Application Infrastructure Middleware Market Report

Published Date: 31 January 2026 | Report Code: application-infrastructure-middleware

Application Infrastructure Middleware Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Application Infrastructure Middleware market, covering trends, forecasts, and competitive landscape from 2023 to 2033. Insights into market size, regional performance, and segment analysis will be explored to guide strategic decision-making.

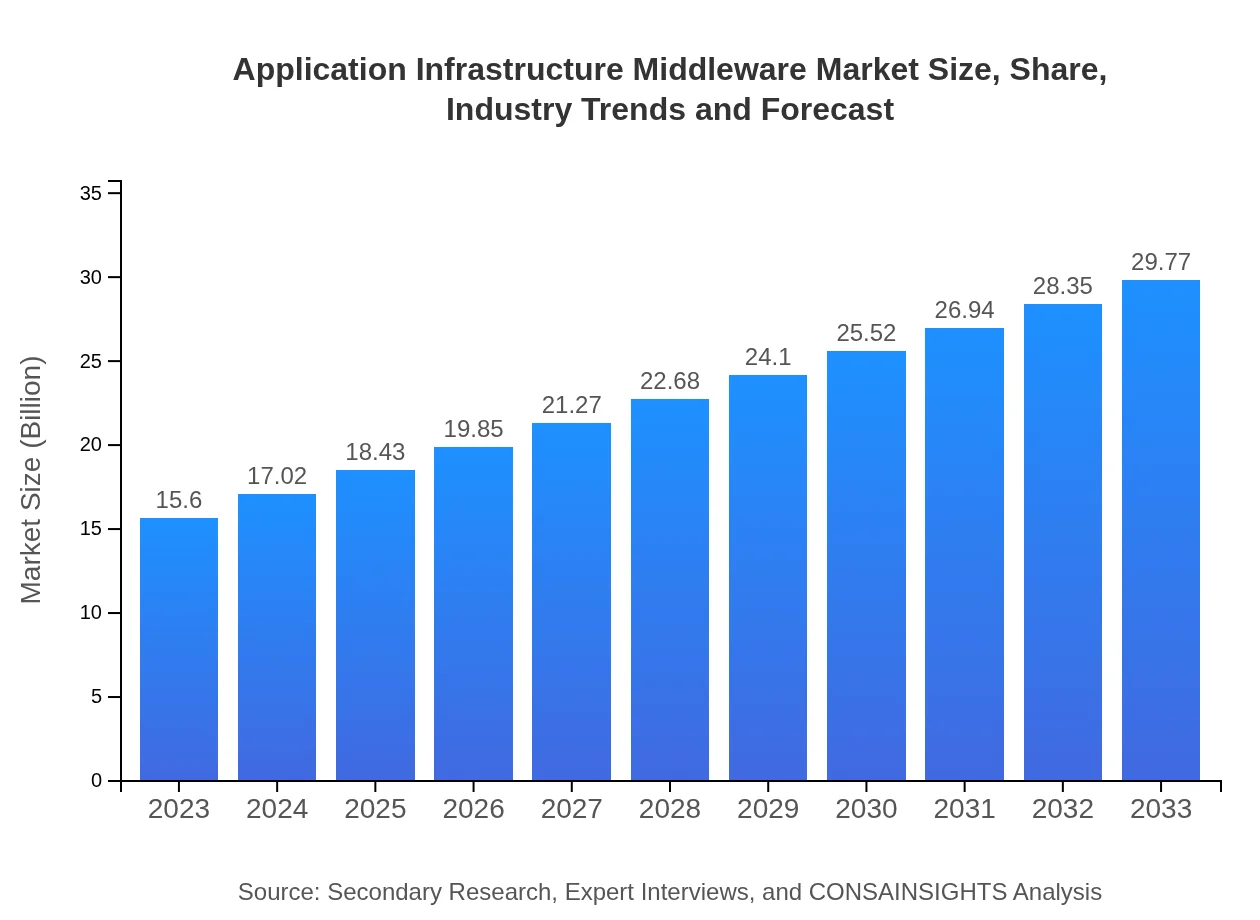

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $29.77 Billion |

| Top Companies | IBM, Oracle, Microsoft, SAP, Red Hat |

| Last Modified Date | 31 January 2026 |

Application Infrastructure Middleware Market Overview

Customize Application Infrastructure Middleware Market Report market research report

- ✔ Get in-depth analysis of Application Infrastructure Middleware market size, growth, and forecasts.

- ✔ Understand Application Infrastructure Middleware's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Application Infrastructure Middleware

What is the Market Size & CAGR of Application Infrastructure Middleware market in 2023?

Application Infrastructure Middleware Industry Analysis

Application Infrastructure Middleware Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Application Infrastructure Middleware Market Analysis Report by Region

Europe Application Infrastructure Middleware Market Report:

Europe's market is projected to grow from $3.96 billion in 2023, reaching $7.55 billion by 2033. Factors contributing to this growth include stringent regulations, a significant focus on data protection, and increasing demand for seamless process integration across sectors. The rise in hybrid cloud deployments emphasizes the need for robust middleware solutions.Asia Pacific Application Infrastructure Middleware Market Report:

In the Asia-Pacific region, the Application Infrastructure Middleware market is projected to grow from $3.21 billion in 2023 to $6.13 billion by 2033, fueled by increasing digital transformation initiatives and a burgeoning IT professional landscape. The proliferation of cloud technologies and IoT applications significantly boosts demand for middleware solutions in various sectors, particularly manufacturing and healthcare.North America Application Infrastructure Middleware Market Report:

The North American market stands as a leader, anticipated to expand from $6.08 billion in 2023 to an impressive $11.60 billion by 2033. High demand for cloud services and the continuous evolution of enterprise application integration drive this growth. Established market players are actively investing in developing advanced middleware solutions to maintain their competitive edge.South America Application Infrastructure Middleware Market Report:

South America is anticipated to experience steady growth, with the market size expected to increase from $1.41 billion in 2023 to $2.69 billion by 2033. Driven by enhanced infrastructure development and growing investments in IT, organizations in this region are gradually adopting middleware solutions to improve operational efficiency and connectivity between applications.Middle East & Africa Application Infrastructure Middleware Market Report:

In the Middle East and Africa, the market is expected to develop from $0.94 billion in 2023 to around $1.80 billion by 2033, driven mainly by increasing investments in IT infrastructure, coupled with growing digital adoption across various local enterprises, leading to a strengthened middleware landscape.Tell us your focus area and get a customized research report.

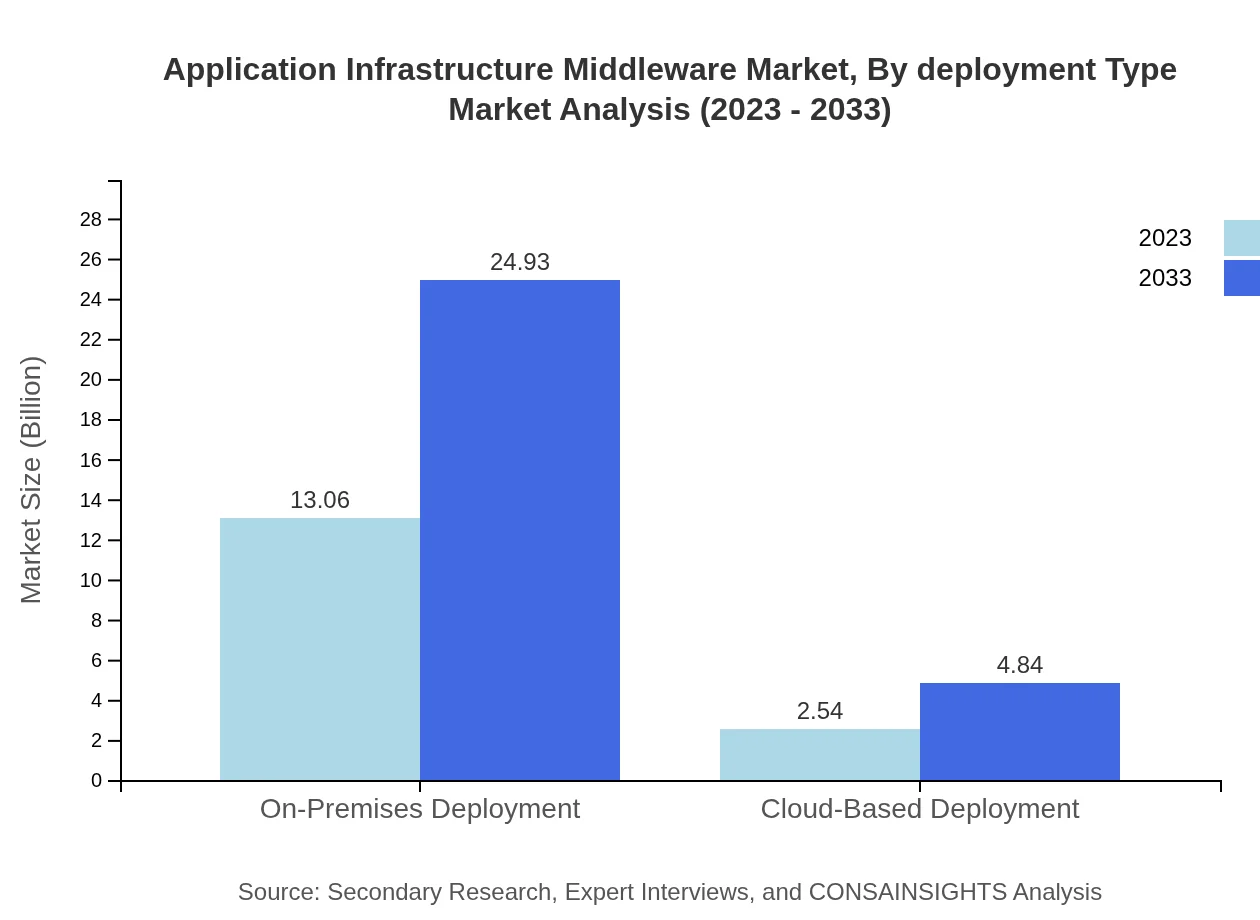

Application Infrastructure Middleware Market Analysis By Deployment Type

The Application Infrastructure Middleware market is segmented by deployment type into On-Premises and Cloud-Based deployments. In 2023, On-Premises solutions dominate with a market size of $13.06 billion (83.75% share), reflecting a consistent demand for robust, customizable middleware. Meanwhile, Cloud-Based deployment is growing steadily, projected to reach $4.84 billion by 2033 (16.25% share) as organizations increasingly prefer flexible and scalable solutions.

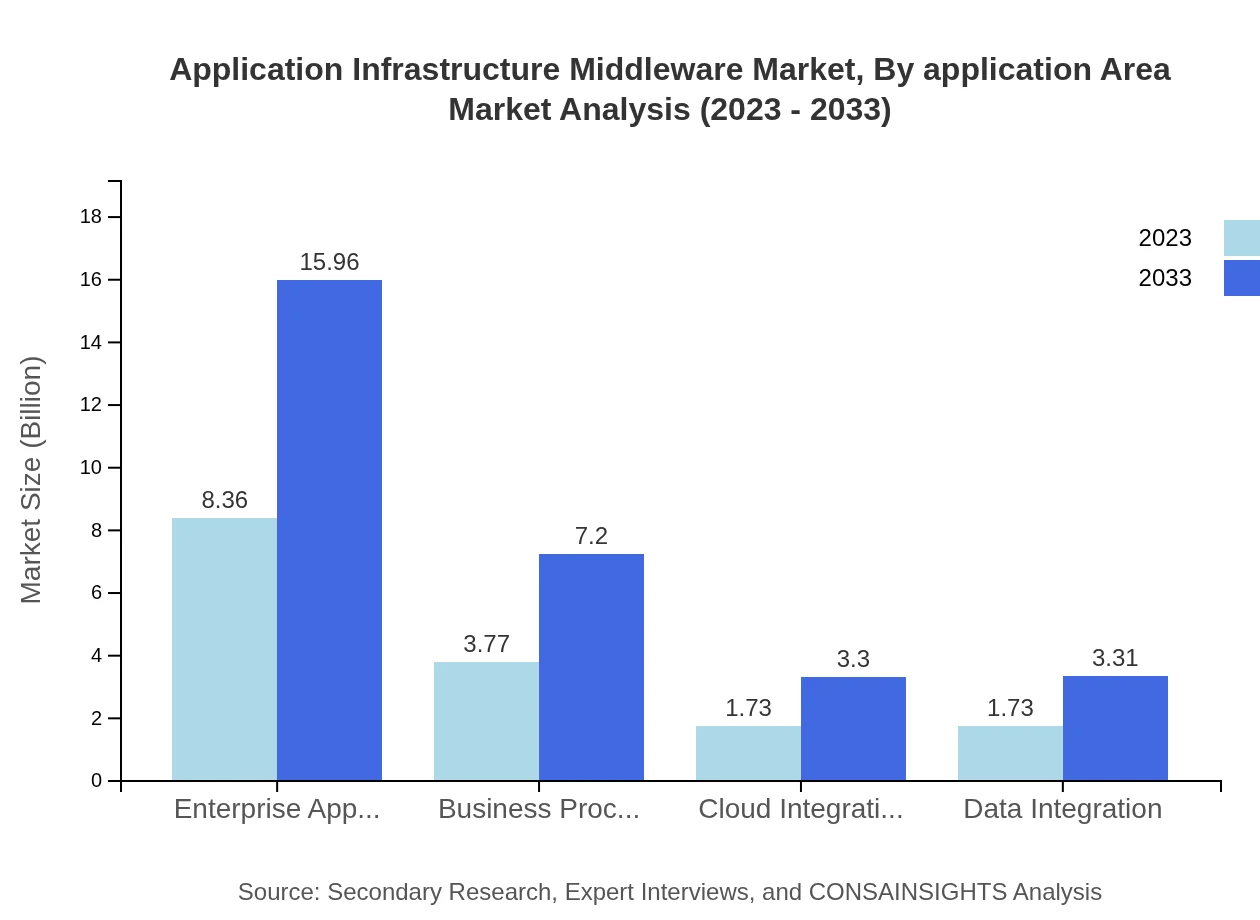

Application Infrastructure Middleware Market Analysis By Application Area

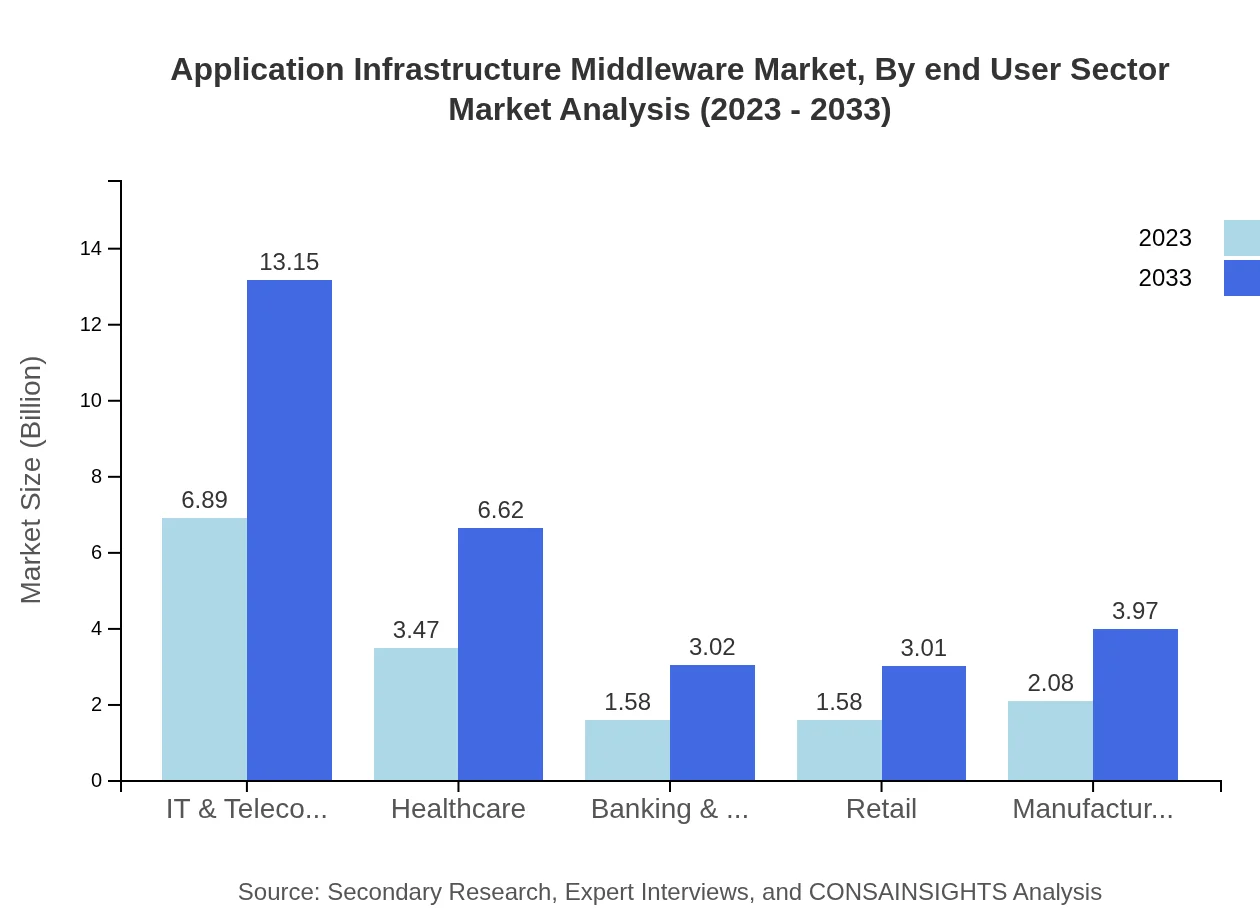

The market is categorized into several application areas: IT & Telecommunications holds significant value at $6.89 billion in 2023 (44.17% share); Healthcare follows with $3.47 billion (22.23% share), emphasizing its importance for patient data management; Banking & Financial Services shows a promising growth segment estimated at $1.58 billion (10.14% share). Retail and Manufacturing both account for $1.58 billion (10.11% share) and $2.08 billion (13.35% share), respectively.

Application Infrastructure Middleware Market Analysis By End User Sector

End-user sectors play a pivotal role in middleware adoption. The IT & Telecommunications sector leads, with revenues of $6.89 billion in 2023, followed by Healthcare at $3.47 billion. Banking & Financial Services and Retail show growing investments, indicating a trend toward comprehensive digital solutions across various sectors, with Manufacturing expecting to grow steadily as process automation becomes crucial.

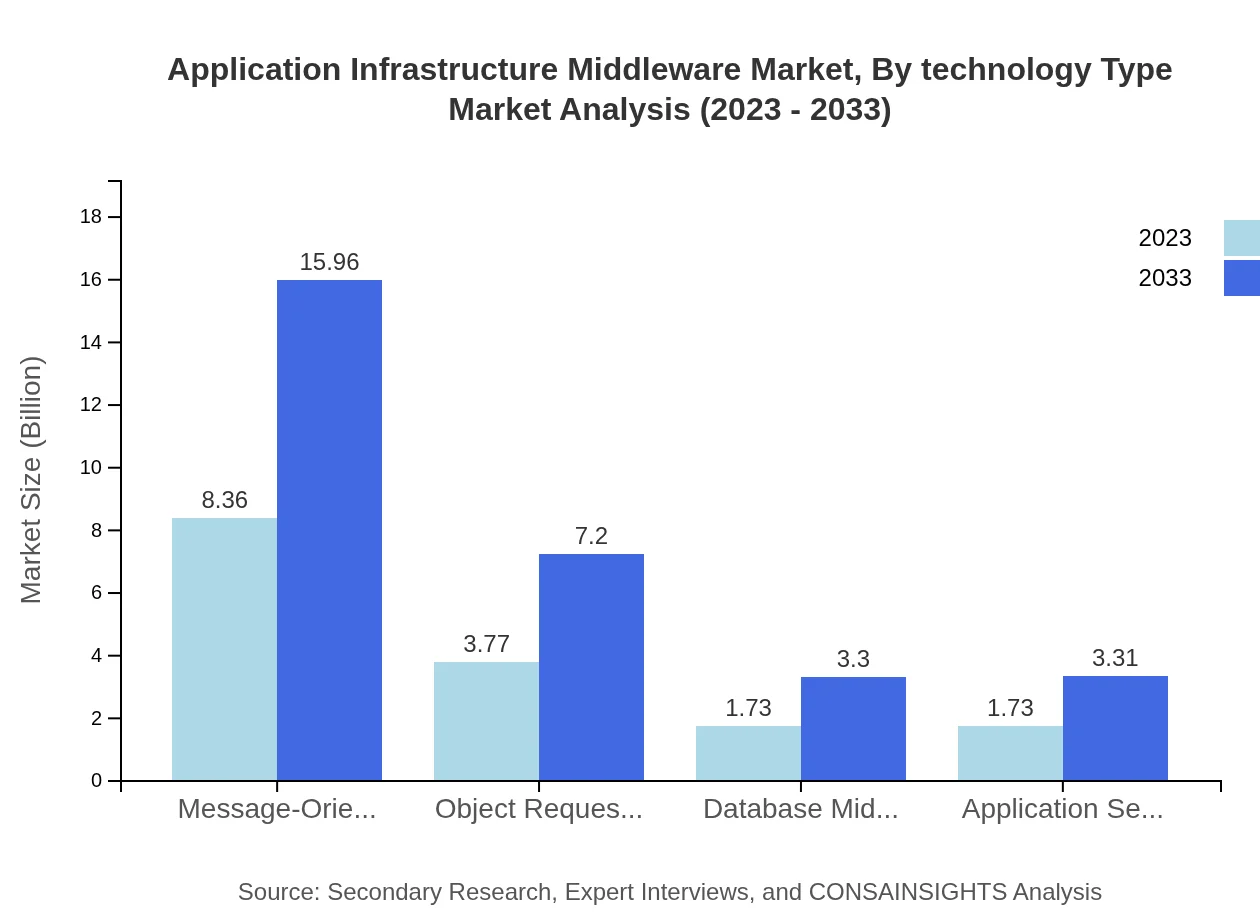

Application Infrastructure Middleware Market Analysis By Technology Type

The technology type segment includes Message-Oriented Middleware, which commanded a market share of $8.36 billion (53.6% share) in 2023, reflecting the growing need for communication between distributed applications. Database Middleware holds $1.73 billion (11.1% share), demonstrating its critical role among data-centric applications. Emerging technologies, including Cloud Integration and Enterprise Application Integration, are critical drivers of innovation within the market, projected for steady growth.

Application Infrastructure Middleware Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Application Infrastructure Middleware Industry

IBM:

IBM is a leading provider in the middleware space, recognized for its robust integration solutions and data management tools, fostering enterprise-wide connectivity.Oracle:

Oracle leads the market with its comprehensive suite of middleware products, enabling seamless application integration and exceptional operational efficiency for enterprises.Microsoft:

Microsoft has carved a significant niche in the middleware sector through its Azure cloud platform, offering innovative solutions for application hosting and integration.SAP:

SAP’s middleware solutions support large enterprises with a focus on data integration and application connectivity in complex IT environments.Red Hat:

Red Hat provides open-source middleware solutions that enhance flexibility and interoperability for enterprise applications, appealing to organizations embracing open-source technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of application Infrastructure Middleware?

The global Application Infrastructure Middleware market is projected to reach approximately $15.6 billion by 2033, growing at a CAGR of 6.5% from its current size. This growth reflects increasing demand across various sectors.

What are the key market players or companies in this application Infrastructure Middleware industry?

Key players in the application infrastructure middleware market include IBM, Oracle, Microsoft, Red Hat, and Software AG, who are leading the charge in innovation, integration, and expansion of middleware solutions to cater to diverse business needs.

What are the primary factors driving the growth in the application Infrastructure Middleware industry?

Growth in the application-infrastructure-middleware industry is driven by the increasing need for scalable integration solutions, rapid digital transformation initiatives, and the demand for automated business processes across industries, enhancing operational efficiency.

Which region is the fastest Growing in the application Infrastructure Middleware?

The fastest-growing region for application infrastructure middleware is North America, expected to grow from $6.08 billion in 2023 to $11.60 billion by 2033, indicating robust adoption of middleware technologies in the region.

Does ConsaInsights provide customized market report data for the application Infrastructure Middleware industry?

Yes, ConsaInsights offers customized market report data tailored to specific queries in the application infrastructure middleware industry, ensuring clients receive insights aligned with their strategic goals.

What deliverables can I expect from this application Infrastructure Middleware market research project?

From the market research project on application infrastructure middleware, you can expect comprehensive reports, market forecasts, segment performance analysis, and strategic recommendations tailored to enhance decision-making.

What are the market trends of application Infrastructure Middleware?

Current trends in application infrastructure middleware include the rise of cloud-based deployments, increased focus on data integration and business process management, and greater emphasis on API management and microservices architecture.