Anti Submarine Warfare Market Report

Published Date: 03 February 2026 | Report Code: anti-submarine-warfare

Anti Submarine Warfare Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Anti Submarine Warfare (ASW) market, outlining current trends, market size, and forecasts from 2023 to 2033. Insights into regional performances and competitive landscapes are also provided to aid stakeholders in strategic decision-making.

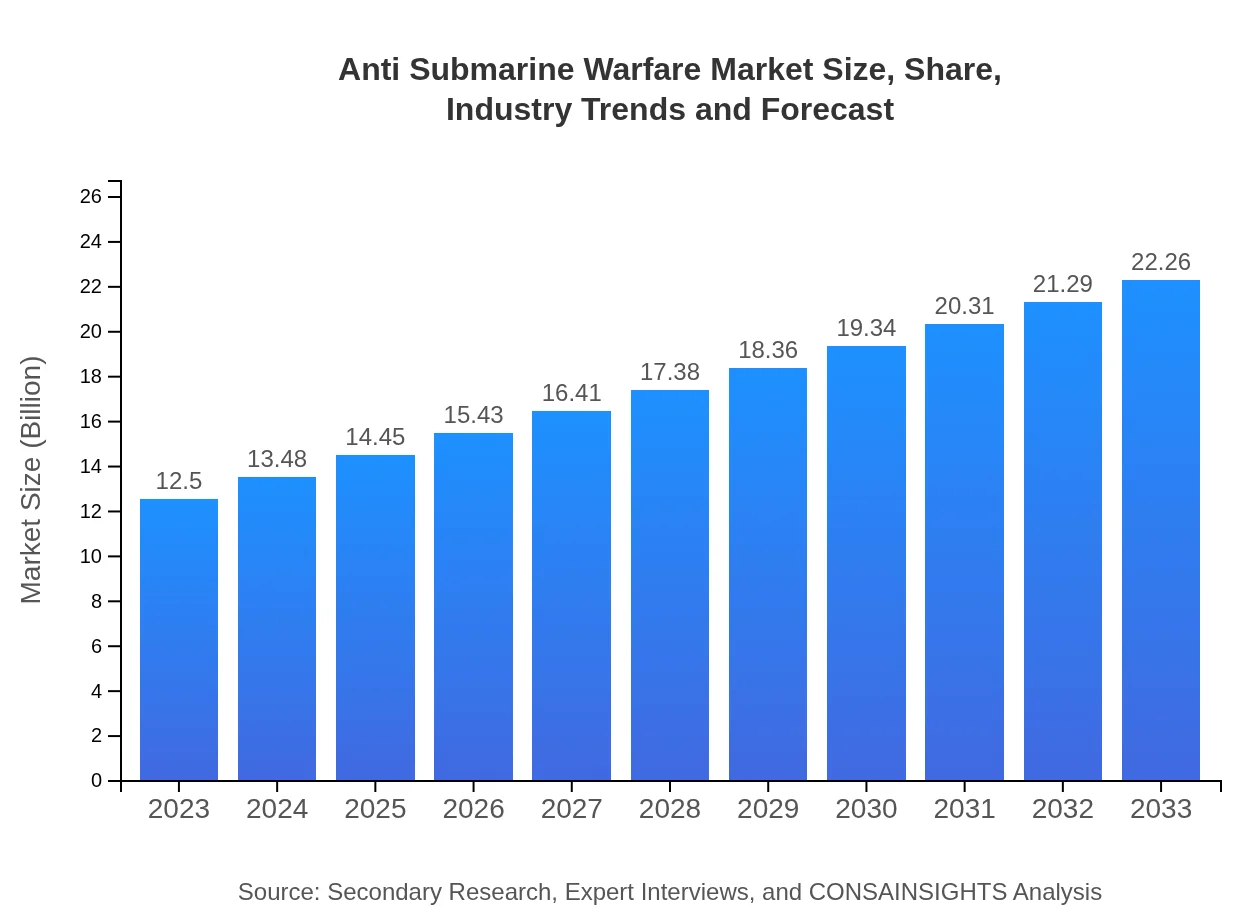

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.26 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems |

| Last Modified Date | 03 February 2026 |

Anti Submarine Warfare Market Overview

Customize Anti Submarine Warfare Market Report market research report

- ✔ Get in-depth analysis of Anti Submarine Warfare market size, growth, and forecasts.

- ✔ Understand Anti Submarine Warfare's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Submarine Warfare

What is the Market Size & CAGR of Anti Submarine Warfare market in 2023?

Anti Submarine Warfare Industry Analysis

Anti Submarine Warfare Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Submarine Warfare Market Analysis Report by Region

Europe Anti Submarine Warfare Market Report:

The European market is set to increase from $4.11 billion in 2023 to $7.33 billion by 2033. Countries are investing in modernization programs and cooperative defense initiatives, reflecting concerns about emerging threats such as piracy and state-sponsored incursions.Asia Pacific Anti Submarine Warfare Market Report:

The Asia Pacific region is projected to experience significant growth, with the market size anticipated to grow from $2.11 billion in 2023 to $3.76 billion by 2033. This growth is driven by increased naval expenditures from countries like China and India, focusing on enhancing their ASW capabilities amidst rising maritime tensions in the South China Sea and Indian Ocean.North America Anti Submarine Warfare Market Report:

North America, led by the United States, accounts for the largest share of the market, projected to rise from $4.59 billion in 2023 to $8.18 billion by 2033. Defense spending focused on advanced technologies, along with regional collaborations within NATO, emphasizes the critical role of ASW in national and collective security.South America Anti Submarine Warfare Market Report:

The South American ASW market, while smaller, is expected to grow steadily from $1.25 billion in 2023 to $2.22 billion by 2033. Nations like Brazil are increasingly recognizing the importance of ASW technologies for protecting their extensive coastlines and maritime resources, leading to moderate investments in naval defense.Middle East & Africa Anti Submarine Warfare Market Report:

In the Middle East and Africa, the market is projected to grow from $0.43 billion in 2023 to $0.77 billion by 2033. Although growth is modest, increasing military cooperation and security needs relating to critical waterways are likely to contribute to market development.Tell us your focus area and get a customized research report.

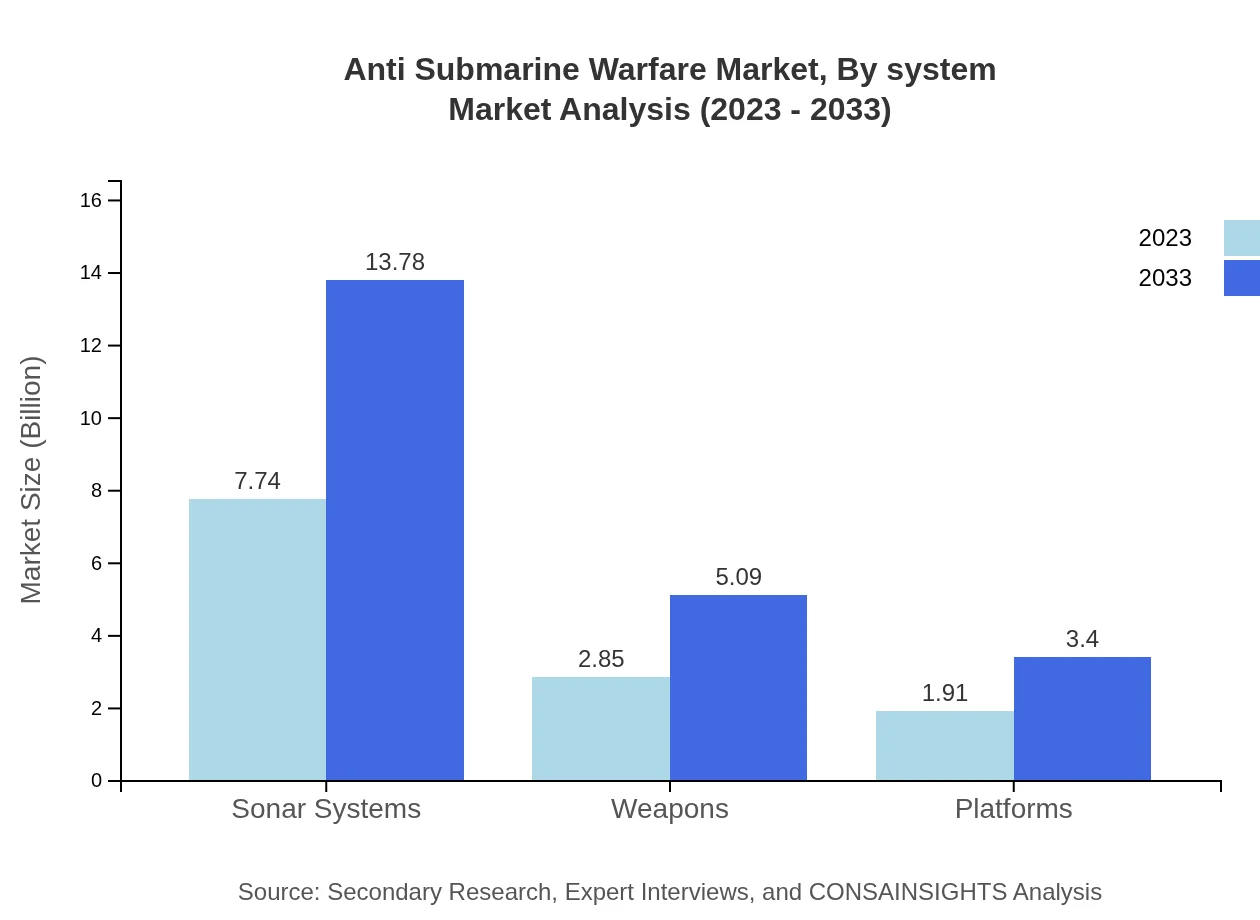

Anti Submarine Warfare Market Analysis By System

In the ASW market, sonar systems represent the largest segment, projected to increase from $7.74 billion in 2023 to $13.78 billion by 2033. The segment held a market share of 61.89% in 2023, which is expected to remain stable through the forecast period. Weapons are the second-largest segment, anticipated to grow from $2.85 billion to $5.09 billion, maintaining a 22.84% market share. Other systems, including platforms and military applications, also contribute significantly to the overall market landscape.

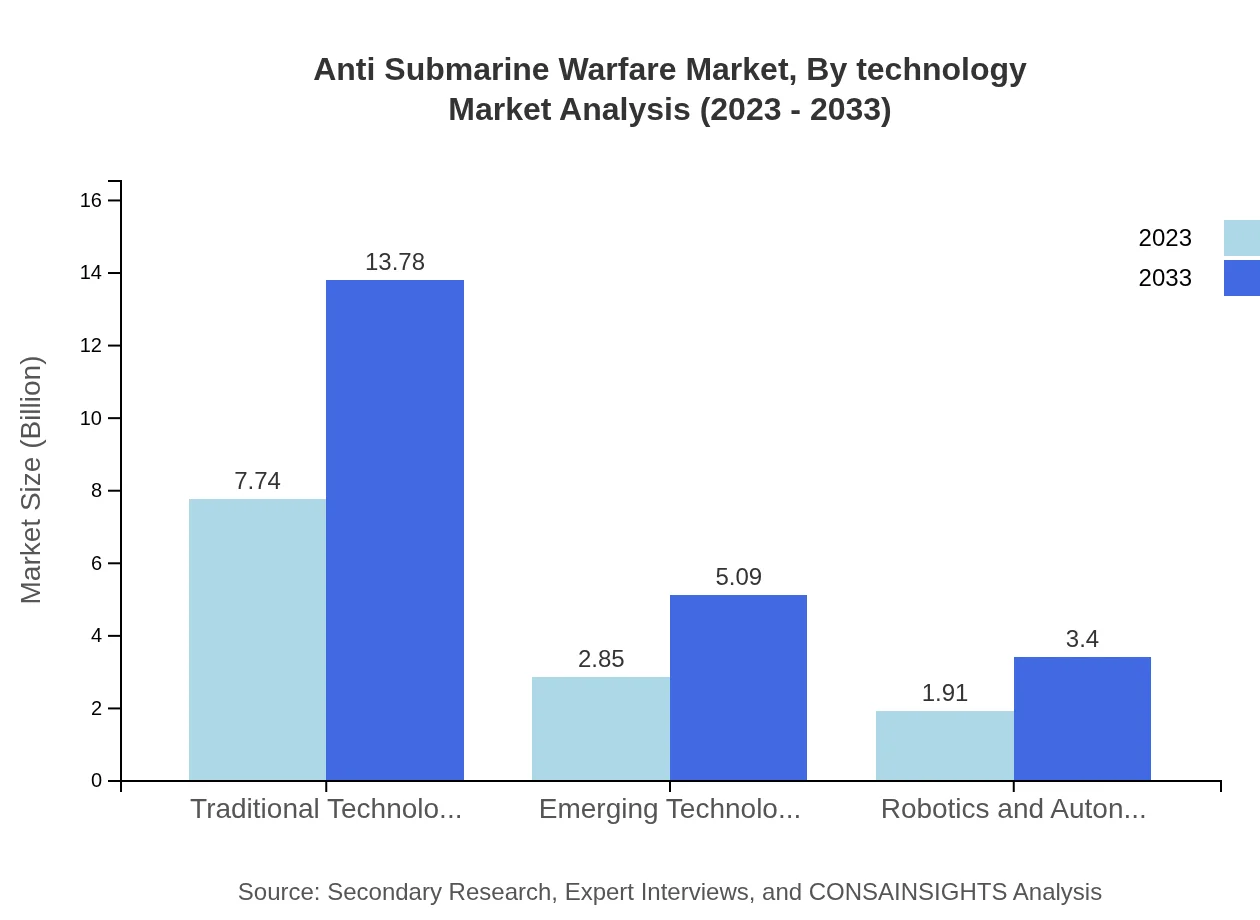

Anti Submarine Warfare Market Analysis By Technology

Traditional technologies will continue to dominate the ASW landscape, with a market size forecast to grow from $7.74 billion in 2023 to $13.78 billion by 2033, holding a steady 61.89% share. Emerging technologies, including Artificial Intelligence-driven systems, are expected to witness rapid growth from $2.85 billion to $5.09 billion, marking a 22.84% share, driven by innovations in detection and operational efficiency.

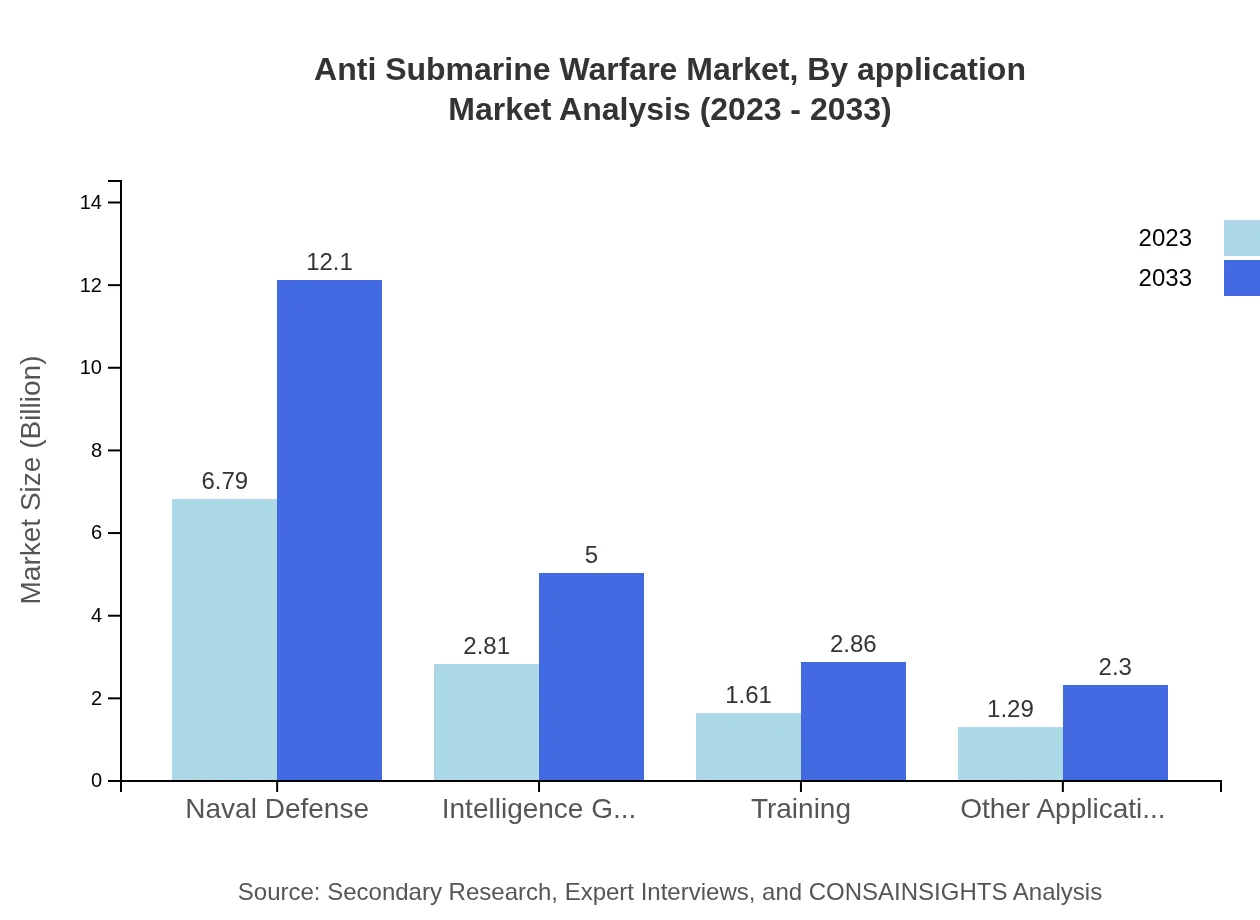

Anti Submarine Warfare Market Analysis By Application

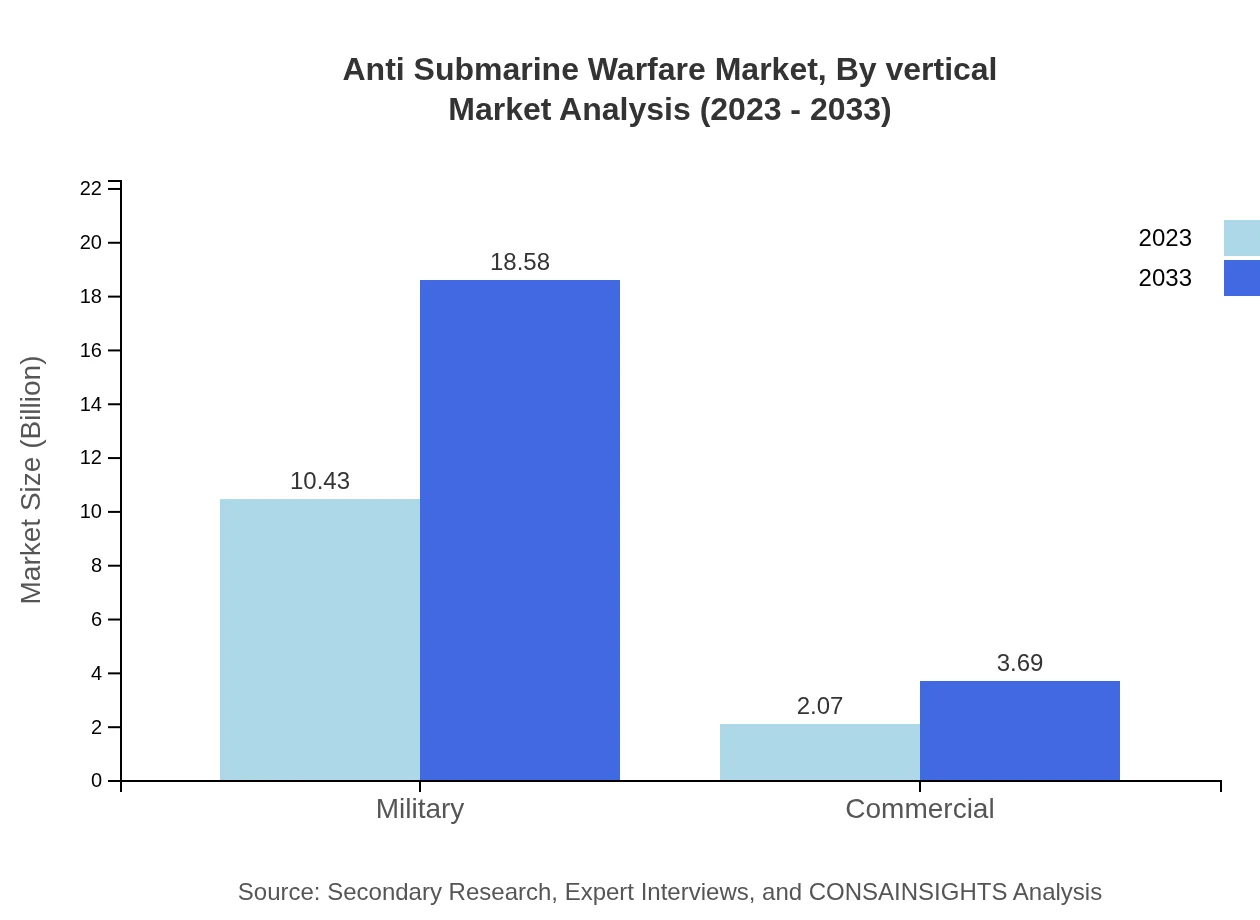

The military application segment dominates the ASW market, expected to increase from $10.43 billion in 2023 to $18.58 billion by 2033, representing an 83.43% market share. Other applications, including intelligence gathering and environmental monitoring, are growing segments, with increased investments seen in training and simulation technologies as naval forces adapt to modern threats.

Anti Submarine Warfare Market Analysis By Vertical

The ASW vertical markets include naval defense, commercial shipping, and research institutions, with naval defense accounting for a majority share. Projections indicate growth in naval defense expenditure from $6.79 billion in 2023 to $12.10 billion by 2033, with a share of 54.36%. Commercial sectors are recognized for their increasing need for advanced surveillance systems, projected to rise from $2.07 billion to $3.69 billion, while applications in intelligence gathering expand significantly.

Anti Submarine Warfare Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Submarine Warfare Industry

Lockheed Martin:

Lockheed Martin is a leading global aerospace and defense company, known for its advanced systems and technologies that enhance anti-submarine warfare capabilities, including the development of sonar systems and naval platforms.Raytheon Technologies:

Raytheon Technologies focuses on providing advanced weapons systems and technologies, significantly contributing to anti-submarine warfare through innovative solutions and an expanded portfolio of maritime defense systems.Northrop Grumman:

Northrop Grumman offers comprehensive ASW solutions, including unmanned systems and advanced sensors, to improve situational awareness and operational effectiveness in anti-submarine tactics.BAE Systems:

BAE Systems delivers cutting-edge naval platforms and technologies, playing a pivotal role in modernizing anti-submarine capabilities and fostering joint maritime operations across allied nations.We're grateful to work with incredible clients.

FAQs

What is the market size of anti Submarine Warfare?

The anti-submarine warfare market is valued at approximately $12.5 billion in 2023, with a projected CAGR of 5.8%. This growth reflects increasing investments in advanced submarine detection technologies and naval defense systems over the next decade.

What are the key market players or companies in the anti Submarine Warfare industry?

Key players in the anti-submarine warfare market include Lockheed Martin, Raytheon Technologies, Northrop Grumman, and Thales Group, which lead with innovative sonar systems and advanced naval equipment to enhance maritime security.

What are the primary factors driving the growth in the anti Submarine Warfare industry?

Key growth factors in the anti-submarine warfare market include rising submarine threats, heightened naval defense budgets, technological advancements in detection systems, and increasing geopolitical tensions in strategic maritime regions.

Which region is the fastest Growing in the anti Submarine Warfare market?

The North American region is experiencing rapid growth, projected to increase from $4.59 billion in 2023 to $8.18 billion by 2033, driven by significant investments in naval defense technologies and modernization programs.

Does ConsaInsights provide customized market report data for the anti Submarine Warfare industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the anti-submarine warfare sector, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this anti Submarine Warfare market research project?

Expect comprehensive deliverables including market analysis reports, trend forecasts, competitive landscape assessments, segmented market insights, and strategic recommendations specific to the anti-submarine warfare industry.

What are the market trends of anti Submarine Warfare?

Market trends in anti-submarine warfare include the rise of autonomous naval systems, advancements in sonar technology, and increased collaboration among nations for maritime security, influencing both military and commercial sectors.