Antifouling Paints And Coatings Market Report

Published Date: 02 February 2026 | Report Code: antifouling-paints-and-coatings

Antifouling Paints And Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Antifouling Paints and Coatings market, covering market trends, dynamics, segmentation, and growth forecasts from 2023 to 2033.

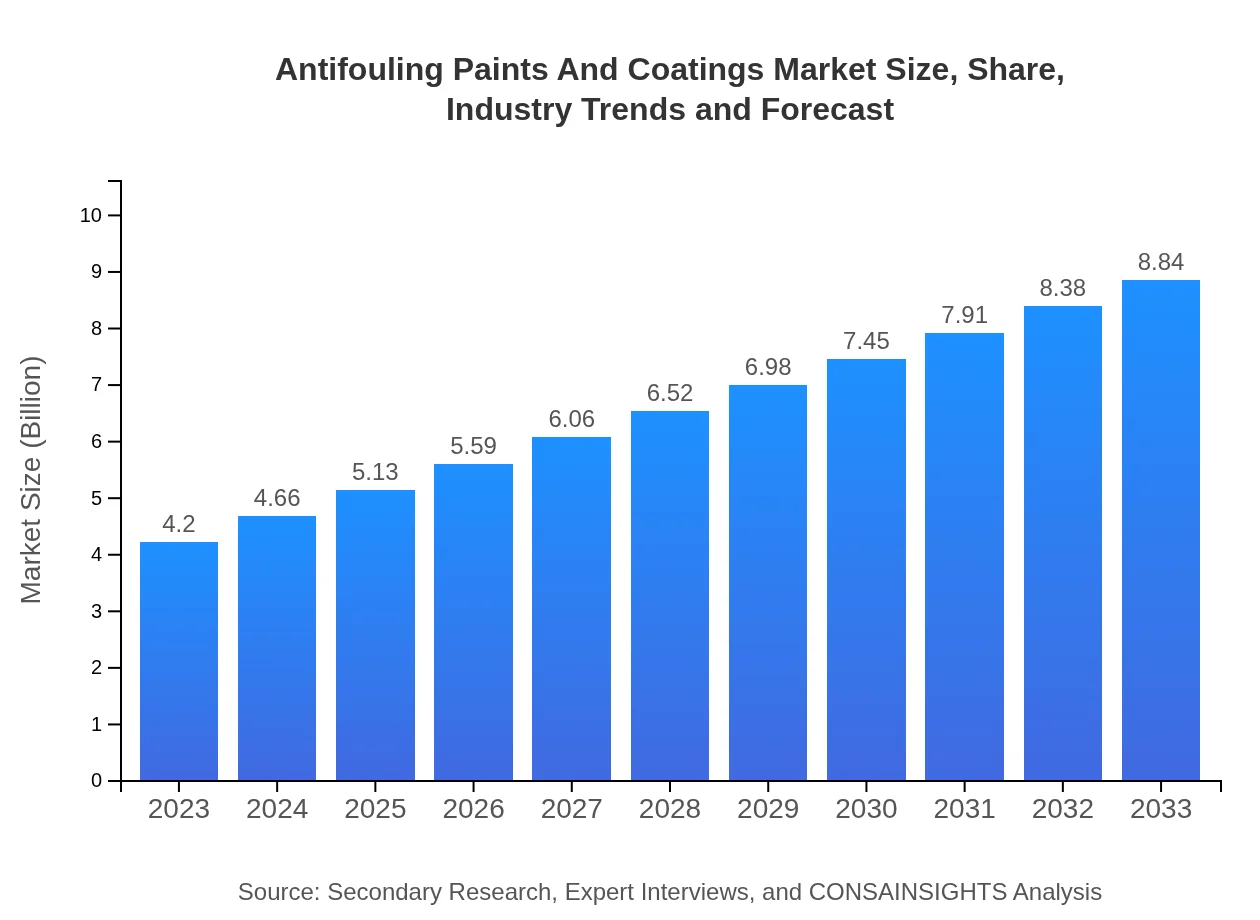

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.20 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | International Paint Ltd., PPG Industries Inc. |

| Last Modified Date | 02 February 2026 |

Antifouling Paints And Coatings Market Overview

Customize Antifouling Paints And Coatings Market Report market research report

- ✔ Get in-depth analysis of Antifouling Paints And Coatings market size, growth, and forecasts.

- ✔ Understand Antifouling Paints And Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Antifouling Paints And Coatings

What is the Market Size & CAGR of Antifouling Paints And Coatings market in 2023 and 2033?

Antifouling Paints And Coatings Industry Analysis

Antifouling Paints And Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Antifouling Paints And Coatings Market Analysis Report by Region

Europe Antifouling Paints And Coatings Market Report:

In Europe, the market is forecasted to grow from $1.14 billion in 2023 to $2.39 billion by 2033, influenced by stringent environmental policies and demand for high-performance coatings for maritime activities.Asia Pacific Antifouling Paints And Coatings Market Report:

The Asia Pacific region is witnessing significant growth in the Antifouling Paints and Coatings market, projected to expand from $0.82 billion in 2023 to $1.73 billion by 2033. This growth is attributed to booming maritime activities and a rising fleet of commercial vessels.North America Antifouling Paints And Coatings Market Report:

North America holds a considerable market share, expected to grow from $1.60 billion in 2023 to $3.37 billion by 2033, primarily due to high investments in shipping infrastructure and rigorous regulations for marine protection.South America Antifouling Paints And Coatings Market Report:

The South American market is relatively small but shows growth from $0.11 billion in 2023 to $0.24 billion by 2033, driven by increased attention to sustainable marine practices amid growing environmental regulations.Middle East & Africa Antifouling Paints And Coatings Market Report:

The Middle East and Africa region is projected to increase from $0.52 billion in 2023 to $1.10 billion by 2033. Increased investments in the shipping industry and the energy sector are driving the growth of antifouling solutions in this area.Tell us your focus area and get a customized research report.

Antifouling Paints And Coatings Market Analysis By Type

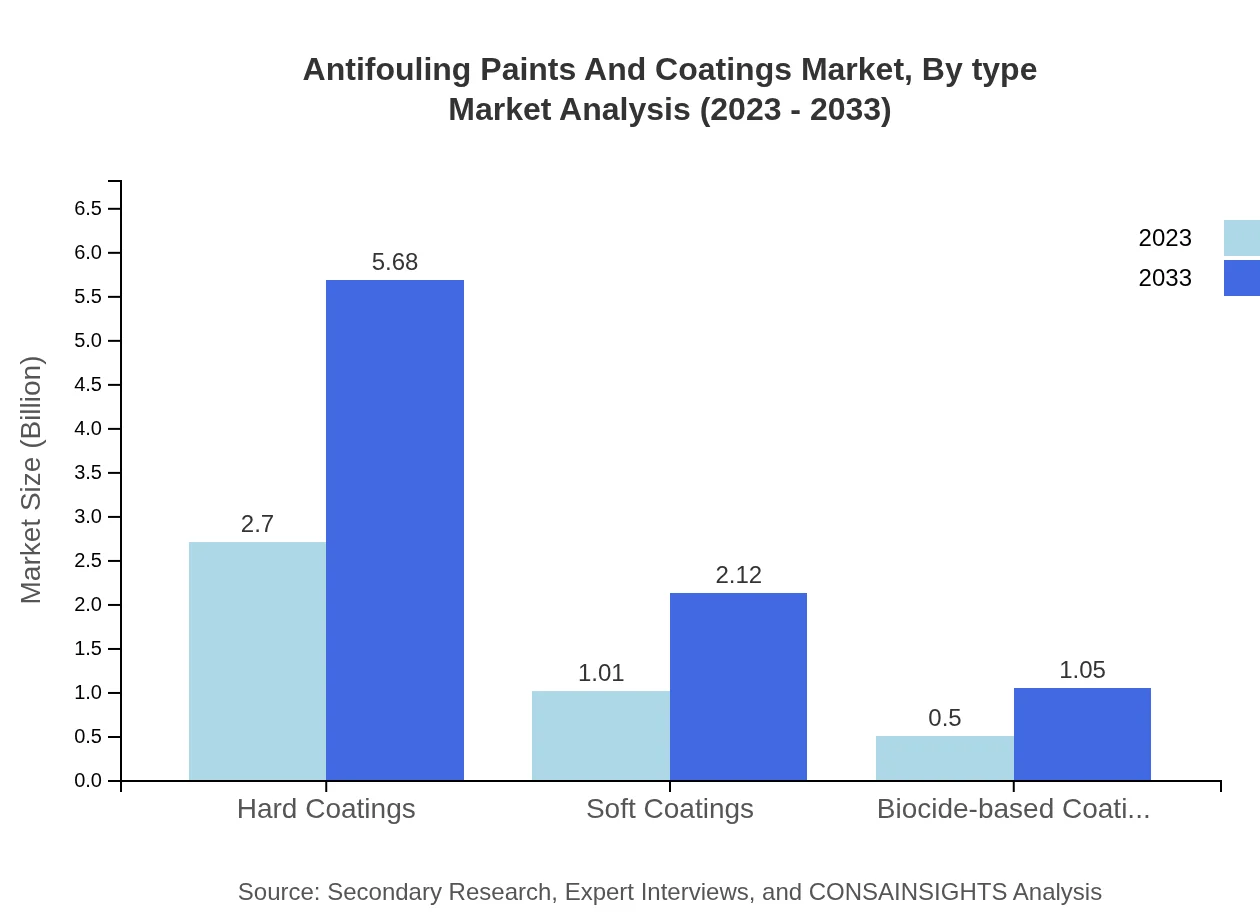

The Antifouling Paints and Coatings market is categorized into several types, including hard coatings, soft coatings, and biocide-based coatings. Hard coatings dominate the market, with an expected increase from $2.70 billion in 2023 to $5.68 billion in 2033, maintaining a market share of 64.21%. Soft coatings and biocide-based coatings are also significant, reflecting the industry's shift towards less harmful alternatives. Soft coatings are forecasted to grow from $1.01 billion to $2.12 billion, while biocide-based coatings are anticipated to grow from $0.50 billion to $1.05 billion.

Antifouling Paints And Coatings Market Analysis By Application

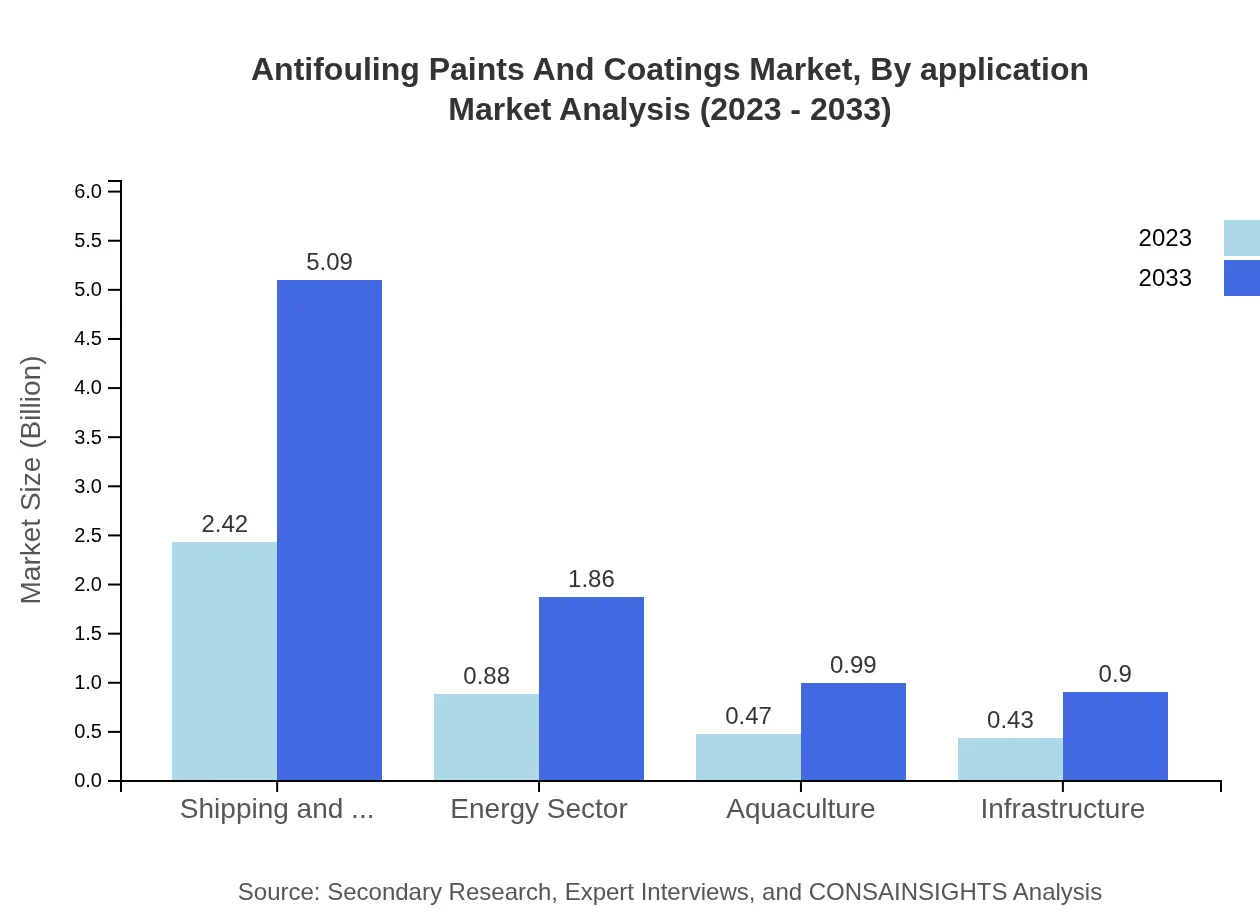

The market is segmented by application into sectors such as shipping and maritime, energy, aquaculture, and infrastructure. The maritime sector is the largest, with revenues growing from $2.42 billion in 2023 to $5.09 billion in 2033. The energy sector is also significant, moving from $0.88 billion to $1.86 billion during the same period, driven by offshore energy developments.

Antifouling Paints And Coatings Market Analysis By End Use

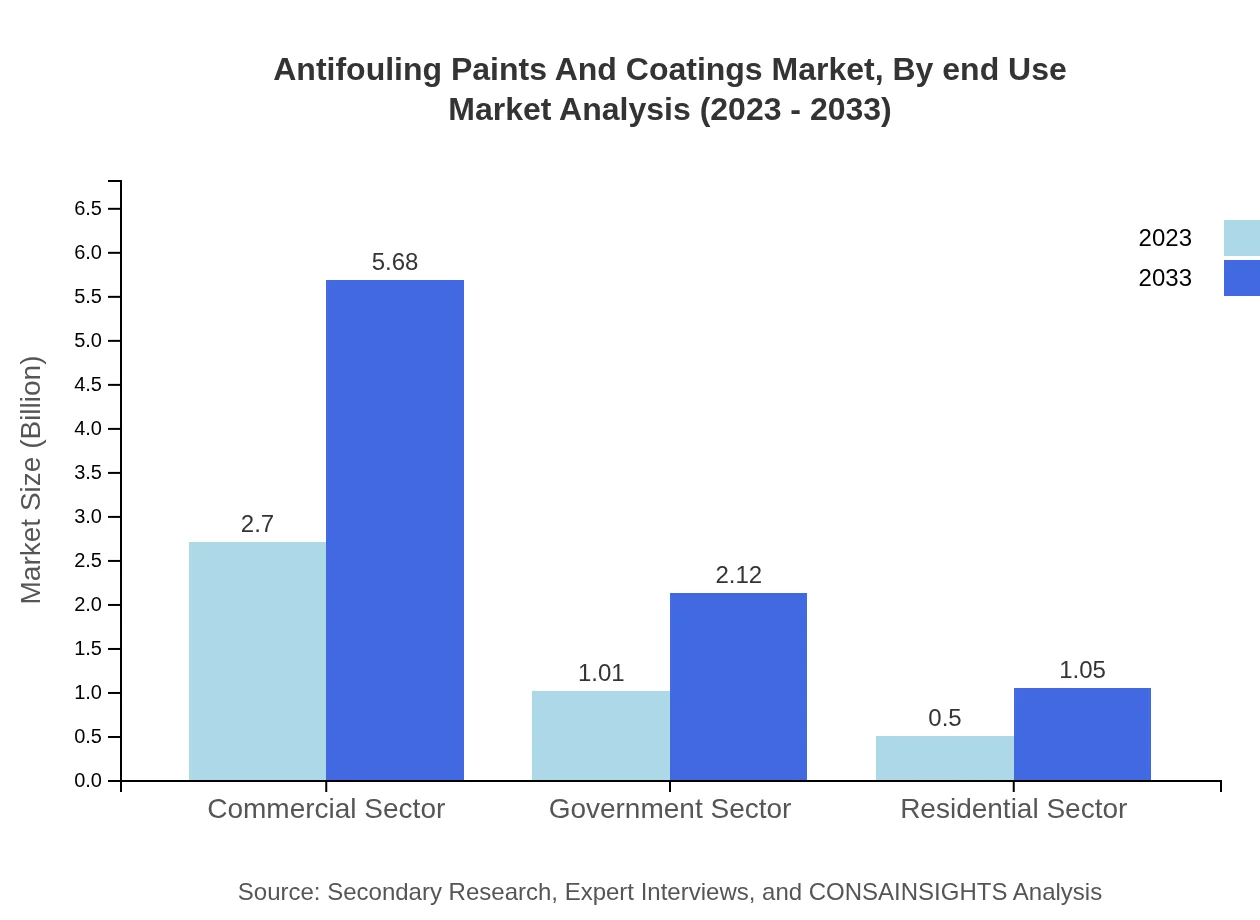

End-use segmentation includes commercial, government, and residential sectors. The commercial sector leads with anticipated growth from $2.70 billion to $5.68 billion by 2033, while the residential sector remains smaller but is projected to grow from $0.50 billion to $1.05 billion, emphasizing the need for domestic marine care.

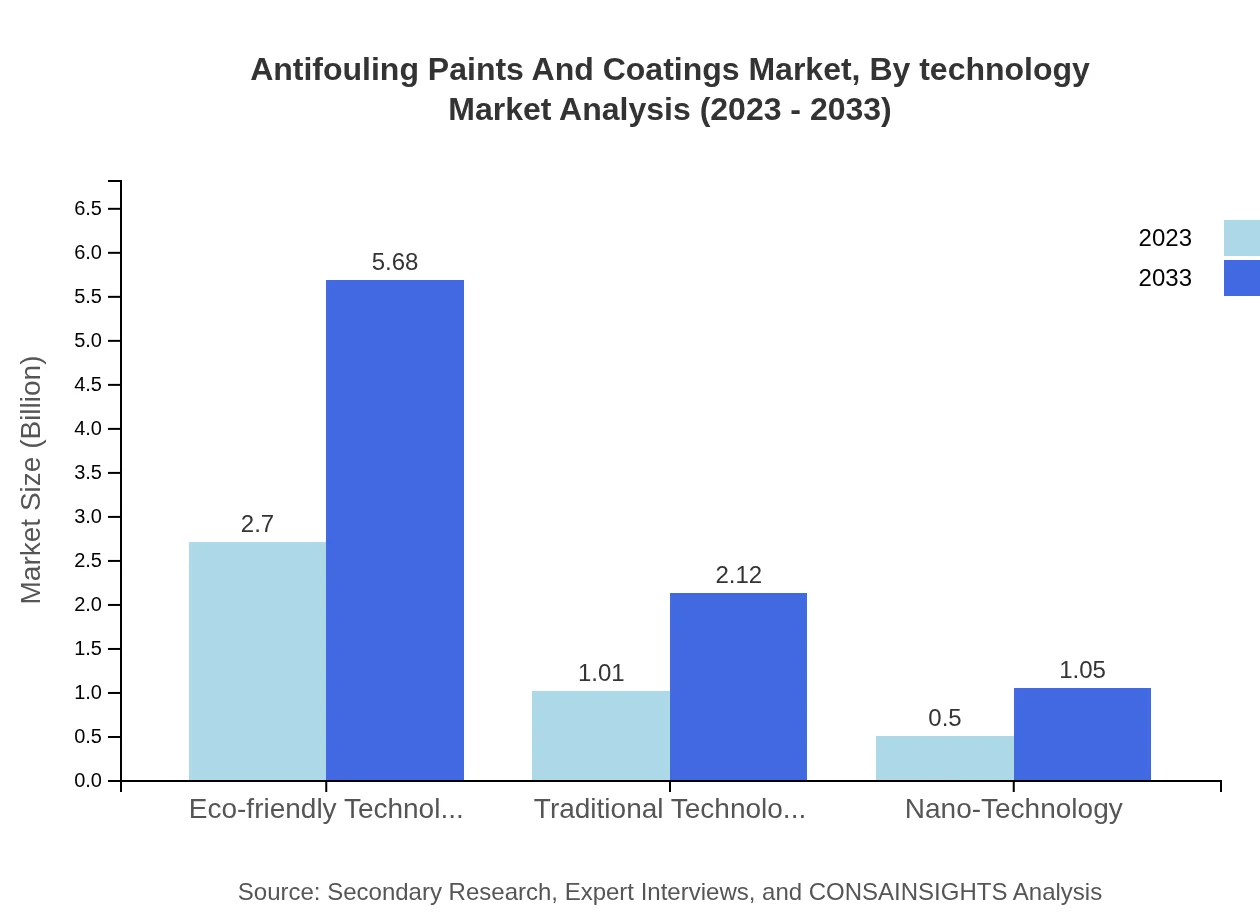

Antifouling Paints And Coatings Market Analysis By Technology

In terms of technology, the market is divided into eco-friendly technologies, traditional technologies, and nanotechnology. Eco-friendly technologies occupy a large share, expected to grow from $2.70 billion in 2023 to $5.68 billion in 2033. Traditional technologies remain relevant but face competition from eco-friendly and nanotechnology advancements, which also show potential growth from $0.50 billion to $1.05 billion.

Antifouling Paints And Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Antifouling Paints And Coatings Industry

International Paint Ltd.:

A leading manufacturer offering a comprehensive range of antifouling products. Their commitment to research and environmentally friendly solutions positions them at the forefront of the market.PPG Industries Inc.:

A global leader in coatings with a strong portfolio in marine coatings, PPG emphasizes innovation and sustainable practices in its antifouling product lines.We're grateful to work with incredible clients.

FAQs

What is the market size of antifouling Paints And Coatings?

The global market size for antifouling paints and coatings is currently valued at $4.2 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 7.5%, expecting to reach significant growth by 2033.

What are the key market players or companies in the antifouling Paints And Coatings industry?

Key players in the antifouling paints and coatings market include prominent manufacturers and suppliers, although exact names are often specific to detailed reports where comprehensive competitive analysis is provided.

What are the primary factors driving the growth in the antifouling Paints And Coatings industry?

The growth drivers for antifouling paints and coatings include increasing maritime trade, the rise in marine tourism, and innovations leading to eco-friendly solutions while meeting stringent environmental regulations.

Which region is the fastest Growing in the antifouling Paints And Coatings?

The fastest-growing region in the antifouling paints and coatings market is Asia-Pacific, anticipated to expand from $0.82 billion in 2023 to $1.73 billion by 2033, indicating robust industry growth.

Does ConsaInsights provide customized market report data for the antifouling Paints And Coatings industry?

Yes, Consainsights offers customized market reports tailored to specific needs, ensuring relevant data for stakeholders in the antifouling paints and coatings industry.

What deliverables can I expect from this antifouling Paints And Coatings market research project?

Expected deliverables from the antifouling paints and coatings market research include comprehensive market analysis, segmentation, forecasts, and insights into emerging trends and competitive landscape.

What are the market trends of antifouling Paints And Coatings?

Current trends in the antifouling paints and coatings market include a shift towards sustainable materials, increasing adoption of biocide-based technologies, and innovations in nanotechnology for enhanced performance.