Application Delivery Network Market Report

Published Date: 31 January 2026 | Report Code: application-delivery-network

Application Delivery Network Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Application Delivery Network market, covering key trends, forecasts, and analyses from 2023 to 2033. It explores market dynamics, regional outlooks, segments, leading players, and future growth trajectories.

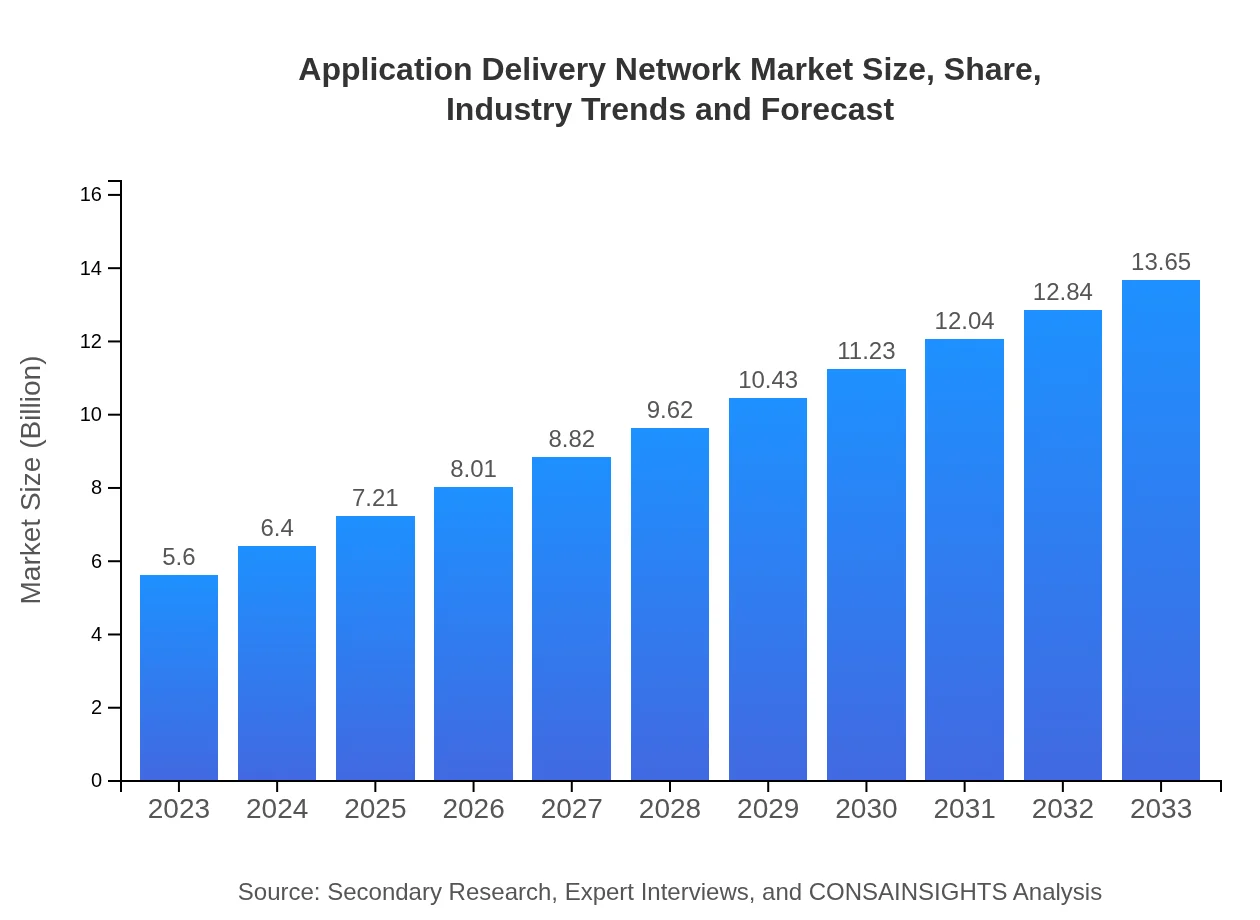

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $13.65 Billion |

| Top Companies | F5 Networks, Inc., Citrix Systems, Inc., Akamai Technologies, Inc., Amazon Web Services, Inc., Loadbalancer.org |

| Last Modified Date | 31 January 2026 |

Application Delivery Network Market Overview

Customize Application Delivery Network Market Report market research report

- ✔ Get in-depth analysis of Application Delivery Network market size, growth, and forecasts.

- ✔ Understand Application Delivery Network's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Application Delivery Network

What is the Market Size & CAGR of Application Delivery Network market in 2023 and 2033?

Application Delivery Network Industry Analysis

Application Delivery Network Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Application Delivery Network Market Analysis Report by Region

Europe Application Delivery Network Market Report:

In Europe, the ADN market is anticipated to expand from $1.66 billion in 2023 to $4.04 billion by 2033, reflecting a CAGR of 9.24%. The region's digital transformation initiatives and regulatory compliance measures are enhancing market opportunities.Asia Pacific Application Delivery Network Market Report:

In the Asia Pacific region, the Application Delivery Network market is expected to grow from $1.07 billion in 2023 to $2.60 billion by 2033, highlighting a robust CAGR of 9.04%. Driving factors include increasing internet penetration, rapid digitalization, and a burgeoning e-commerce ecosystem.North America Application Delivery Network Market Report:

North America holds a significant share of the ADN market, with estimates of $2.04 billion in 2023 and a projected market size of $4.96 billion by 2033, corresponding to a CAGR of 9.32%. Factors such as technological advancements, early adoption of cloud technologies, and the proliferation of data centers are key growth drivers.South America Application Delivery Network Market Report:

The South American Application Delivery Network market, currently valued at $0.33 billion in 2023, is projected to reach $0.80 billion by 2033, reflecting a CAGR of 9.29%. This growth is facilitated by rising mobile data usage and the need for reliable application delivery solutions to enhance customer experiences.Middle East & Africa Application Delivery Network Market Report:

The Middle East and Africa ADN market, valued at $0.51 billion in 2023, is expected to grow to $1.25 billion by 2033, exhibiting a CAGR of 9.42%. The region's growing emphasis on cybersecurity and increasing internet connectivity are factors driving this growth.Tell us your focus area and get a customized research report.

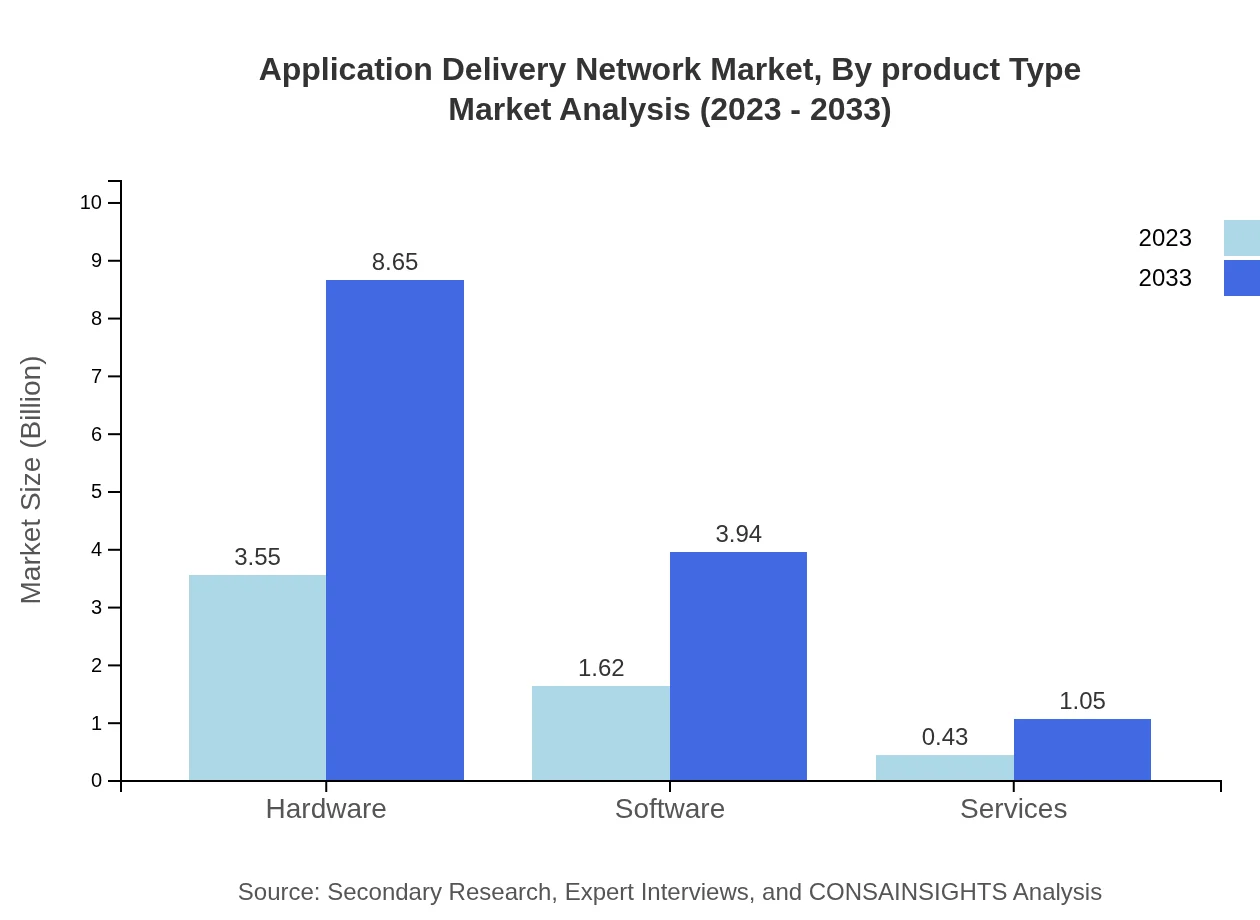

Application Delivery Network Market Analysis By Product Type

The Application Delivery Network, by product type, showcases a significant dominance of hardware solutions, which account for approximately $3.55 billion in 2023 and are expected to rise to $8.65 billion by 2033, maintaining a share of 63.39%. Software solutions represent a growing opportunity, projected to increase from $1.62 billion in 2023 to $3.94 billion by 2033, capturing a notable share of 28.89%.

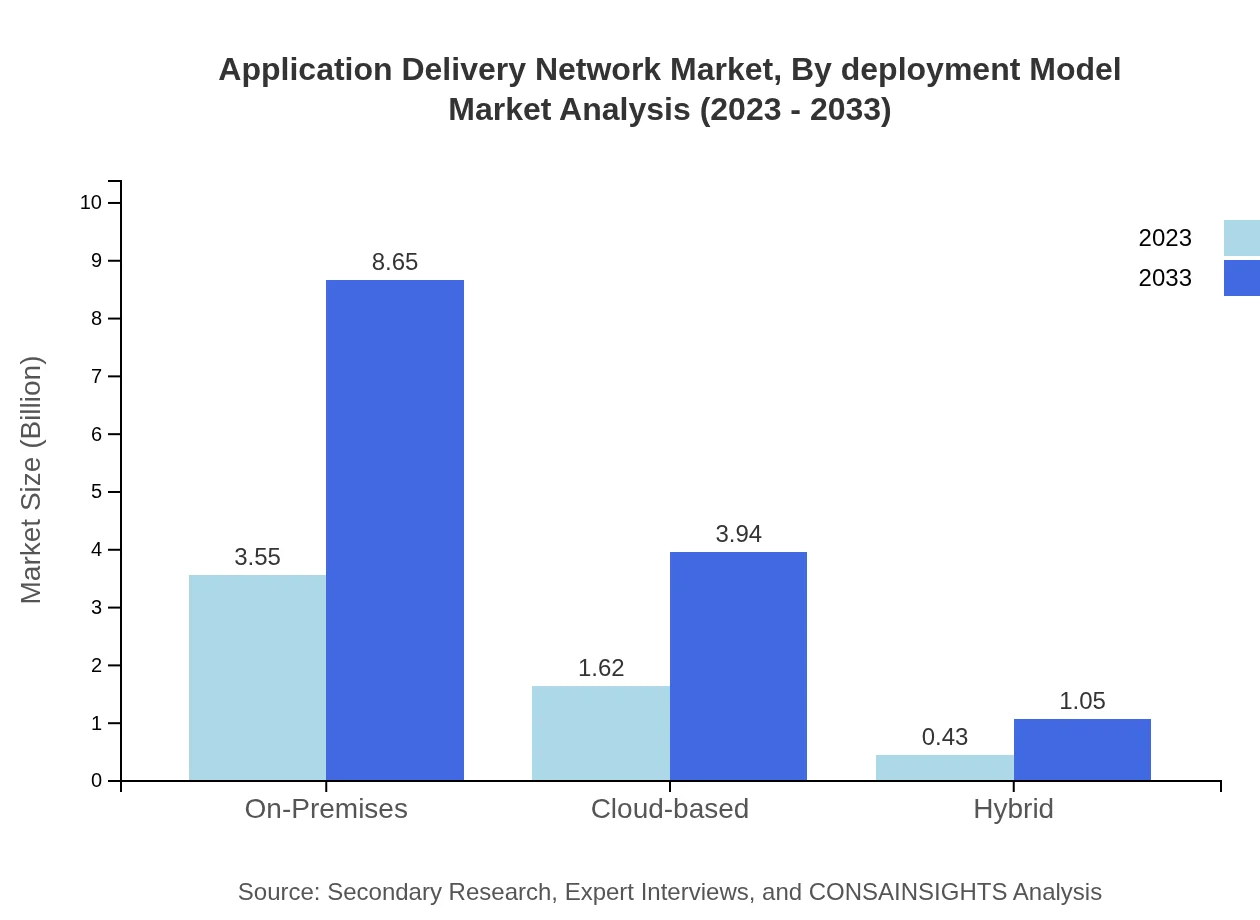

Application Delivery Network Market Analysis By Deployment Model

Deployment models are critical in shaping the Application Delivery Network's approach, with on-premises models dominating at $3.55 billion in 2023, rising to $8.65 billion by 2033, equivalent to a 63.39% market share. Cloud-based models are also significant, forecasted to grow from $1.62 billion to $3.94 billion, and hybrid models making up a smaller yet growing segment, from $0.43 billion to $1.05 billion.

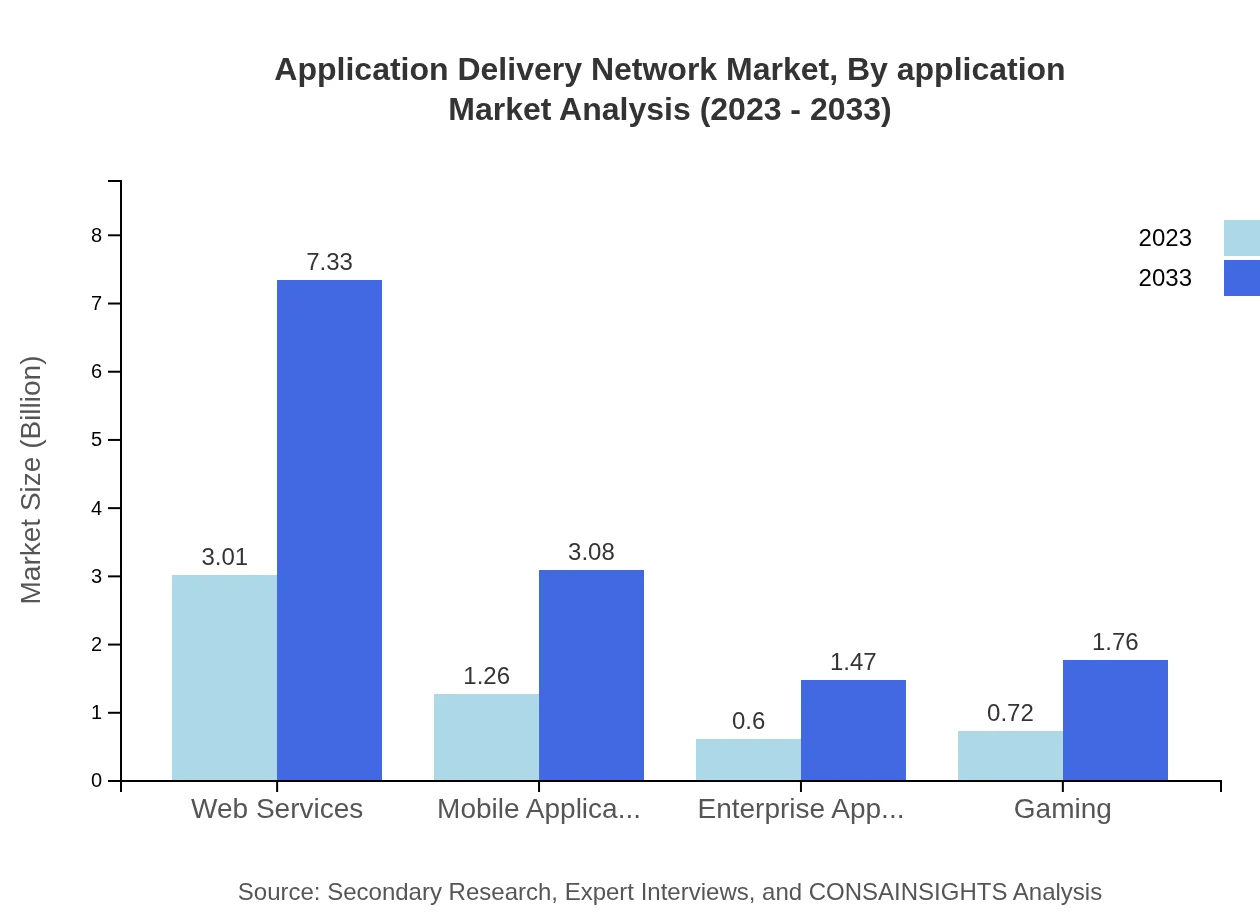

Application Delivery Network Market Analysis By Application

In terms of application segments, web services lead the market with a size of $3.01 billion in 2023, reaching $7.33 billion by 2033, accounting for a robust share of 53.74%. Mobile applications and enterprise applications follow, with significant projections and shares, while gaming and healthcare applications reflect lower values but represent niche growth opportunities.

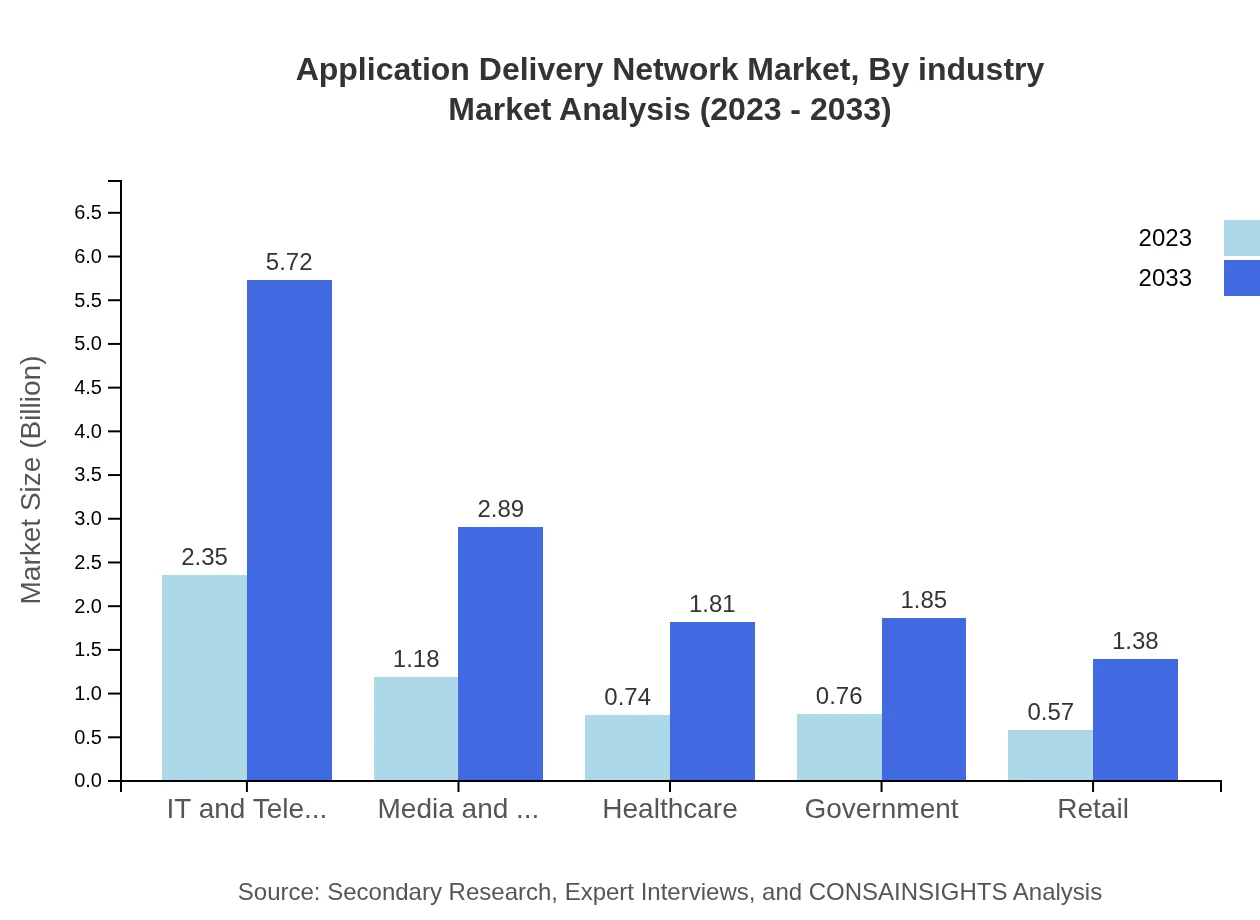

Application Delivery Network Market Analysis By Industry

The Application Delivery Network market is heavily influenced by the IT and Telecom sector, comprising $2.35 billion in 2023 and anticipated to escalate to $5.72 billion by 2033, securing a dominant share of 41.89%. Other sectors like media & entertainment and healthcare demonstrate strong growth patterns and represent critical industries relying on ADN for enhanced performance.

Application Delivery Network Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Application Delivery Network Industry

F5 Networks, Inc.:

F5 Networks is a prominent player in the Application Delivery industry, offering solutions that ensure application security, availability, and performance through their advanced software and hardware products.Citrix Systems, Inc.:

Citrix specializes in virtualization technology and is recognized for its application delivery and networking products, addressing contemporary enterprise needs for remote work and cloud access.Akamai Technologies, Inc.:

Akamai is a leading content delivery network (CDN) provider, enhancing application performance and security through innovative services, catering to a diverse customer base.Amazon Web Services, Inc.:

AWS provides robust cloud-based application delivery solutions, leveraging its vast infrastructure to deliver high-performance applications globally.Loadbalancer.org:

Loadbalancer.org offers advanced load balancing solutions, emphasizing the importance of reliable application delivery and uptime for businesses worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of Application Delivery Network?

The application delivery network market is currently valued at approximately $5.6 billion, with an expected CAGR of 9% over the next decade. This growth indicates a substantial increase in demand and investment in this sector by 2033.

What are the key market players or companies in the Application Delivery Network industry?

Key players in the application delivery network industry include Akamai Technologies, Cloudflare, F5 Networks, Citrix Systems, and Amazon Web Services. These companies dominate in delivering robust application delivery solutions to various sectors.

What are the primary factors driving the growth in the Application Delivery Network industry?

Growth factors include increasing online traffic, the surge in mobile applications, the rise of cloud computing, enhanced security needs, and demand for better application performance. These factors collectively enhance the necessity for application delivery networks.

Which region is the fastest Growing in the Application Delivery Network?

The fastest-growing region is expected to be North America, with the market projected to grow from $2.04 billion in 2023 to $4.96 billion by 2033. This growth is attributed to technological advancements and an increase in online services.

Does Consainsights provide customized market report data for the Application Delivery Network industry?

Yes, Consainsights offers customized market report data tailored to specific client needs within the application delivery network industry. This includes bespoke analysis and detailed segments to support strategic decision-making.

What deliverables can I expect from this Application Delivery Network market research project?

Deliverables from the market research project include detailed market analysis, regional breakdowns, competitive landscape assessments, growth forecasts, and sector-specific insights, providing a comprehensive overview of the application delivery network landscape.

What are the market trends of Application Delivery Network?

Key market trends include increasing adoption of cloud services, integration of AI for optimized performance, rising security concerns, and growing mobile connectivity, reflecting broader shifts towards enhanced network efficiency and reliability.