Anticoagulants Market Report

Published Date: 31 January 2026 | Report Code: anticoagulants

Anticoagulants Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Anticoagulants market, highlighting key market trends, size projections from 2023 to 2033, and valuable insights into regional dynamics and segment performance.

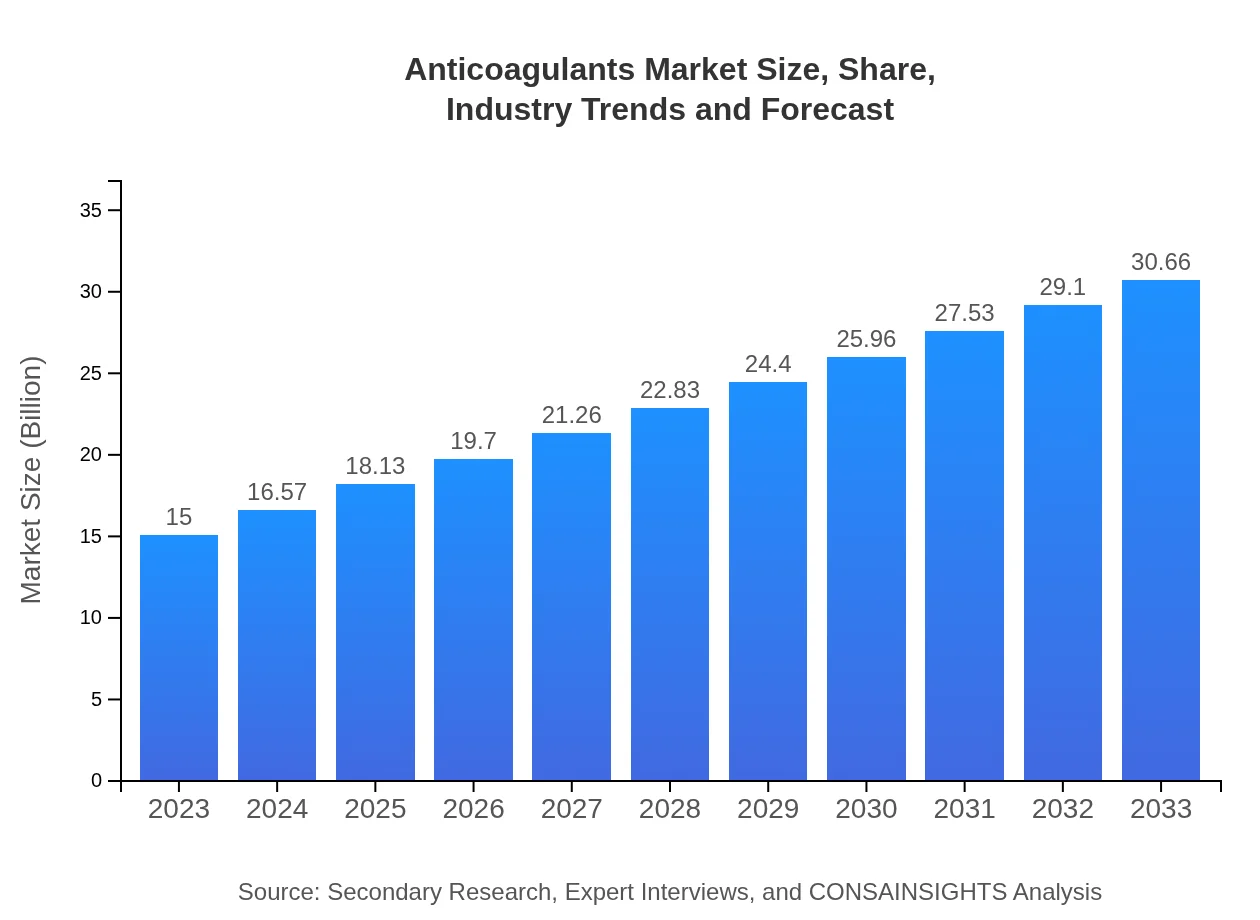

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Bayer AG, Bristol-Myers Squibb, Sanofi, Roche |

| Last Modified Date | 31 January 2026 |

Anticoagulants Market Overview

Customize Anticoagulants Market Report market research report

- ✔ Get in-depth analysis of Anticoagulants market size, growth, and forecasts.

- ✔ Understand Anticoagulants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anticoagulants

What is the Market Size & CAGR of Anticoagulants market in 2023?

Anticoagulants Industry Analysis

Anticoagulants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anticoagulants Market Analysis Report by Region

Europe Anticoagulants Market Report:

In Europe, the Anticoagulants market is anticipated to grow substantially, from $5.09 billion in 2023 to $10.40 billion by 2033. The aging population, as well as guidelines promoting anticoagulation therapies, augment the market’s expansion.Asia Pacific Anticoagulants Market Report:

In the Asia-Pacific region, the Anticoagulants market was valued at $2.51 billion in 2023, expected to rise to $5.14 billion by 2033, driven by increasing healthcare awareness and improving healthcare infrastructure. Growing incidences of cardiovascular diseases will foster demand.North America Anticoagulants Market Report:

North America is currently the largest market for Anticoagulants, valued at $5.21 billion in 2023, and expected to reach $10.64 billion by 2033. Factors influencing this growth include high prevalence of cardiovascular diseases, advanced healthcare frameworks, and significant investment in healthcare innovation.South America Anticoagulants Market Report:

The South American Anticoagulants market is projected to grow from $0.67 billion in 2023 to $1.37 billion by 2033. Enhanced healthcare policies and rising incidences of blood disorders pose significant opportunities for market growth in the region.Middle East & Africa Anticoagulants Market Report:

The Middle East and Africa region shows promising growth prospects, with the market projected to increase from $1.52 billion in 2023 to $3.11 billion by 2033. The expanding healthcare sector, alongside rising chronic disease prevalence, will drive this market.Tell us your focus area and get a customized research report.

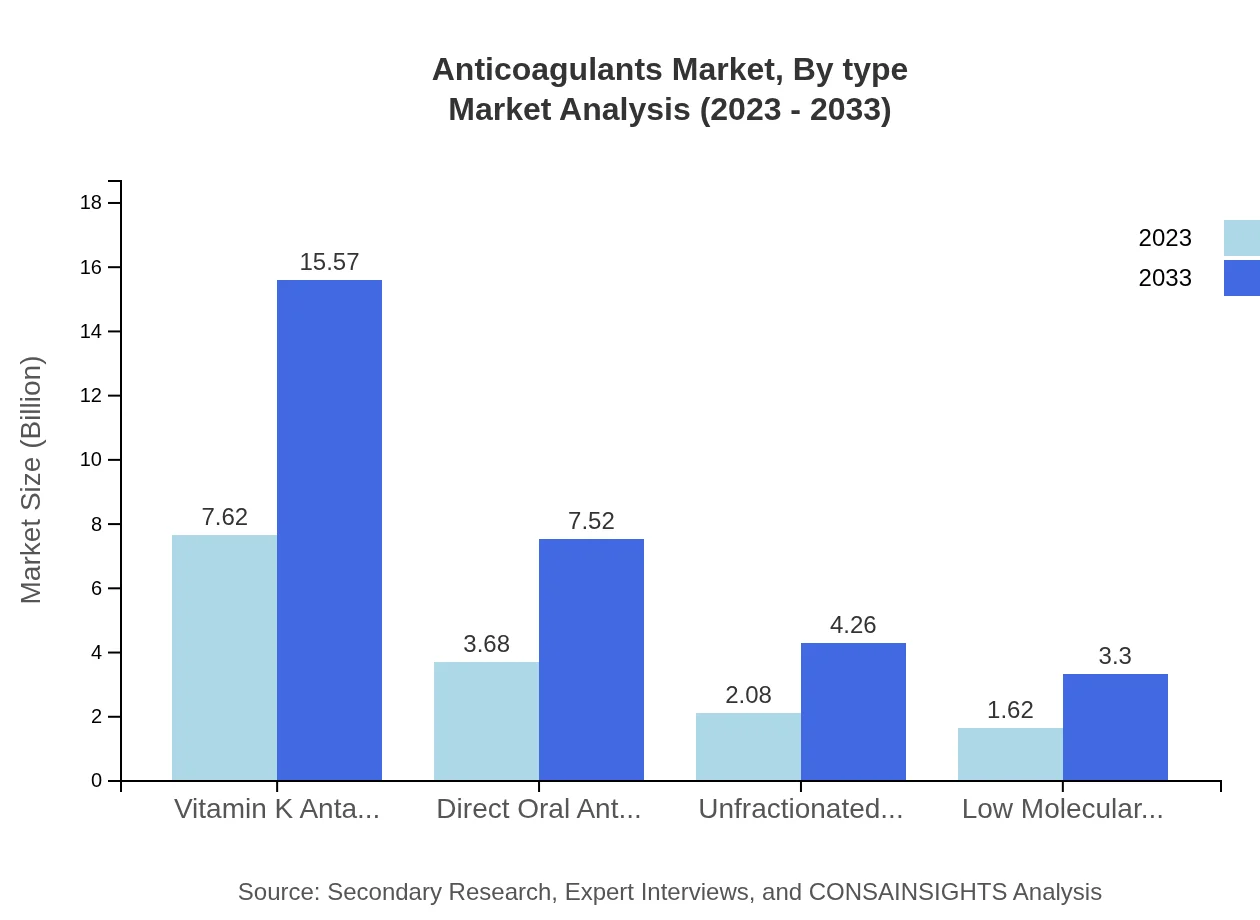

Anticoagulants Market Analysis By Type

The Anticoagulants market, segmented by type, shows that Vitamin K Antagonists dominate in size with $7.62 billion in 2023, forecasting $15.57 billion by 2033. Direct Oral Anticoagulants (DOACs) are gaining traction, with a market size of $3.68 billion in 2023 growing to $7.52 billion by 2033. Unfractionated Heparin and Low Molecular Weight Heparin claimed $2.08 billion and $1.62 billion, respectively, in 2023, exhibiting potential growth to $4.26 billion and $3.30 billion by 2033.

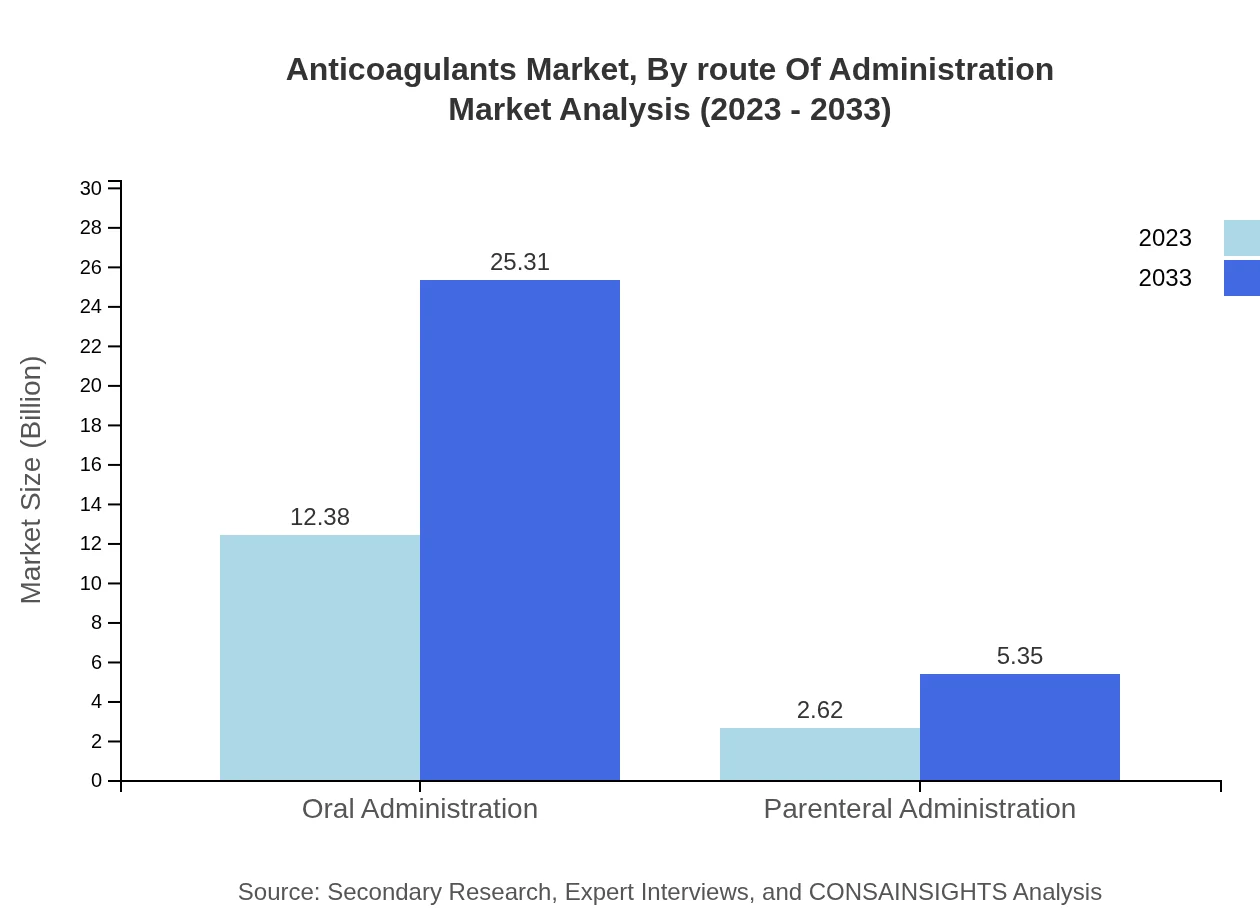

Anticoagulants Market Analysis By Route Of Administration

The oral administration route holds the largest market share, valued at $12.38 billion in 2023 with projections of $25.31 billion by 2033. Parenteral administration is also significant, expected to climb from $2.62 billion in 2023 to $5.35 billion by 2033. This expansion reflects increasing patient preference for oral medications and advancements in drug formulations.

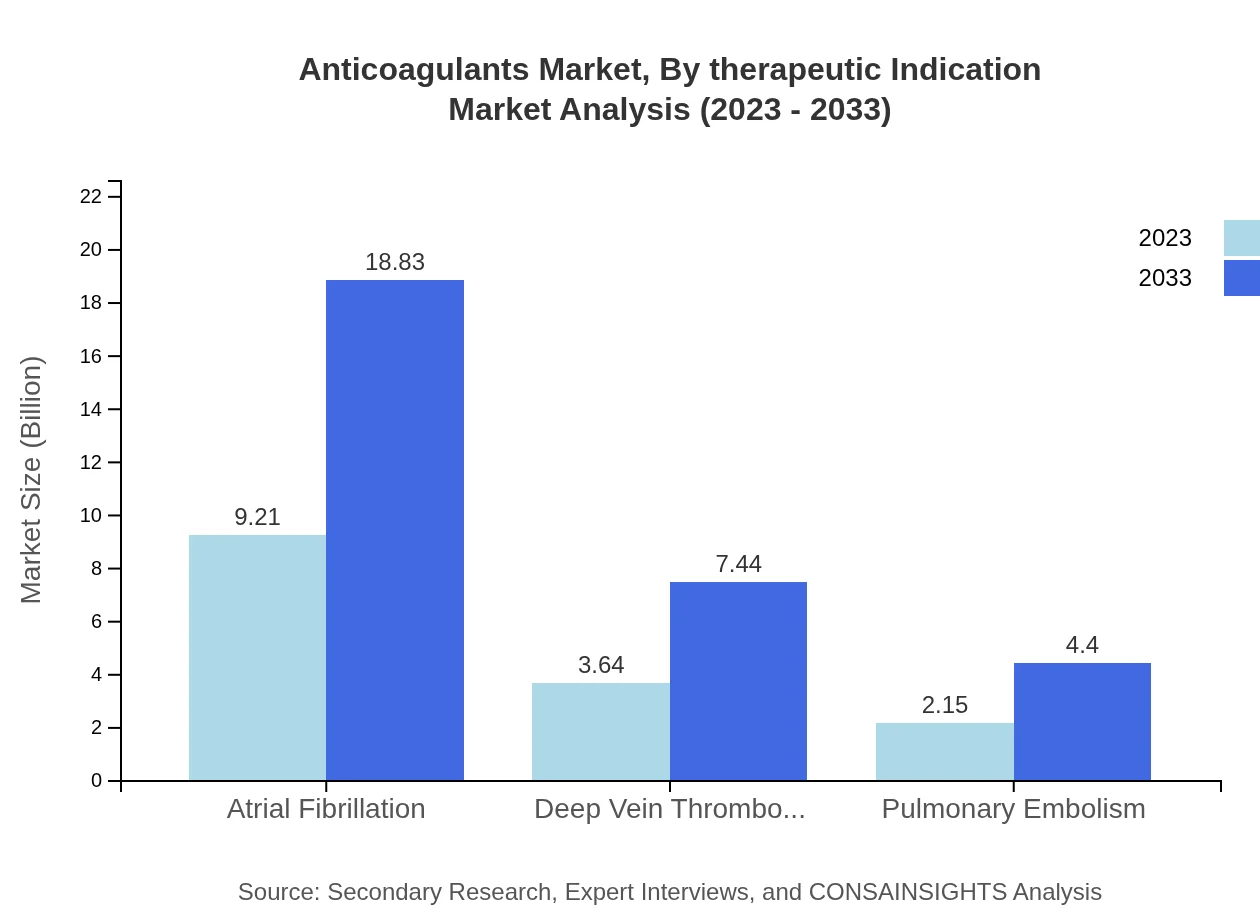

Anticoagulants Market Analysis By Therapeutic Indication

Atrial fibrillation is the leading therapeutic indication for Anticoagulants, anticipated to grow from $9.21 billion in 2023 to $18.83 billion by 2033. Other significant indications include Deep Vein Thrombosis (DVT) and Pulmonary Embolism, which are expected to grow to $7.44 billion and $4.40 billion respectively, underscoring the drug's essential role in managing these critical conditions.

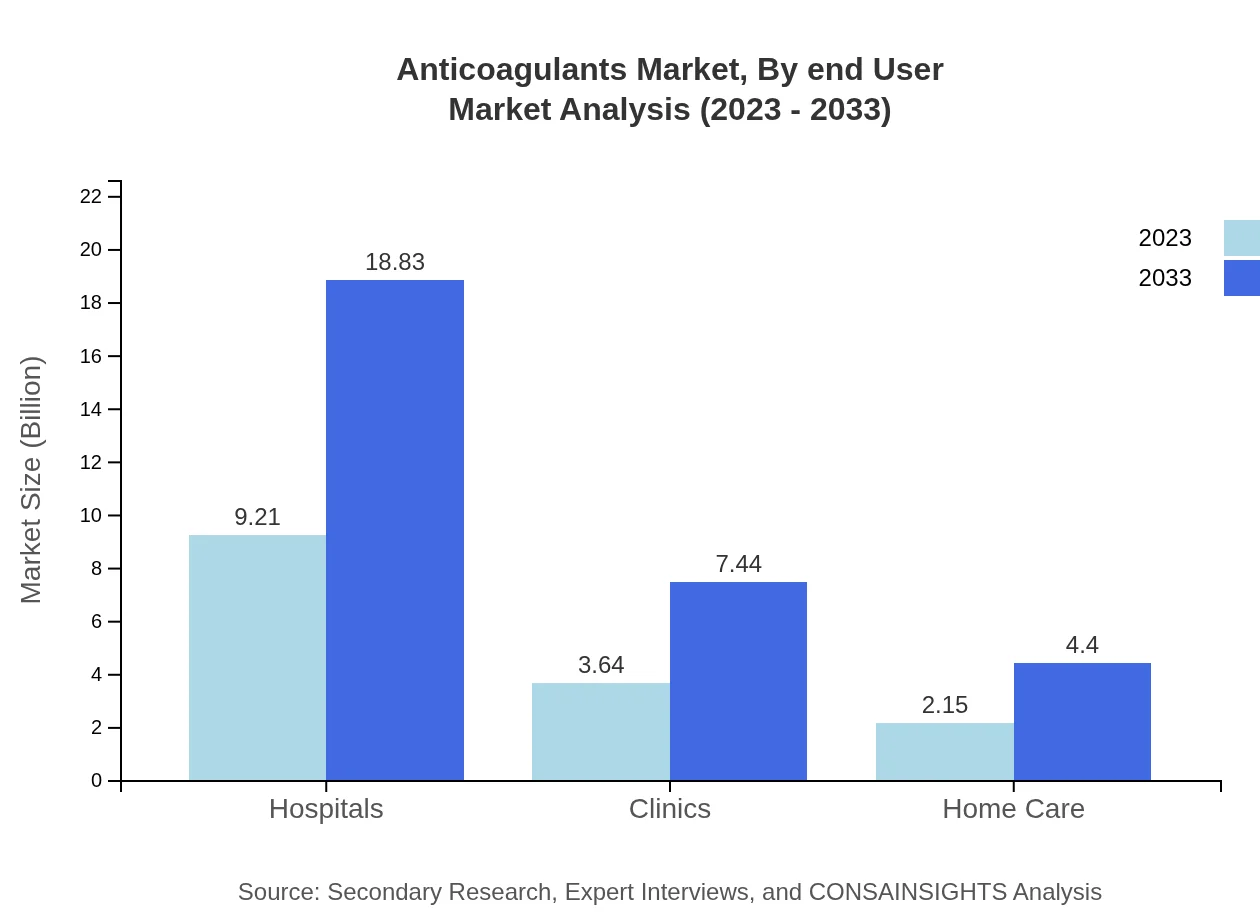

Anticoagulants Market Analysis By End User

The hospital sector represents the largest end-user segment, forecasted to reach $18.83 billion by 2033 from $9.21 billion in 2023. Clinics and home care settings also show notable demand, driven by increased accessibility to anticoagulant therapies.

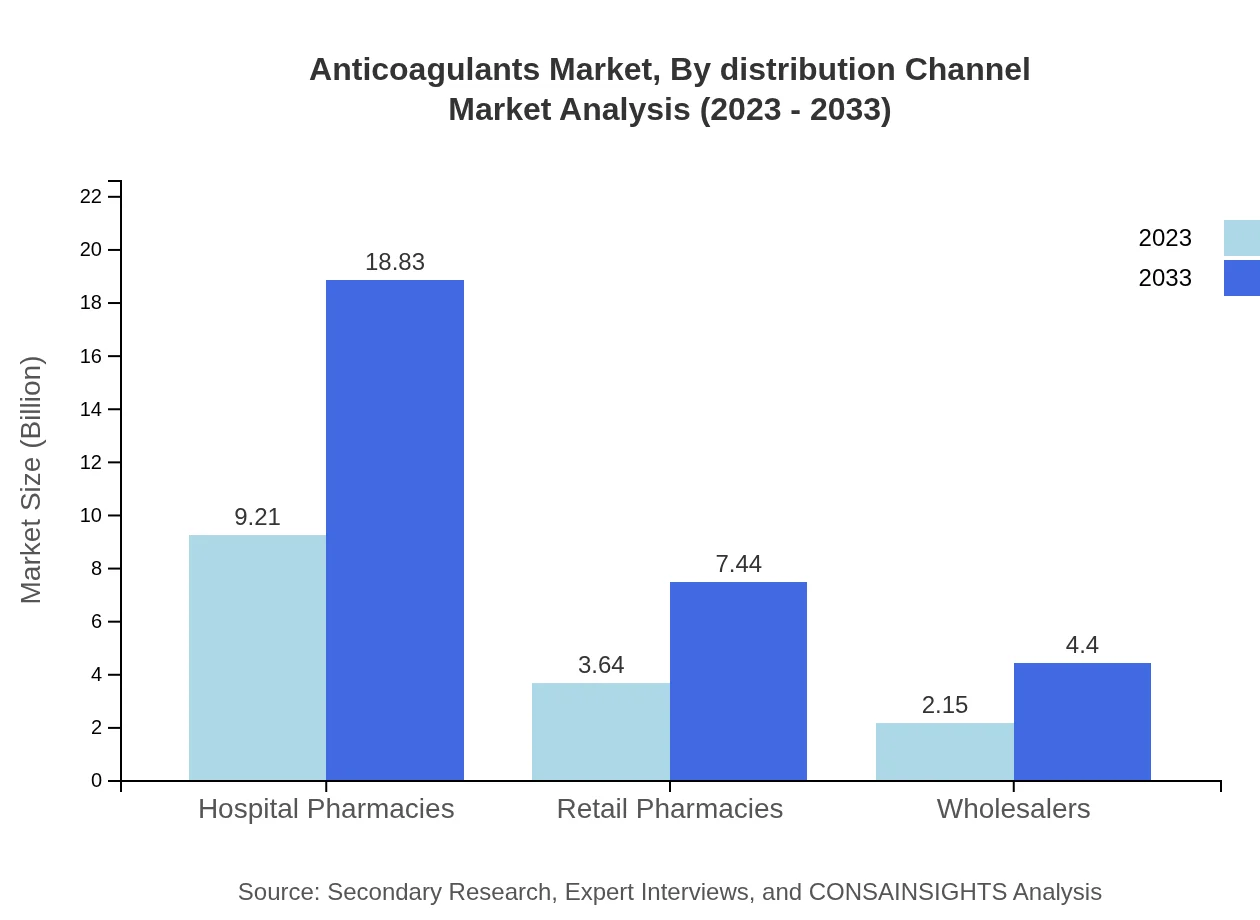

Anticoagulants Market Analysis By Distribution Channel

Hospital Pharmacies are the primary distribution channel, expected to maintain a market share of $18.83 billion by 2033. Retail pharmacies account for a significant segment as well, projected to grow substantially due to rising consumer preference and availability of anticoagulant therapies over retail networks.

Anticoagulants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anticoagulants Industry

Bayer AG:

A leading global pharmaceutical company, Bayer AG is at the forefront of anticoagulant innovation, with products like Xarelto revolutionizing treatment options for patients with thromboembolic disorders.Bristol-Myers Squibb:

Bristol-Myers Squibb is recognized for its research and development of anticoagulants including Eliquis, known for its effectiveness in treating atrial fibrillation and DVT, contributing significantly to market revenue.Sanofi:

Sanofi plays a vital role in the anticoagulants market with its product Lovenox, a low molecular weight heparin widely utilized for the prevention and treatment of thrombotic conditions.Roche:

As a global healthcare leader, Roche is involved in developing innovative anticoagulant treatments that address critical patient needs, enhancing overall therapeutic options.We're grateful to work with incredible clients.

FAQs

What is the market size of anticoagulants?

The global anticoagulants market is projected to reach approximately $15 billion by 2033, growing at a CAGR of 7.2%. The market is currently valued at around $7 billion in 2023, showing significant growth opportunities.

What are the key market players or companies in this anticoagulants industry?

Key players in the anticoagulants market include Bayer AG, Bristol-Myers Squibb, Pfizer Inc., and Boehringer Ingelheim. These companies are recognized for their strong product pipelines and innovative drug delivery systems.

What are the primary factors driving the growth in the anticoagulants industry?

The growth in the anticoagulants industry is primarily driven by the rising prevalence of cardiovascular diseases, increased awareness and diagnosis of conditions like atrial fibrillation, and advancements in anticoagulant drug formulations.

Which region is the fastest Growing in the anticoagulants market?

Asia Pacific is expected to be the fastest-growing region in the anticoagulants market, with a projected market size increase from $2.51 billion in 2023 to $5.14 billion by 2033. This growth is driven by rising healthcare expenditure.

Does ConsaInsights provide customized market report data for the anticoagulants industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the anticoagulants industry. This includes detailed insights into market trends, forecasts, and competitive analysis.

What deliverables can I expect from this anticoagulants market research project?

Deliverables from the market research project include comprehensive reports detailing market size, growth forecasts, competitive landscape analysis, segment breakdown, and regional performance insights tailored to the anticoagulants market.

What are the market trends of anticoagulants?

Current market trends in the anticoagulants sector include increased adoption of direct oral anticoagulants (DOACs), a shift towards patient-friendly drug formulations, and a growing emphasis on home care and remote monitoring solutions.