Aroma Ingredients Market Report

Published Date: 02 February 2026 | Report Code: aroma-ingredients

Aroma Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aroma Ingredients market from 2023 to 2033, including market trends, size, segmentation, and regional insights. It aims to forecast future growth and challenges while providing insights into key players and technological advancements in the industry.

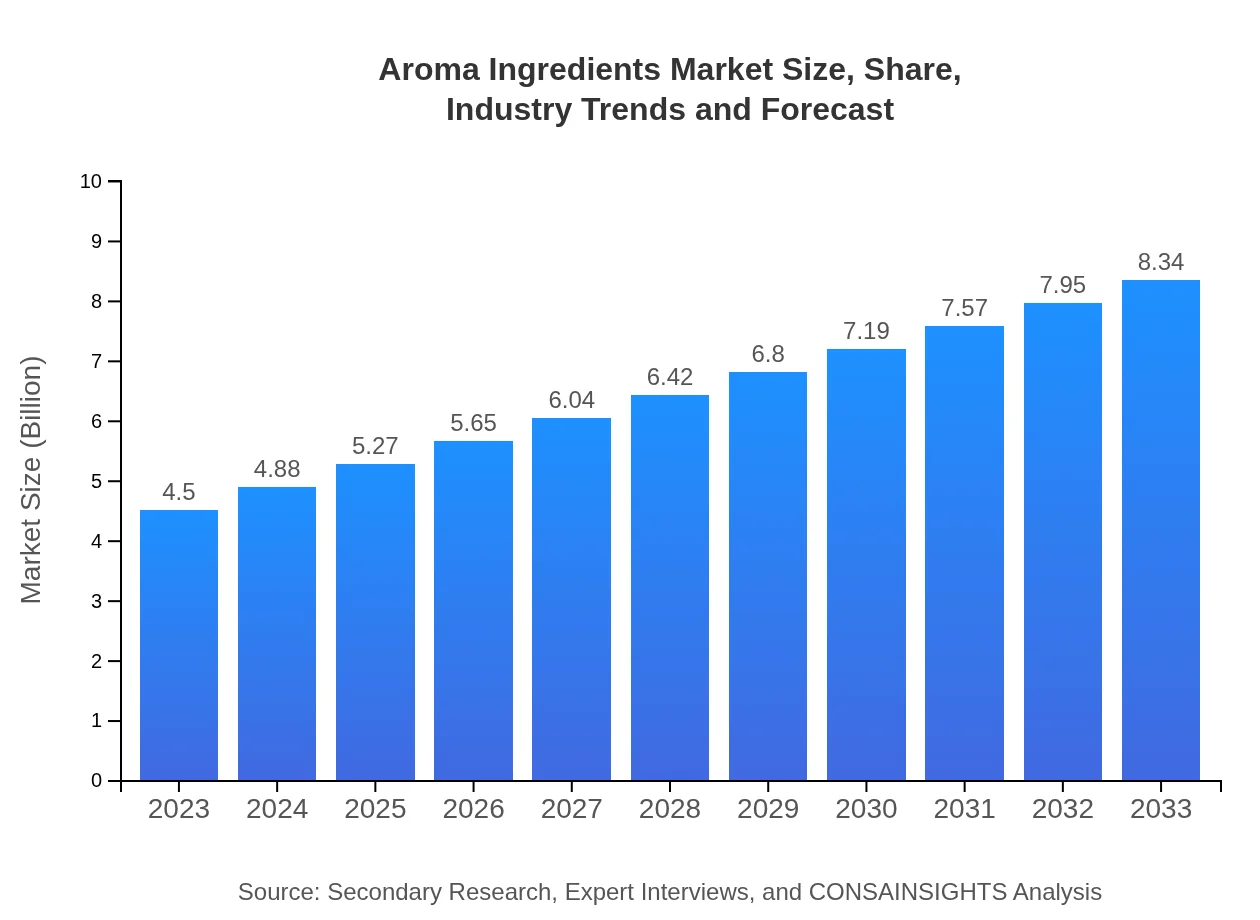

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.34 Billion |

| Top Companies | Givaudan, Firmenich, International Flavors & Fragrances (IFF), Symrise |

| Last Modified Date | 02 February 2026 |

Aroma Ingredients Market Overview

Customize Aroma Ingredients Market Report market research report

- ✔ Get in-depth analysis of Aroma Ingredients market size, growth, and forecasts.

- ✔ Understand Aroma Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aroma Ingredients

What is the Market Size & CAGR of Aroma Ingredients market in 2023?

Aroma Ingredients Industry Analysis

Aroma Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aroma Ingredients Market Analysis Report by Region

Europe Aroma Ingredients Market Report:

Europe is a leading market for aroma ingredients, valued at USD 1.45 billion in 2023 and expected to grow to USD 2.68 billion by 2033. Stringent regulations regarding the safety and sustainability of ingredients further promote the industry's shift towards natural aroma solutions.Asia Pacific Aroma Ingredients Market Report:

The Asia Pacific region holds significant growth potential, having recorded a market size of USD 0.84 billion in 2023 and projected to increase to USD 1.55 billion by 2033. The region's growing middle class, emphasis on personal care products, and robust food industry are driving demand for aroma ingredients.North America Aroma Ingredients Market Report:

North America represented a market size of USD 1.54 billion in 2023, projected to reach USD 2.86 billion by 2033. The region's mature food and beverage sector, coupled with a significant trend towards natural and organic products, supports continuous demand for aroma ingredients.South America Aroma Ingredients Market Report:

In South America, the aroma ingredients market is expected to grow from USD 0.22 billion in 2023 to USD 0.40 billion in 2033. Factors such as rising disposable income and the increasing popularity of organic fragrances in cosmetics are influencing market growth.Middle East & Africa Aroma Ingredients Market Report:

In the Middle East and Africa, the market is set to expand from USD 0.46 billion in 2023 to USD 0.84 billion by 2033. Growing consumer awareness regarding product quality and wellness trends in the cosmetics sector are driving market penetration.Tell us your focus area and get a customized research report.

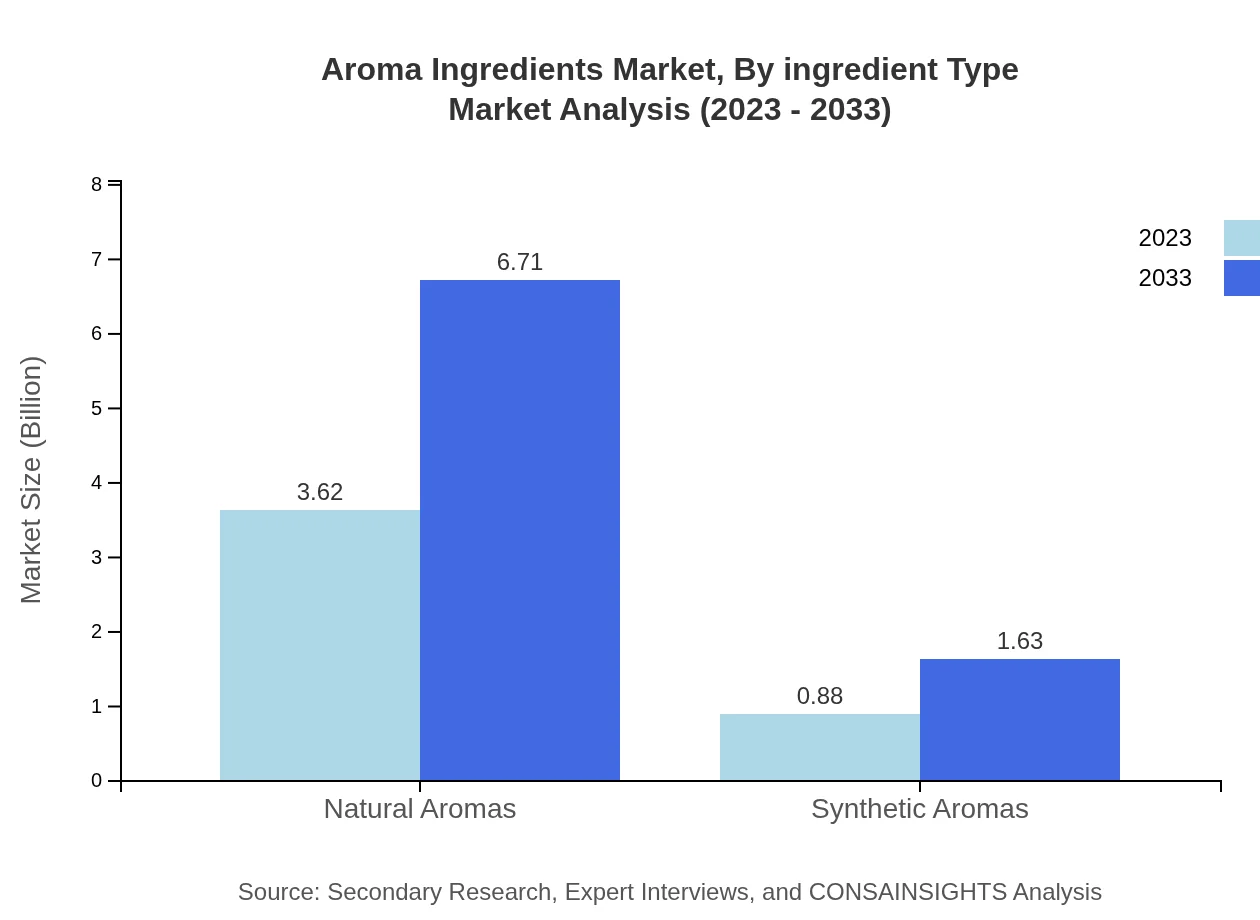

Aroma Ingredients Market Analysis By Ingredient Type

Natural aromas dominate the market with an estimated size of USD 3.62 billion in 2023, projected to grow to USD 6.71 billion by 2033. Synthetic aromas, while smaller at USD 0.88 billion in 2023, show potential growth to USD 1.63 billion. The preference shift towards natural ingredients is boosting the demand for higher-quality aroma extracts.

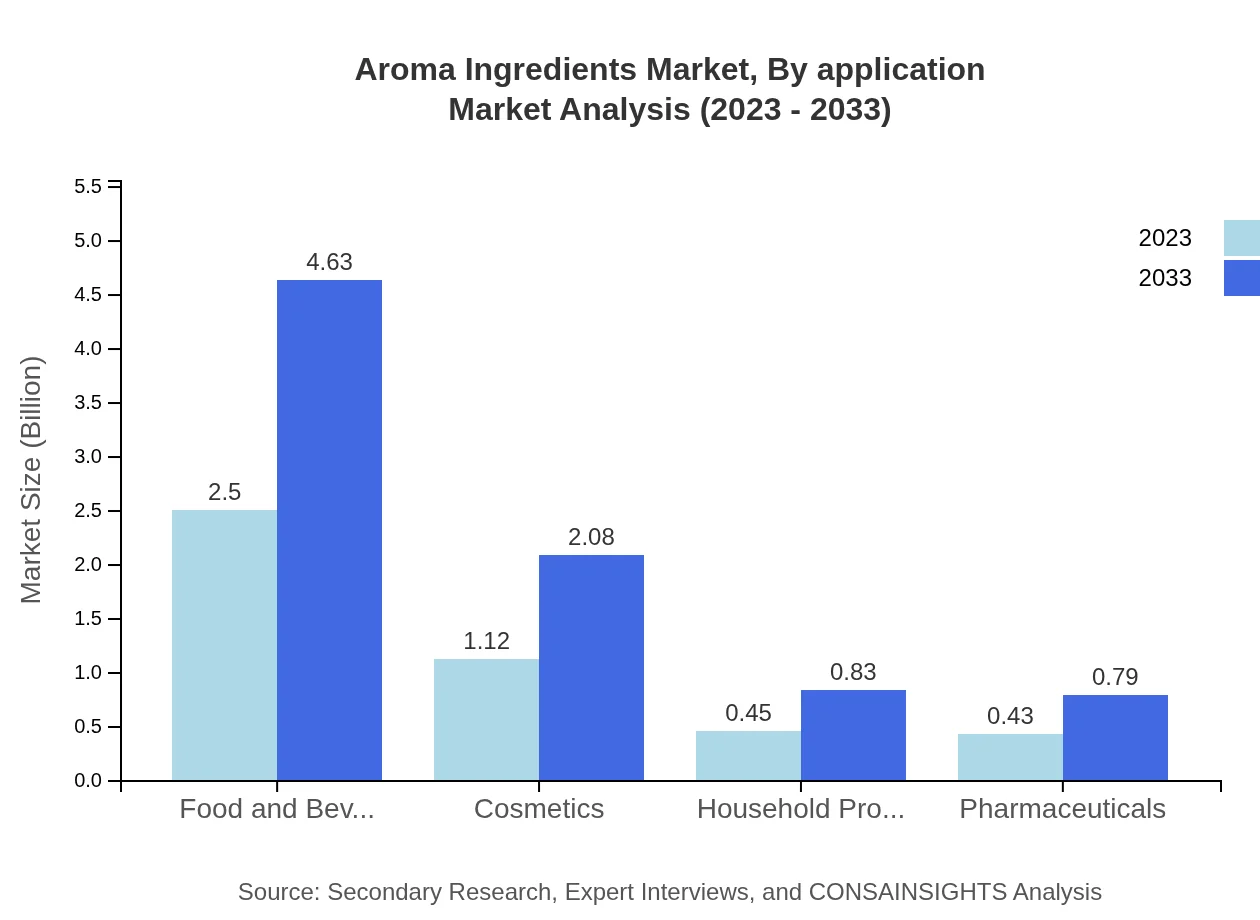

Aroma Ingredients Market Analysis By Application

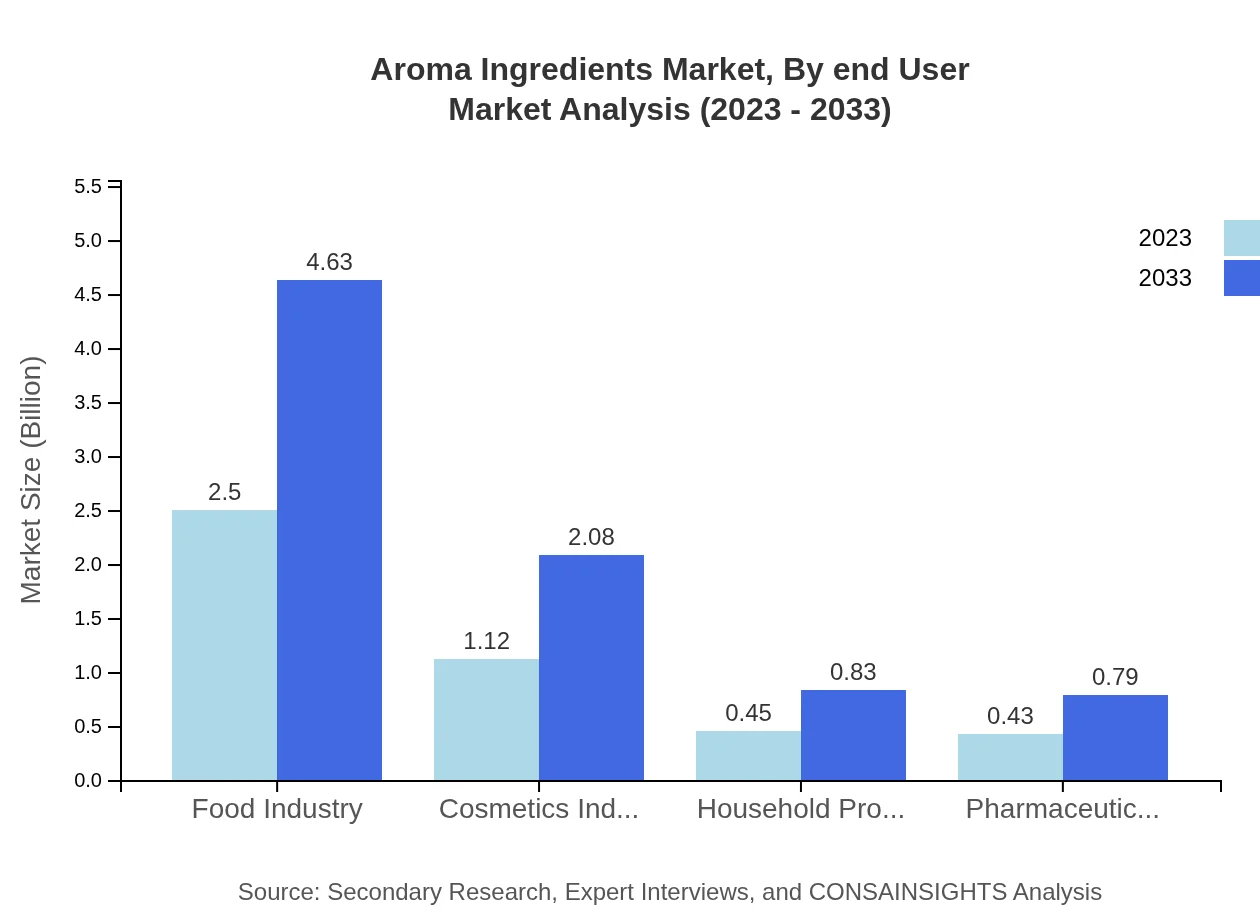

The food industry leads with a size of USD 2.50 billion in 2023, set to reach USD 4.63 billion by 2033. Following closely, the cosmetics industry is projected to grow from USD 1.12 billion to USD 2.08 billion in the same period. Household products and pharmaceuticals are lesser contributors but showcase steady growth trends.

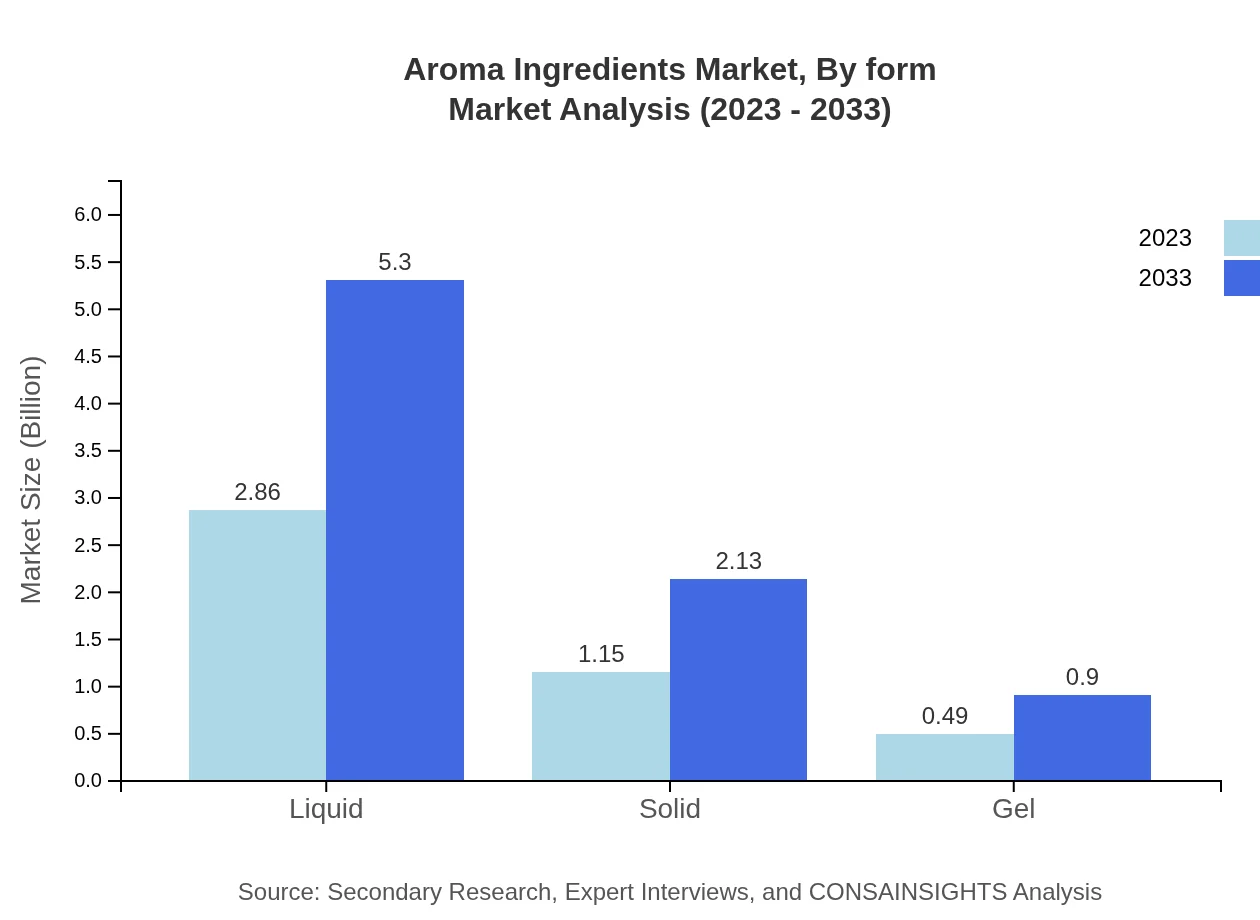

Aroma Ingredients Market Analysis By Form

In terms of product form, liquid aroma ingredients dominate the segment with a size of USD 2.86 billion in 2023, targeting food and beverage applications prominently. Solid forms follow with USD 1.15 billion, catering primarily to the cosmetics and home care markets; the gel form remains a niche segment with growth potential in specialty applications.

Aroma Ingredients Market Analysis By End User

The Food and Beverage industry is the largest end-user of aroma ingredients with a market size of USD 2.50 billion in 2023. The Cosmetics sector holds a vital share of $1.12 billion, underscoring a robust demand for innovative fragrance solutions driven by market trends towards personal care.

Aroma Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aroma Ingredients Industry

Givaudan:

As one of the largest suppliers of flavor and fragrance, Givaudan focuses heavily on research and development to create innovative aroma solutions addressing market needs.Firmenich:

Firmenich is renowned for its sustainable practices and technological advancements in aroma ingredients, enhancing its presence in the global market.International Flavors & Fragrances (IFF):

IFF is at the forefront of the aroma ingredients market with extensive product offerings that span various applications in the food, beverage, and personal care sectors.Symrise:

Symrise is recognized for its diverse portfolio of aroma products and commitment to sustainability, driving growth in natural aroma ingredients.We're grateful to work with incredible clients.

FAQs

What is the market size of aroma Ingredients?

The global aroma ingredients market is valued at approximately $4.5 billion in 2023, with a projected growth at a CAGR of 6.2% through 2033, indicating robust expansion in the industry.

What are the key market players or companies in this aroma Ingredients industry?

Key players in the aroma ingredients market include major companies such as Givaudan, Firmenich, IFF, and Symrise, recognized for their innovative product offerings and substantial market influence.

What are the primary factors driving the growth in the aroma ingredients industry?

Key growth drivers for the aroma ingredients industry include rising demand in the food and beverage sector, increasing consumer interest in natural and organic ingredients, and the expansion of the personal care industry.

Which region is the fastest Growing in the aroma ingredients market?

The Asia Pacific region is noted as the fastest-growing market, projected to expand from $0.84 billion in 2023 to $1.55 billion by 2033, reflecting a notable increase in consumer demand and market activities.

Does ConsaInsights provide customized market report data for the aroma ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the aroma ingredients industry, providing tailored insights and projections based on client requirements.

What deliverables can I expect from this aroma ingredients market research project?

Deliverables from the aroma ingredients market research include detailed reports, market trends analysis, competitive landscape insights, and forecasts segmented by region and application.

What are the market trends of aroma ingredients?

Market trends in aroma ingredients show a significant shift towards natural products, increased varieties in consumer preferences, and a burgeoning market for sustainable ingredients.