Antitheft System Market Report

Published Date: 31 January 2026 | Report Code: antitheft-system

Antitheft System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Antitheft System market, covering insights on market trends, segmentation, region-specific analyses, and forecasts from 2023 to 2033.

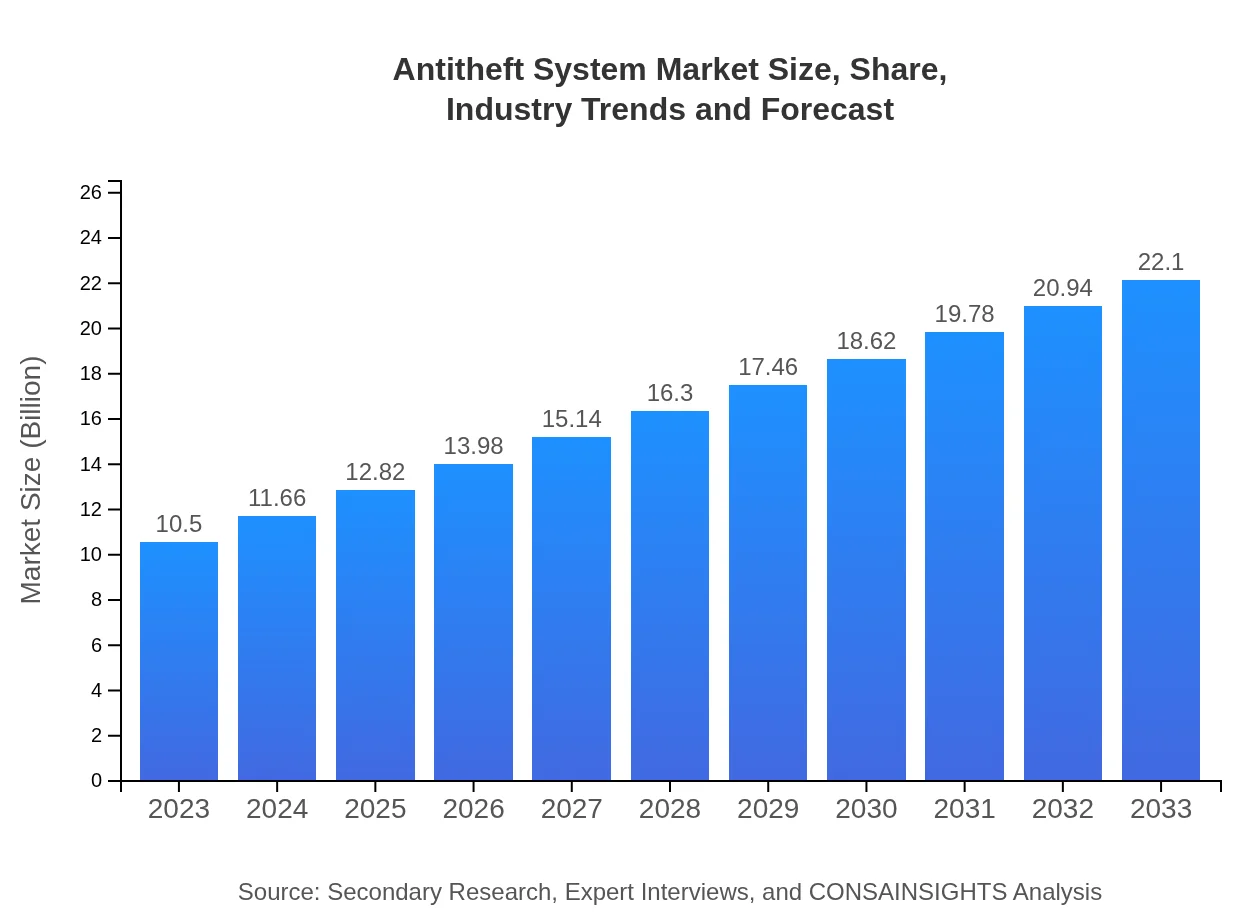

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $22.10 Billion |

| Top Companies | ADT Inc., Honeywell International Inc., Johnson Controls International plc., Bosch Security Systems |

| Last Modified Date | 31 January 2026 |

Antitheft System Market Overview

Customize Antitheft System Market Report market research report

- ✔ Get in-depth analysis of Antitheft System market size, growth, and forecasts.

- ✔ Understand Antitheft System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Antitheft System

What is the Market Size & CAGR of Antitheft System market in 2023?

Antitheft System Industry Analysis

Antitheft System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Antitheft System Market Analysis Report by Region

Europe Antitheft System Market Report:

In Europe, the Antitheft System market stands at $2.81 billion in 2023, with a potential increase to $5.91 billion by 2033. The region's growth is attributed to stringent regulations on security and increased installations of smart security systems.Asia Pacific Antitheft System Market Report:

In 2023, the Antitheft System market in the Asia Pacific region is valued at approximately $2.00 billion, projected to expand to $4.20 billion by 2033. Key drivers include rapid urbanization, increasing disposable incomes, and growing crime rates boosting demand for security solutions.North America Antitheft System Market Report:

North America is the largest market, with a size of $4.04 billion in 2023, anticipated to grow to $8.51 billion by 2033. The significant growth is fueled by high adoption rates of advanced security technologies in both residential and commercial sectors.South America Antitheft System Market Report:

South America is estimated to have a market size of $0.92 billion in 2023, expected to double to $1.93 billion by 2033. The growth is driven by heightened awareness of security risks and an influx of investments in technological advancements.Middle East & Africa Antitheft System Market Report:

The market in the Middle East and Africa is at $0.74 billion in 2023, likely to rise to $1.55 billion by 2033. The growth is significantly influenced by ongoing urbanization projects and heightened security measures in various countries.Tell us your focus area and get a customized research report.

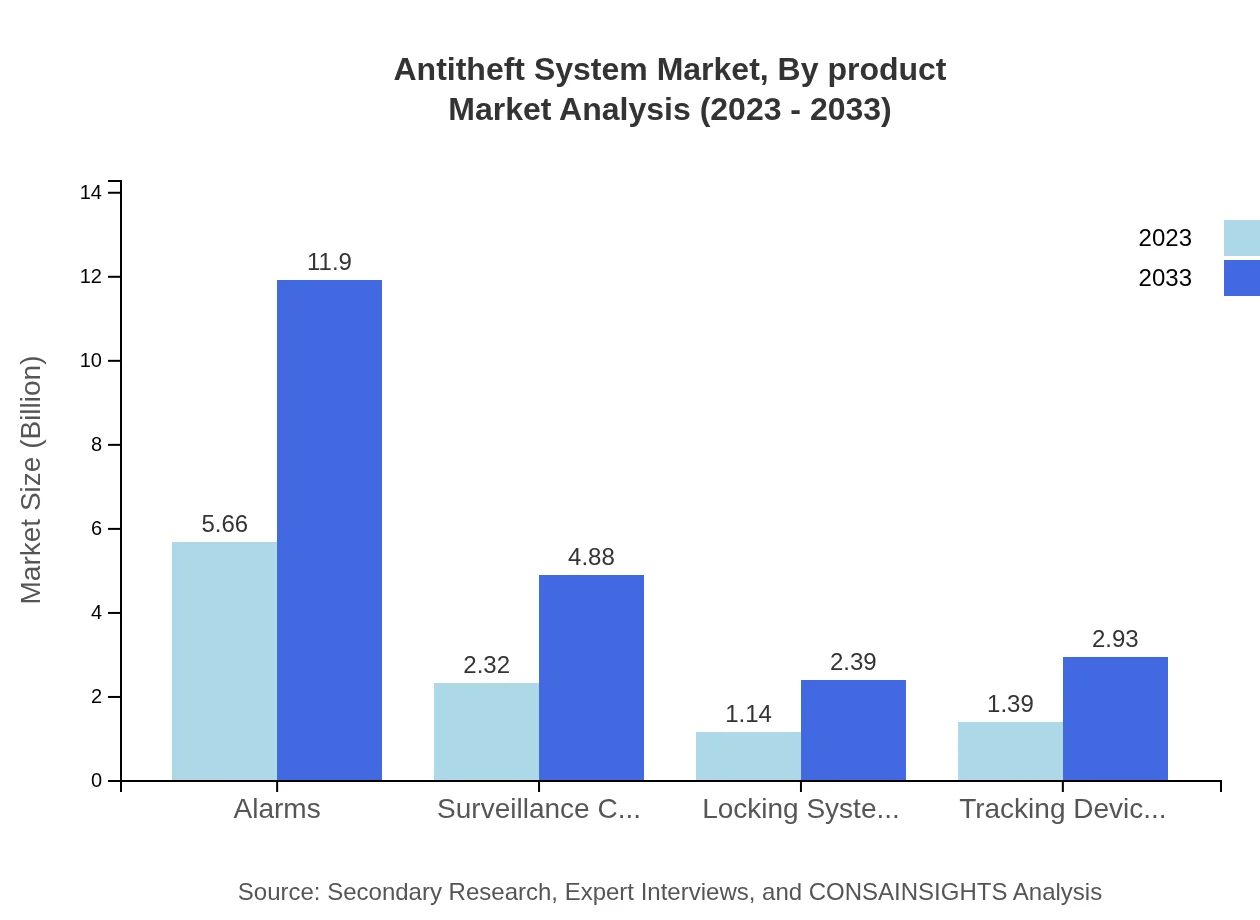

Antitheft System Market Analysis By Product

The product types contributing to the Antitheft System market demonstrate varied growth trajectories. Alarms dominate the market with a size of $5.66 billion in 2023, expected to reach $11.90 billion by 2033, holding a market share of 53.86%. Surveillance cameras and locking systems follow with projected growths from $2.32 billion to $4.88 billion and from $1.14 billion to $2.39 billion, respectively. Tracking devices are also witnessing a growth trend, from $1.39 billion to $2.93 billion.

Antitheft System Market Analysis By Application

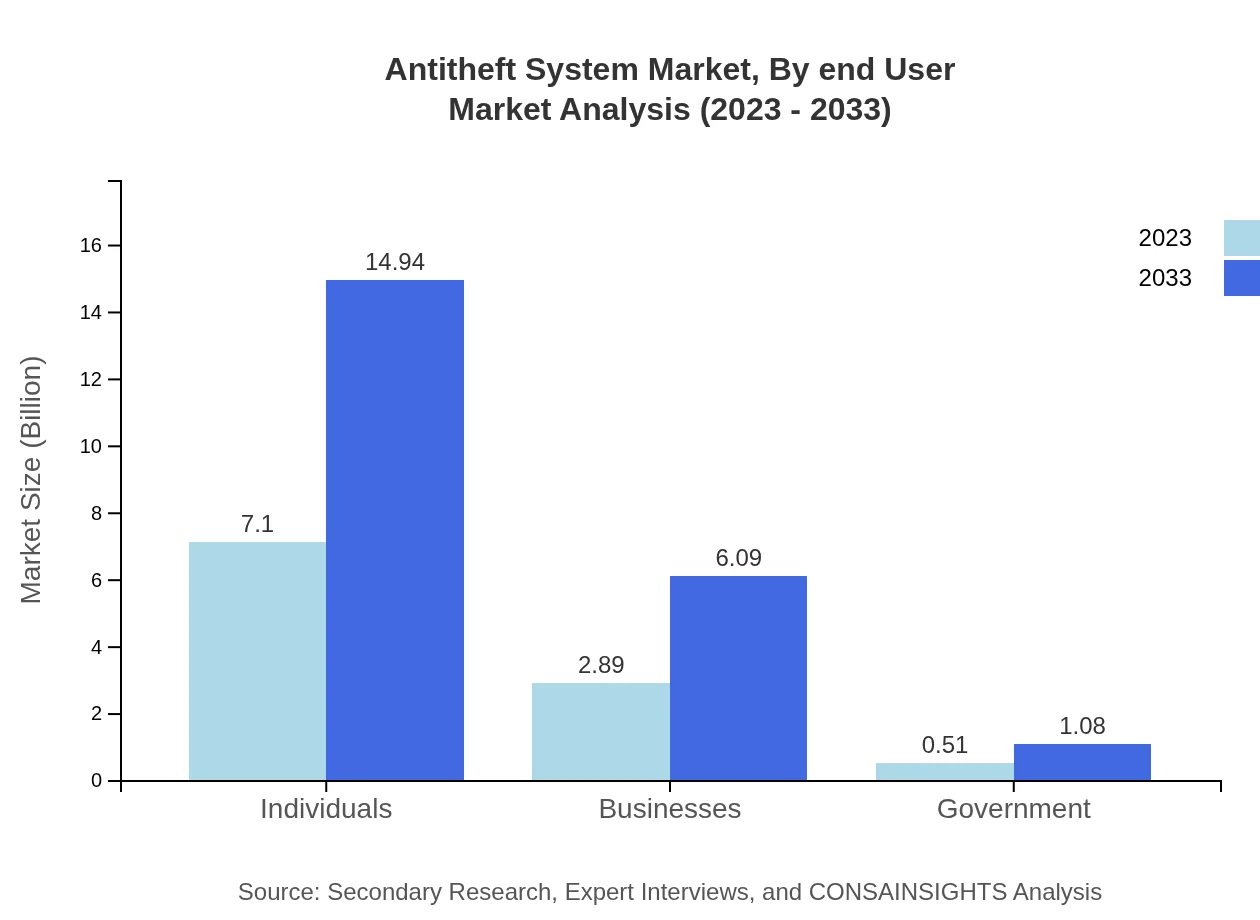

The application segment is pivotal in determining the demand for Antitheft Systems. Individuals account for the largest share with a market size of $7.10 billion in 2023, projected to grow to $14.94 billion by 2033 (67.58% share). Businesses and government segments also exhibit growth potential, increasing from $2.89 billion to $6.09 billion and from $0.51 billion to $1.08 billion, respectively.

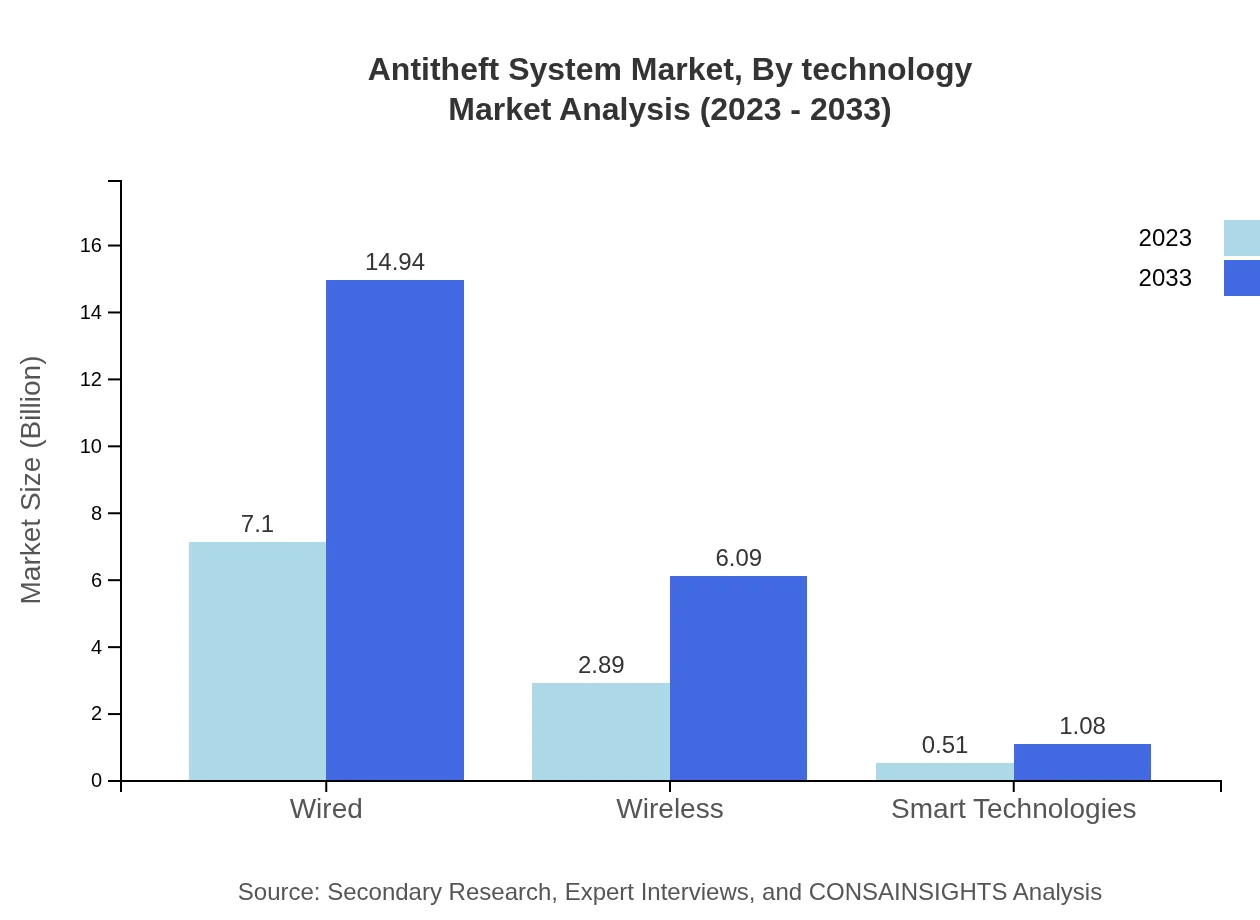

Antitheft System Market Analysis By Technology

The technology segment distinguishes products into wired and wireless solutions. Wired systems stand out with a size of $7.10 billion in 2023, expected to reach $14.94 billion by 2033, capturing 67.58% of the market share. Wireless technologies follow, growing from $2.89 billion to $6.09 billion, demonstrating increasing consumer preference for flexible and mobile solutions.

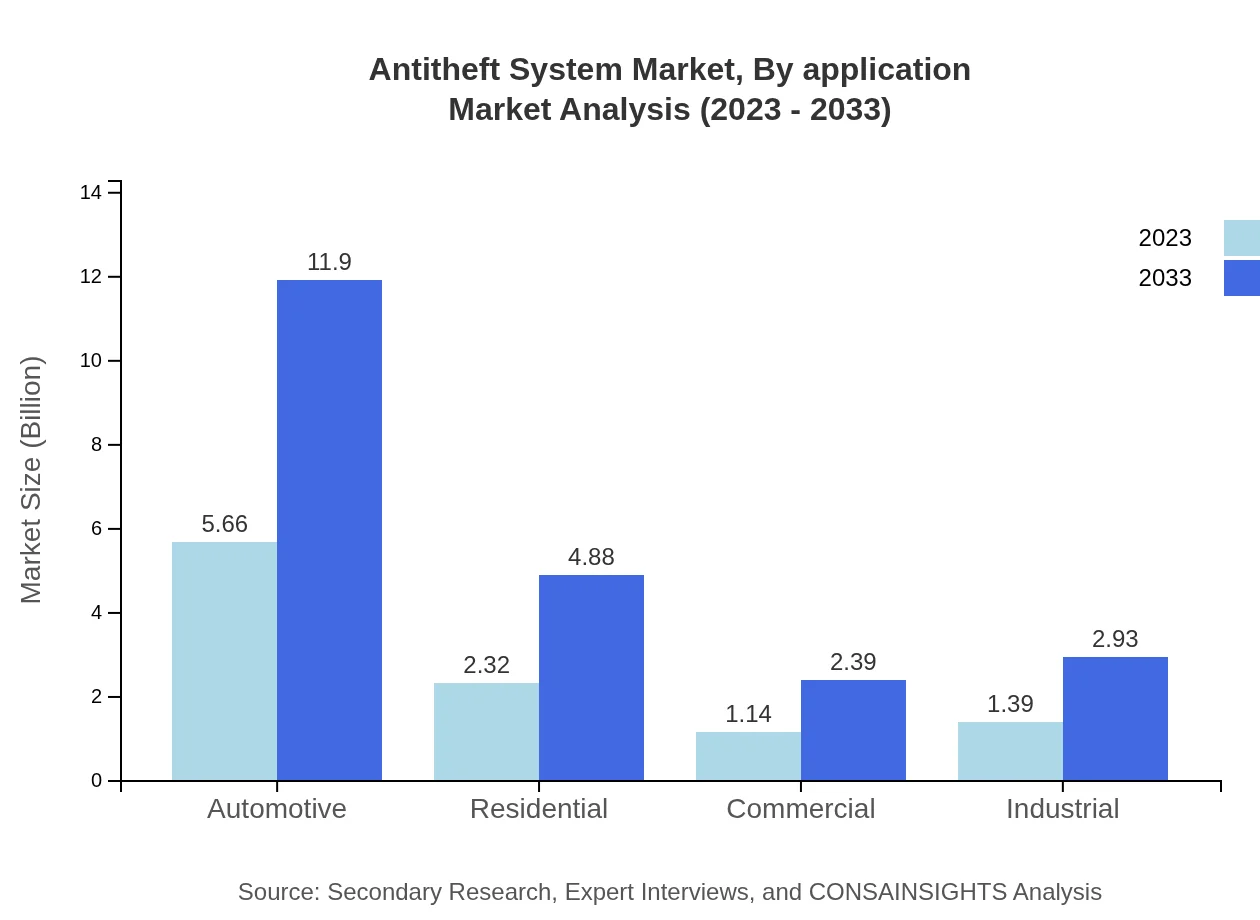

Antitheft System Market Analysis By End User

End-users play a crucial role in the adoption of Antitheft Systems. The automotive segment leads with a size of $5.66 billion in 2023, expected to grow to $11.90 billion by 2033, holding a significant share of 53.86%. Other segments, including residential and commercial users, are also projected to see notable growth in response to rising security demands.

Antitheft System Market Analysis By Distribution Channel

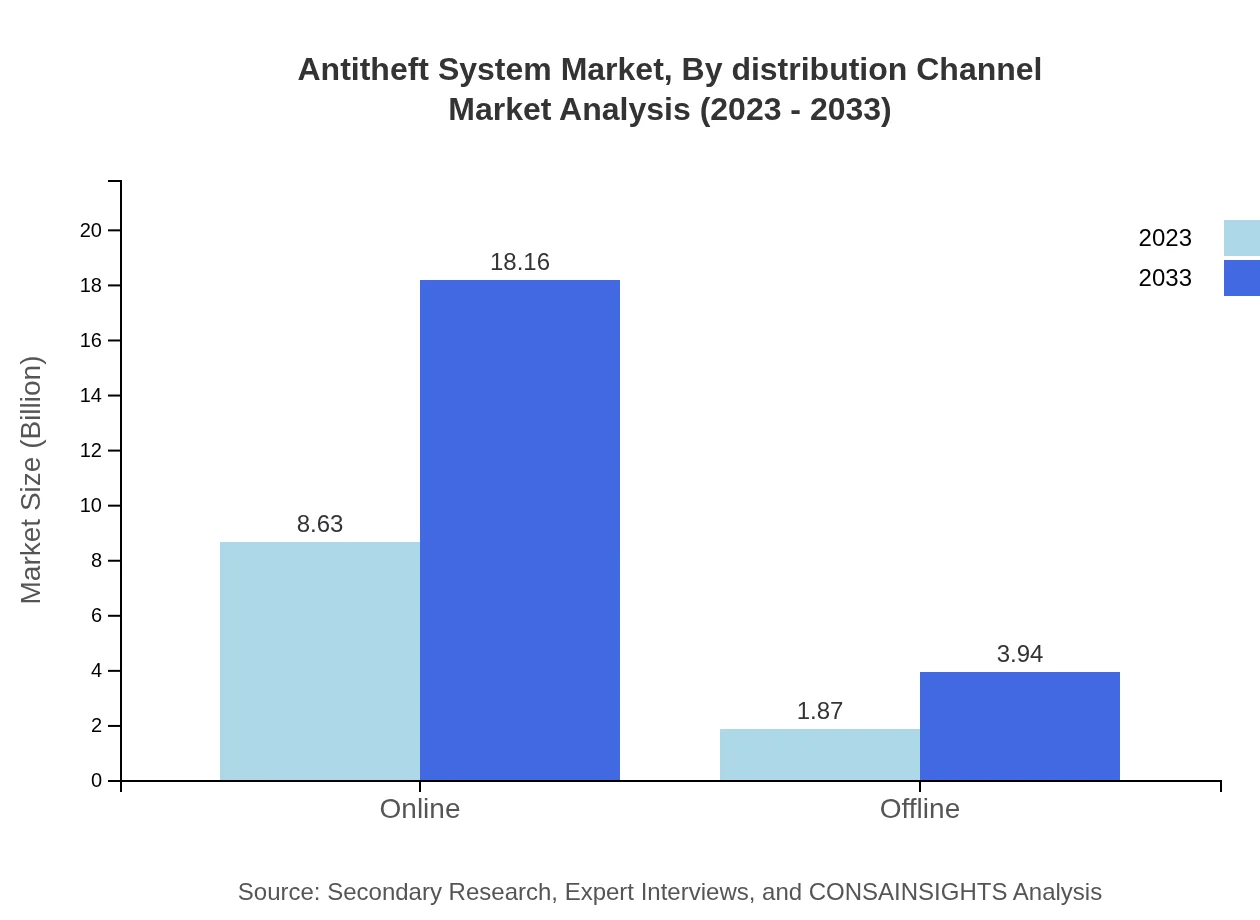

Distribution channels are critical in the Antitheft System market, with online channels leading sales at $8.63 billion in 2023, projected to grow to $18.16 billion by 2033, capturing 82.16% of the market share. Offline channels, although smaller, are projected to rise from $1.87 billion to $3.94 billion, as traditional retailers adapt to the evolving consumer purchasing behavior.

Antitheft System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Antitheft System Industry

ADT Inc.:

ADT Inc. is one of the largest security services providers in North America, recognized for its robust alarm systems and advanced home automation solutions.Honeywell International Inc.:

Honeywell is a multinational conglomerate that offers a range of high-tech security products including video surveillance systems and smart alarm units.Johnson Controls International plc.:

Johnson Controls is a global leader in smart building technologies, providing integrated security solutions that enhance safety across residential and commercial sectors.Bosch Security Systems:

Bosch Security Systems is renowned for delivering innovative surveillance and security products and solutions tailored to various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of antitheft System?

The global antitheft system market is currently valued at approximately $10.5 billion, with a projected compound annual growth rate (CAGR) of 7.5% from 2023 to 2033, indicating robust growth opportunities as security concerns escalate.

What are the key market players or companies in the antitheft System industry?

Key players in the antitheft system industry include established companies like ADT Inc., Axis Communications AB, and Bosch Security Systems, among others who contribute significantly to technological advancements and market competitiveness.

What are the primary factors driving the growth in the antitheft System industry?

Growth in the antitheft system industry is primarily driven by increasing consumer concerns regarding theft, advancements in technology, and heightened demand for security solutions in residential, commercial, and automotive sectors, propelling the market forward.

Which region is the fastest Growing in the antitheft system?

The North American region is the fastest-growing market for antitheft systems, expected to grow from $4.04 billion in 2023 to $8.51 billion by 2033, driven by robust security requirements and technological adoption.

Does Consainsights provide customized market report data for the antitheft System industry?

Yes, Consainsights offers tailored market report data for the antitheft system industry, allowing clients to specify their data requirements and receive insights that align with their strategic objectives.

What deliverables can I expect from this antitheft System market research project?

Deliverables from the antitheft system market research project include comprehensive reports, detailed data analytics, market forecasts, competitive landscapes, and strategic recommendations catering to various stakeholders in the industry.

What are the market trends of antitheft System?

Market trends in the antitheft system include the rise of smart technologies and wireless solutions, increasing integration of advanced surveillance systems, heightened focus on IoT applications, as well as growth in demand across various consumer segments.