Antiviral Drugs Market Report

Published Date: 31 January 2026 | Report Code: antiviral-drugs

Antiviral Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the antiviral drugs market, covering market trends, segmentation, and forecasts from 2023 to 2033. It provides valuable insights for industry stakeholders looking to understand growth opportunities and market dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

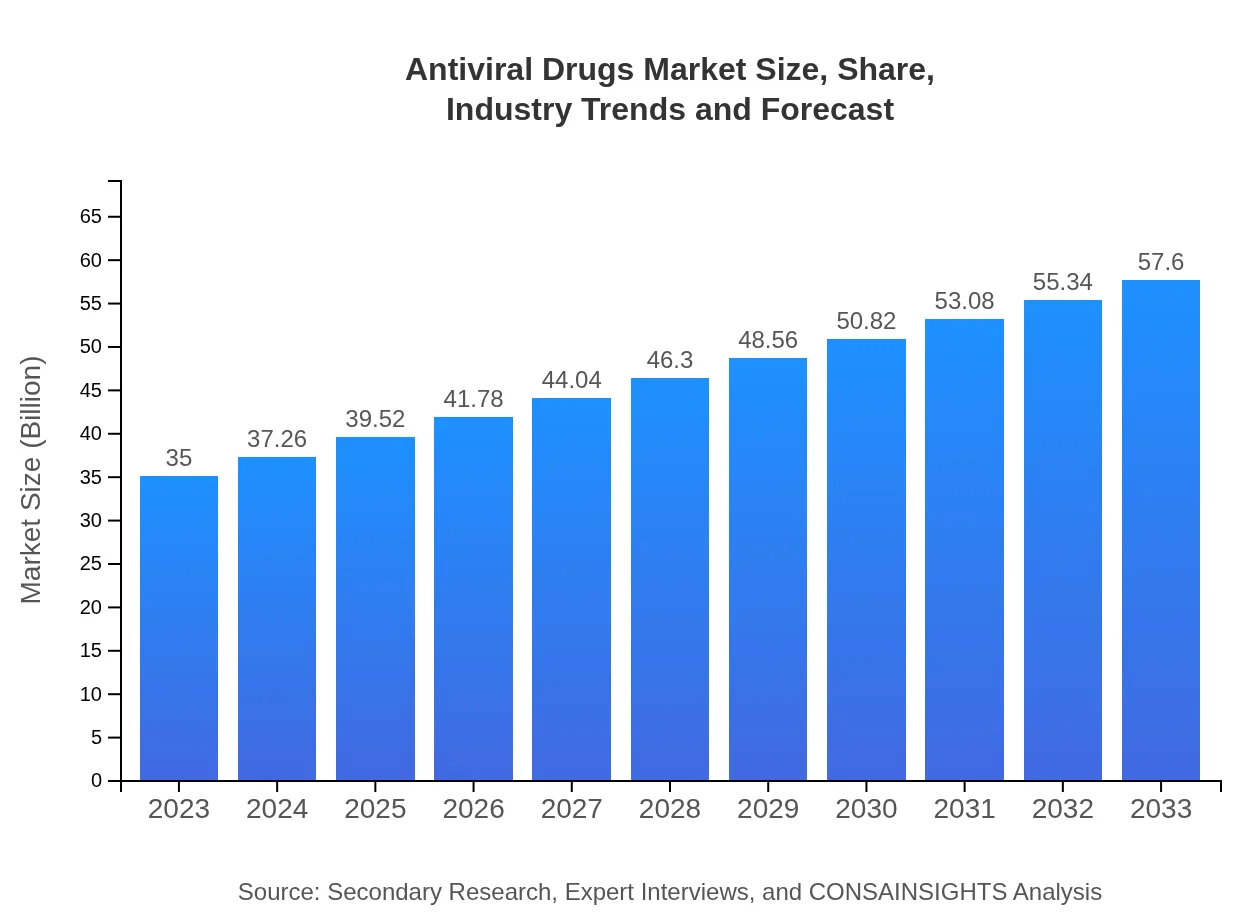

| 2023 Market Size | $35.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $57.60 Billion |

| Top Companies | Gilead Sciences, Roche, Merck & Co., AbbVie, GlaxoSmithKline |

| Last Modified Date | 31 January 2026 |

Antiviral Drugs Market Overview

Customize Antiviral Drugs Market Report market research report

- ✔ Get in-depth analysis of Antiviral Drugs market size, growth, and forecasts.

- ✔ Understand Antiviral Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Antiviral Drugs

What is the Market Size & CAGR of Antiviral Drugs market in 2023?

Antiviral Drugs Industry Analysis

Antiviral Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Antiviral Drugs Market Analysis Report by Region

Europe Antiviral Drugs Market Report:

Europe’s market for antiviral drugs is estimated at $9.35 billion in 2023, expanding to $15.38 billion by 2033. The growth is attributed to a well-established healthcare system and increased investment in R&D.Asia Pacific Antiviral Drugs Market Report:

In the Asia Pacific, the antiviral drugs market is valued at approximately $6.87 billion in 2023 and is expected to grow to $11.31 billion by 2033, driven by increasing healthcare access, rising incidences of viral infections, and supportive government initiatives.North America Antiviral Drugs Market Report:

North America is the largest market, valued at $12.19 billion in 2023, with projections to reach $20.06 billion by 2033. The demand is driven by innovative drug development, high healthcare expenditure, and prevalence of viral diseases.South America Antiviral Drugs Market Report:

The South American market, assessed at $2.33 billion in 2023, is projected to reach $3.83 billion by 2033. This growth is fueled by improving healthcare infrastructure and increased awareness about viral diseases.Middle East & Africa Antiviral Drugs Market Report:

In the Middle East and Africa, the market is currently worth $4.27 billion and is expected to grow to $7.03 billion by 2033. This growth is supported by expanding healthcare services and rising disease awareness.Tell us your focus area and get a customized research report.

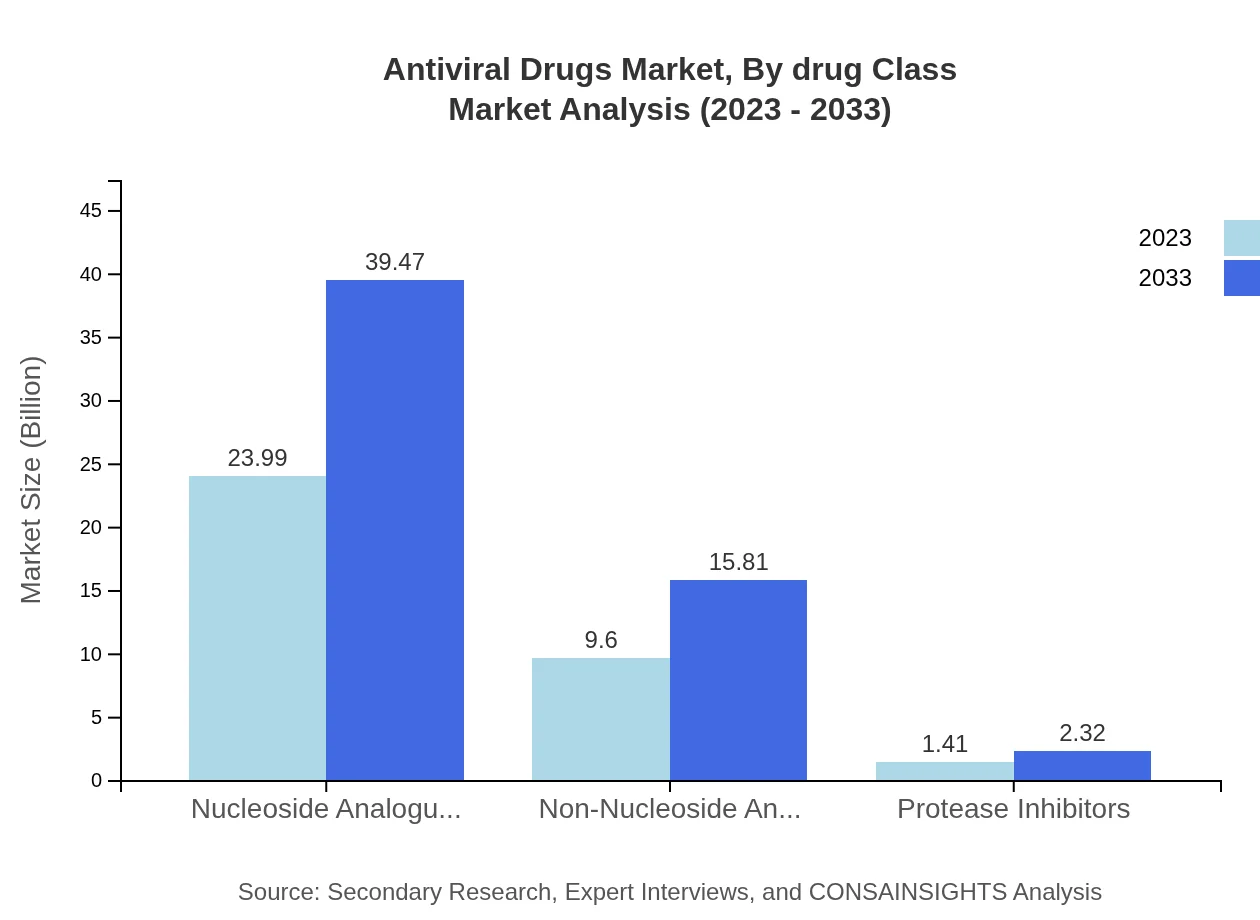

Antiviral Drugs Market Analysis By Drug Class

The drug class segment leads with nucleoside analogues accounting for 68.53% of the market share in 2023 and projected to maintain a similar share by 2033. Non-nucleoside analogues and protease inhibitors also contribute significantly, with shares of 27.44% and 4.03%, respectively.

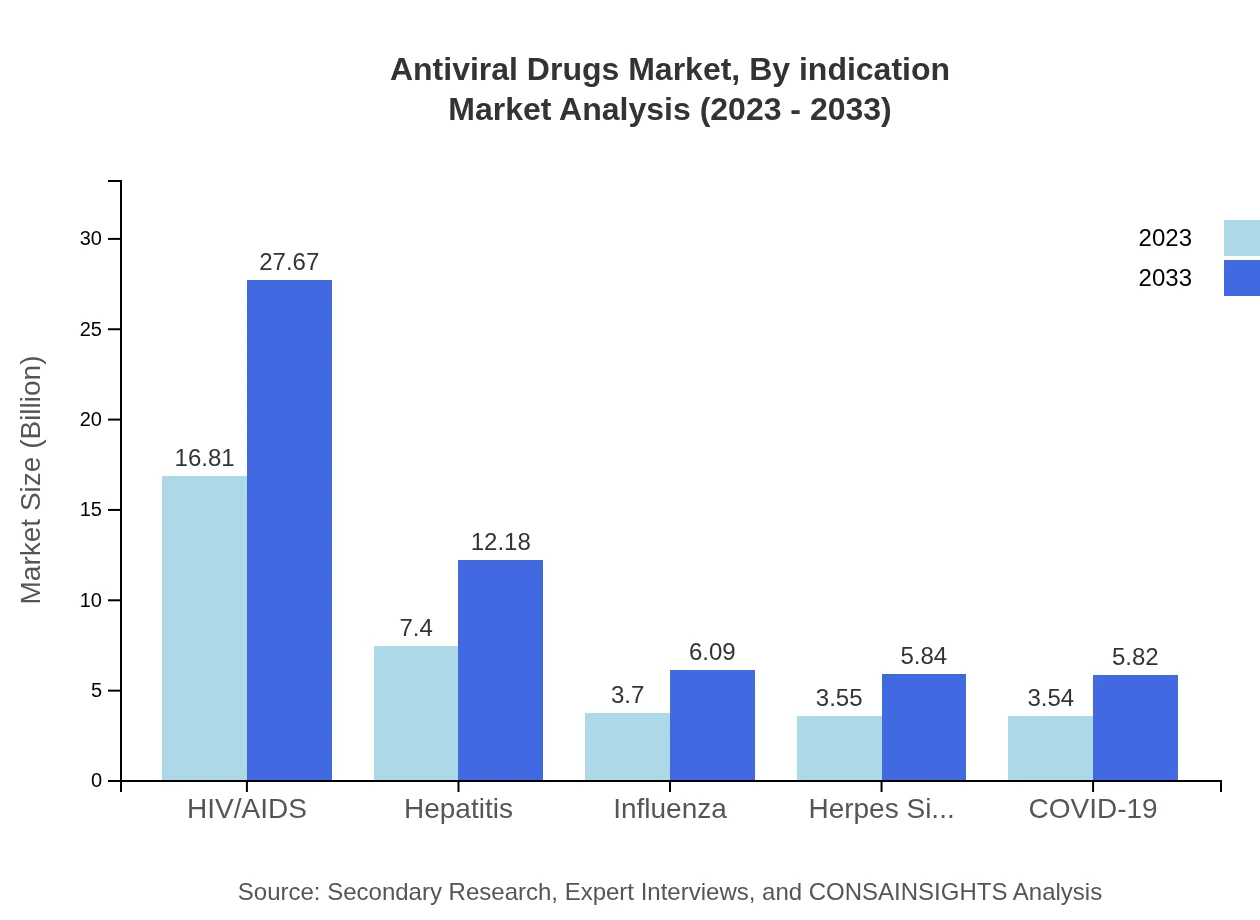

Antiviral Drugs Market Analysis By Indication

The HIV/AIDS segment is a major contributor, accounting for 48.04% of the market share in 2023, while hepatitis, influenza, and COVID-19 segments are also gaining traction due to increased patient awareness and prevalence.

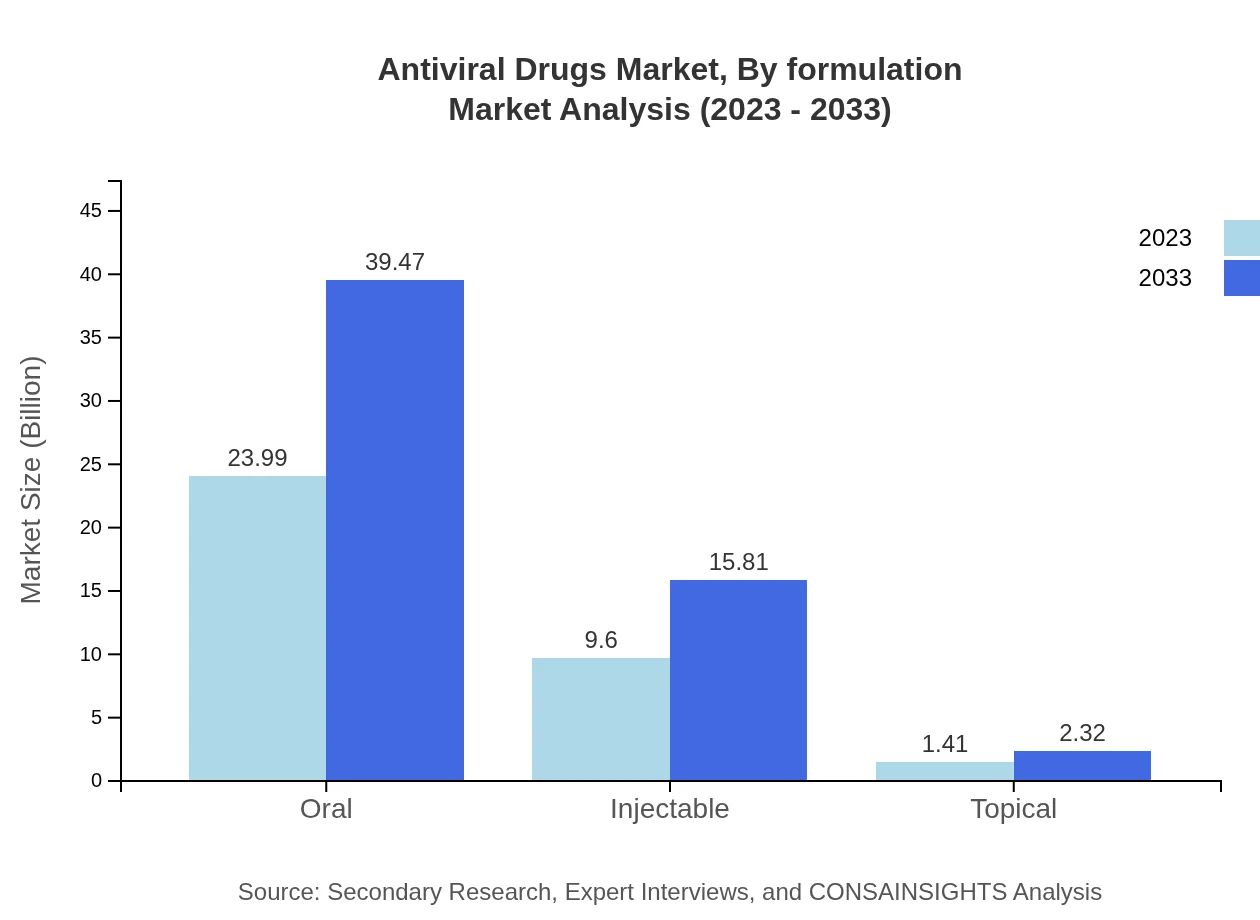

Antiviral Drugs Market Analysis By Formulation

Oral formulations dominate the market with a 68.53% share in 2023, while injectable forms represent 27.44% and topical forms 4.03% of the market, indicating consumer preference for ease of administration.

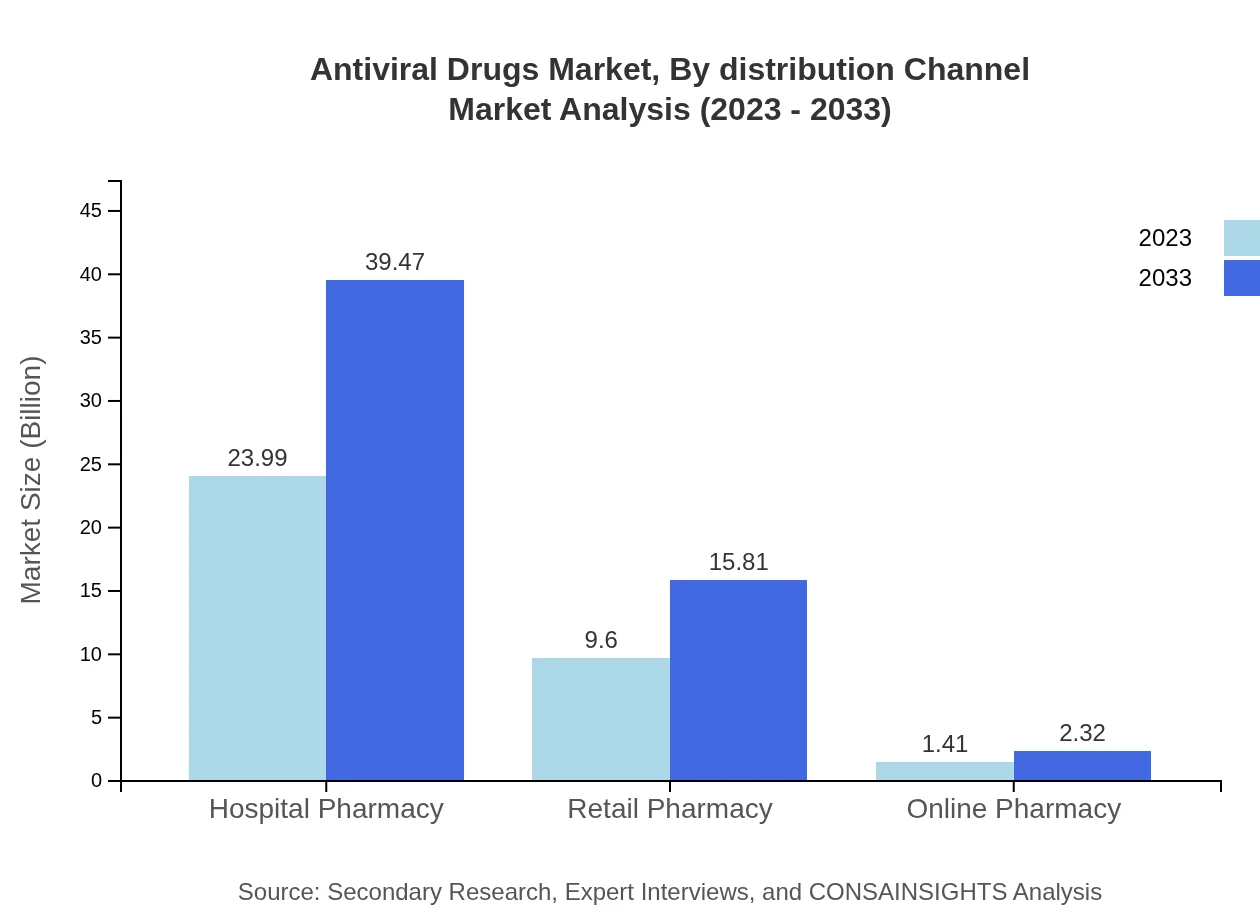

Antiviral Drugs Market Analysis By Distribution Channel

Hospital pharmacies lead the distribution channel with a 68.53% market share, followed by retail pharmacies at 27.44%, emphasizing hospital-based healthcare delivery in managing viral infections.

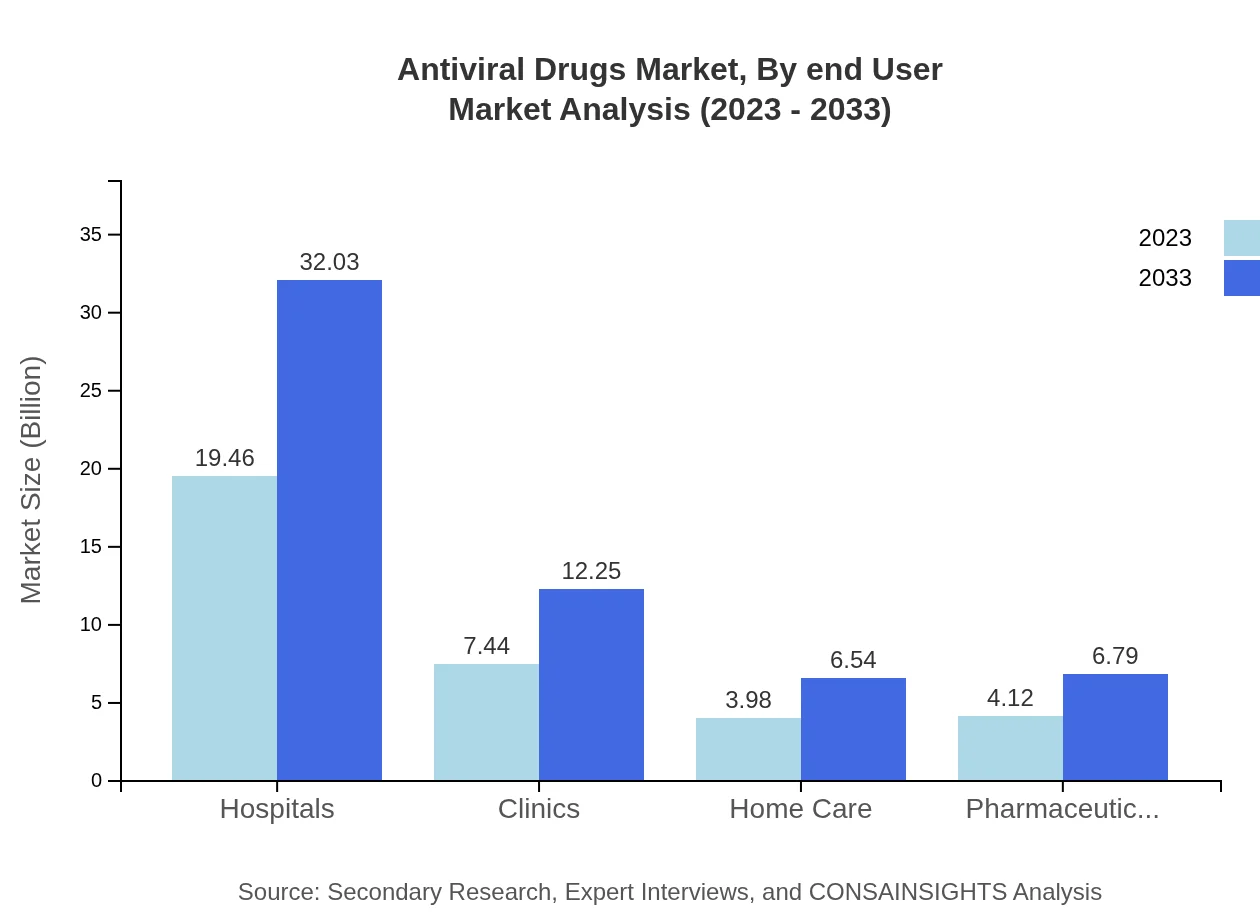

Antiviral Drugs Market Analysis By End User

Hospitals represent the largest end-user segment, holding a share of 55.6% in 2023, followed by clinics and home care settings, reflecting the critical role hospitals play in antiviral treatment protocols.

Antiviral Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Antiviral Drugs Industry

Gilead Sciences:

A key player in antiviral therapies focusing on HIV and hepatitis C treatments, known for its innovative drug pipeline.Roche:

A leading pharmaceutical company with a strong portfolio in antiviral medications, particularly for influenza and HIV.Merck & Co.:

An influential company in the antiviral market, recognized for its contributions to HIV and hepatitis drug development.AbbVie:

Specializes in the research and development of antiviral therapies, particularly in the hepatitis and HIV segments.GlaxoSmithKline:

An established player known for its antiviral product lines and a commitment to innovative research.We're grateful to work with incredible clients.

FAQs

What is the market size of antiviral Drugs?

The antiviral drugs market is currently valued at approximately $35 billion in 2023, with an expected Compound Annual Growth Rate (CAGR) of 5%, indicating substantial growth in the upcoming years.

What are the key market players or companies in this antiviral Drugs industry?

Key players in the antiviral drugs market include major pharmaceutical companies such as Gilead Sciences, Roche, GlaxoSmithKline, and AbbVie, known for their wide range of antiviral products and ongoing research.

What are the primary factors driving the growth in the antiviral Drugs industry?

The growth in the antiviral drugs industry is primarily driven by the increasing prevalence of viral infections, a rise in research funding, and advancements in drug development technologies.

Which region is the fastest Growing in the antiviral Drugs?

The North American region is expected to be the fastest-growing market for antiviral drugs, projected to expand from $12.19 billion in 2023 to $20.06 billion by 2033.

Does ConsaInsights provide customized market report data for the antiviral Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs, encompassing detailed analysis and forecasts in the antiviral drugs sector.

What deliverables can I expect from this antiviral Drugs market research project?

Clients can expect comprehensive reports including market size insights, growth forecasts, competitive analysis, and detailed segmentation data within the antiviral drugs research project.

What are the market trends of antiviral Drugs?

Current trends in the antiviral drugs market include the increasing preference for oral formulations and the growing focus on developing treatments for viral diseases like HIV, hepatitis, and influenza.