Armored Vehicles Upgrade And Retrofit Market Report

Published Date: 03 February 2026 | Report Code: armored-vehicles-upgrade-and-retrofit

Armored Vehicles Upgrade And Retrofit Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Armored Vehicles Upgrade And Retrofit market, covering current trends, segmentation, regional insights, and future forecasts for the period 2023 to 2033.

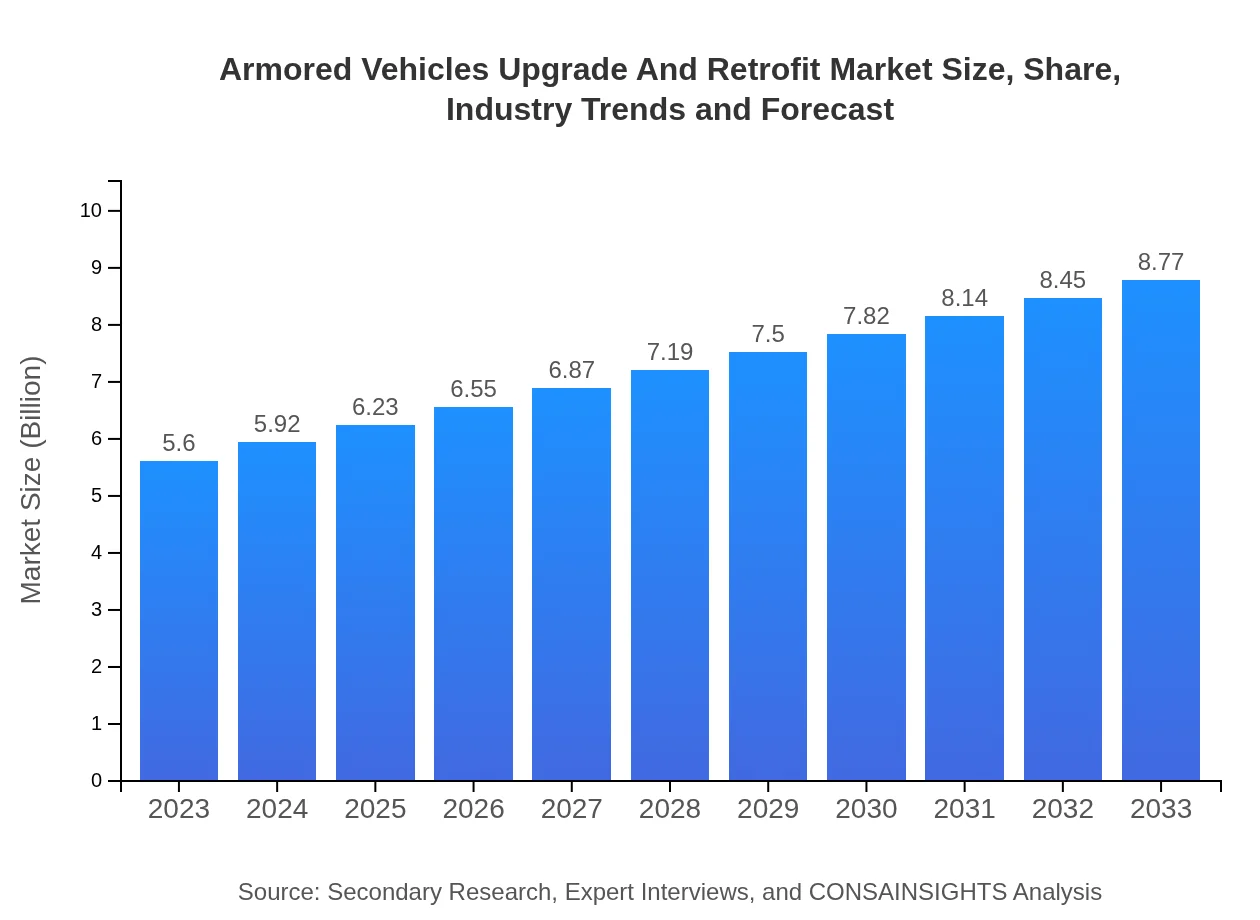

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $8.77 Billion |

| Top Companies | BAE Systems, General Dynamics, Rheinmetall AG, Oshkosh Defense |

| Last Modified Date | 03 February 2026 |

Armored Vehicles Upgrade And Retrofit Market Overview

Customize Armored Vehicles Upgrade And Retrofit Market Report market research report

- ✔ Get in-depth analysis of Armored Vehicles Upgrade And Retrofit market size, growth, and forecasts.

- ✔ Understand Armored Vehicles Upgrade And Retrofit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Armored Vehicles Upgrade And Retrofit

What is the Market Size & CAGR of Armored Vehicles Upgrade And Retrofit market in 2023?

Armored Vehicles Upgrade And Retrofit Industry Analysis

Armored Vehicles Upgrade And Retrofit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Armored Vehicles Upgrade And Retrofit Market Analysis Report by Region

Europe Armored Vehicles Upgrade And Retrofit Market Report:

Europe's market is set to increase from $1.73 billion in 2023 to $2.71 billion by 2033, influenced by ongoing military conflicts and the necessity for upgraded defense systems to counter emerging threats.Asia Pacific Armored Vehicles Upgrade And Retrofit Market Report:

In the Asia Pacific, the market size is projected to be $1.09 billion in 2023, growing to $1.70 billion by 2033. Rapid military modernization and increased defense spending from countries like India and China are driving this growth, alongside regional security concerns.North America Armored Vehicles Upgrade And Retrofit Market Report:

North America is predicted to rise from $1.93 billion in 2023 to $3.03 billion by 2033. Continuous enhancement of military capabilities and technological innovation in the U.S. and Canada is leading this substantial growth.South America Armored Vehicles Upgrade And Retrofit Market Report:

The South American market is anticipated to grow from $0.48 billion in 2023 to $0.75 billion by 2033. Demand for armored vehicle upgrades in Brazil and Colombia is primarily driven by national security and peacekeeping missions.Middle East & Africa Armored Vehicles Upgrade And Retrofit Market Report:

The market in the Middle East and Africa is expected to grow from $0.37 billion in 2023 to $0.58 billion by 2033. The region’s focus on counter-terrorism and stabilization operations significantly boosts the demand for armored vehicle upgrades.Tell us your focus area and get a customized research report.

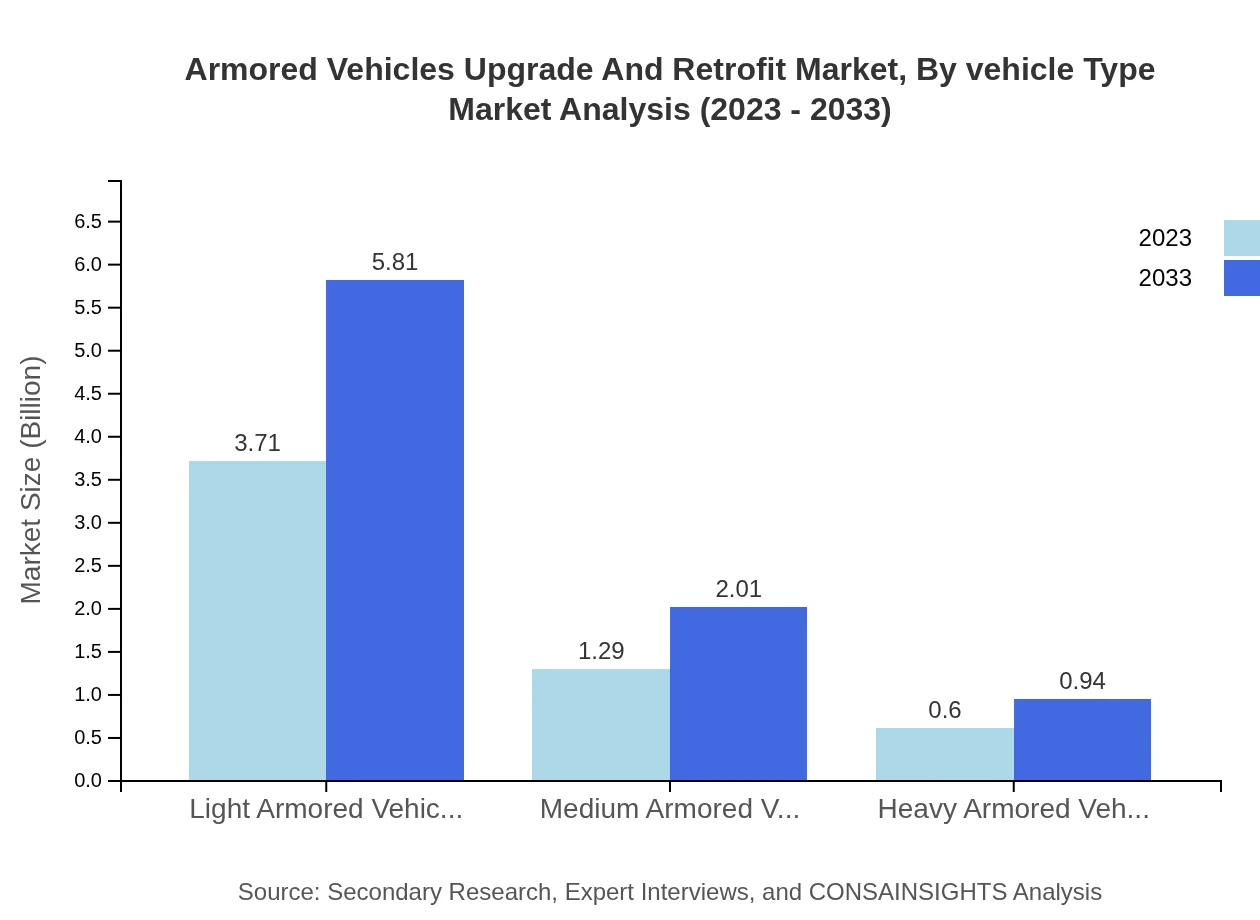

Armored Vehicles Upgrade And Retrofit Market Analysis By Vehicle Type

The armored vehicles segment shows promising growth, with light armored vehicles leading the market. In 2023, the market for light armored vehicles stands at $3.71 billion, projected to reach $5.81 billion by 2033. Medium armored vehicles and heavy armored vehicles follow, with sizes of $1.29 billion and $0.60 billion in 2023, expecting to grow to $2.01 billion and $0.94 billion, respectively.

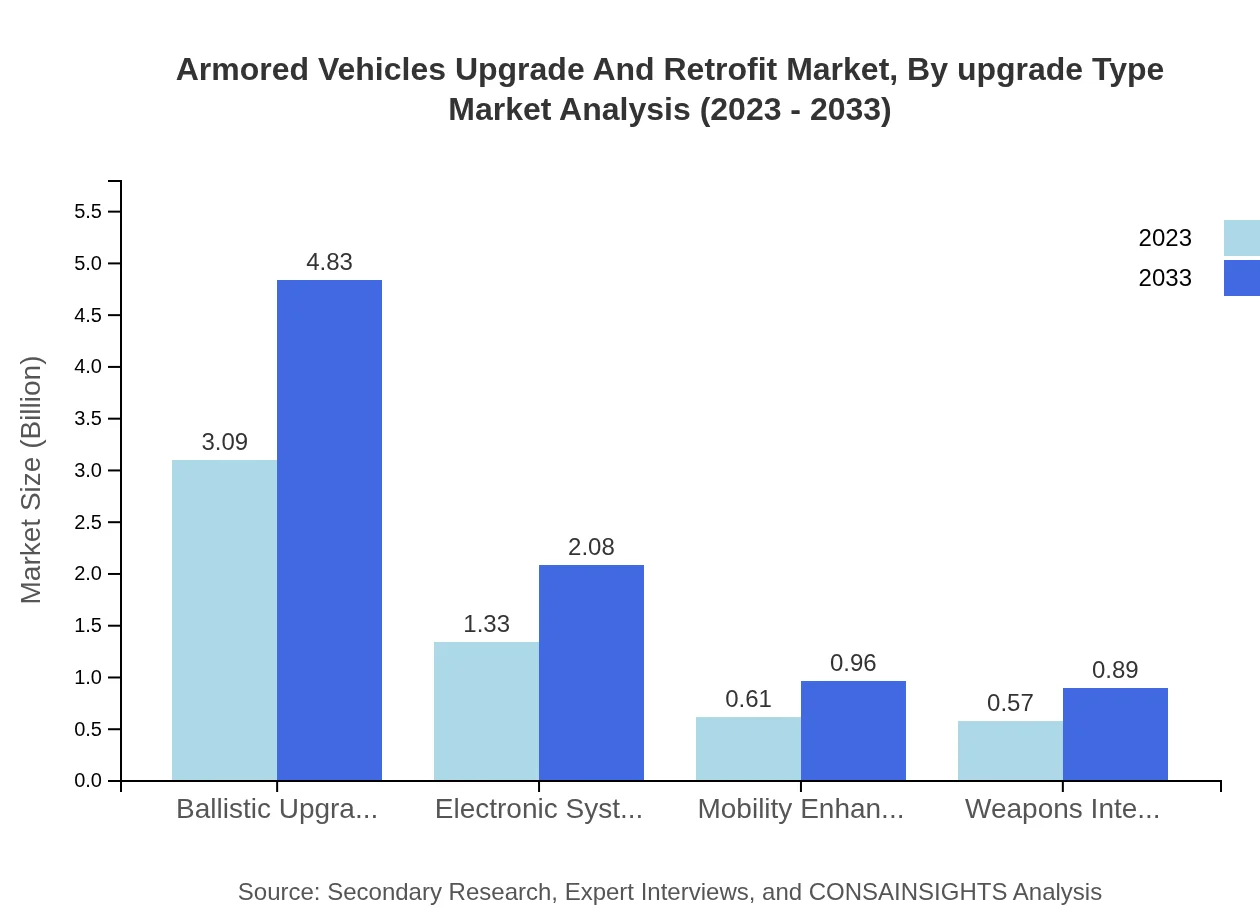

Armored Vehicles Upgrade And Retrofit Market Analysis By Upgrade Type

Ballistic upgrades dominate the segment, representing a market size of $3.09 billion in 2023, forecasted to reach $4.83 billion by 2033. Other types, such as electronic systems upgrades at $1.33 billion and add-on protection at $1.29 billion, illustrate the increasing diversification and specialization among upgrade solutions.

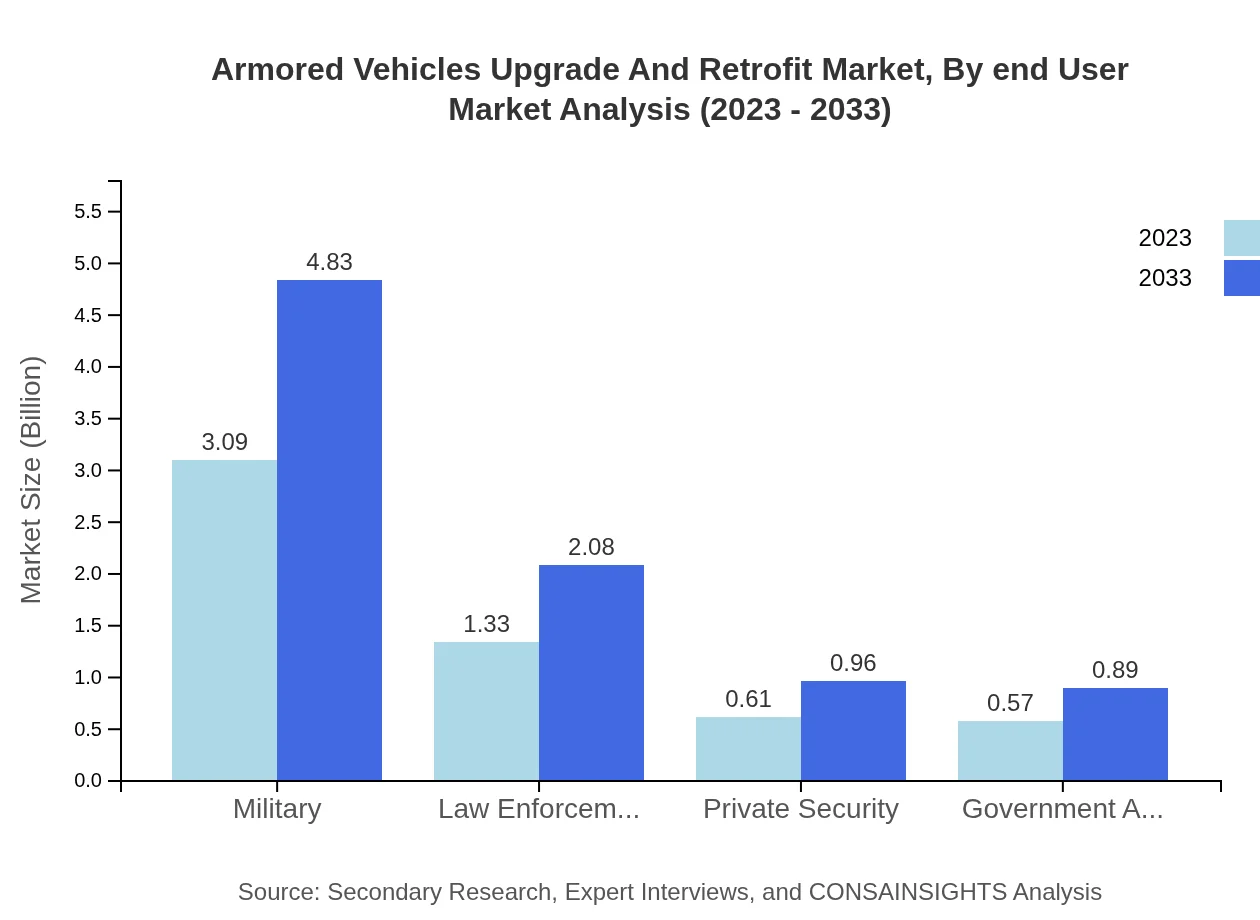

Armored Vehicles Upgrade And Retrofit Market Analysis By End User

Military applications account for the majority share, valued at $3.09 billion in 2023, projected to be $4.83 billion by 2033. Law enforcement and government agencies are other significant segments, with current values of $1.33 billion and $0.57 billion, respectively, indicating an upward trend as security concerns rise.

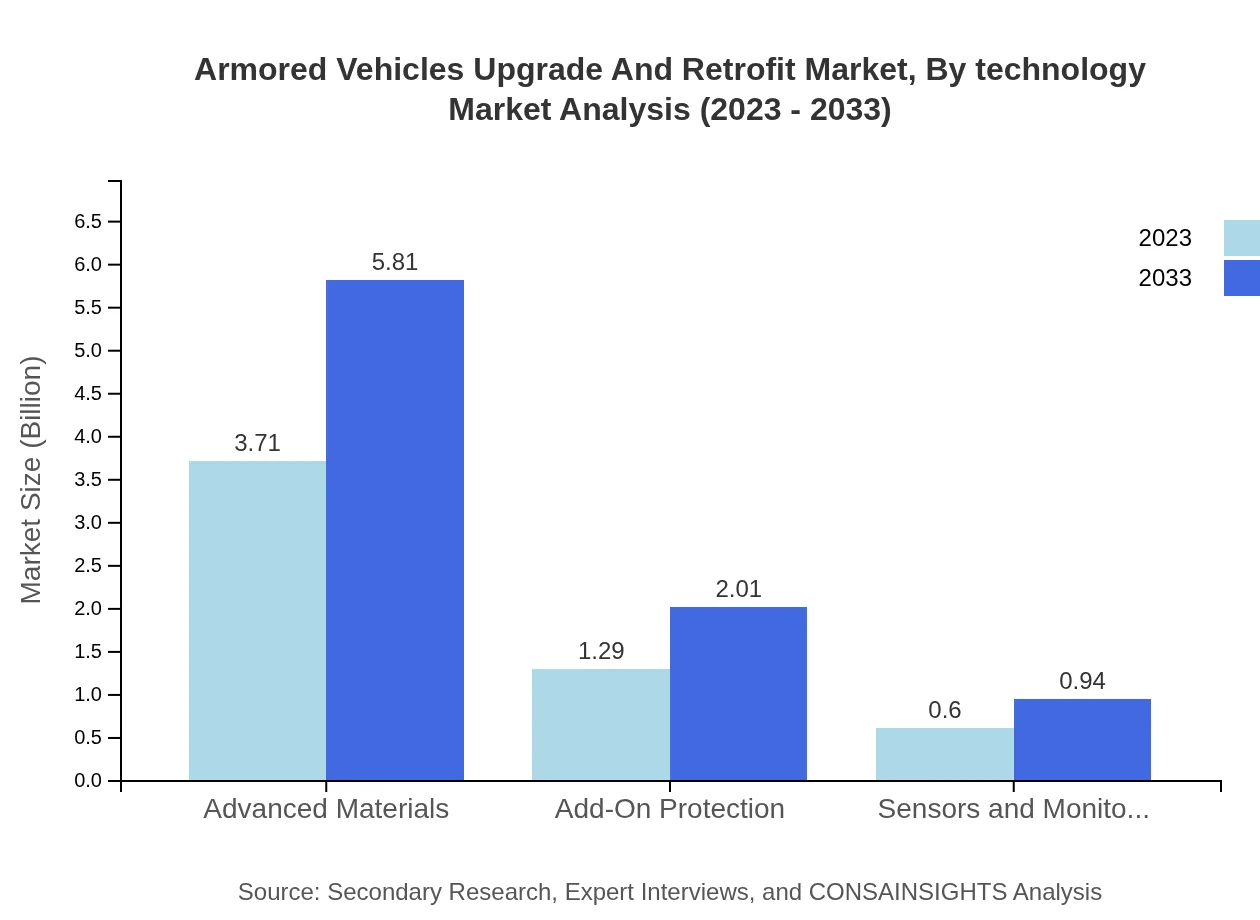

Armored Vehicles Upgrade And Retrofit Market Analysis By Technology

Advanced materials make up a significant portion of the technology segment, estimated at $3.71 billion in 2023 and projected to rise to $5.81 billion by 2033. Innovations in electronics and monitoring systems are also expected to gain traction, highlighting trends towards smarter and more efficient armored solutions.

Armored Vehicles Upgrade And Retrofit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Armored Vehicles Upgrade And Retrofit Industry

BAE Systems:

A leading defense and aerospace company that provides advanced armored vehicle solutions and upgrades to military and allied forces worldwide.General Dynamics:

Known for producing combat vehicles, General Dynamics delivers cutting-edge technologies and upgrade services to enhance the performance of armored vehicles.Rheinmetall AG:

This German company specializes in military technology, offering innovative retrofit solutions for armored vehicles to enhance capabilities.Oshkosh Defense:

Provides tactical military vehicles and upgrade options, focusing on improving vehicle resilience and adaptability in various operational environments.We're grateful to work with incredible clients.

FAQs

What is the market size of armored Vehicles Upgrade And Retrofit?

The market size for armored vehicles upgrade and retrofit stands at approximately $5.6 billion in 2023, with a projected CAGR of 4.5% from 2023 to 2033, reflecting steady growth in defense and security sectors.

What are the key market players or companies in this armored Vehicles Upgrade And Retrofit industry?

Key players in the armored vehicles upgrade and retrofit industry include leading defense contractors and specialized vehicle manufacturers. They focus on innovations that enhance vehicle performance, safety, and survivability in various operational environments.

What are the primary factors driving the growth in the armored Vehicles Upgrade And Retrofit industry?

Growth in the armored vehicles upgrade and retrofit industry is primarily driven by escalating security threats, advancements in technology, and increased defense budgets globally. Additionally, aging military vehicle fleets necessitate upgrades to maintain operational effectiveness.

Which region is the fastest Growing in the armored Vehicles Upgrade And Retrofit?

North America is currently the fastest-growing region in the armored vehicles upgrade and retrofit market, expected to expand from $1.93 billion in 2023 to $3.03 billion by 2033, driven by strong military spending and modernization efforts.

Does ConsaInsights provide customized market report data for the armored Vehicles Upgrade And Retrofit industry?

Yes, ConsaInsights offers tailored market report data for the armored vehicles upgrade and retrofit industry to meet specific client needs, ensuring comprehensive insights on market trends, competitive landscape, and growth opportunities.

What deliverables can I expect from this armored Vehicles Upgrade And Retrofit market research project?

Deliverables from the armored vehicles upgrade and retrofit market research project typically include an in-depth market analysis report, competitive assessments, segmentation insights, regional forecasts, and actionable recommendations for stakeholders.

What are the market trends of armored Vehicles Upgrade And Retrofit?

Current trends in the armored vehicles upgrade and retrofit market include increased investment in advanced materials, integration of smart technology, and focus on enhancing mobility and protection features, catering to diverse operational demands.