Armored Vehicles Navigation Systems Market Report

Published Date: 03 February 2026 | Report Code: armored-vehicles-navigation-systems

Armored Vehicles Navigation Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Armored Vehicles Navigation Systems market, covering trends, forecasts, industry analysis, and segmentation from 2023 to 2033. It aims to inform stakeholders about market dynamics, regional performance, and key players in this sector.

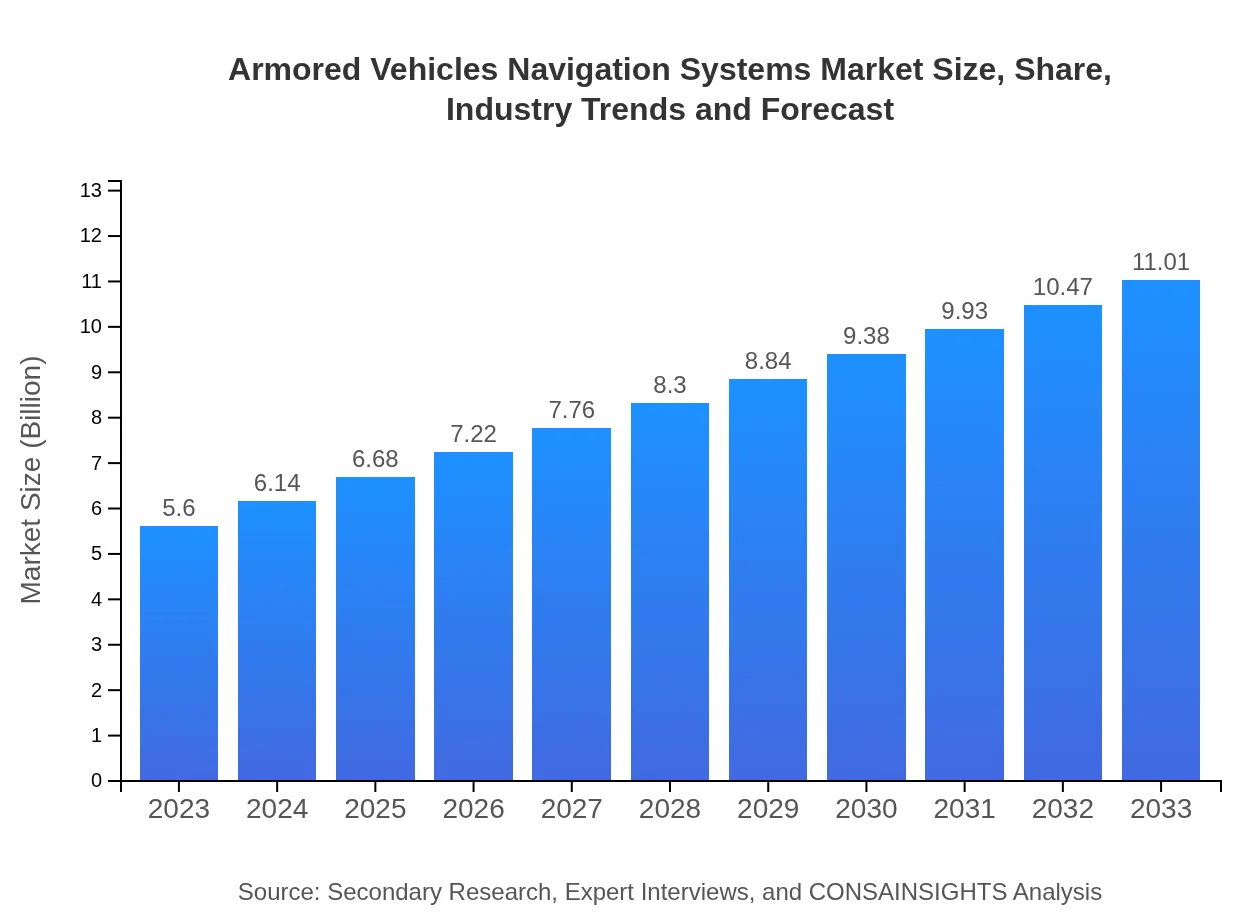

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Thales Group, Lockheed Martin Corporation, Northrop Grumman, BAE Systems |

| Last Modified Date | 03 February 2026 |

Armored Vehicles Navigation Systems Market Overview

Customize Armored Vehicles Navigation Systems Market Report market research report

- ✔ Get in-depth analysis of Armored Vehicles Navigation Systems market size, growth, and forecasts.

- ✔ Understand Armored Vehicles Navigation Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Armored Vehicles Navigation Systems

What is the Market Size & CAGR of Armored Vehicles Navigation Systems market in 2023?

Armored Vehicles Navigation Systems Industry Analysis

Armored Vehicles Navigation Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Armored Vehicles Navigation Systems Market Analysis Report by Region

Europe Armored Vehicles Navigation Systems Market Report:

Europe's market is anticipated to expand from $1.62 billion in 2023 to $3.19 billion by 2033, stimulated by the need for enhanced defense mechanisms amidst rising regional tensions and governmental modernization programs. Countries like the UK, Germany, and France are at the forefront.Asia Pacific Armored Vehicles Navigation Systems Market Report:

In the Asia Pacific region, the market is projected to grow from $1.17 billion in 2023 to $2.30 billion by 2033, driven by increasing defense budgets, military modernization initiatives, and geopolitical tensions. Countries like India and China are key players, leading to robust market growth.North America Armored Vehicles Navigation Systems Market Report:

North America holds a significant market share estimated at $1.89 billion in 2023, growing to $3.71 billion by 2033. The U.S. defense budget and the focus on advanced military capabilities are critical drivers of this growth, alongside technological innovations from leading companies.South America Armored Vehicles Navigation Systems Market Report:

The South American market is relatively smaller, expected to rise from $0.41 billion in 2023 to $0.81 billion by 2033, bolstered by improving security dynamics and increasing investments in military technology, notably in Brazil and Colombia.Middle East & Africa Armored Vehicles Navigation Systems Market Report:

The Middle East and Africa market is witnessing enhancements with a growth from $0.51 billion in 2023 to $0.99 billion by 2033, driven by elevated defense spending in countries like Saudi Arabia and the UAE amidst ongoing conflicts and security challenges.Tell us your focus area and get a customized research report.

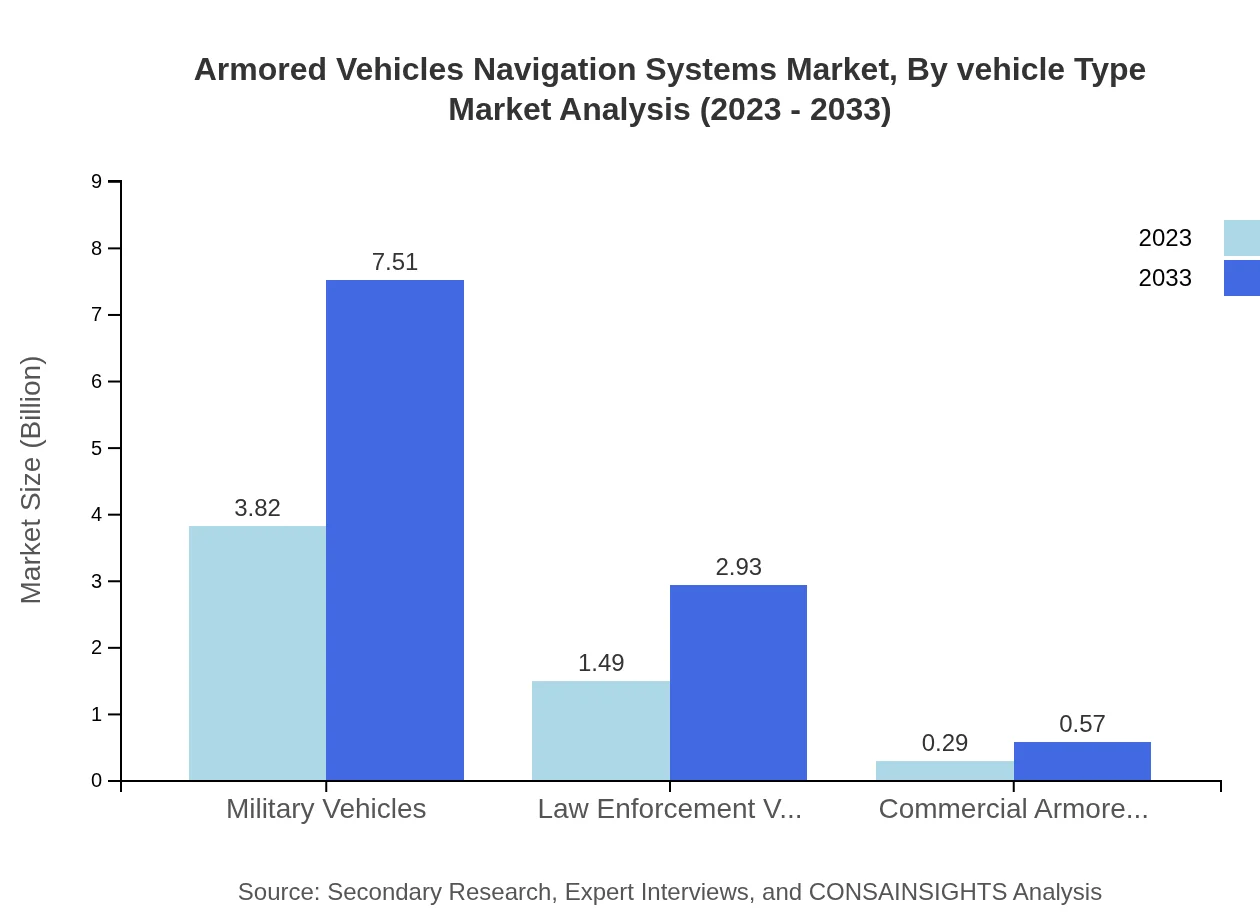

Armored Vehicles Navigation Systems Market Analysis By Vehicle Type

The majority of market revenue is driven by military vehicles, generating $3.82 billion in 2023 and projected to reach $7.51 billion by 2033, comprising 68.21% of the market share. Law enforcement vehicles will account for $1.49 billion in 2023 and $2.93 billion by 2033, while commercial armored vehicles are expected to increase from $0.29 billion in 2023 to $0.57 billion in 2033, representing a growing segment.

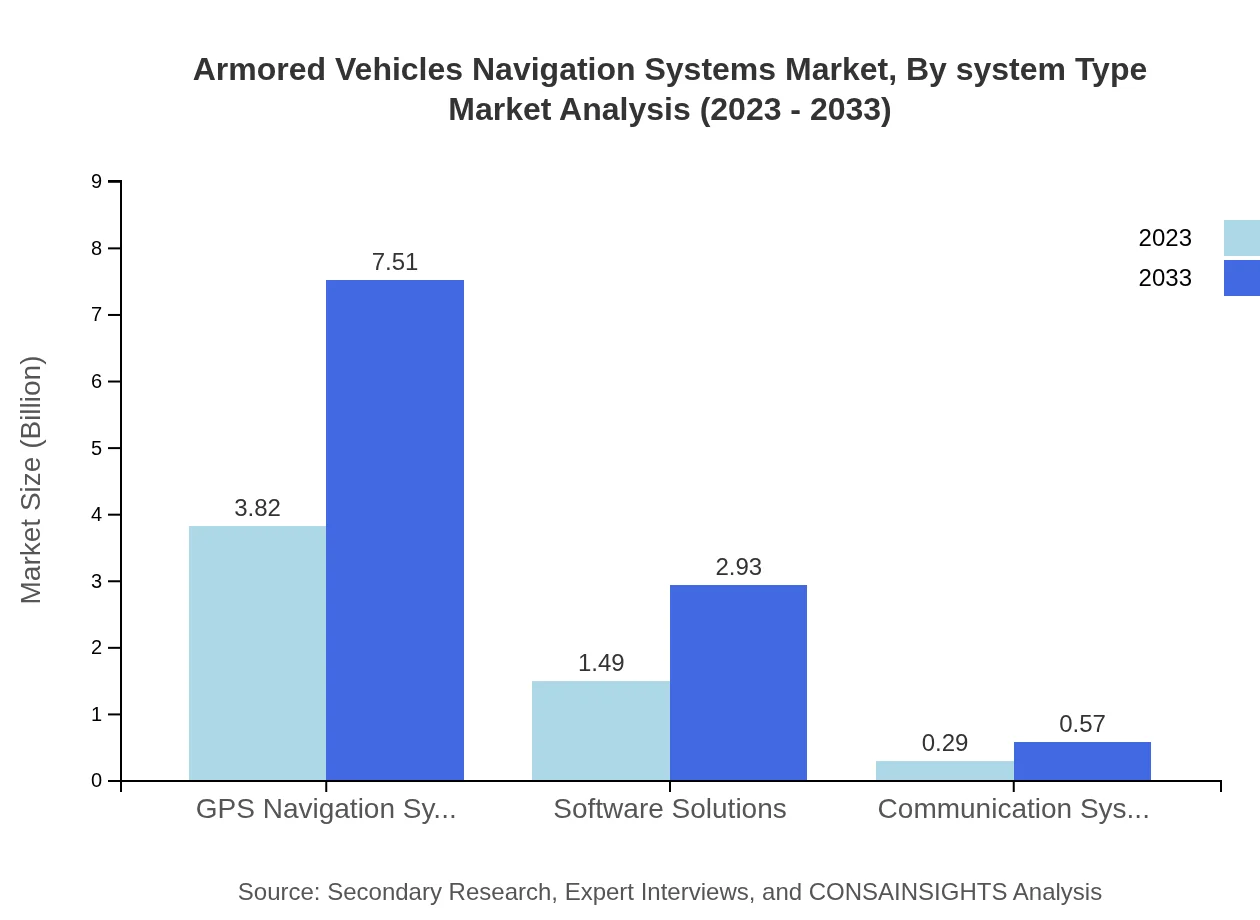

Armored Vehicles Navigation Systems Market Analysis By System Type

The satellite navigation system leads the segment with $4.67 billion in 2023, growing to $9.18 billion by 2033, comprising 83.45% of the market share. GPS navigation systems, generating $3.82 billion in 2023 and $7.51 billion by 2033, consist of 68.21% market share. Software solutions are also significant, increasing from $1.49 billion to $2.93 billion, comprising 26.59% of the market share.

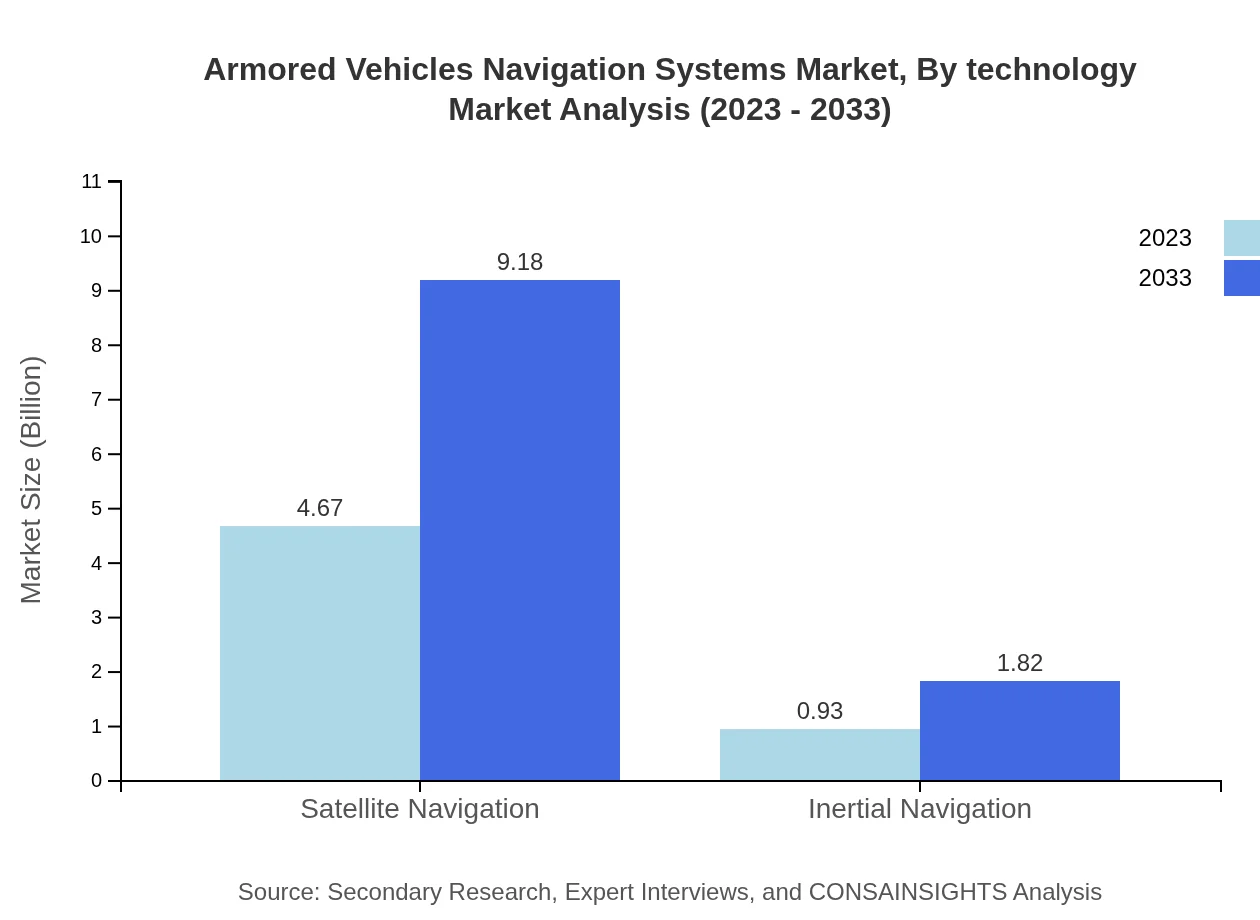

Armored Vehicles Navigation Systems Market Analysis By Technology

As technology evolves, both satellite navigation ($4.67 billion) and GPS ($3.82 billion) systems dominate with shares of 83.45% and 68.21% respectively. Inertial navigation systems contribute to the market with a share of 16.55%, valued at $0.93 billion in 2023, with anticipated growth to $1.82 billion in 2033.

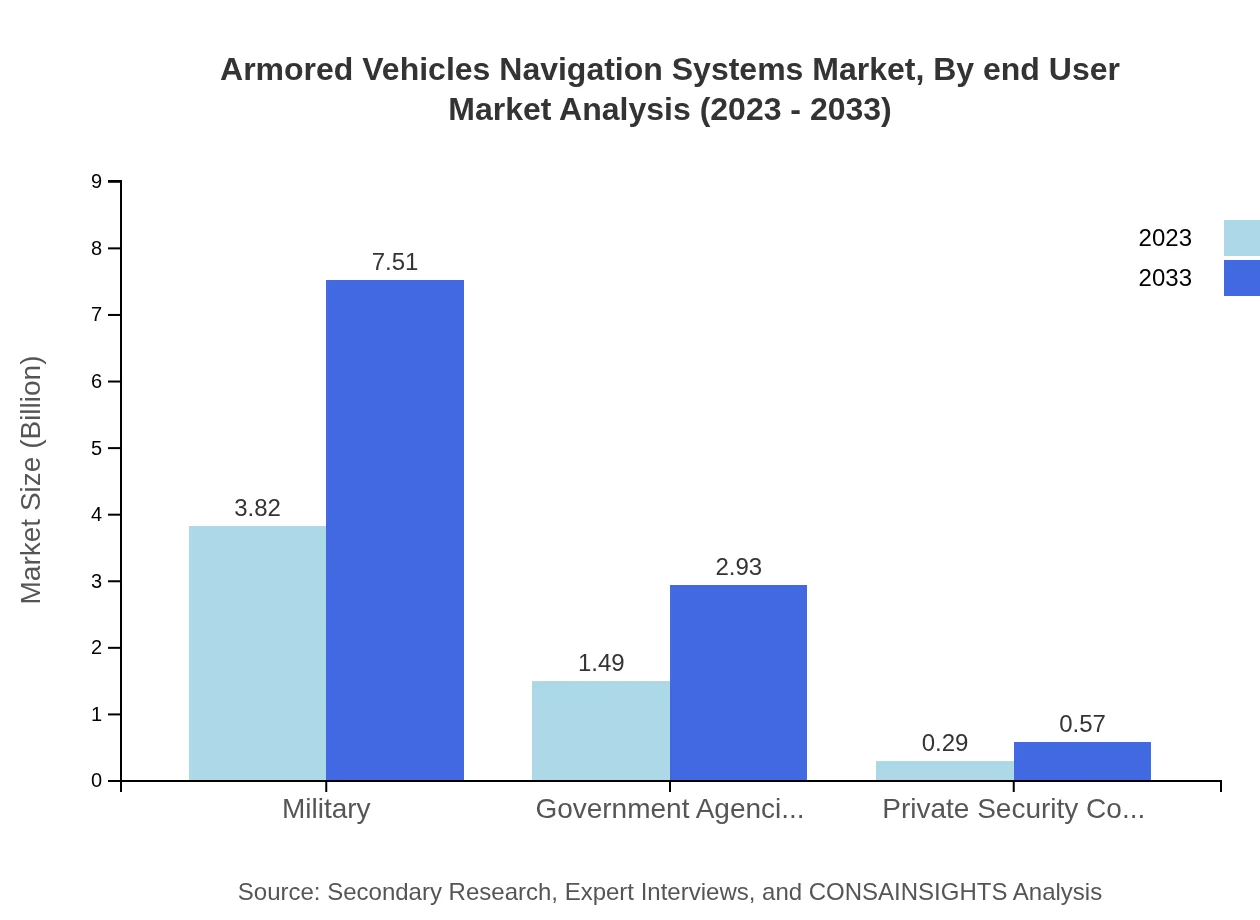

Armored Vehicles Navigation Systems Market Analysis By End User

Military forces account for the majority with a significant share of 68.21%, generating $3.82 billion in 2023, while government agencies represent 26.59% at $1.49 billion. Private security companies show growth potential, valued at $0.29 billion in 2023, and expanding further in the forecast period.

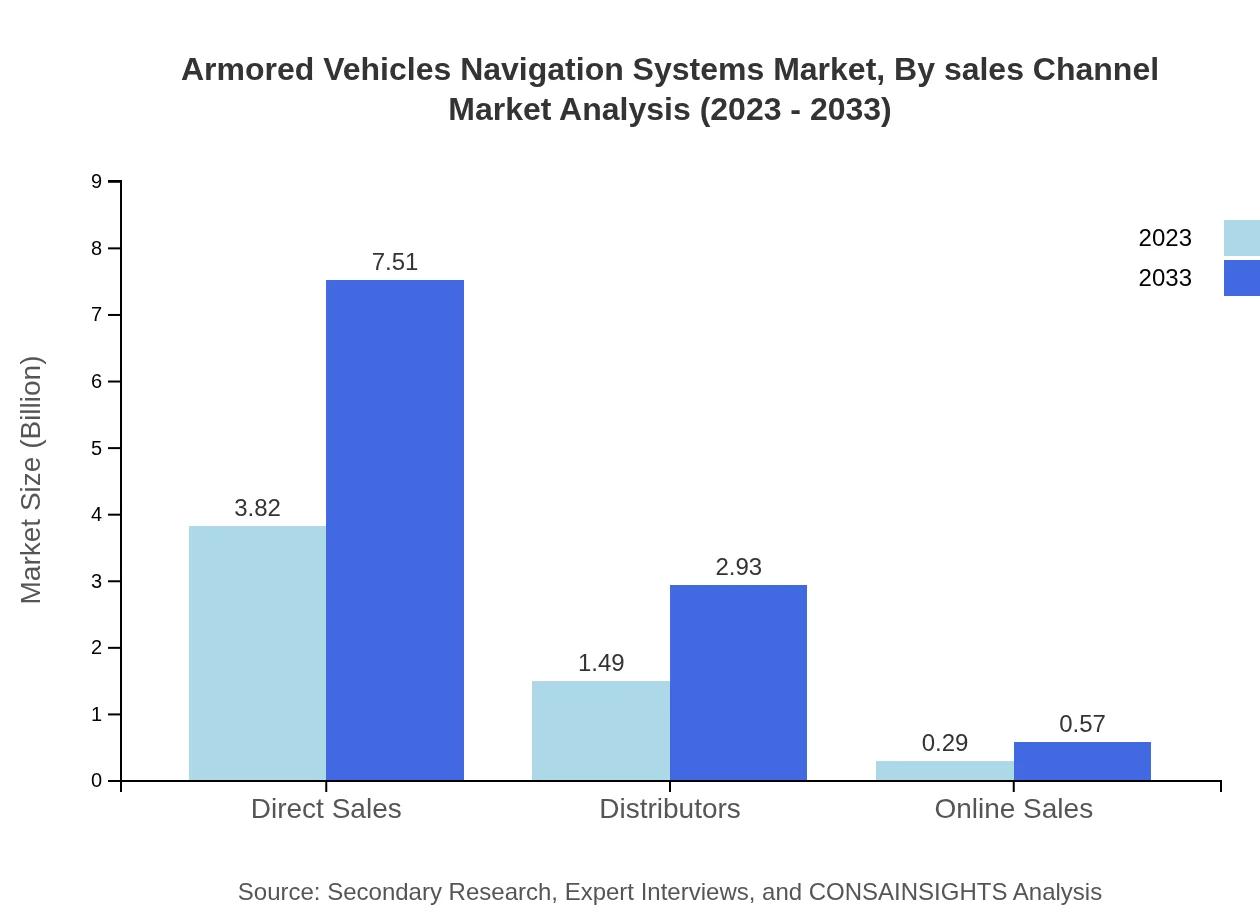

Armored Vehicles Navigation Systems Market Analysis By Sales Channel

Direct sales dominate the market, comprising 68.21% of total revenue, valued at $3.82 billion in 2023 and expected to rise to $7.51 billion by 2033. Distributors and online sales channels are also relevant, contributing $1.49 billion and $0.29 billion respectively, showcasing diverse reach in sales strategies.

Armored Vehicles Navigation Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Armored Vehicles Navigation Systems Industry

Thales Group:

Thales Group is a global technology leader that provides advanced navigation systems and solutions for defense applications, emphasizing innovation and reliability in military vehicles.Lockheed Martin Corporation:

Lockheed Martin is a major player in the defense industry, offering a range of navigation systems integrated within armored vehicles to enhance operational effectiveness.Northrop Grumman:

Northrop Grumman specializes in defense technology solutions, providing high-precision navigation and targeting systems that support military operations around the globe.BAE Systems:

BAE Systems offers comprehensive armored vehicle navigation technologies, focusing on safety, performance, and advanced functionalities tailored to military requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of armored vehicles navigation systems?

The global market size for armored vehicles navigation systems is projected to be $5.6 billion in 2023, with a compound annual growth rate (CAGR) of 6.8% expected until 2033.

What are the key market players or companies in this armored vehicles navigation systems industry?

Key players in the armored vehicles navigation systems industry include major defense contractors, technology firms specializing in GPS and navigational equipment, and manufacturers of military-grade vehicles. Their contributions significantly shape the market dynamics.

What are the primary factors driving the growth in the armored vehicles navigation systems industry?

The growth in the armored vehicles navigation systems industry is driven by increased military spending, technological advancements in navigation systems, rising geopolitical tensions, and the growing demand for enhanced safety and operational efficiency in military operations.

Which region is the fastest Growing in the armored vehicles navigation systems?

The fastest-growing region for armored vehicles navigation systems is expected to be North America, expanding from $1.89 billion in 2023 to $3.71 billion by 2033, fueled by robust defense budgets and a focus on advanced military technologies.

Does ConsaInsights provide customized market report data for the armored vehicles navigation systems industry?

Yes, ConsaInsights offers customized market report data tailored to the armored vehicles navigation systems industry, enabling clients to obtain insights specifically aligned with their strategic interests and operational requirements.

What deliverables can I expect from this armored vehicles navigation systems market research project?

From this market research project, you can expect comprehensive reports, detailed data analyses, market forecasts by region and segment, competitive landscape insights, and strategic recommendations tailored to your business objectives.

What are the market trends of armored vehicles navigation systems?

Market trends in the armored vehicles navigation systems sector include increased integration of AI-driven technology, a shift towards hybrid navigation solutions, and a growing emphasis on cybersecurity measures to protect navigational data from threats.