Armor Materials Market Report

Published Date: 03 February 2026 | Report Code: armor-materials

Armor Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the armor materials market from 2023 to 2033, highlighting key trends, growth factors, and challenges. Insights on market size, segmentation, regional performance, and key players will be covered.

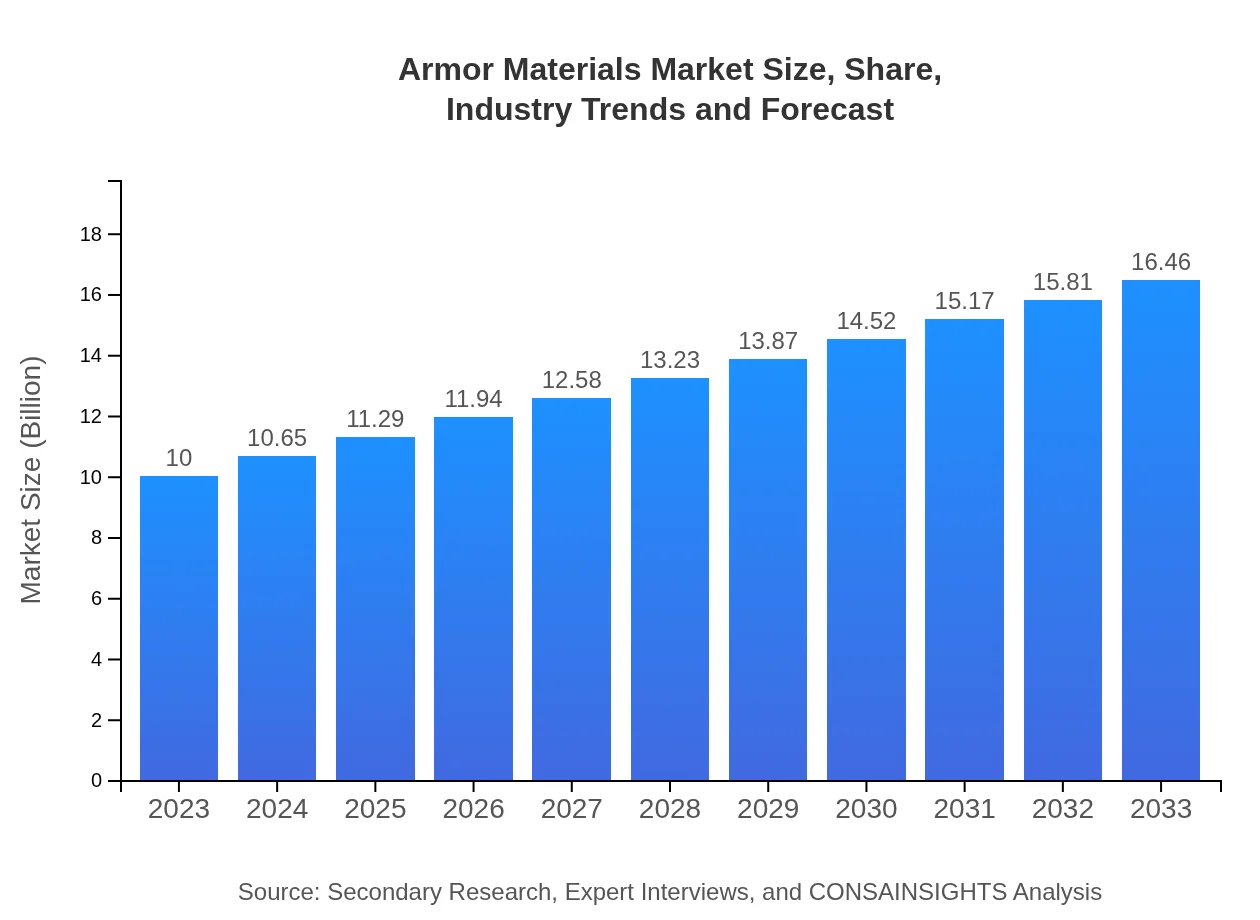

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Dupont, Teijin, Honeywell , Morgan Advanced Materials, Bae Systems |

| Last Modified Date | 03 February 2026 |

Armor Materials Market Overview

Customize Armor Materials Market Report market research report

- ✔ Get in-depth analysis of Armor Materials market size, growth, and forecasts.

- ✔ Understand Armor Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Armor Materials

What is the Market Size & CAGR of Armor Materials market in 2023?

Armor Materials Industry Analysis

Armor Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Armor Materials Market Analysis Report by Region

Europe Armor Materials Market Report:

The European armor materials market, standing at $2.86 billion in 2023, is anticipated to reach $4.72 billion by 2033. Countries such as Germany and France are investing in modernization of military equipment, and the increasing number of security threats in the region pushes demand for innovative armor solutions.Asia Pacific Armor Materials Market Report:

In 2023, the Asia-Pacific armor materials market is valued at approximately $1.91 billion, expected to grow to $3.15 billion by 2033. Demand in this region is driven by increasing military budgets and a growing emphasis on homeland security, particularly in countries such as China and India. The region is also witnessing collaborations between local manufacturers and global players to enhance production capabilities and innovate material technologies.North America Armor Materials Market Report:

North America leads the global armor materials market with a value of approximately $3.66 billion in 2023, expected to grow to $6.03 billion by 2033. The region benefits from advanced technology, significant defense budgets, and a strong emphasis on research and development. The U.S. military's focus on enhancing soldier protection is a key driver for growth.South America Armor Materials Market Report:

The South American market for armor materials is currently valued at around $0.16 billion in 2023 and is projected to reach $0.27 billion by 2033. The growth potential here is moderate due to economic challenges, but increasing governmental spending on defense and law enforcement is likely to spur the market, particularly in Brazil and Argentina.Middle East & Africa Armor Materials Market Report:

The Middle East and Africa market is expected to grow from $1.40 billion in 2023 to $2.30 billion by 2033. The geopolitical tensions in the region and substantial investments in defense and security are forecasted to drive the demand for armor materials significantly.Tell us your focus area and get a customized research report.

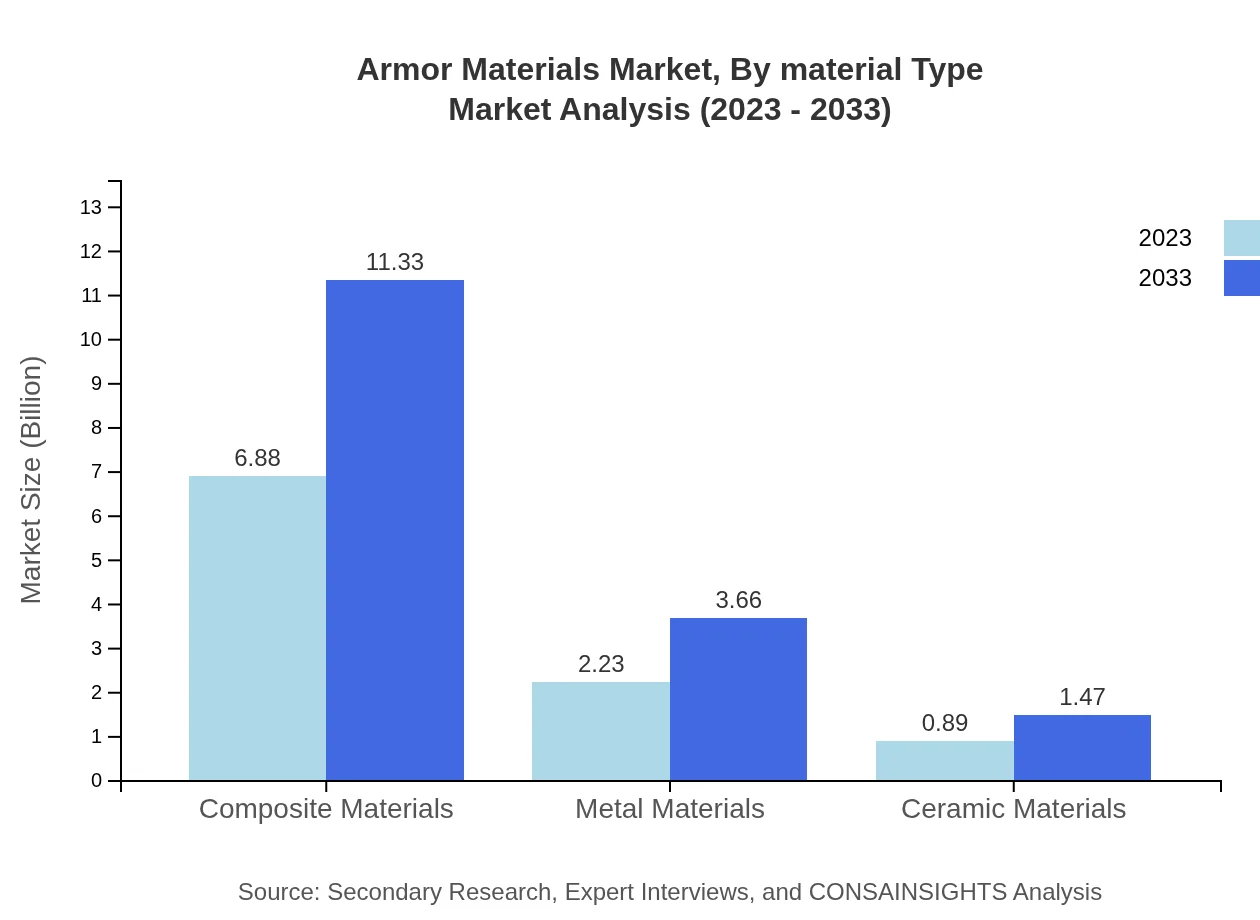

Armor Materials Market Analysis By Material Type

The armor materials market is primarily driven by composite materials, which accounted for approximately 68.83% market share in 2023 with a size of $6.88 billion. Metal materials and ceramic materials represent 22.26% and 8.91% shares respectively, valued at $2.23 billion and $0.89 billion in the same year. The growth in the composite segment is attributed to its lightweight and high-strength properties, making it ideal for various applications.

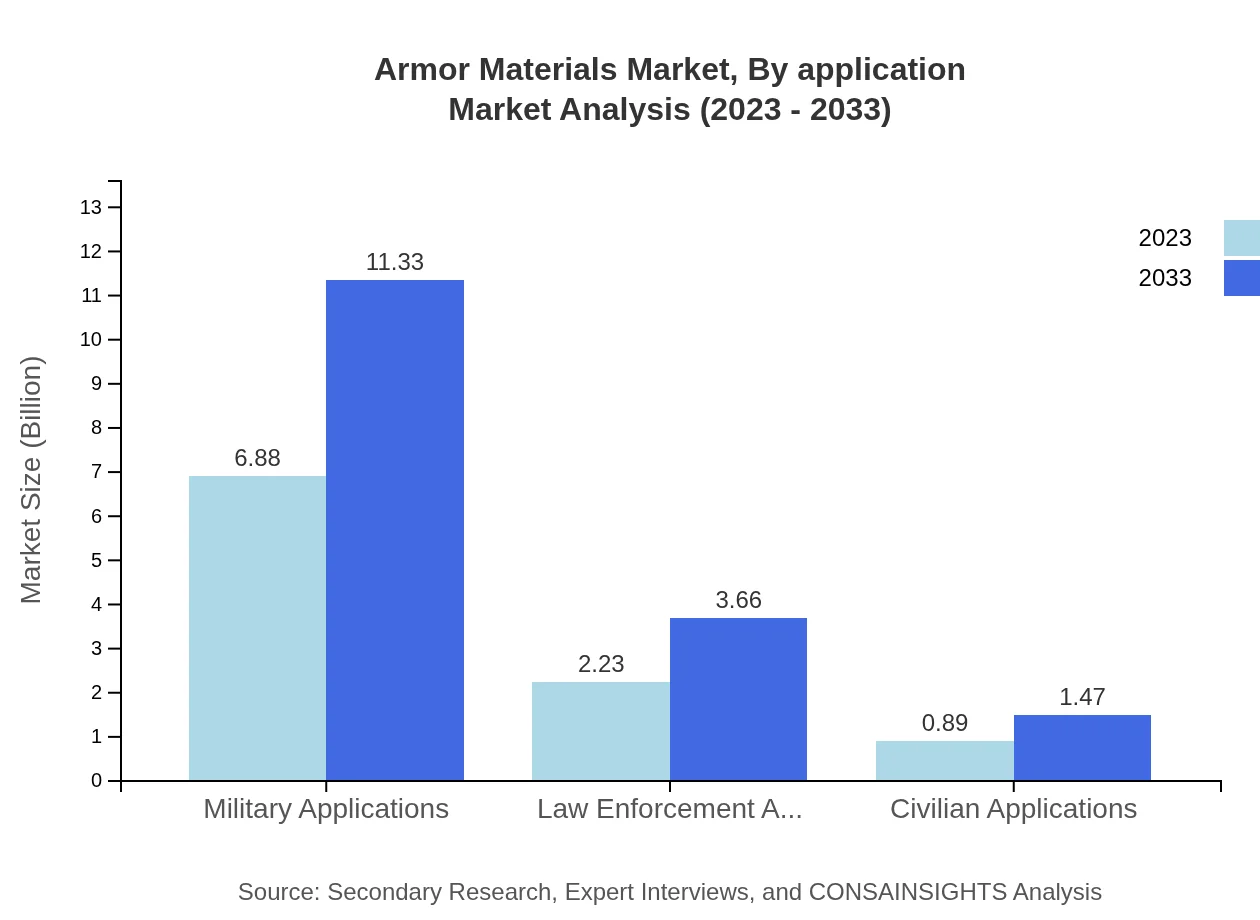

Armor Materials Market Analysis By Application

The defense sector dominates the market with a size of $6.88 billion in 2023 and is expected to remain steady, holding a 68.83% share throughout the forecast period. Security applications, including law enforcement, are also significant, growing from $2.23 billion to $3.66 billion by 2033. The civilian applications segment, albeit smaller, is seeing increased adoption due to the rising awareness of personal safety and security.

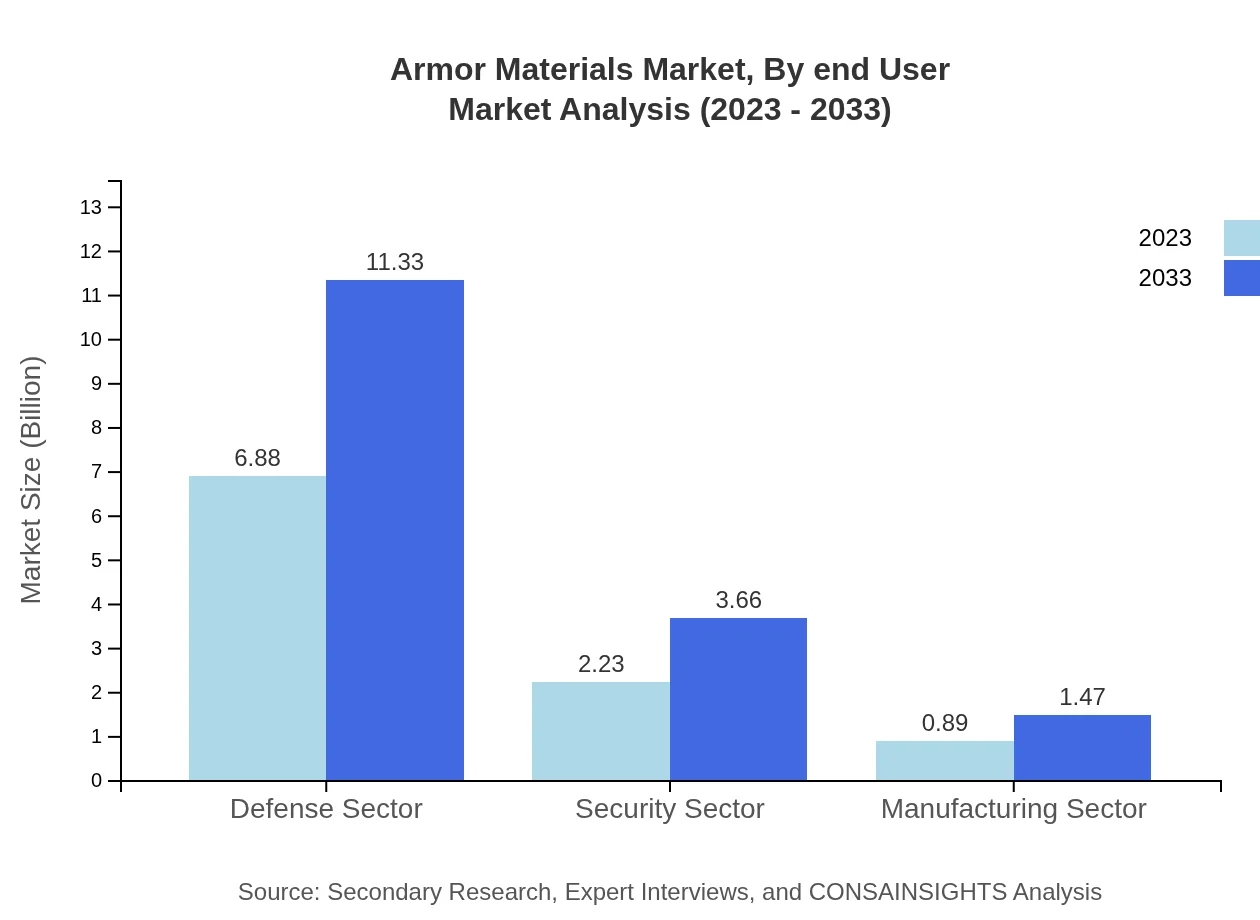

Armor Materials Market Analysis By End User

End-user segments include military, law enforcement, and civilian sectors. The military remains the largest end-user, consuming 68.83% of the total market share valued at $6.88 billion in 2023. Law enforcement applications are also critical to market growth, supported by increasing demand for body armor and protective gear amidst rising global crime rates.

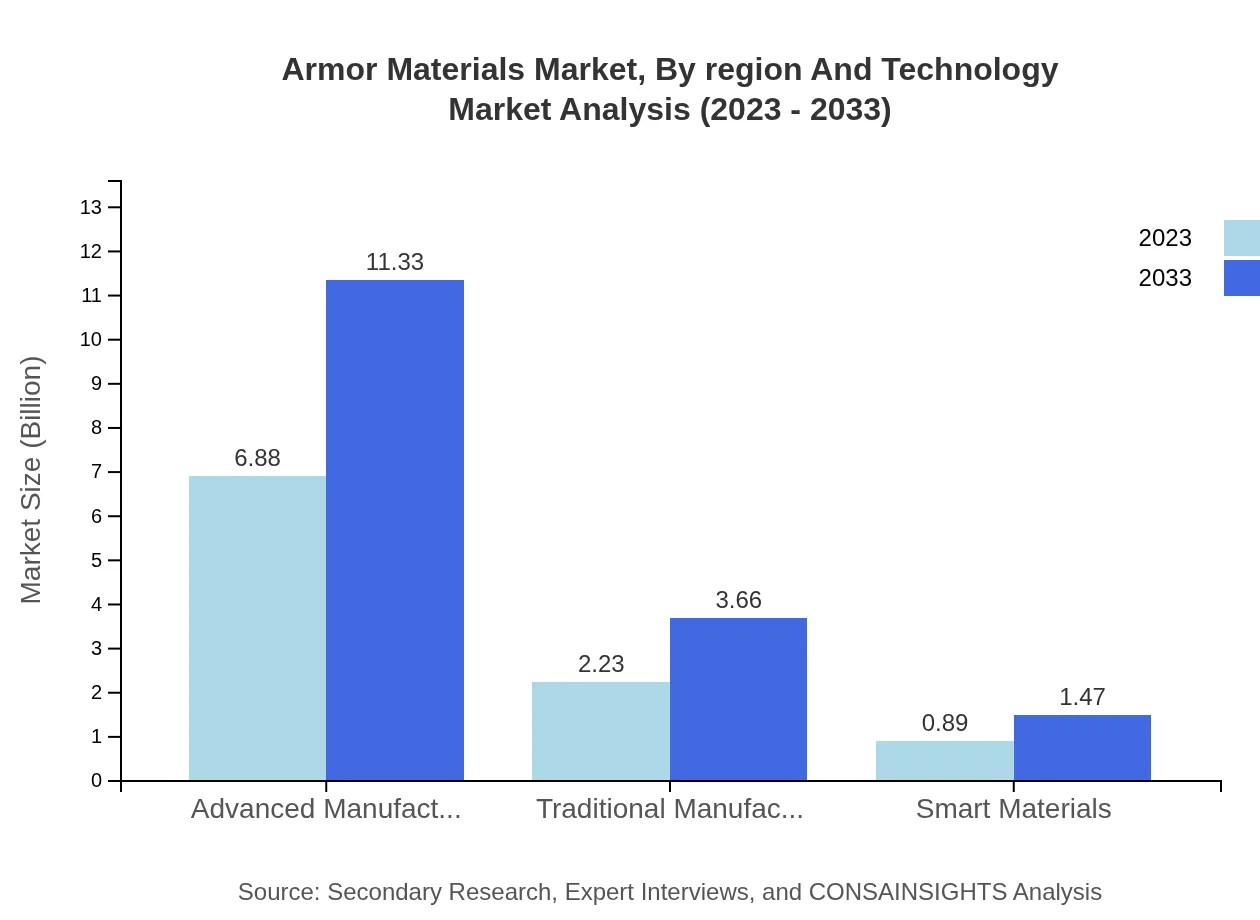

Armor Materials Market Analysis By Region And Technology

Technologically, the market is witnessing a shift towards advanced manufacturing processes, such as additive manufacturing and smart materials, which offer superior performance and customization. Traditional manufacturing processes maintain a significant presence but are gradually being supplemented by newer methods to meet modern protection needs.

Armor Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Armor Materials Industry

Dupont:

A leader in the development of advanced materials, Dupont's Kevlar® is synonymous with high-performance protection solutions across various applications.Teijin:

Teijin is a advanced fiber and resin manufacturer, highly recognized for their aramid fibers that are critical in the production of ballistic protection materials.Honeywell :

Honeywell provides armor material solutions that are not only innovative but also focus on sustainability and enhanced performance for military and civilian applications.Morgan Advanced Materials:

A specialist in advanced ceramics, Morgan Advanced Materials offers solutions tailored for complex armor requirements efficiently meeting military standards.Bae Systems:

Bae Systems’ armor solutions are widely used in defense contracts, consistently setting industry standards for protective capabilities and technology.We're grateful to work with incredible clients.

FAQs

What is the market size of armor materials?

The global armor materials market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5% from 2023. This growth is driven by increasing defense spending and the demand for advanced protective gear.

What are the key market players or companies in the armor materials industry?

Key players in the armor materials market include DuPont, Honeywell International, and Rheinmetall AG. These companies are renowned for their innovative products and significant investments in research and development to enhance material performance.

What are the primary factors driving the growth in the armor materials industry?

Growth in the armor materials industry is primarily driven by increasing global defense budgets, rising threats from terrorism, and the demand for personal and vehicle protection solutions across various sectors including military and law enforcement.

Which region is the fastest Growing in the armor materials market?

North America is currently the fastest-growing region in the armor materials market, projected to grow from $3.66 billion in 2023 to $6.03 billion by 2033, attributed to strong military investment and advanced technology integrations.

Does Consainsights provide customized market report data for the armor materials industry?

Yes, Consainsights offers customized market report data tailored to specific client needs within the armor materials industry, ensuring relevant insights that align with strategic objectives and market dynamics.

What deliverables can I expect from this armor materials market research project?

From our armor materials market research project, expect comprehensive reports detailing market size, growth projections, competitive analysis, and insights into regional trends and key player strategies to inform your business decisions.

What are the market trends of armor materials?

The armor materials market is witnessing trends towards lightweight composites, advanced manufacturing technologies, and the use of smart materials. These innovations enhance protection while reducing weight, catering to evolving operational needs.