Application Release Automation Market Report

Published Date: 31 January 2026 | Report Code: application-release-automation

Application Release Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Application Release Automation market from 2023 to 2033, including insights into market size, growth potential, regional dynamics, and key segments driving the industry.

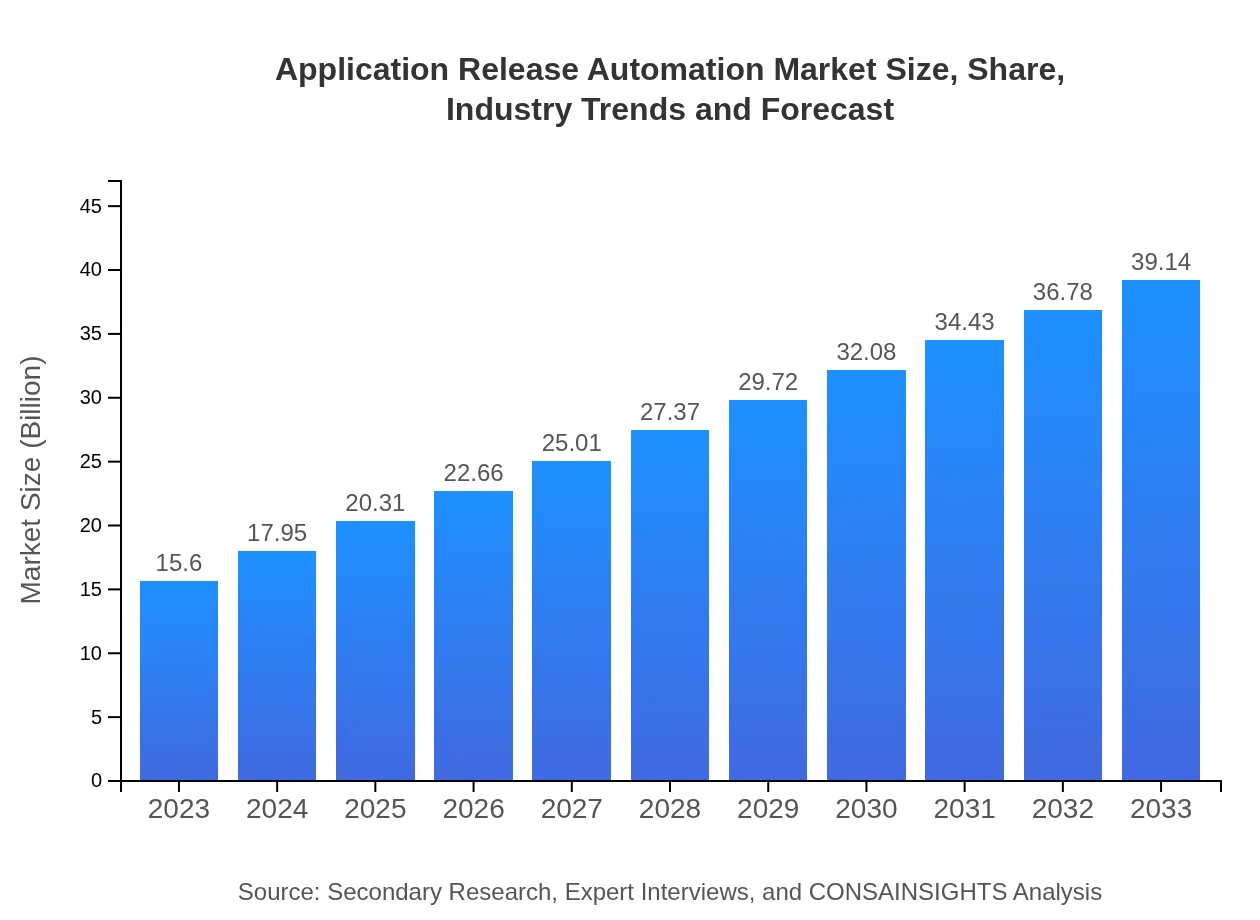

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $39.14 Billion |

| Top Companies | IBM, Chef Software, Jenkins, Microsoft |

| Last Modified Date | 31 January 2026 |

Application Release Automation Market Overview

Customize Application Release Automation Market Report market research report

- ✔ Get in-depth analysis of Application Release Automation market size, growth, and forecasts.

- ✔ Understand Application Release Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Application Release Automation

What is the Market Size & CAGR of Application Release Automation market in 2023?

Application Release Automation Industry Analysis

Application Release Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Application Release Automation Market Analysis Report by Region

Europe Application Release Automation Market Report:

Europe's market is expected to grow from $4.22 billion in 2023 to $10.57 billion by 2033, as enterprises focus on enhancing operational efficiencies to comply with stringent regulations.Asia Pacific Application Release Automation Market Report:

The Asia Pacific market is valued at approximately $3.33 billion in 2023, projected to grow to $8.36 billion by 2033, driven by rapid digital advancement and increasing investments in IT infrastructure.North America Application Release Automation Market Report:

North America is currently the largest market, valued at $5.27 billion in 2023, and is forecasted to reach $13.21 billion by 2033, primarily due to the high concentration of tech companies and increased adoption of DevOps practices.South America Application Release Automation Market Report:

The South American market shows a modest growth trajectory, with its size reaching $0.68 billion in 2023 and expected to grow to $1.70 billion by 2033, as organizations begin to embrace automation.Middle East & Africa Application Release Automation Market Report:

The Middle East and Africa market is valued at $2.11 billion in 2023, growing to $5.30 billion by 2033, driven by the demand for technology solutions in oil and gas, telecom, and government sectors.Tell us your focus area and get a customized research report.

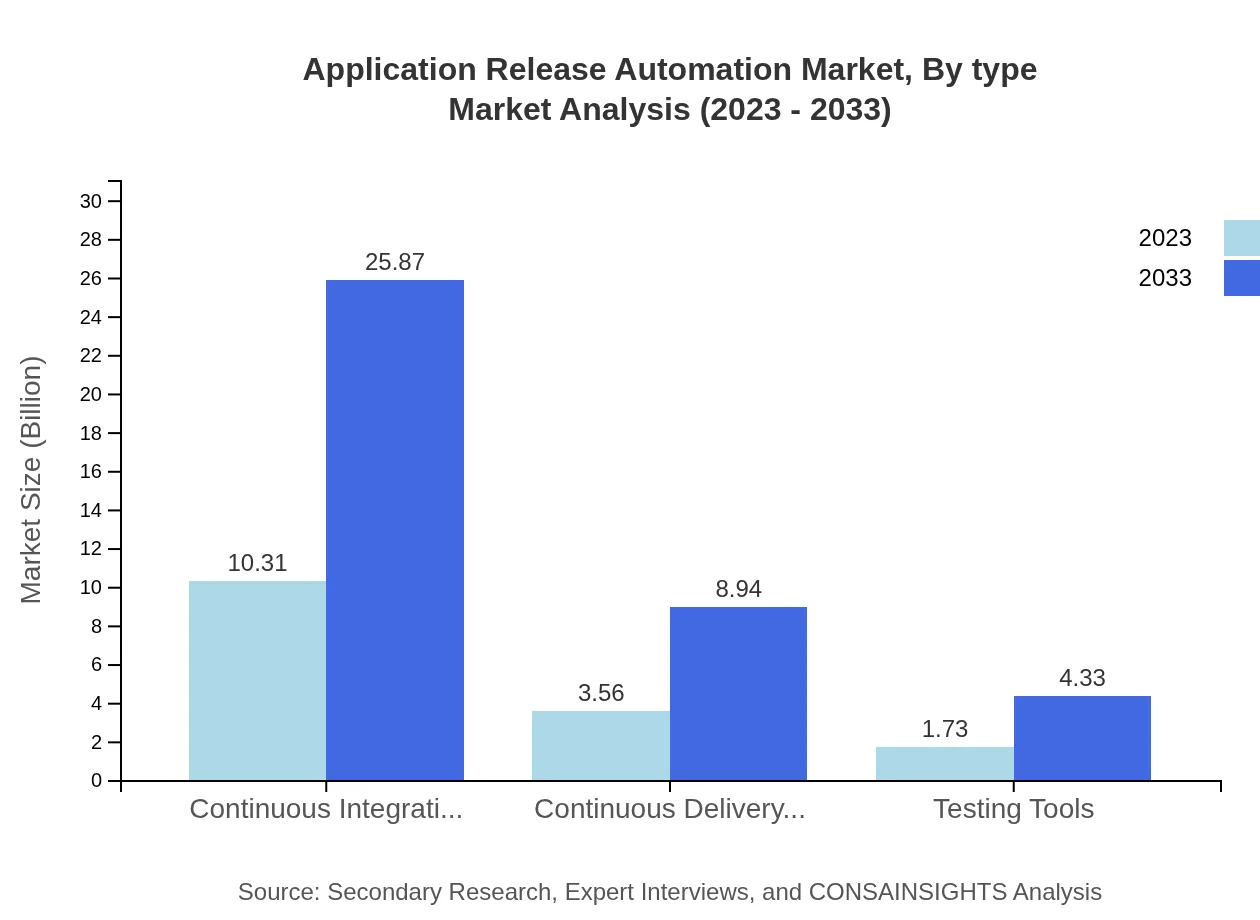

Application Release Automation Market Analysis By Type

The market segmentation by type includes continuous integration tools, continuous delivery tools, testing tools, and more. Continuous integration tools lead the market with a size of $10.31 billion in 2023, projected to grow to $25.87 billion by 2033. Continuous delivery tools are expected to grow from $3.56 billion to $8.94 billion during the same period.

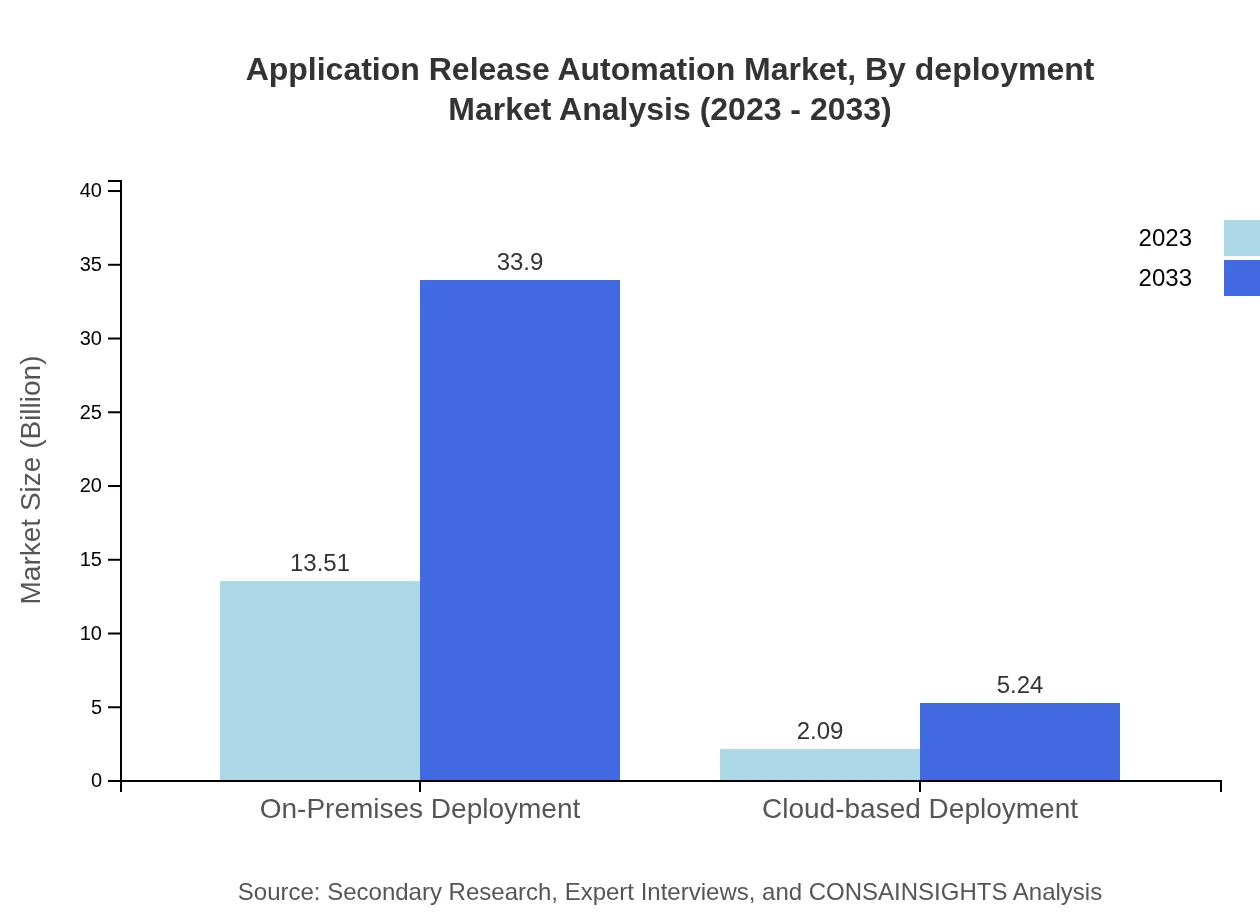

Application Release Automation Market Analysis By Deployment

The market primarily consists of on-premises and cloud-based deployment models. On-premises deployment holds a significant share, valued at $13.51 billion in 2023 and expected to reach $33.90 billion by 2033, reflecting the preference of large enterprises for control. Cloud-based solutions are also gaining traction, growing from $2.09 billion to $5.24 billion.

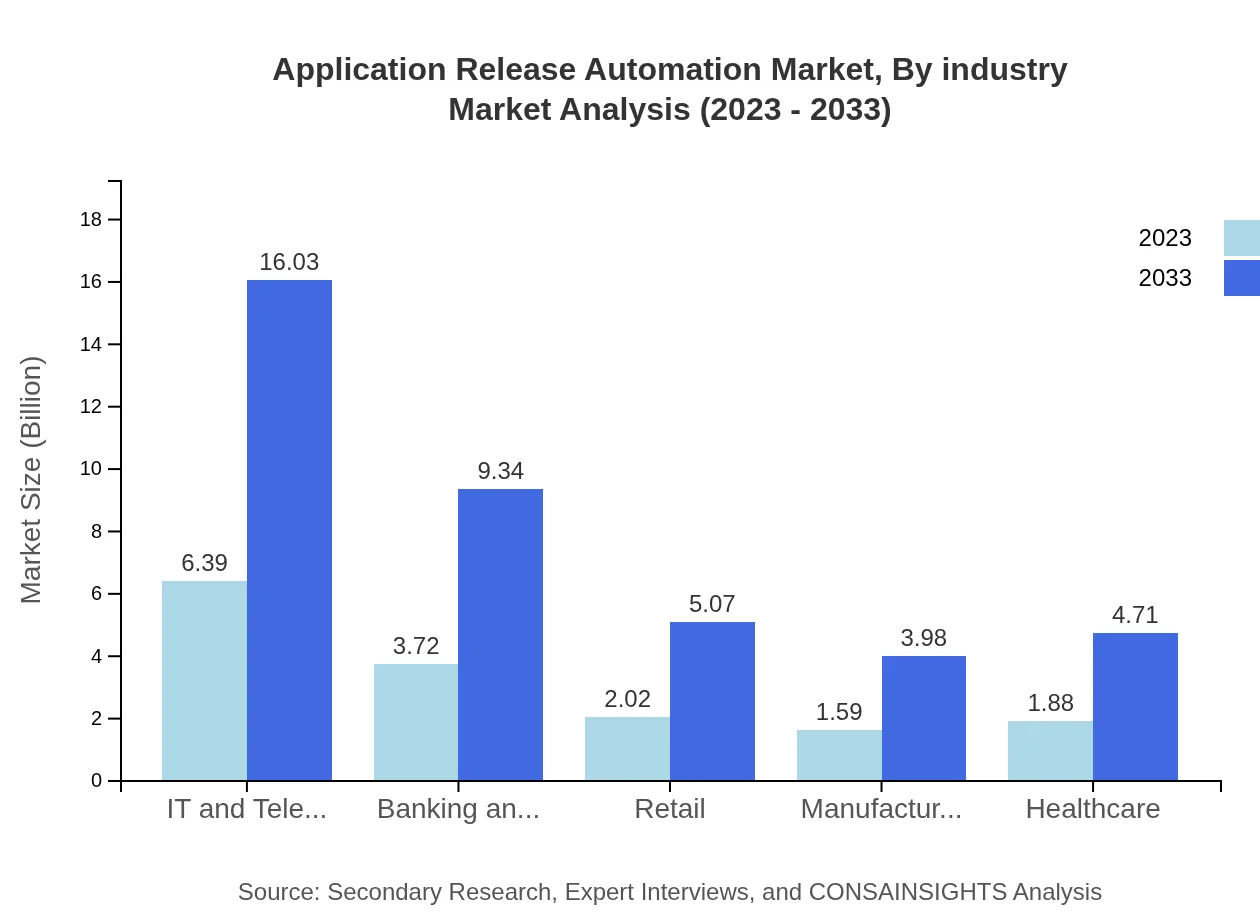

Application Release Automation Market Analysis By Industry

Key industry sectors utilizing ARA solutions include IT and telecom, banking and financial services, retail, manufacturing, and healthcare. The IT and telecom sector holds a substantial market share, valued at $6.39 billion in 2023. The banking and financial services segment is also poised for growth, expected to rise from $3.72 billion to $9.34 billion by 2033.

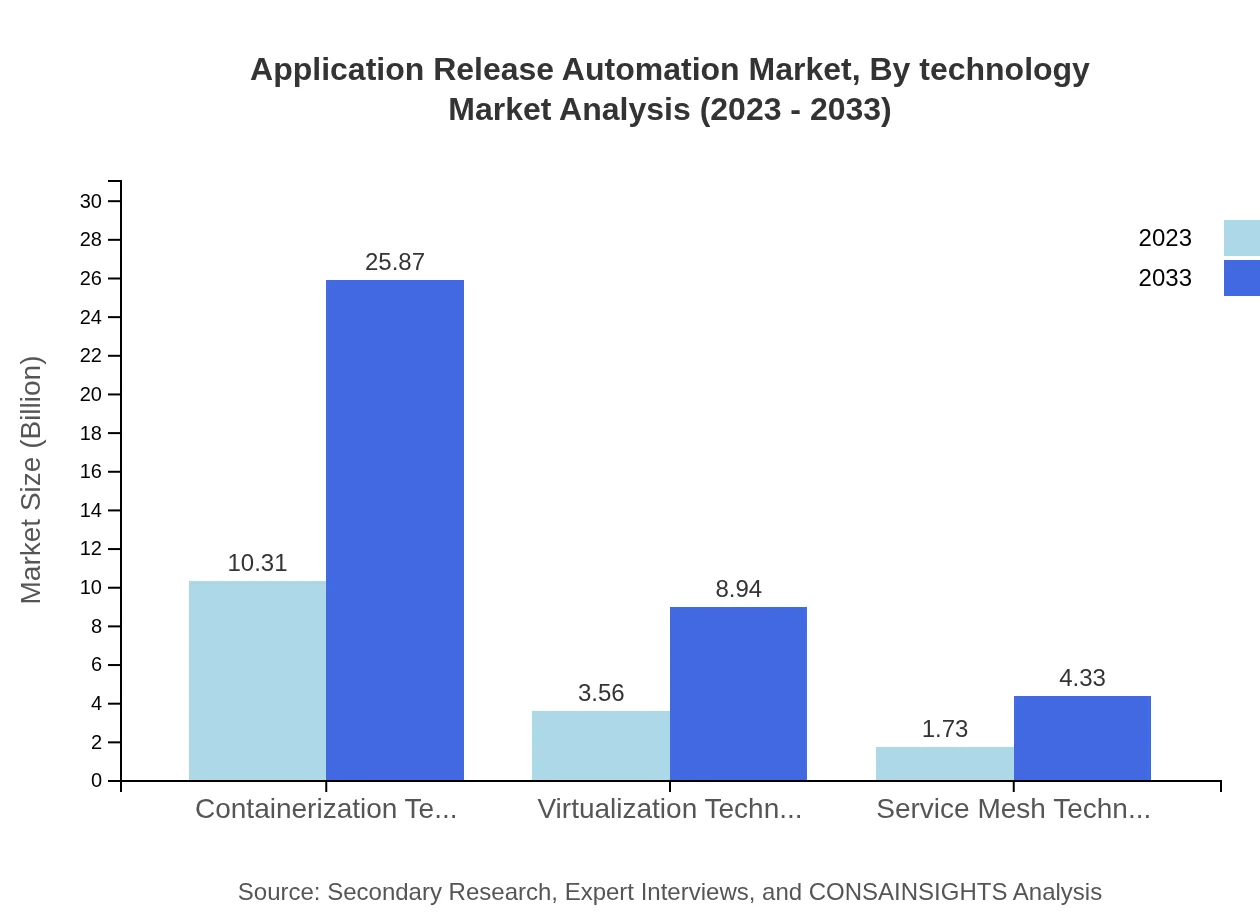

Application Release Automation Market Analysis By Technology

Technologies influencing the ARA market include containerization technologies, virtualization technologies, and service mesh technologies. Containerization technologies dominate with a market size of $10.31 billion in 2023, expect to grow to $25.87 billion by 2033.

Application Release Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Application Release Automation Industry

IBM:

IBM offers a comprehensive suite of application release automation tools that enhance DevOps pipelines, promoting faster delivery and better alignment with business objectives.Chef Software:

Chef Software provides automation frameworks that facilitate continuous integration and deployment, crucial for agile development environments.Jenkins:

As an open-source automation server, Jenkins is widely used for implementing CI/CD, helping organizations efficiently manage their software development lifecycle.Microsoft:

Microsoft's Azure DevOps provides a full range of tools for application lifecycle management, enabling teams to plan, build, and deploy applications in a streamlined manner.We're grateful to work with incredible clients.

FAQs

What is the market size of Application Release Automation?

The Application Release Automation market is valued at approximately $15.6 billion in 2023, with a robust compound annual growth rate (CAGR) of 9.3%. Projections show significant growth, expected to expand notably through to 2033.

What are the key market players or companies in the Application Release Automation industry?

Key players in the Application Release Automation industry include major technology firms specializing in software development and deployment solutions, driving innovation and competition in the market. Their engagement fosters advancements, creating a dynamic environment for service improvement.

What are the primary factors driving the growth in the Application Release Automation industry?

Growth in the Application Release Automation industry is primarily fueled by increasing demand for faster software delivery, enhanced operational efficiency, and the growing need for continuous integration and delivery methodologies, empowering organizations to optimize deployment processes.

Which region is the fastest Growing in the Application Release Automation?

The Application Release Automation market is experiencing rapid growth in the North America region, projected to increase from $5.27 billion in 2023 to $13.21 billion by 2033, driven by robust technological advancements and high demand for automated solutions.

Does ConsaInsights provide customized market report data for the Application Release Automation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Application Release Automation industry, allowing clients to acquire insights relevant to their unique requirements and strategic objectives.

What deliverables can I expect from this Application Release Automation market research project?

Deliverables from the Application Release Automation market research project include comprehensive market analysis, trends, projections, and segmented data for specific regions and technologies, providing valuable insights for informed business decision-making.

What are the market trends of Application Release Automation?

Current trends in the Application Release Automation market include increased adoption of cloud-based solutions, rising usage of containerization technologies, and a shift towards continuous delivery methods, reflecting an industry focused on enhancing deployment efficiency.