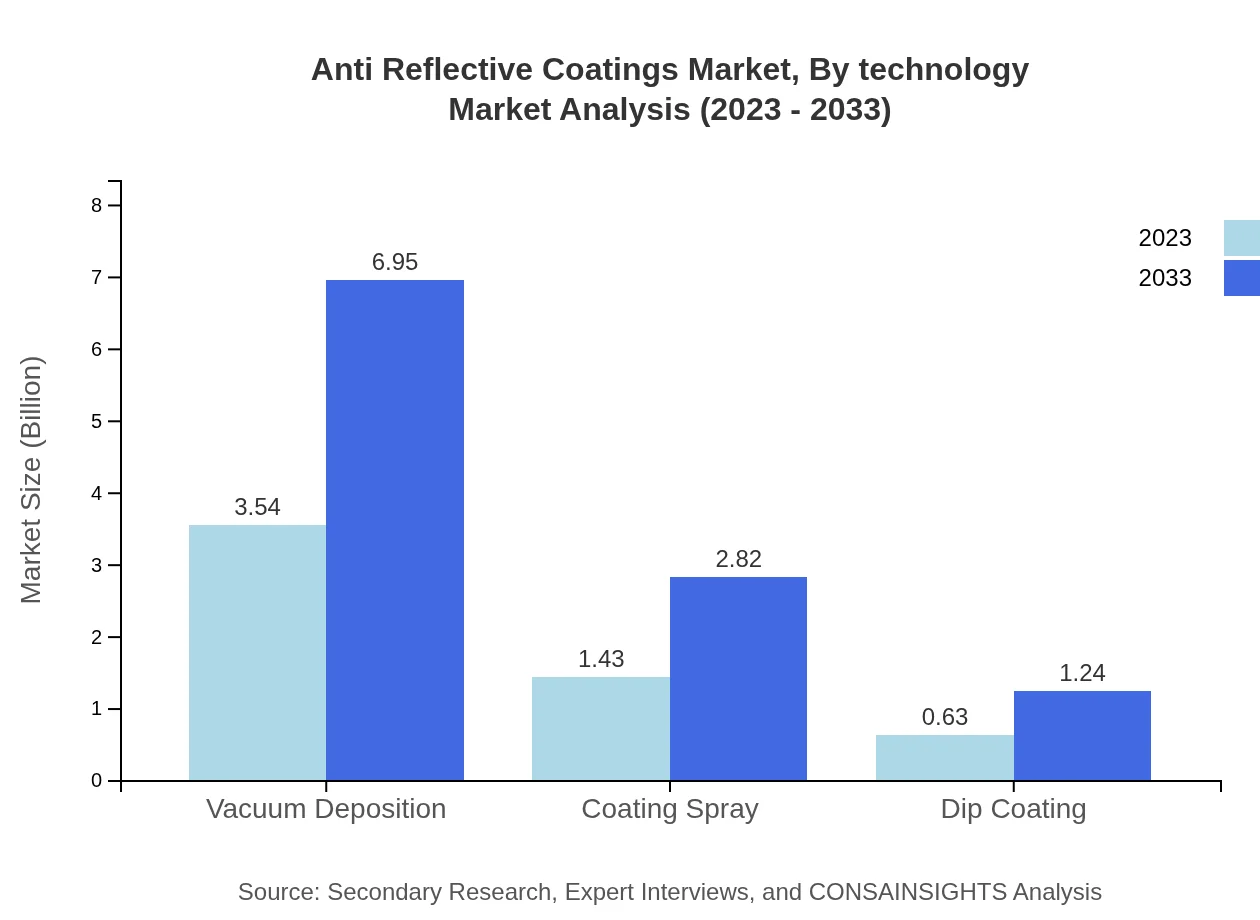

Anti Reflective Coatings Market Analysis By Technology

Technologies employed in producing anti-reflective coatings encompass vacuum deposition, coating spray, and dip coating. Vacuum deposition remains the predominant technology, holding a 63.15% market share in 2023, favored for its effectiveness in producing high-quality coatings. Spray coating and dip coating are also gaining popularity due to their simplicity and cost-effectiveness.

Anti Reflective Coatings Market Analysis By Region

The regional analysis indicates varied growth trends, with North America and Europe leading financially due to established markets and innovation. The Asia Pacific presents significant growth opportunities driven by increasing manufacturing capabilities, while South America and the Middle East are emerging as regions with potential for rapid growth.

Anti Reflective Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Reflective Coatings Industry

PPG Industries, Inc.:

A leading global supplier of coatings and specialty materials, known for its advanced anti-reflective coatings used in eyewear and automotive applications.Essilor International:

Leader in optical products, Essilor specializes in anti-reflective coatings for lenses, enhancing visual quality and comfort for consumers worldwide.Carl Zeiss AG:

Renowned for precision optics, Carl Zeiss develops advanced anti-reflective coatings, optimizing lens performance and consumer experience.Honeywell International Inc.:

Honeywell provides innovative coating solutions across various sectors including automotive, with a focus on durability and function.Mitsui Chemicals, Inc.:

Mitsui Chemicals manufactures high-performance anti-reflective coatings used in electronics and automotive applications.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Reflective coatings?

The global anti-reflective coatings market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8% over the next decade, indicating significant potential for growth and expansion through to 2033.

What are the key market players or companies in this anti Reflective coatings industry?

Key players in the anti-reflective coatings market include industry leaders specializing in coatings technology, optical films, and surface treatments, contributing to innovation and market competition, although specific company names were not disclosed in the research.

What are the primary factors driving the growth in the anti Reflective coatings industry?

The growth of the anti-reflective coatings market is primarily driven by increasing demand from consumer electronics, advancements in healthcare devices, and innovations in automotive applications, coupled with rising consumer awareness regarding performance-enhancing coatings.

Which region is the fastest Growing in the anti Reflective coatings?

The Asia Pacific region is projected to be the fastest-growing market for anti-reflective coatings, expanding from a market size of $1.19 billion in 2023 to $2.34 billion by 2033, showcasing robust growth opportunities.

Does ConsaInsights provide customized market report data for the anti Reflective coatings industry?

Yes, ConsaInsights offers customized market report data tailored specifically for stakeholders in the anti-reflective coatings industry, ensuring relevant insights and detailed analysis based on particular market needs.

What deliverables can I expect from this anti Reflective coatings market research project?

Deliverables from the anti-reflective coatings market research include comprehensive market reports, data analytics, regional insights, competitive analysis, and actionable recommendations to guide strategic decision-making.

What are the market trends of anti Reflective coatings?

Key trends in the anti-reflective coatings market include advancements in hybrid and inorganic coatings technology, increased adoption in the electronics and optics sectors, and a growing emphasis on sustainable manufacturing practices.