Aquatic Feed Market Report

Published Date: 02 February 2026 | Report Code: aquatic-feed

Aquatic Feed Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aquatic Feed market from 2023 to 2033, outlining growth trends, market size, segmentation, regional insights, and key industry players. It aims to equip stakeholders with valuable data for informed decision-making.

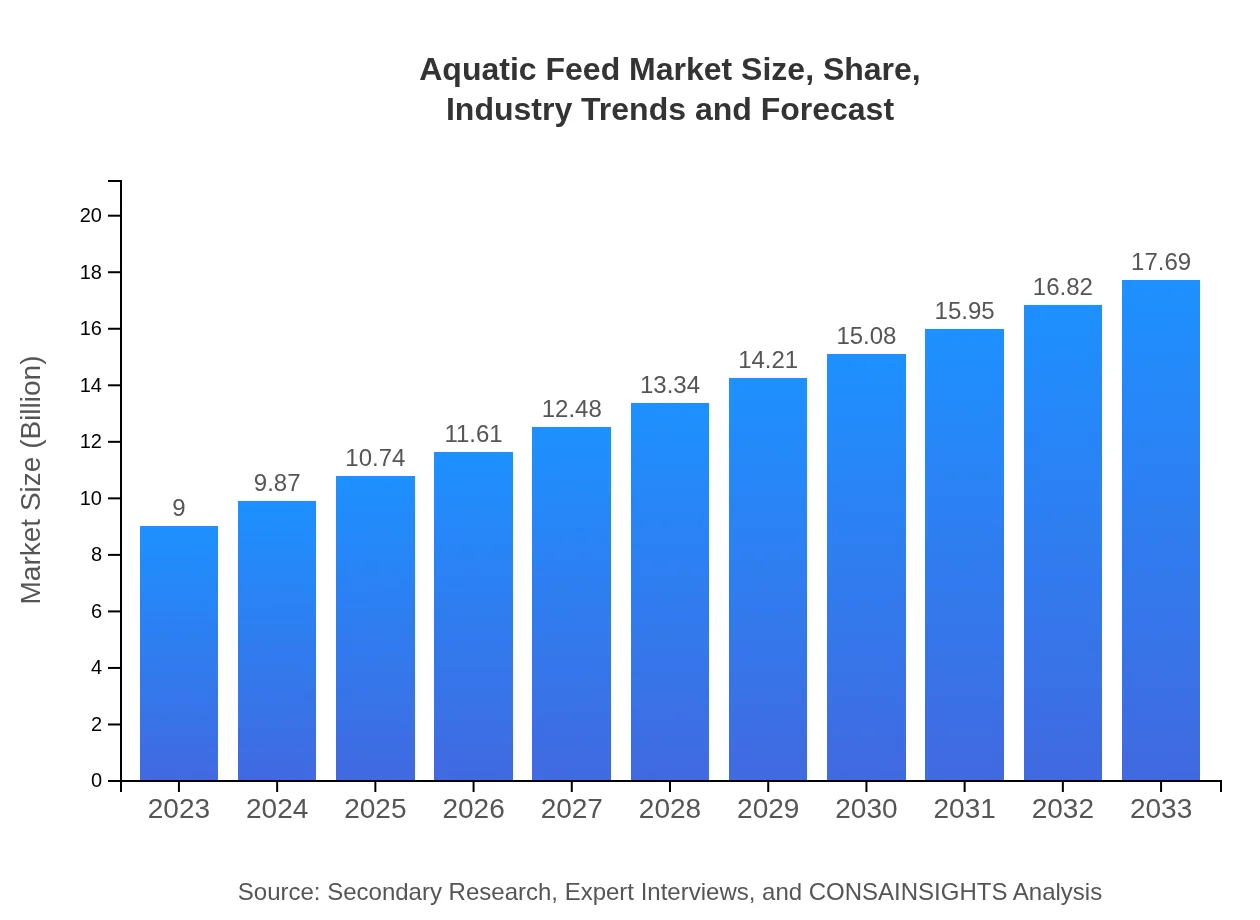

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $17.69 Billion |

| Top Companies | Cargill Inc., Nutreco N.V., ADM, Alltech Inc. |

| Last Modified Date | 02 February 2026 |

Aquatic Feed Market Overview

Customize Aquatic Feed Market Report market research report

- ✔ Get in-depth analysis of Aquatic Feed market size, growth, and forecasts.

- ✔ Understand Aquatic Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aquatic Feed

What is the Market Size & CAGR of Aquatic Feed market in 2023?

Aquatic Feed Industry Analysis

Aquatic Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aquatic Feed Market Analysis Report by Region

Europe Aquatic Feed Market Report:

Europe's Aquatic Feed market is expected to grow from $2.81 billion in 2023 to $5.53 billion by 2033. The region emphasizes aquaculture sustainability and innovation, promoting fish feed solutions that enhance fish health and environmental impacts.Asia Pacific Aquatic Feed Market Report:

In the Asia Pacific region, the Aquatic Feed market valued at $1.60 billion in 2023 is projected to expand to $3.15 billion by 2033, driven by dominant aquaculture practices in countries like China, India, and Vietnam. This region is essential for global seafood production, thus significantly impacting feed ingredient sourcing and innovations.North America Aquatic Feed Market Report:

In North America, the Aquatic Feed market stood at $3.27 billion in 2023, anticipated to grow to $6.43 billion by 2033. The market's growth is propelled by innovations in feed technology and an increasing preference for sustainably sourced seafood, alongside regulatory support for aquaculture.South America Aquatic Feed Market Report:

The South American market, valued at $0.69 billion in 2023 and expected to reach $1.36 billion by 2033, is characterized by rising shrimp farming and tilapia production. Increased investments in aquaculture facilities are bolstering the demand for specialized feed formulations.Middle East & Africa Aquatic Feed Market Report:

The Middle East and Africa market is on a growth trajectory, expanding from $0.62 billion in 2023 to $1.21 billion by 2033. The region is witnessing an increase in aquaculture investments to meet rising seafood consumption in local markets.Tell us your focus area and get a customized research report.

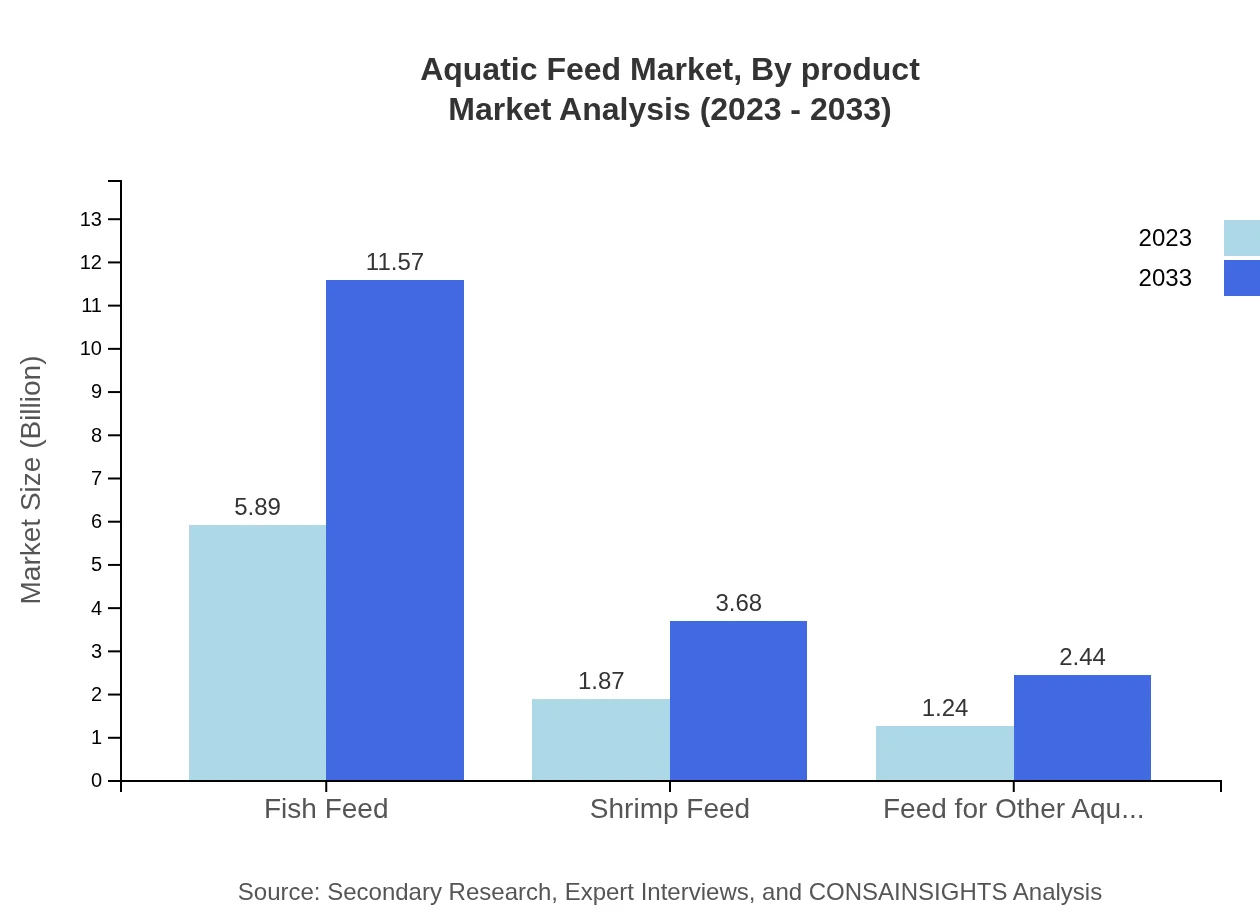

Aquatic Feed Market Analysis By Product

The Aquatic Feed market is prominently divided into categories like Fish Feed, Shrimp Feed, and others. As of 2023, Fish Feed had a market size of $5.89 billion, expected to reach $11.57 billion by 2033. Shrimp Feed is projected to grow from $1.87 billion to approximately $3.68 billion during the same period. Each segment plays a critical role in addressing the nutritional requirements of different aquatic species.

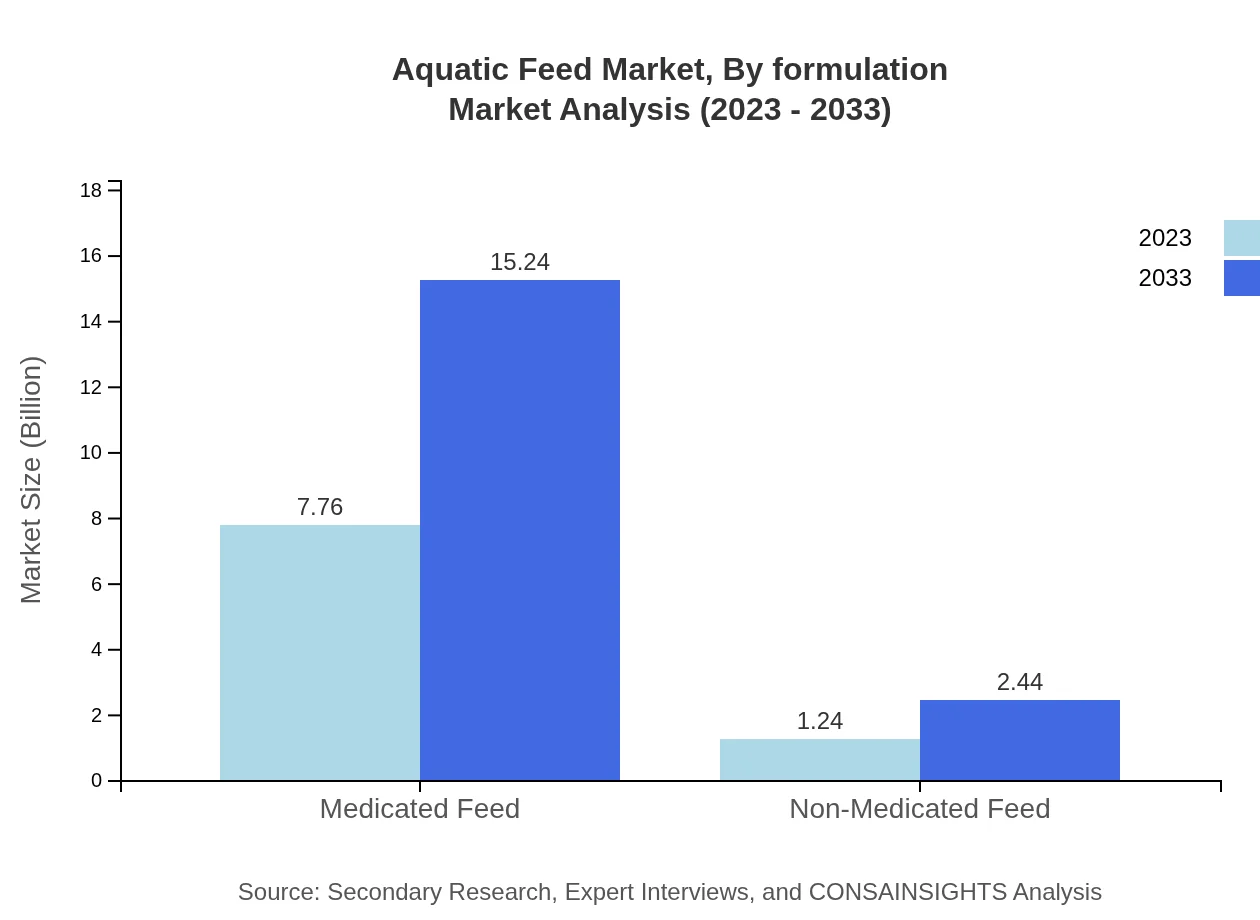

Aquatic Feed Market Analysis By Formulation

The Aquatic Feed market is categorized based on formulation into Medicated and Non-Medicated Feed. Medicated feed, valued at $7.76 billion in 2023, is projected to double by 2033, accounting for significant share. Non-medicated feed is also witnessing growth in response to rising health consciousness among consumers, driving demand for organic feed solutions.

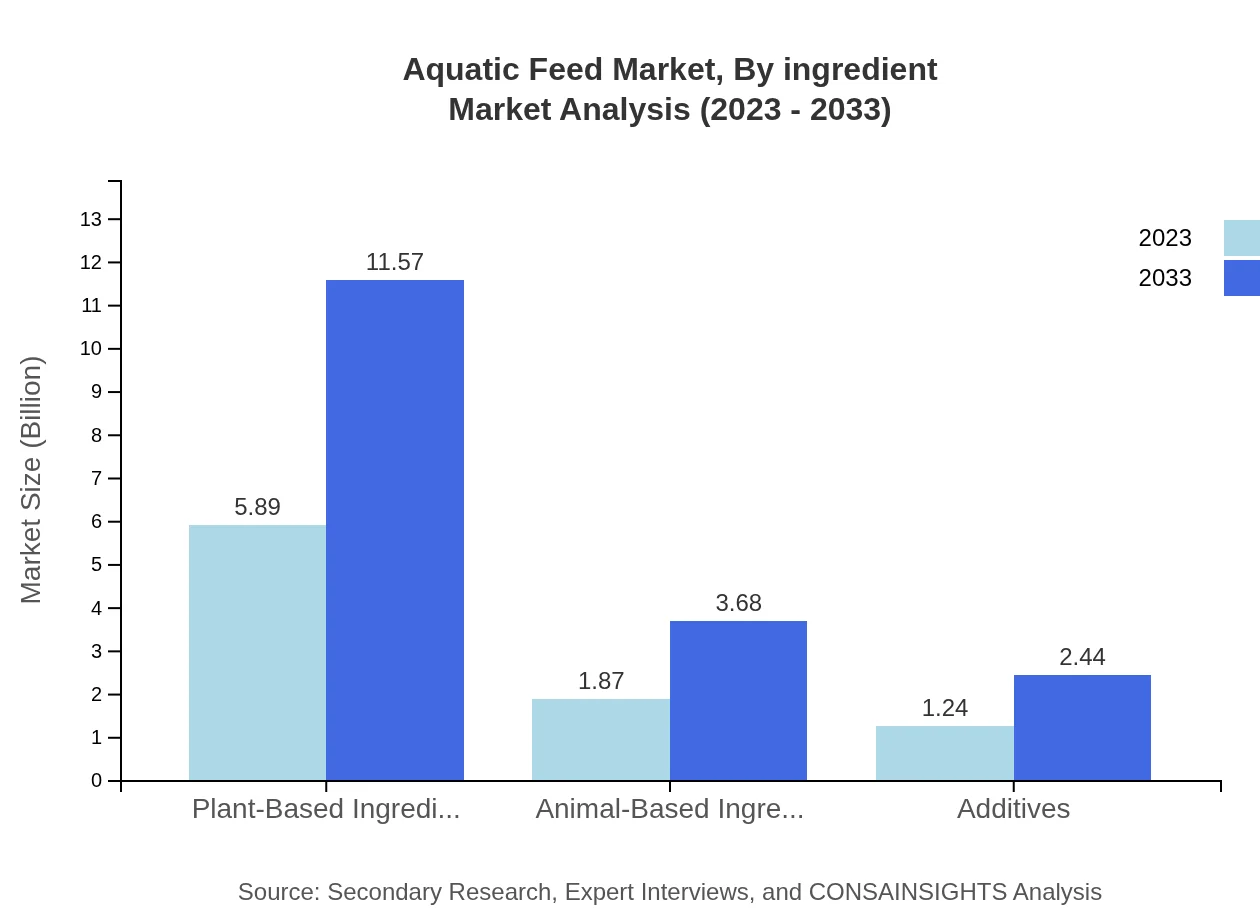

Aquatic Feed Market Analysis By Ingredient

Aquatic Feed ingredients are classified into Plant-Based, Animal-Based, and additives. Plant-Based Ingredients make up the significant bulk of the market, valued at $5.89 billion in 2023, and anticipated to reach $11.57 billion by 2033. Animal-Based and Additives segments also see growth driven by innovation in feed formulations aimed at improving nutrient absorption and overall aquatic health.

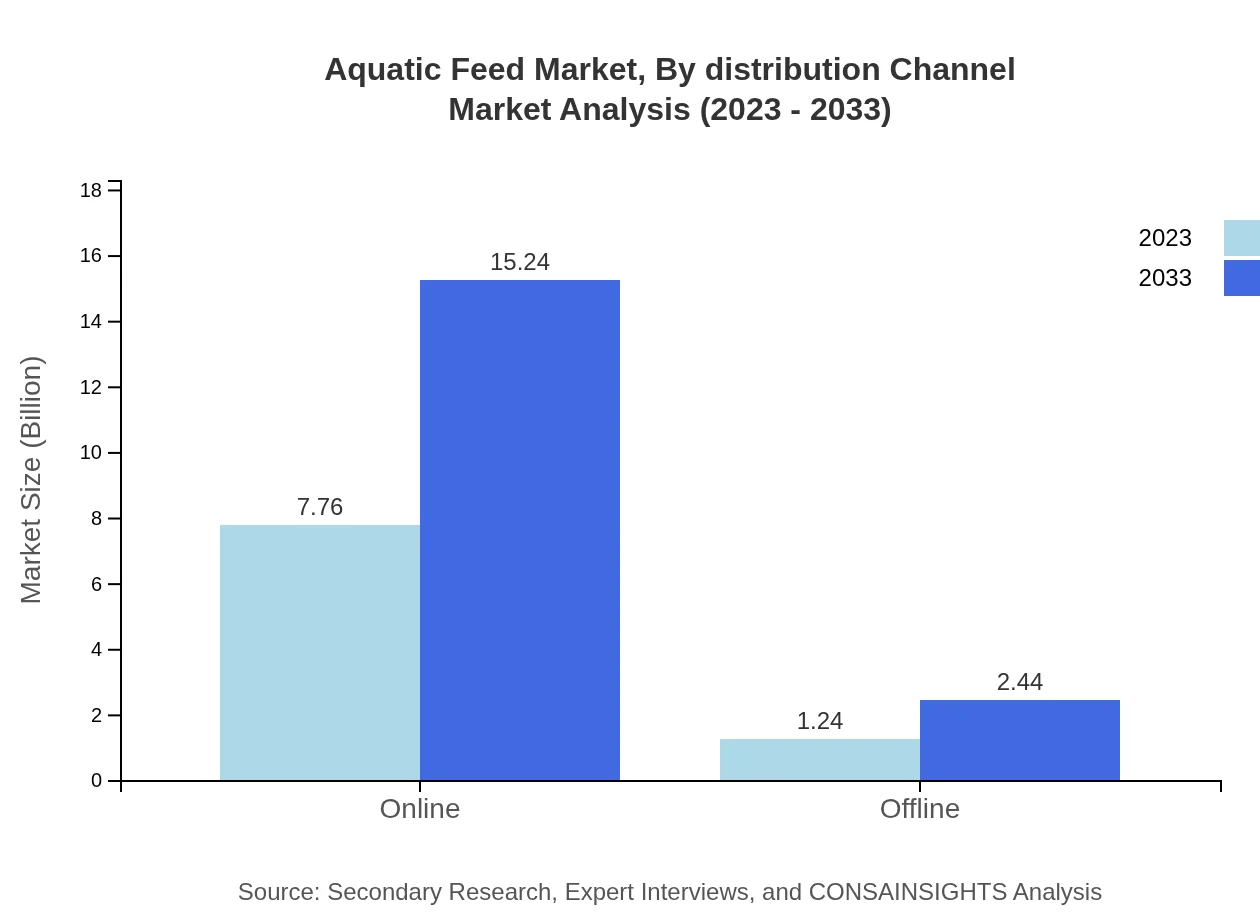

Aquatic Feed Market Analysis By Distribution Channel

Distribution channels in the Aquatic Feed market are segmented into Online and Offline channels. Online distribution is projected to grow significantly from $7.76 billion in 2023 to $15.24 billion by 2033, reflecting the shift towards e-commerce in various sectors.

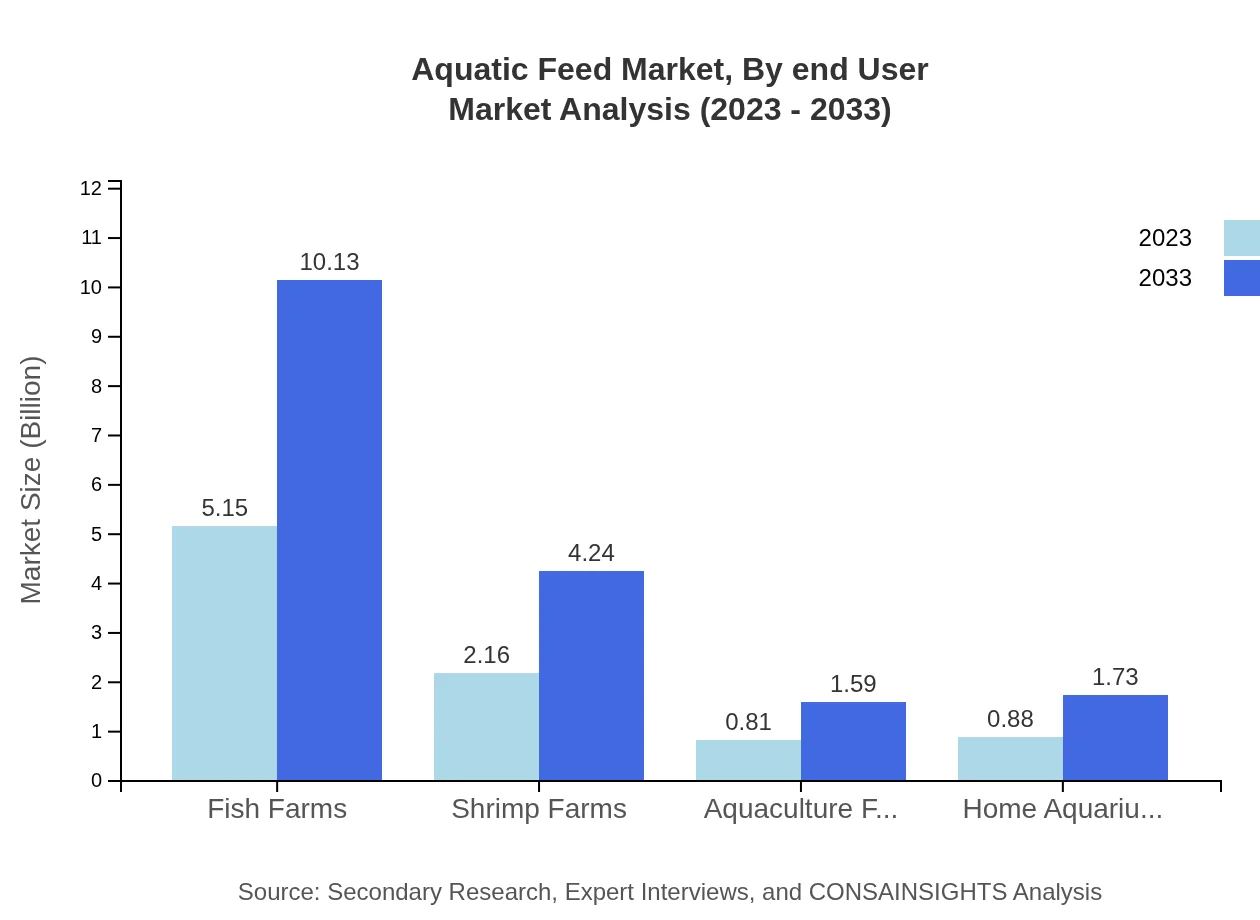

Aquatic Feed Market Analysis By End User

End-user segments in the Aquatic Feed market include Fish Farms, Shrimp Farms, and Home Aquarium Owners, with Fish Farms leading the market share. This segment expects to maintain its leading position, growing from $5.15 billion to $10.13 billion by 2033 as aquaculture practices become more prevalent.

Aquatic Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aquatic Feed Industry

Cargill Inc.:

Cargill is a global leader in food and agriculture providing a variety of aquatic feed products that meet diverse customer needs while emphasizing sustainability.Nutreco N.V.:

Nutreco is known for its innovative feed solutions and commitment to responsible practices in aquaculture, offering a range of high-quality aquatic feed products.ADM:

Archer Daniels Midland Company offers a spectrum of feed options and focuses on cutting-edge research and development for aquatic feeds to optimize growth performance.Alltech Inc.:

Alltech is dedicated to advancing animal health and nutrition solutions, providing tailored aquatic feed formulations to enhance fish and shrimp farming.We're grateful to work with incredible clients.

FAQs

What is the market size of aquatic Feed?

The aquatic-feed market is currently valued at approximately $9 billion, with a projected CAGR of 6.8% from 2023 to 2033. This growth is driven by increasing global demand for sustainable aquaculture practices and protein-rich aquatic feed products.

What are the key market players or companies in the aquatic Feed industry?

Key players in the aquatic-feed industry include major global corporations engaging in aquaculture solutions such as Nutreco, Cargill, and Skretting. These companies lead in innovation, product development, and distribution networks in the aquatic feed segment.

What are the primary factors driving the growth in the aquatic Feed industry?

The growth of the aquatic-feed industry is largely driven by the increasing global demand for seafood, advancements in aquaculture technology, and a rising focus on sustainable farming practices. Moreover, the nutritional needs of farmed fish and shrimp require innovative feed solutions.

Which region is the fastest Growing in the aquatic Feed?

The fastest-growing region in the aquatic-feed market is Europe, which is expected to increase from $2.81 billion in 2023 to $5.53 billion by 2033. Asia-Pacific is rapidly expanding as well, forecasted to grow from $1.60 billion to $3.15 billion.

Does ConsaInsights provide customized market report data for the aquatic Feed industry?

Yes, ConsaInsights offers tailored market report data for the aquatic-feed industry. These custom reports include detailed analysis, market trends, and forecasts to cater to specific business needs and regional insights.

What deliverables can I expect from this aquatic Feed market research project?

Deliverables from the aquatic-feed market research project include comprehensive reports with market data, competitive analysis, segment insights, and future trends, enabling stakeholders to make informed business decisions and strategize accordingly.

What are the market trends of aquatic Feed?

Market trends in aquatic-feed include a shift towards plant-based and sustainable feed ingredients, increased use of technology in aquaculture, and the rise of online sales channels, indicating a move towards efficiency and sustainability in the industry.