Anticounterfeit Electronics And Automobiles Packaging Market Report

Published Date: 02 February 2026 | Report Code: anticounterfeit-electronics-and-automobiles-packaging

Anticounterfeit Electronics And Automobiles Packaging Market Size, Share, Industry Trends and Forecast to 2033

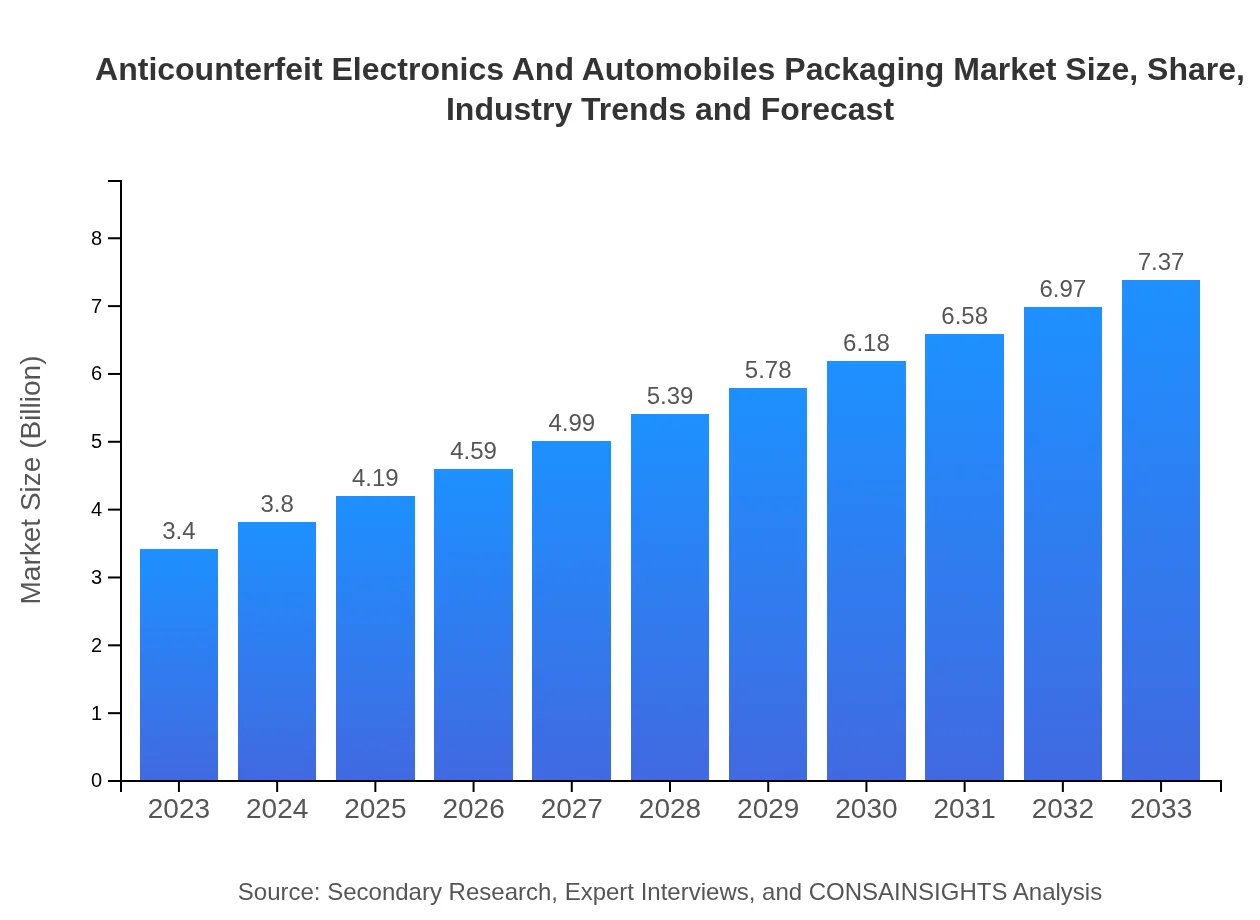

This comprehensive report analyzes the Anticounterfeit Electronics And Automobiles Packaging market, offering insights into market size, trends, and forecasts from 2023 to 2033, along with data on technologies, segments, and regional performance.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.37 Billion |

| Top Companies | Zebra Technologies, SATO Holdings, CCL Industries, Avery Dennison |

| Last Modified Date | 02 February 2026 |

Anticounterfeit Electronics And Automobiles Packaging Market Overview

Customize Anticounterfeit Electronics And Automobiles Packaging Market Report market research report

- ✔ Get in-depth analysis of Anticounterfeit Electronics And Automobiles Packaging market size, growth, and forecasts.

- ✔ Understand Anticounterfeit Electronics And Automobiles Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anticounterfeit Electronics And Automobiles Packaging

What is the Market Size & CAGR of Anticounterfeit Electronics And Automobiles Packaging market in 2023?

Anticounterfeit Electronics And Automobiles Packaging Industry Analysis

Anticounterfeit Electronics And Automobiles Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anticounterfeit Electronics And Automobiles Packaging Market Analysis Report by Region

Europe Anticounterfeit Electronics And Automobiles Packaging Market Report:

Europe's market is set to grow from 0.90 billion USD in 2023 to approximately 1.94 billion USD in 2033. European manufacturers are increasingly investing in innovative packaging solutions to protect their brands and comply with stringent regulations concerning quality and safety.Asia Pacific Anticounterfeit Electronics And Automobiles Packaging Market Report:

In the Asia Pacific region, the market is anticipated to grow from 0.65 billion USD in 2023 to approximately 1.41 billion USD in 2033. This growth can be attributed to the rapid expansion of industrial sectors, coupled with increasing awareness and demand for secure packaging solutions across the electronics and automotive industries.North America Anticounterfeit Electronics And Automobiles Packaging Market Report:

The North American market is expected to expand from 1.11 billion USD in 2023 to 2.41 billion USD in 2033. North America is a leader in adopting advanced packaging technologies, supported by stringent regulatory frameworks and high consumer awareness regarding product authenticity.South America Anticounterfeit Electronics And Automobiles Packaging Market Report:

South America is projected to see growth from 0.30 billion USD in 2023 to about 0.66 billion USD in 2033. The region's growth is driven by increasing investments in technology upgrades and heightened regulatory measures against counterfeits, particularly in pharmaceuticals and electronics.Middle East & Africa Anticounterfeit Electronics And Automobiles Packaging Market Report:

In the Middle East and Africa, the market is projected to rise from 0.44 billion USD in 2023 to 0.95 billion USD in 2033. This growth is attributed to increased consumer demand for high-quality products and growing government initiatives aiming to combat counterfeits.Tell us your focus area and get a customized research report.

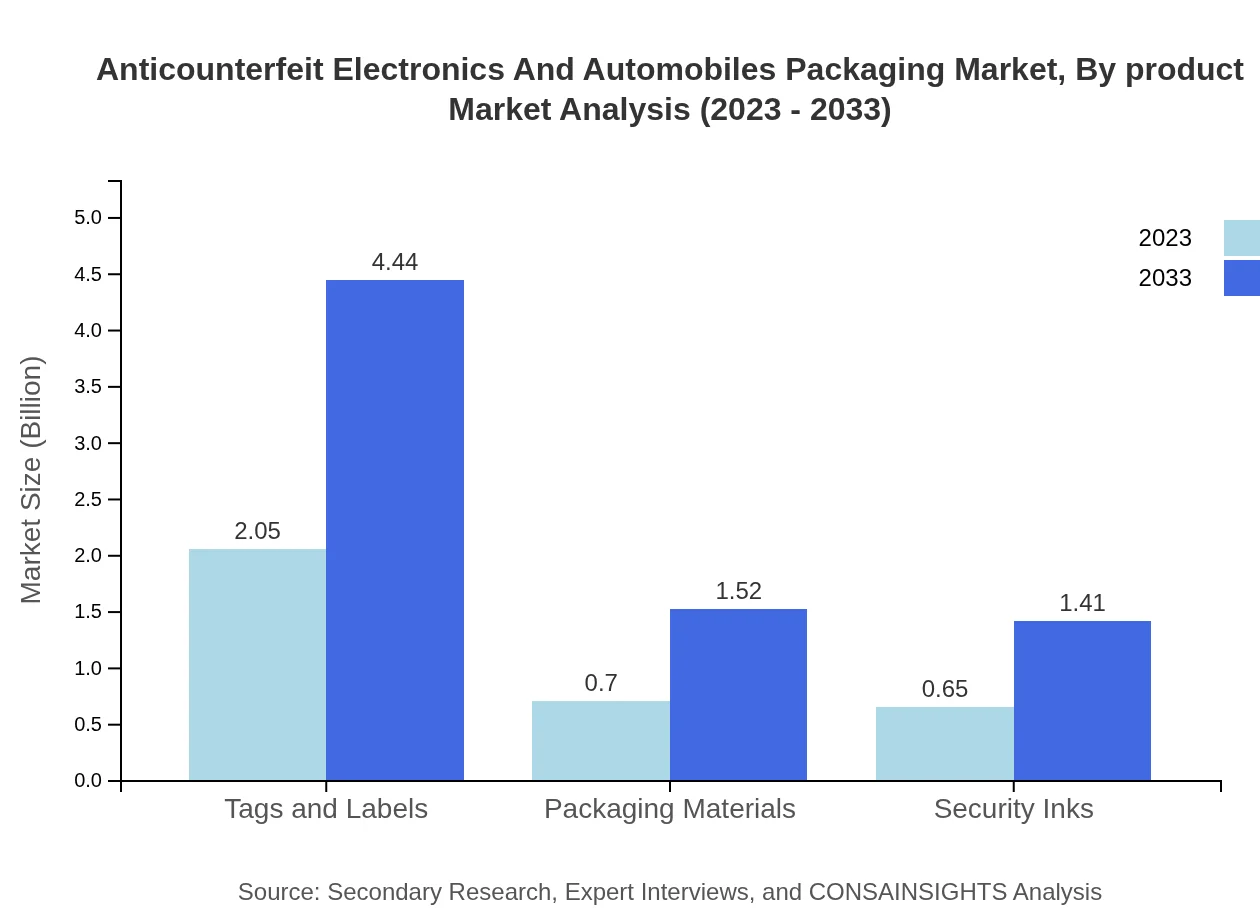

Anticounterfeit Electronics And Automobiles Packaging Market Analysis By Product

By product type, Tags and Labels lead the market, accounting for 60.19% of total revenue in 2023, projected to grow significantly, with a market size expanding from 2.05 billion USD in 2023 to 4.44 billion USD in 2033. Packaging Materials and Security Inks are also vital, reflecting the increasing integration of security features in packaging solutions.

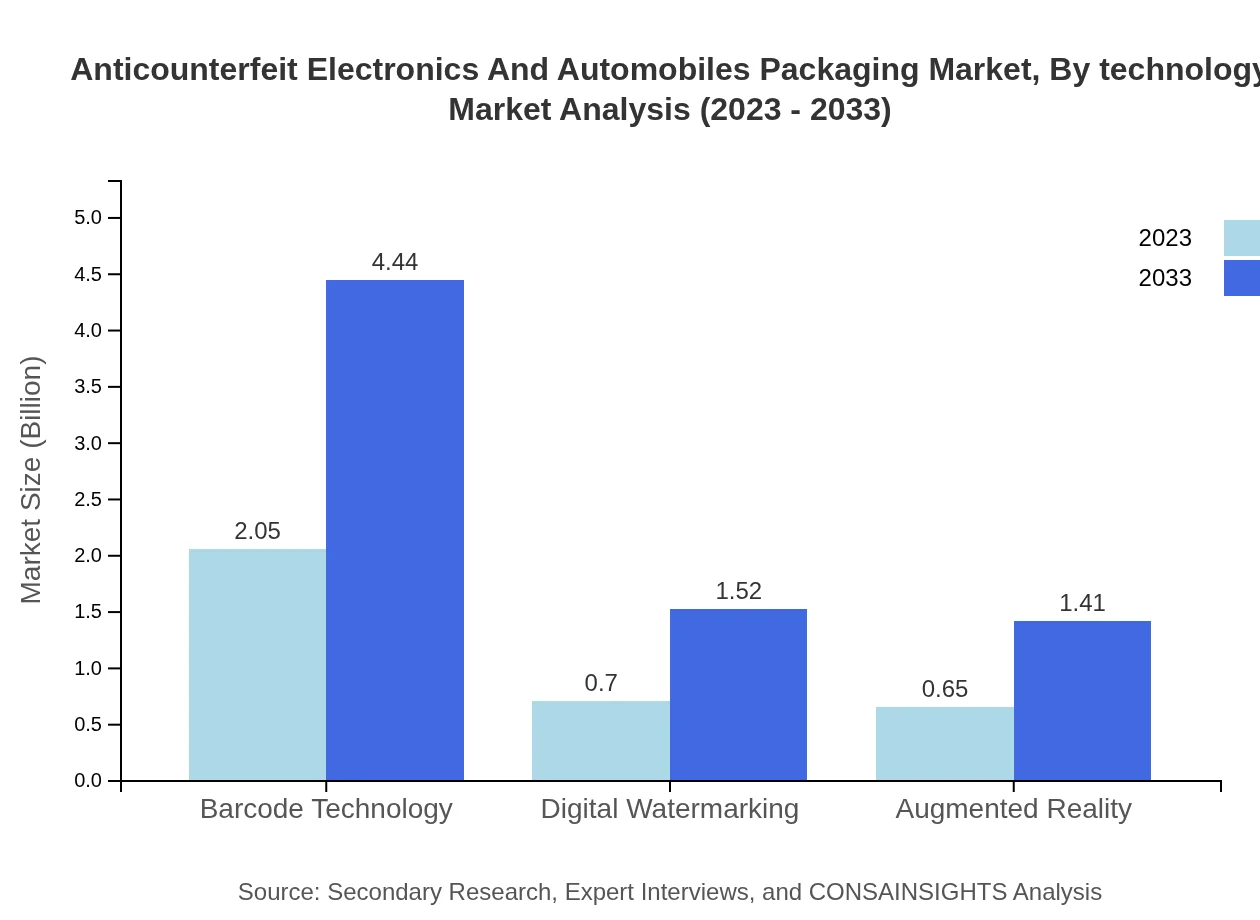

Anticounterfeit Electronics And Automobiles Packaging Market Analysis By Technology

In terms of technology, Barcode Technology takes precedence, holding a significant market share of 60.19% in 2023. Innovations like Digital Watermarking and Augmented Reality are gaining traction, reflecting the industry's shift towards more sophisticated and consumer-friendly verification methods.

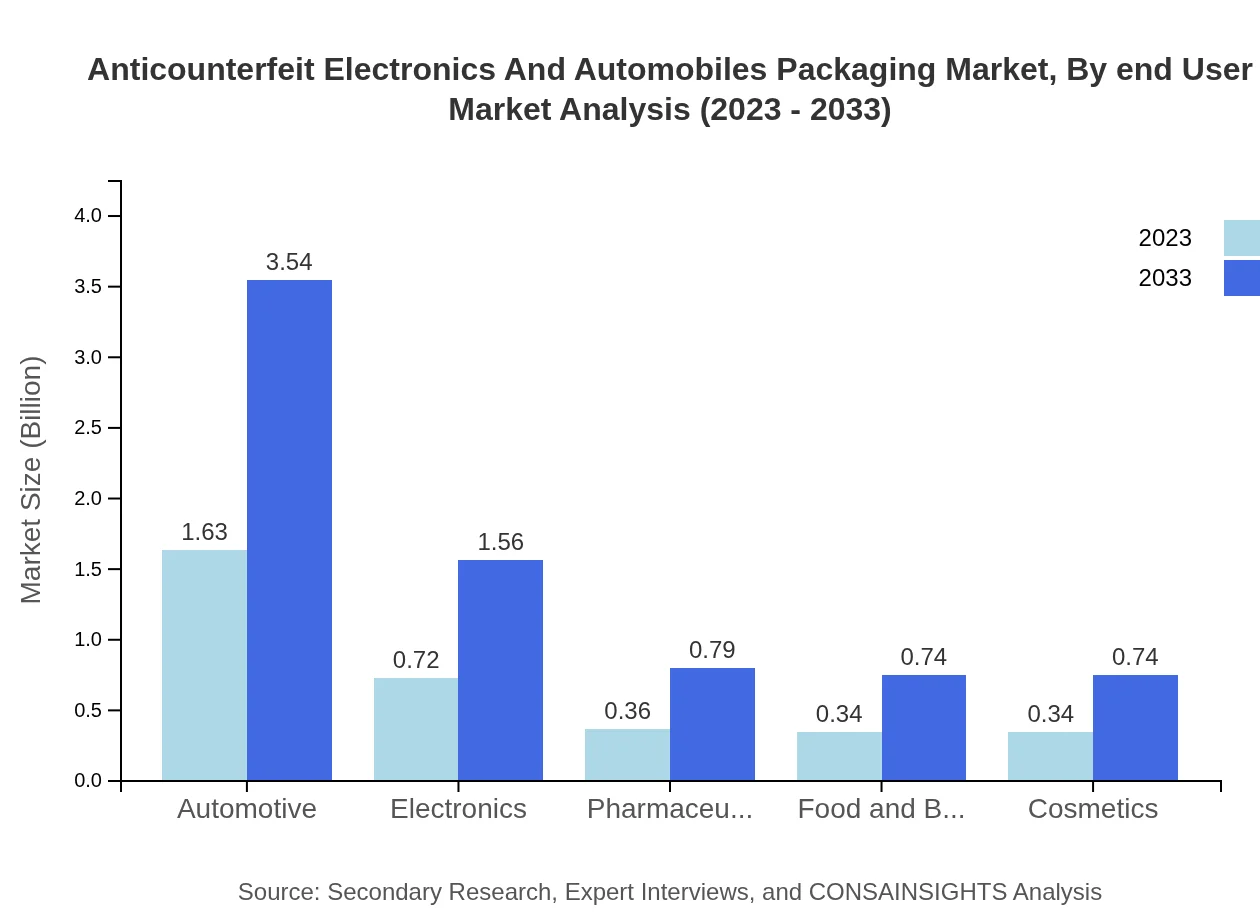

Anticounterfeit Electronics And Automobiles Packaging Market Analysis By End User

The Automotive sector leads the end-user market, representing 48.07% in 2023. The Electronics segment follows closely at 21.13%, emphasizing the need for secure packaging solutions in industries where products face a high risk of counterfeiting.

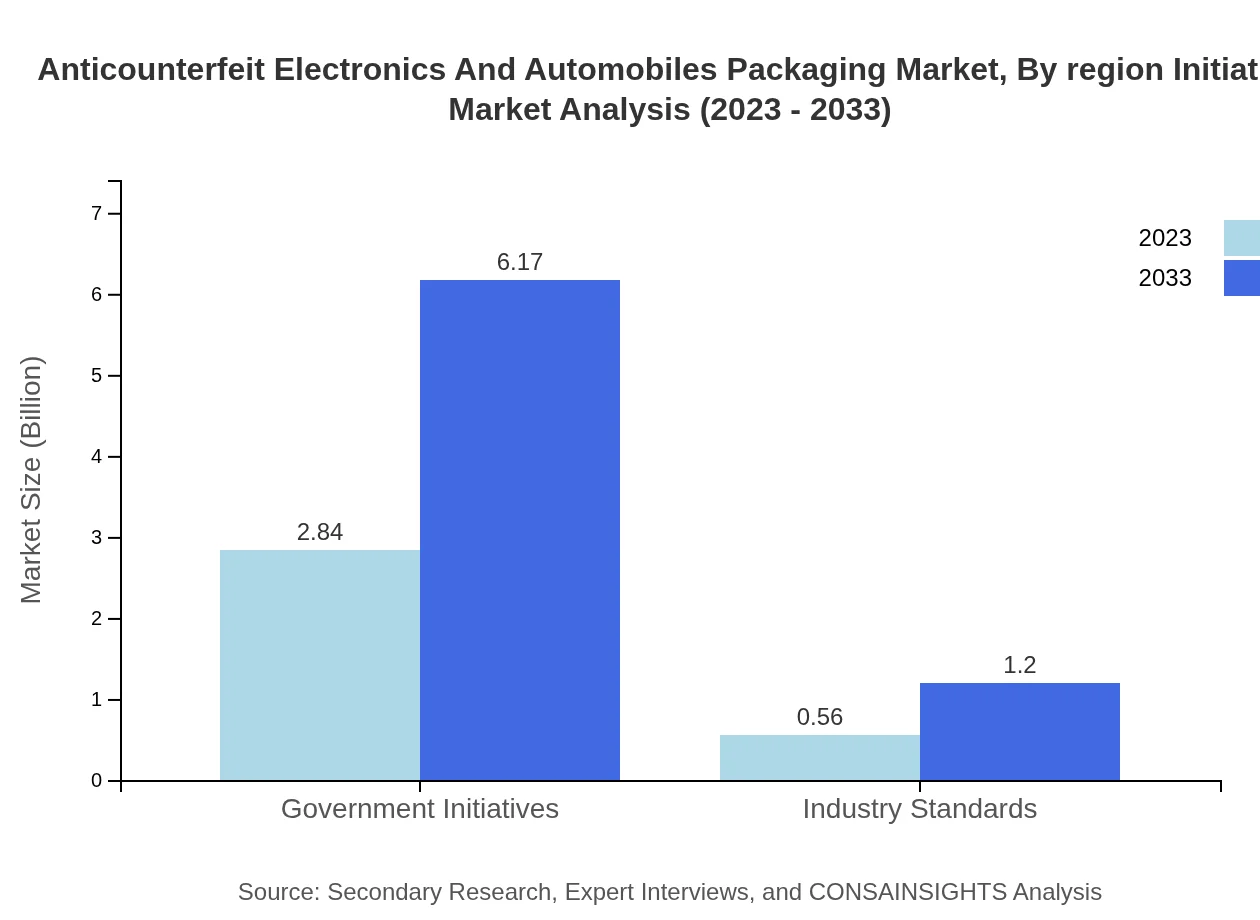

Anticounterfeit Electronics And Automobiles Packaging Market Analysis By Region Initiative

Government Initiatives play a significant role, representing 83.67% of the market efforts in 2023. This includes enhancing regulations to protect consumers and businesses from counterfeit products, reflecting the global push for quality assurance.

Anticounterfeit Electronics And Automobiles Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anticounterfeit Electronics And Automobiles Packaging Industry

Zebra Technologies:

Zebra Technologies is a prominent player specializing in advanced tracking and printing solutions that help businesses secure their products against counterfeiting.SATO Holdings:

SATO Holdings offers innovative labeling and data management solutions that enhance product security across various industries, including automotive and electronics.CCL Industries:

CCL Industries is a major global provider of value-added labels and packaging solutions, focusing extensively on anticounterfeit technologies.Avery Dennison:

Avery Dennison is known for its intelligent labeling and packaging solutions, mitigating the risks associated with counterfeit products through innovative technology.We're grateful to work with incredible clients.

FAQs

What is the market size of anticounterfeit Electronics And Automobiles Packaging?

The current market size for anticounterfeit electronics and automobiles packaging is approximately $3.4 billion, with a compound annual growth rate (CAGR) of 7.8%. This growth is projected to continue over the next decade.

What are the key market players or companies in this anticounterfeit Electronics And Automobiles Packaging industry?

Key players in the anticounterfeit electronics and automobiles packaging market include major firms specializing in security packaging technologies, printing technologies, and authentication solutions. These companies often lead the market with innovative anti-counterfeiting technologies, enhancing product integrity.

What are the primary factors driving the growth in the anticounterfeit Electronics And Automobiles Packaging industry?

The primary factors driving growth include increasing counterfeiting incidents, stricter regulatory compliance, and rising consumer awareness about product authenticity. Additionally, advancements in technology such as digital watermarks and augmented reality solutions are boosting market demand.

Which region is the fastest Growing in the anticounterfeit Electronics And Automobiles Packaging?

The fastest-growing region in the anticounterfeit electronics and automobiles packaging market is North America, forecasted to grow from $1.11 billion in 2023 to $2.41 billion by 2033. This growth is fueled by high demand for advanced security features.

Does ConsaInsights provide customized market report data for the anticounterfeit Electronics And Automobiles Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the anticounterfeit electronics and automobiles packaging industry, catering to unique business requirements and helping firms strategize effectively.

What deliverables can I expect from this anticounterfeit Electronics And Automobiles Packaging market research project?

Expected deliverables from the anticounterfeit electronics and automobiles packaging market research project include comprehensive reports featuring market analysis, trends, forecasts, and insights into competitive landscapes and regional performance data.

What are the market trends of anticounterfeit Electronics And Automobiles Packaging?

Market trends include the rising adoption of innovative technologies for secure packaging, increased investment in R&D for enhanced features like digital watermarking, and the growing focus on sustainability in packaging solutions, driven by consumer preferences.