Application Performance Management Market Report

Published Date: 31 January 2026 | Report Code: application-performance-management

Application Performance Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Application Performance Management (APM) market, focusing on market size, trends, segmentation, and regional insights for the forecast period 2023-2033.

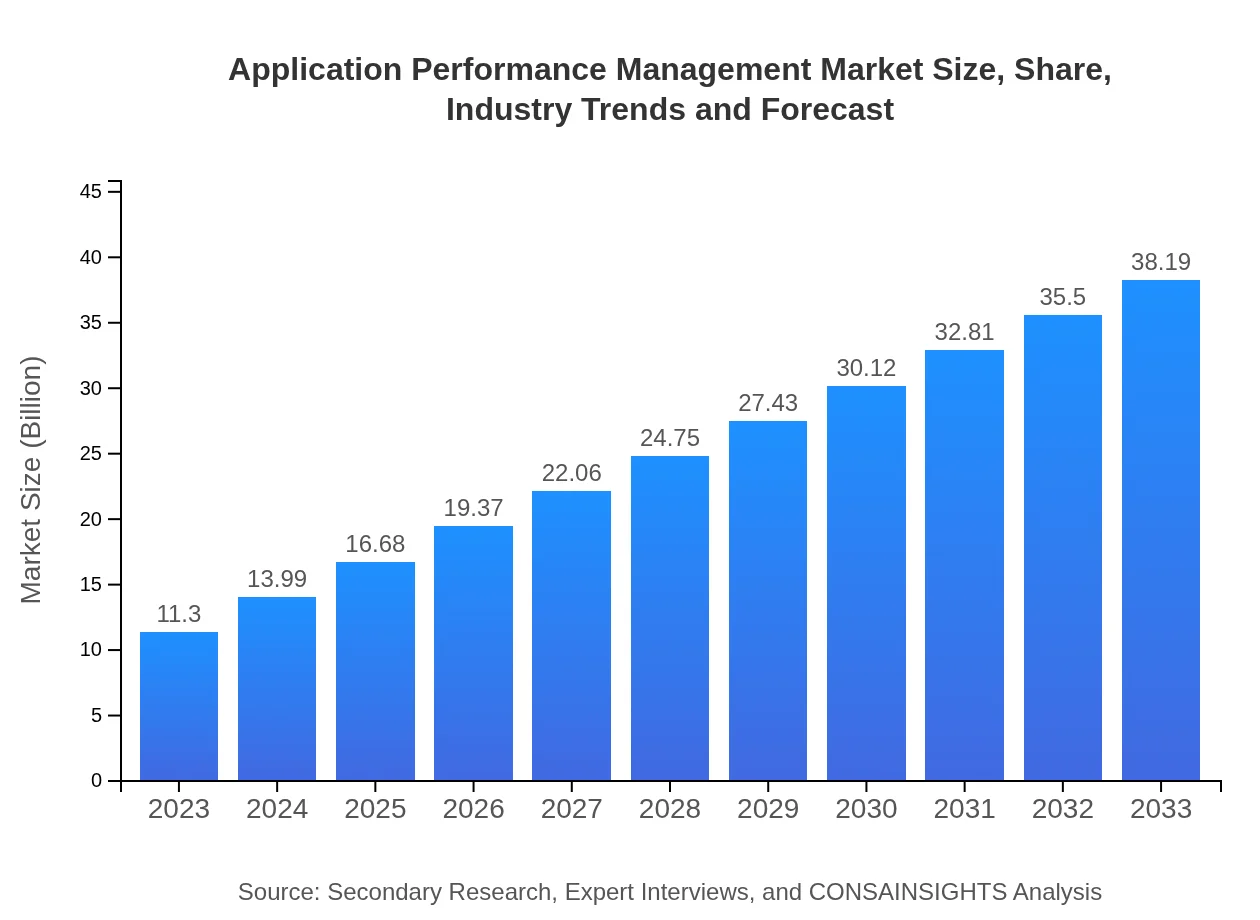

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.30 Billion |

| CAGR (2023-2033) | 12.4% |

| 2033 Market Size | $38.19 Billion |

| Top Companies | Dynatrace, New Relic, AppDynamics, Splunk |

| Last Modified Date | 31 January 2026 |

Application Performance Management Market Overview

Customize Application Performance Management Market Report market research report

- ✔ Get in-depth analysis of Application Performance Management market size, growth, and forecasts.

- ✔ Understand Application Performance Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Application Performance Management

What is the Market Size & CAGR of Application Performance Management market in 2023?

Application Performance Management Industry Analysis

Application Performance Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Application Performance Management Market Analysis Report by Region

Europe Application Performance Management Market Report:

Europe's APM market is valued at approximately $2.71 billion in 2023, forecasted to grow to $9.17 billion by 2033. The market is characterized by stringent regulations regarding data privacy and security, driving demand for comprehensive APM solutions.Asia Pacific Application Performance Management Market Report:

In 2023, the Asia Pacific region's APM market stands at $2.29 billion, with a predicted expansion to $7.74 billion by 2033. Factors propelling this growth include rapid digitalization across enterprises, rising smartphone penetration, and increasing cloud adoption. Countries like India and China are significant contributors to market expansion, driven by IT outsourcing and growing tech ecosystems.North America Application Performance Management Market Report:

The North American region dominates the APM market, valued at $4.28 billion in 2023, with expectations to reach $14.45 billion by 2033. The region's leadership is attributed to robust technological advancements, high adoption rates of next-gen APM solutions, and significant investments in cloud services.South America Application Performance Management Market Report:

The Latin America APM market is projected to grow from $0.48 billion in 2023 to $1.62 billion in 2033. This growth is fueled by increasing investments in IT infrastructure and enhanced focus on improving application performance as organizations undergo digital transformations.Middle East & Africa Application Performance Management Market Report:

The MENA region’s APM market is projected to expand from $1.54 billion in 2023 to $5.21 billion by 2033. The increasing awareness of application performance monitoring across various sectors, coupled with digital transformation initiatives, is propelling market growth.Tell us your focus area and get a customized research report.

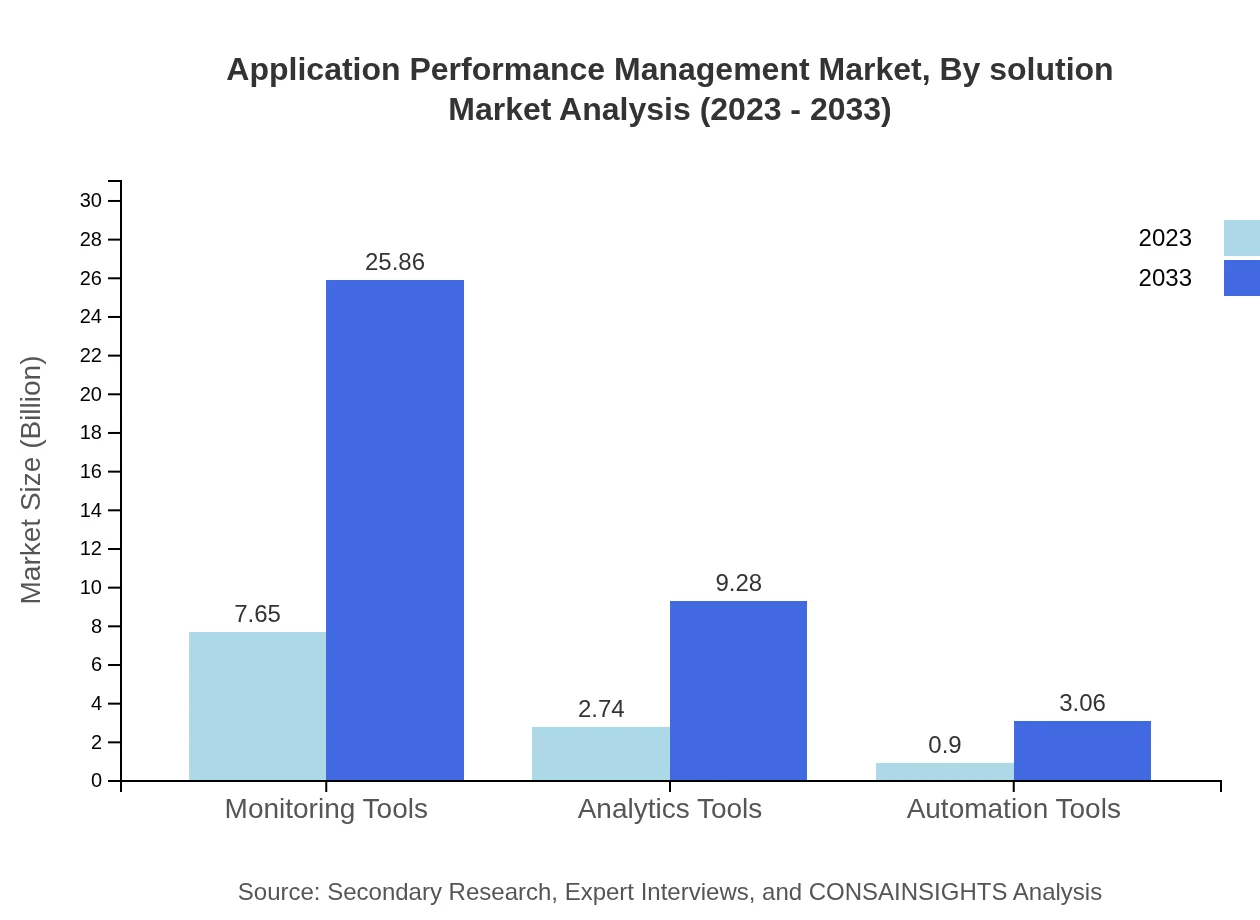

Application Performance Management Market Analysis By Solution

The market split by solution shows strong growth for monitoring tools, which will increase from $7.65 billion in 2023 to $25.86 billion in 2033, capturing 67.71% of the share in 2023. Analytics tools and automation tools are also critical, with analytical solutions seeing growth from $2.74 billion to $9.28 billion, maintaining a 24.29% market share.

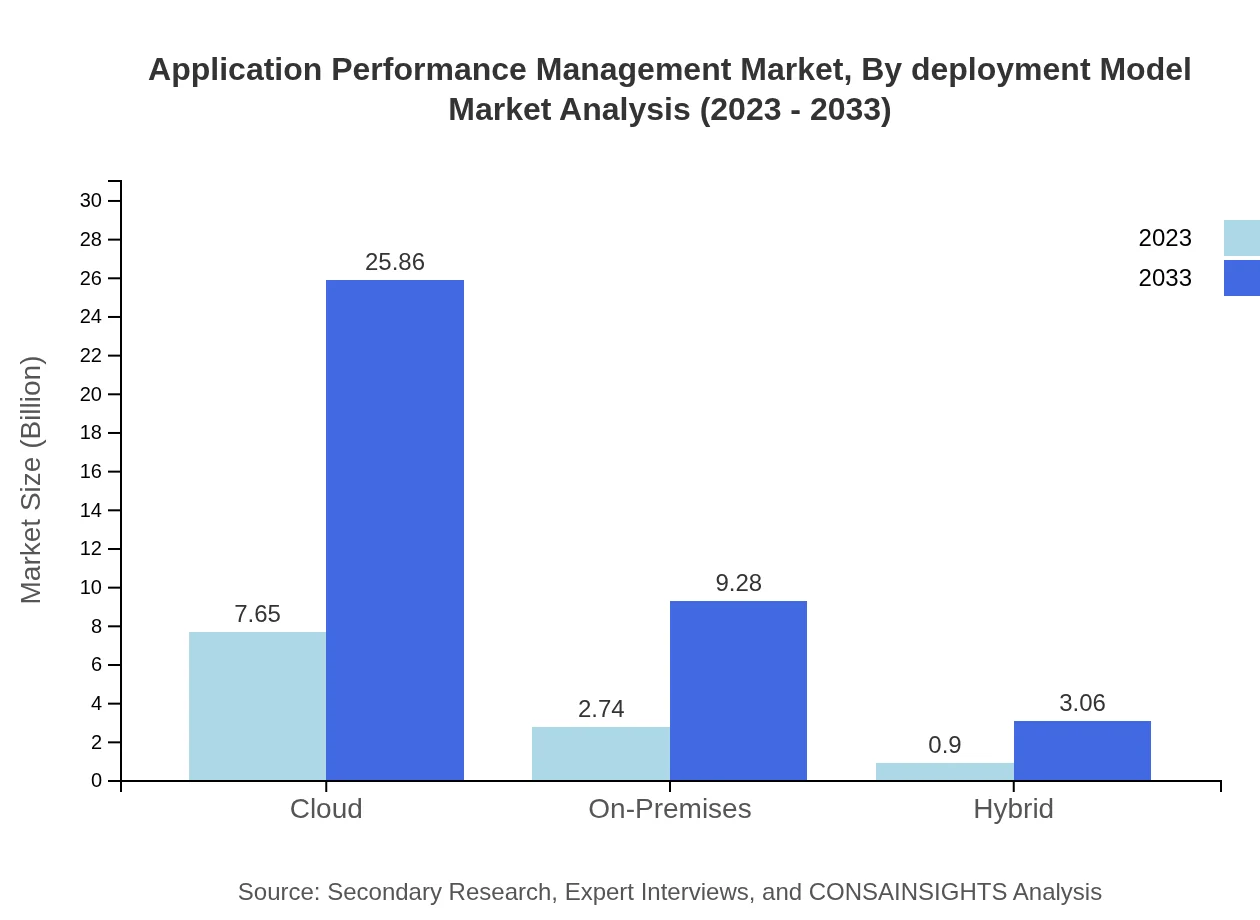

Application Performance Management Market Analysis By Deployment Model

By deployment model, cloud solutions will dominate the APM market, growing from $7.65 billion in 2023 to $25.86 billion in 2033, leading with a 67.71% market share due to their scalability and flexibility. Conversely, on-premises solutions will see growth, but cloud adoption continues to dominate.

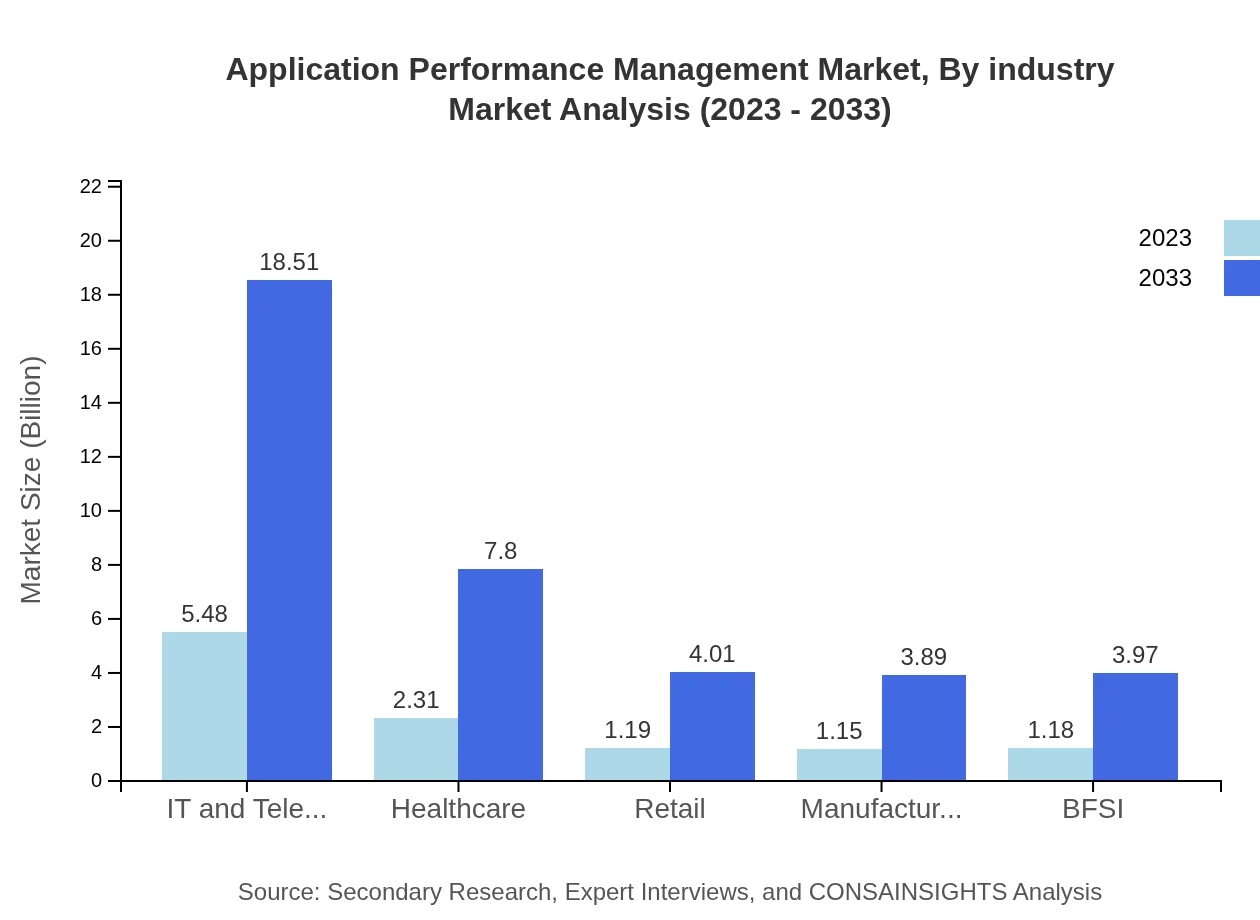

Application Performance Management Market Analysis By Industry

The sector-wise analysis shows that IT and Telecom leads the APM market, with a size of $5.48 billion in 2023, expected to grow to $18.51 billion by 2033. Healthcare also plays a crucial role with growth from $2.31 billion to $7.80 billion during the same period.

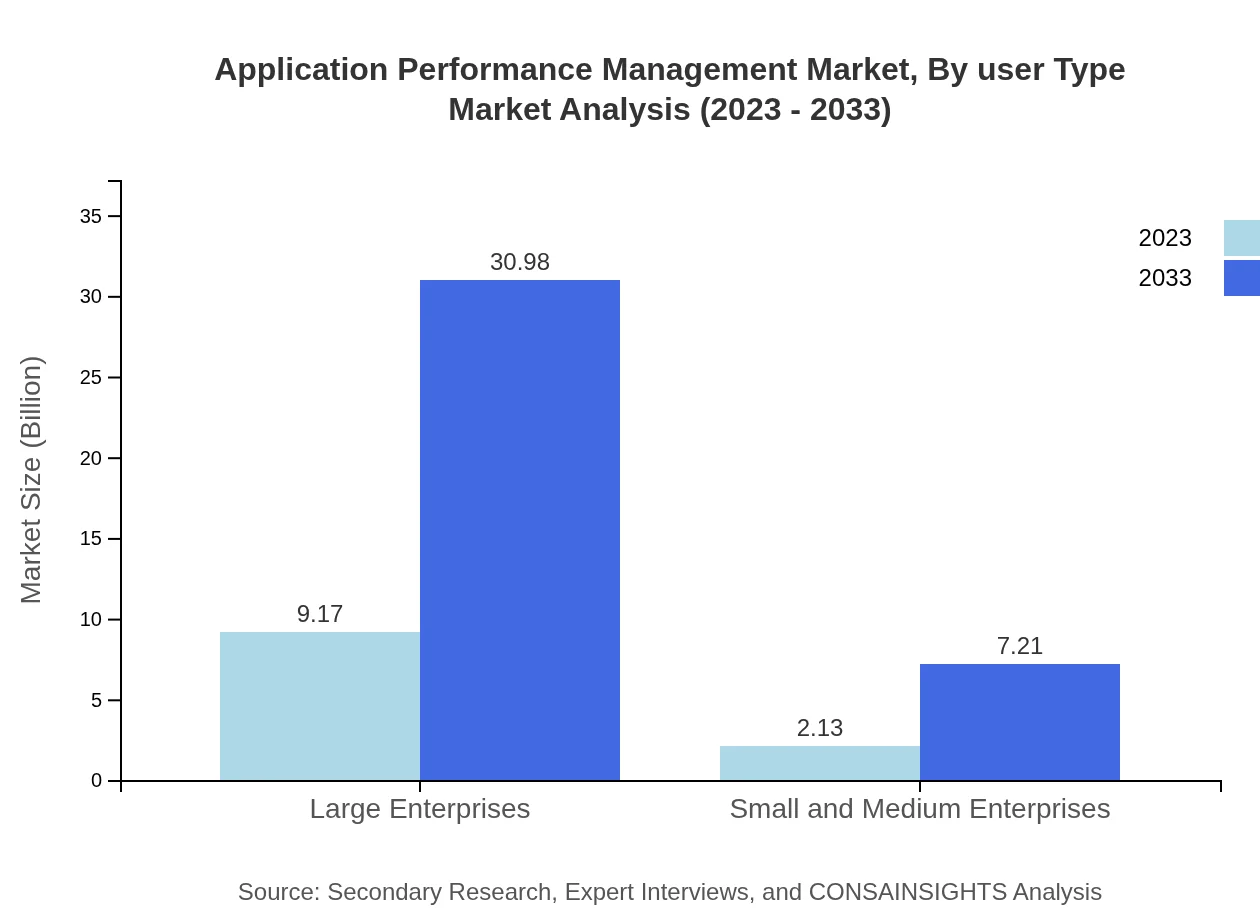

Application Performance Management Market Analysis By User Type

Large enterprises dominate the user type segment with a market size of $9.17 billion in 2023 and a projected size of $30.98 billion in 2033. SMEs, while smaller in size, are also growing rapidly, from $2.13 billion to $7.21 billion, reflecting increased software service adoption.

Application Performance Management Market Analysis By Service Type

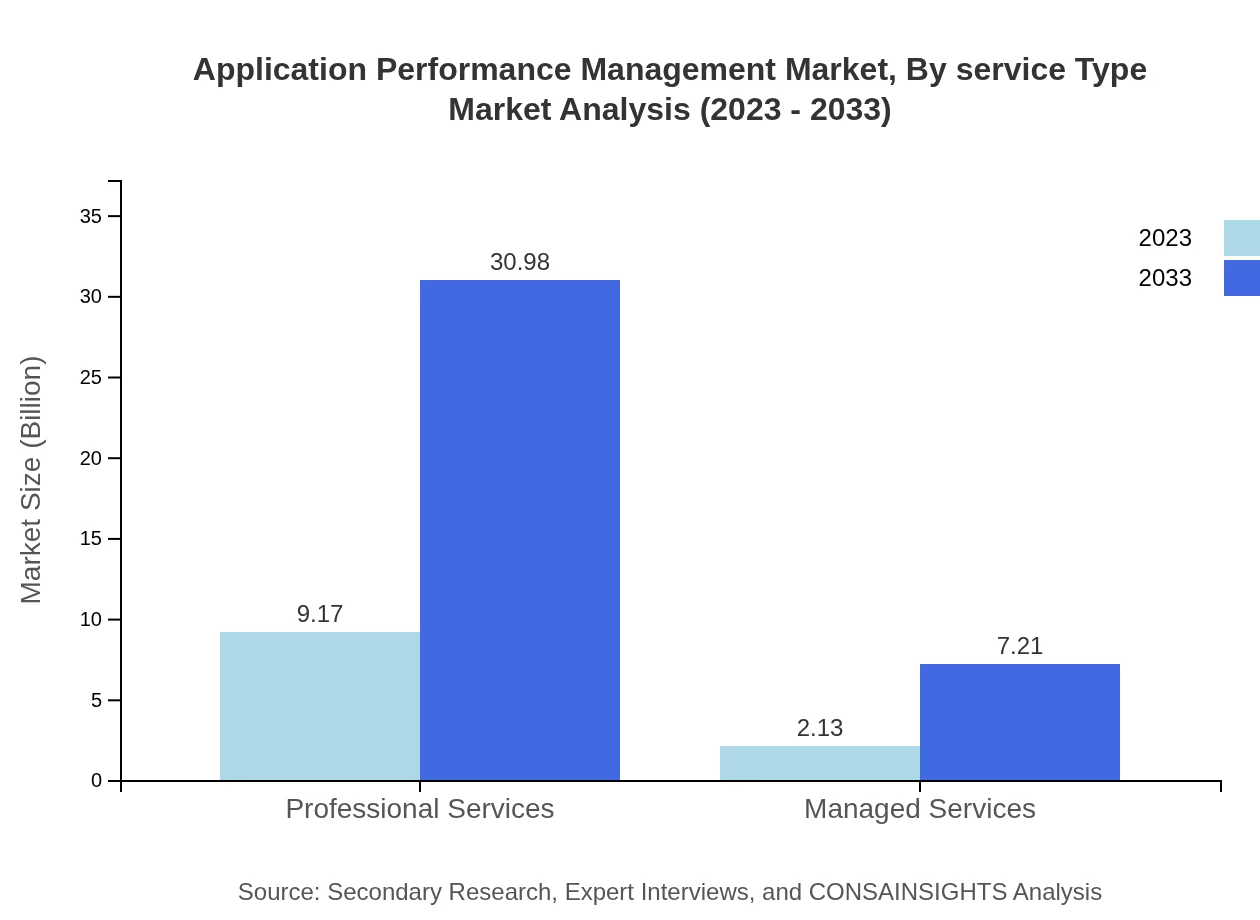

Service type analysis reveals professional services are paramount, accounting for $9.17 billion in 2023, doubling by 2033. Managed services are growing as businesses increasingly outsource application monitoring tasks to third parties to enhance focus on core activities.

Application Performance Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Application Performance Management Industry

Dynatrace:

Dynatrace is a leading provider of software intelligence, delivering APM solutions that enable organizations to optimize performance, enhance user experiences, and accelerate the path to digital transformation.New Relic:

New Relic offers a comprehensive APM suite that allows businesses to observe application performance and troubleshoot issues effectively, providing real-time insights into their operations.AppDynamics:

AppDynamics, a Cisco company, provides APM services that empower organizations to understand application performance in real time, ensuring superior performance and user satisfaction.Splunk:

Splunk is known for its ability to analyze machine-generated data, offering APM solutions that provide insights into application performance, enabling proactive issue resolution.We're grateful to work with incredible clients.

FAQs

What is the market size of application Performance Management?

The global Application Performance Management market is valued at approximately $11.3 billion in 2023, with a projected CAGR of 12.4% leading to significant growth over the next decade.

What are the key market players or companies in this application Performance Management industry?

Key players in the Application Performance Management industry include Oracle Corporation, IBM Corporation, Microsoft, Dynatrace, and New Relic, among others, contributing significantly to market advancement through innovation and strategic initiatives.

What are the primary factors driving the growth in the application Performance Management industry?

Factors driving growth include the increasing need for improved application performance, growing adoption of cloud-based services, and the rising demand for real-time analytics to enhance user experience and operational efficiency across sectors.

Which region is the fastest Growing in the application Performance Management?

North America is the fastest-growing region in the Application Performance Management market, with a market size projected to reach $14.45 billion by 2033, driven by the expanding technology landscape and high adoption rates of APM solutions.

Does ConsaInsights provide customized market report data for the application Performance Management industry?

Yes, ConsaInsights offers customized market report data for the Application Performance Management industry, tailored to meet specific client needs regarding market trends, competitive analysis, and segment insights.

What deliverables can I expect from this application Performance Management market research project?

Deliverables include a comprehensive market analysis report, detailed insights on market size, trends, competitive landscape, regional data, and actionable recommendations tailored for business strategy and investment decisions.

What are the market trends of application Performance Management?

Current trends in the Application Performance Management market include a shift towards cloud-based APM solutions, increased integration of AI and machine learning for predictive analytics, and a focus on enhancing user experience through performance optimization.