Architectural Coatings Market Report

Published Date: 02 February 2026 | Report Code: architectural-coatings

Architectural Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the global market for Architectural Coatings, presenting insights on market size, trends, segmentation, and forecasts from 2023 to 2033.

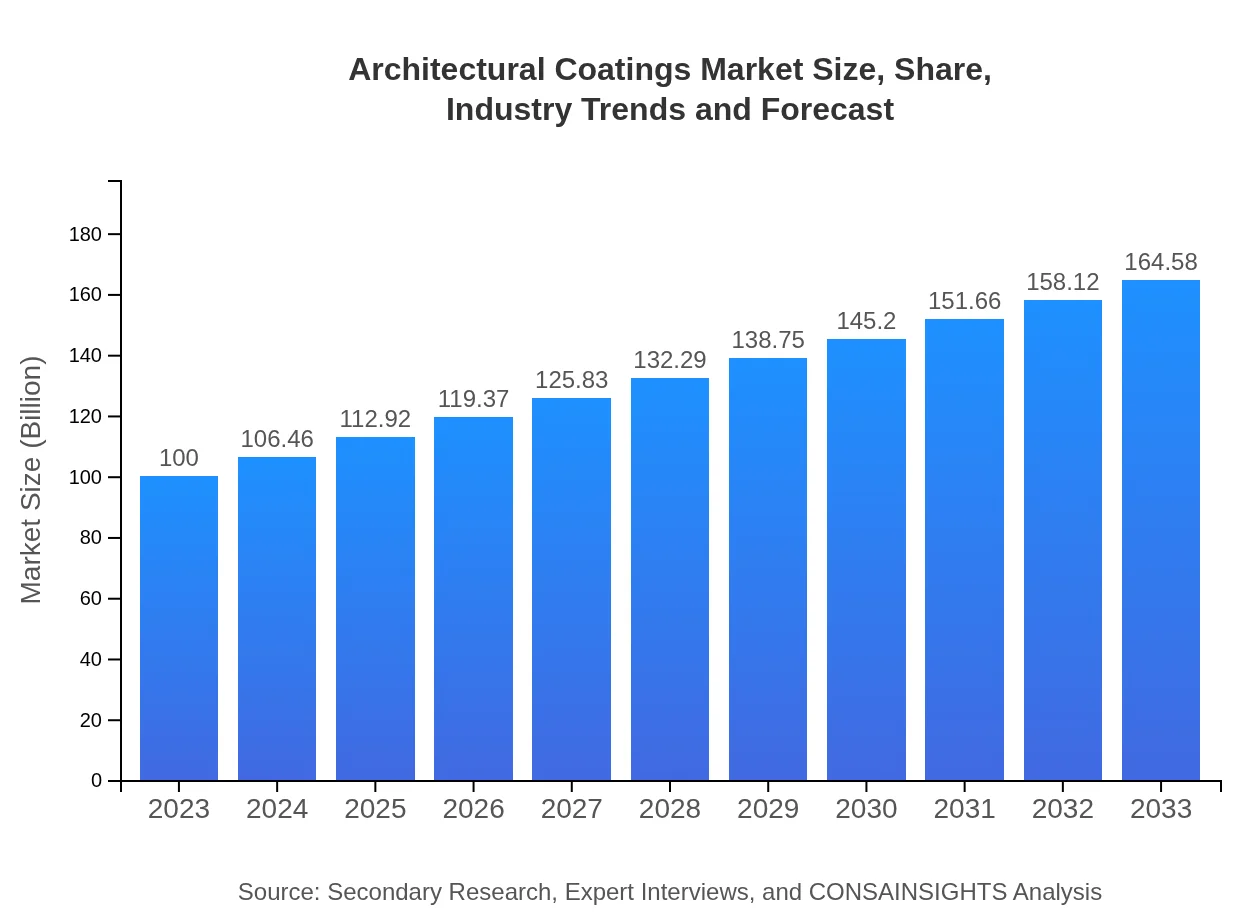

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Billion |

| Top Companies | PPG Industries, Sherwin-Williams, BASF, AkzoNobel |

| Last Modified Date | 02 February 2026 |

Architectural Coatings Market Overview

Customize Architectural Coatings Market Report market research report

- ✔ Get in-depth analysis of Architectural Coatings market size, growth, and forecasts.

- ✔ Understand Architectural Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Architectural Coatings

What is the Market Size & CAGR of Architectural Coatings market in 2023?

Architectural Coatings Industry Analysis

Architectural Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Architectural Coatings Market Analysis Report by Region

Europe Architectural Coatings Market Report:

Europe's market is forecasted to grow from USD 34.68 billion in 2023 to USD 57.08 billion by 2033, supported by stringent environmental regulations stimulating demand for low-VOC and water-based coatings. Countries like Germany, the UK, and France are key players in driving market growth.Asia Pacific Architectural Coatings Market Report:

The Asia-Pacific region reflects significant growth, projected to rise from USD 16.79 billion in 2023 to USD 27.63 billion by 2033. Rapid urban population expansion, along with aggressive infrastructure projects, fuels this growth. Key countries such as China and India are major contributors to the demand for architectural coatings, facilitated by government initiatives promoting housing and infrastructure development.North America Architectural Coatings Market Report:

North America is anticipated to rise from USD 34.50 billion in 2023 to USD 56.78 billion by 2033. The region is characterized by a robust real estate market and continuous investments in infrastructure, with a shift towards sustainable and energy-efficient coatings.South America Architectural Coatings Market Report:

In South America, the market is expected to increase from USD 4.58 billion in 2023 to USD 7.54 billion by 2033. The demand for architectural coatings in Brazil and Argentina is primarily driven by rising construction activities and urbanization.Middle East & Africa Architectural Coatings Market Report:

In the Middle East and Africa, the market is projected to grow from USD 9.45 billion in 2023 to USD 15.55 billion by 2033. The expansion of the construction sector, particularly in the UAE and South Africa, coupled with increasing expenditure on residential and commercial buildings, plays a significant role in the region's market growth.Tell us your focus area and get a customized research report.

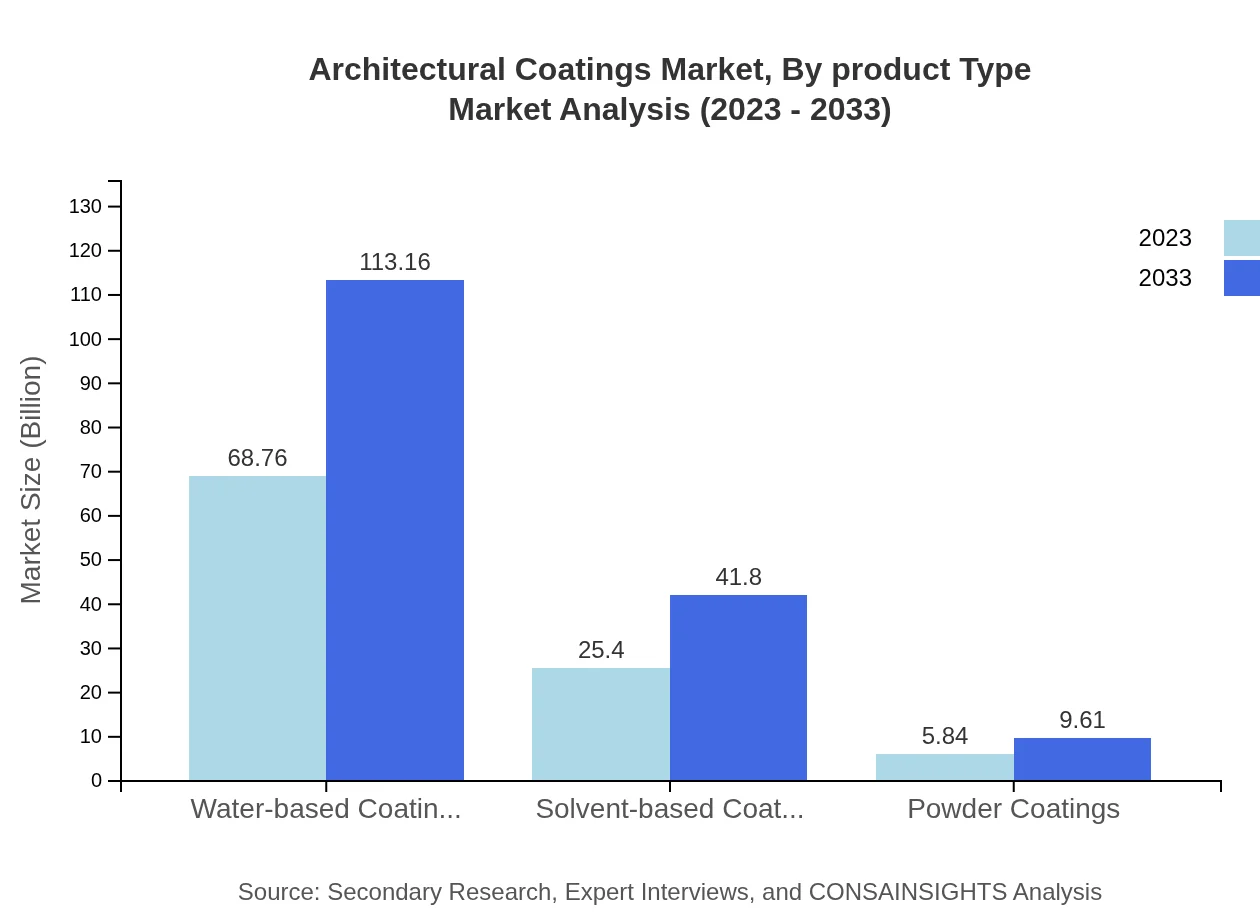

Architectural Coatings Market Analysis By Product Type

The architectural coatings market can be classified into various product types including water-based coatings, solvent-based coatings, powder coatings, and ready-to-use formulations. Water-based coatings dominate the market, with expected growth from USD 68.76 billion in 2023 to USD 113.16 billion by 2033 due to their environmentally friendly properties. Solvent-based coatings and powder coatings also contribute significantly, but the demand for water-based solutions remains more robust.

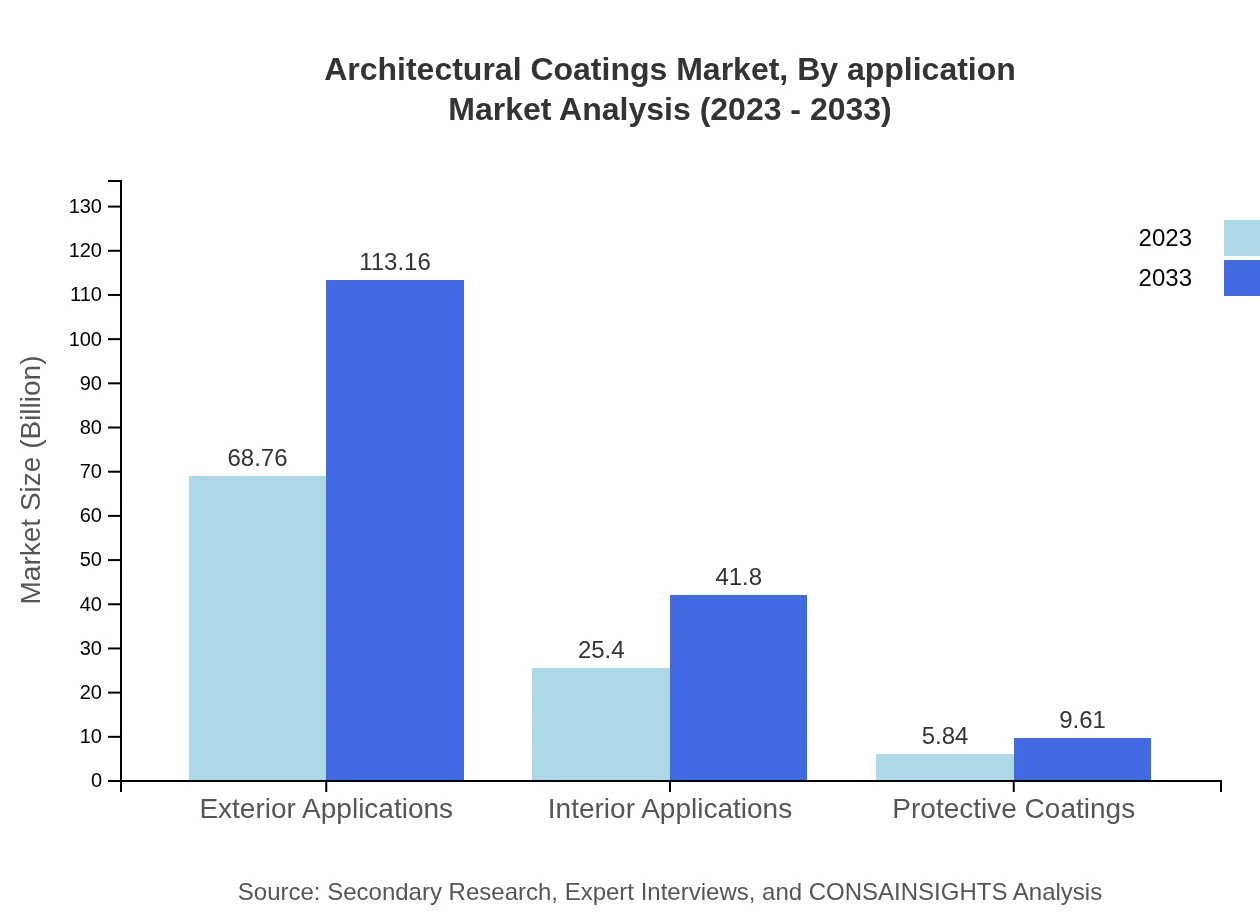

Architectural Coatings Market Analysis By Application

The market's applications are primarily segmented into interior and exterior applications. Exterior applications hold a larger share, projected to grow from USD 68.76 billion in 2023 to USD 113.16 billion by 2033, reflecting ongoing demand for protective and decorative coatings for buildings. Interior applications, which encompass both residential and commercial uses, are also expected to witness substantial growth from USD 25.40 billion to USD 41.80 billion during the same period.

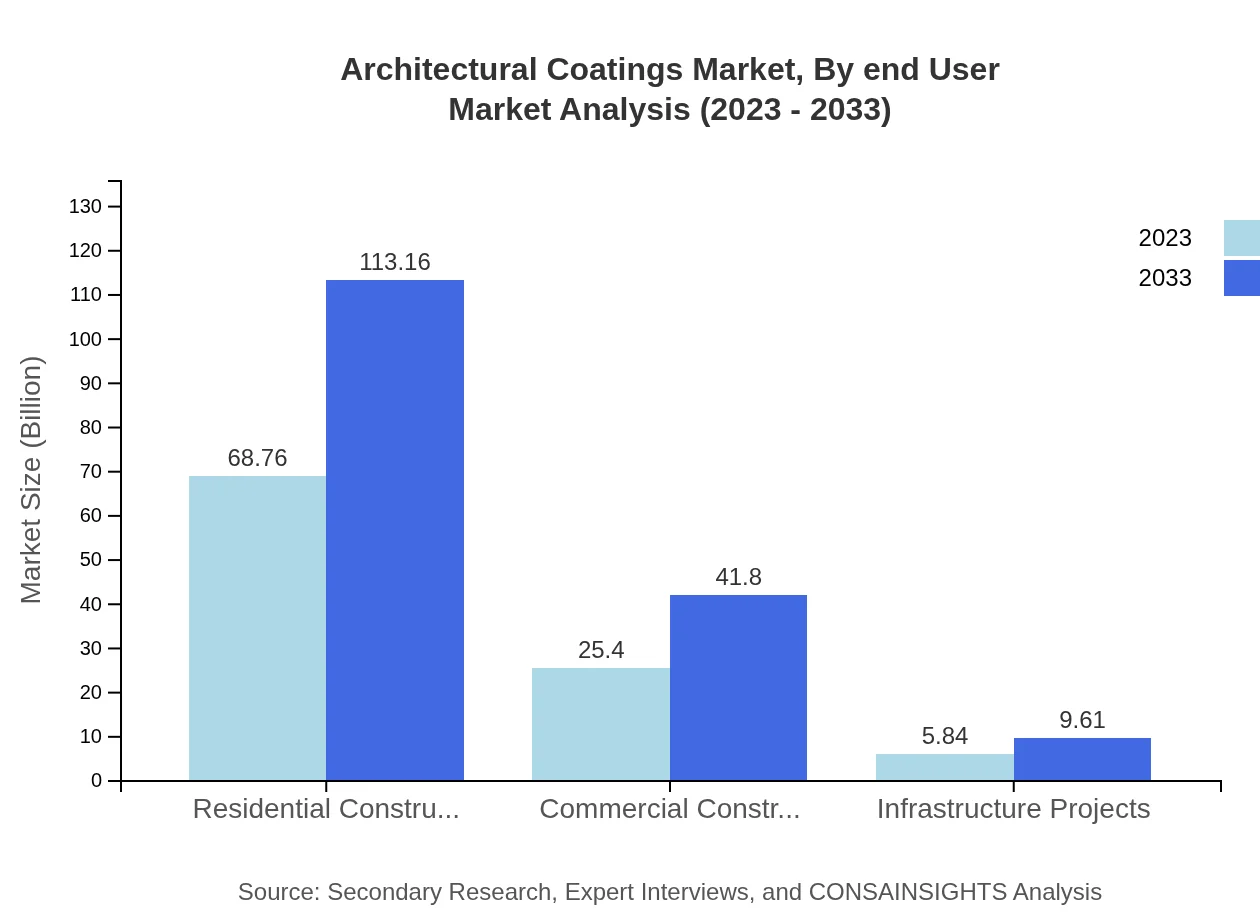

Architectural Coatings Market Analysis By End User

The end-user segmentation reflects a robust market share driven primarily by residential construction, which holds a significant market size of USD 68.76 billion in 2023, expected to expand to USD 113.16 billion by 2033. Commercial construction also plays a vital role, with a size of USD 25.40 billion in 2023 and growth projected to reach USD 41.80 billion by 2033.

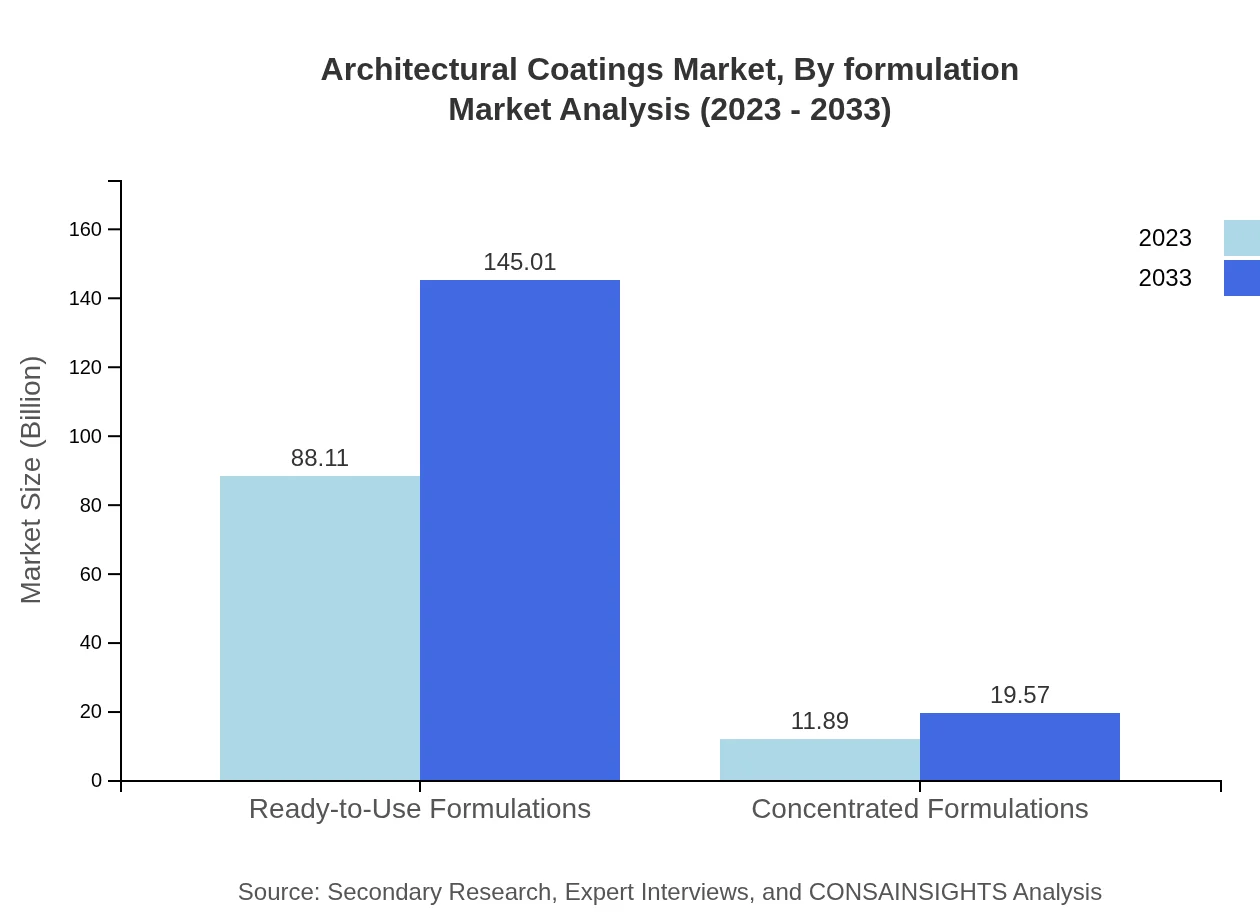

Architectural Coatings Market Analysis By Formulation

Architectural coatings are also categorized by formulation, with ready-to-use formulations being the predominant type. This segment, forecasted to increase from USD 88.11 billion in 2023 to USD 145.01 billion by 2033, reflects consumer preference for convenience. Concentrated formulations are less dominant, reflecting growth from USD 11.89 billion to USD 19.57 billion over the same forecast period.

Architectural Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Architectural Coatings Industry

PPG Industries:

PPG Industries is a leading global supplier of paints, coatings, and specialty materials, providing innovative solutions across various sectors including architectural, automotive, and industrial markets.Sherwin-Williams:

Sherwin-Williams is a major player in the architectural coatings market, known for its high-performance products and extensive distribution network, serving both professional and DIY segments.BASF:

BASF is a global chemical company with a substantial stake in the coatings market, developing advanced technologies to create eco-friendly and high-quality paint solutions.AkzoNobel:

AkzoNobel is a key player in the global coatings market, providing innovative and sustainable products for both decorative and protective applications within the architectural coatings sector.We're grateful to work with incredible clients.

FAQs

What is the market size of architectural coatings?

The architectural coatings market is projected to reach around USD 100 billion by 2033, growing at a CAGR of 5% from 2023, where it currently stands at USD 68.76 billion.

What are the key market players or companies in the architectural coatings industry?

Key players in the architectural coatings market include Sherwin-Williams, PPG Industries, AkzoNobel, BASF, and RPM International. These companies are pivotal in shaping market trends and innovations.

What are the primary factors driving the growth in the architectural coatings industry?

Growth in the architectural coatings industry is primarily driven by rising construction activities, increased demand for environmentally friendly products, and technological advancements that improve coating performance and durability.

Which region is the fastest Growing in the architectural coatings market?

The fastest-growing region in the architectural coatings market is North America, projected to expand from USD 34.50 billion in 2023 to USD 56.78 billion by 2033, driven by robust residential renovation.

Does ConsaInsights provide customized market report data for the architectural coatings industry?

Yes, ConsaInsights offers tailored market reports for the architectural coatings industry, enabling clients to receive specific insights based on unique business needs and market conditions.

What deliverables can I expect from this architectural coatings market research project?

Deliverables from the architectural coatings market research project typically include comprehensive reports, data analysis, market forecasts, segmented data insights, and strategic recommendations tailored to business objectives.

What are the market trends of architectural coatings?

Current trends in the architectural coatings market include a growing preference for eco-friendly and low-VOC products, increased usage of smart coatings, and innovations in application techniques enhancing user experience.