Apron Bus Market Report

Published Date: 03 February 2026 | Report Code: apron-bus

Apron Bus Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Apron Bus market, covering market size, trends, segmentation, and regional insights from 2023 to 2033. It aims to equip industry stakeholders with valuable data and forecasts to facilitate strategic planning.

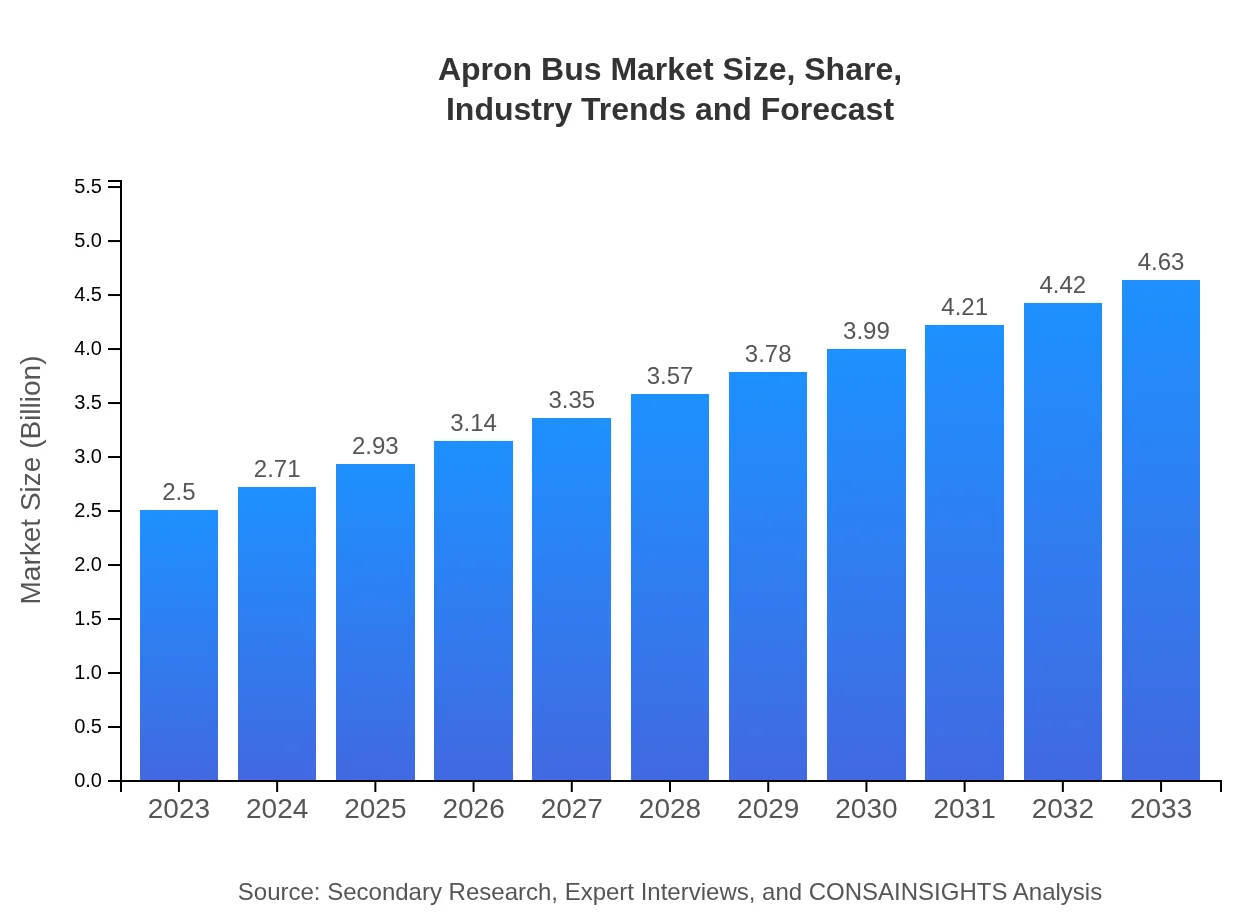

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.63 Billion |

| Top Companies | Oshkosh Corporation, NABI Bus, Mercedes-Benz, Volvo Buses |

| Last Modified Date | 03 February 2026 |

Apron Bus Market Overview

Customize Apron Bus Market Report market research report

- ✔ Get in-depth analysis of Apron Bus market size, growth, and forecasts.

- ✔ Understand Apron Bus's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Apron Bus

What is the Market Size & CAGR of Apron Bus Market in 2023?

Apron Bus Industry Analysis

Apron Bus Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Apron Bus Market Analysis Report by Region

Europe Apron Bus Market Report:

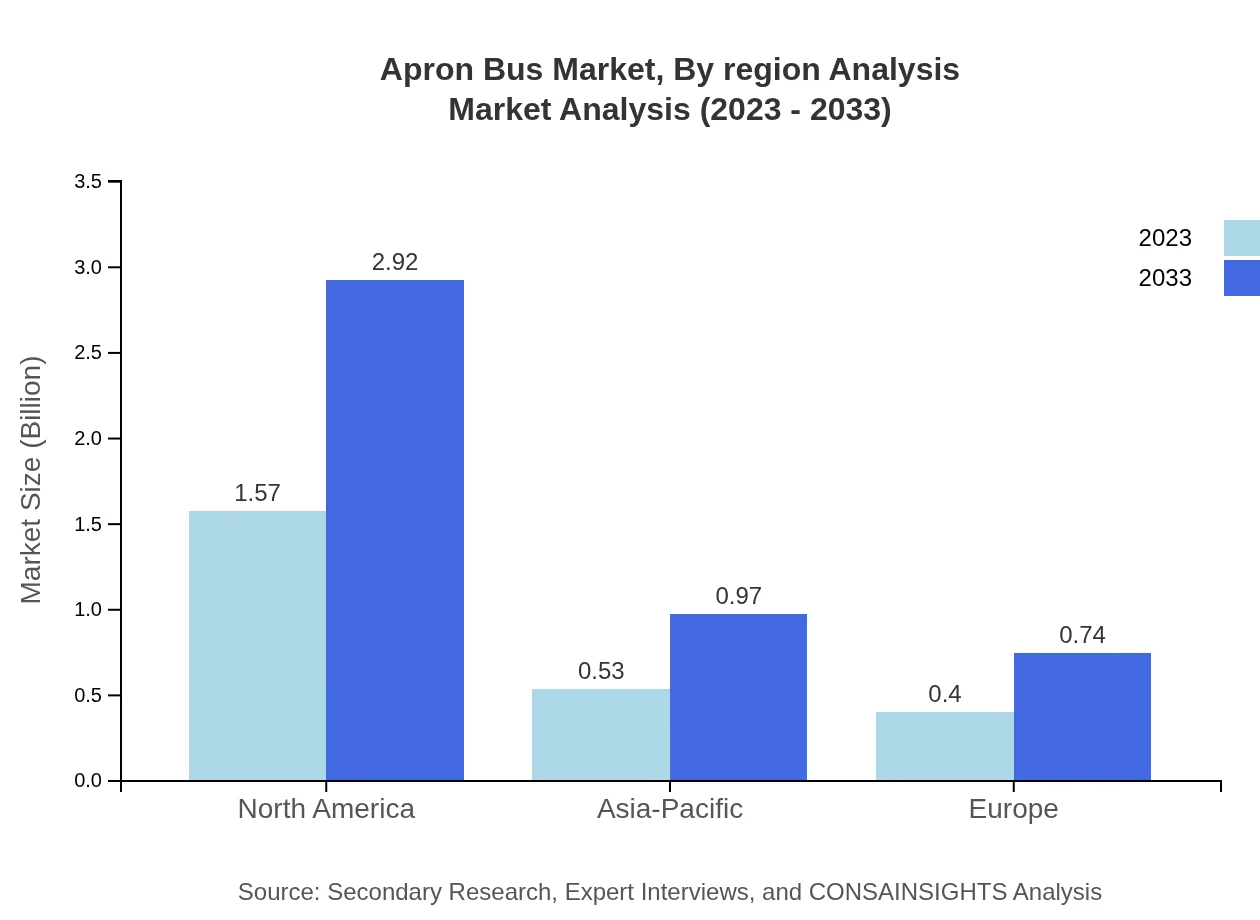

Europe's market size is projected to expand from $0.83 billion in 2023 to $1.54 billion by 2033. Sustainable transport initiatives and modernization efforts in airports are major growth factors.Asia Pacific Apron Bus Market Report:

The Asia Pacific region is witnessing significant growth, with the market projected to grow from $0.48 billion in 2023 to $0.89 billion by 2033. Increased air travel and rapid airport expansions are primary drivers.North America Apron Bus Market Report:

The North American market is expected to surge from $0.80 billion in 2023 to $1.49 billion by 2033, propelled by high passenger volumes and ongoing investments in infrastructure enhancements.South America Apron Bus Market Report:

In South America, the market is anticipated to grow from $0.13 billion in 2023 to $0.24 billion in 2033. Despite challenges, nascent airport projects are creating opportunities for Apron Bus manufacturers.Middle East & Africa Apron Bus Market Report:

The Middle East and Africa market is set to grow from $0.26 billion in 2023 to $0.47 billion by 2033. Rapid urbanization and enhanced airport facilities are fuelling this growth.Tell us your focus area and get a customized research report.

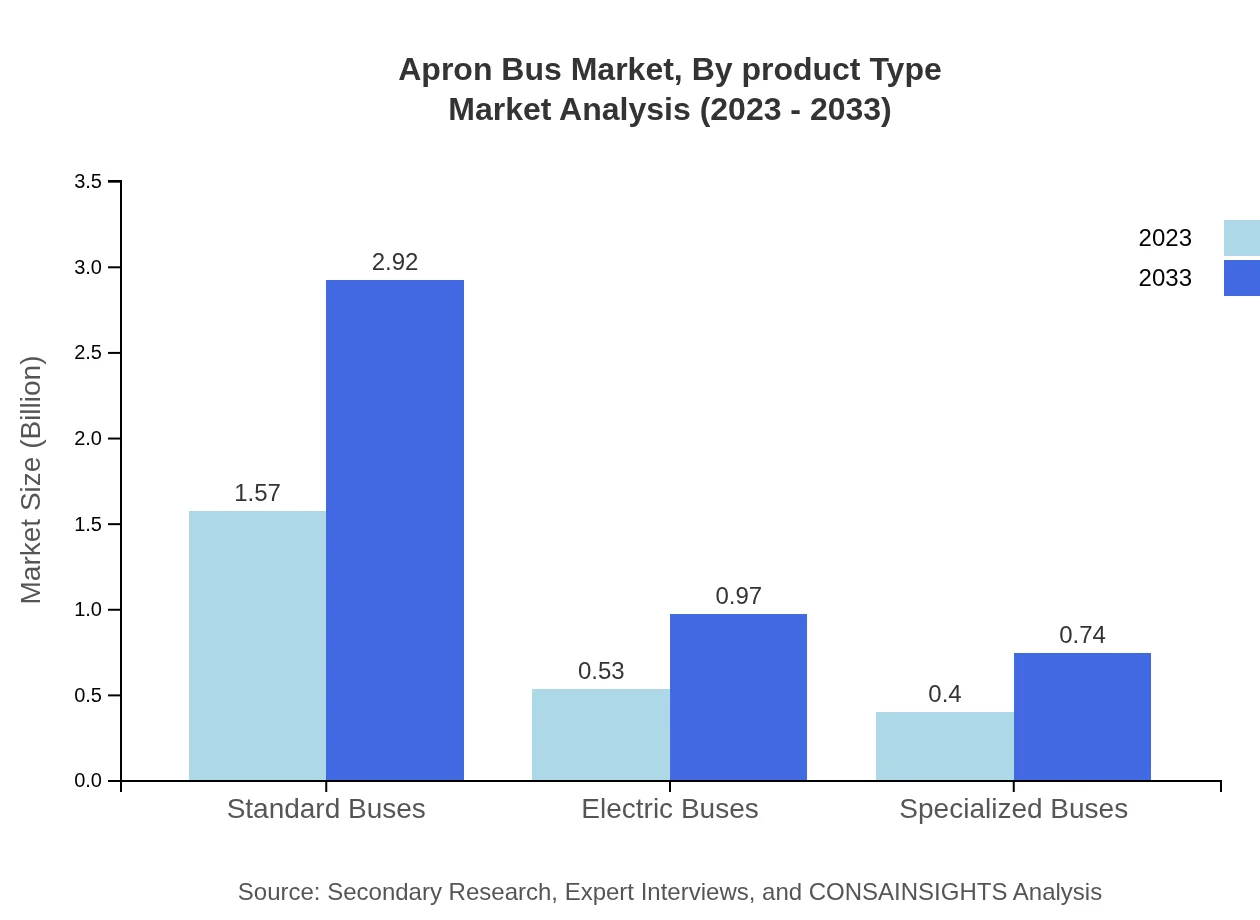

Apron Bus Market Analysis By Product Type

The market consists of segments such as standard buses, electric buses, and specialized buses. Standard buses dominate the market due to their widespread adoption, while electric buses show promise with increasing environmental concerns.

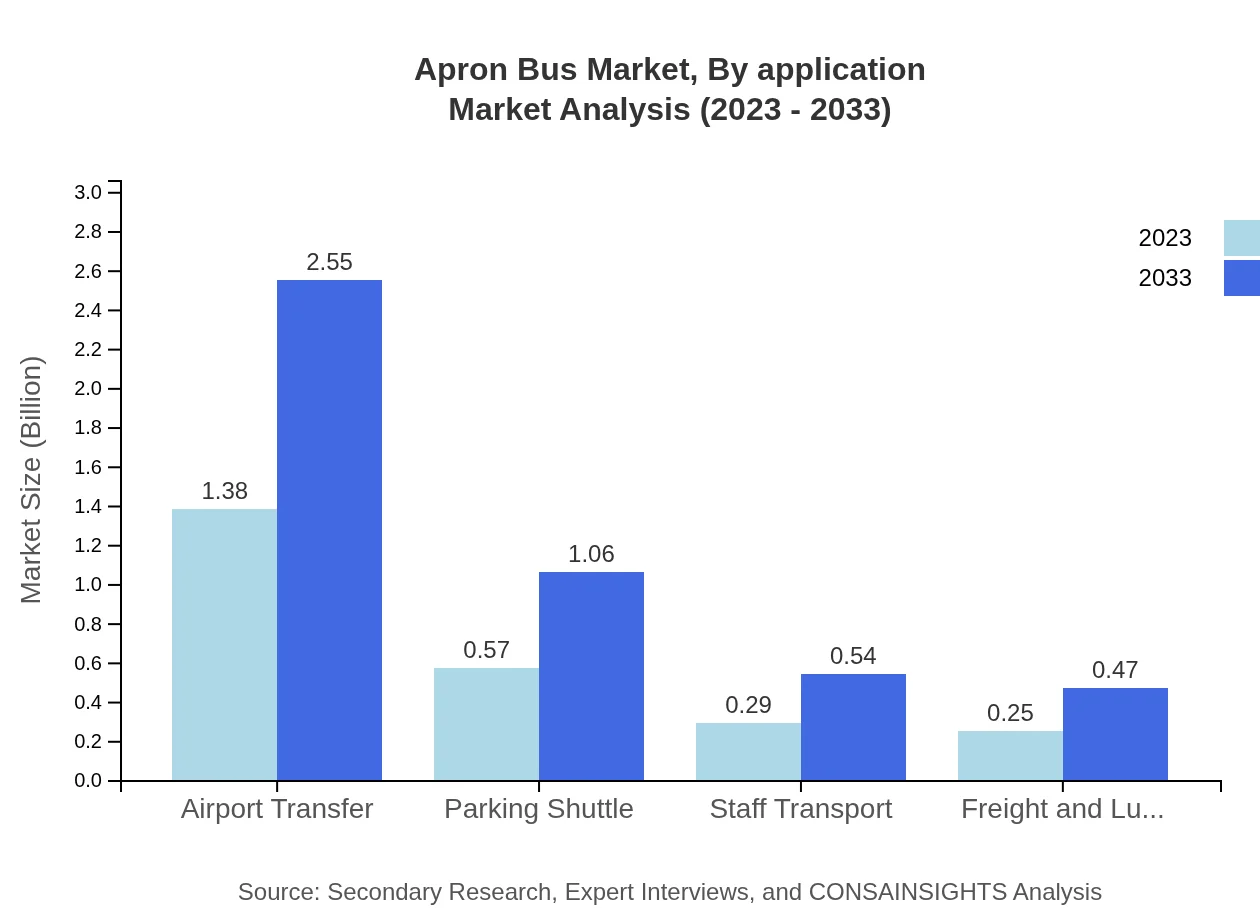

Apron Bus Market Analysis By Application

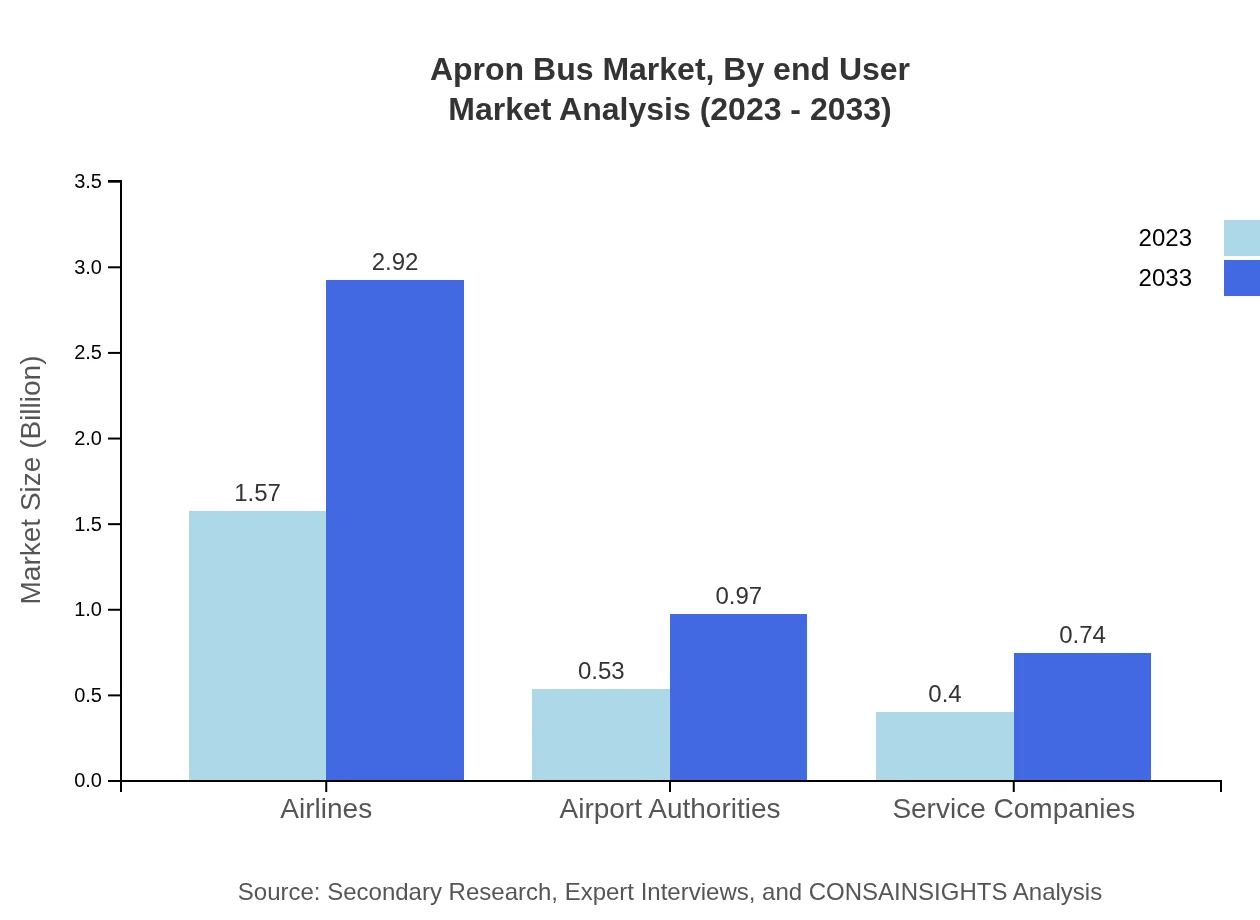

Airlines represent the largest application segment, expected to grow from $1.57 billion in 2023 to $2.92 billion by 2033, with significant contributions from airport authorities and service companies.

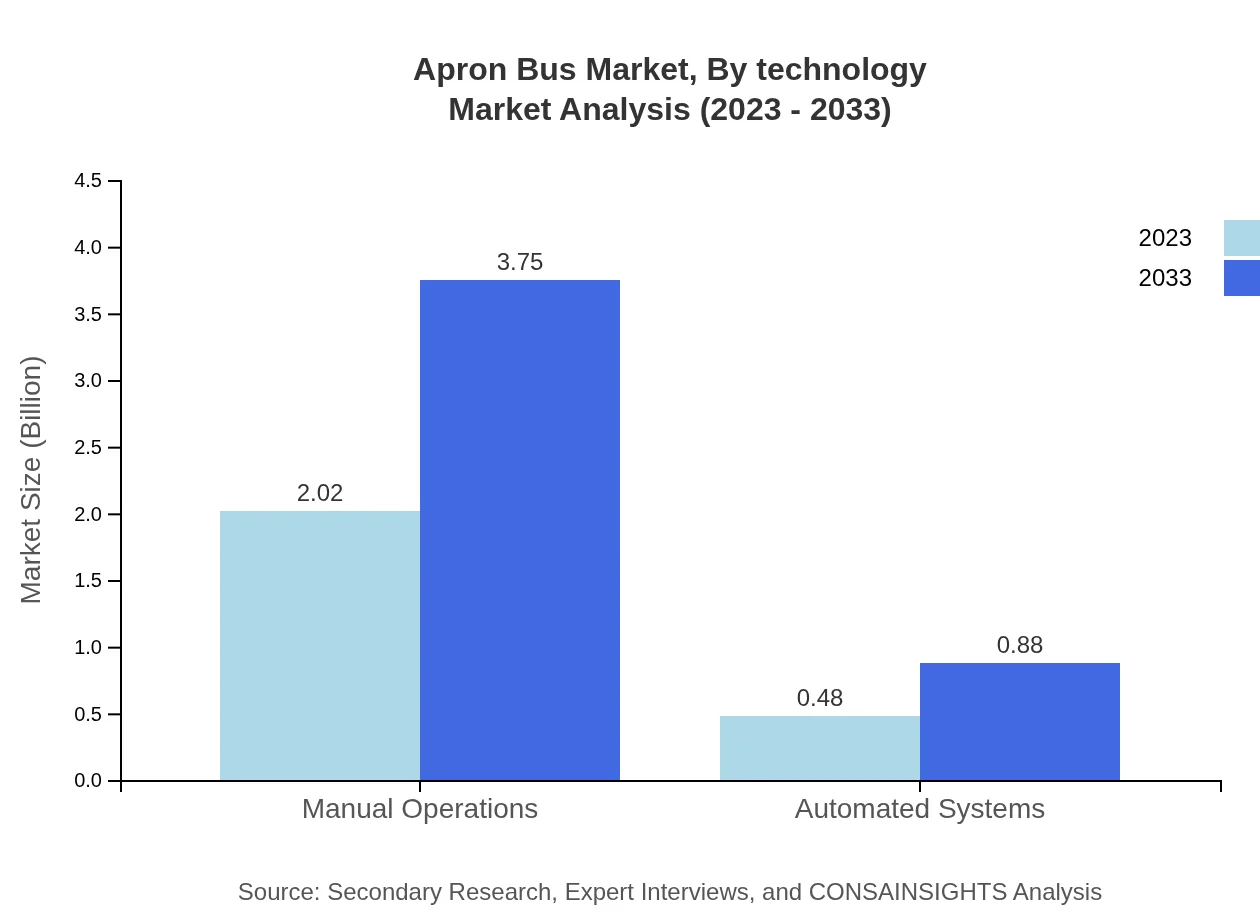

Apron Bus Market Analysis By Technology

Manual operations currently dominate the market, accounting for around 80.97%, but automated systems are gaining traction as technology adoption increases.

Apron Bus Market Analysis By End User

Key end-users include airlines, airport authorities, and service companies, each with distinct needs affecting market dynamics and growth projections.

Apron Bus Market Analysis By Region Analysis

Regional demand shows varying growth rates, influenced by local air travel patterns, airport development projects, and technological adoption. North America and Europe lead the market, while Asia Pacific is emerging as a critical growth region.

Apron Bus Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Apron Bus Industry

Oshkosh Corporation:

A leading manufacturer of specialty vehicles, including airport buses, known for their innovative designs and robust safety features.NABI Bus:

Specializes in designing and manufacturing buses with a strong presence in the airport transport sector, focusing on energy-efficient technologies.Mercedes-Benz:

Offers a range of high-quality buses designed for airport services, emphasizing luxury, efficiency, and passenger comfort.Volvo Buses:

Recognized for integrating sustainable technologies in their bus models, Volvo is a key player in the apron bus market, particularly with electric models.We're grateful to work with incredible clients.

FAQs

What is the market size of apron Bus?

The global apron bus market is valued at $2.5 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching significant market numbers in the next decade.

What are the key market players or companies in this apron Bus industry?

Key players in the apron-bus market include major airlines, airport authorities, and service companies, each contributing significantly to various segments and operational capacities within the industry.

What are the primary factors driving the growth in the apron Bus industry?

Growth in the apron-bus industry is driven by increasing air travel demand, need for efficient airport operations, and advancements in bus technologies, including electric and automated systems.

Which region is the fastest Growing in the apron Bus?

Europe is the fastest-growing region in the apron-bus market, with an estimated market growth from $0.83 billion in 2023 to $1.54 billion by 2033, indicating robust regional development.

Does ConsaInsights provide customized market report data for the apron Bus industry?

Yes, Consainsights offers customized market report data tailored to the apron-bus industry, allowing clients to focus on specific market segments or regional analyses according to their needs.

What deliverables can I expect from this apron Bus market research project?

Deliverables from the apron-bus market research project include detailed market analysis, segment data, growth trends, competitive landscape assessments, and tailored insights for strategic decision-making.

What are the market trends of apron Bus?

Current trends in the apron-bus market include a shift towards electric and automated buses, increased emphasis on sustainability, and a growing focus on enhancing passenger and operational efficiencies.