Aprotic Solvents Market Report

Published Date: 02 February 2026 | Report Code: aprotic-solvents

Aprotic Solvents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aprotic Solvents market, covering market size, trends, segmentation, regional insights, and forecasts from 2023 to 2033. Key market players and technological developments are also highlighted.

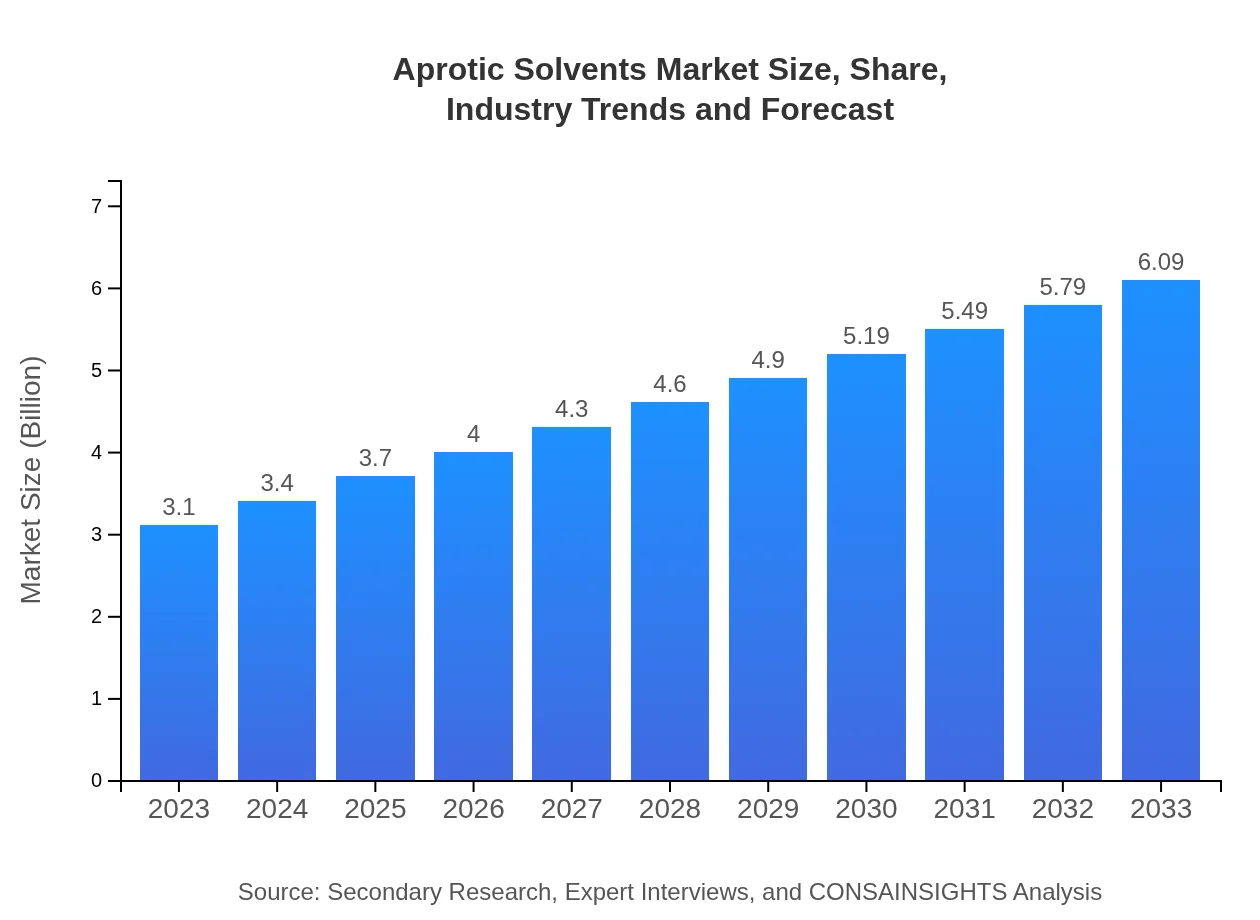

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.10 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.09 Billion |

| Top Companies | BASF SE, Memphis Chemical Corporation, Dow Chemical Company |

| Last Modified Date | 02 February 2026 |

Aprotic Solvents Market Overview

Customize Aprotic Solvents Market Report market research report

- ✔ Get in-depth analysis of Aprotic Solvents market size, growth, and forecasts.

- ✔ Understand Aprotic Solvents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aprotic Solvents

What is the Market Size & CAGR of Aprotic Solvents market in 2023?

Aprotic Solvents Industry Analysis

Aprotic Solvents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aprotic Solvents Market Analysis Report by Region

Europe Aprotic Solvents Market Report:

In Europe, the Aprotic Solvents market is expected to rise from 1.02 billion USD in 2023 to 2.00 billion USD by 2033, supported by stringent regulations supporting eco-friendly solvents.Asia Pacific Aprotic Solvents Market Report:

In the Asia Pacific region, the Aprotic Solvents market is poised to expand from 0.51 billion USD in 2023 to 1.01 billion USD by 2033, driven by a burgeoning manufacturing sector and increasing industrialization.North America Aprotic Solvents Market Report:

The North American market is projected to grow from 1.14 billion USD in 2023 to 2.24 billion USD by 2033, propelled by advancements in technology and increased investment in manufacturing.South America Aprotic Solvents Market Report:

The South American market is estimated to grow from 0.19 billion USD in 2023 to 0.38 billion USD by 2033, supported by rising demand in the construction and automotive sectors.Middle East & Africa Aprotic Solvents Market Report:

In the Middle East and Africa, the market is anticipated to expand from 0.23 billion USD in 2023 to 0.46 billion USD by 2033, spurred by growing industrial applications and energy sectors.Tell us your focus area and get a customized research report.

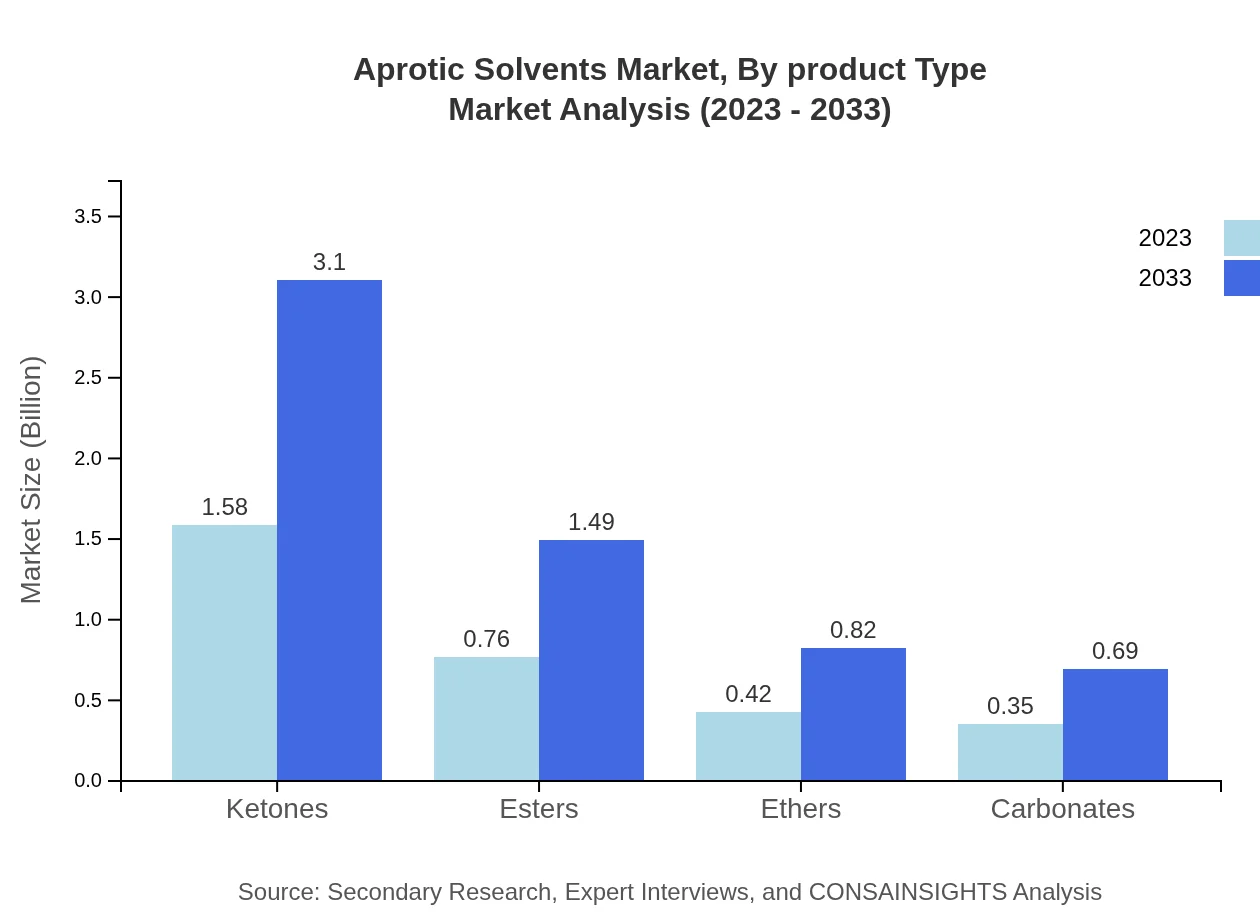

Aprotic Solvents Market Analysis By Product Type

The Aprotic Solvents market is significantly dominated by ketones, which alone account for a market size of 1.58 billion USD in 2023, projected to reach 3.10 billion USD by 2033, representing 50.82% market share.

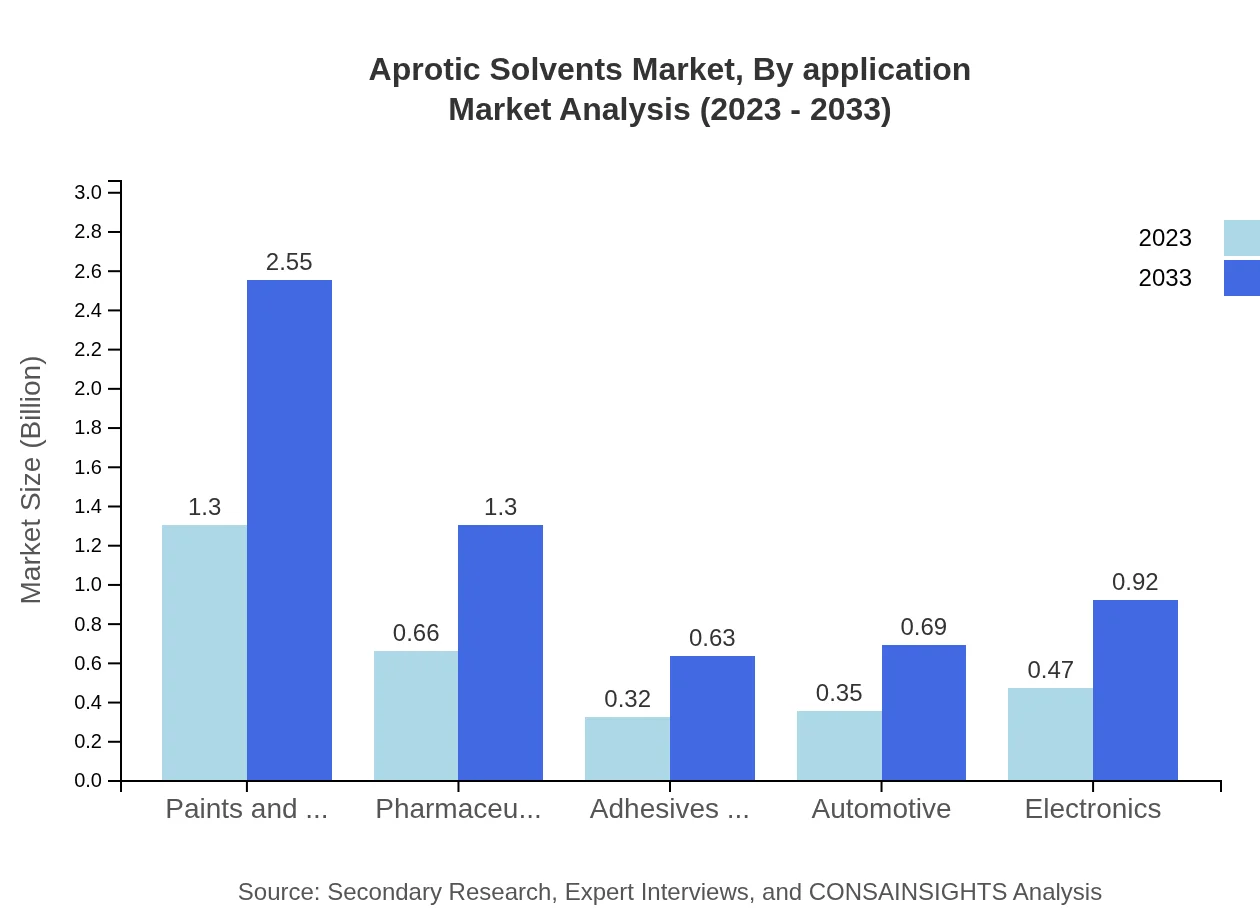

Aprotic Solvents Market Analysis By Application

In 2023, the paints and coatings application contributes significantly to the Aprotic Solvents segment with a market size of 1.30 billion USD, expected to grow to 2.55 billion USD by 2033, marking a consistent demand in construction and automotive industries.

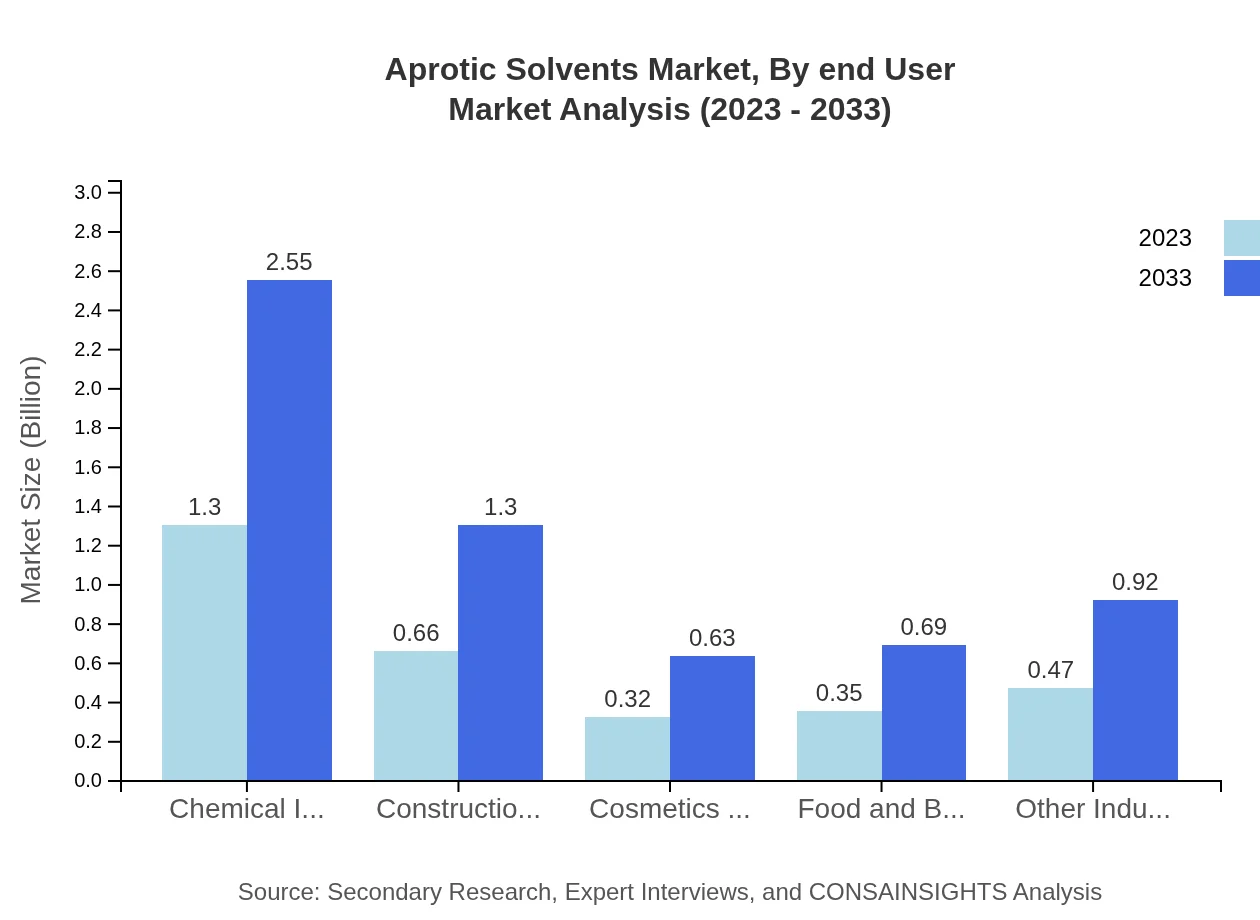

Aprotic Solvents Market Analysis By End User

Pharmaceuticals are projected to see growth from 0.66 billion USD in 2023 to 1.30 billion USD in 2033, indicating an increasing reliance on Aprotic Solvents for drug formulation and production applications.

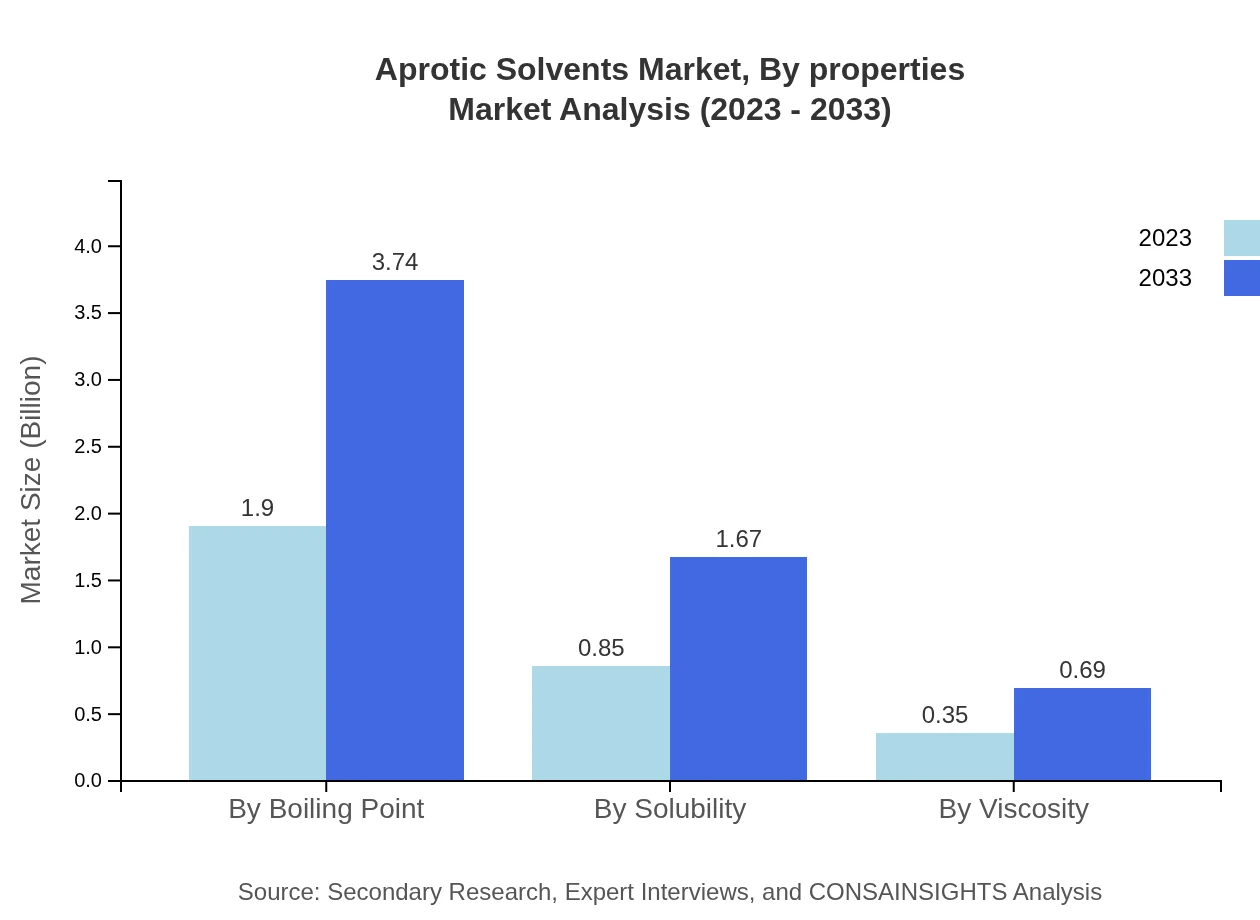

Aprotic Solvents Market Analysis By Properties

By viscosity, the segment is expected to grow from 0.35 billion USD in 2023 to 0.69 billion USD by 2033, indicating a surging requirement for solvents that can provide desired fluidity in industrial processes.

Aprotic Solvents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aprotic Solvents Industry

BASF SE:

A leading global chemical company, BASF offers innovative Aprotic Solvents and invests in sustainable technologies to enhance their product offerings in various applications.Memphis Chemical Corporation:

Specializes in high-quality Aprotic Solvents used in pharmaceuticals and industrial applications, focusing on compliance and performance-driven solutions.Dow Chemical Company:

Dow provides a broad portfolio of Aprotic Solvents, focusing on R&D and sustainable practices within the chemical industry.We're grateful to work with incredible clients.

FAQs

What is the market size of aprotic Solvents?

The aprotic solvents market is valued at approximately $3.1 billion in 2023, with a projected CAGR of 6.8% leading up to 2033. This growth reflects increasing demand across various industries, significantly shaping the market landscape.

What are the key market players or companies in this aprotic Solvents industry?

The aprotic solvents market features prominent companies including BASF, Dow Chemical, and Merck Group. These key players are strategizing their growth through product innovations and expanding their market reach to capitalize on increasing demand.

What are the primary factors driving the growth in the aprotic Solvents industry?

Growth in the aprotic solvents market is driven by rising demand for these solvents in the chemical, pharmaceutical, and automotive industries. Additionally, advancements in solvent formulations and applications support their increasing adoption, further propelling market growth.

Which region is the fastest Growing in the aprotic Solvents?

The fastest-growing region in the aprotic solvents market is Europe, expected to grow from $1.02 billion in 2023 to $2.00 billion by 2033. North America also shows significant growth, reflecting a robust demand in diverse industrial applications.

Does ConsaInsights provide customized market report data for the aprotic Solvents industry?

Yes, ConsaInsights offers customized market report data tailored for the aprotic solvents industry. This includes specialized insights on market dynamics, trends, and forecasts catering to specific business needs and strategies.

What deliverables can I expect from this aprotic Solvents market research project?

From the aprotic solvents market research project, expect comprehensive deliverables including detailed market analysis, competitive landscape assessment, and projections for various segments, alongside actionable insights for strategic decision-making.

What are the market trends of aprotic Solvents?

Current trends in the aprotic solvents market involve increasing demand within the chemical processing and pharmaceuticals sectors, alongside innovation in eco-friendly solvent alternatives. This evolution is also shaped by regulatory pressures for safer and sustainable solvents.