Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report

Published Date: 02 February 2026 | Report Code: anticounterfeit-pharmaceuticals-and-cosmetics-packaging

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the anticounterfeit pharmaceuticals and cosmetics packaging market from 2023 to 2033, detailing market trends, size, regional insights, and forecasts, aimed at providing readers with actionable insights and strategic recommendations.

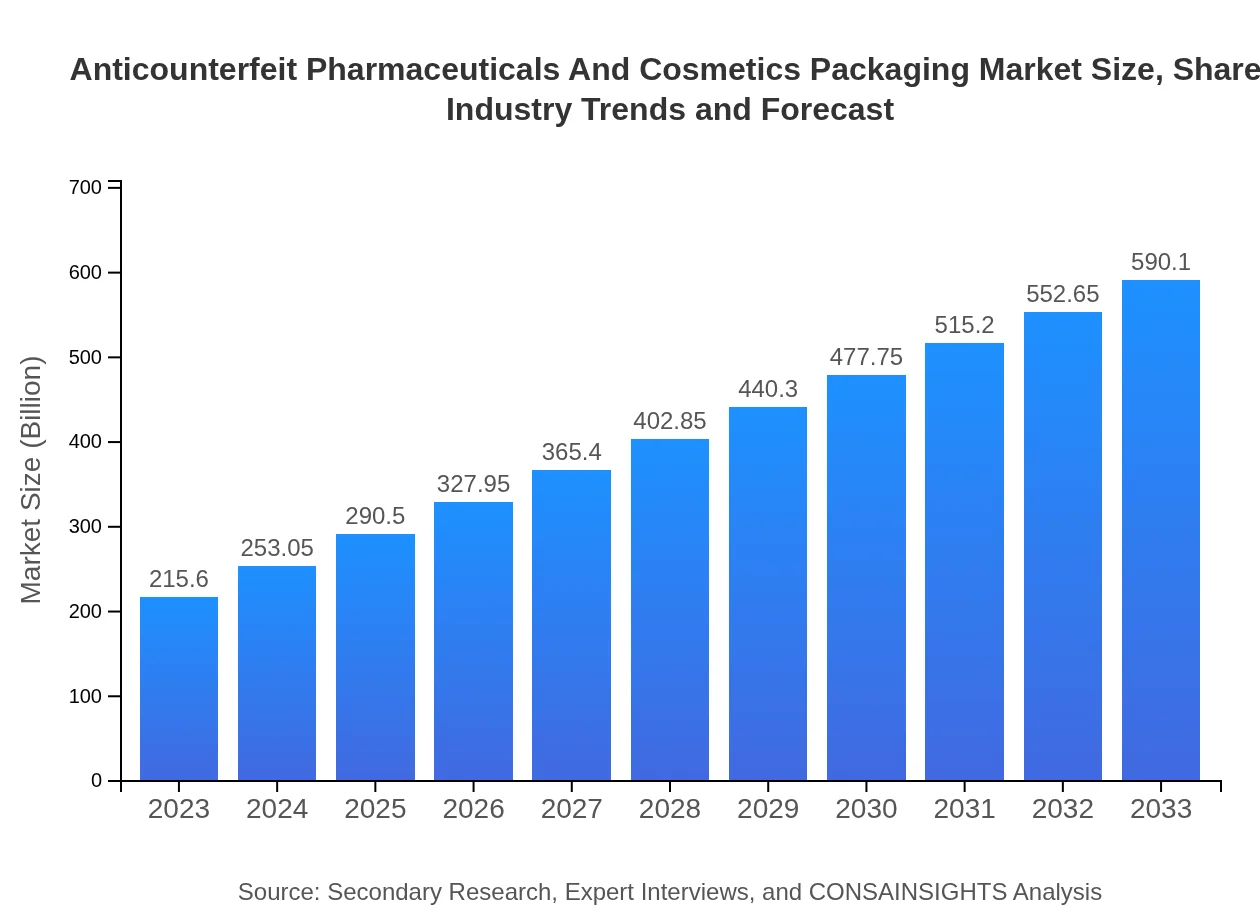

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $215.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $590.10 Billion |

| Top Companies | Avery Dennison Corporation, Schreiner Group, Sato Holdings Corporation, Zebra Technologies, Authentix |

| Last Modified Date | 02 February 2026 |

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Overview

Customize Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report market research report

- ✔ Get in-depth analysis of Anticounterfeit Pharmaceuticals And Cosmetics Packaging market size, growth, and forecasts.

- ✔ Understand Anticounterfeit Pharmaceuticals And Cosmetics Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anticounterfeit Pharmaceuticals And Cosmetics Packaging

What is the Market Size & CAGR of Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market in 2023?

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Industry Analysis

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Analysis Report by Region

Europe Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report:

Europe's market is expected to grow from $74.23 billion in 2023 to $203.17 billion by 2033, fueled by stringent regulations concerning drug safety and packaging standards and increased focus on product authenticity.Asia Pacific Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report:

In the Asia Pacific region, the market is estimated to grow from $33.18 billion in 2023 to $90.82 billion by 2033. This growth is driven by rising demand for pharmaceuticals and cosmetics, increasing awareness of counterfeit products, and expanding distribution networks.North America Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report:

In North America, with a market size of $75.89 billion in 2023, projected to grow to $207.71 billion by 2033, factors include rising incidences of counterfeiting and the implementation of advanced packaging technologies across leading companies.South America Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report:

For South America, the market will increase from $7.87 billion in 2023 to $21.54 billion by 2033, driven by growing regulations against counterfeit products and the expansion of the economy fostering pharmaceutical and cosmetics markets.Middle East & Africa Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Report:

The Middle East and Africa region anticipates growth from $24.43 billion in 2023 to $66.86 billion by 2033, due to the increasing prevalence of counterfeit goods, necessitating stronger packaging solutions and awareness initiatives in the region.Tell us your focus area and get a customized research report.

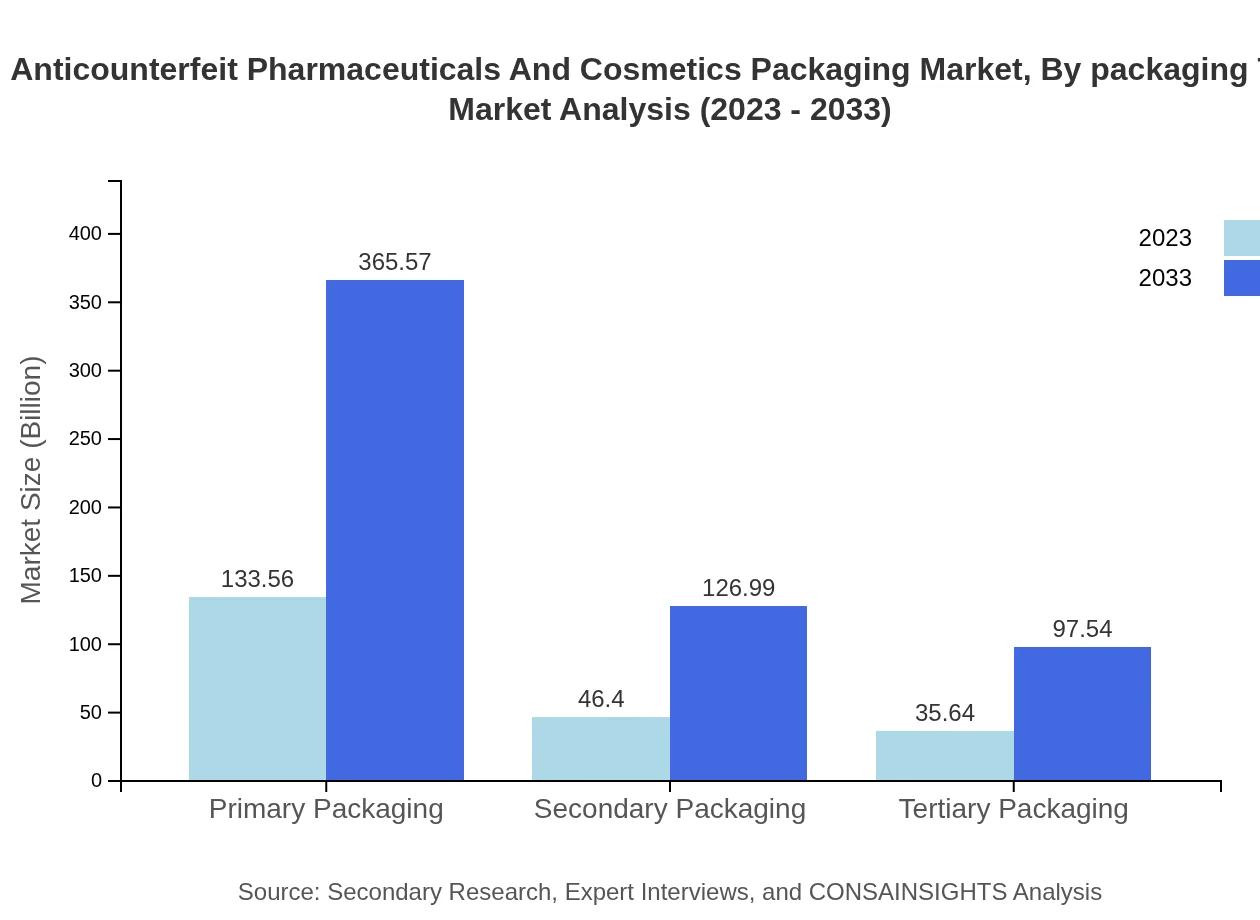

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Analysis By Packaging Type

The market for anti-counterfeit packaging is diversely segmented into primary, secondary, and tertiary packaging. Primary packaging, which directly contains the product, is crucial for maintaining product integrity, while secondary and tertiary packaging serve protective roles and enhance logistical security.

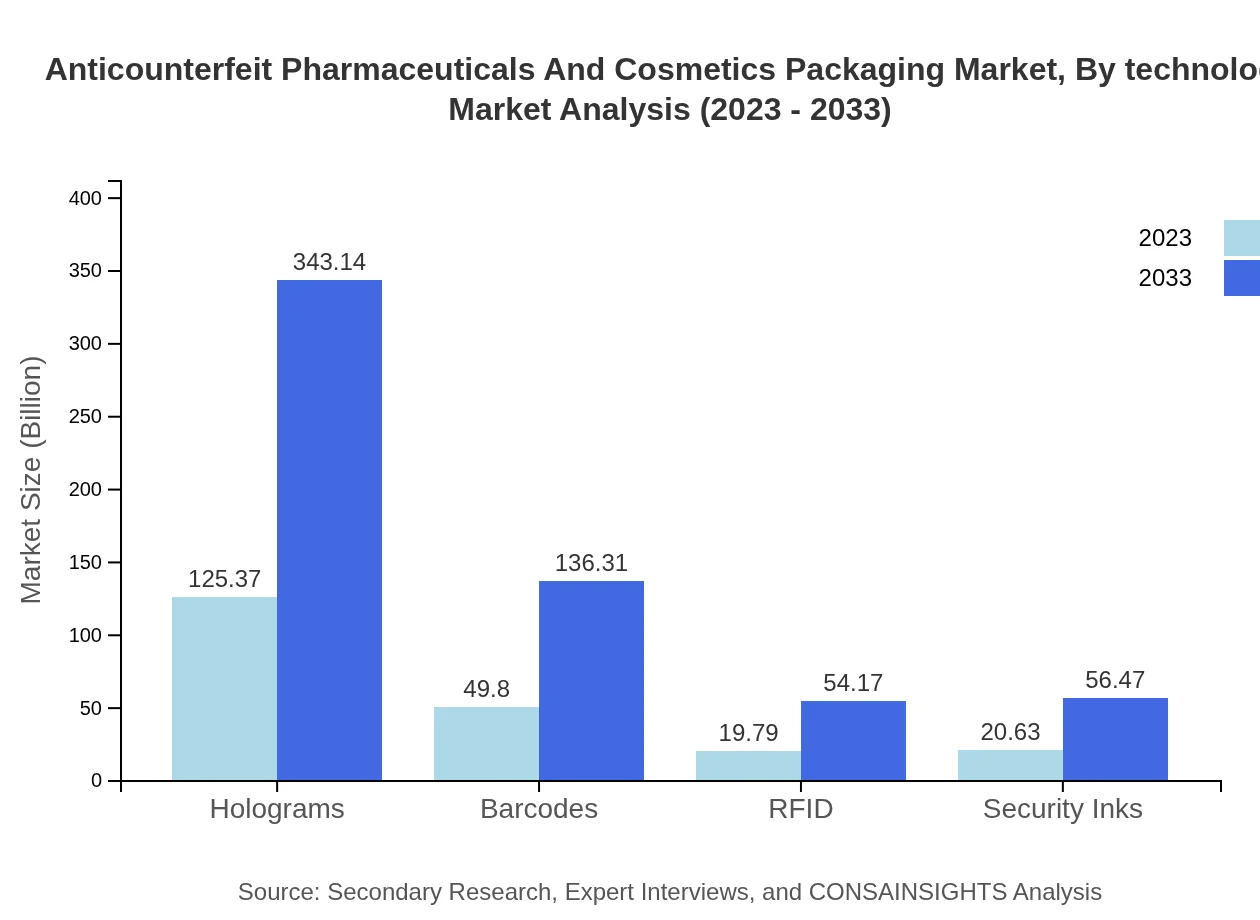

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Analysis By Technology

Key technologies contributing to the market include holograms, barcodes, RFID, and security inks. Holograms dominate the market due to their high security level, accounting for $125.37 billion in 2023, representing 58.15% market share. RFID solutions are also poised for growth as they facilitate detailed tracking and authentication.

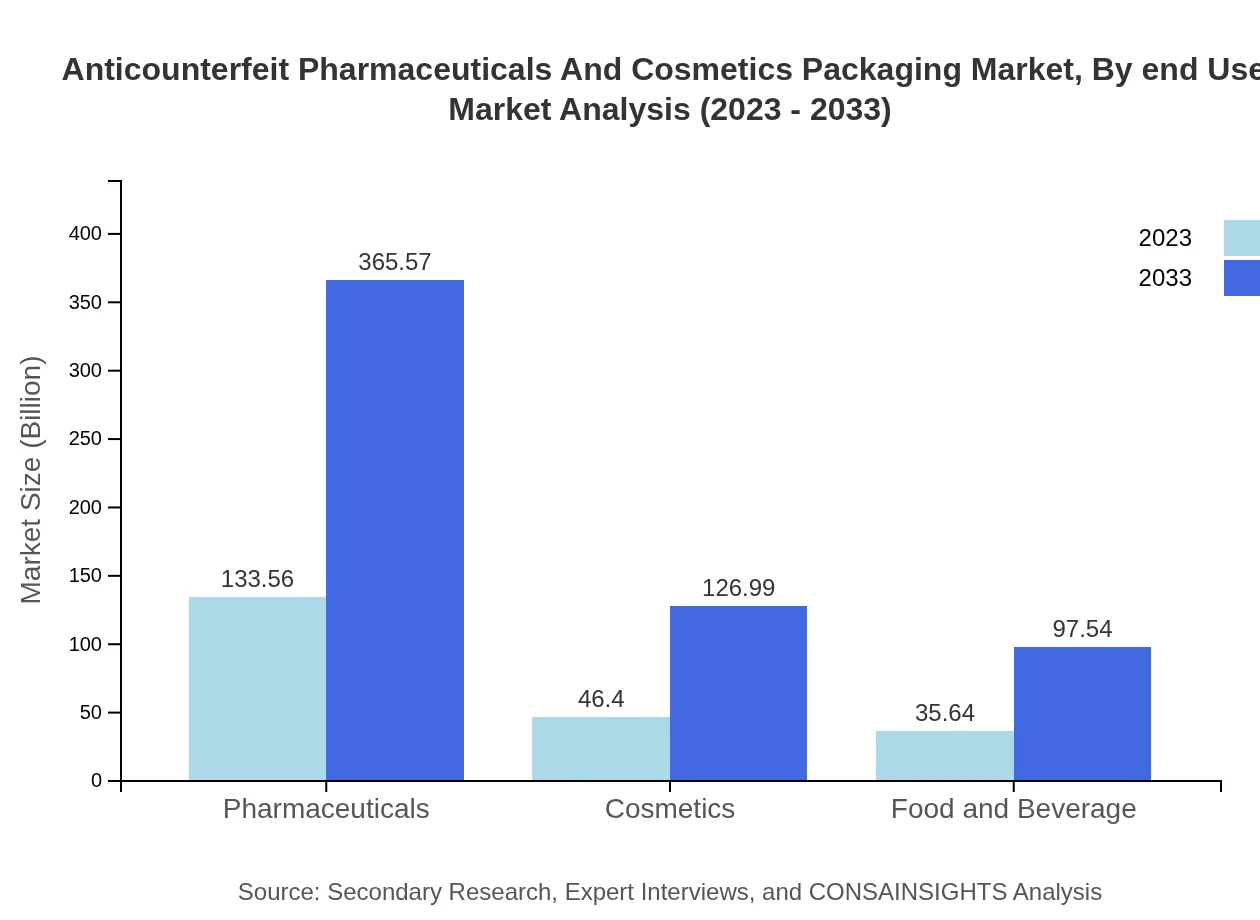

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Analysis By End User

The end-user segment is primarily divided into pharmaceuticals, cosmetics, and food and beverages. Pharmaceuticals hold the largest market share of 61.95% in 2023 will see substantial growth, driven by increased government regulations and consumer awareness regarding counterfeit drugs.

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Analysis By Region

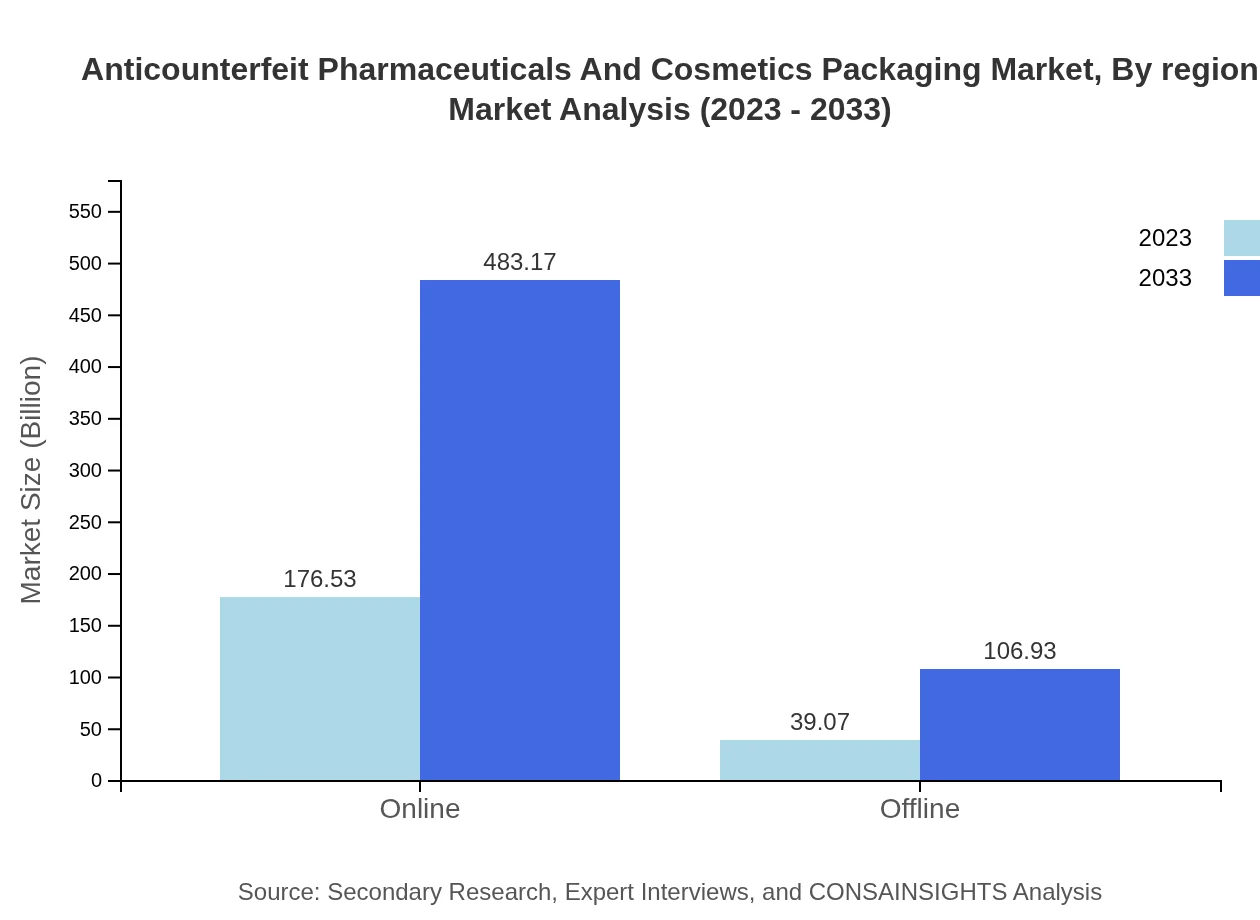

Distribution channels can be classified as online and offline. Online sales channels are exhibiting significant growth, indicating a shifting trend in purchasing behavior, with projected values of $176.53 billion in 2023 and expected growth to $483.17 billion by 2033.

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Analysis By Application

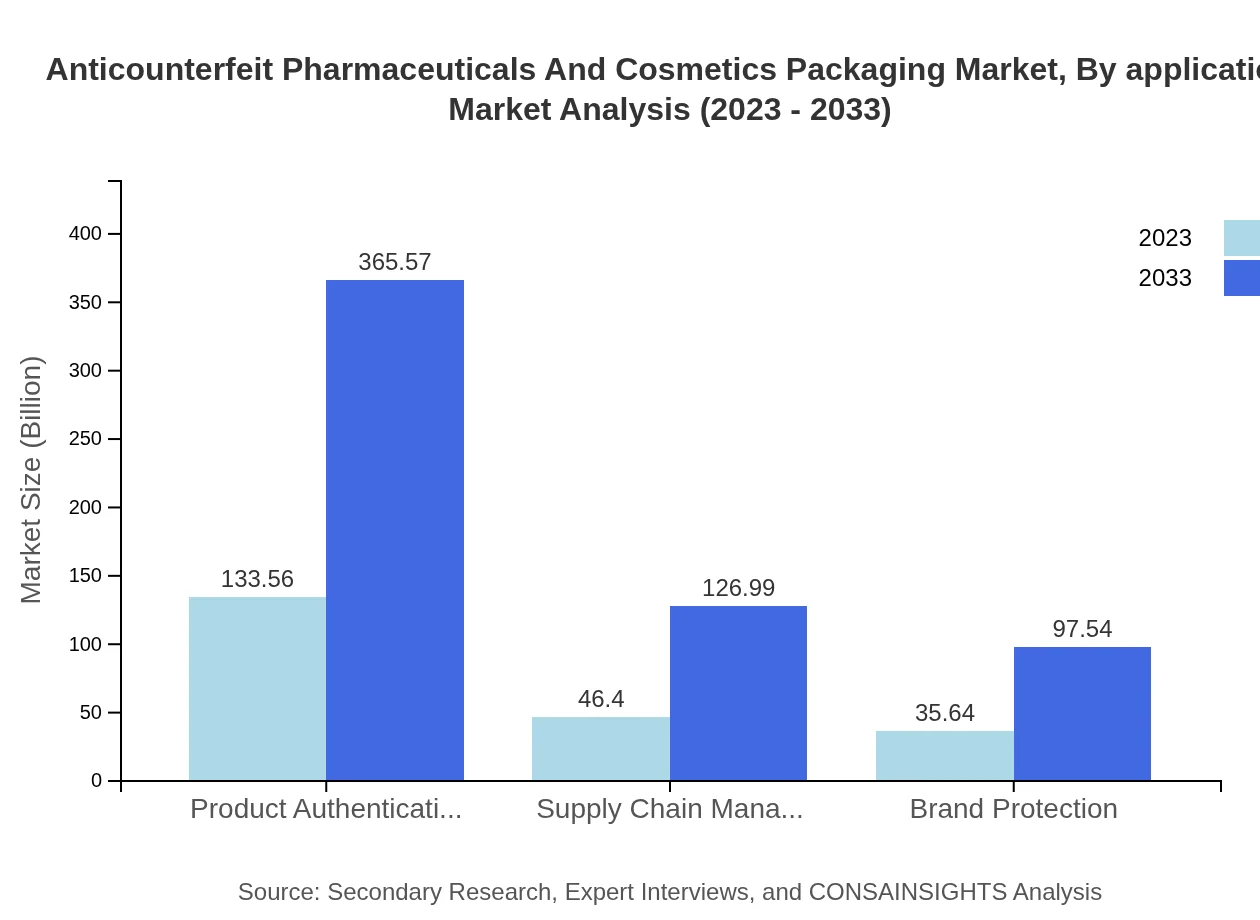

Applications range across product authentication, brand protection, and supply chain management. Product authentication, with a significant market share, is expected to grow from $133.56 billion in 2023 to $365.57 billion by 2033, owing to rising consumer demand for assurance against counterfeit products.

Anticounterfeit Pharmaceuticals And Cosmetics Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anticounterfeit Pharmaceuticals And Cosmetics Packaging Industry

Avery Dennison Corporation:

Avery Dennison is a global leader in labeling and packaging materials that specializes in innovative solutions against counterfeit products.Schreiner Group:

The Schreiner Group provides high-precision self-adhesive labeling solutions and anti-counterfeiting technologies across various industries, enhancing secure packaging.Sato Holdings Corporation:

Sato Holdings offers a broad range of labeling and printing solutions, enhancing product authentication methods significantly in the pharmaceuticals sector.Zebra Technologies:

Zebra Technologies specializes in data capture solutions allowing companies to enhance supply chain visibility while combating counterfeiting.Authentix:

Authentix focuses on delivering high-quality authentication solutions, enabling brands to protect their identities and products.We're grateful to work with incredible clients.

FAQs

What is the market size of anticounterfeit pharmaceuticals and cosmetics packaging?

The anticounterfeit pharmaceuticals and cosmetics packaging market is estimated to reach approximately $215.6 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 10.2% through 2033, highlighting rapid growth in demand.

What are the key market players or companies in the anticounterfeit pharmaceuticals and cosmetics packaging industry?

Key players in this industry often involve a mix of large pharmaceutical companies, technology firms specializing in packaging solutions, and chemical manufacturers that provide security features. Specific company names are often identified in detailed market reports.

What are the primary factors driving the growth in the anticounterfeit pharmaceuticals and cosmetics packaging industry?

The major growth factors include increased counterfeit incidents, regulatory requirements pushing for secure packaging, and rising awareness among consumers regarding product authenticity, driving companies to invest in advanced packaging technologies.

Which region is the fastest Growing in the anticounterfeit pharmaceuticals and cosmetics packaging?

The fastest-growing region is expected to be Europe, with market growth projected from $74.23 billion in 2023 to approximately $203.17 billion by 2033, reflecting the increasing regulatory frameworks and consumer demand for secure packaging.

Does ConsaInsights provide customized market report data for the anticounterfeit pharmaceuticals and cosmetics packaging industry?

Yes, ConsaInsights offers the flexibility to provide tailored market report data to meet specific interests or queries related to the anticounterfeit pharmaceuticals and cosmetics packaging sector, ensuring relevant insights.

What deliverables can I expect from this anticounterfeit pharmaceuticals and cosmetics packaging market research project?

Deliverables generally include comprehensive reports, executive summaries, detailed segmented data, regional analysis, and insights into trends and competitive landscapes that inform strategic decisions.

What are the market trends of anticounterfeit pharmaceuticals and cosmetics packaging?

Trends include the increasing adoption of technologies like holograms and RFID tags for improved security, a shift towards sustainable packaging solutions, and the rise of online platforms requiring secure product verification systems.