Armored Fighting Vehicles Market Report

Published Date: 03 February 2026 | Report Code: armored-fighting-vehicles

Armored Fighting Vehicles Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Armored Fighting Vehicles market, covering market size, growth potential, regional insights, technology advancements, and the competitive landscape from 2023 to 2033.

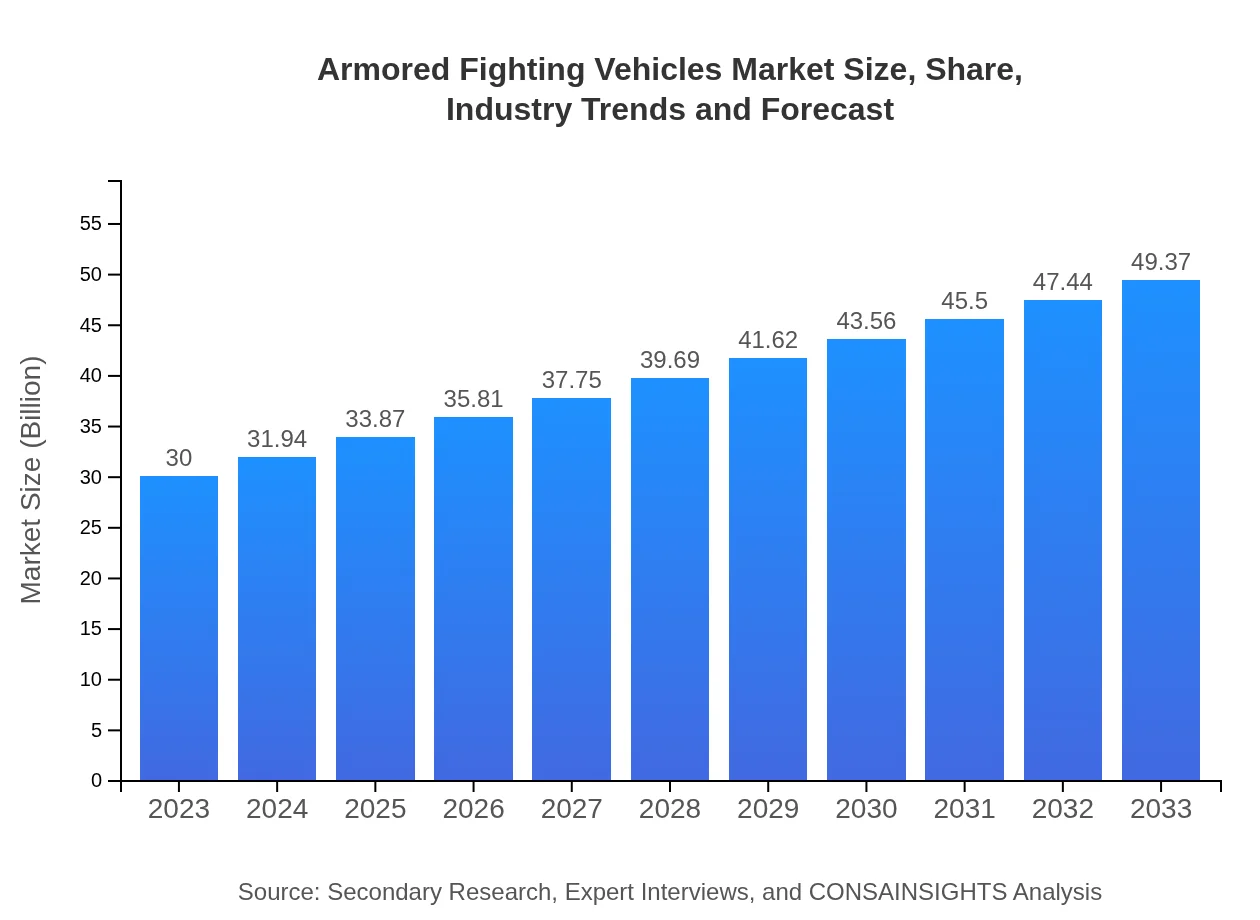

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $49.37 Billion |

| Top Companies | General Dynamics Land Systems, BAE Systems, Rheinmetall AG, Oshkosh Defense |

| Last Modified Date | 03 February 2026 |

Armored Fighting Vehicles Market Overview

Customize Armored Fighting Vehicles Market Report market research report

- ✔ Get in-depth analysis of Armored Fighting Vehicles market size, growth, and forecasts.

- ✔ Understand Armored Fighting Vehicles's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Armored Fighting Vehicles

What is the Market Size & CAGR of Armored Fighting Vehicles market in 2023?

Armored Fighting Vehicles Industry Analysis

Armored Fighting Vehicles Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Armored Fighting Vehicles Market Analysis Report by Region

Europe Armored Fighting Vehicles Market Report:

The European market, at 7.33 billion USD in 2023, is forecasted to expand to 12.06 billion USD by 2033. The ongoing conflict in Eastern Europe has invigorated investments in military capabilities, necessitating modernization of existing fleets with high-quality armored vehicles.Asia Pacific Armored Fighting Vehicles Market Report:

In 2023, the Asia Pacific market is valued at 5.77 billion USD and is anticipated to grow to 9.49 billion USD by 2033. Countries like India and China are significantly enhancing their defense capabilities, fueled by geopolitical tensions and modernization initiatives.North America Armored Fighting Vehicles Market Report:

North America's AFV market, valued at 9.80 billion USD in 2023, is expected to grow to 16.13 billion USD by 2033. The United States leads in military spending and technological innovations, driving robust demand for advanced AFVs in defense programs.South America Armored Fighting Vehicles Market Report:

With a market size of 2.92 billion USD in 2023, Latin America is projected to reach 4.81 billion USD by 2033. Nations are investing in AFVs to bolster internal security and meet external threats, focusing primarily on procurement of light armored vehicles.Middle East & Africa Armored Fighting Vehicles Market Report:

In 2023, the Middle East and Africa market is valued at 4.18 billion USD, anticipated to grow to 6.88 billion USD by 2033. Heightened security concerns and regional conflicts lead many nations to enhance their military hardware, including AFVs.Tell us your focus area and get a customized research report.

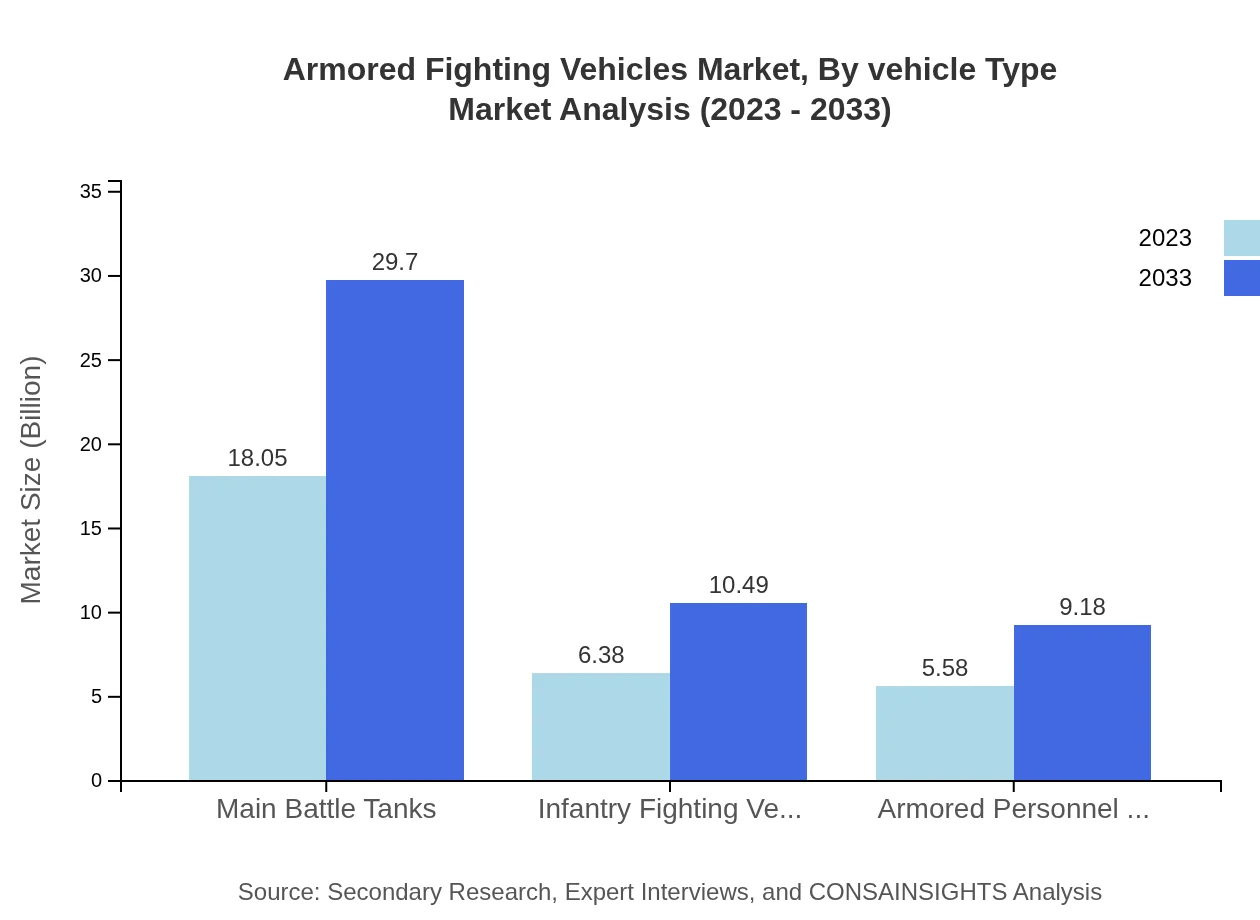

Armored Fighting Vehicles Market Analysis By Vehicle Type

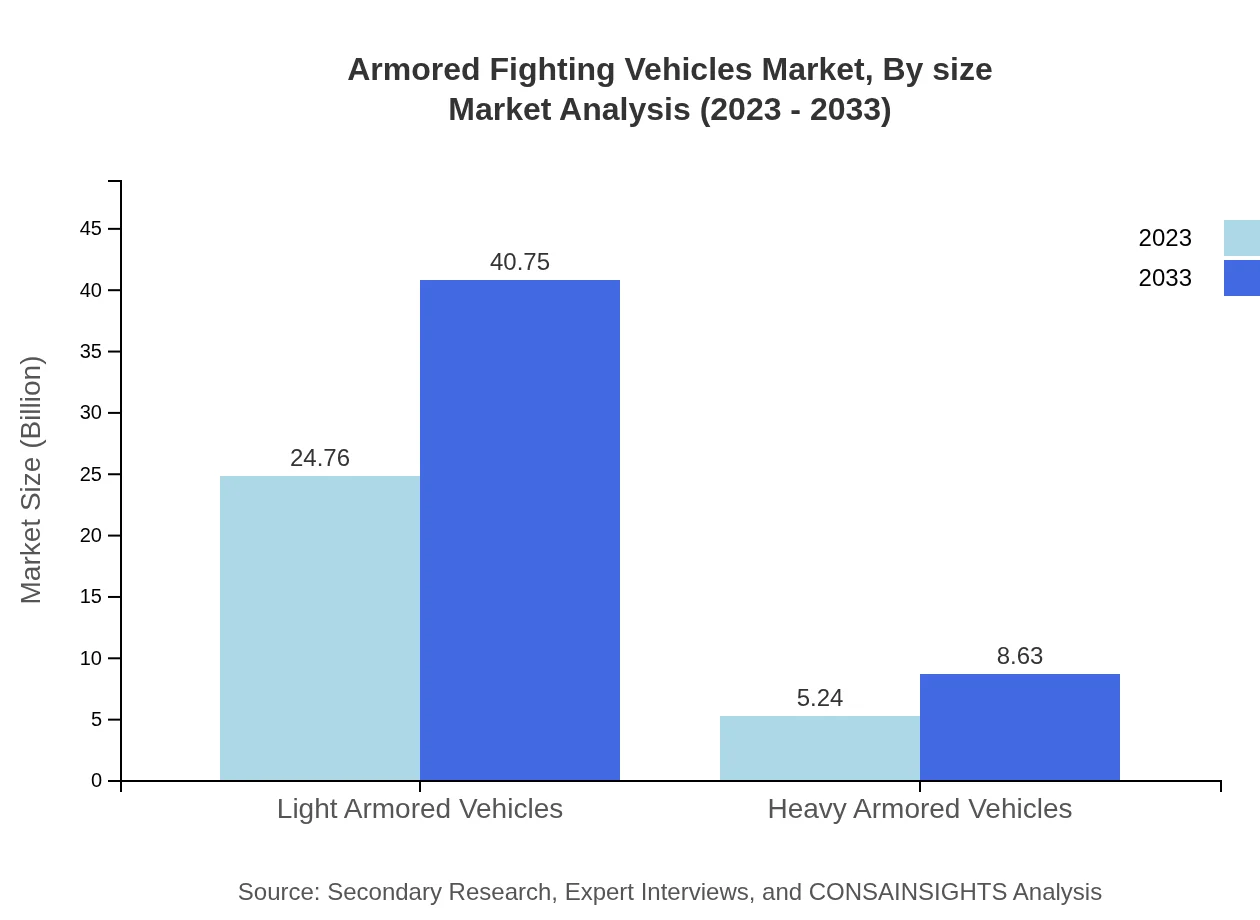

The Armored Fighting Vehicles market by vehicle type is primarily segmented into Light Armored Vehicles, Heavy Armored Vehicles, Main Battle Tanks, Infantry Fighting Vehicles, and Armored Personnel Carriers. Light Armored Vehicles are projected to dominate the market with a size of 24.76 billion USD in 2023, expanding to 40.75 billion USD by 2033, maintaining an 82.53% market share. Conversely, Heavy Armored Vehicles will grow from 5.24 billion USD in 2023 to 8.63 billion USD by 2033, holding a 17.47% share.

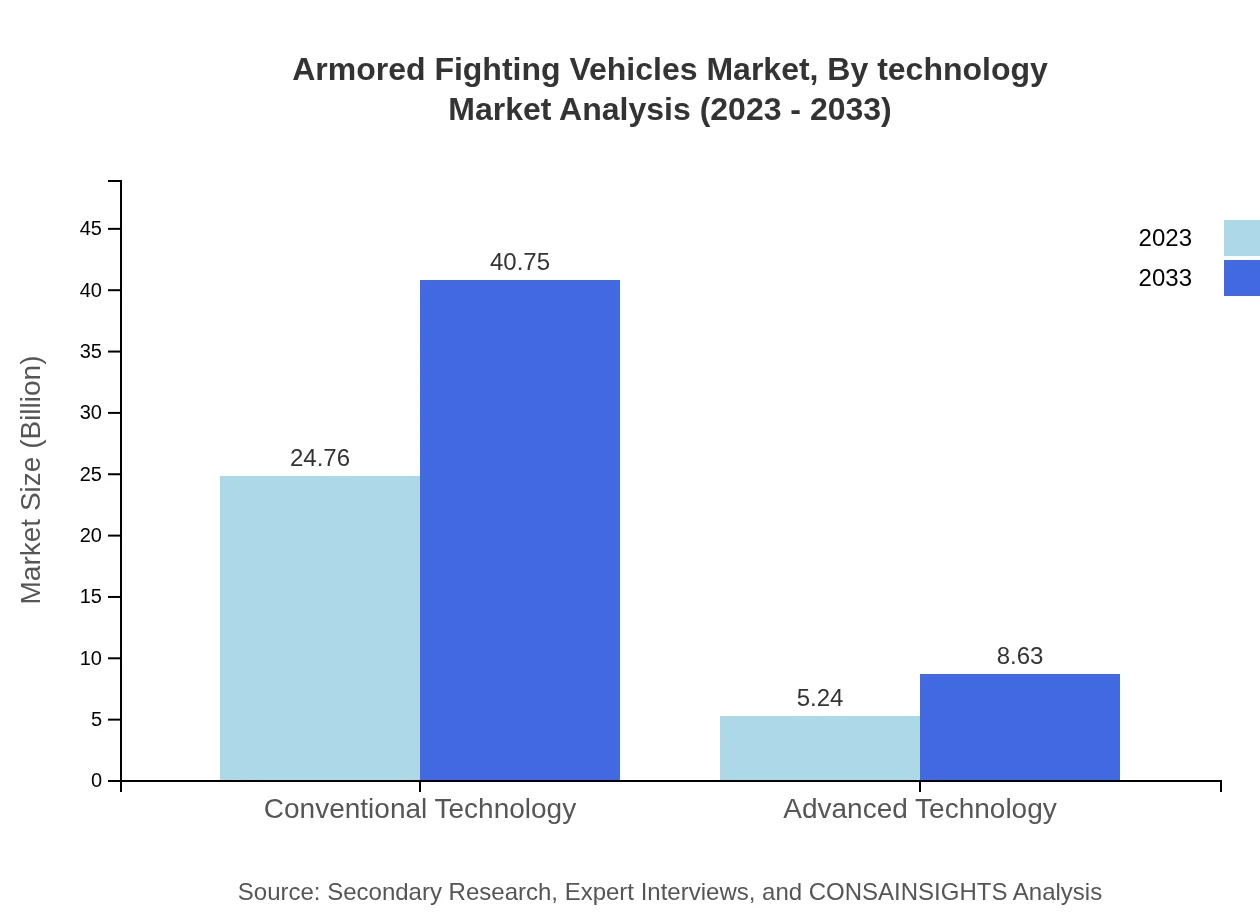

Armored Fighting Vehicles Market Analysis By Technology

The tech spectrum of the AFV market includes Conventional and Advanced Technologies. Conventional Technology is poised to sustain its dominant market position with an anticipated size increase from 24.76 billion USD in 2023 to 40.75 billion USD by 2033, while Share reflects 82.53%. Advanced Technology, while smaller at 5.24 billion USD in 2023, is expected to grow to 8.63 billion USD by 2033, sustaining a market share of 17.47%, indicating a shift toward modernized capabilities.

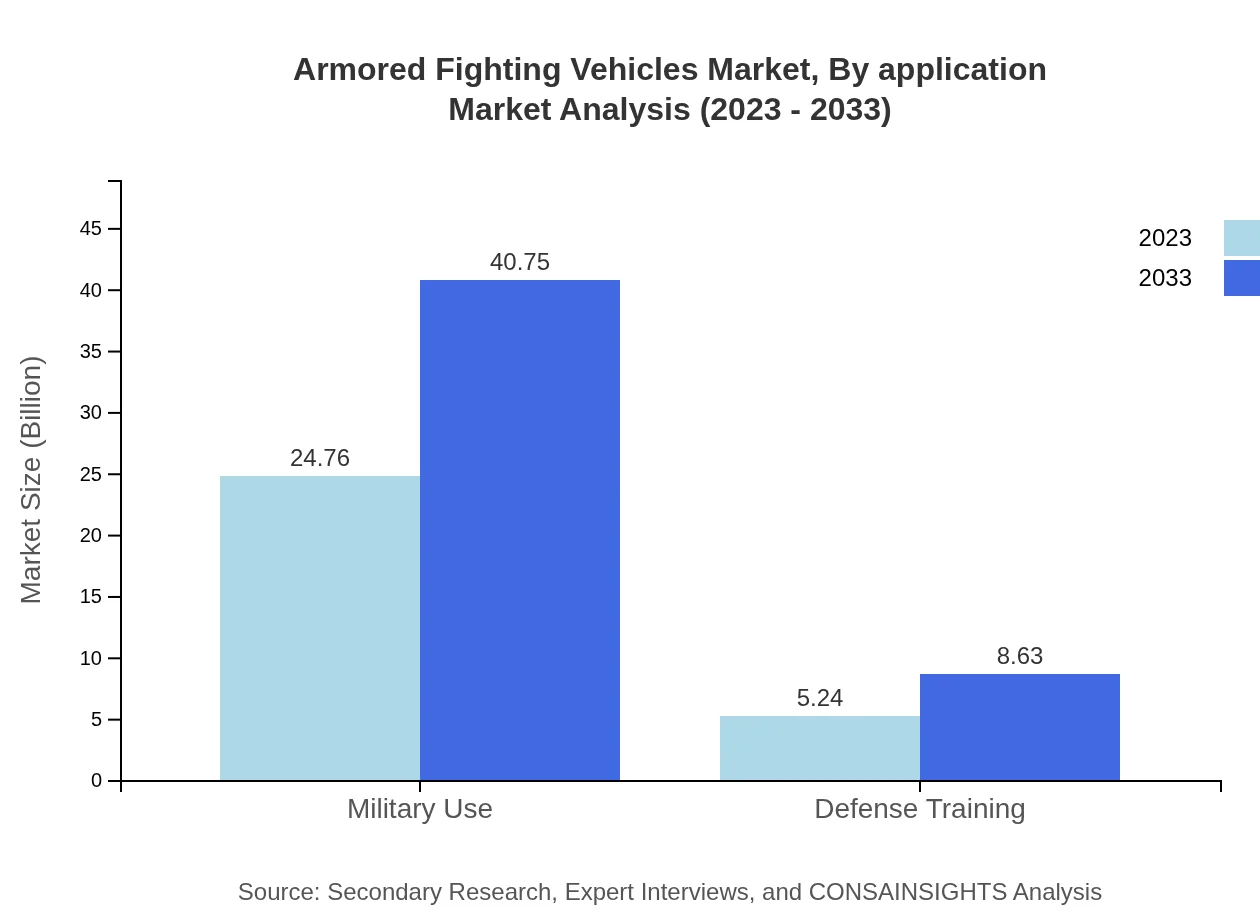

Armored Fighting Vehicles Market Analysis By Application

The applications of AFVs primarily span Military Use and Defense Training. Military Use is significant, attained a market size of 24.76 billion USD in 2023 and forecasted to rise to 40.75 billion USD by 2033, securing an 82.53% market share. In contrast, Defense Training, while growing from 5.24 billion USD to 8.63 billion USD during the same period, holds a 17.47% share, emphasizing the need for enhanced training capabilities to support operational readiness.

Armored Fighting Vehicles Market Analysis By Size

The market can also be analyzed through size categories. Large-scale AFVs, notably the Main Battle Tanks, show substantial growth from 18.05 billion USD in 2023 to 29.70 billion USD by 2033, capturing a 60.16% share. Meanwhile, Infantry Fighting Vehicles and Armored Personnel Carriers are expected to expand, exhibiting strong demand for combat and support capabilities across diverse military operations.

Armored Fighting Vehicles Market Analysis By End User

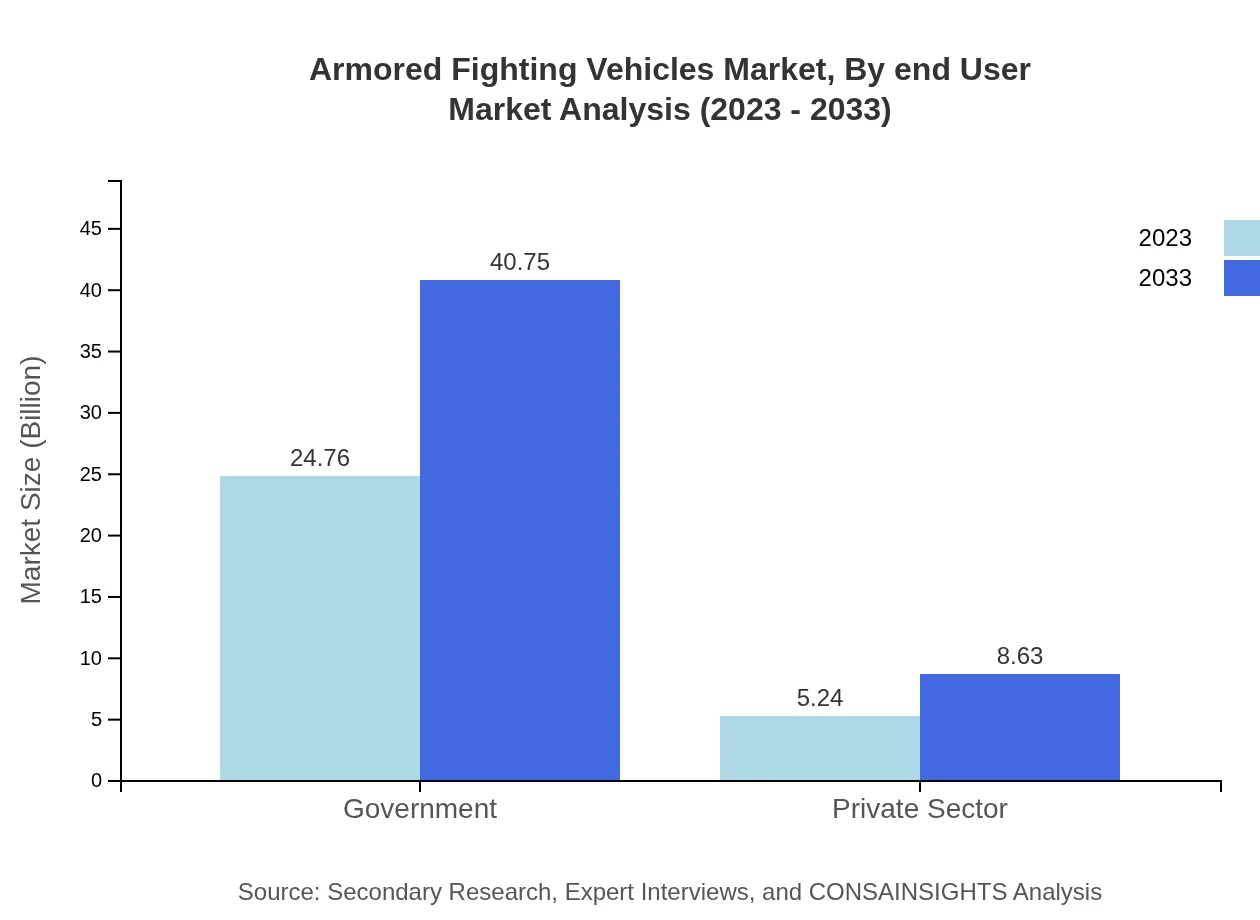

In the AFV market context, end-users primarily consist of governmental defense departments and private sector contractors. Governmental bodies are anticipated to dominate the procurement landscape with a market size of 24.76 billion USD in 2023 and an expected growth to 40.75 billion USD by 2033, maintaining an 82.53% share, while the private sector comprises a smaller yet significant segment indicating a collaborative trend for advanced combat vehicle solutions.

Armored Fighting Vehicles Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Armored Fighting Vehicles Industry

General Dynamics Land Systems:

A premier combat vehicle manufacturer, GDLS is renowned for its innovation in designing advanced armored vehicles including the Stryker and LAV series, enhancing mobility and survivability.BAE Systems:

With a strong portfolio including the CV90 and Bradley vehicles, BAE Systems leverages advanced technology to deliver cutting-edge armored solutions for defense forces globally.Rheinmetall AG:

A leading European defense company, specializing in armored vehicles and defense electronics, Rheinmetall is recognized for its advanced Leopard series, tailored for multi-environment operations.Oshkosh Defense:

Renowned for its tactical wheeled vehicles, including the MRAP family, Oshkosh focuses on developing protective products for military applications, emphasizing safety and durability.We're grateful to work with incredible clients.

FAQs

What is the market size of armored fighting vehicles?

The global armored fighting vehicles market is currently valued at approximately $30 billion, with an expected CAGR of 5% from 2023 to 2033, indicating steady growth and increasing demand across various segments.

What are the key market players or companies in this armored fighting vehicles industry?

Key players in the armored fighting vehicles market include well-established defense contractors and manufacturers who specialize in military vehicles, including major corporations focused on innovation and technology.

What are the primary factors driving the growth in the armored fighting vehicles industry?

Growth is primarily driven by increasing defense budgets, rising geopolitical tensions, technological advancements in vehicle capabilities, and demand for modernization of military equipment globally.

Which region is the fastest Growing in the armored fighting vehicles market?

The North American region is projected to be the fastest-growing market, with expected growth from $9.80 billion in 2023 to $16.13 billion by 2033, driven by significant military expenditures and procurement plans.

Does ConsaInsights provide customized market report data for the armored fighting vehicles industry?

Yes, ConsaInsights offers tailored market research reports on armored fighting vehicles, enabling clients to gain insights specific to their needs, including customized data and analysis.

What deliverables can I expect from this armored fighting vehicles market research project?

Expect detailed reports including market trends, drivers, challenges, forecasts, and competitive analysis, as well as insights into market segmentation and regional performance.

What are the market trends of armored fighting vehicles?

Current trends in the armored fighting vehicles market include a shift towards light armored vehicles, increased focus on advanced technologies, and integration of artificial intelligence and automation into military operations.