Aquaculture Products Market Report

Published Date: 02 February 2026 | Report Code: aquaculture-products

Aquaculture Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the aquaculture products market, emphasizing key trends, market size, and future forecasts for 2023 to 2033. It includes detailed insights into industry segments, geographical regions, technology impacts, and leading market players.

| Metric | Value |

|---|---|

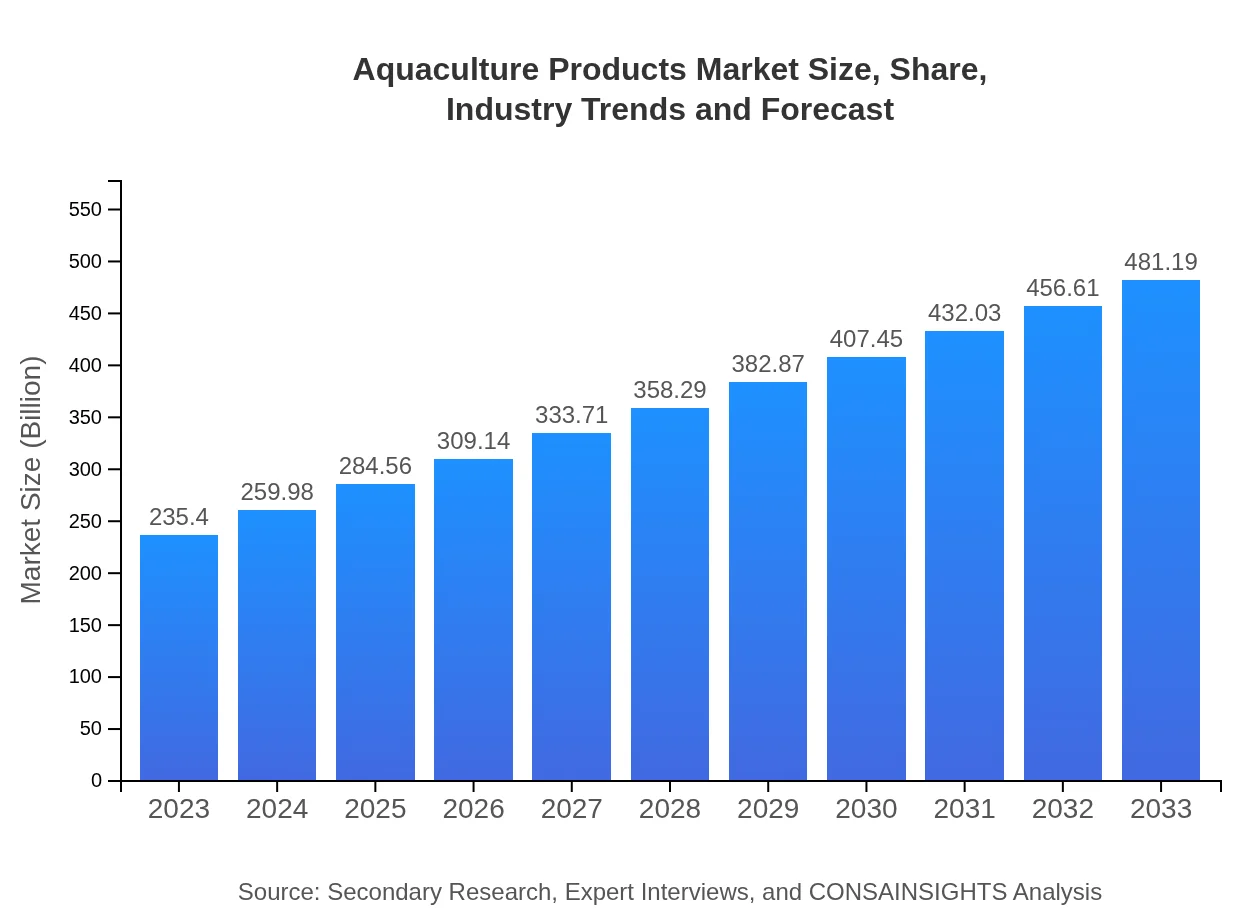

| Study Period | 2023 - 2033 |

| 2023 Market Size | $235.40 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $481.19 Billion |

| Top Companies | Mowi ASA, Thai Union Group, Cermaq Group, Nutreco |

| Last Modified Date | 02 February 2026 |

Aquaculture Products Market Overview

Customize Aquaculture Products Market Report market research report

- ✔ Get in-depth analysis of Aquaculture Products market size, growth, and forecasts.

- ✔ Understand Aquaculture Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aquaculture Products

What is the Market Size & CAGR of Aquaculture Products market in 2023?

Aquaculture Products Industry Analysis

Aquaculture Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aquaculture Products Market Analysis Report by Region

Europe Aquaculture Products Market Report:

Europe has a well-developed aquaculture market generating a value of $74.10 billion in 2023, expected to double to $151.48 billion by 2033. The implementation of rigorous sustainability measures and quality control have positioned Europe as a key player in the industry.Asia Pacific Aquaculture Products Market Report:

The Asia Pacific region dominates the aquaculture products market, accounting for a substantial share due to extensive coastal areas and technological advancements. In 2023, the market size is valued at $41.34 billion, expected to reach $84.50 billion by 2033, growing at a CAGR of 7.4%. Major contributors include countries like China, India, and Vietnam, which lead in fish production.North America Aquaculture Products Market Report:

North America represents a dynamic market for aquaculture products, with a 2023 value of $84.77 billion that may escalate to $173.28 billion by 2033. The presence of technological hubs and advancements in farming practices significantly fuel this sector, with the USA leading production.South America Aquaculture Products Market Report:

The South American aquaculture market is steadily growing with a market size of $20.55 billion in 2023, projected to increase to $42.01 billion by 2033. The ongoing investment in infrastructure and technological innovation in countries like Brazil and Chile supports this growth.Middle East & Africa Aquaculture Products Market Report:

The Middle East and Africa market, valued at $14.64 billion in 2023, is anticipated to reach $29.93 billion by 2033. Emerging aquaculture initiatives in countries like Egypt and the increasing demand for fish protein are significant growth drivers.Tell us your focus area and get a customized research report.

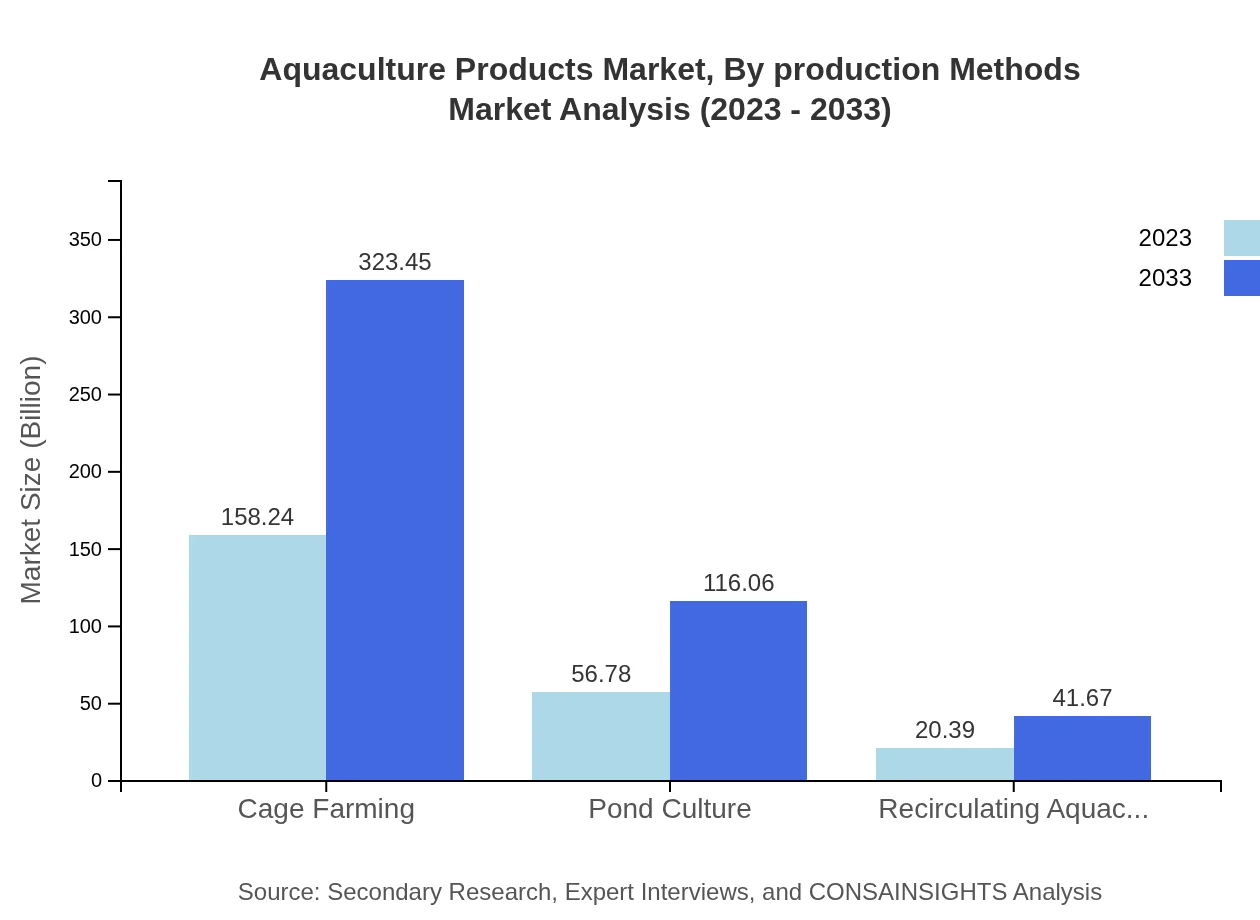

Aquaculture Products Market Analysis By Production Methods

This segment includes various farming techniques like cage farming, pond culture, and RAS. Cage farming holds a major market share due to its efficiency and high yield. RAS systems are gaining popularity for their sustainability advantage and better resource management.

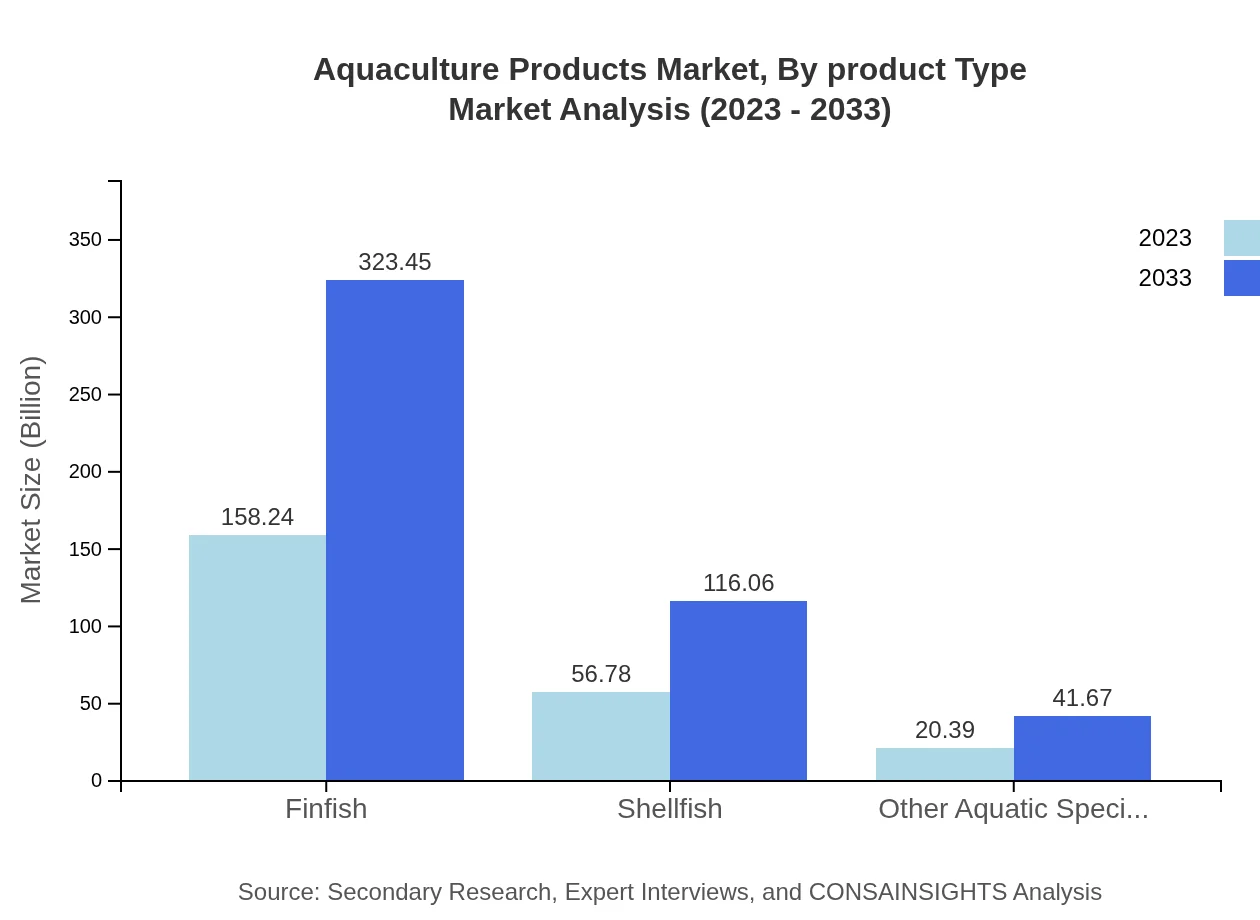

Aquaculture Products Market Analysis By Product Type

With finfish leading this segment, they provide a significant market size of $158.24 billion in 2023, projected to rise to $323.45 billion by 2033. Shellfish and other species follow, gaining ground due to rising demands in gourmet dining and health food markets.

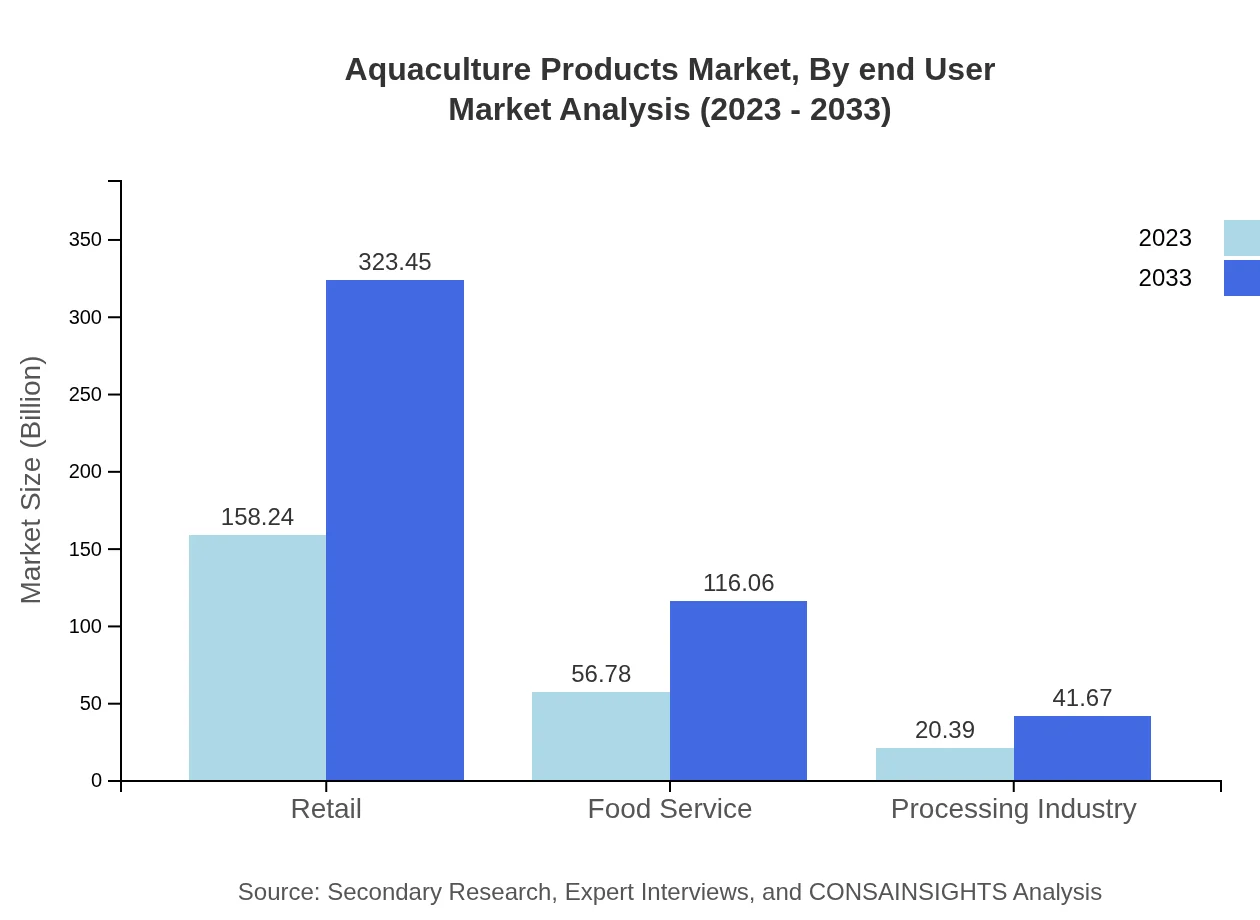

Aquaculture Products Market Analysis By End User

The retail sector dominates, making up a considerable portion of total sales due to direct consumer access to aquatic products. The food service industry, valued at $56.78 billion in 2023, is expected to double by 2033, reflecting growing seafood consumption in restaurants and catering services.

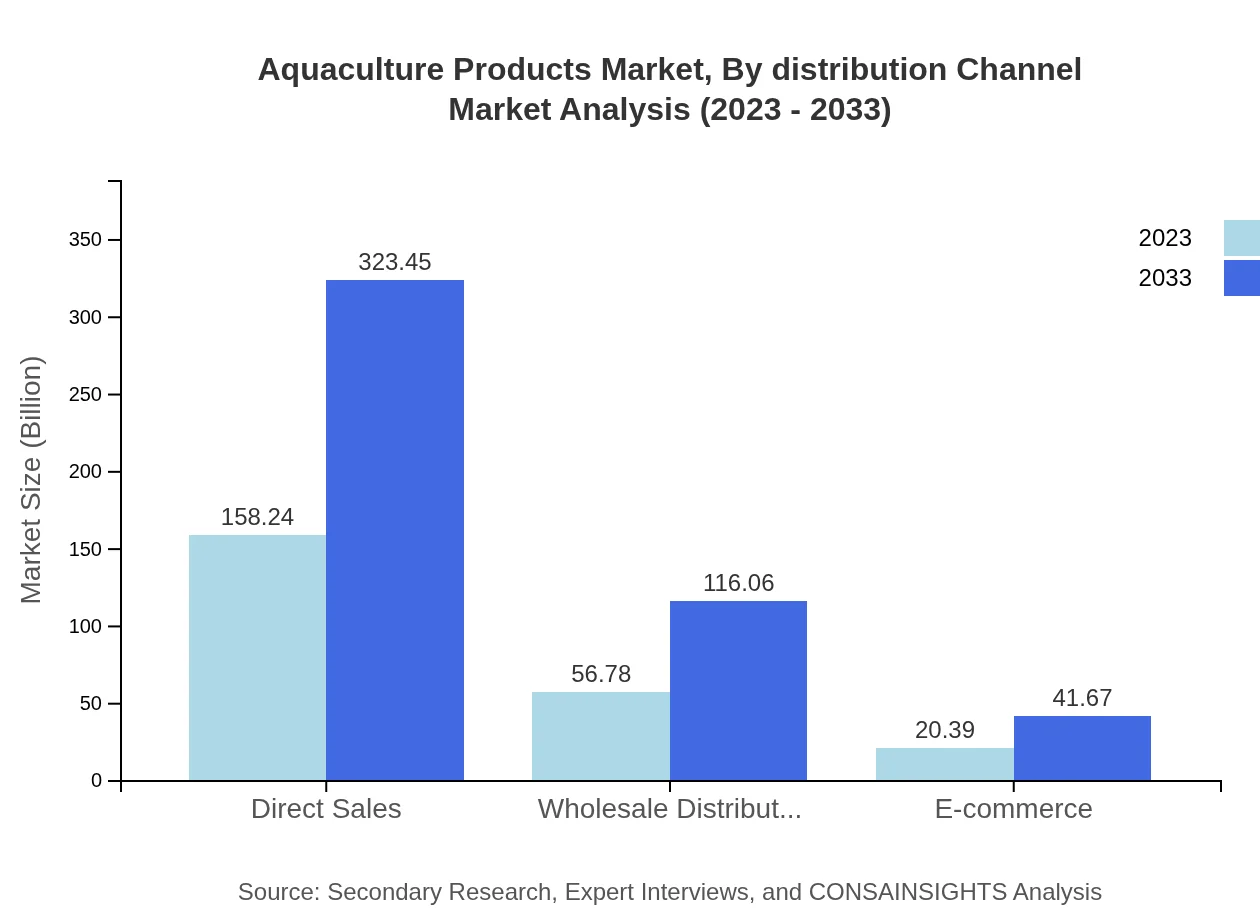

Aquaculture Products Market Analysis By Distribution Channel

Distribution channels include direct sales, wholesale distributors, and e-commerce, adapting to changing consumer purchasing behaviors. E-commerce is rapidly growing, providing a convenient platform for consumers to access fresh seafood.

Aquaculture Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aquaculture Products Industry

Mowi ASA:

Mowi ASA is one of the world's largest producers of Atlantic salmon, leading in sustainable aquaculture practices and innovation in farming technologies.Thai Union Group:

A global seafood leader, Thai Union is well-regarded for its commitment to quality and sustainability, producing a variety of seafood products and advocating for responsible fishing.Cermaq Group:

Cermaq specializes in salmon farming with a focus on sustainable practices and continuous research and innovation to enhance production processes.Nutreco:

Nutreco is a key player providing feed solutions and nutritional services globally, with a commitment to improving efficiency and sustainability in the aquaculture industry.We're grateful to work with incredible clients.

FAQs

What is the market size of aquaculture Products?

The global aquaculture products market is valued at approximately $235.4 billion in 2023 and is expected to grow at a CAGR of 7.2%, reflecting robust growth potential through 2033.

What are the key market players or companies in this aquaculture Products industry?

Key players in the aquaculture products industry include prominent firms like Thai Union Group, Mowi ASA, Marine Harvest, and Cermaq, which significantly influence market dynamics through their innovations and production capabilities.

What are the primary factors driving the growth in the aquaculture Products industry?

Key growth drivers for the aquaculture products industry include increasing global seafood demand, technological advancements in farming practices, rising health-conscious consumer trends, and governmental support for sustainable aquaculture initiatives.

Which region is the fastest Growing in the aquaculture Products market?

The fastest-growing region in the aquaculture products market is North America, anticipated to expand from $84.77 billion in 2023 to $173.28 billion in 2033, leading the growth rate among other regions.

Does ConsaInsights provide customized market report data for the aquaculture Products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and requirements within the aquaculture products industry, ensuring insights are relevant and actionable for decision-making.

What deliverables can I expect from this aquaculture Products market research project?

Deliverables from the aquaculture products market research project typically include comprehensive reports, key market insights, segment analysis, regional trends, and strategic recommendations for market entry and expansion.

What are the market trends of aquaculture Products?

Current trends in the aquaculture products market include a shift towards sustainable practices, advancements in aquaculture technology, increased consumer preference for ethically sourced seafood, and rising use of e-commerce platforms for distribution.