Application Lifecycle Management Market Report

Published Date: 31 January 2026 | Report Code: application-lifecycle-management

Application Lifecycle Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Application Lifecycle Management (ALM) market, covering insights and data from 2023 to 2033. It highlights market trends, segmentation, regional analysis, and forecasts to equip stakeholders with actionable information for strategic planning.

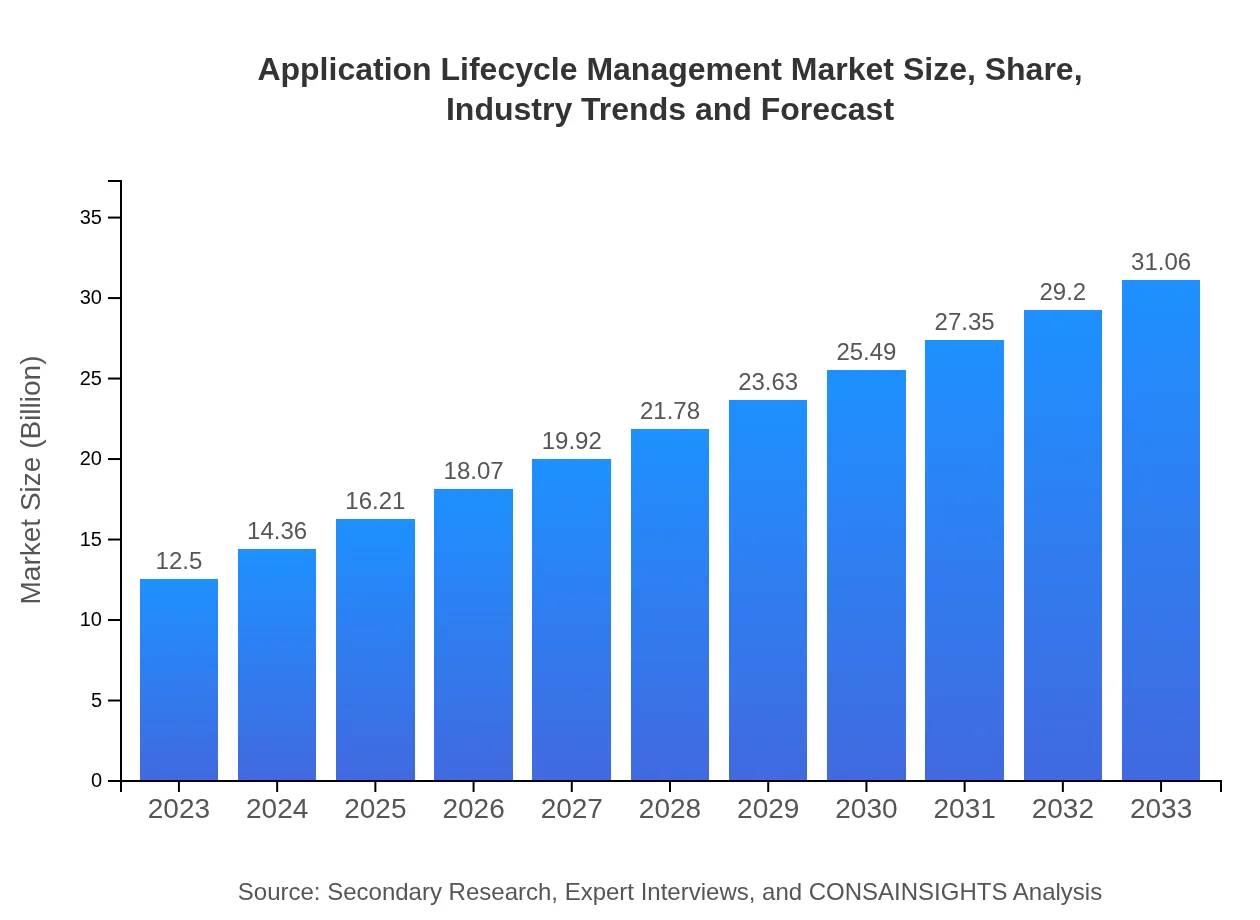

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $31.06 Billion |

| Top Companies | Atlassian, Micro Focus, CA Technologies, IBM, Microsoft |

| Last Modified Date | 31 January 2026 |

Application Lifecycle Management Market Overview

Customize Application Lifecycle Management Market Report market research report

- ✔ Get in-depth analysis of Application Lifecycle Management market size, growth, and forecasts.

- ✔ Understand Application Lifecycle Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Application Lifecycle Management

What is the Market Size & CAGR of Application Lifecycle Management market in 2023?

Application Lifecycle Management Industry Analysis

Application Lifecycle Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Application Lifecycle Management Market Analysis Report by Region

Europe Application Lifecycle Management Market Report:

The European ALM market is forecasted to grow from USD 3.39 billion in 2023 to USD 8.43 billion by 2033. The adoption of stringent regulatory frameworks and emphasis on software quality and compliance are driving the demand for effective ALM solutions.Asia Pacific Application Lifecycle Management Market Report:

In the Asia Pacific region, the ALM market is projected to grow from USD 2.47 billion in 2023 to USD 6.14 billion by 2033, driven by increasing investments in digital transformation and the expansion of IT infrastructure. Countries like India and China are witnessing a surge in software and application development initiatives, making this region a crucial growth driver.North America Application Lifecycle Management Market Report:

North America holds a significant share of the ALM market, valued at USD 4.33 billion in 2023 and projected to grow to USD 10.75 billion by 2033. The region's leadership is attributed to its advanced technological infrastructure, high adoption rates of ALM solutions, and strong participation from key industry players.South America Application Lifecycle Management Market Report:

The South American ALM market is valued at USD 0.77 billion in 2023 and is expected to reach USD 1.91 billion by 2033. Despite being the smallest regional market, the increasing focus on digital solutions and cloud adoption is expected to enhance growth in this region.Middle East & Africa Application Lifecycle Management Market Report:

For the Middle East and Africa, the ALM market is expected to grow from USD 1.54 billion in 2023 to USD 3.82 billion by 2033. Increasing investments in digital technologies and a growing recognition of the importance of software development best practices are key factors influencing this growth.Tell us your focus area and get a customized research report.

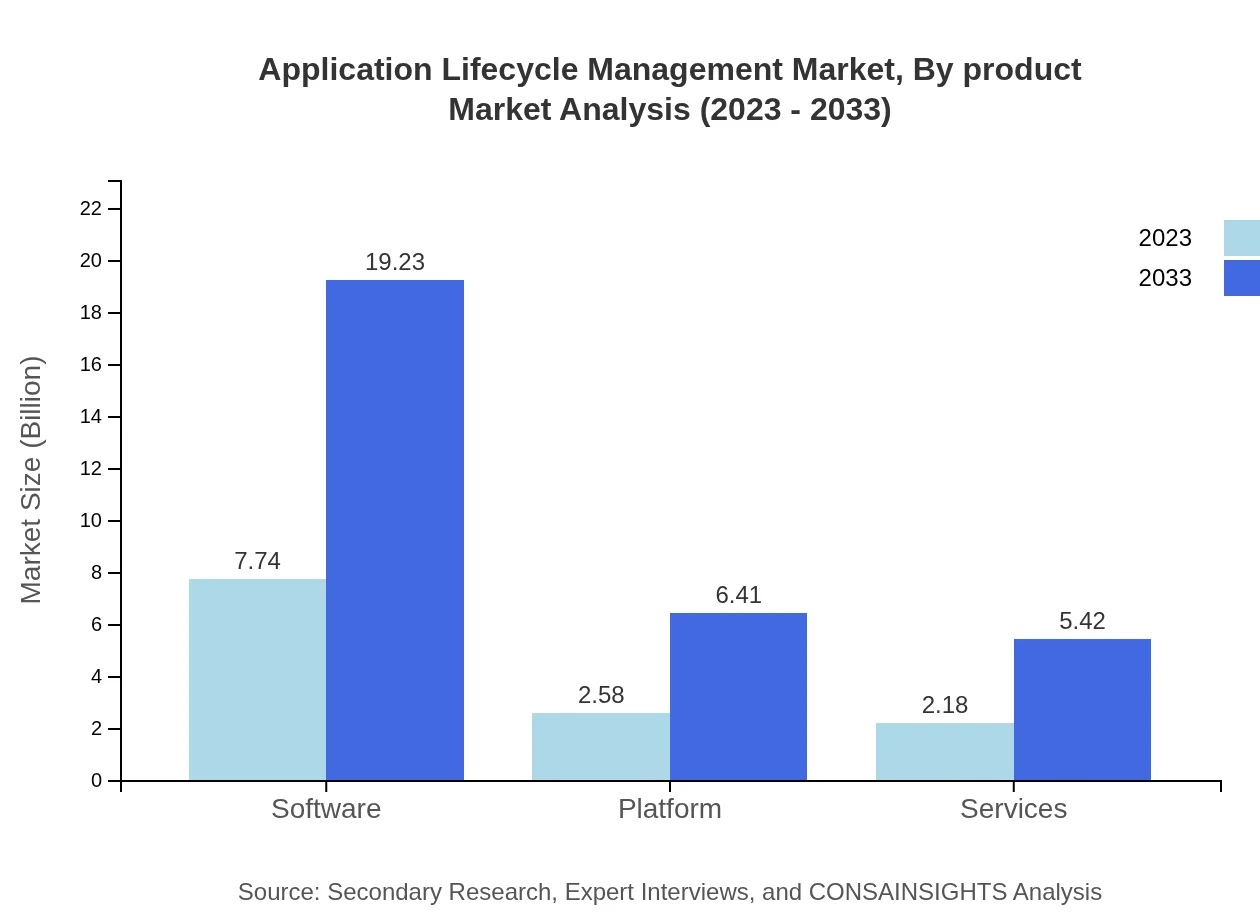

Application Lifecycle Management Market Analysis By Product

The ALM market, segmented by product, consists of Software, Platform, and Services. The Software segment, valued at USD 7.74 billion in 2023 and growing to USD 19.23 billion by 2033, dominates the space, primarily due to increasing demand for effective project management and tracking tools. The Platform segment follows, with expected growth from USD 2.58 billion to USD 6.41 billion, indicative of the rising need for integration and collaboration tools. Services account for a significant portion as well, with expected growth from USD 2.18 billion to USD 5.42 billion as organizations seek expert support for implementations.

Application Lifecycle Management Market Analysis By Application

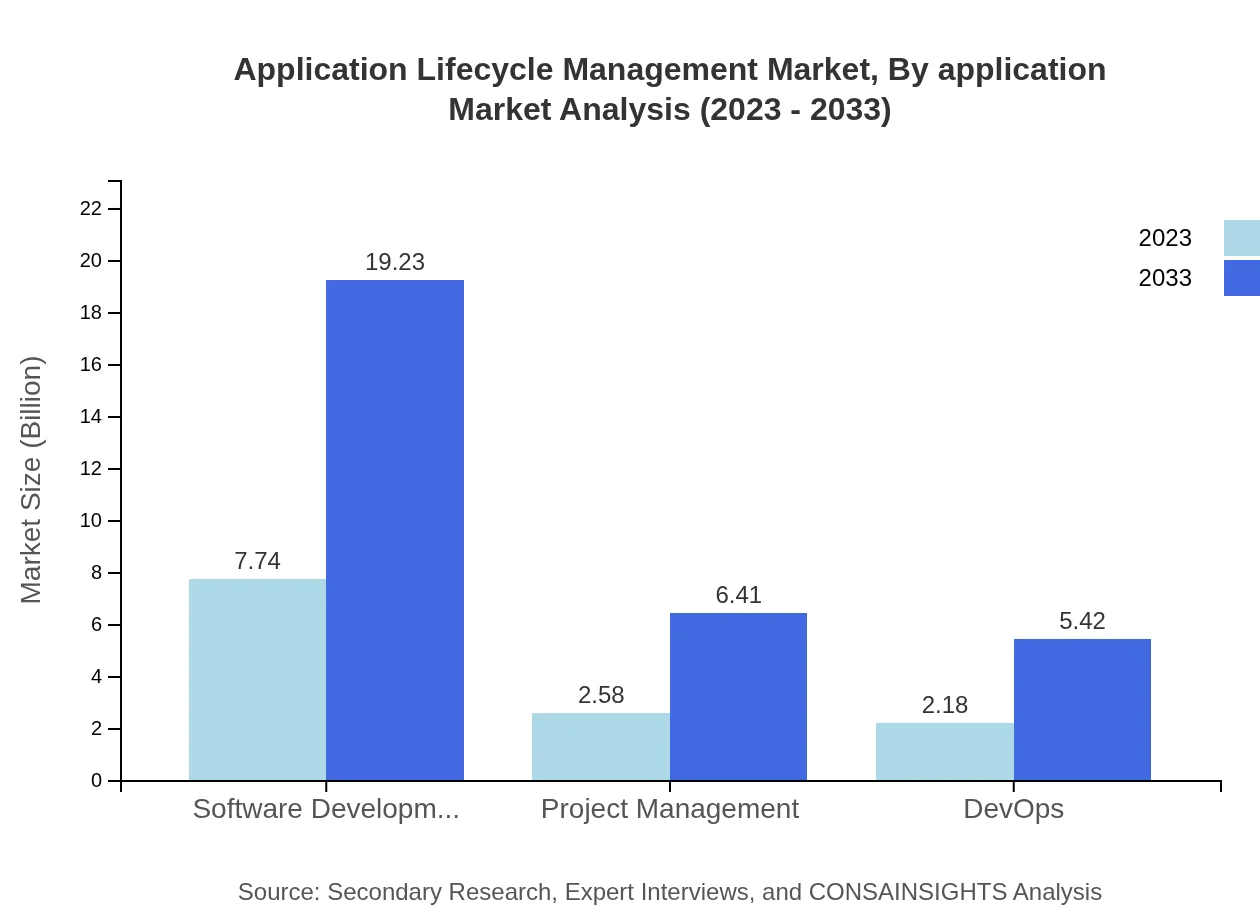

The market is segmented by applications such as Software Development, Project Management, and DevOps. The Software Development application accounts for a notable share, moving from USD 7.74 billion in 2023 to USD 19.23 billion by 2033. Project Management and DevOps also demonstrate strong growth, supported by increased adoption of agile methodologies and continuous integration/continuous deployment practices.

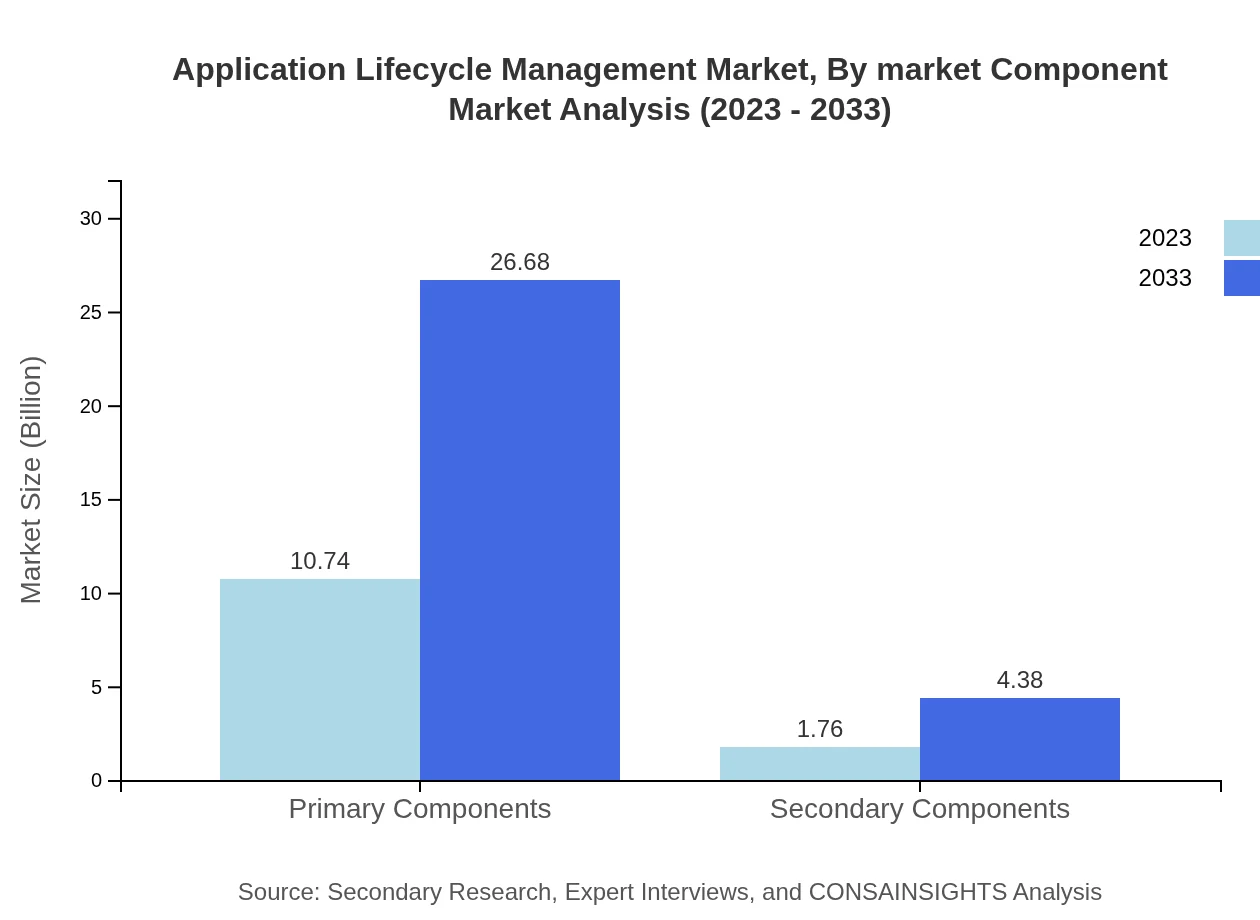

Application Lifecycle Management Market Analysis By Deployment Mode

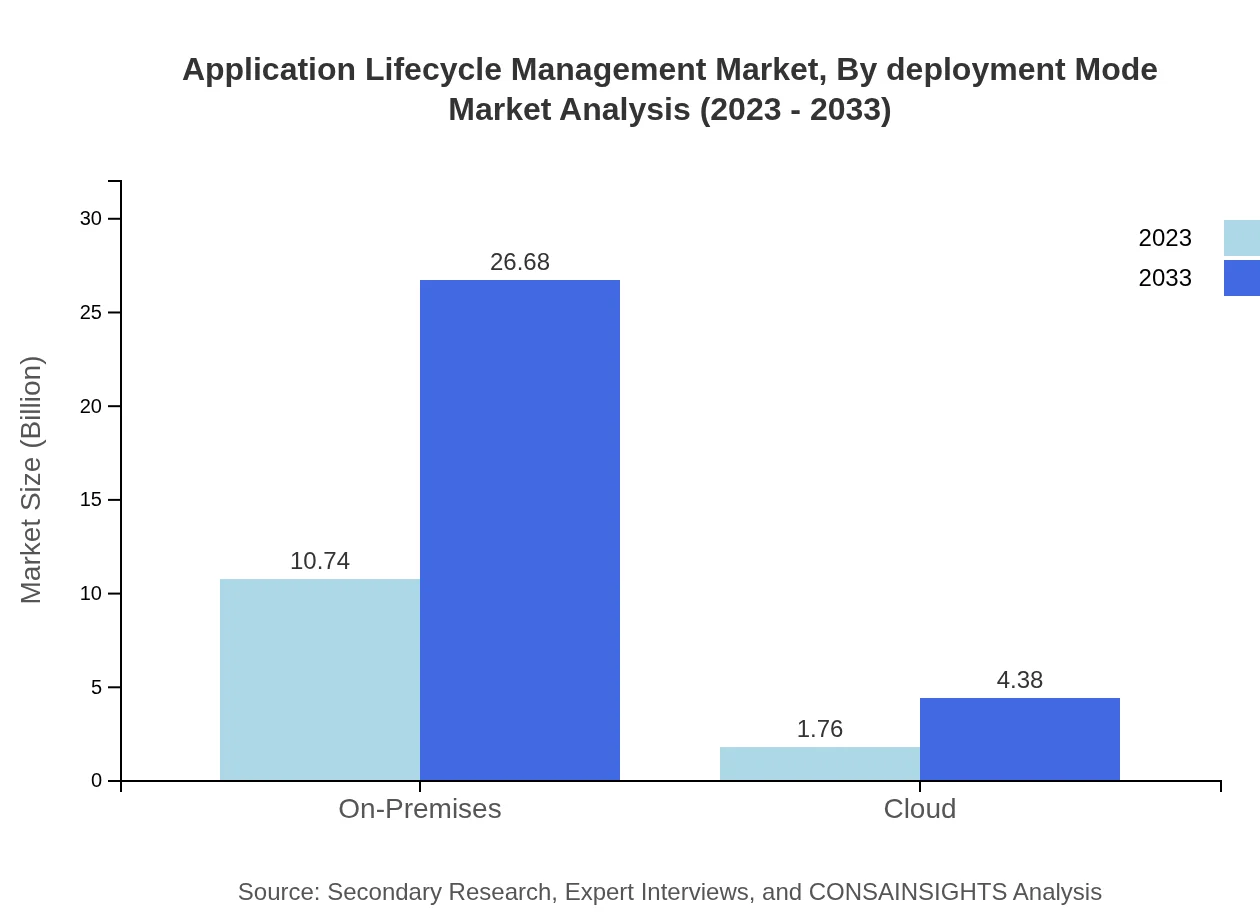

In terms of deployment mode, the market is differentiated between On-Premises and Cloud. The On-Premises segment leads with a market size of USD 10.74 billion in 2023, projected to rise to USD 26.68 billion by 2033. The Cloud deployment model, valued at USD 1.76 billion in 2023, is also expected to experience significant growth, reflecting the shift towards more flexible, scalable solutions that cloud technologies provide.

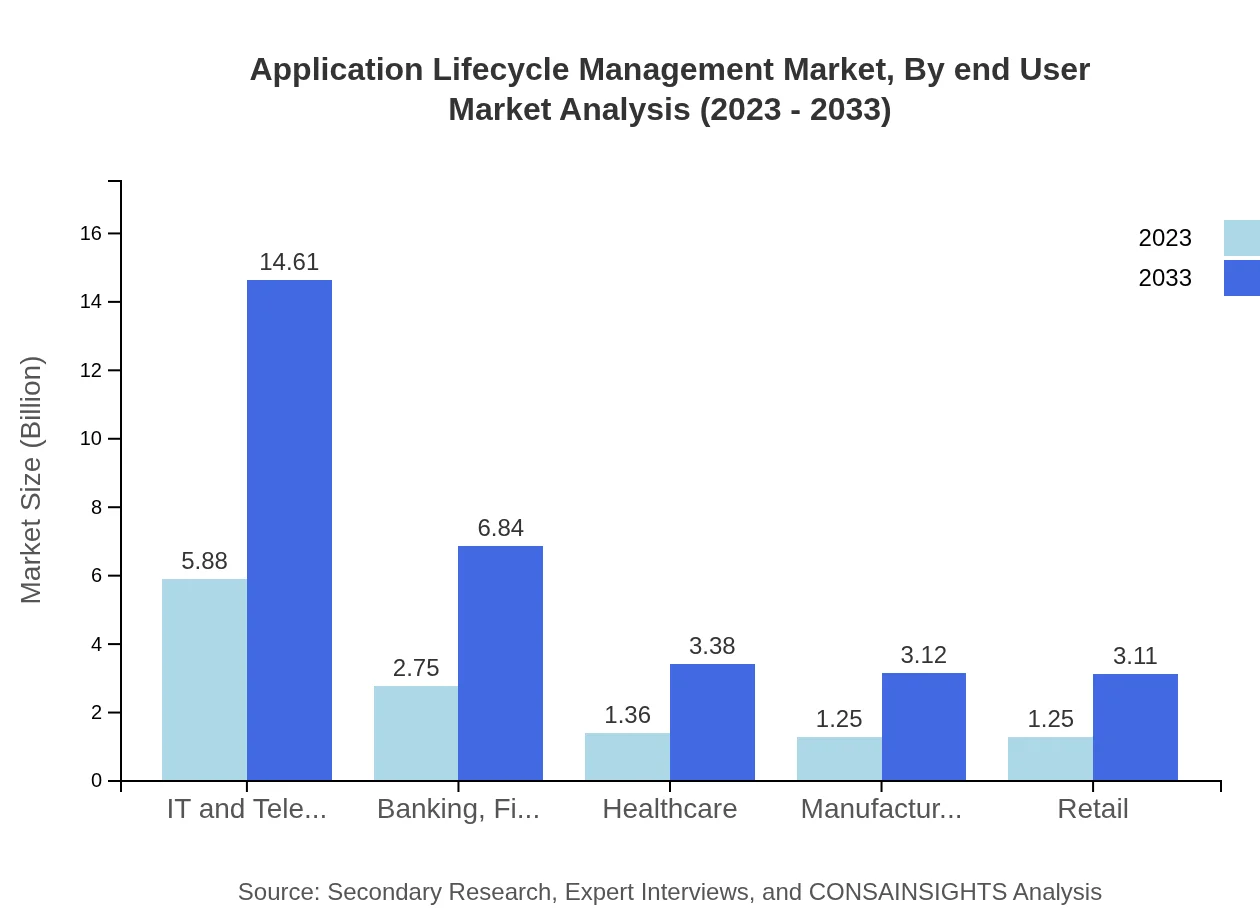

Application Lifecycle Management Market Analysis By End User

End-user segmentation includes industries such as IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Healthcare, Manufacturing, and Retail. The IT and Telecom sectors represent a substantial market share of USD 5.88 billion in 2023, forecasted to grow to USD 14.61 billion by 2033. BFSI, Healthcare, and other sectors are also contributing significantly to the market development, driven by unique needs for compliance and risk management.

Application Lifecycle Management Market Analysis By Market Component

The market components are divided into Primary and Secondary. Primary components dominate the market with USD 10.74 billion in 2023, expected to reach USD 26.68 billion by 2033, indicating a strong inclination towards comprehensive ALM solutions. Secondary components, while smaller, are also expected to grow as organizations seek more specialized and flexible options.

Application Lifecycle Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Application Lifecycle Management Industry

Atlassian:

Atlassian is a leader in collaborative software development tools, best known for its product JIRA, which provides high-level task management and tracking capabilities. They continue to enhance their offerings in ALM to support DevOps practices.Micro Focus:

Micro Focus specializes in enterprise software solutions, including ALM tools that facilitate application development and lifecycle management. Their comprehensive product suite addresses various project management needs.CA Technologies:

CA Technologies, now Broadcom Inc., provides robust ALM solutions that improve software delivery processes. Their tools help businesses simplify the software development lifecycle while enhancing collaboration.IBM:

IBM offers integrated ALM solutions as part of its larger portfolio of software and services aimed at maximizing application efficiency. Their tools leverage artificial intelligence to improve lifecycle processes.Microsoft:

Microsoft's ALM offerings, particularly within Azure DevOps, showcase their dedication to enhancing productivity in software development and lifecycle management, catering to both small businesses and enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of Application Lifecycle Management?

The Application Lifecycle Management market is currently valued at approximately $12.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2%, indicating strong growth potential through 2033.

What are the key market players or companies in the Application Lifecycle Management industry?

Key players in the Application Lifecycle Management industry include IBM, Microsoft, Micro Focus, Oracle, and CA Technologies, all of whom are actively shaping market dynamics and contributing to technological advancements.

What are the primary factors driving the growth in the Application Lifecycle Management industry?

Key growth factors include increased demand for efficient software development processes, adoption of cloud technologies, and the need for integrated project management solutions, driving companies to enhance their ALM practices.

Which region is the fastest Growing in the Application Lifecycle Management?

The Asia Pacific region is the fastest-growing market for Application Lifecycle Management, with a rise from $2.47 billion in 2023 to an estimated $6.14 billion by 2033, indicating a strong market presence.

Does ConsaInsights provide customized market report data for the Application Lifecycle Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs in the Application Lifecycle Management industry, ensuring clients receive relevant insights for their strategic decisions.

What deliverables can I expect from this Application Lifecycle Management market research project?

Deliverables include detailed market analysis reports, growth trend forecasts, competitive landscape evaluations, and segmentation analysis, providing comprehensive insights into the Application Lifecycle Management market.

What are the market trends of Application Lifecycle Management?

Current trends in Application Lifecycle Management include the shift towards cloud-based solutions, increasing automation in development processes, and a growing emphasis on DevOps practices, shaping the future of the industry.