Apparel Logistics Market Report

Published Date: 02 February 2026 | Report Code: apparel-logistics

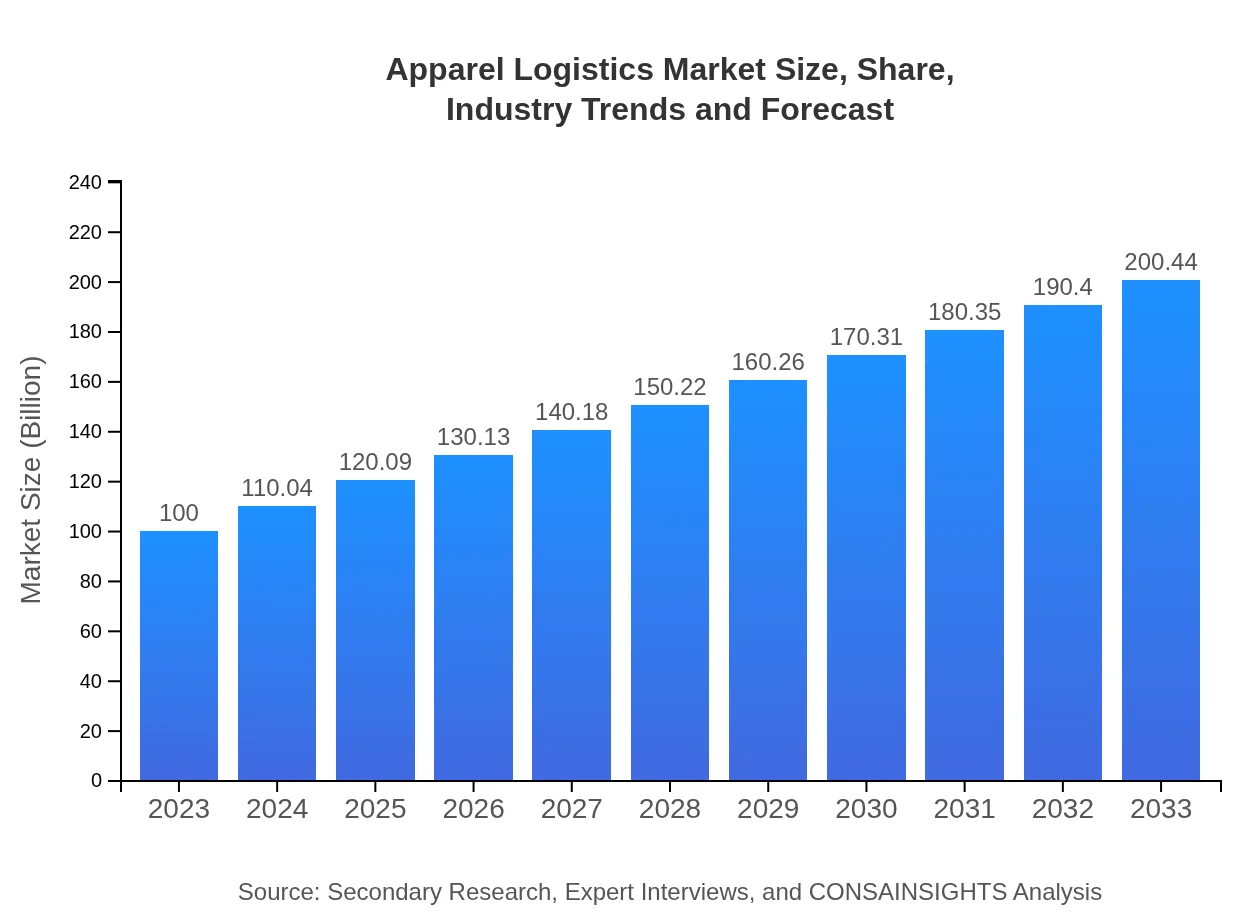

Apparel Logistics Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Apparel Logistics market, providing insights and analyses from 2023 to 2033. It covers market size, growth trends, regional analysis, technology impacts, leading companies, and future forecasts to aid strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $200.44 Billion |

| Top Companies | DHL Supply Chain, XPO Logistics, Kuehne + Nagel, FedEx |

| Last Modified Date | 02 February 2026 |

Apparel Logistics Market Overview

Customize Apparel Logistics Market Report market research report

- ✔ Get in-depth analysis of Apparel Logistics market size, growth, and forecasts.

- ✔ Understand Apparel Logistics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Apparel Logistics

What is the Market Size & CAGR of Apparel Logistics Market in 2023?

Apparel Logistics Industry Analysis

Apparel Logistics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Apparel Logistics Market Analysis Report by Region

Europe Apparel Logistics Market Report:

Europe’s Apparel Logistics market presents significant growth from USD 30.09 billion in 2023 to USD 60.31 billion by 2033. European countries are focusing on sustainability in logistics, impacting their operations positively. Also, Brexit has prompted companies to rethink their logistics strategies.Asia Pacific Apparel Logistics Market Report:

In 2023, the Apparel Logistics market in the Asia Pacific region is valued at approximately USD 20.52 billion, projected to double to USD 41.13 billion by 2033. Socioeconomic growth and increasing consumer spending drive this expansion, fueled by e-commerce growth. Countries like China and India are pivotal markets, supported by their substantial production and export capacities.North America Apparel Logistics Market Report:

North America shows a market value of USD 34.37 billion in 2023, expected to reach USD 68.89 billion by 2033. The region benefits from high consumer demand for fast fashion, substantial investments in logistics technology, and a robust transportation network that supports swift garment distribution.South America Apparel Logistics Market Report:

The South American market for Apparel Logistics is expected to grow from USD 8.82 billion in 2023 to USD 17.68 billion by 2033. This growth is supported by rising urbanization, improved infrastructure, and better international relationships. Companies are investing more in logistics to cater to a growing middle class with greater disposable income.Middle East & Africa Apparel Logistics Market Report:

The Middle East and Africa region sees the Apparel Logistics market growing from USD 6.20 billion in 2023 to USD 12.43 billion by 2033. The growth is driven by increasing retail activities, investment in supply chain innovations, and a growing focus on e-commerce as consumers shift towards online purchasing.Tell us your focus area and get a customized research report.

Apparel Logistics Market Analysis Automated Systems

Global Apparel Logistics Market, By Logistics Type Market Analysis (2023 - 2033)

The Automated Systems segment, valued at USD 68.87 billion in 2023, is expected to achieve USD 138.04 billion by 2033. The adoption of robotics and automation in warehouses improves the speed and accuracy of order fulfillment. This segment's growth underlines the importance of technological integration in logistics operations.

Apparel Logistics Market Analysis Tracking Technologies

Global Apparel Logistics Market, By Service Type Market Analysis (2023 - 2033)

Tracking Technologies exhibit significant growth, with market values expected to increase from USD 21.84 billion in 2023 to USD 43.78 billion by 2033. As logistics companies strive for transparency and efficiency, investing in tracking solutions enhances customer satisfaction and operational agility.

Apparel Logistics Market Analysis Third Party Logistics

Global Apparel Logistics Market, By Product Category Market Analysis (2023 - 2033)

Third-Party Logistics (3PL) remains a dominant force in the market, holding a steady 68.87% market share as it grows towards USD 138.04 billion by 2033. Retailers are increasingly outsourcing logistics functions to focus on core competencies while leveraging 3PL's expertise in this complex industry.

Apparel Logistics Market Analysis Customs Brokerage

Global Apparel Logistics Market, By Technology Market Analysis (2023 - 2033)

Customs Brokerage plays a crucial role, leveraging automation to streamline cross-border movements, projected to grow from USD 21.84 billion in 2023 to USD 43.78 billion by 2033. Efficient customs processing is paramount as global trade regulations become increasingly stringent.

Apparel Logistics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Apparel Logistics Industry

DHL Supply Chain:

DHL Supply Chain offers integrated solutions for managed logistics in the apparel sector, focusing on enhancing efficiency and sustainability.XPO Logistics:

XPO Logistics provides innovative logistics solutions powered by technology, designed to meet the fast-paced demands of the apparel industry, including advanced warehousing and distribution services.Kuehne + Nagel:

Kuehne + Nagel is a global leader in logistics offering tailor-made solutions for the apparel industry, emphasizing real-time tracking and customized supply chain management.FedEx :

FedEx offers comprehensive logistics solutions, including international shipping and supply chain optimization specifically tailored for the garment sector.We're grateful to work with incredible clients.

FAQs

What is the market size of apparel Logistics?

The global apparel logistics market is projected to reach approximately $100 billion by 2033, with a compound annual growth rate (CAGR) of 7% from 2023 to 2033, indicating robust growth in the sector.

What are the key market players or companies in the apparel Logistics industry?

Key players in the apparel logistics industry include major courier, logistics, and third-party logistics companies. Their roles span transportation, warehousing, and complete supply chain solutions tailored for the apparel market.

What are the primary factors driving the growth in the apparel Logistics industry?

Growth drivers in apparel logistics include rising e-commerce demand, advancements in supply chain technologies, and the pursuit of efficient, sustainable distribution methods to improve customer satisfaction and reduce operational costs.

Which region is the fastest Growing in the apparel Logistics?

The North American region currently leads with a market value of $68.89 billion projected by 2033, followed by Europe and Asia Pacific, showcasing the fastest growth trajectories in apparel logistics.

Does ConsaInsights provide customized market report data for the apparel Logistics industry?

Yes, ConsaInsights offers customized market reporting solutions tailored to specific needs within the apparel logistics industry, ensuring stakeholders gain relevant insights and data-driven strategies.

What deliverables can I expect from this apparel Logistics market research project?

The deliverables include comprehensive reports detailing market size, growth forecasts, competitive analysis, regional insights, and segment-specific data to inform strategic decisions in apparel logistics.

What are the market trends of apparel Logistics?

Emerging trends in apparel logistics feature increased automation, utilization of tracking technologies, and growing emphasis on sustainable practices to meet customer expectations and enhance operational efficiency.