Aramid Fiber Market Report

Published Date: 02 February 2026 | Report Code: aramid-fiber

Aramid Fiber Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aramid Fiber market from 2023 to 2033, focusing on market size, growth trends, industry insights, and regional performance. It aims to equip stakeholders with relevant data and forecasts to support strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

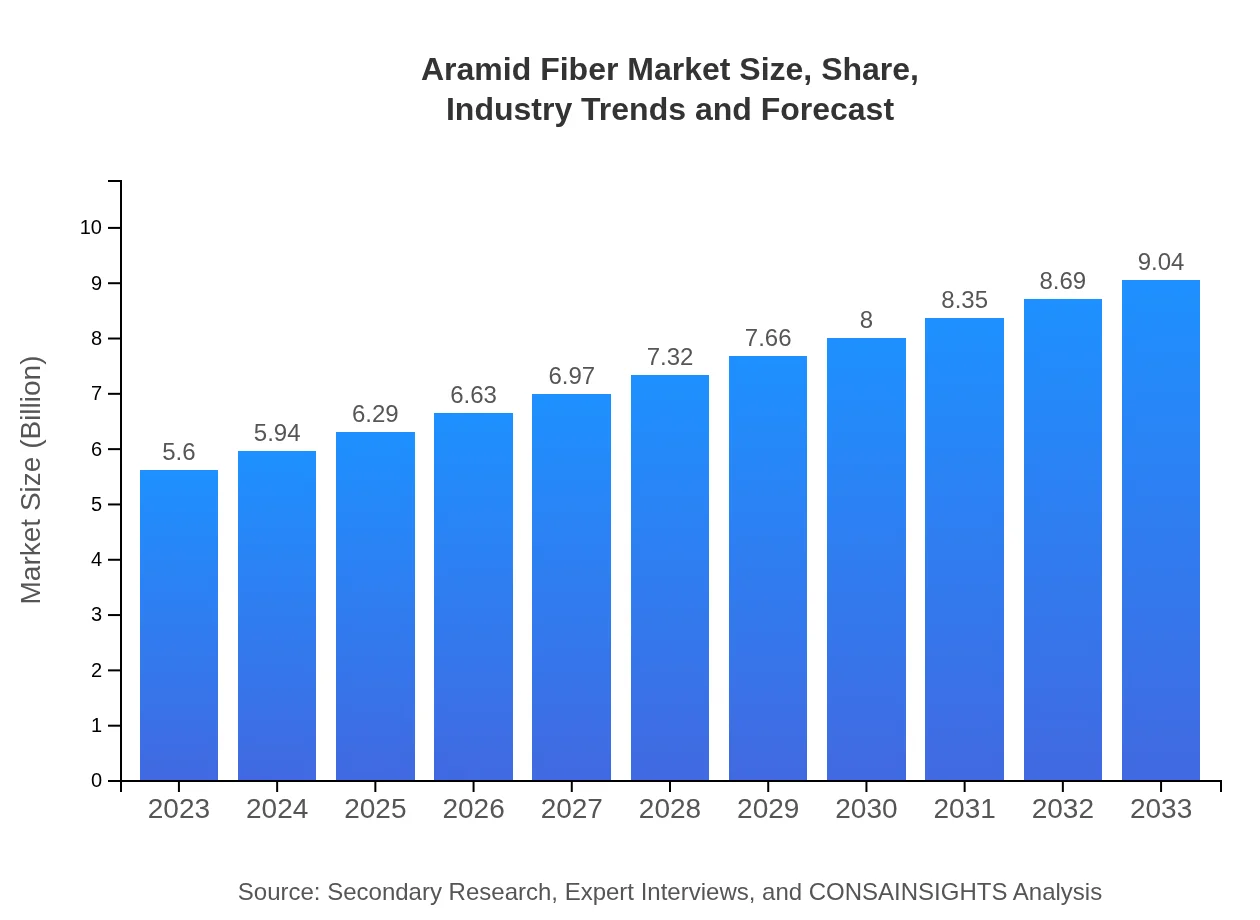

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $9.04 Billion |

| Top Companies | DuPont, Teijin Limited, Kermel, Kratek Company |

| Last Modified Date | 02 February 2026 |

Aramid Fiber Market Overview

Customize Aramid Fiber Market Report market research report

- ✔ Get in-depth analysis of Aramid Fiber market size, growth, and forecasts.

- ✔ Understand Aramid Fiber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aramid Fiber

What is the Market Size & CAGR of Aramid Fiber market in 2033?

Aramid Fiber Industry Analysis

Aramid Fiber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aramid Fiber Market Analysis Report by Region

Europe Aramid Fiber Market Report:

The European market for aramid fibers is set to grow from $1.35 billion in 2023 to $2.18 billion by 2033. The stringent regulations concerning safety and environmental issues bolster the usage of aramid fibers in automotive and defense applications across leading nations like Germany and France.Asia Pacific Aramid Fiber Market Report:

The Asia Pacific region is anticipated to witness significant growth, driven by rising industrialization and demand for durable materials, projected to increase from $1.13 billion in 2023 to $1.82 billion by 2033. Key markets include China and India, where the automotive and aerospace sectors are expanding rapidly.North America Aramid Fiber Market Report:

North America is the largest market for aramid fibers, projected to reach $3.27 billion by 2033, up from $2.03 billion in 2023. The U.S. dominates, supported by a strong aerospace sector and heightened demand for personal protective equipment in various industries.South America Aramid Fiber Market Report:

In South America, the aramid fiber market is expected to grow from $0.49 billion in 2023 to $0.79 billion in 2033. Increasing investments in infrastructure and automotive industries are central to this growth, with Brazil and Argentina leading in market demand.Middle East & Africa Aramid Fiber Market Report:

In the Middle East and Africa, the market will expand from $0.60 billion in 2023 to $0.97 billion by 2033, fueled by growing construction activities and military expenditure. Countries like the UAE and South Africa are pivotal in this growth.Tell us your focus area and get a customized research report.

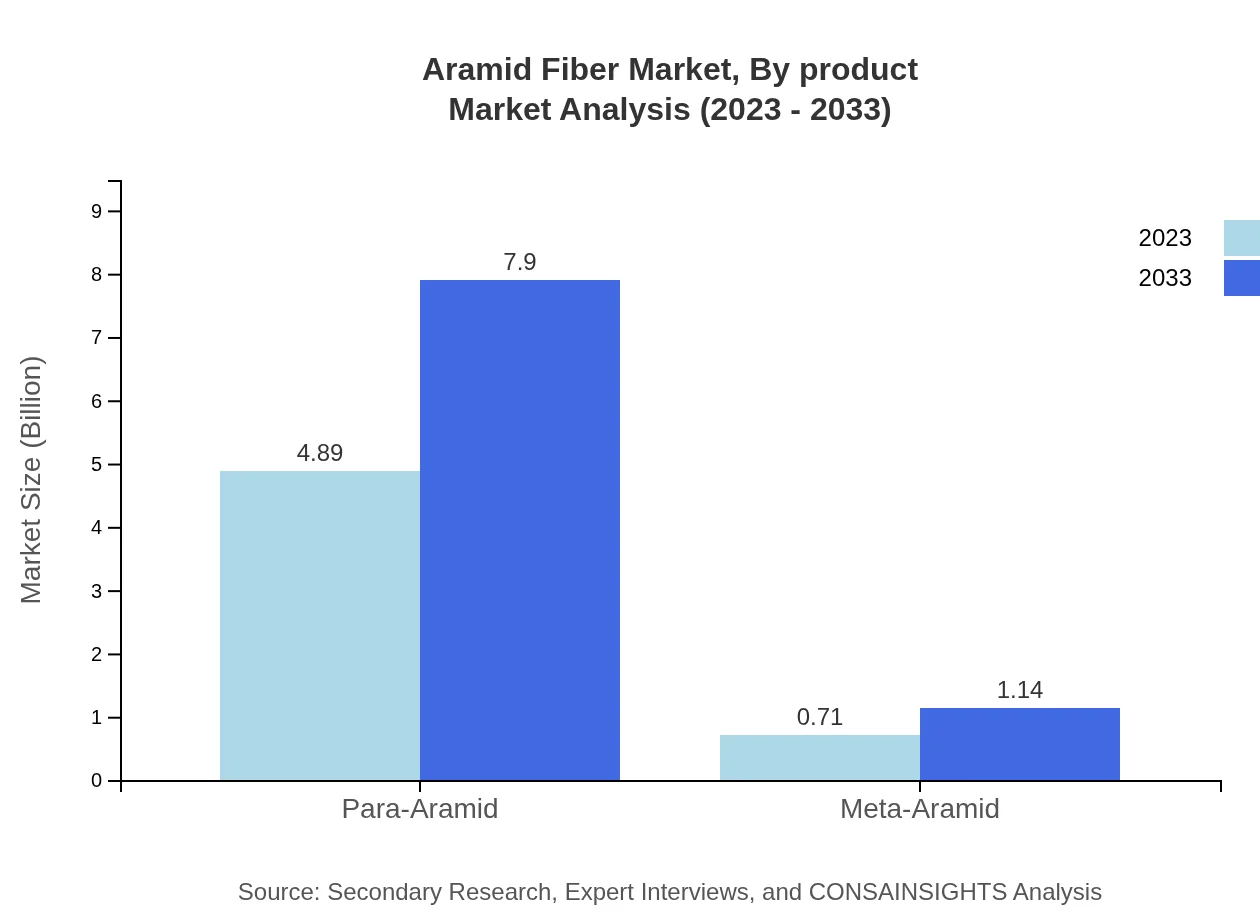

Aramid Fiber Market Analysis By Product

Para-Aramid fibers dominate the market, expected to grow from $4.89 billion in 2023 to $7.90 billion by 2033, representing approximately 87.4% market share. In contrast, Meta-Aramid fibers, while smaller, are also growing, projected to increase from $0.71 billion to $1.14 billion, retaining a share of 12.6%.

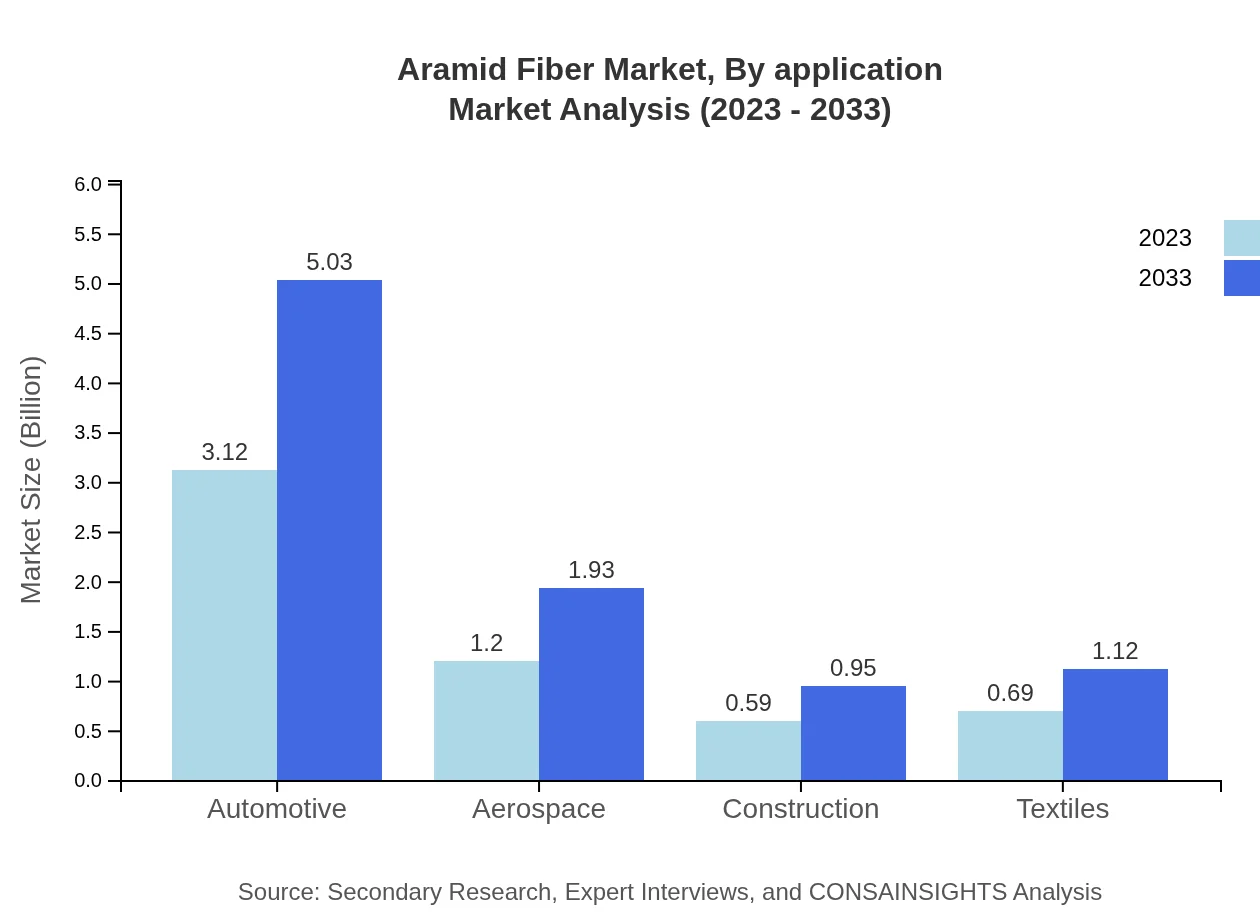

Aramid Fiber Market Analysis By Application

The automotive application constitutes 55.66% of the market share and is anticipated to grow from $3.12 billion in 2023 to $5.03 billion by 2033. The aerospace sector follows, growing from $1.20 billion to $1.93 billion, holding 21.37% of the market. Other key applications include construction and textiles.

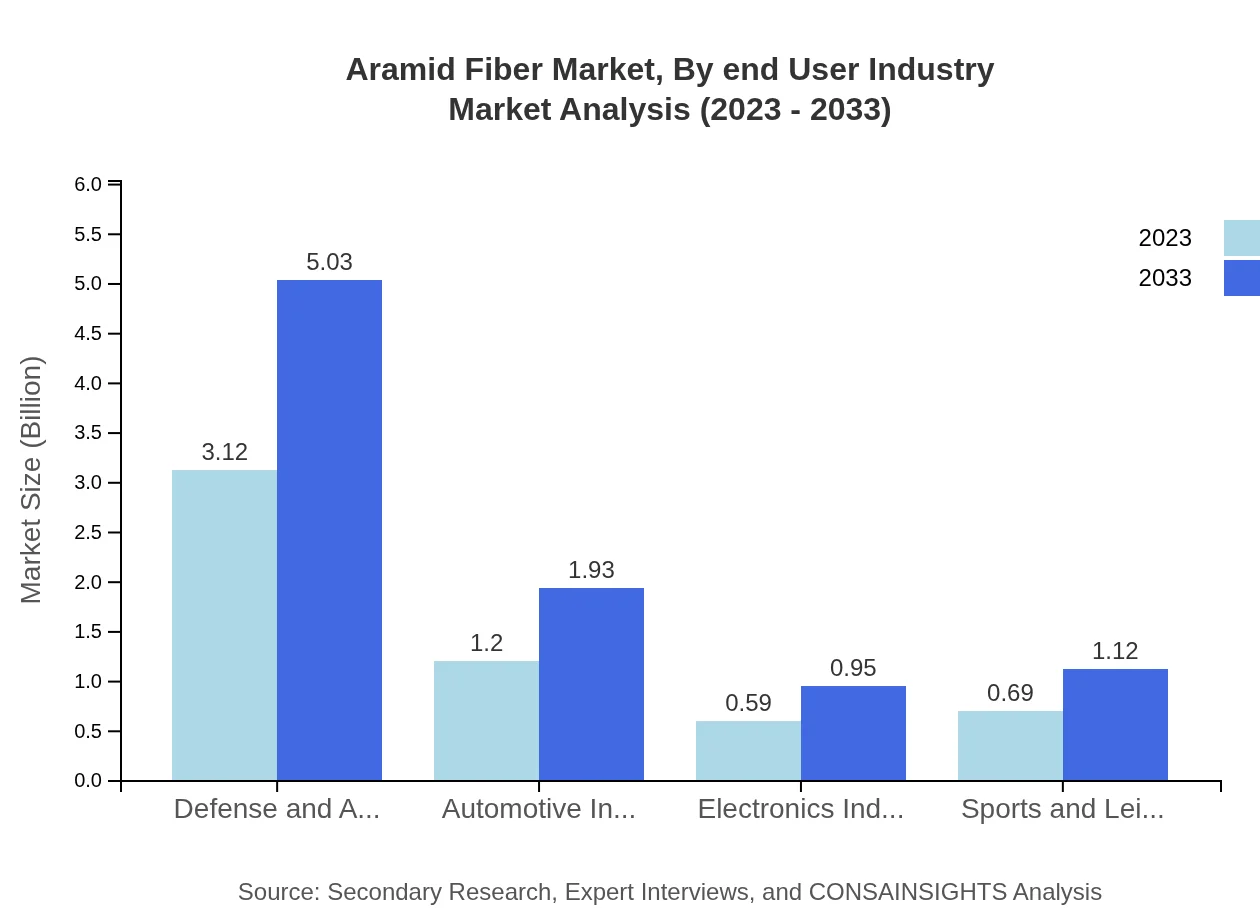

Aramid Fiber Market Analysis By End User Industry

The defense and aerospace industry remains the largest consumer of aramid fibers, with a market size of $3.12 billion in 2023, expected to grow to $5.03 billion by 2033. The automotive and electronics industries also significantly impact market dynamics.

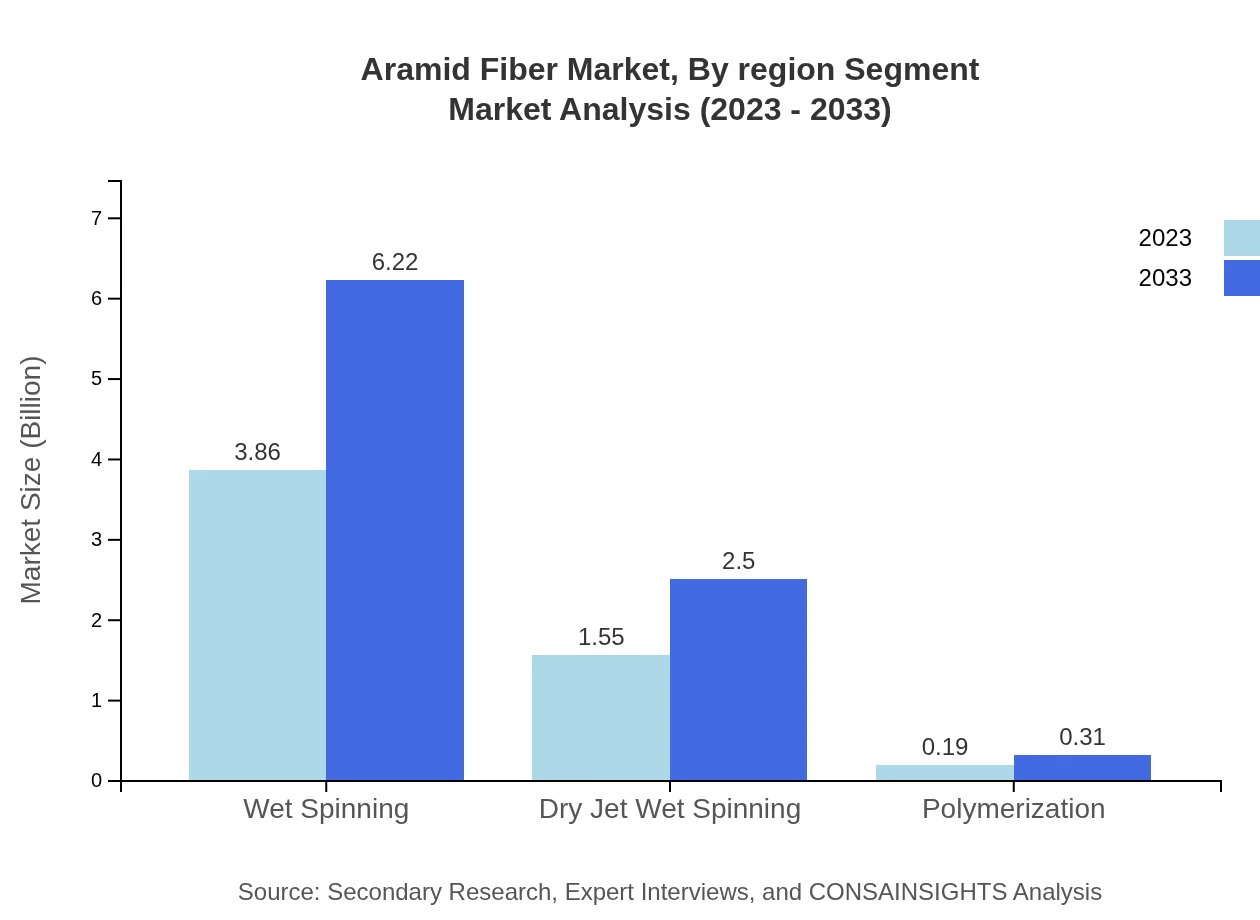

Aramid Fiber Market Analysis By Region Segment

The aramid fiber market is also categorized by production processes, such as wet spinning and dry jet wet spinning, with wet spinning currently holding 68.89% of the market share. This method is projected to grow from a market size of $3.86 billion in 2023 to $6.22 billion by 2033.

Aramid Fiber Market Analysis By Competitive Landscape

Key players in the industry include major manufacturers from the USA, Europe, and Asia, driving innovation and efficiency. Competitive strategies involve partnerships, new product development, and sustainability initiatives.

Aramid Fiber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aramid Fiber Industry

DuPont:

A pioneer in aramid fiber manufacturing, known for its strong brand Kevlar, extensively used in performance apparel and protective gear.Teijin Limited:

A leading global provider of aramid fibers, Teijin offers high-tenacity fibers suitable for a variety of applications, especially in automotive and aerospace.Kermel:

Specializing in meta-aramid fibers, Kermel produces materials known for their heat and flame-resistant properties, used in protective clothing.Kratek Company:

An emerging leader in the production of aramid fibers tailored for industrial applications, offering innovative solutions for various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of aramid Fiber?

The global aramid fiber market size is valued at approximately $5.6 billion in 2023, with an expected CAGR of 4.8%. The market is projected to reach around $8.6 billion by 2033, indicating significant growth opportunities in various applications.

What are the key market players or companies in this aramid Fiber industry?

Key players in the aramid fiber market include DuPont, Teijin, Kolon Industries, and Mitsubishi Chemical. These companies lead in production, innovation, and market shares, contributing significantly to the dynamics and advancements within the industry.

What are the primary factors driving the growth in the aramid Fiber industry?

Factors driving growth include rising demand in automotive and aerospace sectors, advancements in manufacturing technologies, and increasing awareness of safety regulations. Additionally, the growing application of aramid fibers in defense and electronics fuels market expansion.

Which region is the fastest Growing in the aramid Fiber?

The fastest-growing region for aramid fibers is North America, projected to grow from $2.03 billion in 2023 to $3.27 billion by 2033. This growth is driven by a robust demand in automotive and defense applications, alongside technological advancements.

Does Consainsights provide customized market report data for the aramid Fiber industry?

Yes, Consainsights offers customized market report data tailored to the specific needs of clients in the aramid-fiber industry, ensuring in-depth insights, innovative solutions, and detailed market analysis aligned with your business objectives.

What deliverables can I expect from this aramid Fiber market research project?

Deliverables generally include comprehensive market analysis, trends, forecasts, competitive landscape reports, and actionable insights. Clients can also expect detailed segment data, regional insights, and tailored recommendations based on specific market conditions.

What are the market trends of aramid Fiber?

Current trends include increased adoption in automotive and aerospace sectors, innovation in fiber manufacturing technologies, and sustainability efforts promoting eco-friendly materials. The shift towards advanced composites also signifies a notable trend in the aramid fiber market.