Aquafeed Additives Market Report

Published Date: 31 January 2026 | Report Code: aquafeed-additives

Aquafeed Additives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aquafeed Additives market, outlining key trends, forecasts, and detailed insights from 2023 to 2033. It covers market size, segmentation, regional dynamics, and leading players, aimed at equipping stakeholders with essential data and trends within the aquaculture industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

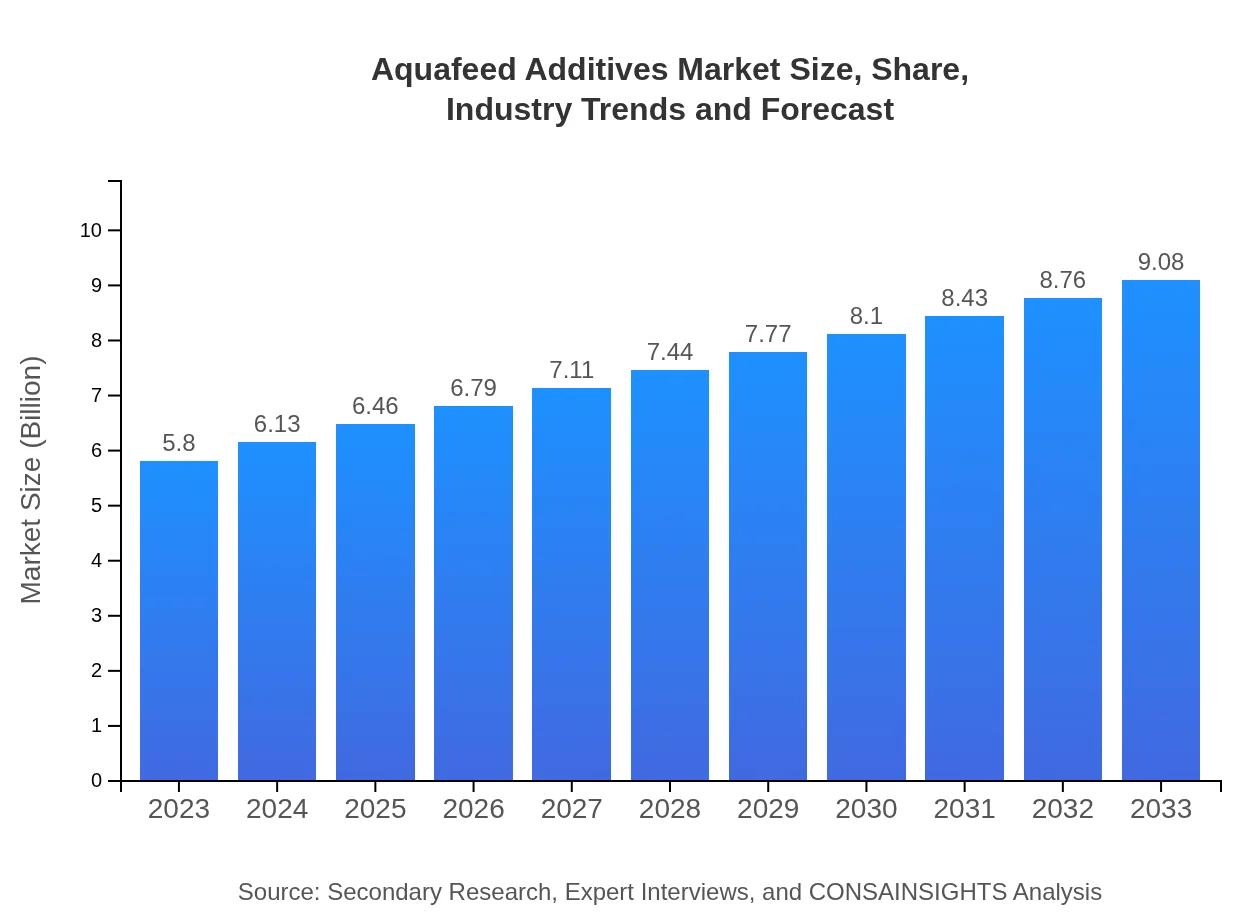

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Cargill, Inc., Nutreco N.V., Alltech, Inc., BASF SE, Archer Daniels Midland Company |

| Last Modified Date | 31 January 2026 |

Aquafeed Additives Market Overview

Customize Aquafeed Additives Market Report market research report

- ✔ Get in-depth analysis of Aquafeed Additives market size, growth, and forecasts.

- ✔ Understand Aquafeed Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aquafeed Additives

What is the Market Size & CAGR of Aquafeed Additives market in 2023 and 2033?

Aquafeed Additives Industry Analysis

Aquafeed Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aquafeed Additives Market Analysis Report by Region

Europe Aquafeed Additives Market Report:

The European market for Aquafeed Additives is valued at USD 1.67 billion in 2023, anticipated to grow to USD 2.62 billion by 2033. The region's stringent regulations regarding animal feed safety and increasing demand for eco-friendly aquaculture practices play significant roles in market growth.Asia Pacific Aquafeed Additives Market Report:

The Asia-Pacific region leads the Aquafeed Additives market, with an estimated market size of USD 1.12 billion in 2023, projected to grow to USD 1.75 billion by 2033. This growth is driven by significant aquaculture production in countries like China, Japan, and India. The region's focus on sustainable aquaculture practices and innovations in feed formulations contribute positively to market expansion.North America Aquafeed Additives Market Report:

North America, particularly the USA, represents a strong market for Aquafeed Additives with a valuation of USD 2.06 billion in 2023, reaching USD 3.23 billion by 2033. The market is supported by advancements in aquaculture technologies and a rising preference for sustainable and nutritious seafood.South America Aquafeed Additives Market Report:

South America is gradually emerging as a key player in the Aquafeed Additives sector, with a market size of USD 0.55 billion in 2023 expected to rise to USD 0.86 billion by 2033. This growth is propelled by increasing aquaculture activities, especially in Brazil, and the industry's shift toward higher-quality feed additives.Middle East & Africa Aquafeed Additives Market Report:

The Middle East and Africa market size for Aquafeed Additives is currently USD 0.40 billion, projected to reach USD 0.62 billion by 2033. The growth in this region is driven by improved aquaculture practices and government initiatives aimed at boosting local fish production.Tell us your focus area and get a customized research report.

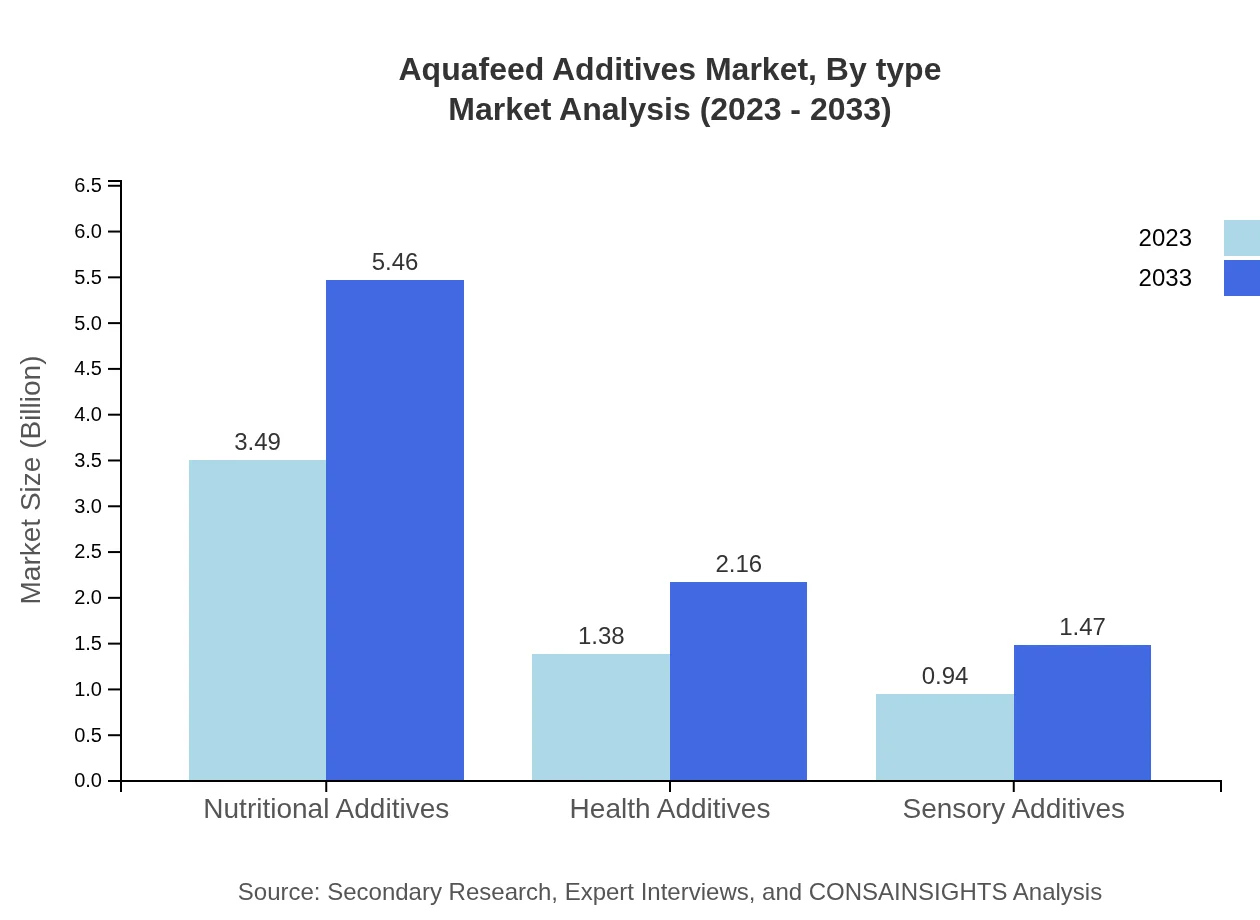

Aquafeed Additives Market Analysis By Type

The Aquafeed Additives market by type is largely dominated by Nutritional Additives, representing 60.09% of the market share in 2023, valued at USD 3.49 billion, projected to reach USD 5.46 billion by 2033. Health Additives account for 23.76% share, with market sizes of USD 1.38 billion in 2023, growing to USD 2.16 billion. Sensory Additives constitute 16.15%, expected to grow from USD 0.94 billion to USD 1.47 billion during the same period.

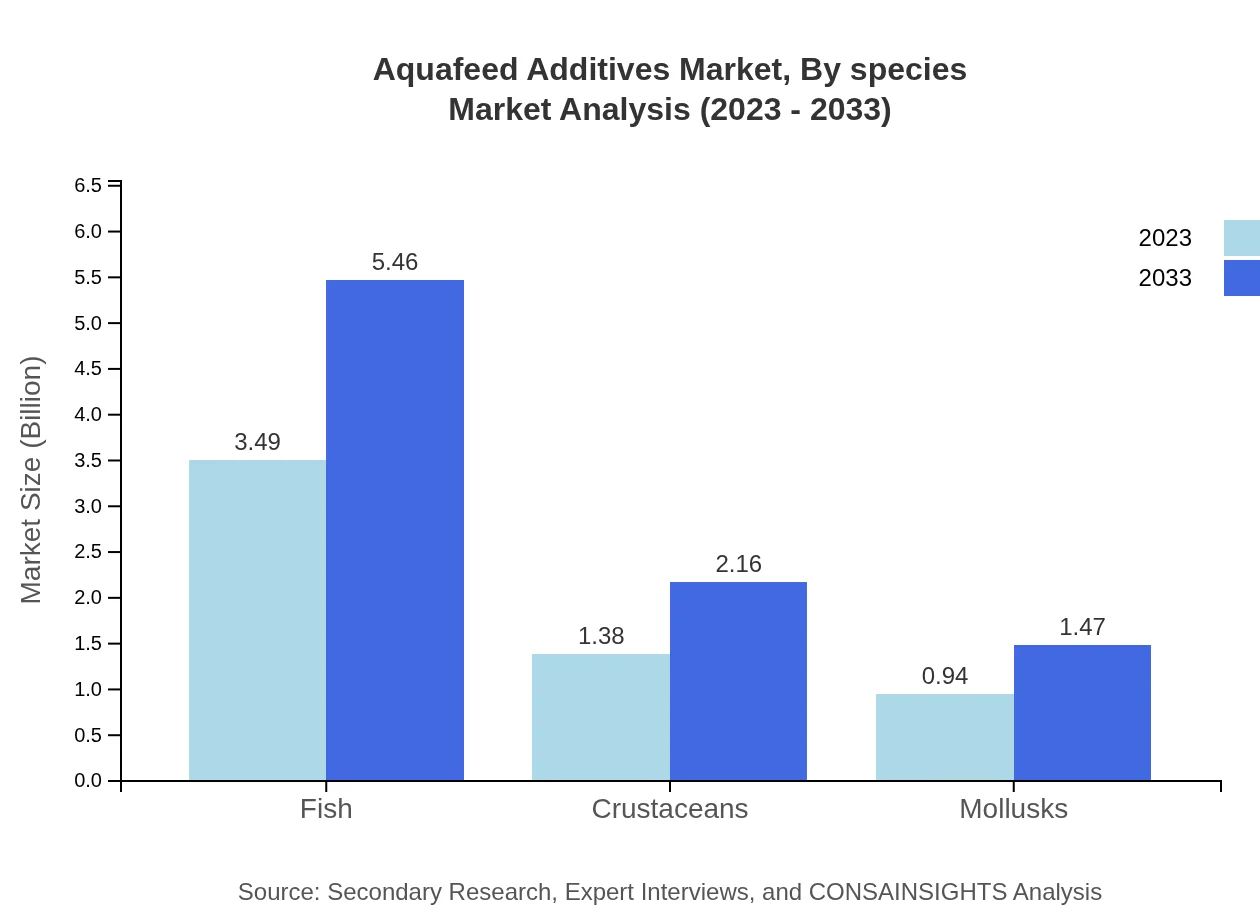

Aquafeed Additives Market Analysis By Species

Fish additives dominate the species segment of the Aquafeed Additives market, making up 60.09% of the market share with a size of USD 3.49 billion in 2023, expected to reach USD 5.46 billion by 2033. Crustacean additives hold a 23.76% market share, growing from USD 1.38 billion to USD 2.16 billion. Mollusk additives represent 16.15% of the market, expanding from USD 0.94 billion to USD 1.47 billion through the same period.

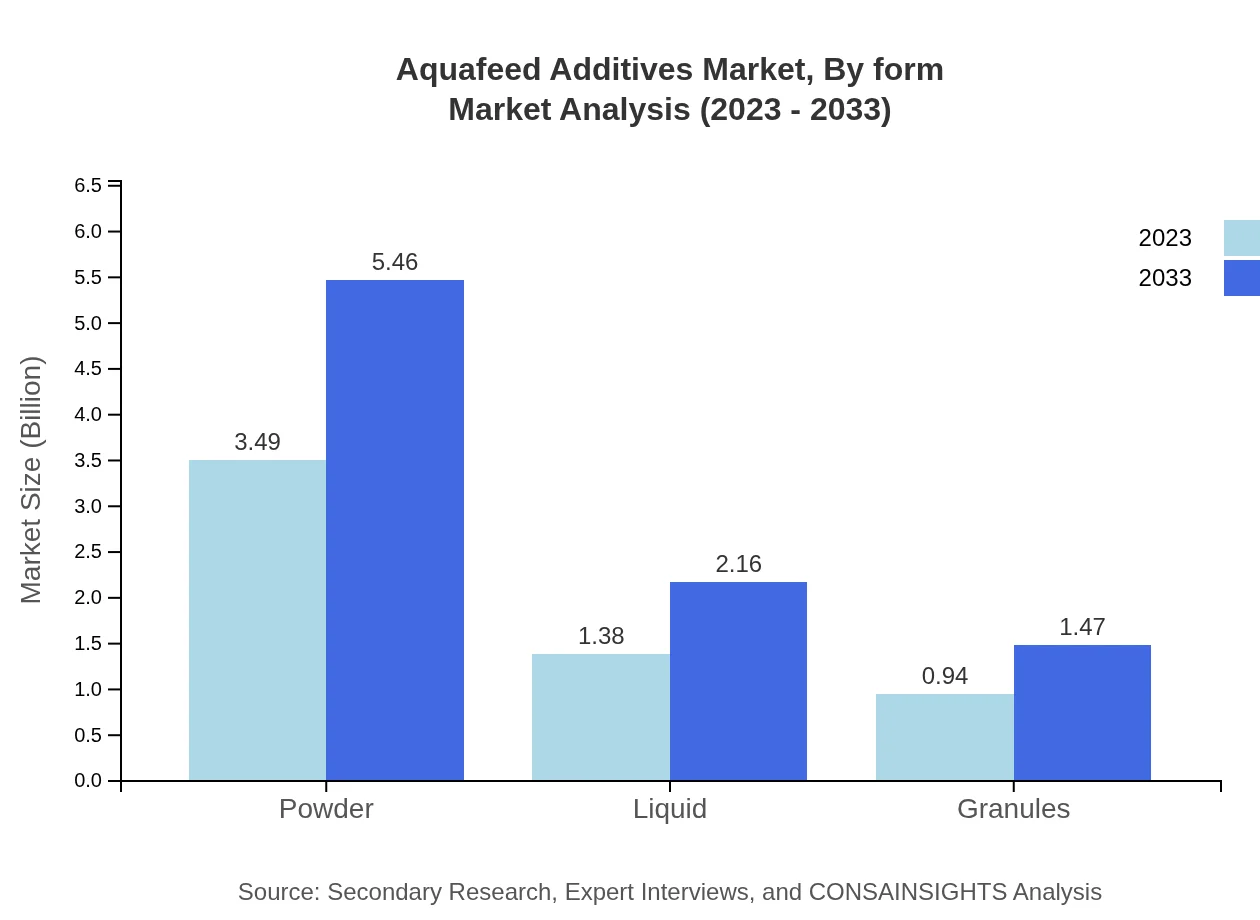

Aquafeed Additives Market Analysis By Form

Powdered form additives currently lead the market, constituting 60.09% of the share with sizes of USD 3.49 billion in 2023 and a forecast of USD 5.46 billion in 2033. Liquid additives are next, holding a 23.76% share, expected to grow from USD 1.38 billion to USD 2.16 billion, while granule additives represent 16.15%, projected to grow from USD 0.94 billion to USD 1.47 billion.

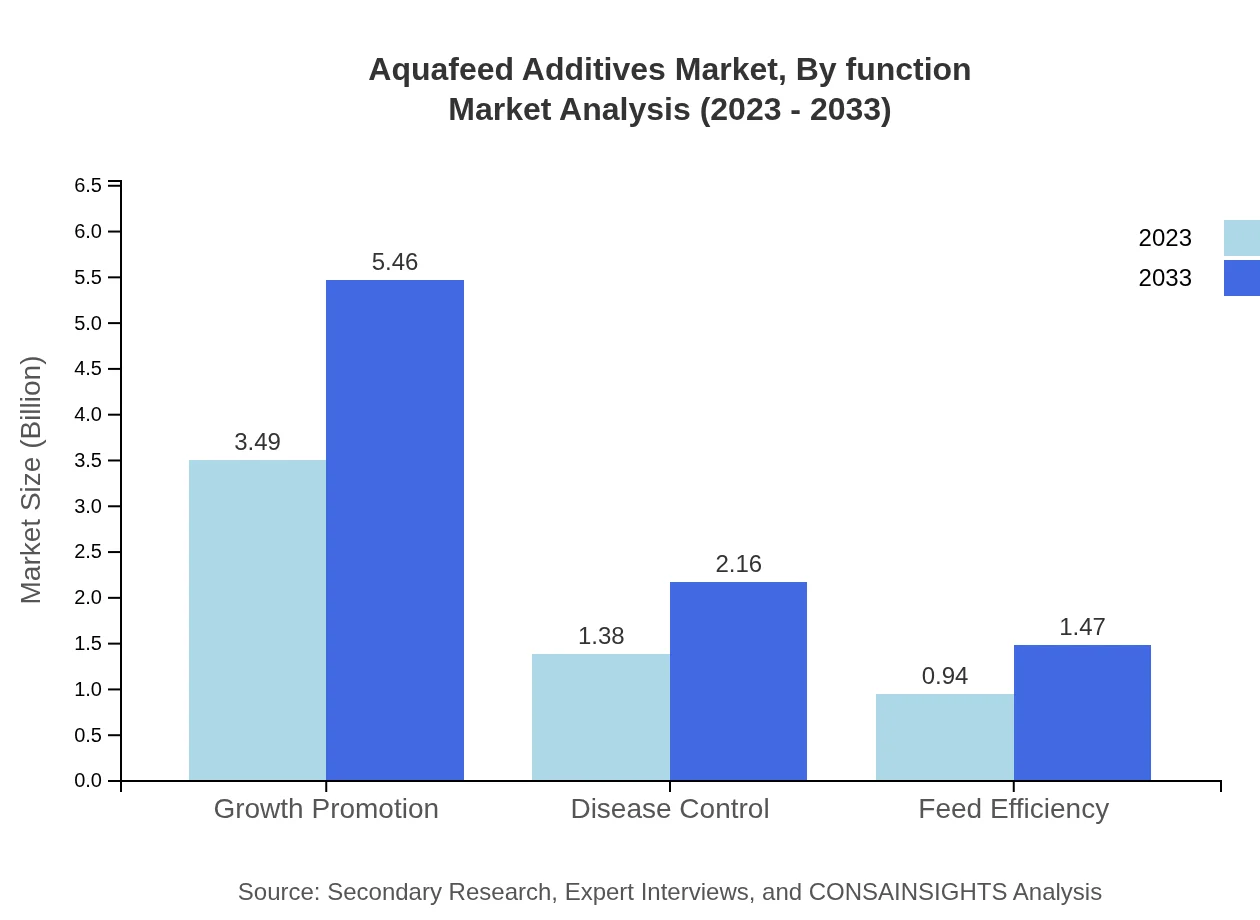

Aquafeed Additives Market Analysis By Function

The growth promotion function dominates with a 60.09% market share, translating to USD 3.49 billion in 2023, projected to reach USD 5.46 billion by 2033. Disease control accounts for 23.76%, growing from USD 1.38 billion to USD 2.16 billion, while feed efficiency functions comprise 16.15%, growing from USD 0.94 billion to USD 1.47 billion.

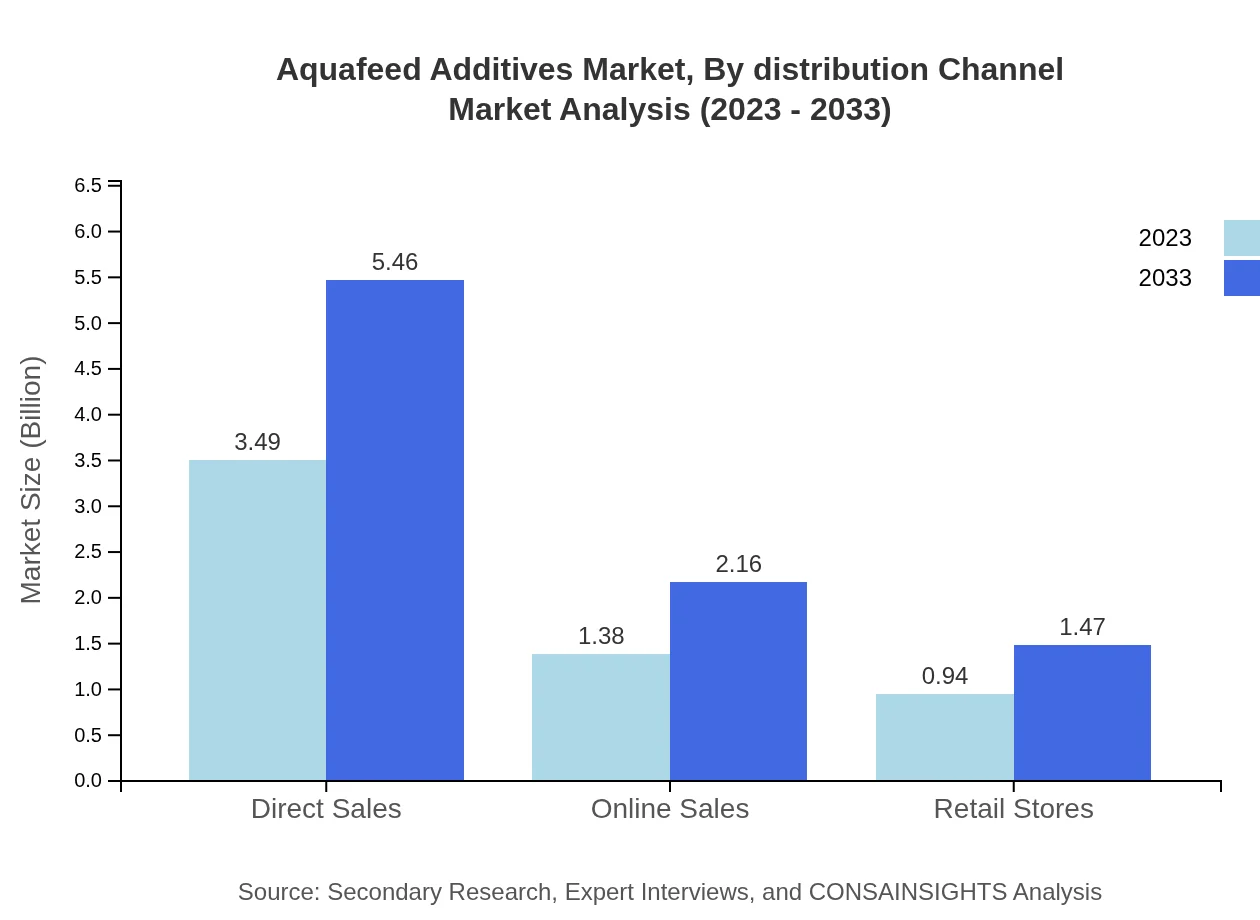

Aquafeed Additives Market Analysis By Distribution Channel

Direct sales dominate the distribution channel, holding a 60.09% share, forecasted to grow from USD 3.49 billion in 2023 to USD 5.46 billion by 2033. Online sales make up 23.76%, expected to expand from USD 1.38 billion to USD 2.16 billion, and retail store sales represent 16.15%, projected from USD 0.94 billion to USD 1.47 billion over the same period.

Aquafeed Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aquafeed Additives Industry

Cargill, Inc.:

Cargill is a global leader in animal nutrition, offering a comprehensive portfolio of specially formulated aquafeed additives aimed at improving the health, growth, and sustainability of aquaculture operations.Nutreco N.V.:

Nutreco specializes in animal nutrition and aquaculture, providing innovative aquafeed products that cater to the specific needs of aquatic species and aim to achieve optimal growth and health.Alltech, Inc.:

Alltech is known for its research-driven approach to animal nutrition, offering a range of aquafeed additives that enhance growth performance and reduce the environmental impact of aquaculture.BASF SE:

BASF is a leading chemical company that supplies a variety of specialty ingredients and additives for aquaculture, focusing on sustainability and innovation for improved feed efficiency.Archer Daniels Midland Company:

ADM is a global leader in nutrition and agricultural services, providing cutting-edge aquafeed additives designed to meet the growing demand for healthy and sustainable aquaculture.We're grateful to work with incredible clients.

FAQs

What is the market size of Aquafeed Additives?

The global aquafeed additives market is valued at approximately USD 5.8 billion in 2023, with a projected CAGR of 4.5% through 2033, indicating robust growth and increased demand for feed supplements in aquaculture.

What are the key market players or companies in the Aquafeed Additives industry?

Key players in the aquafeed additives market include major companies like DSM Nutritional Products, BASF SE, and Evonik Industries, which are involved in the research and development of innovative additive solutions for aquaculture.

What are the primary factors driving the growth in the Aquafeed Additives industry?

Factors include increasing global seafood demand, advancements in aquaculture practices, rising awareness of sustainable fish farming, and the health benefits associated with nutritionally enhanced feed additives for aquatic species.

Which region is the fastest Growing in the Aquafeed Additives market?

The North America region is expected to witness significant growth, with market size projected to increase from USD 2.06 billion in 2023 to USD 3.23 billion by 2033, driven by a rise in aquaculture activities and healthier seafood options.

Does ConsaInsights provide customized market report data for the Aquafeed Additives industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs in the aquafeed additives sector, ensuring clients receive relevant and actionable insights for strategic decision-making.

What deliverables can I expect from this Aquafeed Additives market research project?

Deliverables typically include a comprehensive market analysis report, detailed segmentation data, competitive landscape insights, and future growth forecasts, all enabling informed business strategies in the aquafeed additives market.

What are the market trends of Aquafeed Additives?

Current trends in the aquafeed additives market include a growing preference for organic and natural additives, rising investments in R&D for innovative feed solutions, and increased focus on environmentally sustainable aquaculture practices.