Architectural Services Market Report

Published Date: 31 January 2026 | Report Code: architectural-services

Architectural Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Architectural Services market, covering various aspects, including market size, segmentation, regional insights, key trends, and forecasts from 2023 to 2033.

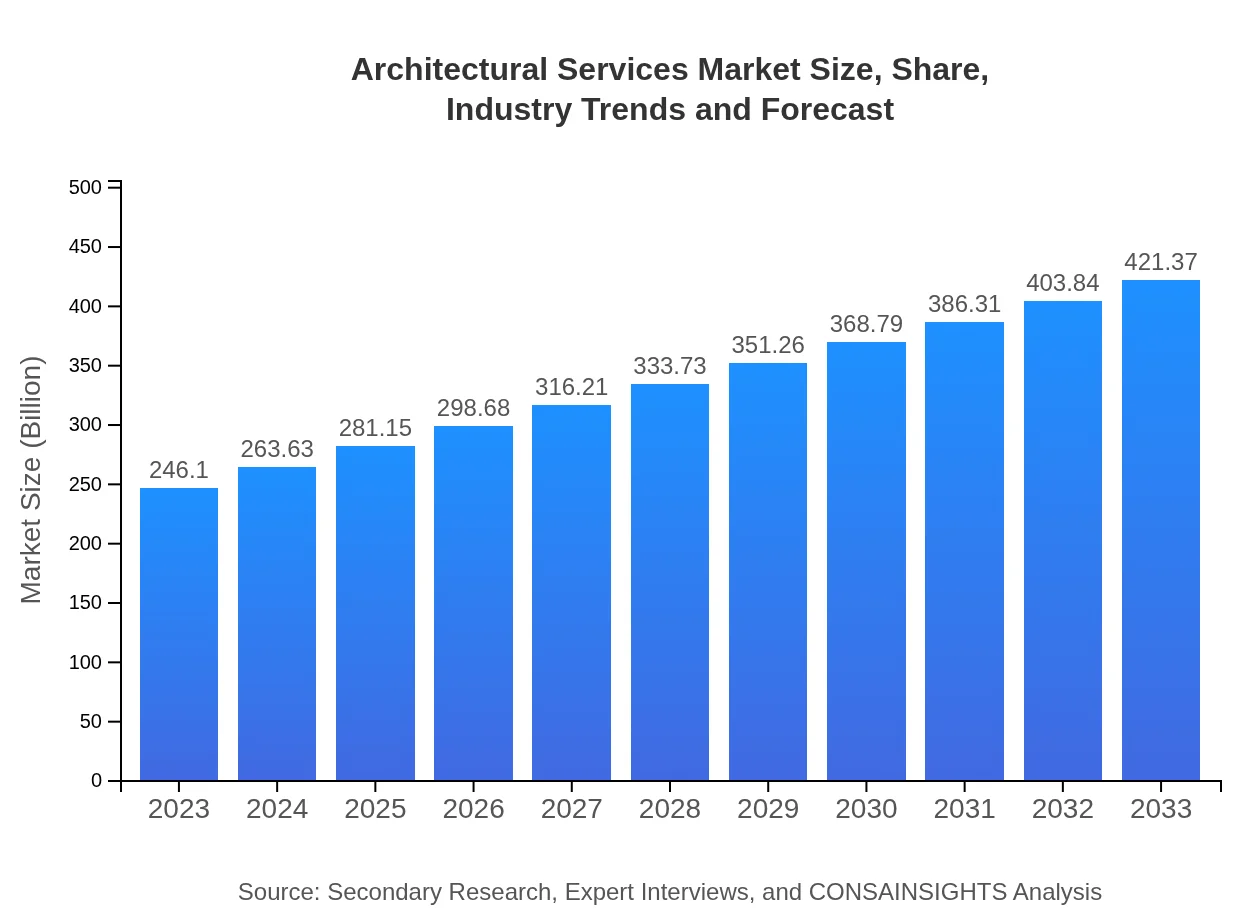

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $246.10 Billion |

| CAGR (2023-2033) | 5.4% |

| 2033 Market Size | $421.37 Billion |

| Top Companies | Gensler, AECOM, Foster + Partners, Stantec |

| Last Modified Date | 31 January 2026 |

Architectural Services Market Overview

Customize Architectural Services Market Report market research report

- ✔ Get in-depth analysis of Architectural Services market size, growth, and forecasts.

- ✔ Understand Architectural Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Architectural Services

What is the Market Size & CAGR of the Architectural Services market in 2023?

Architectural Services Industry Analysis

Architectural Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Architectural Services Market Analysis Report by Region

Europe Architectural Services Market Report:

The European market for architectural services is projected to expand from USD 62.80 billion in 2023 to USD 107.53 billion by 2033. Europe is leading the way in architectural innovation, particularly in sustainable design practices. Countries like Germany and the UK are heavily investing in infrastructure and green buildings, driving demand.Asia Pacific Architectural Services Market Report:

In the Asia Pacific region, the architectural services market is projected to reach USD 83.39 billion by 2033, growing from USD 48.70 billion in 2023. Rapid urbanization, increased infrastructure investments, and rising standards of living are driving growth. Countries like China and India lead in construction activities, further fueling demand for architectural services.North America Architectural Services Market Report:

In North America, the architectural services market is anticipated to grow from USD 86.06 billion in 2023 to USD 147.35 billion by 2033. The region is experiencing a boom in commercial and residential construction, driven by economic growth and a robust housing market, particularly in the United States and Canada.South America Architectural Services Market Report:

The South American market is expected to grow from USD 19.02 billion in 2023 to USD 32.57 billion by 2033. Economic recovery and government initiatives to invest in infrastructure projects are key growth drivers. Brazil and Argentina are the largest markets in this region, focusing on modernization and sustainable urban development.Middle East & Africa Architectural Services Market Report:

The Middle East and Africa market will grow from USD 29.51 billion in 2023 to USD 50.52 billion by 2033, propelled by large-scale infrastructure projects and urban development initiatives in the UAE, Saudi Arabia, and other developing nations. However, economic fluctuations can pose challenges in certain areas.Tell us your focus area and get a customized research report.

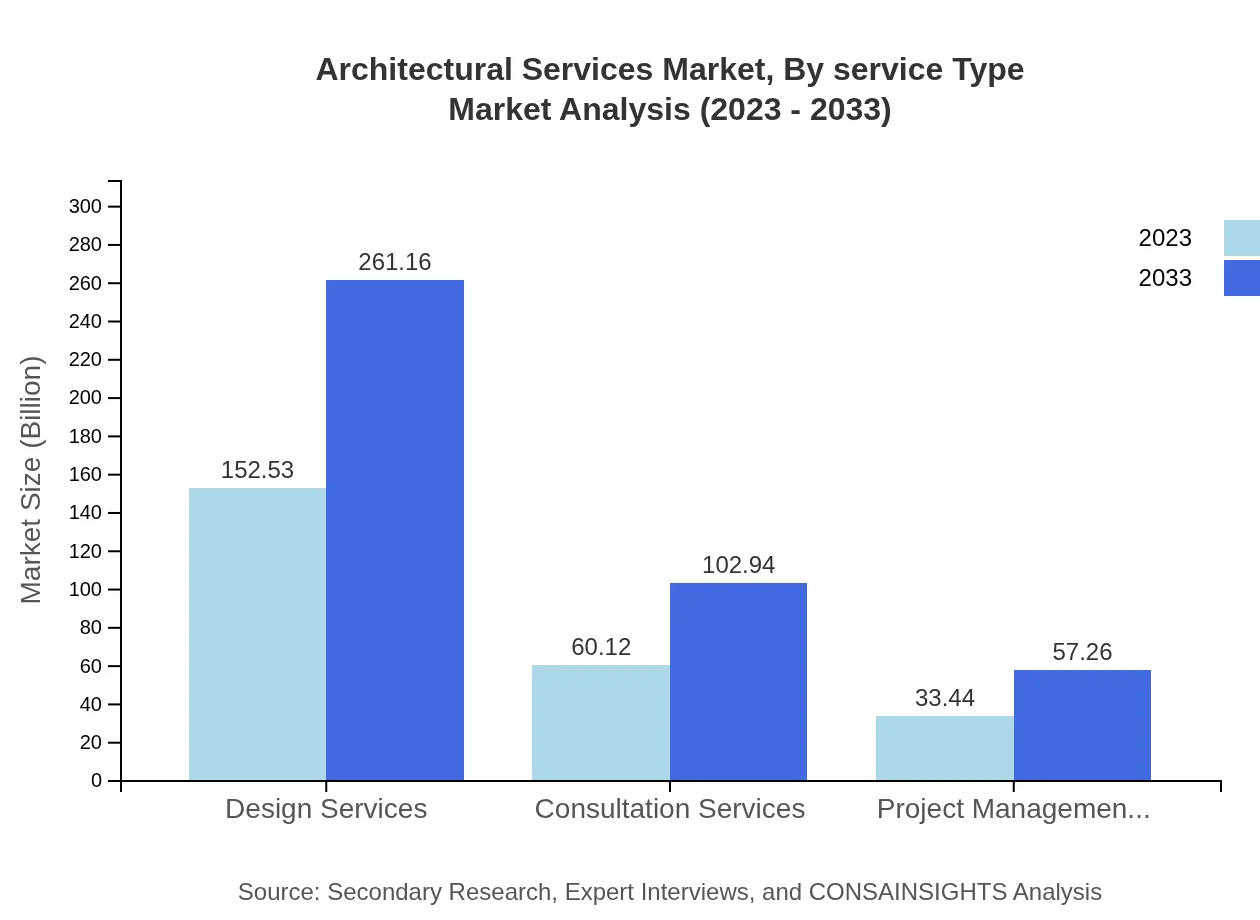

Architectural Services Market Analysis By Service Type

In 2023, the market share for Design Services is USD 152.53 billion, while Consultation and Project Management Services account for USD 60.12 billion and USD 33.44 billion, respectively. Design Services represent the most significant share, growing robustly due to increasing complexities in architectural requirements and regulatory compliance.

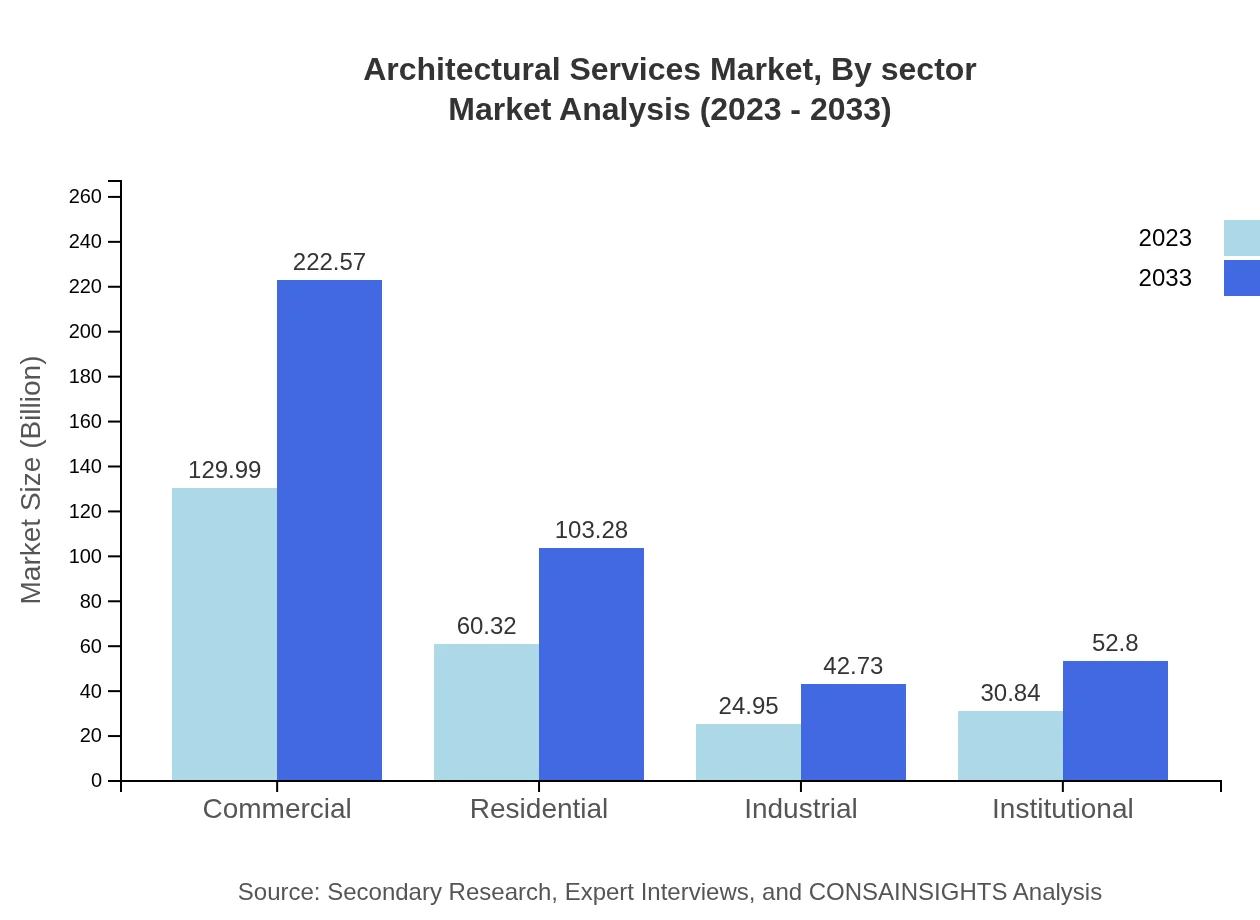

Architectural Services Market Analysis By Sector

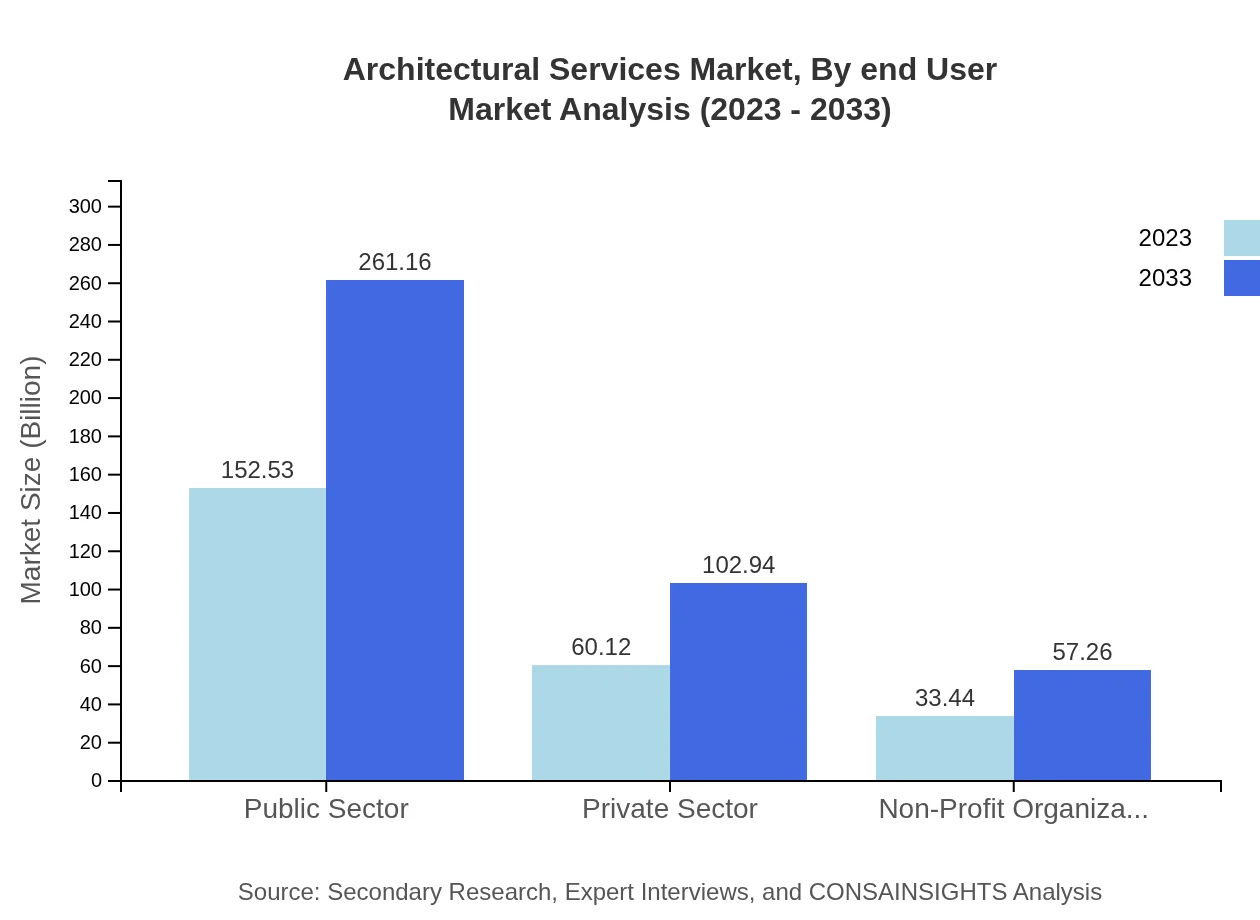

Key sectors for architectural services include Public Sector (USD 152.53 billion) and Private Sector (USD 60.12 billion). The Public Sector holds a dominant market share due to ongoing government projects, while the Private Sector reflects a growing emphasis on upscale and custom architecture.

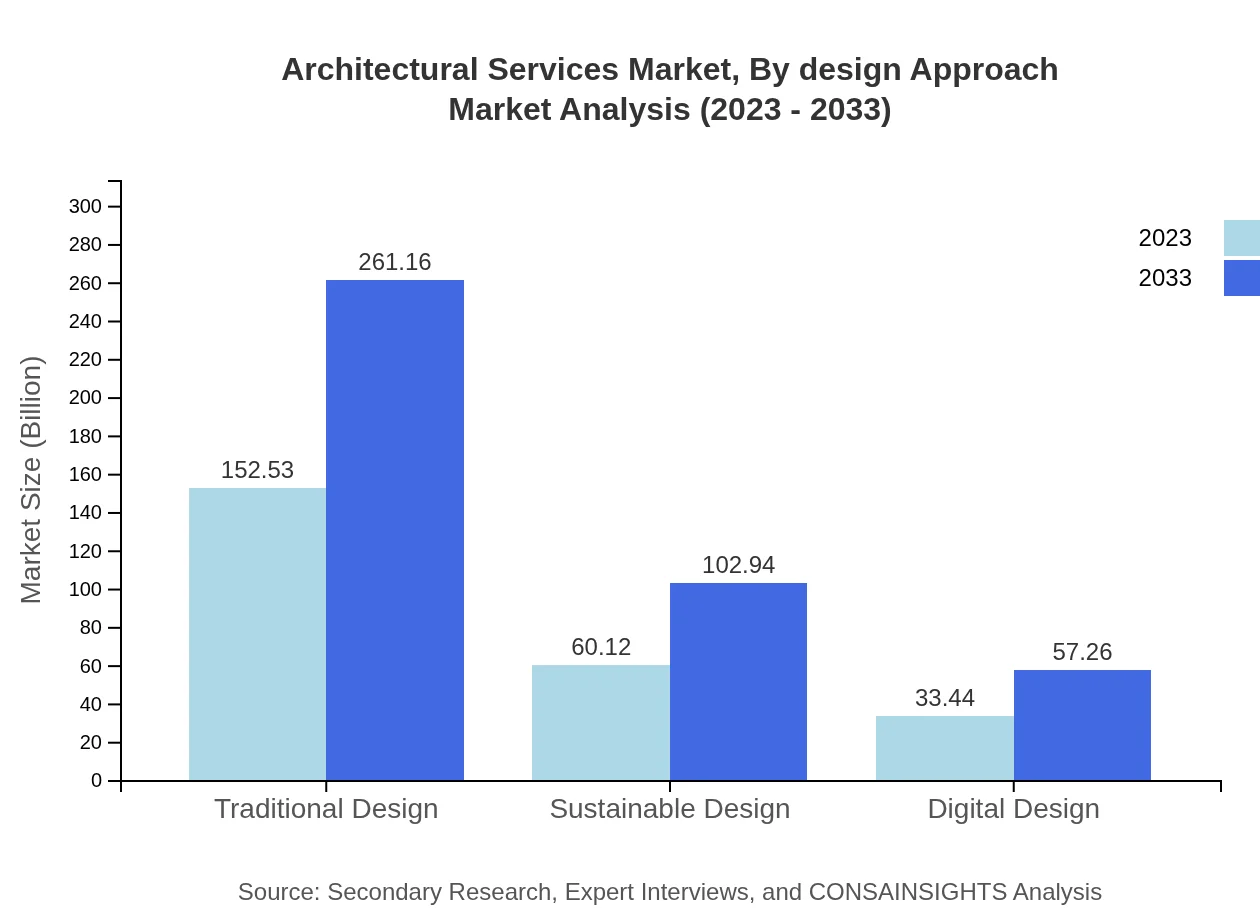

Architectural Services Market Analysis By Design Approach

Traditional Design remains a key segment with a market size of USD 152.53 billion in 2023, while Sustainable Design is catching up at USD 60.12 billion. Digital Design also plays a growing role, supported by technological innovations in architecture.

Architectural Services Market Analysis By End User

The Non-Profit Organizations segment is valued at USD 33.44 billion while the Public Sector commands a significant share. The increasing demand from the Private Sector is expected to see growth parallel to overall economic enhancements and urbanization.

Architectural Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Architectural Services Industry

Gensler:

Gensler is one of the largest architecture firms globally, known for its innovative and sustainable designs across various sectors, including commercial, residential, and urban planning.AECOM:

AECOM is a reputable firm that provides architecture, engineering, and construction management services worldwide, with strong emphasis on infrastructure and design excellence.Foster + Partners:

Foster + Partners is renowned for sustainable architecture and its projects span several sectors including commercial, residential, and hospitality.Stantec:

Stantec provides comprehensive architecture, engineering, and environmental consulting services, focusing on creative design and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of architectural Services?

The architectural services market is projected to reach $246.1 billion by 2033, with a CAGR of 5.4% from 2023. It reflects a robust growth potential in sectors like commercial and residential architecture.

What are the key market players or companies in the architectural Services industry?

Key market players in the architectural services industry include major firms like Gensler, Perkins + Will, and Skidmore, Owings & Merrill. These companies significantly influence market dynamics with their innovative designs and extensive project portfolios.

What are the primary factors driving the growth in the architectural services industry?

Growth in the architectural services industry is primarily driven by urbanization, increased infrastructure investment, and a rising demand for sustainable designs. Additionally, a focus on smart cities and eco-friendly buildings significantly contributes to the market's expansion.

Which region is the fastest Growing in the architectural services?

The Asia-Pacific region is the fastest-growing region in the architectural services market. The market is projected to grow from $48.70 billion in 2023 to $83.39 billion by 2033, driven by rapid urbanization and infrastructural developments.

Does ConsaInsights provide customized market report data for the architectural services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the architectural services industry. Clients can benefit from detailed analysis and insights focused on niche segments and geographical regions.

What deliverables can I expect from this architectural services market research project?

Deliverables from the architectural services market research project include comprehensive reports, market forecasts, segment analysis, competitor insights, and strategic recommendations, ensuring clients have a clear understanding of the market landscape.

What are the market trends of architectural services?

Current market trends in architectural services include a shift towards digital design, increased focus on sustainability, and rising demand for mixed-use developments. These trends indicate a transformative phase aimed at enhancing efficiency and environmental responsibility.