Aroma Chemicals Market Report

Published Date: 02 February 2026 | Report Code: aroma-chemicals

Aroma Chemicals Market Size, Share, Industry Trends and Forecast to 2033

The report provides an in-depth analysis of the Aroma Chemicals market, covering trends, market size, growth forecasts, and regional insights from 2023 to 2033, aimed at informing stakeholders about current conditions and future prospects.

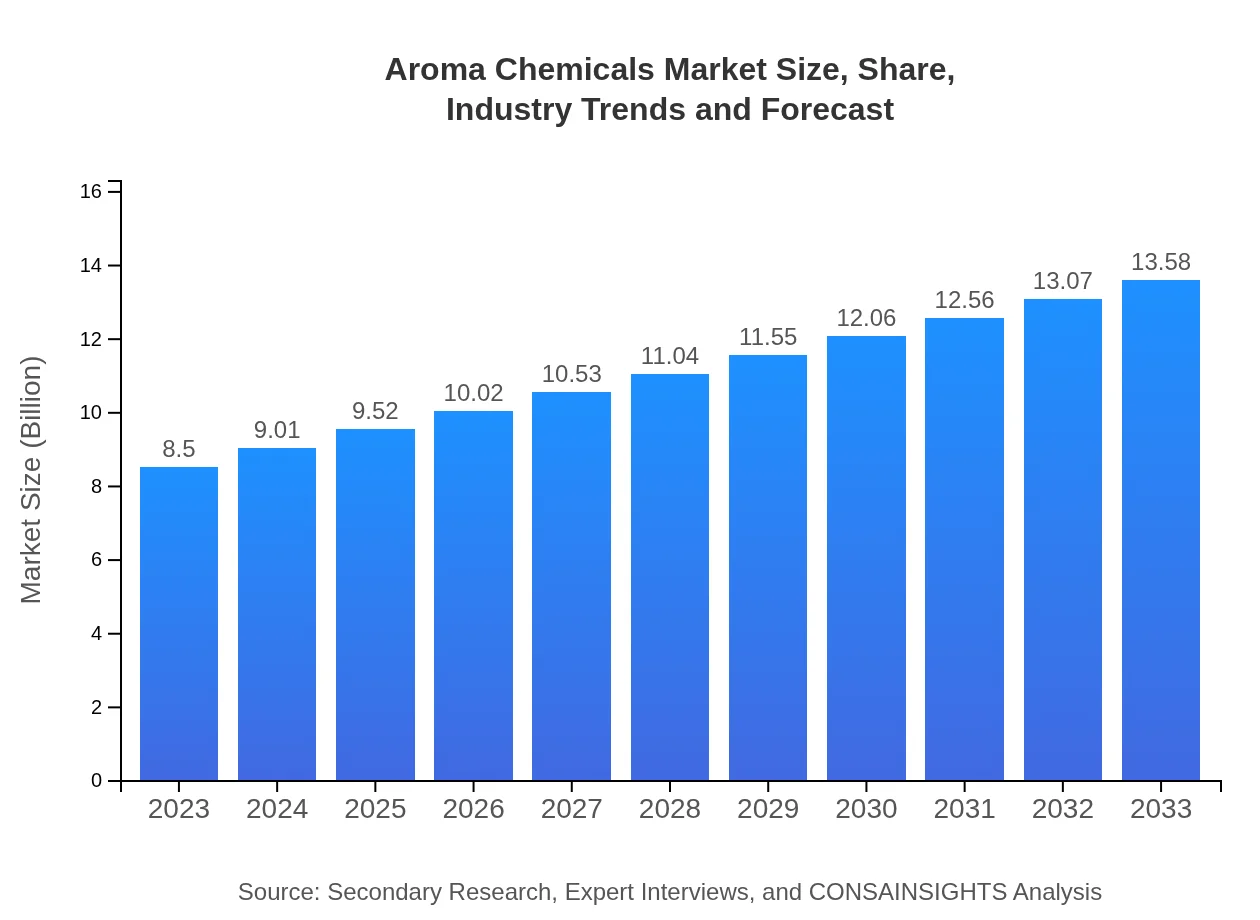

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $13.58 Billion |

| Top Companies | Givaudan, Firmenich, International Flavors & Fragrances (IFF) |

| Last Modified Date | 02 February 2026 |

Aroma Chemicals Market Overview

Customize Aroma Chemicals Market Report market research report

- ✔ Get in-depth analysis of Aroma Chemicals market size, growth, and forecasts.

- ✔ Understand Aroma Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aroma Chemicals

What is the Market Size & CAGR of Aroma Chemicals market in 2023?

Aroma Chemicals Industry Analysis

Aroma Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aroma Chemicals Market Analysis Report by Region

Europe Aroma Chemicals Market Report:

Europe's Aroma Chemicals market is projected to increase from $2.77 billion in 2023 to $4.43 billion by 2033. The European market is characterized by stringent regulations regarding chemical production and usage, driving manufacturers towards sustainable sourcing and production practices. Rising consumer demand for natural and organic products is also further propelling market growth across the fragrance and personal care sectors.Asia Pacific Aroma Chemicals Market Report:

In the Asia-Pacific region, the Aroma Chemicals market was valued at $1.39 billion in 2023 and is expected to grow to $2.23 billion by 2033. This growth is largely driven by the rising middle-class population, increasing urbanization, and a growing preference for personal care products. Moreover, the region's robust food and beverage industry is propelling demand for flavoring agents, contributing to market expansion.North America Aroma Chemicals Market Report:

North America holds a significant share of the Aroma Chemicals market, estimated at $3.17 billion in 2023, with expectations of reaching $5.06 billion by 2033. The growth is attributed to high disposable income, consumer inclination towards premium and organic products, and continuous product innovations. The region also benefits from a well-established distribution network facilitating efficient supply chains.South America Aroma Chemicals Market Report:

The South American Aroma Chemicals market has shown steady growth, valued at $0.53 billion in 2023, projected to increase to $0.85 billion by 2033. This growth is fueled by the expanding fragrance industry and increasing consumer awareness regarding the benefits of natural fragrances, leading to a shift in demand dynamics within personal care and home care sectors.Middle East & Africa Aroma Chemicals Market Report:

The Middle East and Africa market for Aroma Chemicals is projected to grow from $0.64 billion in 2023 to $1.02 billion by 2033. The growth in this region is supported by the expanding cosmetic industry and increasing spending on beauty products. Additionally, there is a rising trend towards luxurious fragrances, which is stimulating demand for a diverse range of aroma chemicals.Tell us your focus area and get a customized research report.

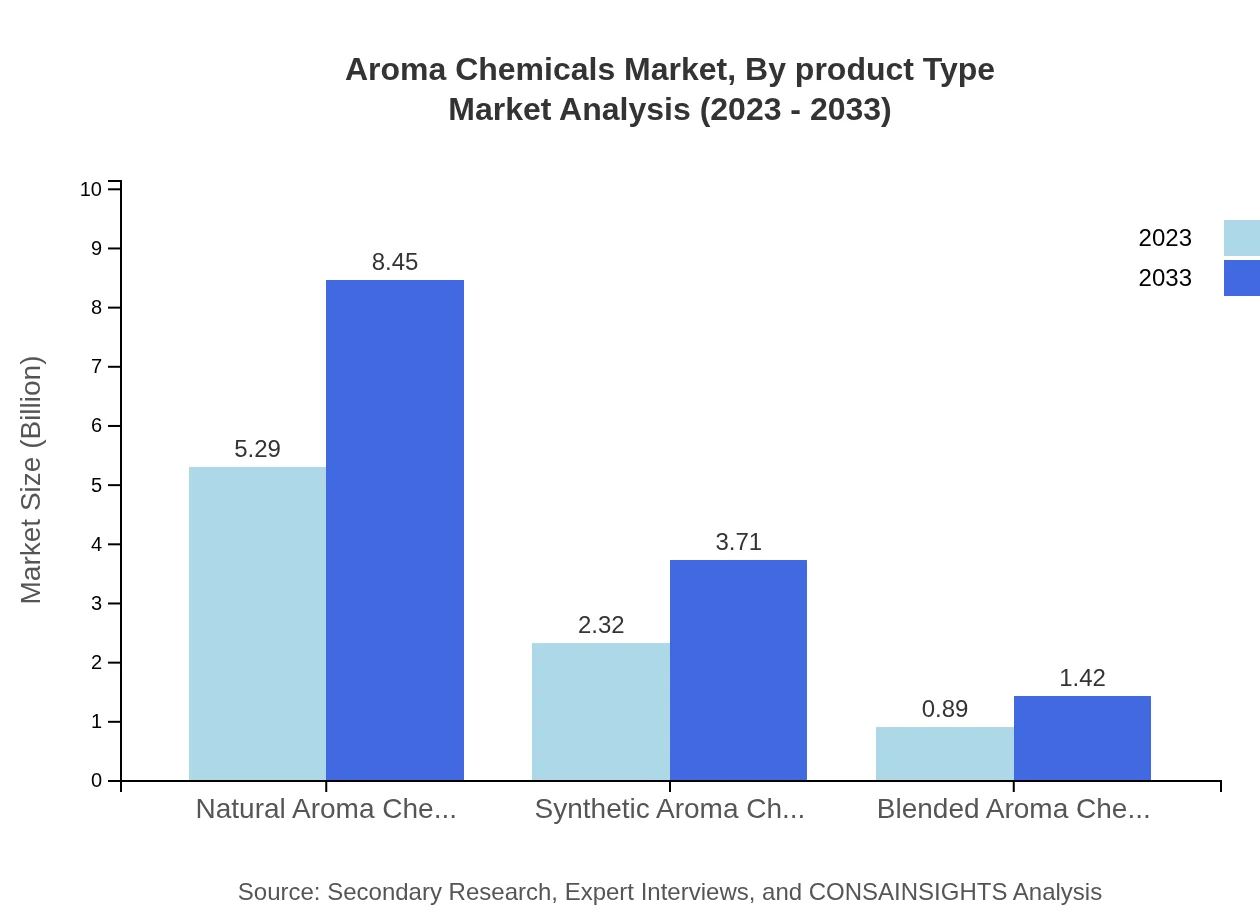

Aroma Chemicals Market Analysis By Product Type

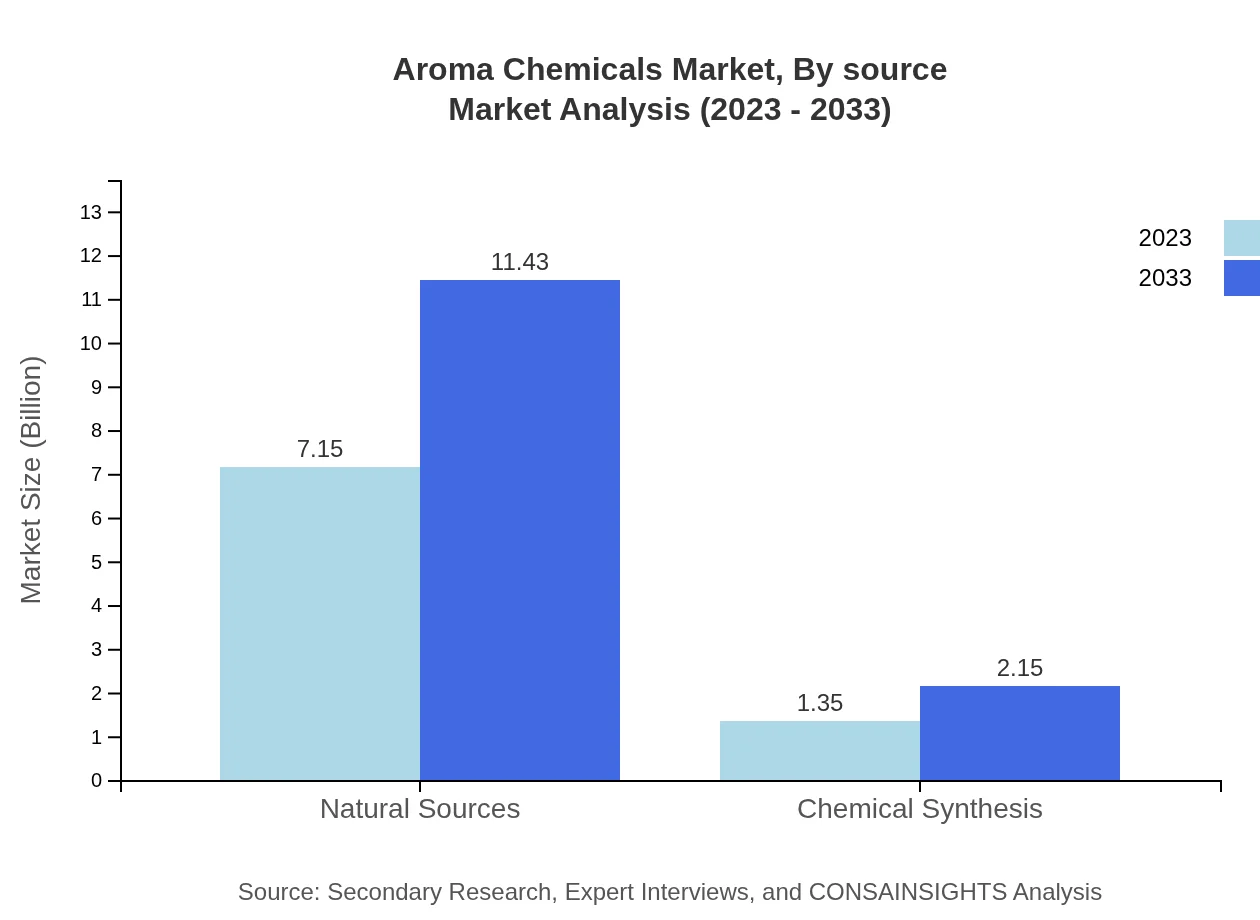

Natural aroma chemicals dominate the market, with a size of $7.15 billion in 2023, expected to reach $11.43 billion by 2033. They account for approximately 84.15% of the market share. Chemical synthesis accounts for a smaller segment with $1.35 billion in 2023, growing to $2.15 billion by 2033, representing 15.85% of the market share.

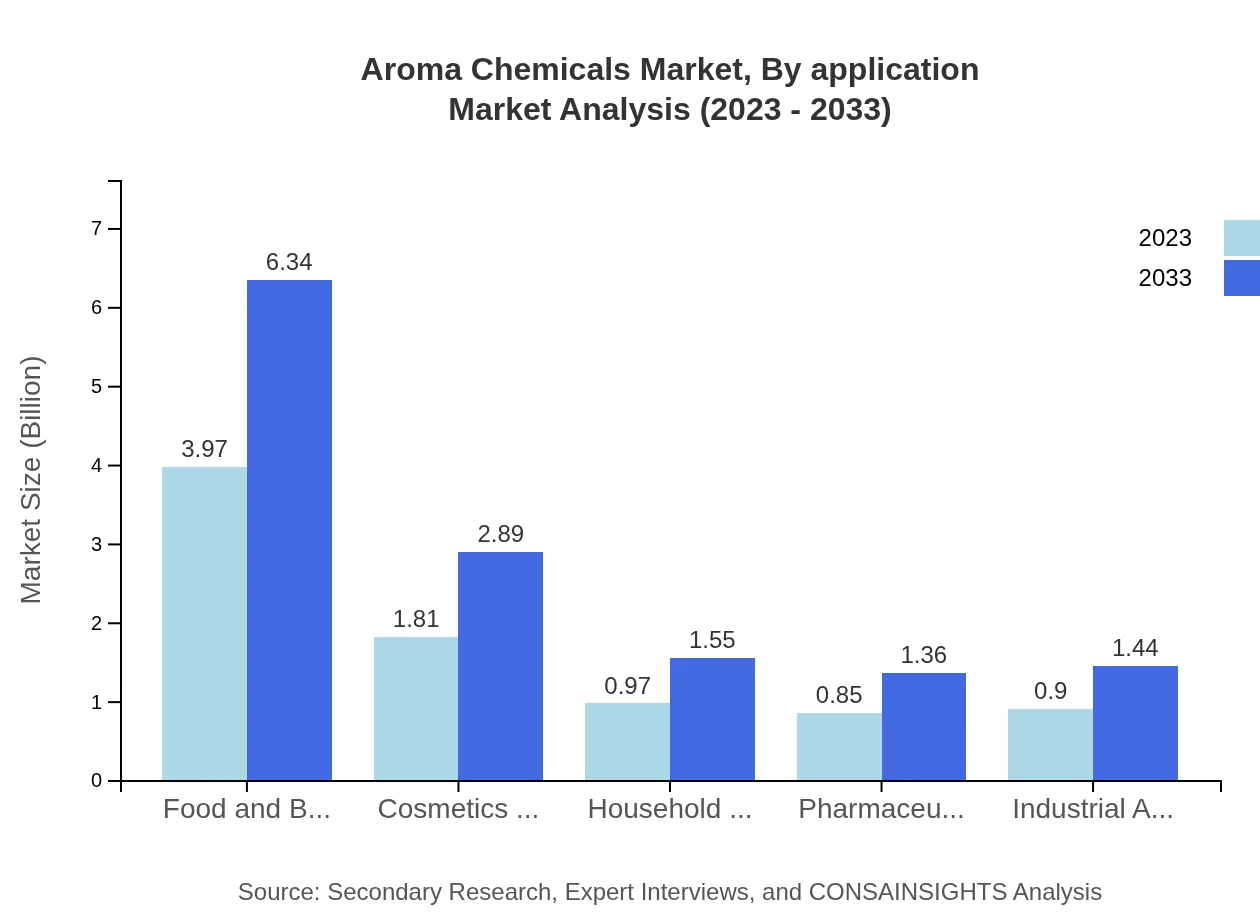

Aroma Chemicals Market Analysis By Application

In 2023, the food and beverages segment holds a market size of $3.97 billion, expected to reach $6.34 billion by 2033, contributing to 46.68% of the market share. The cosmetics and personal care segment is valued at $1.81 billion in 2023, projected to grow to $2.89 billion by 2033, representing 21.3% of the market share.

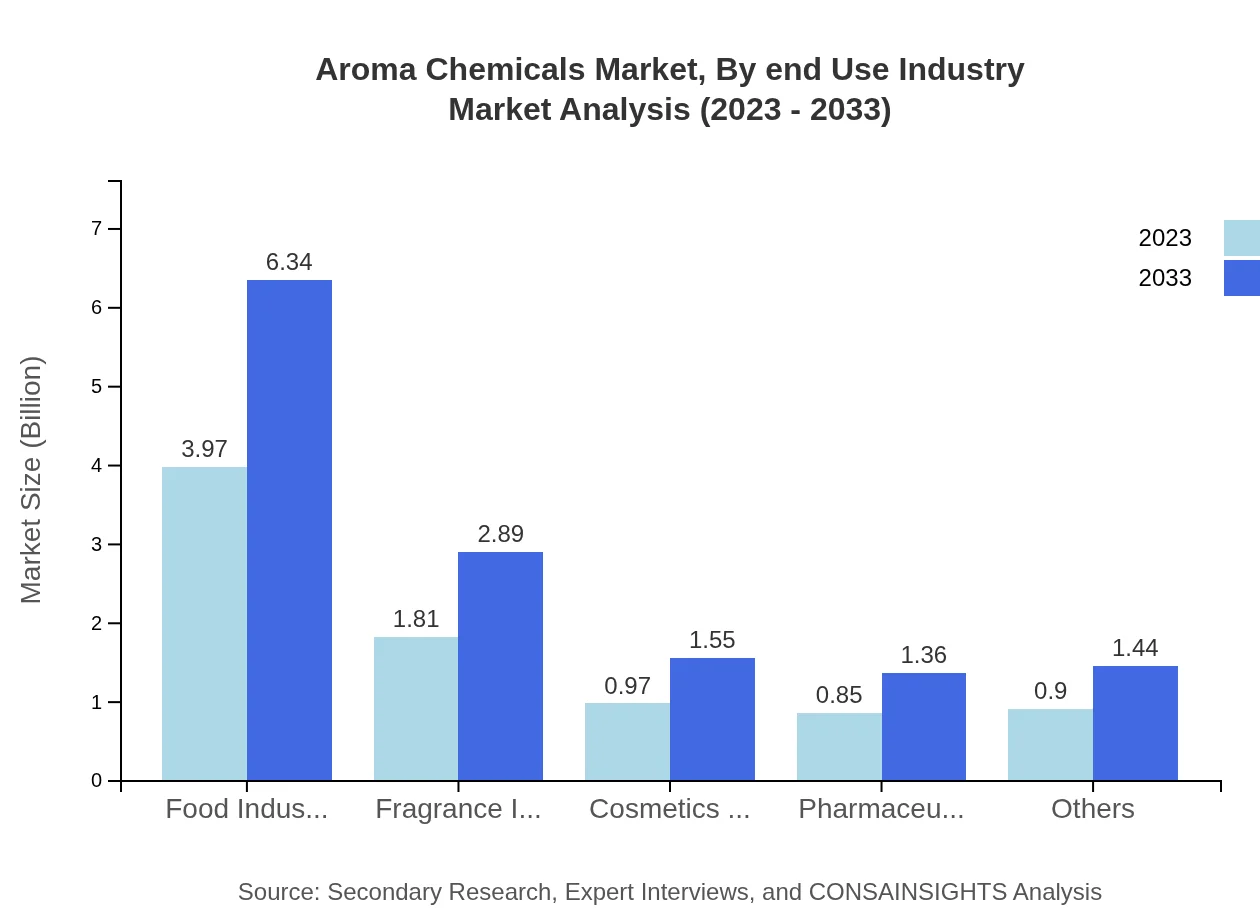

Aroma Chemicals Market Analysis By End Use Industry

The food industry continues to lead the market with a size of $3.97 billion in 2023, climbing to $6.34 billion by 2033. Other significant contributors include the fragrance industry at $1.81 billion, pharmaceuticals at $0.85 billion, and households applications, demonstrating the wide-ranging uses of aroma chemicals across various sectors.

Aroma Chemicals Market Analysis By Source

Natural sources accounted for $5.29 billion of the market in 2023, expected to grow to $8.45 billion by 2033, making up 62.22% of the market share. Synthetic aroma chemicals made up $2.32 billion in 2023, expected to expand to $3.71 billion, representing 27.29% of the market share.

Aroma Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aroma Chemicals Industry

Givaudan:

Givaudan is a global leader in the fragrance and flavor industry, known for its innovation and sustainability practices in aroma chemical production. The company invests heavily in R&D to provide tailored solutions for its customers.Firmenich:

Firmenich is a Swiss-based manufacturer of fragrance and flavor solutions, focusing on high-quality natural ingredients and advancing sustainability initiatives in the aroma chemicals market.International Flavors & Fragrances (IFF):

IFF is a major player in the aroma chemicals industry, delivering innovative and diverse solutions across various applications, particularly in food, beauty, and personal care sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of aroma Chemicals?

The aroma-chemicals market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 4.7% leading up to 2033. This growth is indicative of the increasing demand across various industries for aroma chemicals.

What are the key market players or companies in this aroma Chemicals industry?

Key players in the aroma-chemicals industry include global leaders in chemical production, fragrance and flavor companies, with established names driving innovation and market share. These companies work extensively to meet consumer demand in food, cosmetics, and household products.

What are the primary factors driving the growth in the aroma Chemicals industry?

The primary factors driving growth include rising consumer demand for natural ingredients in personal care products, as well as the expanding food and beverage sector. Additionally, increased awareness of health and wellness trends is shaping consumer preferences.

Which region is the fastest Growing in the aroma Chemicals?

The fastest-growing region in the aroma-chemicals market is projected to be North America, with the market expected to grow from $3.17 billion in 2023 to $5.06 billion by 2033, driven by a strong demand in personal care and food industries.

Does ConsaInsights provide customized market report data for the aroma Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the aroma-chemicals industry. We provide detailed insights based on client requirements for targeted market analysis and decision-making.

What deliverables can I expect from this aroma Chemicals market research project?

From this market research project, you can expect detailed market analysis reports, segmentation data, competitive landscape evaluation, growth forecasts, and strategic recommendations providing comprehensive insights into the aroma-chemicals industry.

What are the market trends of aroma Chemicals?

Current trends in the aroma-chemicals market include a significant shift towards natural and organic products, increased innovation in chemical synthesis methods, and a heightened focus on sustainable practices in production and sourcing of aroma compounds.