Anti Retroviral Drugs Market Report

Published Date: 31 January 2026 | Report Code: anti-retroviral-drugs

Anti Retroviral Drugs Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Anti Retroviral Drugs market, covering insights into market size, growth trends, segmentation, and forecasts for the period 2023-2033.

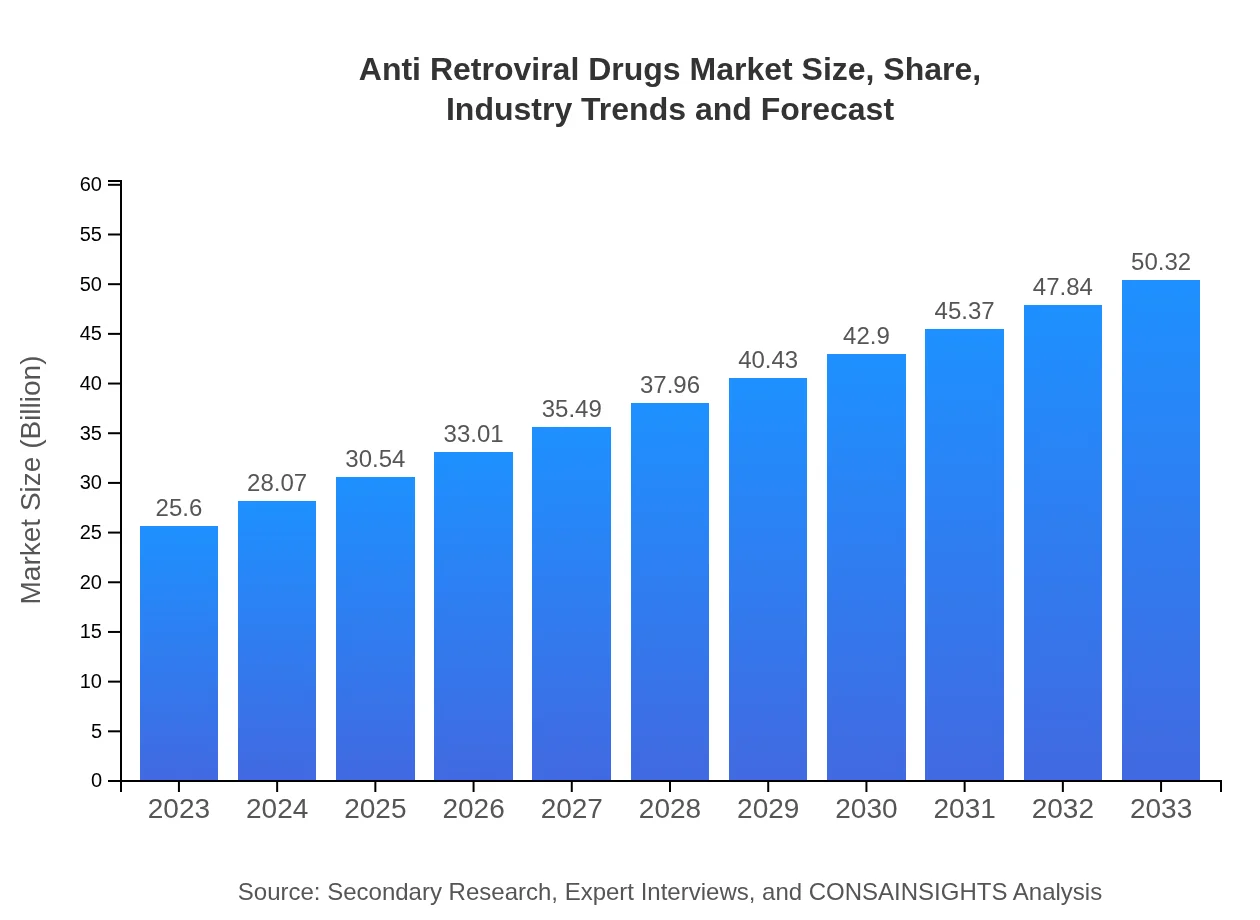

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.32 Billion |

| Top Companies | Gilead Sciences, ViiV Healthcare, Bristol-Myers Squibb, Merck & Co. |

| Last Modified Date | 31 January 2026 |

Anti Retroviral Drugs Market Overview

Customize Anti Retroviral Drugs Market Report market research report

- ✔ Get in-depth analysis of Anti Retroviral Drugs market size, growth, and forecasts.

- ✔ Understand Anti Retroviral Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Retroviral Drugs

What is the Market Size & CAGR of Anti Retroviral Drugs market in 2023?

Anti Retroviral Drugs Industry Analysis

Anti Retroviral Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Retroviral Drugs Market Analysis Report by Region

Europe Anti Retroviral Drugs Market Report:

The European market is also expected to showcase significant growth, escalating from $6.15 billion in 2023 to $12.10 billion in 2033. Strong healthcare policies supporting universal access to treatment contribute to this upward trend, as do continuous innovations in drug formulations.Asia Pacific Anti Retroviral Drugs Market Report:

In the Asia Pacific region, the market is projected to grow from $5.63 billion in 2023 to $11.06 billion by 2033. This growth is supported by rising incidences of HIV infections, an increase in public health initiatives aimed at tackling the disease, and evolving healthcare infrastructure.North America Anti Retroviral Drugs Market Report:

In North America, the market size is expected to rise from $8.55 billion in 2023 to an impressive $16.81 billion by 2033, attributed to advanced healthcare systems, robust pharmaceutical industries, and high awareness levels among the population regarding HIV prevention and treatment.South America Anti Retroviral Drugs Market Report:

The South American market's size is anticipated to expand from $2.18 billion in 2023 to $4.29 billion by 2033. The increase is driven by government-led healthcare programs and partnerships with NGO efforts to improve access to anti-retroviral therapy.Middle East & Africa Anti Retroviral Drugs Market Report:

The Middle East and Africa market is projected to grow from $3.08 billion in 2023 to $6.05 billion by 2033. Efforts to strengthen healthcare systems and enhance drug availability play a crucial role in this market's projected growth.Tell us your focus area and get a customized research report.

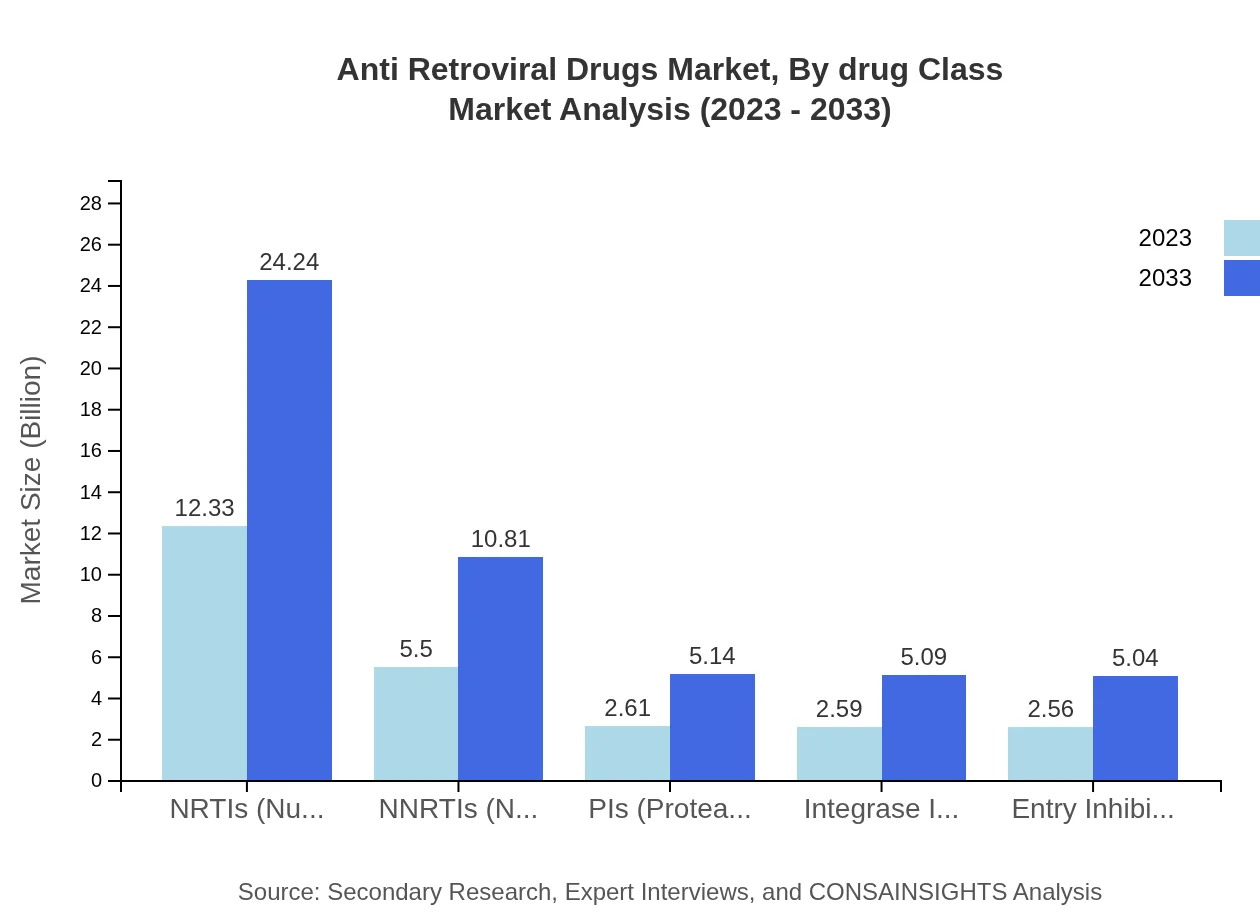

Anti Retroviral Drugs Market Analysis By Drug Class

In 2023, NRTIs lead the market with a size of $12.33 billion, set to double to $24.24 billion by 2033, representing 48.18% market share throughout the period. Following this, NNRTIs, PIs, Integrase Inhibitors, and Entry Inhibitors show promising growth, with significant contributions to treatment advancements.

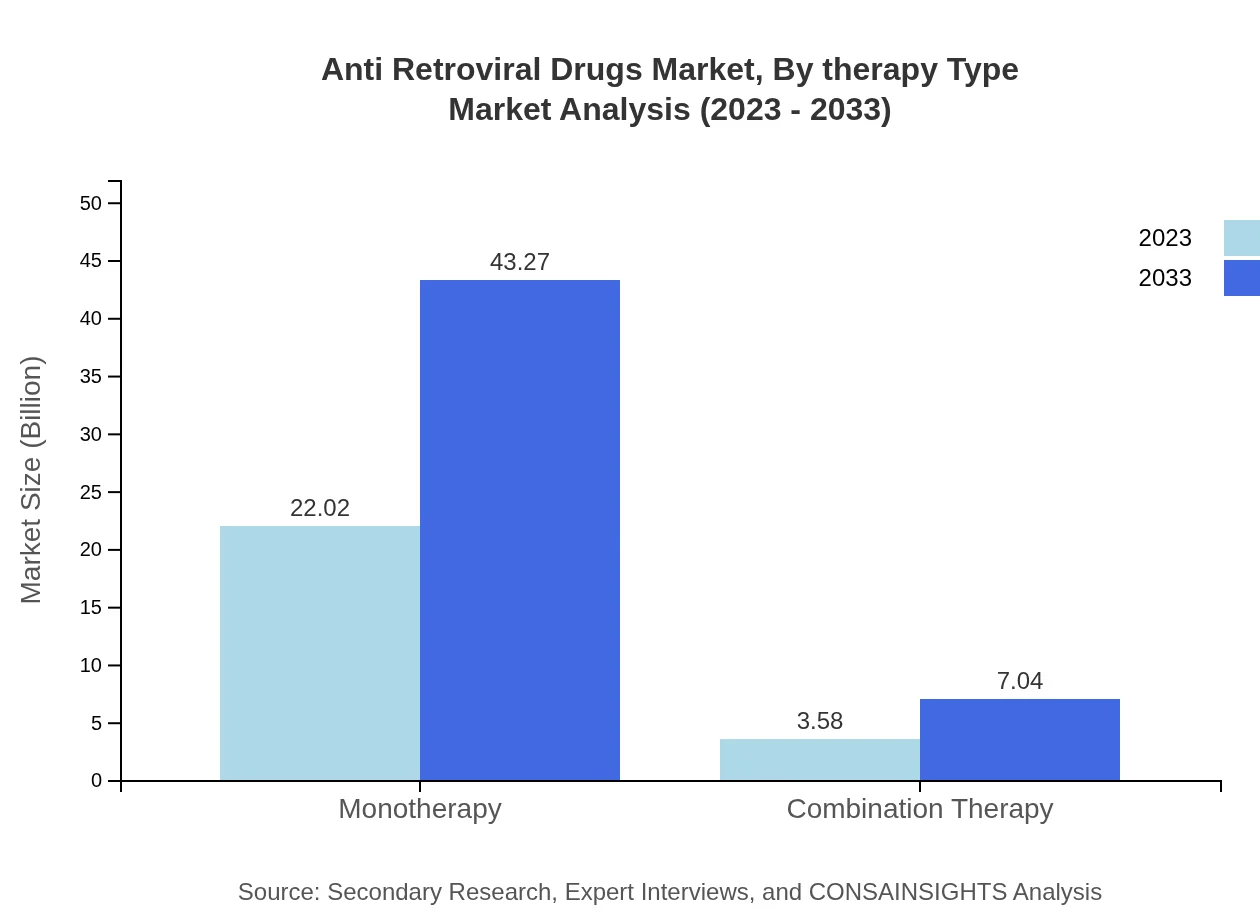

Anti Retroviral Drugs Market Analysis By Therapy Type

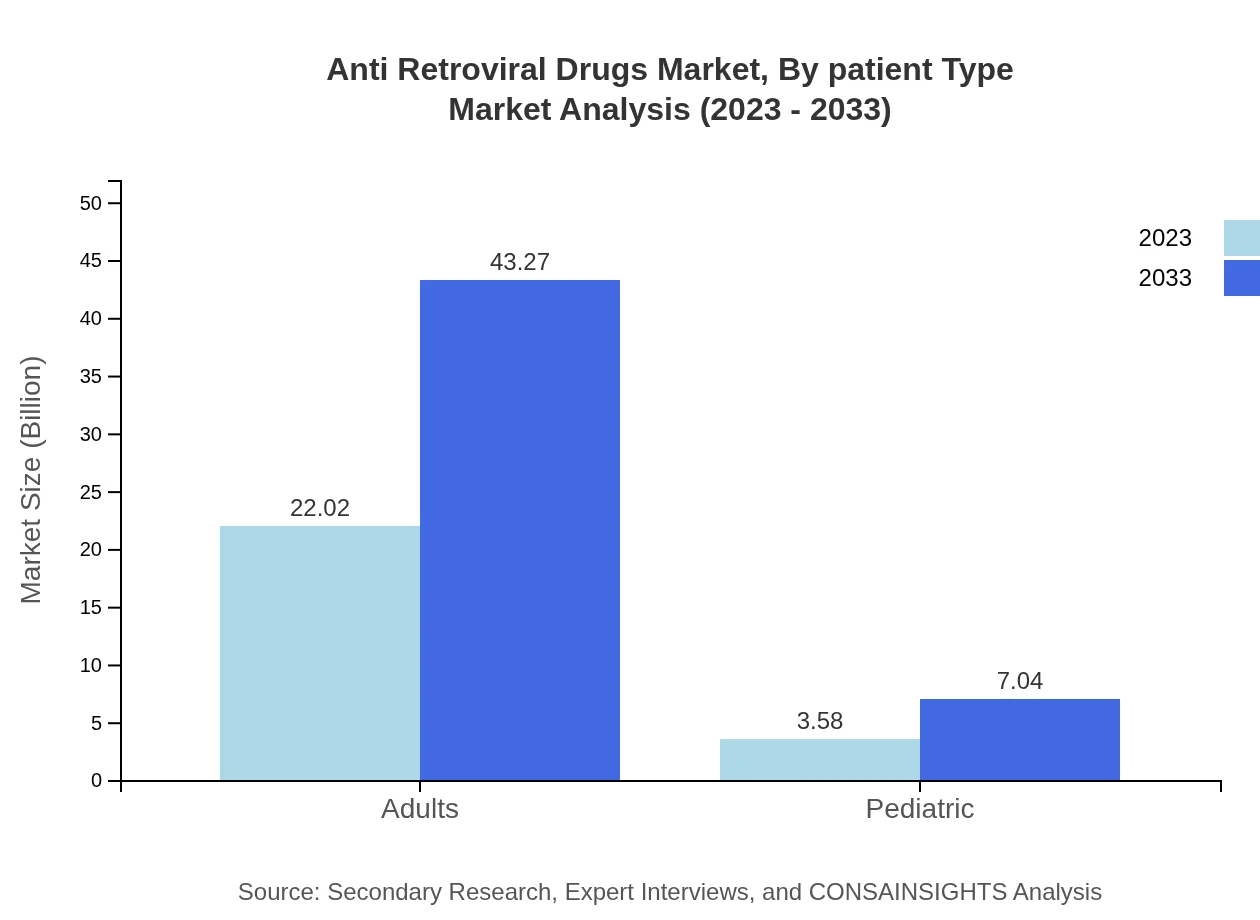

Monotherapy accounts for $22.02 billion of the market in 2023, expected to rise to $43.27 billion by 2033, holding an 86% market share. In contrast, combination therapy, currently valued at $3.58 billion, will increase to $7.04 billion, securing 14% share of the market.

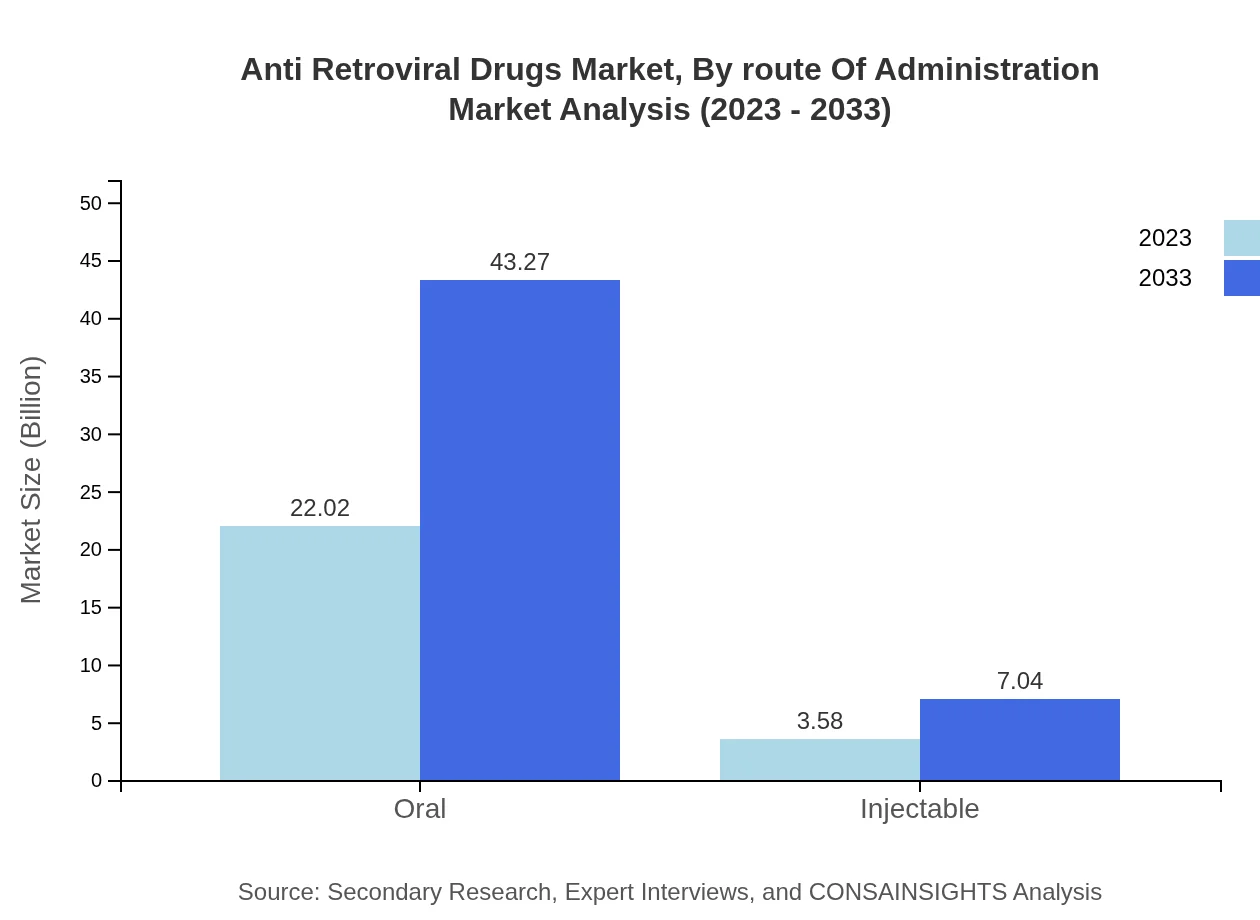

Anti Retroviral Drugs Market Analysis By Route Of Administration

Oral administration dominates the market with a size of $22.02 billion, likely to double to $43.27 billion by 2033. Injectable routes follow, with expectations of growth from $3.58 billion to $7.04 billion by the same year, showcasing evolving preferences among patients.

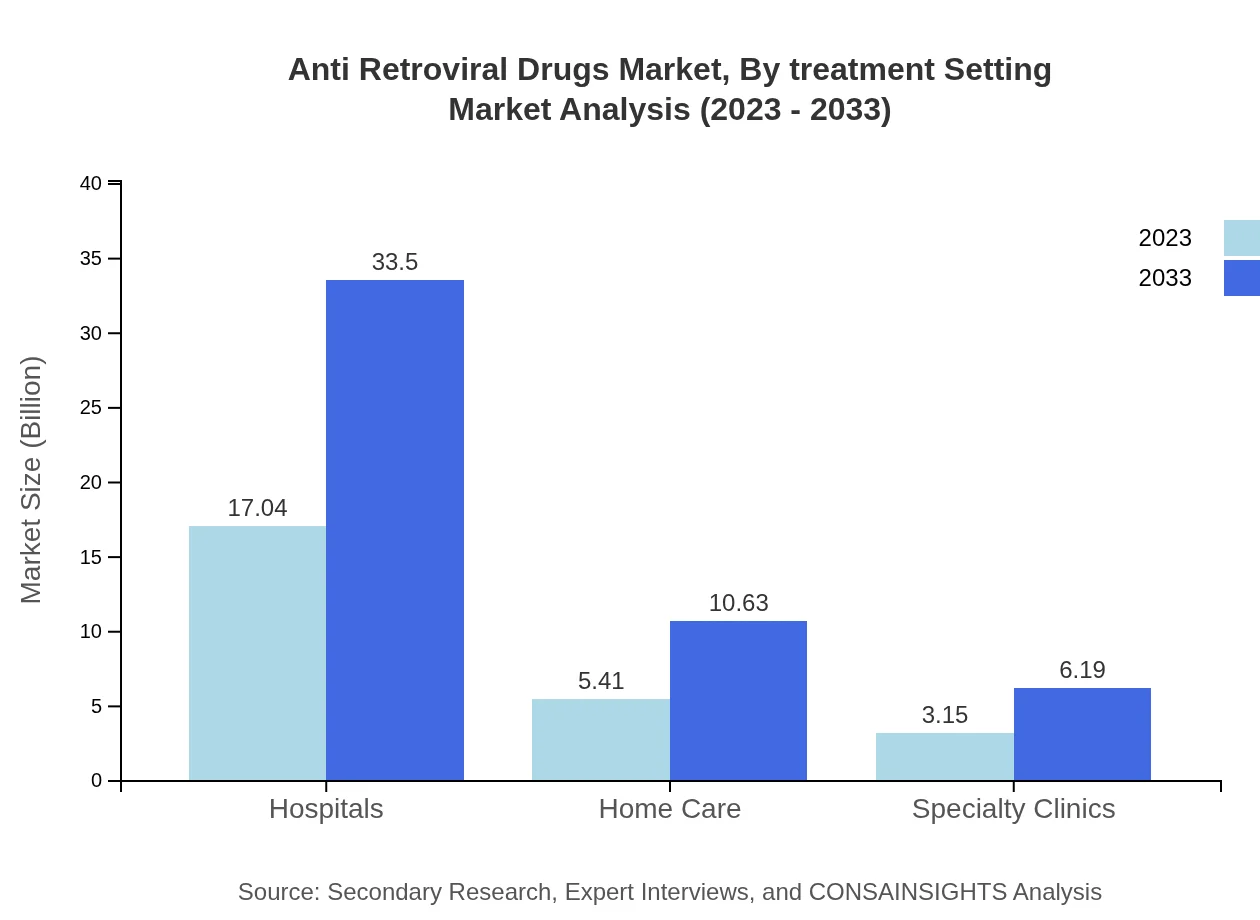

Anti Retroviral Drugs Market Analysis By Treatment Setting

Hospitals are central to the market, valued at $17.04 billion in 2023 and projected to reach $33.50 billion by 2033, constituting 66.58% of the market. Home care and specialty clinics, while smaller, are also crucial in providing increased access to treatments.

Anti Retroviral Drugs Market Analysis By Patient Type

Adults constitute the majority of treatment, leading with $22.02 billion in 2023 with projections of reaching $43.27 billion by 2033, while pediatric treatments are expected to grow from $3.58 billion to $7.04 billion, emphasizing the importance of tailored solutions for all demographic groups.

Anti Retroviral Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Retroviral Drugs Industry

Gilead Sciences:

A leader in HIV treatment, Gilead develops innovative therapies including tenofovir and bictegravir, contributing significantly to the global market with a strong emphasis on research and community support.ViiV Healthcare:

Specialized in HIV treatments, ViiV is known for its collaborative research efforts and the development of new therapeutic options that push advancements in patient care.Bristol-Myers Squibb:

A major player in the development of anti-retroviral therapies, contributing to effective treatment regimens that enhance patient adherence and treatment success.Merck & Co.:

Merck's commitment to HIV research and development has led to breakthroughs in treatment methodologies, securing its position as a leading provider of anti-retroviral drugs.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Retroviral drugs?

The global anti-retroviral drugs market is projected to be valued at approximately $25.6 billion in 2023, with a Compound Annual Growth Rate (CAGR) of 6.8% expected through 2033. This growth is driven by increasing demand for effective HIV treatments.

What are the key market players or companies in the anti Retroviral drugs industry?

Key players in the anti-retroviral drugs market include Gilead Sciences, ViiV Healthcare, AbbVie, Johnson & Johnson, and Merck. These companies are instrumental in developing innovative therapies and expanding their product portfolios to meet growing market needs.

What are the primary factors driving the growth in the anti Retroviral drugs industry?

Growth in the anti-retroviral drugs industry is primarily driven by increasing HIV prevalence, advancements in drug formulations, rising awareness and screening, government initiatives for disease management, and improved healthcare access in developing regions.

Which region is the fastest Growing in the anti Retroviral drugs?

The North American region is the fastest-growing market for anti-retroviral drugs, projected to reach $16.81 billion by 2033, up from $8.55 billion in 2023. Strong healthcare infrastructure and high treatment rates contribute to this growth.

Does ConsaInsights provide customized market report data for the anti Retroviral drugs industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the anti-retroviral drugs industry. Clients can request in-depth analytics, focusing on market dynamics, trends, and competitor strategies.

What deliverables can I expect from this anti Retroviral drugs market research project?

From this market research project, you can expect comprehensive deliverables including detailed market analysis, forecasts, segmentation insights, competitive landscape assessments, and strategic recommendations tailored to your specific interests.

What are the market trends of anti Retroviral drugs?

Key market trends in the anti-retroviral drugs sector include the shift towards combination therapies, the growing focus on long-acting formulations, increasing adoption of personalized medicine, and the expansion of access to treatments in low- and middle-income countries.