Antimony Market Report

Published Date: 02 February 2026 | Report Code: antimony

Antimony Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the antimony market, including insights on market size, growth forecasts, segmentation, and trends from 2023 to 2033. It covers detailed regional analyses, industry dynamics, and profiles of key market players.

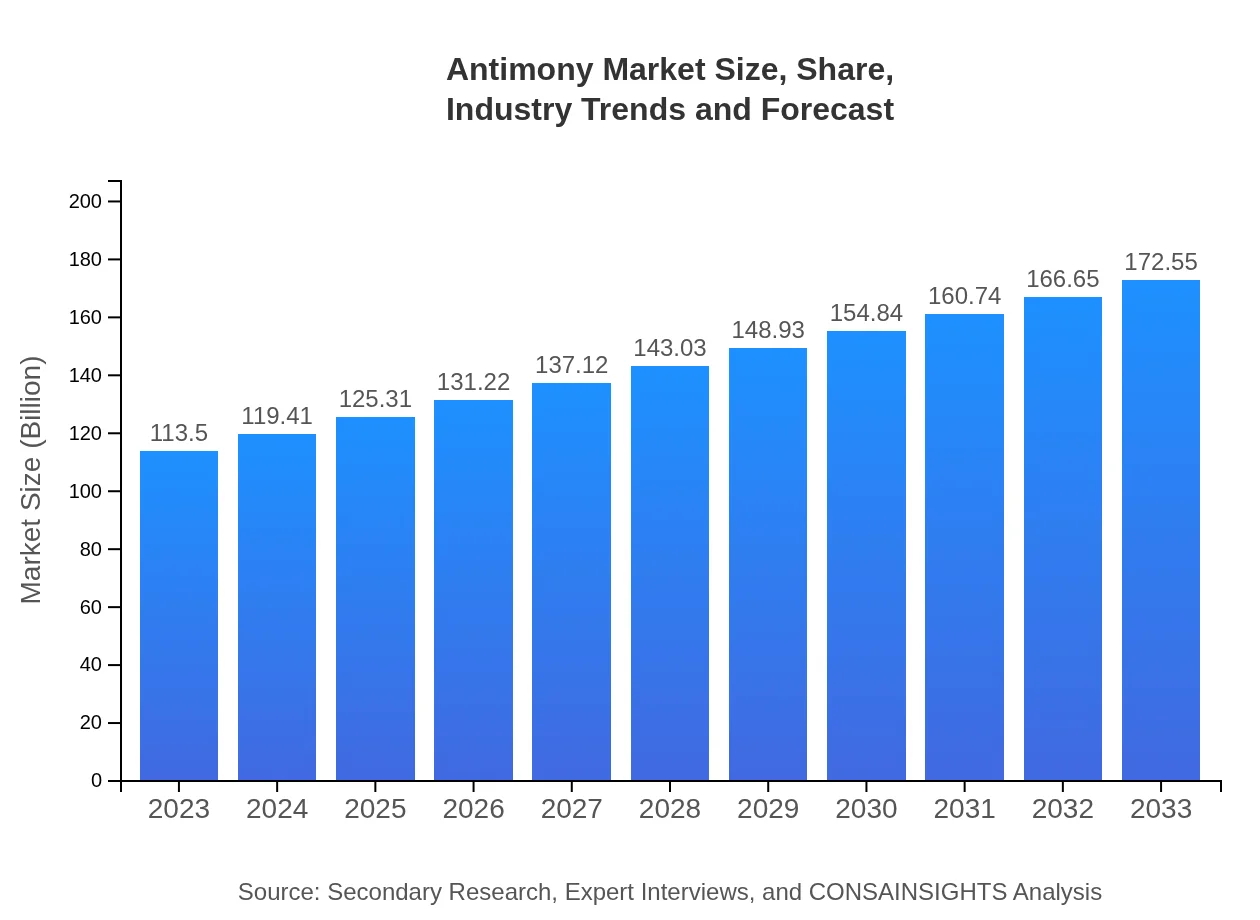

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $113.50 Million |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $172.55 Million |

| Top Companies | Mandalay Resources, Hunan Nonferrous Metals Corporation, Wenfu Group |

| Last Modified Date | 02 February 2026 |

Antimony Market Overview

Customize Antimony Market Report market research report

- ✔ Get in-depth analysis of Antimony market size, growth, and forecasts.

- ✔ Understand Antimony's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Antimony

What is the Market Size & CAGR of Antimony market in 2023?

Antimony Industry Analysis

Antimony Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Antimony Market Analysis Report by Region

Europe Antimony Market Report:

Europe's antimony market in 2023 was valued at $30.15 million, with projections of $45.83 million by 2033. Growth is attributed to increasing safety regulations in construction and electronics industries, leading to higher consumption of flame retardants.Asia Pacific Antimony Market Report:

In 2023, the Asia Pacific antimony market is valued at $24.54 million, projected to reach $37.31 million by 2033. The region's growth is propelled by increasing industrial activities in countries like China and India, where antimony is essential for various manufacturing processes.North America Antimony Market Report:

North America boasts a larger market size, estimated at $40.72 million in 2023 and rising to $61.91 million by 2033. Major players in the U.S. and Canada are driving demand for antimony in flame retardants and batteries, supported by stringent safety regulations.South America Antimony Market Report:

South America presents a growing opportunity, with antimony market values rising from $10.98 million in 2023 to $16.69 million in 2033. The rise is largely due to expanding construction and infrastructure sectors in Brazil and Argentina.Middle East & Africa Antimony Market Report:

The Middle East and Africa represent a smaller segment, with market values of $7.12 million in 2023 and $10.82 million by 2033. The region's growth is influenced by mining activities in South Africa, alongside rising demand in automotive applications.Tell us your focus area and get a customized research report.

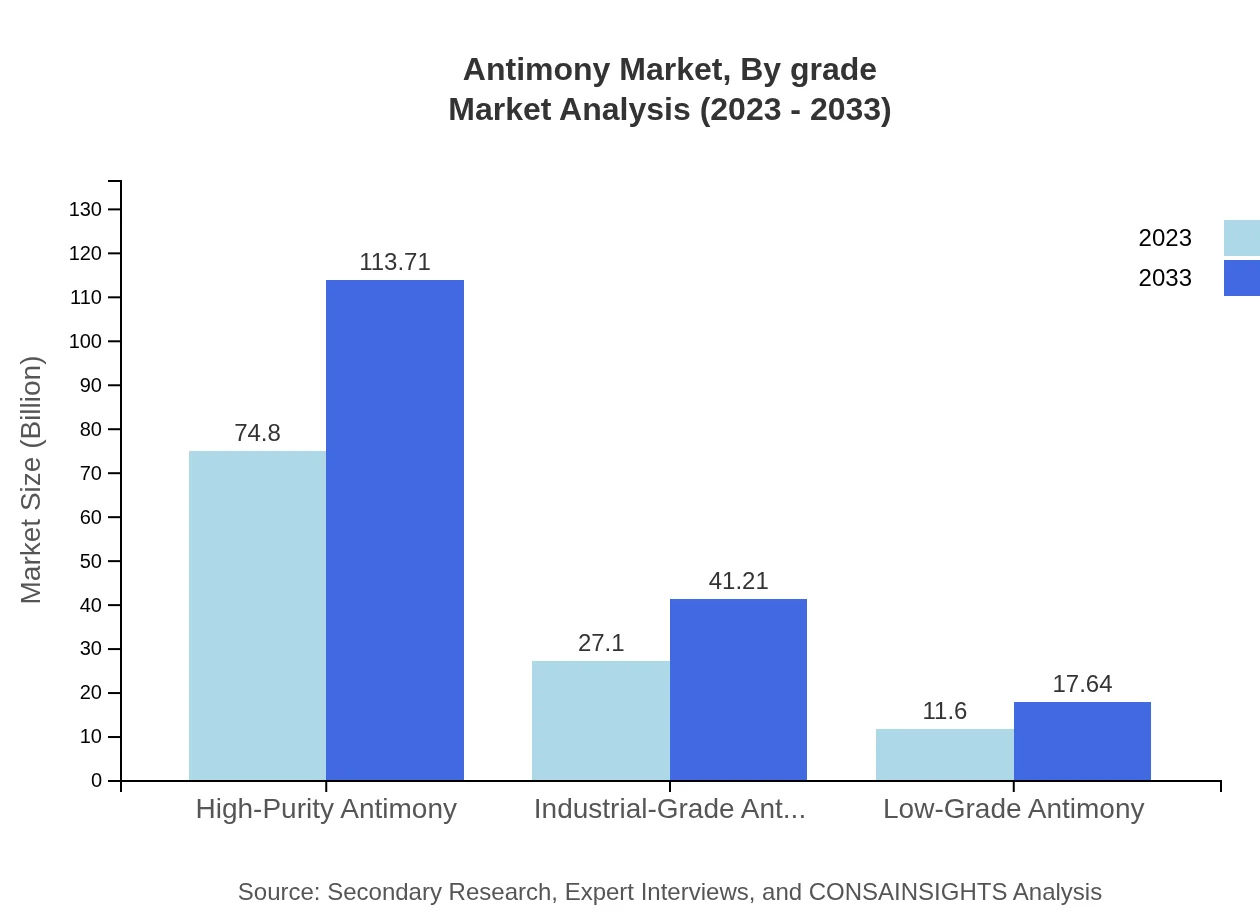

Antimony Market Analysis By Grade

The antimony market by grade shows that antimony trioxide leads with a size of $74.80 million in 2023, growing to $113.71 million in 2033. Antimony oxide and metal also contribute significant revenues, with respective sizes of $27.10 million and $11.60 million in 2023.

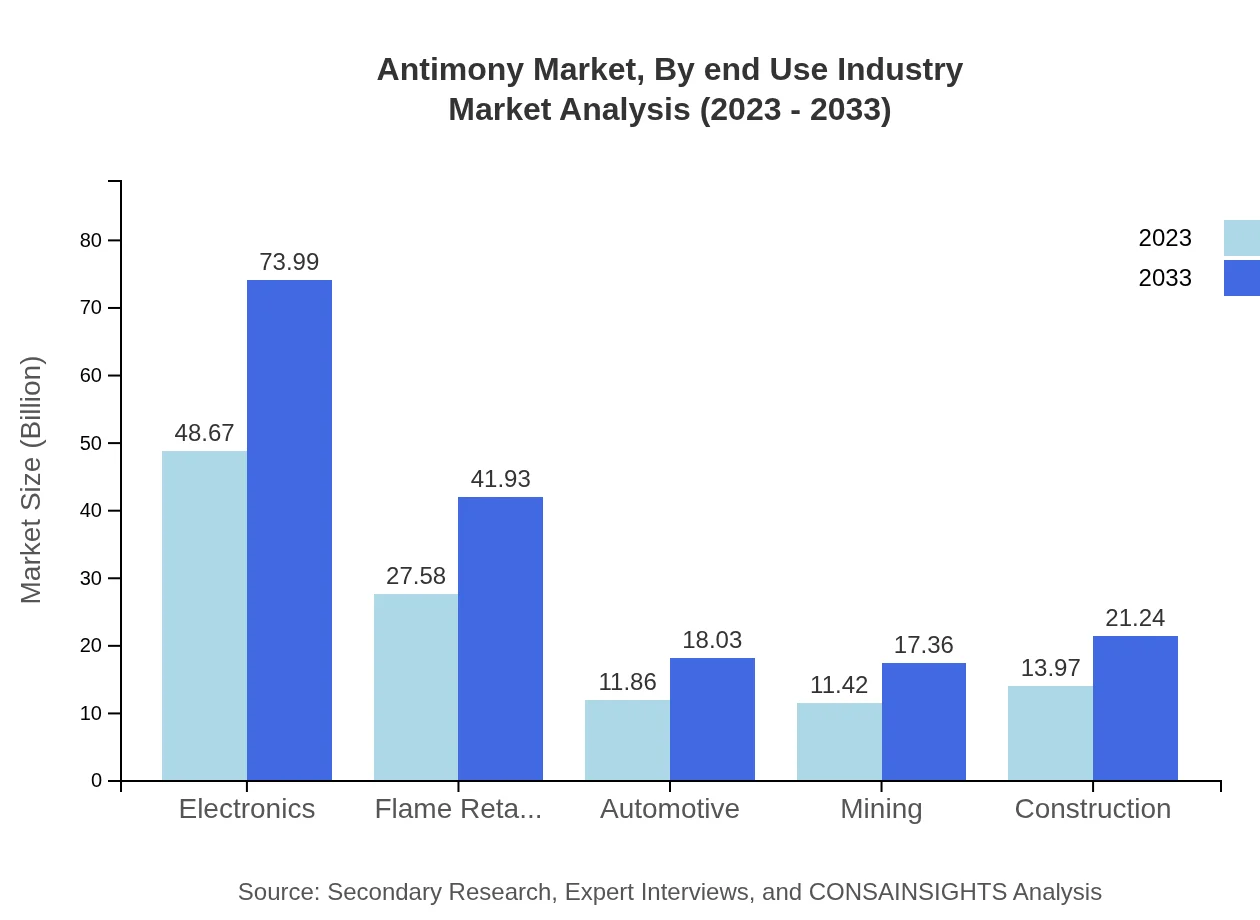

Antimony Market Analysis By End Use Industry

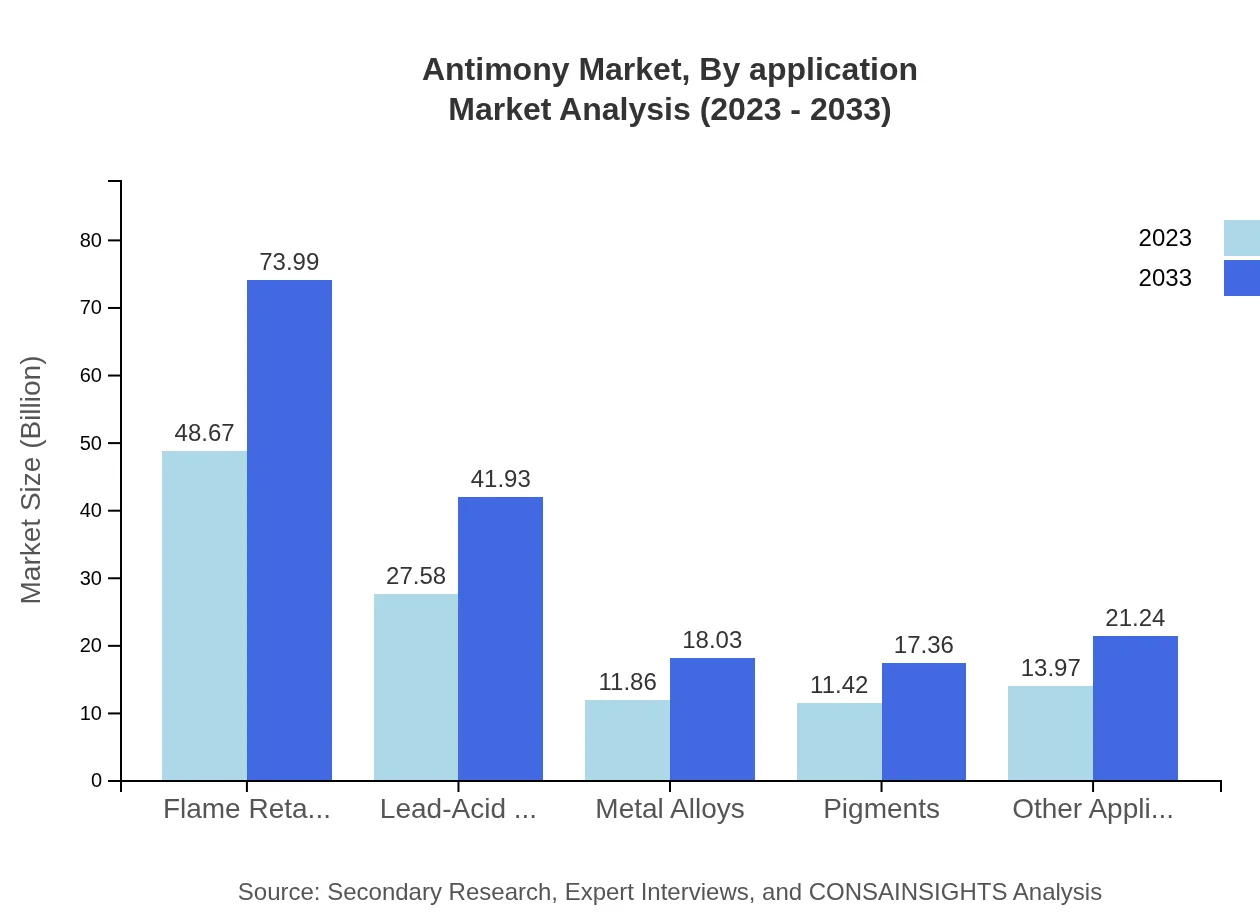

In the by-end-use industry analysis, flame retardants dominate with a market size of $48.67 million in 2023, expected to grow to $73.99 million by 2033. The electronics and lead-acid battery sectors also show strong demand, with significant growth over the forecast period.

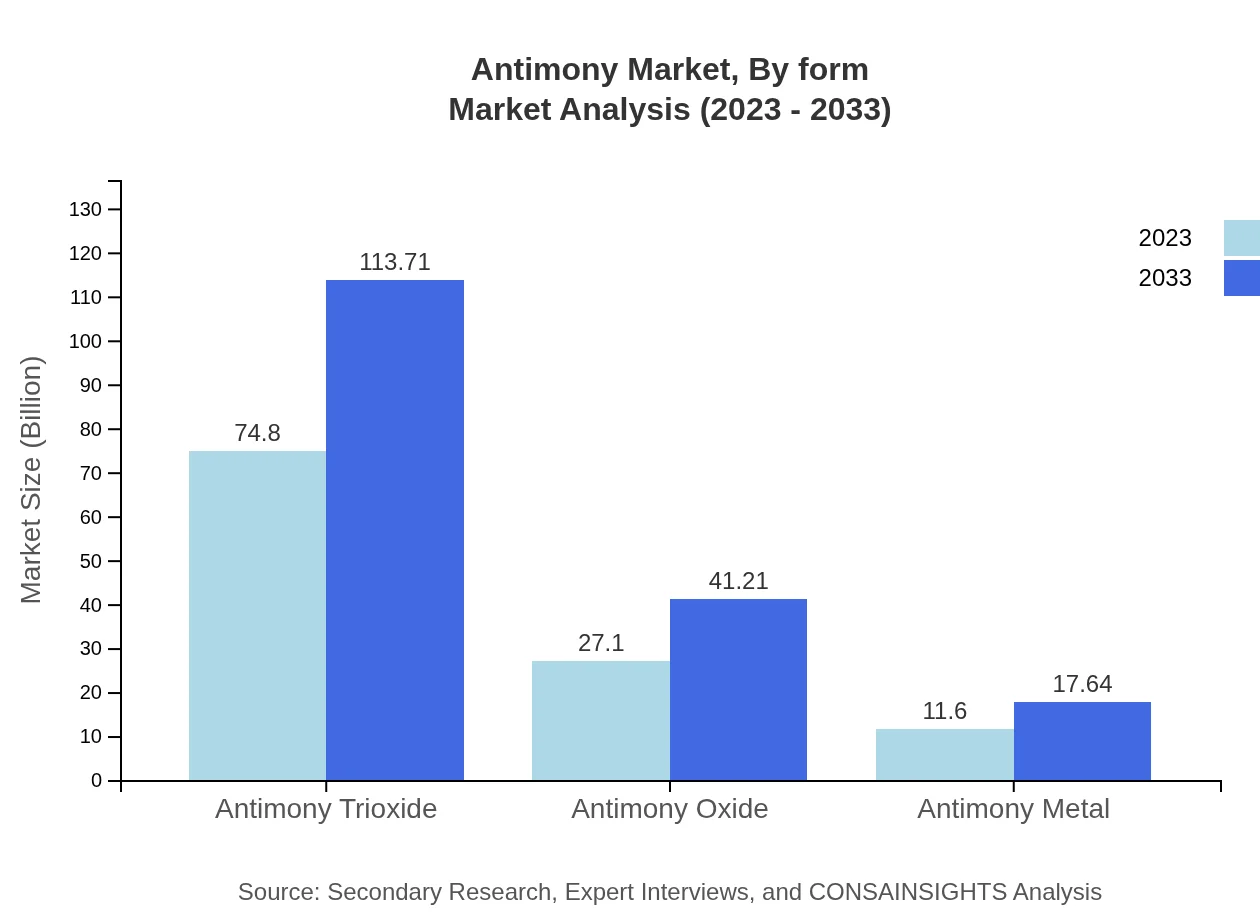

Antimony Market Analysis By Form

The by-form analysis reveals that antimony powder is gaining traction, serving diversified applications in the automotive and electronics sectors. The focus on high-purity formulations meets strict industry standards, indicating a transition towards quality over quantity.

Antimony Market Analysis By Application

Application-wise, the flame retardants sector is the largest, with an estimated size of $48.67 million in 2023, while construction applications are also expanding significantly in tandem with global infrastructure projects.

Antimony Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Antimony Industry

Mandalay Resources:

A leading mining and production company, Mandalay Resources specializes in antimony extraction and has significant operations in Australia and China.Hunan Nonferrous Metals Corporation:

This China-based enterprise is a major player in antimony production and processing, contributing significantly to the global supply chain.Wenfu Group:

Wenfu Group is recognized for its comprehensive mining and processing efforts, leading to significant advancements in antimony production technology.We're grateful to work with incredible clients.

FAQs

What is the market size of antimony?

The global antimony market is valued at approximately $113.5 million in 2023, with a projected annual growth rate (CAGR) of 4.2%. It is expected to continue expanding, reflecting increased demand across various applications.

What are the key market players or companies in this antimony industry?

Key players in the antimony market include global mining and chemical companies that specialize in antimony extraction and production. These companies drive innovation and supply to meet growing demand across industries such as electronics and flame retardants.

What are the primary factors driving the growth in the antimony industry?

Growth in the antimony market is primarily fueled by the increasing demand for flame retardants, advancements in electronics relying on antimony, and the material's use in lead-acid batteries, which are essential for the automotive industry.

Which region is the fastest Growing in the antimony market?

The Asia Pacific region is the fastest-growing in the antimony market, expanding from approximately $24.54 million in 2023 to $37.31 million by 2033, driven by rapid industrialization and increased utilization in various applications.

Does ConsaInsights provide customized market report data for the antimony industry?

Yes, ConsaInsights offers tailored market reports for the antimony industry, enabling clients to access specific data and insights to support their strategic decisions and understand market dynamics comprehensively.

What deliverables can I expect from this antimony market research project?

Deliverables from the antimony market research project will include comprehensive market analysis, segmented data by application and region, competitive landscape insights, and forecasts, all aimed at providing a clear market understanding.

What are the market trends of antimony?

Current trends in the antimony market include a rising focus on sustainable practices, increased demand for high-purity antimony in electronics, and advancements in flame retardant applications, reflecting broader industry trends towards safety and efficiency.